Increasing awareness regarding the benefits of maintaining cleanliness and personal hygiene has been a significant driver in the growth of the Saudi Arabian body care and personal hygiene market. Over the past decade, there has been a notable shift in consumer behavior, with individuals becoming more conscious of the importance of hygiene in maintaining overall health and well-being. This awareness has been fueled by various factors, including education campaigns, media exposure, and a growing emphasis on health and wellness in society.

In Saudi Arabia, personal hygiene is not only seen as a matter of cleanliness but also as a part of cultural and religious practices. The importance of hygiene is deeply rooted in Islamic teachings, which stress cleanliness as an essential component of daily life. This cultural context, combined with modern health initiatives, has led to greater acceptance of hygiene products and routines, especially among the younger population.

The rise in health consciousness has also been supported by the government’s efforts to promote wellness through various public health initiatives. Additionally, the growing availability of information through social media and other platforms has further encouraged consumers to adopt hygiene practices. With the increasing awareness of how cleanliness can prevent diseases, improve skin health, and enhance overall quality of life, more consumers are turning to body care and personal hygiene products such as soaps, lotions, deodorants, and oral care items.

In response to this demand, companies in the Saudi Arabian market are introducing innovative, high-quality products that cater to the needs of diverse consumer segments. There is also a rising preference for natural, organic, and sustainable personal care products, which are perceived as healthier and safer alternatives to conventional items. As a result, the Saudi body care and personal hygiene market is witnessing strong growth, driven by consumers’ heightened understanding of hygiene’s vital role in health maintenance.

Access Full Report @ https://www.databridgemarketresearch.com/reports/saudi-arabia-body-care-and-personal-hygiene-market

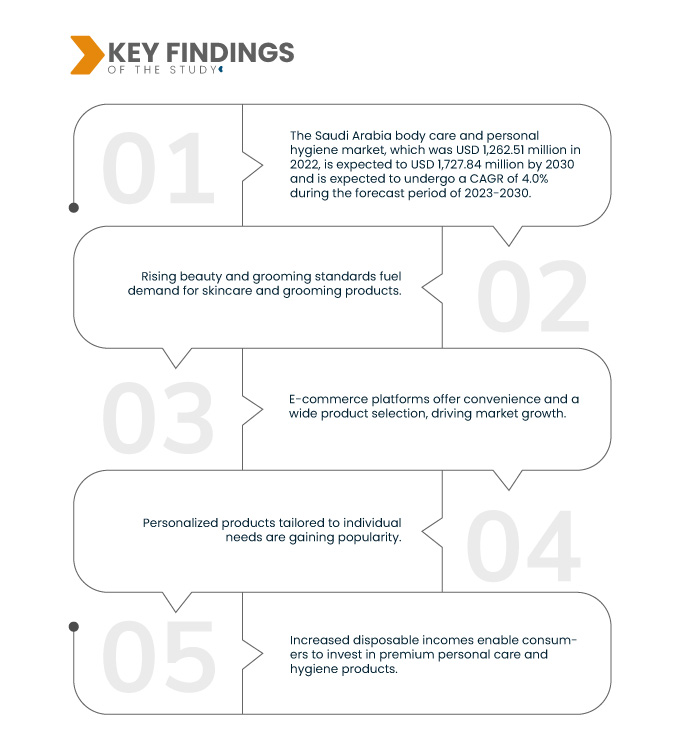

Data Bridge market research analyzes that the Saudi Arabia Body Care and Personal Hygiene Market is expected to reach USD 1.84 billion by 2032 from USD 1.35 billion in 2024, growing with a substantial CAGR of 3.9% in the forecast period of 2025 to 2032.

Key Findings of the Study

Surge in Epidemic or Pandemic Outbreaks or Diseases

The surge in epidemic or pandemic outbreaks, such as the COVID-19 pandemic, has significantly impacted the Saudi Arabian body care and personal hygiene market. In times of health crises, there is a marked increase in the public's awareness of hygiene practices and the need for proper sanitation to prevent the spread of infectious diseases. During the COVID-19 pandemic, for instance, personal hygiene became a top priority, with people focusing on maintaining cleanliness to protect themselves from the virus. This shift in behavior led to heightened demand for hygiene products like hand sanitizers, disinfectants, antibacterial soaps, face masks, and other personal care items.

The pandemic highlighted the critical role of hygiene in disease prevention and prompted consumers to adopt more rigorous personal care routines. As a result, there was a noticeable surge in the use of hand sanitizers and antibacterial products, with many individuals incorporating them into their daily habits. Moreover, the emphasis on personal cleanliness extended beyond just hand hygiene, with increased use of disinfectants for surfaces and other hygiene-related products.

In response to this growing demand, manufacturers and retailers in Saudi Arabia have expanded their product offerings, ensuring that consumers have access to a wide range of personal hygiene solutions. Additionally, with increased awareness of the connection between hygiene and health, there has been a shift toward products that provide added protection, such as antibacterial soaps, sanitizing wipes, and oral hygiene products.

This heightened awareness around hygiene, driven by the surge in epidemic outbreaks, has also led to long-term changes in consumer behavior. Even after the pandemic's peak, many consumers continue to prioritize hygiene and cleanliness, contributing to the sustained growth of the body care and personal hygiene market in Saudi Arabia

Report Scope and Market Segmentation

|

Report Metric

|

Details

|

|

Forecast Period

|

2025 to 2032

|

|

Base Year

|

2024

|

|

Historic Years

|

2023 (Customizable to 2013-2017)

|

|

Quantitative Units

|

Revenue in USD Billion

|

|

Segments Covered

|

By Product (Body Shampoo / Wash / Shower Gel, Hair Shampoo, Body Scrub, Shower Oil, Petroleum Jelly, Hand Liquid Wash, Wet Wipes, Hand Sanitizer, Nail Polish Remover, Baby Shampoo, Alcohol Antiseptic Spray, and Others), Price Range (Mass, Premium, and Luxury), Packaging (Bottles And Jars, Containers, Tubes, Pouches, Sachets, and Dispensers), Target Customer (Women, Men, Kids, and Unisex), Distribution Channel (Non-Store Based Retailer, Store Based Retailer, Distributors And Wholesalers, and Duty Free Shops)

|

|

Market Players Covered

|

Unilever (U.K.), Procter & Gamble (U.S.), L'ORÉAL (France), BEIERSDORF AG (U.A.E), Henkel Ag & Co. KGaA (Germany), Church & Dwight Co., Inc. (U.S.), Coty Inc. (U.S.), Kao Corporation (Tokyo), NAOS (U.S.), and Shiseido Company, Limited (Japan)

|

|

Data Points Covered in the Report

|

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, geographically represented company-wise production and capacity, network layouts of distributors and partners, detailed and updated price trend analysis and deficit analysis of supply chain and demand.

|

Segment Analysis

The Saudi Arabia body care and personal hygiene market is segmented into five notable segments based on by product, price range, packaging, target customers, and distribution channel.

- On the basis of product, the market is segmented into body shampoo / wash / shower gel, hair shampoo, body scrub, shower oil, petroleum jelly, hand liquid wash, wet wipes, hand sanitizer, nail polish remover, baby shampoo, alcohol antiseptic spray, and others

In 2025, the body shampoo / wash / shower gel segment is expected to dominate the market with a market share of 22.74%

In 2025, the body shampoo / wash / shower gel segment is expected to dominate the market with a market share of 22.74% due to cultural emphasis on frequent cleansing, increasing awareness of hygiene, rising disposable incomes, and growing preference for premium and fragrant personal care products.

- On the basis of price range, the market is segmented into mass, premium, and luxury

In 2025, the mass segment is expected to dominate the market with a market share of 62.22%

In 2025, the mass segment is expected to dominate the market with a market share of 62.22% due to high demand from price-sensitive consumers, widespread availability, and strong marketing by established local and global brands.

- On the basis of packaging, the market is segmented into bottles and jars, containers, tubes, pouches, sachets, and dispensers

- On the basis of target customer, the market is segmented into women, men, kids, and unisex

- On the basis of distribution channel, the market is segmented into non-store based retailer, store based retailer, distributors and wholesalers, and duty free shops

Major Players

Data Bridge market research analyzes Unilever (U.K.), Procter & Gamble(U.S.), L'ORÉAL GROUP (France), BEIERSDORF AG (Germany), and Henkel AG & Co. KGaA (Germany) as major market players.

Market Developments

- In November 2024, Unilever has partnered with Nufarm to cultivate sustainable biomass oil from energy cane. This collaboration aims to reduce reliance on petrochemical ingredients, support Unilever's net-zero emissions target by 2039, and create a more resilient and waste-free supply chain

- In September 2024, L’Oréal has partnered with Abolis Biotechnologies and Evonik to develop sustainable, bio-based ingredients for beauty products. The collaboration, backed by significant investments, aims to scale up the production of innovative ingredients, supporting L’Oréal's sustainability goals and advancing biotechnology in various industries

- In August 2024, L’Oréal has acquired a 10% stake in Galderma Group and entered a strategic scientific partnership to combine their expertise in dermatology and skin biology. This collaboration focuses on enhancing performance in the fast-growing aesthetics market. The deal is expected to drive innovation in skincare and aesthetic treatments, further strengthening both companies' positions in the beauty and dermatology sectors

- In February 2024, Henkel has signed an agreement to acquire Vidal Sassoon's hair care business in Greater China from Procter & Gamble. This acquisition will expand Henkel’s presence in the premium retail segment of the Chinese hair care market, complementing its existing portfolio and providing a complete range of hair care products

- In January 2023, P&G Beauty announced its acquisition of Mielle Organics, a leading textured hair care brand. Co-founders Monique and Melvin Rodriguez will continue to lead Mielle as an independent subsidiary. The partnership expands access to high-quality products and supports Mielle's community-focused initiatives, including the Mielle Cares program

As per Data Bridge Market Research analysis:

For more detailed information about the Saudi Arabia body care and personal hygiene market report, click here – https://www.databridgemarketresearch.com/reports/saudi-arabia-body-care-and-personal-hygiene-market