Sulfuric acid, a potent mineral acid, plays a pivotal role across industries, facilitating chemical synthesis, metal processing, and wastewater treatment. Available in varied concentrations such as 98%, 96.5%, 76%, 70%, and 38%, it's integral in manufacturing fertilizers and detergents, refining petroleum, and producing potassium sulfates. Its diverse applications underscore its significance as a crucial catalyst, contributing substantially to industrial processes and the creation of essential products in the market.

Access Full Report @ https://www.databridgemarketresearch.com/reports/sulfuric-acid-market

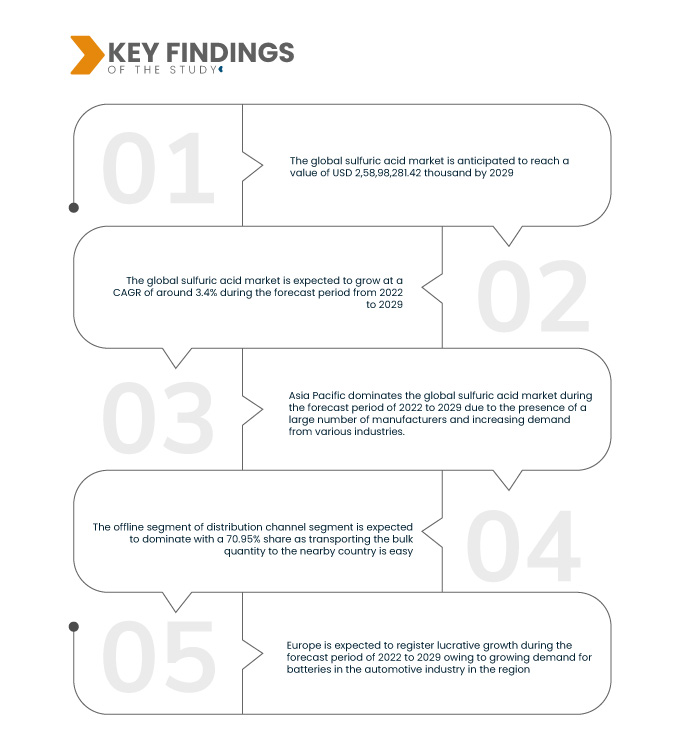

Data Bridge Market Research analyses that the Global Sulfuric Acid Market which was USD 1,98,20,136.25 thousand in 2021, is expected to reach USD 2,58,98,281.42 thousand by 2029, at a CAGR of 3.4% during the forecast period from 2022-2029. Sulfuric acid is essential in petroleum refining, facilitating key processes in the energy sector. As the energy industry expands, the demand for sulfuric acid continues to rise significantly.

Key Findings of the Study

Increasing demand of fertilizers in agriculture industry is expected to drive the market's growth rate

The escalating demand for fertilizers in agriculture propels the sulfuric acid market. As a crucial component in manufacturing fertilizers, sulfuric acid enhances soil fertility and crop production. Its versatility allows easy integration into soil and liquid fertilizers. With farmers seeking high-quality fertilizers to increase complete yield productivity, the agricultural industry's reliance on sulfuric acid for essential nutrient incorporation contributes significantly to the growing demand for this chemical in the market.

Report Scope and Market Segmentation

|

Report Metric

|

Details

|

|

Forecast Period

|

2022 to 2029

|

|

Base Year

|

2021

|

|

Historic Years

|

2020 (Customizable to 2014-2019)

|

|

Quantitative Units

|

Revenue in USD Thousand, Volumes in Units, Pricing in USD

|

|

Segments Covered

|

Raw Material (Base Metal Smelters, Elemental Sulfur, Pyrite Ore and Others), Form (Concentrated, 66 Degree Baume Sulfuric Acid, Tower/Glover Acid, Chamber/Fertilizer Acid, Battery Acid and Dilute Sulfuric Acid), Manufacturing Process (Contact Process, Lead Chamber Process, Wet Sulfuric Acid Process, Metabisulfite Process and Others), Distribution Channel (Offline and Online), Application (Fertilizers, Chemical Manufacturing, Petroleum Refining, Metal Processing, Automotive, Textile, Drug Manufacturing, Pulp and Paper, Industrial And Others)

|

|

Countries Covered

|

U.S., Canada and Mexico in North America, Germany, France, U.K., Netherlands, Switzerland, Belgium, Russia, Italy, Spain, Turkey, Rest of Europe in Europe, China, Japan, India, South Korea, Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in the Asia-Pacific (APAC), Saudi Arabia, United Arab Emirates, South Africa, Egypt, Israel, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA), Brazil, Argentina and Rest of South America as part of South America

|

|

Market Players Covered

|

LANXESS (Germany), Brenntag GmbH (Germany), Boliden Group (Sweden), Adisseo (France), Veolia (France), Univar Solutions Inc (U.S.), NORAM Engineering & Construction Ltd. (Canada), Nouryon (Netherlands), International Raw Materials LTD (U.S.), Eti Bakır (Turkey), ACIDEKA SA (Spain), Airedale Chemical Company Limited.( U.K.), BASF SE (Germany), Aguachem Ltd (U.K.), Feralco AB (U.K.), Fluorsid (Italy), Aurubis AG (Germany), Nyrstar (Netherlands), Merck KGaA (Germany), Shrieve (U.S.)

|

|

Data Points Covered in the Report

|

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, geographically represented company-wise production and capacity, network layouts of distributors and partners, detailed and updated price trend analysis and deficit analysis of supply chain and demand.

|

Segment Analysis:

The global sulfuric acid market is segmented on the basis of raw material, form, manufacturing process, distribution channel, and application.

- On the basis of raw material, the global sulfuric acid market is segmented into base metal smelters, elemental sulfur, pyrite ore, and others. The elemental sulfur segment is expected to dominate with a 57.62% share due to the abundant availability of sulfur across the globe

- On the basis of form, the global sulfuric acid market is segmented into concentrated (98%), tower/glover acid (77.67%), chamber/fertilizer acid (62.8%), battery acid (33.5%), 66 degree Baume sulfuric acid (93%) and dilute sulfuric acid (10%). The chamber/fertilizer acid (62.8%) segment is expected to dominate with a 36.03% share as it is available with a high acidic range and drops the soil's pH level, which improves the uptake of nutrients

- On the basis of manufacturing process, the global sulfuric acid market is segmented into contact process, lead chamber process, wet sulfuric acid process, metabisulfite process, and others. The contact process is expected to dominate with a 37.53% share as this process lowers the emission of harmful gases during the production of sulfuric acid

- On the basis of distribution channel, the global sulfuric acid market is segmented into offline and online. The offline segment is expected to dominate with a 70.95% share as transporting the bulk quantity to the nearby country is easy due to which offline distribution channel is dominating the market

Offline segment of the distribution channel is expected to dominate the global sulfuric acid market

The offline segment is expected to dominate with a 70.95% share as change among farmers and agriculturalists, favoring traditional procurement methods, contributes to this trend. Additionally, the increasing number of small-scale retailers, particularly in emerging economies, is expected to further broaden the growth prospects in the market.

- On the basis of application, the global sulfuric acid market is segmented into fertilizers, chemical manufacturing, petroleum refining, metal processing, automotive, textile, drug manufacturing, pulp and paper, industrial, and others. The fertilizers segment is expected to dominate with a 49.55% share as the demand for sulfuric fertilizers increases for crop plantation and soil fertility

Fertilizers segment of the application segment is expected to dominate the global sulfuric acid market

The fertilizers segment is expected to dominate with a 49.55% share as the demand for high-quality fertilizers, manufactured with sulfuric acid, enhances crop production. Agricultural industry growth, propelled by technological advancements and infrastructure development, boosts the market. Ongoing research in organic fertilizers contributes to their acceptance, fostering market expansion.

Major Players

Data Bridge Market Research recognizes the following companies as the major global sulfuric acid market players in global sulfuric acid market are Eti Bakır (Turkey), ACIDEKA SA (Spain), Airedale Chemical Company Limited.( U.K.), BASF SE (Germany), Aguachem Ltd (U.K.), Feralco AB (U.K.), Fluorsid (Italy), Aurubis AG (Germany), Nyrstar (Netherlands), Merck KGaA (Germany), Shrieve (U.S.)

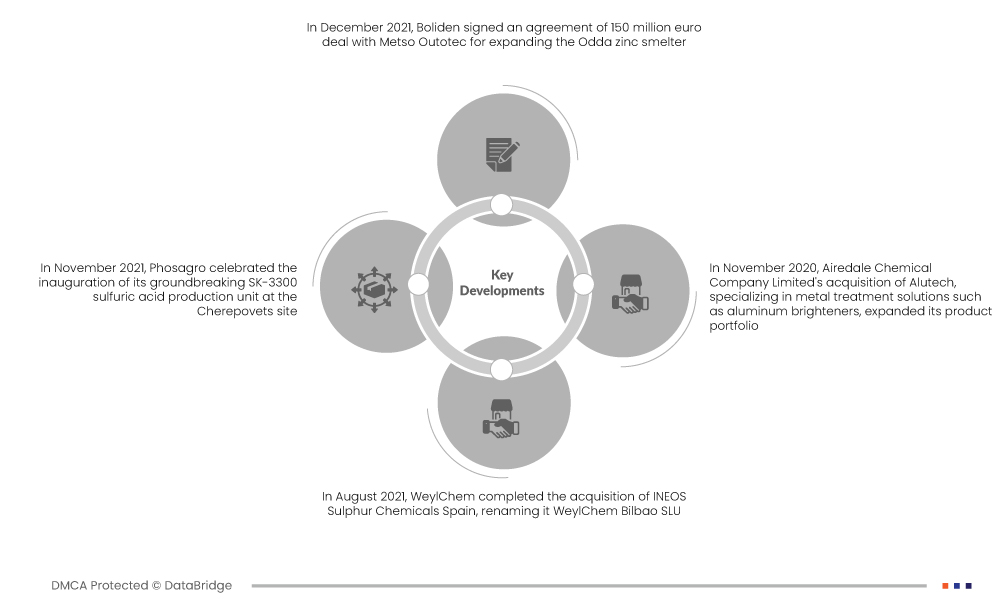

Market Developments

Market Developments

- In December 2021, Boliden signed an agreement of 150 million euro deal with Metso Outotec for expanding the Odda zinc smelter. The agreement encompasses a roasting plant, sulfuric acid plant, and leaching technology. This investment aims to increase Boliden Odda's annual production capacity from 200,000 to 350,000 tonnes, with the increased capacity set for commissioning in Q4 2024, as part of a 700 million euro investment plan spanning 2021-2024

- In November 2021, Phosagro celebrated the inauguration of its groundbreaking SK-3300 sulfuric acid production unit at the Cherepovets site. Boasting a record 3,300-ton-per-day capacity, it stands as Russia's most prolific unit. Developed with cutting-edge technology from top scientific institutes, the unit enhances energy efficiency and reduces emissions. The plant's CHP ingeniously utilizes water vapor from the sulfuric acid manufacturing process for electricity generation

- In August 2021, WeylChem completed the acquisition of INEOS Sulphur Chemicals Spain, renaming it WeylChem Bilbao SLU. With an annual capacity of 350 KT of sulfuric acid, this acquisition enhances WeylChem's position as a leading sulphur chemical company in Europe. The addition of INEOS Sulphur Chemicals Spain complements WeylChem's existing sulfuric acid facility in northern France, consolidating its presence in the market

- In November 2020, Airedale Chemical Company Limited's acquisition of Alutech, specializing in metal treatment solutions such as aluminum brighteners, expanded its product portfolio. This strategic move has boosted the demand for sulfuric acid, contributing to increased profits for the company. The acquisition strengthens Airedale Chemical's position in the market and aligns with its growth objectives

Regional Analysis

Geographically, the countries covered in the global sulfuric acid market report are U.S., Canada and Mexico in North America, Germany, France, U.K., Netherlands, Switzerland, Belgium, Russia, Italy, Spain, Turkey, Rest of Europe in Europe, China, Japan, India, South Korea, Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in the Asia-Pacific (APAC), Saudi Arabia, U.A.E, South Africa, Egypt, Israel, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA), Brazil, Argentina and Rest of South America as part of South America.

As per Data Bridge Market Research analysis:

Asia-Pacific is the dominant region in global sulfuric acid market during the forecast period 2022-2029

Asia-Pacific dominates the global sulfuric acid market due to a high concentration of manufacturers and surging demand across diverse industries. The region, particularly prominent in chemical and fertilizer production, witnesses robust market growth. With an extensive network of sulfuric acid manufacturers, Asia-Pacific plays a pivotal role in meeting the escalating demand from these sectors, solidifying its position as a key driver in the global sulfuric acid market.

Europe is estimated to be the fastest growing region in global sulfuric acid market during the forecast period 2022-2029

Europe is expected to dominate the global sulfuric acid market, experiencing substantial growth from 2022 to 2029. This surge is attributed to the rising demand for batteries within the regional automotive industry. The automotive sector's increasing need for sulfuric acid, particularly in battery production, positions Europe as a key player in driving the market's expansion during the forecast period.

For more detailed information about the global sulfuric acid market report, click here – https://www.databridgemarketresearch.com/reports/sulfuric-acid-market