Benelux Africa And Saudi Arabia Earthworks And Excavation Equipment Market

Tamanho do mercado em biliões de dólares

CAGR :

%

USD

21.87 Billion

USD

32.30 Billion

2024

2032

USD

21.87 Billion

USD

32.30 Billion

2024

2032

| 2025 –2032 | |

| USD 21.87 Billion | |

| USD 32.30 Billion | |

|

|

|

|

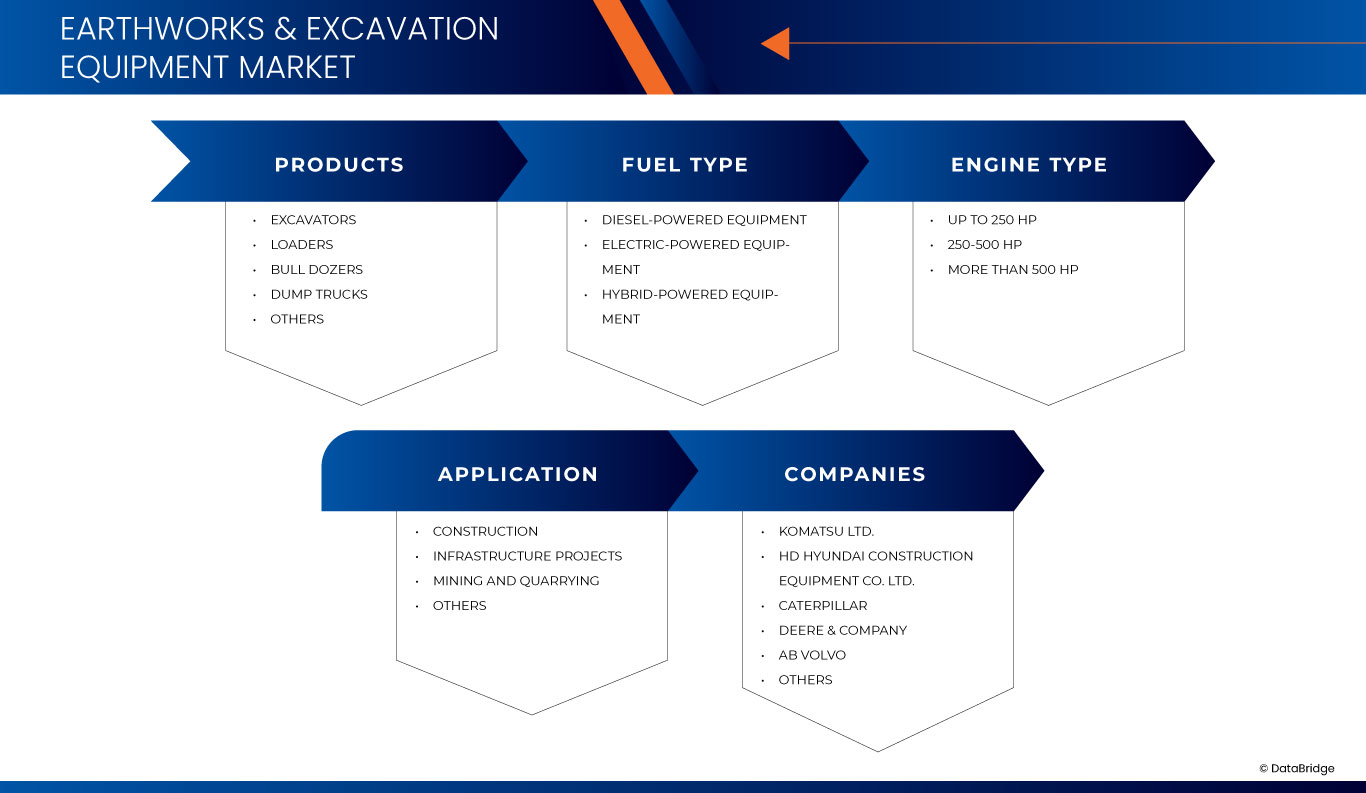

Benelux, Africa, and Saudi Arabia Earthworks & Excavation Equipment Market Segmentation, By Products (Excavators, Loaders, Bull Dozers, Dump Trucks, and Others), Fuel Type (Diesel-Powered Equipment, Electric-Powered Equipment, and Hybrid-Powered Equipment), Engine Type (Up To 250 HP, 250-500 HP, and More Than 500 HP), Application (Construction, Infrastructure Projects, Mining and Quarrying, and Others) - Industry Trends and Forecast to 2032

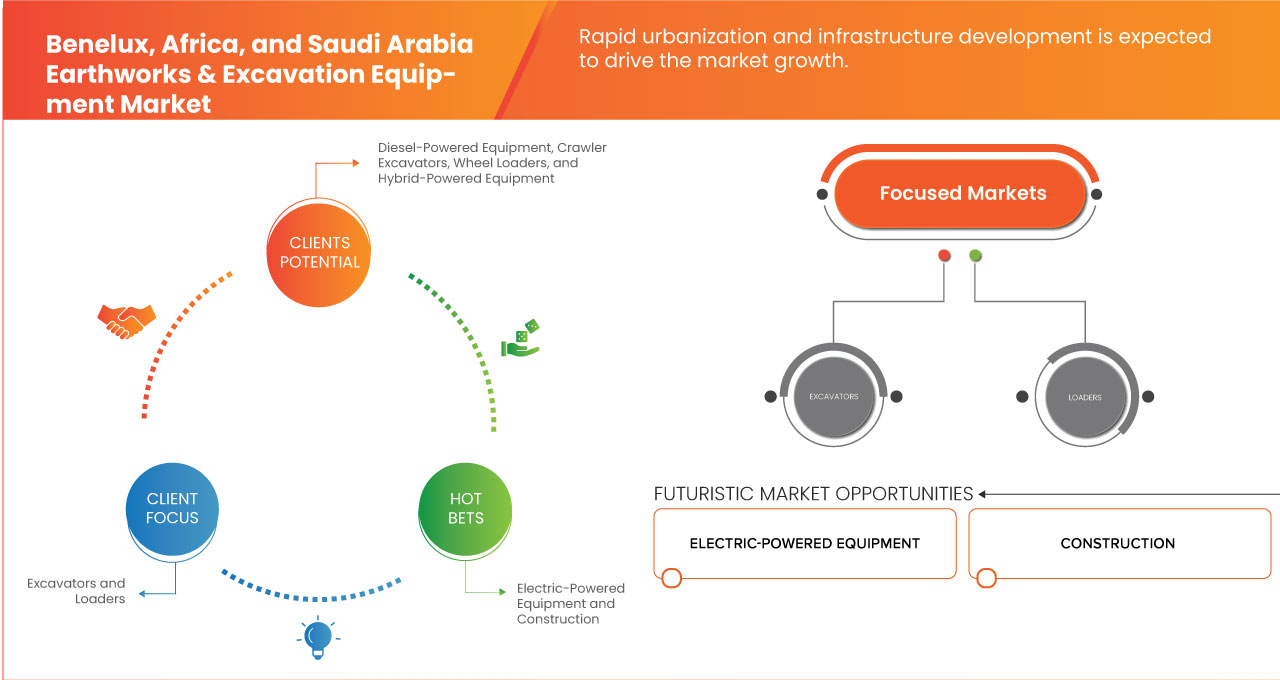

Earthworks & Excavation Equipment Market Analysis

The earthworks & excavation equipment market in Benelux, Africa, and Saudi Arabia is witnessing steady growth, driven by expanding infrastructure projects, urbanization, and economic diversification efforts. In Benelux, investments in housing, transportation, and port expansions are fueling demand for advanced excavation machinery, while Africa's market is propelled by rising investments in mining, energy, and large-scale construction initiatives. Saudi Arabia, under Vision 2030, is experiencing a surge in demand for earthmoving equipment due to its focus on megaprojects and smart city developments. The adoption of technologically advanced and fuel-efficient machinery, along with increasing government funding for infrastructure, is further accelerating market expansion. As automation and sustainability trends gain momentum, the sector is expected to see continued innovation and growth in the coming years.

Earthworks & Excavation Equipment Market Size

Benelux, Africa, and Saudi Arabia earthworks & excavation equipment market is expected to reach USD 32.30 billion by 2032 from USD 21.87 billion in 2024 growing with a CAGR of 5.1% in the forecast period of 2025 to 2032. In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework.

Earthworks & Excavation Equipment Market Trends

“Rising Adoption of Advanced and Sustainable Excavation Equipment”

The earthworks & excavation equipment market in Benelux, Africa, and Saudi Arabia is experiencing a growing shift towards advanced and sustainable machinery. Increasing regulatory pressure and environmental concerns are driving the adoption of fuel-efficient, electric, and hybrid excavation equipment, reducing emissions and operational costs. In Benelux, government initiatives promoting green construction practices are accelerating the transition to low-emission machinery, while Africa’s mining and construction sectors are exploring automation and telematics to enhance efficiency. Saudi Arabia’s Vision 2030 infrastructure projects are fueling demand for smart and high-performance earthmoving equipment with IoT integration for better monitoring and productivity. As sustainability and digital transformation reshape the industry, manufacturers are investing in eco-friendly innovations to meet evolving market demands. These trends indicate a dynamic and evolving earthworks & excavation equipment poised for long-term expansion.

Report Scope andEarthworks & ExcavationEquipment MarketSegmentation

|

Attributes |

Earthworks & Excavation Equipment Key MarketInsights |

|

Segments Covered |

|

|

Countries Covered |

Africa, Saudi Arabia, Netherlands, Belgium, and Luxembourg |

|

Key Market Players |

CNH Industrial N.V. (U.K.), Komatsu Ltd. (Japan), Deere & Company (U.S.), AB Volvo (Sweden), BEML Limited (India), Caterpillar (U.S.), Doosan Bobcat (South Korea), Hitachi Construction Machinery Co., Ltd. (Japan), HD Hyundai Construction Equipment Co.Ltd. (Republic of Korea), J C Bamford Excavators Ltd. (U.K.), Kobelco Construction Machinery Co. Ltd (Japan), LIEBHERR (Switzerland), SANY Group (China), Sumitomo Heavy Industries, Ltd. (Japan), Terex Corporation (U.S.), and XCMG Group (China) among others |

|

Market Opportunities |

|

|

Value Added Data |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Earthworks & Excavation Equipment Market Definition

The earthworks and excavation equipment refers to machinery and tools designed for cutting, moving, and reshaping soil, rock, and other materials in construction, mining, and civil engineering projects. This includes excavators, bulldozers, loaders, graders, trenchers, and compactors, which are used for tasks such as digging, leveling, trenching, and site preparation. These machines enhance efficiency, precision, and safety in large-scale earthmoving operations, playing a crucial role in infrastructure development, road construction, and foundation work.

Earthworks & Excavation Equipment Market Dynamics

Drivers

- Rapid Urbanization and Infrastructure Development

Rapid urbanization and large-scale infrastructure projects in the Benelux region, Africa, and Saudi Arabia are driving demand for earthworks and excavation equipment. In Benelux, urban renewal and sustainable construction initiatives fuel equipment adoption, while Africa's expanding road, rail, and energy projects boost market growth. Saudi Arabia’s Vision 2030, focused on megaprojects such as NEOM and the Red Sea Development, accelerates demand for advanced excavation machinery. Rising investments in smart cities, transportation networks, and resource extraction further support market expansion across these regions.

For instance,

According to an article published by the FIEC (European Construction Industry Federation), the number of building permits in residential construction in Belgium has shown fluctuations in recent years, with a peak of 57,720 permits in 2021, followed by a decline to an estimated 47,980 in 2023 and a forecasted 47,150 in 2024. While this indicates a shift in residential construction activity, the continued demand for housing particularly in collective dwellings remains a key driver for the earthworks & excavation equipment market. Infrastructure modernization and urban development projects will sustain the need for excavation machinery, supporting efficiency in site preparation, foundation work, and large-scale residential projects across Belgium.

- Expansion of Mining and Construction Projects Continues to Accelerate Market Demand and Industry Growth

In Benelux, continuous investments in transportation, commercial infrastructure, and sustainable urban projects are increasing the demand for excavation machinery. Africa’s expanding mining sector, along with large-scale road and energy developments, is driving the need for efficient earthmoving equipment. Meanwhile, Saudi Arabia’s focus on infrastructure expansion, industrial projects, and resource extraction is further boosting demand. As these regions advance their construction and mining activities, the market for excavation equipment is expected to see steady growth.

For instance,

According to the Government of the Netherlands, the country remains committed to a world free of landmines and explosive remnants of war through its Mine Action and Cluster Munitions Programme (2020-2024). The presence of landmines not only poses a severe safety risk but also hinders stability, reconstruction, and economic development. By clearing contaminated land, the program restores access to farmland, facilitates infrastructure projects, and enables the safe return of displaced populations. This initiative directly supports growth in mining and construction projects, driving demand for earthworks and excavation equipment. As cleared land becomes available for development, investments in infrastructure, agriculture, and urban expansion further fuel the need for advanced excavation machinery in the Netherlands.

Opportunities

- Advancements in Electric and Autonomous Construction Equipment

The push for sustainability and stricter emissions regulations in Benelux is driving demand for eco-friendly machinery, while Africa’s growing urbanization and infrastructure projects create a need for cost-efficient, low-maintenance equipment. In Saudi Arabia, large-scale construction and smart city initiatives align with the adoption of advanced, automated solutions to enhance productivity and efficiency. As these regions shift towards modernized construction practices, the demand for electric and autonomous equipment is expected to grow, offering new revenue streams for manufacturers and suppliers.

For instance,

In July 2024, according to the blog published by Quarrying Africa, the introduction of the LiuGong 856H-E Max battery-electric wheel loader in South Africa marks a significant advancement in earthmoving technology. Deployed at Samancor Chrome, this machine demonstrates the potential of battery-electric equipment in reducing environmental impact and lowering operational costs. With positive feedback from operators and promising early results in cost savings, the adoption of such technology presents a major opportunity for the Africa earthworks & excavation equipment market.

- Integration of AI and Machine Learning in Machinery

These advanced technologies enhance operational efficiency, precision, and safety by enabling predictive maintenance, real-time data analysis, and autonomous machine control. AI-driven automation reduces downtime, optimizes fuel consumption, and minimizes human error, leading to cost savings and improved productivity. As the demand for smart construction and mining solutions grows, companies that invest in AI-powered machinery will gain a competitive edge, accelerating project timelines and meeting the evolving needs of the industry.

For instance,

In October 2024, John Deere introduced SmartDetect, an AI-powered object detection system, into select utility and production-class wheel loaders to enhance operator visibility and job site safety. Utilizing stereo cameras and machine learning, SmartDetect provides 3D perception, detects bystanders and obstacles, and delivers real-time alerts through a secondary display. Future enhancements include an Assist feature for automatic stopping and SmartDetect Digital for push notifications, near-miss reports, and heat maps. This integration of AI and machine learning into construction machinery presents significant opportunities for Benelux, Africa, and Saudi Arabia’s earthworks and excavation markets.

Restraints/Challenges

- Delays in Government Project Approvals and Funding

The earthworks & excavation equipment market in the Benelux region, Africa, and Saudi Arabia faces significant challenges due to delays in government project approvals and funding. These setbacks lead to stalled construction and infrastructure projects, reducing demand for machinery and equipment. The uncertainty surrounding project timelines also hampers long-term investments and disrupts supply chains, ultimately affecting market growth and profitability in these regions.

For instance,

In November 2024, according to the blog published by the Government of South Africa, Minister Dean Macpherson addressed the delays in infrastructure projects across the country, which have caused significant financial and social repercussions. With nearly 80% of ongoing public infrastructure projects delayed, costing the government billions of rands, these stalled projects have resulted in wasted funds, incomplete buildings, and disrupted services. Delayed government approvals and funding slow the progress of large construction projects. These setbacks hinder machinery demand and market growth, as unfinished projects tie up resources and disrupt construction timelines, impacting the profitability and long-term viability of the earthworks and excavation sectors in these regions.

- Limited Infrastructure Development in Underdeveloped Regions

In Africa, poor transportation networks, unreliable power supply, and a lack of modern construction facilities hinder equipment deployment and reduce demand. In Saudi Arabia, while urban centers experience growth, remote and less-developed areas struggle with infrastructure gaps that limit large-scale earthworks projects. In the Benelux region, strict regulations and space constraints restrict expansion in rural and underdeveloped areas. These challenges lead to lower investment in advanced excavation machinery, hampering market penetration and technological progress.

For instance,

In April 2022, according to a blog published by Transport Africa, the continent's transport system remains underdeveloped due to inadequate infrastructure, poor road networks, and high transportation costs. Africa has only 2% of the world’s total railway coverage and 3% of its roadways, with over 200 million people living without access to all-weather roads. Additionally, poor maintenance and limited funding shorten the lifespan of existing infrastructure. High transportation costs, nearly double the global average, further hinder mobility.

This market report provides details of new recent developments, trade regulations, import-export analysis, production analysis, value chain optimization, market share, impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, strategic market growth analysis, market size, category market growths, application niches and dominance, product approvals, product launches, geographic expansions, technological innovations in the market. To gain more info on the market contact Data Bridge Market Research for an Analyst Brief, our team will help you take an informed market decision to achieve market growth.

Impact and Current Market Scenario of Raw Material Shortage and Shipping Delays

Data Bridge Market Research offers a high-level analysis of the market and delivers information by keeping in account the impact and current market environment of raw material shortage and shipping delays. This translates into assessing strategic possibilities, creating effective action plans, and assisting businesses in making important decisions.

Apart from the standard report, we also offer in-depth analysis of the procurement level from forecasted shipping delays, distributor mapping by region, commodity analysis, production analysis, price mapping trends, sourcing, category performance analysis, supply chain risk management solutions, advanced benchmarking, and other services for procurement and strategic support.

Expected Impact of Economic Slowdown on the Pricing and Availability of Products

When economic activity slows, industries begin to suffer. The forecasted effects of the economic downturn on the pricing and accessibility of the products are taken into account in the market insight reports and intelligence services provided by DBMR. With this, our clients can typically keep one step ahead of their competitors, project their sales and revenue, and estimate their profit and loss expenditures.

Earthworks & Excavation Equipment Market Scope

The market is segmented on the basis of products, fuel type, engine type, and application. The growth amongst these segments will help you analyze meagre growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Products

- Excavators

- Crawler Excavators

- Mini Excavators

- Wheeled Excavators

- Long Reach Excavators

- Dragline Excavators

- Skid Steer Excavators

- Suction Excavators

- Loaders

- Wheel Loaders

- Backhoe Loaders

- Skid Steer Loaders

- Bull Dozers

- Dump Trucks

- Others

Fuel Type

- Diesel-Powered Equipment

- Electric-Powered Equipment

- Hybrid-Powered Equipment

Engine Type

- Up To 250 HP

- 250-500 HP

- More Than 500 HP

Application

- Construction

- Commercial

- Residential

- Infrastructure Projects

- Mining and Quarrying

- Others

Earthworks & Excavation Equipment Market Regional Analysis

The market is analyzed and market size insights and trends are provided by country, products, fuel type, engine type, and application.

The countries covered in the market are Luxembourg, Belgium, Netherlands, Africa, and Saudi Arabia.

Africa is expected to dominate and the fastest growing region in the market due to rapid urbanization, large-scale infrastructure projects, and increasing foreign investments. Growing demand for expansion of mining and construction projects continues to accelerate market demand and industry growth.

The country section of the report also provides individual market impacting factors and changes in market regulation that impact the current and future trends of the market. Data points like down-stream and upstream value chain analysis, technical trends and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of Europe aerospace adhesive - sealants brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

Earthworks & Excavation Equipment Market Share

The market competitive landscape provides details of the competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

Earthworks & Excavation Equipment Market Leaders Operating in the Marketare:

- CNH Industrial N.V. (U.K.)

- Komatsu Ltd. (Japan)

- Deere & Company (U.S.)

- AB Volvo (Sweden)

- BEML Limited (India)

- Caterpillar (U.S.)

- Doosan Bobcat (South Korea)

- Hitachi Construction Machinery Co., Ltd. (Japan)

- HD Hyundai Construction Equipment Co.Ltd. (Republic of Korea)

- J C Bamford Excavators Ltd. (U.K.)

- Kobelco Construction Machinery Co. Ltd (Japan)

- LIEBHERR (Switzerland)

- SANY Group (China)

- Sumitomo Heavy Industries, Ltd. (Japan)

- Terex Corporation (U.S.)

- XCMG Group (China)

Latest Developments in Earthworks & Excavation Equipment Market

- In September 2024, Deere & Company introduced SmartDetect for select utility-class and production-class wheel loaders, enhancing jobsite safety through advanced object detection. Utilizing cameras, radar, and machine learning, SmartDetect improves situational awareness by providing operators with enhanced visibility of their surroundings. Expanding its portfolio of safety solutions, John Deere also offers SmartDetect Field Kits, enabling improved detection capabilities on existing machines, reinforcing its commitment to innovation and operator confidence in demanding jobsite environments

- In October 2024, Deere & Company introduced its next-generation SmartGrade technology for small dozers, enhancing flexibility, ease of use, and performance. Now available with both Leica and Topcon solutions, the upgraded system expands options for construction professionals. "Since its launch in 2016, SmartGrade has been a proven solution, enabling customers to achieve precise grading efficiently," said Matt Costello, Product Marketing Manager at John Deere

- In October 2024, BEML Limited has planned a ₹900 crore (USD 103.08 million) capital expenditure until FY25 and re-entered the construction equipment market after five years to tap into a ₹45,000 crore (USD 5,154.02 million) market opportunity. This move boosts BEML’s presence in Earthworks and Excavation Equipment by introducing higher-capacity machines, expanding its product portfolio, and driving long-term growth through strategic business restructuring

- In October 2024, Caterpillar and Trimble have extended their joint venture to advance grade control solutions, expanding distribution and interoperability in construction equipment. This move enhances Caterpillar’s presence in Earthworks and Excavation Equipment by offering factory-fit grade control options, seamless upgrades, and broader aftermarket solutions, boosting efficiency, precision, and accessibility for Cat and mixed fleet customers

SKU-

Obtenha acesso online ao relatório sobre a primeira nuvem de inteligência de mercado do mundo

- Painel interativo de análise de dados

- Painel de análise da empresa para oportunidades de elevado potencial de crescimento

- Acesso de analista de pesquisa para personalização e customização. consultas

- Análise da concorrência com painel interativo

- Últimas notícias, atualizações e atualizações Análise de tendências

- Aproveite o poder da análise de benchmark para um rastreio abrangente da concorrência

Índice

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELING

2.7 PRODUCTS TIMELINE CURVE

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 DBMR VENDOR SHARE ANALYSIS

2.11 MARKET APPLICATION COVERAGE GRID

2.12 SECONDARY SOURCES

2.13 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PORTERS 5 FORCES

4.2 SUPPLY CHAIN ANALYSIS OF THE BENELUX EARTHWORKS & EXCAVATION EQUIPMENT MARKET

4.3 REGULATORY STANDARDS

4.4 TECHNOLOGICAL TRENDS IN BENELUX EARTHWORKS & EXCAVATION EQUIPMENT MARKET

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 RAPID URBANIZATION AND INFRASTRUCTURE DEVELOPMENT

5.1.2 GROWING CONSTRUCTION PROJECTS CONTINUES TO ACCELERATE MARKET DEMAND AND INDUSTRY GROWTH

5.1.3 INCREASING INVESTMENTS IN TRANSPORTATION AND SMART CITIES

5.1.4 RISING DEMAND FOR SMART AND AUTOMATED MACHINERY

5.2 RESTRAINTS

5.2.1 HIGH COST OF ADVANCED MACHINERY WITH AUTOMATION FEATURES

5.2.2 LIMITED INFRASTRUCTURE DEVELOPMENT IN UNDERDEVELOPED REGIONS

5.3 OPPORTUNITIES

5.3.1 ADVANCEMENTS IN ELECTRIC AND AUTONOMOUS CONSTRUCTION EQUIPMENT

5.3.2 INTEGRATION OF AI AND MACHINE LEARNING IN MACHINERY

5.3.3 DEMAND FOR MULTI-FUNCTIONAL AND COMPACT EQUIPMENT

5.4 CHALLENGES

5.4.1 DELAYS IN GOVERNMENT PROJECT APPROVALS AND FUNDING

5.4.2 STRICT REGULATORY COMPLIANCE AND SAFETY STANDARDS

6 BENELUX EARTHWORKS & EXCAVATION EQUIPMENT MARKET, BY PRODUCTS

6.1 OVERVIEW

6.2 EXCAVATORS

6.2.1 CRAWLER EXCAVATORS

6.2.2 MINI EXCAVATORS

6.2.3 WHEELED EXCAVATORS

6.2.4 LONG REACH EXCAVATORS

6.2.5 DRAGLINE EXCAVATORS

6.2.6 SKID STEER EXCAVATORS

6.2.7 SUCTION EXCAVATORS

6.3 LOADERS

6.3.1 WHEEL LOADERS

6.3.2 BACKHOE LOADERS

6.3.3 SKID STEER LOADERS

6.4 BULL DOZERS

6.5 DUMP TRUCKS

6.6 OTHERS

7 BENELUX EARTHWORKS & EXCAVATION EQUIPMENT MARKET, BY FUEL TYPE

7.1 OVERVIEW

7.2 DIESEL-POWERED EQUIPMENT

7.3 ELECTRIC-POWERED EQUIPMENT

7.4 HYBRID-POWERED EQUIPMENT

8 BENELUX EARTHWORKS & EXCAVATION EQUIPMENT MARKET, BY ENGINE TYPE

8.1 OVERVIEW

8.2 UP TO 250 HP

8.3 250-500 HP

8.4 MORE THAN 500 HP

9 BENELUX EARTHWORKS & EXCAVATION EQUIPMENT MARKET, BY APPLICATION

9.1 OVERVIEW

9.2 CONSTRUCTION

9.2.1 COMMERCIAL

9.2.2 RESIDENTIAL

9.3 INFRASTRUCTURE PROJECTS

9.4 MINING AND QUARRYING

9.5 OTHERS

10 BENELUX, EARTHWORKS & EXCAVATION EQUIPMENT MARKET, BY COUNTRY

10.1 BENELUX

10.1.1 NETHERLANDS

10.1.2 BELGIUM

10.1.3 LUXEMBOURG

11 BENELUX EARTHWORKS & EXCAVATION EQUIPMENT MARKET, COMPANY LANDSCAPE

11.1 COMPANY SHARE ANALYSIS: BENELUX

12 SWOT ANALYSIS

13 COMPANY PROFILE

13.1 KOMATSU LTD.

13.1.1 COMPANY SNAPSHOT

13.1.2 REVENUE ANALYSIS

13.1.3 BUSINESS PORTFOLIO

13.1.4 RECENT DEVELOPMENTS

13.2 HD HYUNDAI CONSTRUCTION EQUIPMENT CO.,LTD.

13.2.1 COMPA.NY SNAPSHOT

13.2.2 REVENUE ANALYSIS

13.2.3 PRODUCT PORTFOLIO

13.2.4 RECENT DEVELOPMENTS/NEWS

13.3 CATERPILLAR

13.3.1 COMPANY SNAPSHOT

13.3.2 REVENUE ANALYSIS

13.3.3 BRAND PORTFOLIO

13.3.4 RECENT DEVELOPMENTS

13.4 DEERE & COMPANY

13.4.1 COMPANY SNAPSHOT

13.4.2 REVENUE ANALYSIS

13.4.3 PRODUCT PORTFOLIO

13.4.4 RECENT DEVELOPMENTS

13.5 AB VOLVO

13.5.1 COMPANY SNAPSHOT

13.5.2 REVENUE ANALYSIS

13.5.3 PRODUCT PORTFOLIO

13.5.4 RECENT DEVELOPMENTS

13.6 CNH INDUSTRIAL N.V.

13.6.1 COMPANY SNAPSHOT

13.6.2 REVENUE ANALYSIS

13.6.3 PRODUCT PORTFOLIO

13.6.4 RECENT DEVELOPMENTS/NEWS

13.7 DOOSAN BOBCAT

13.7.1 COMPANY SNAPSHOT

13.7.2 REVENUE ANALYSIS

13.7.3 PRODUCT PORTFOLIO

13.7.4 RECENT DEVELOPMENTS

13.8 HITACHI CONSTRUCTION MACHINERY CO., LTD.

13.8.1 COMPANY SNAPSHOT

13.8.2 REVENUE ANALYSIS

13.8.3 PRODUCT PORTFOLIO

13.8.4 RECENT DEVELOPMENTS

13.9 J C BAMFORD EXCAVATORS LTD.

13.9.1 COMPANY SNAPSHOT

13.9.2 PRODUCT PORTFOLIO

13.9.3 RECENT DEVELOPMENTS

13.1 KOBELCO CONSTRUCTION MACHINERY CO., LTD.

13.10.1 COMPANY SNAPSHOT

13.10.2 PRODUCT PORTFOLIO

13.10.3 RECENT DEVELOPMENTS/NEWS

13.11 LIEBHERR

13.11.1 COMPANY SNAPSHOT

13.11.2 REVENUE ANALYSIS

13.11.3 PRODUCT PORTFOLIO

13.11.4 RECENT DEVELOPMENTS

13.12 MANITOU BF

13.12.1 COMPANY SNAPSHOT

13.12.2 REVENUE ANALYSIS

13.12.3 BRAND PORTFOLIO

13.12.4 RECENT DEVELOPMENTS

13.13 SUMITOMO HEAVY INDUSTRIES, LTD.

13.13.1 COMPANY SNAPSHOT

13.13.2 REVENUE ANALYSIS

13.13.3 PRODUCT PORTFOLIO

13.13.4 RECENT DEVELOPMENTS

13.14 TEREX CORPORATION

13.14.1 COMPANY SNAPSHOT

13.14.2 REVENUE ANALYSIS

13.14.3 PRODUCT PORTFOLIO

13.14.4 RECENT DEVELOPMENTS

13.15 XCMG GROUP

13.15.1 COMPANY SNAPSHOT

13.15.2 REVENUE ANALYSIS

13.15.3 PRODUCT PORTFOLIO

13.15.4 RECENT DEVELOPMENT

14 QUESTIONNAIRE

15 RELATED REPORTS

Lista de Tabela

TABLE 1 REGULATORY STANDARDS RELATED TO BENELUX EARTHWORKS & EXCAVATION EQUIPMENT MARKET

TABLE 2 REGULATORY COMPLIANCE & SAFETY STANDARDS

TABLE 3 BENELUX EARTHWORKS & EXCAVATION EQUIPMENT MARKET, BY PRODUCTS, 2018-2032 (USD THOUSAND)

TABLE 4 BENELUX EXCAVATORS IN EARTHWORKS & EXCAVATION EQUIPMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 5 BENELUX LOADERS IN EARTHWORKS & EXCAVATION EQUIPMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 6 BENELUX EARTHWORKS & EXCAVATION EQUIPMENT MARKET, BY FUEL TYPE, 2018-2032 (USD THOUSAND)

TABLE 7 BENELUX EARTHWORKS & EXCAVATION EQUIPMENT MARKET, BY ENGINE TYPE, 2018-2032 (USD THOUSAND)

TABLE 8 BENELUX EARTHWORKS & EXCAVATION EQUIPMENT MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 9 BENELUX CONSTRUCTION IN EARTHWORKS & EXCAVATION EQUIPMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 10 BENELUX EARTHWORKS & EXCAVATION EQUIPMENT MARKET, BY COUNTRY, 2018-2032 (USD THOUSAND)

TABLE 11 NETHERLANDS EARTHWORKS & EXCAVATION EQUIPMENT MARKET, BY PRODUCTS, 2018-2032 (USD THOUSAND)

TABLE 12 NETHERLANDS EXCAVATORS IN EARTHWORKS & EXCAVATION EQUIPMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 13 NETHERLANDS LOADERS IN EARTHWORKS & EXCAVATION EQUIPMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 14 NETHERLANDS EARTHWORKS & EXCAVATION EQUIPMENT MARKET, BY FUEL TYPE, 2018-2032 (USD THOUSAND)

TABLE 15 NETHERLANDS EARTHWORKS & EXCAVATION EQUIPMENT MARKET, BY ENGINE TYPE, 2018-2032 (USD THOUSAND)

TABLE 16 NETHERLANDS EARTHWORKS & EXCAVATION EQUIPMENT MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 17 NETHERLANDS CONSTRUCTION IN EARTHWORKS & EXCAVATION EQUIPMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 18 BELGIUM EARTHWORKS & EXCAVATION EQUIPMENT MARKET, BY PRODUCTS, 2018-2032 (USD THOUSAND)

TABLE 19 BELGIUM EXCAVATORS IN EARTHWORKS & EXCAVATION EQUIPMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 20 BELGIUM LOADERS IN EARTHWORKS & EXCAVATION EQUIPMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 21 BELGIUM EARTHWORKS & EXCAVATION EQUIPMENT MARKET, BY FUEL TYPE, 2018-2032 (USD THOUSAND)

TABLE 22 BELGIUM EARTHWORKS & EXCAVATION EQUIPMENT MARKET, BY ENGINE TYPE, 2018-2032 (USD THOUSAND)

TABLE 23 BELGIUM EARTHWORKS & EXCAVATION EQUIPMENT MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 24 BELGIUM CONSTRUCTION IN EARTHWORKS & EXCAVATION EQUIPMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 25 LUXEMBOURG EARTHWORKS & EXCAVATION EQUIPMENT MARKET, BY PRODUCTS, 2018-2032 (USD THOUSAND)

TABLE 26 LUXEMBOURG EXCAVATORS IN EARTHWORKS & EXCAVATION EQUIPMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 27 LUXEMBOURG LOADERS IN EARTHWORKS & EXCAVATION EQUIPMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 28 LUXEMBOURG EARTHWORKS & EXCAVATION EQUIPMENT MARKET, BY FUEL TYPE, 2018-2032 (USD THOUSAND)

TABLE 29 LUXEMBOURG EARTHWORKS & EXCAVATION EQUIPMENT MARKET, BY ENGINE TYPE, 2018-2032 (USD THOUSAND)

TABLE 30 LUXEMBOURG EARTHWORKS & EXCAVATION EQUIPMENT MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 31 LUXEMBOURG CONSTRUCTION IN EARTHWORKS & EXCAVATION EQUIPMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

Lista de Figura

FIGURE 1 BENELUX EARTHWORKS & EXCAVATION EQUIPMENT MARKET

FIGURE 2 BENELUX EARTHWORKS & EXCAVATION EQUIPMENT MARKET: DATA TRIANGULATION

FIGURE 3 BENELUX EARTHWORKS & EXCAVATION EQUIPMENT MARKET: DROC ANALYSIS

FIGURE 4 BENELUX EARTHWORKS & EXCAVATION EQUIPMENT MARKET: COUNTRY-WISE MARKET ANALYSIS

FIGURE 5 BENELUX EARTHWORKS & EXCAVATION EQUIPMENT MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 BENELUX EARTHWORKS & EXCAVATION EQUIPMENT MARKET: MULTIVARIATE MODELLING

FIGURE 7 BENELUX EARTHWORKS & EXCAVATION EQUIPMENT MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 8 BENELUX EARTHWORKS & EXCAVATION EQUIPMENT MARKET: DBMR MARKET POSITION GRID

FIGURE 9 BENELUX EARTHWORKS & EXCAVATION EQUIPMENT MARKET: VENDOR SHARE ANALYSIS

FIGURE 10 BENELUX EARTHWORKS & EXCAVATION EQUIPMENT MARKET: APPLICATION COVERAGE GRID

FIGURE 11 BENELUX EARTHWORKS & EXCAVATION EQUIPMENT MARKET: SEGMENTATION

FIGURE 12 FIVE SEGMENTS COMPRISE THE BENELUX EARTHWORKS & EXCAVATION EQUIPMENT MARKET, BY PRODUCTS (2024)

FIGURE 13 BENELUX EARTHWORKS & EXCAVATION EQUIPMENT MARKET: EXECUTIVE SUMMARY

FIGURE 14 STRATEGIC DECISIONS

FIGURE 15 RAPID URBANIZATION AND INFRASTRUCTURE DEVELOPMENT IS EXPECTED TO DRIVE THE BENELUX EARTHWORKS & EXCAVATION EQUIPMENT MARKET IN THE FORECAST PERIOD

FIGURE 16 THE EXCAVATORS SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE BENELUX EARTHWORKS & EXCAVATION EQUIPMENT MARKET IN 2025 AND 2032

FIGURE 17 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES IN BENELUX EARTHWORKS & EXCAVATION EQUIPMENT MARKET

FIGURE 18 NUMBER OF BUILDING PERMITS IN RESIDENTIAL CONSTRUCTION (BELGIUM)

FIGURE 19 KEY BENELUX CONSTRUCTION PROJECTS (2022)

FIGURE 20 BENELUX EARTHWORKS & EXCAVATION EQUIPMENT MARKET: BY PRODUCTS, 2024

FIGURE 21 BENELUX EARTHWORKS & EXCAVATION EQUIPMENT MARKET: BY FUEL TYPE, 2024

FIGURE 22 BENELUX EARTHWORKS & EXCAVATION EQUIPMENT MARKET: BY ENGINE TYPE, 2024

FIGURE 23 BENELUX EARTHWORKS & EXCAVATION EQUIPMENT MARKET: BY APPLICATION, 2024

FIGURE 24 BENELUX EARTHWORKS & EXCAVATION EQUIPMENT MARKET: COMPANY SHARE 2024 (%)

Metodologia de Investigação

A recolha de dados e a análise do ano base são feitas através de módulos de recolha de dados com amostras grandes. A etapa inclui a obtenção de informações de mercado ou dados relacionados através de diversas fontes e estratégias. Inclui examinar e planear antecipadamente todos os dados adquiridos no passado. Da mesma forma, envolve o exame de inconsistências de informação observadas em diferentes fontes de informação. Os dados de mercado são analisados e estimados utilizando modelos estatísticos e coerentes de mercado. Além disso, a análise da quota de mercado e a análise das principais tendências são os principais fatores de sucesso no relatório de mercado. Para saber mais, solicite uma chamada de analista ou abra a sua consulta.

A principal metodologia de investigação utilizada pela equipa de investigação do DBMR é a triangulação de dados que envolve a mineração de dados, a análise do impacto das variáveis de dados no mercado e a validação primária (especialista do setor). Os modelos de dados incluem grelha de posicionamento de fornecedores, análise da linha de tempo do mercado, visão geral e guia de mercado, grelha de posicionamento da empresa, análise de patentes, análise de preços, análise da quota de mercado da empresa, normas de medição, análise global versus regional e de participação dos fornecedores. Para saber mais sobre a metodologia de investigação, faça uma consulta para falar com os nossos especialistas do setor.

Personalização disponível

A Data Bridge Market Research é líder em investigação formativa avançada. Orgulhamo-nos de servir os nossos clientes novos e existentes com dados e análises que correspondem e atendem aos seus objetivos. O relatório pode ser personalizado para incluir análise de tendências de preços de marcas-alvo, compreensão do mercado para países adicionais (solicite a lista de países), dados de resultados de ensaios clínicos, revisão de literatura, mercado remodelado e análise de base de produtos . A análise de mercado dos concorrentes-alvo pode ser analisada desde análises baseadas em tecnologia até estratégias de carteira de mercado. Podemos adicionar quantos concorrentes necessitar de dados no formato e estilo de dados que procura. A nossa equipa de analistas também pode fornecer dados em tabelas dinâmicas de ficheiros Excel em bruto (livro de factos) ou pode ajudá-lo a criar apresentações a partir dos conjuntos de dados disponíveis no relatório.