A Universal Serial Bus (USB) is a plug-and-play interface that allows computers to communicate with peripherals and other devices. USB-connected devices cover a broad range of keyboards and mice, music players, and flash drives. USB is used to send power to the devices, such as powering smartphones and tablets and charging their batteries. A power adapter that generates the 5-volt DC standard is required by USB. The amperage varies typically from .07A to 2.4A. The charger is plugged into an AC outlet, while a USB cable is plugged into the charger. USB ports on computers have an upper limit of up to 500 milliamps; however, USB chargers that come with cellphones and other devices handle the current of one or more amps.

Access Full Report @ https://www.databridgemarketresearch.com/reports/us-usb-charger-market

There are different types of USB chargers in the market, such as wall chargers, car chargers, and wireless chargers among others. There are also different types of USB cables such as USB-A, USB-B, and USB-C in the market, of which USB-A and USB-C are in great demand due to their data transfer and charging speed.

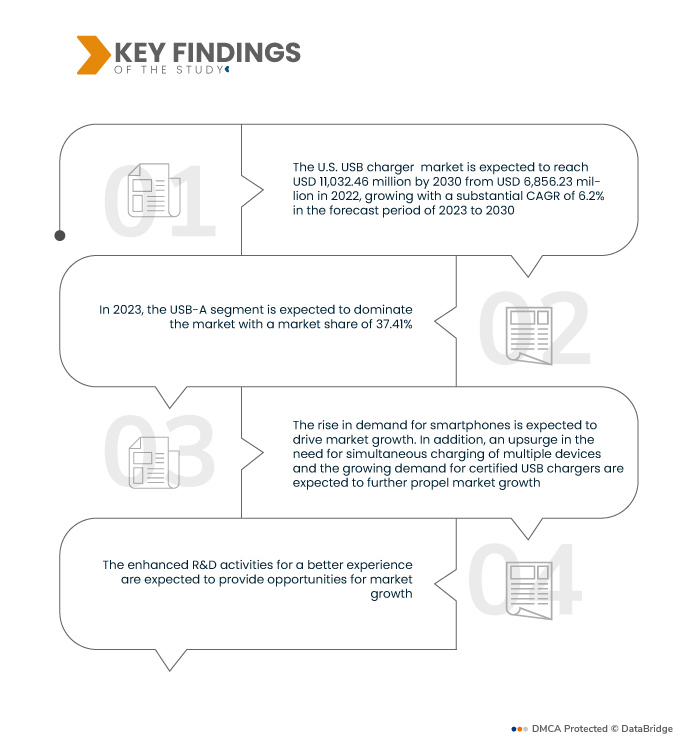

Data Bridge Market Research analyzes the U.S. USB Charger Market is expected to reach USD 11,032.46 million by 2030 from USD 6,856.23 million in 2022, growing with a substantial CAGR of 6.2% in the forecast period of 2023 to 2030.

Key Findings of the Study

Growing Demand for Certified USB Charges

People are opting for a certified charger in the market as they are becoming aware of the advantages of certified products over fake chargers. This charger comes not only with good quality but with safety and protection which makes people opt for certified chargers. This leads to a rise in demand in the market. Many companies are trying to get the USB IF certification to prove their product is of high quality and safe to use. Also, the USB-IF cable certification program aims to provide USB end-users with a list of cables that meet the quality standards necessary to operate in a USB environment. Moreover, many companies try for Qi certification as Qi-certified products are tested to international regulatory standards to increase safety, assure quality, reduce risk, prove interoperability, and ensure reliability.

Report Scope and Market Segmentation

|

Report Metric

|

Details

|

|

Forecast Period

|

2023 to 2030

|

|

Base Year

|

2022

|

|

Historic Years

|

2021 (Customizable to 2015- 2020)

|

|

Quantitative Units

|

Revenue in USD Million

|

|

Segments Covered

|

Product (USB-A, USB-C, Micro-USB, Mini-USB, USB-3, and USB-B), Charger Type (Portable Power Bank/Docking System/Alarm Clock, Wall Chargers, Car Chargers, and Others), Port (Single Port and Multi-Port), Distribution Channel (Online and Offline), Power (30W-44W, 45W-59W, 60W-75W and others), Connector (Macro Connectors, Micro Connectors, and Others), Functionality (USB 2.0, USB 3.0, and Others), Application (Smartphones, Laptops, Desktop, Tablets, Headsets/Audio Accessories, Smartwatches, Camera/Video Cameras, Game Controllers, E-Readers, Smart Clocks, Music Players, Toys, Printers, Optical Drive and Hard Drive, and Others)

|

|

Countries Covered

|

U.S.

|

|

Market Players Covered

|

Goal Zero (Utah), J5create (U.S.), MIZCO International Limited (New Jersey), myCharge (Michigan), Nekteck (California), Ravpower (China), Spigen (California), Inc., Native Union, Belkin (U.S.), ZAGG Inc. (Utah), Fantasia Trading LLC (U.S.), Apple Inc. (California), Eaton (Ireland), SAMSUNG (Korea), and AT&T Intellectual Property (Texas) among others

|

|

Data Points Covered in the Report

|

In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and consumer behavior.

|

Segment Analysis

The U.S. USB charger market is segmented into eight notable segments based on product, charger type, port, distribution channel, power, connector, functionality, and application.

- On the basis of product, the market is segmented into USB-A, USB-C, Micro-USB, Mini-USB, USB-3, and USB-B.

In 2023, the USB-A segment is expected to dominate the U.S. USB charger market

In 2023, the USB-A segment is expected to dominate the market with a 37.41% market share as it is the most common port on laptops and chargers. It can also accommodate the USB-2 and USB-3 standards in the same form factor, making it the most versatile and common type.

- On the basis of charger type, the market is segmented into portable power bank/docking system/alarm clock, wall chargers, car chargers, and others.

In 2023, the portable power bank/docking system/alarm clock segment is expected to dominate the U.S. USB charger market

In 2023, the portable power bank/docking system/alarm clock segment is expected to dominate the market with a 45.99% market share due to the increased demand for consumer electronic devices such as smartphones, laptops, tablets, and others. In addition, with the increase in power consumption of these devices, the need for portable power banks has risen drastically.

- On the basis of port, the market is segmented into single port and multi-port. In 2023, the single port segment is expected to dominate the market with a 57.82% market share

- On the basis of distribution channel, the market is segmented into offline and online. In 2023, the online segment is expected to dominate the market with a 64.04% market share

- On the basis of power, the market is segmented into 30W-44W, 45W-59W, 60W-75W. In 2023, the 30W-44W segment is expected to dominate the market with a 42.64% market share

- On the basis of connector, the market is segmented into macro connectors, micro connectors, and others. In 2023, the macro connectors segment is expected to dominate the market with a 40.45% market share

- On the basis of functionality, the market is segmented into USB 2.0, USB 3.0, and others. In 2023, the USB-3.0 segment is expected to dominate the market with a 73.24% market share

- On the basis of application, the market is segmented into smartphones, laptops, desktop, tablets, headsets/audio accessories, smartwatches, camera/video cameras, game controllers, e-readers, smart clocks, music players, toys, printers, optical drive and hard drive, and others. In 2023, the smartphones segment is expected to dominate the market with a 22.54% market share

Major Players

Data Bridge Market Research recognizes the following companies as the major players in the U.S. USB charger market that include Goal Zero (Utah), J5create (U.S.), MIZCO International Limited (New Jersey), myCharge (Michigan), Nekteck (California), Ravpower (China), Spigen (California), Inc., Native Union, Belkin (U.S.), ZAGG Inc. (Utah), Fantasia Trading LLC (U.S.), Apple Inc. (California), Eaton (Ireland), SAMSUNG (Korea), and AT&T Intellectual Property (Texas) among others.

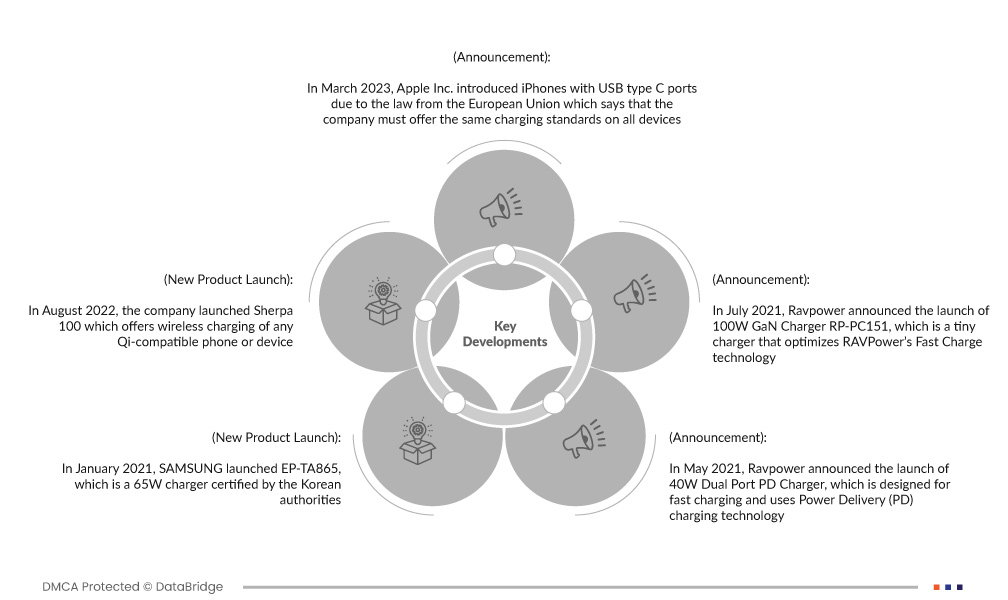

Market Developments

- In March 2023, Apple Inc. introduced iPhones with USB type C ports due to the law from the European Union which says that the company must offer the same charging standards on all devices. This will make it more convenient for customers to charge their devices

- In August 2022, the company launched Sherpa 100 which offers wireless charging of any Qi-compatible phone or device. This will help the company to expand its product portfolio, which will add up to the company’s revenue

- In January 2021, SAMSUNG launched EP-TA865, which is a 65W charger certified by the Korean authorities. It supports USB Power Delivery at up to 20V and 3.25A, including Programmable Power Supply. This product is powerful enough to be used with laptops and the device can be charged through their USB-C ports. Thus, the company was able to provide its customers with fast-charging chargers

- In May 2021, Ravpower announced the launch of 40W Dual Port PD Charger, which is designed for fast charging and uses Power Delivery (PD) charging technology. RP-PC152 is built to handle higher power, allowing different devices to charge quickly over a USB connection. With this, the company provided their customer with a charger that is 70% faster than the standard charger

In July 2021, Ravpower announced the launch of 100W GaN Charger RP-PC151, which is a tiny charger that optimizes RAVPower’s Fast Charge technology. The product features advanced GaN II tech and has dual USB-C charging ports. With this, the company brought forward a smaller USB charger product without sacrificing power output to cater to the customers’ needs and demands.

For more detailed information about the Sweden flour market report, click here – https://www.databridgemarketresearch.com/reports/us-usb-charger-market