Modular construction has been utilized for a long time in the construction of residential and many other commercial product types due to the quick delivery times for the assigned project. Modular buildings are constructed off-site in modules and brought to the site in flat-packed panels. Construction off-site is transforming the construction process for schools, commercial buildings, hospitals, and other segments, ensuring better construction quality management and quicker delivery times. Modularization methods for construction can help perform several tasks simultaneously. Weather conditions have no significant impact on the schedule, due to which the time required to complete a modular construction project is usually less than that of traditional on-site building methods.

Access Full Report @ https://www.databridgemarketresearch.com/reports/saudi-arabia-and-gcc-modular-construction-market

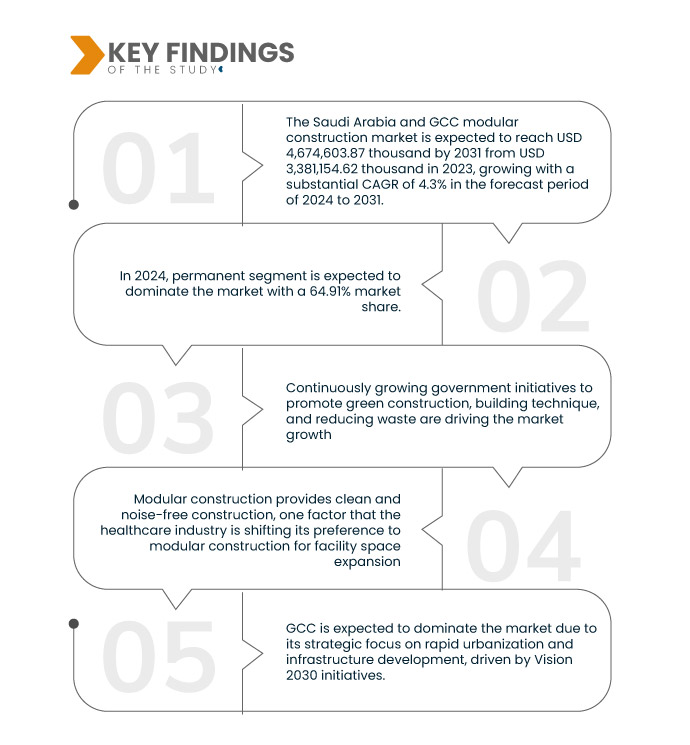

Data Bridge Market Research analyzes that the Saudi Arabia and GCC Modular Construction Market is expected to reach USD 4,674,603.87 thousand by 2031 from USD 3,381,154.62 thousand in 2023, growing with a substantial CAGR of 4.3% in the forecast period of 2024 to 2031.

Key Findings of the Study

Growing Emphasis on Sustainability, Quality, and Workers' Safety

Continuously growing government initiatives to promote green construction, building technique, and reducing waste are driving the market growth. Traditional building method generates around 56 million tons of debris every year. However, modular construction uses precise measurement and management through which multiple modules are created so discarded materials can be reused for other projects. This effectively helps in minimizing the generation of waste. The amount of waste generated by traditional construction challenges the environment compared to modular construction. Modular construction generates less waste and is also easy to dispose of. Working on-site involves greater risk and threatens workers' safety, including excessive noise and air-borne contaminants pose serious health risks. Working techniques large operational plant machinery and tools, working at height and in an environment where hazardous materials are present cause damage to the workers' health. Modular strategies are becoming more popular to limit the amount of waste on each project with the environment being a growing concern in the construction industry. There are even efforts to maximize recycling within factories that put the building portions together.

Report Scope and Market Segmentation

|

Report Metric

|

Details

|

|

Forecast Period

|

2024 to 2031

|

|

Base Year

|

2023

|

|

Historic Years

|

2022 (Customizable to 2016-2021)

|

|

Quantitative Units

|

Revenue in USD Thousand

|

|

Segments Covered

|

Type (Permanent and Relocatable), Material (Wood, Steel, Concrete, Plastic, Glass, and Others), End-User (Residential, Commercial, and Industrial)

|

|

Countries Covered

|

Saudi Arabia, U.A.E., Qatar, Kuwait, Oman, and Bahrain

|

|

Market Players Covered

|

Bechtel Corporation (U.S.), LAING O’ROURKE (U.K.), Fluor Corporation (U.S.), Karmod Prefabricated Technologies. (Turkey), SPACEMAKER KSA (Saudi Arabia), BK Gulf LLC (a Subsidiary of Dutco Group of Companies) (U.A.E.), DUBOX (U.A.E.), RED SEA INTERNATIONAL (Saudi Arabia), Arabian Containers LLC (U.A.E.), Gulf Modular International (Saudi Arabia), and KOMA MODULAR (Czech Republic) among others

|

|

Data Points Covered in the Report

|

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, geographically represented company-wise production and capacity, network layouts of distributors and partners, detailed and updated price trend analysis and deficit analysis of supply chain and demand

|

Segment Analysis

The Saudi Arabia and GCC modular construction market is segmented into three notable segments based on type, material, and end-user.

- On the basis of type, the market is segmented into permanent and relocatable

In 2024, the permanent segment is expected to dominate the Saudi Arabia and GCC modular construction market

In 2024, the permanent segment is expected to dominate the market with a 64.91% market share due to due to its durability and long-lasting nature, offering a robust and reliable alternative to traditional construction methods.

- On the basis of material, the market is segmented into wood, steel, concrete, plastic, glass, and others

In 2024, the wood segment is expected to dominate the Saudi Arabia and GCC modular construction market

In 2024, the wood segment is expected to dominate the market with a 51.96% market share due to due to its sustainability, cost-effectiveness, and versatility in creating eco-friendly and aesthetically pleasing structures.

- On the basis of end-user, the market is segmented into commercial, residential, and industrial. In 2024, the commercial segment is expected to dominate the market with a market share of 50.09%

Major Players

Data Bridge Market Research analyzes Bechtel Corporation (U.S.), LAING O’ROURKE (U.K.), Fluor Corporation (U.S.), Karmod Prefabricated Technologies. (Turkey), SPACEMAKER KSA (Saudi Arabia) as the major market players of Saudi Arabia and GCC modular construction market.

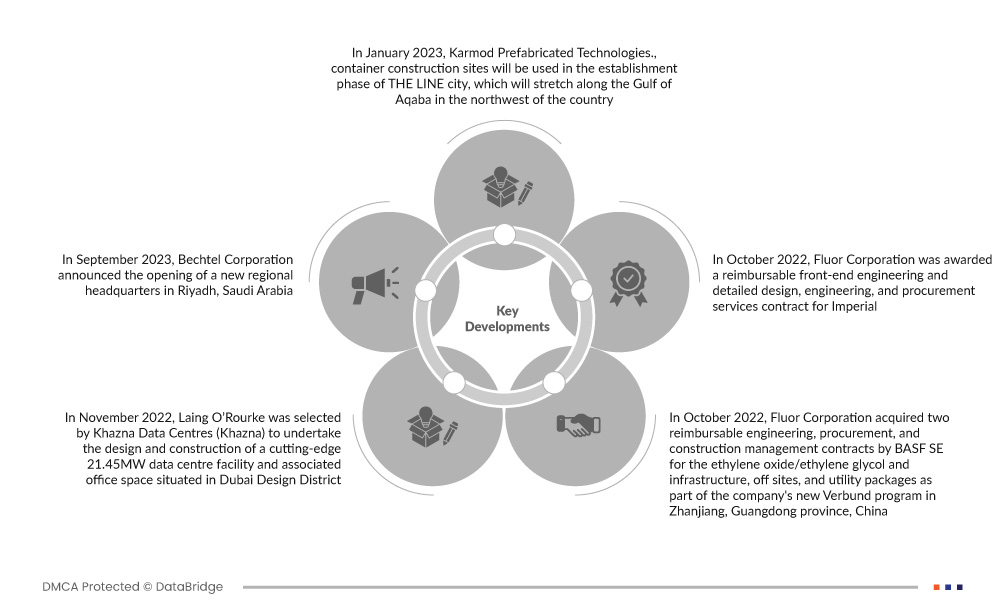

Market Developments

- In September 2023, Bechtel Corporation announced the opening of a new regional headquarters in Riyadh, Saudi Arabia. This new regional headquarters reflects its strong and long-standing commitment to our regional customers and partners

- In November 2022, Laing O’Rourke was selected by Khazna Data Centres (Khazna) to undertake the design and construction of a cutting-edge 21.45MW data centre facility and associated office space situated in Dubai Design District. This project marks the fifth data center Laing O’Rourke will deliver for Khazna in the Middle East under the main contract

- In October 2022, Fluor Corporation acquired two reimbursable engineering, procurement, and construction management contracts by BASF SE for the ethylene oxide/ethylene glycol and infrastructure, off-sites, and utility packages as part of the company's new Verbund program in Zhanjiang, Guangdong province, China

- In October 2022, as part of Architecture Day, KOMA MODULAR opened a new building on their premises. This new building is the Development and Innovation Centre of Modularity, designed by architects Michal Krištof and Ondřej Chybík. The building itself is an innovative project where there is not a single square corner inside

Regional Analysis

Geographically, the countries covered in the market report are Saudi Arabia, U.A.E., Qatar, Kuwait, Oman, and Bahrain.

As per Data Bridge Market Research analysis:

For more detailed information about the Saudi Arabia and GCC modular construction market report, click here – https://www.databridgemarketresearch.com/reports/saudi-arabia-and-gcc-modular-construction-market