Global Pro Self Hosted Master Card Market

Tamanho do mercado em biliões de dólares

CAGR :

%

USD

163.04 Billion

USD

433.45 Billion

2024

2032

USD

163.04 Billion

USD

433.45 Billion

2024

2032

| 2025 –2032 | |

| USD 163.04 Billion | |

| USD 433.45 Billion | |

|

|

|

|

Global Pro/Self-Hosted Master Card Market Segmentation, By Application (Micro and Small Enterprises, Large Enterprises, and Mid-Size Enterprises), End User (E-commerce store owner, Customers, and Others) – Industry Trends and Forecast to 2032

Pro/Self-Hosted Master Card Market Analysis

The pro/self-hosted master card market is experiencing significant growth, driven by the increasing adoption of digital payment solutions worldwide. These platforms allow businesses and individuals to host and manage payment gateways independently, offering enhanced customization, security, and control over transactions. With the global shift toward cashless economies, businesses are actively seeking advanced payment systems to streamline operations and improve customer experiences. Key advancements in the market include the integration of AI and machine learning for fraud detection, blockchain technology for secure and transparent transactions, and APIs enabling seamless integration with e-commerce platforms. These innovations cater to the growing demand for secure, scalable, and efficient payment systems, especially among small and medium enterprises. The Asia-Pacific region leads the market due to widespread adoption of cardless payments and significant investments in research and development. North America follows closely, driven by robust digital infrastructure and consumer preferences for secure, convenient payment methods. As businesses increasingly prioritize security, scalability, and flexibility, the pro/self-hosted master card market is poised for robust growth globally.

Pro/Self-Hosted Master Card Market Size

The global pro/self-hosted master card market size was valued at USD 163.04 billion in 2024 and is projected to reach USD 433.45 billion by 2032, with a CAGR of 13.00% during the forecast period of 2025 to 2032. In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis.

Pro/Self-Hosted Master Card Market Trends

“Increasing Integration of Blockchain Technology”

The pro/self-hosted master card market is witnessing rapid growth, with a notable trend being the integration of blockchain technology to enhance security and transparency in transactions. This trend addresses increasing concerns about fraud and data breaches in digital payments. By leveraging blockchain, companies can provide immutable transaction records and reduce the risk of unauthorized access. For instance, businesses such as GMO Payment Gateway (Japan) have started integrating blockchain-based systems to streamline cross-border payments for small and mid-size enterprises (SMEs). This advancement aligns with the growing demand for customizable and secure payment solutions, especially in regions such as Asia-Pacific, where digital payment adoption is booming. In addition, the market's focus on enabling businesses to independently manage payment gateways ensures scalability and cost efficiency, catering to diverse enterprise needs. As companies prioritize secure, efficient, and transparent payment processes, the integration of blockchain is setting a benchmark in the pro/self-hosted master card market's evolution.

Report Scope and Pro/Self-Hosted Master Card Market Segmentation

|

Attributes |

Pro/Self-Hosted Master Card Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

U.S., Canada and Mexico in North America, Germany, France, U.K., Netherlands, Switzerland, Belgium, Russia, Italy, Spain, Turkey, Rest of Europe in Europe, China, Japan, India, South Korea, Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in the Asia-Pacific (APAC), Saudi Arabia, U.A.E, South Africa, Egypt, Israel, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA), Brazil, Argentina and Rest of South America as part of South America |

|

Key Market Players |

Fiserv, Inc. (U.S.), Adyen (Netherlands), CashU (United Arab Emirates), Stripe (U.S.), GMO Payment Gateway, Inc. (Japan), Verizon (U.S.), Alibaba (China), Verifone (U.S.), Visa (U.S.), CCBill, LLC (U.S.), SecurePay (Australia), NASPERS (South Africa), Global Payments Inc. (U.S.), Capital One (U.S.), American Express Company (U.S.), Mastercard (U.S.), Citigroup Inc. (U.S.), PayPal (U.S.), and State Bank of India (India) |

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis. |

Pro/Self-Hosted Master Card Market Definition

The Pro/Self-Hosted master card refers to a payment solution framework that allows businesses to independently manage and host their payment processing systems. Unlike fully hosted solutions provided by third-party payment processors, pro/self-hosted systems give businesses greater control over transaction workflows, data security, and customization. These systems enable organizations to integrate payment gateways directly into their platforms, providing a seamless and branded payment experience for customers. Pro/self-hosted Mastercard solutions are particularly favored by enterprises seeking enhanced flexibility, scalability, and autonomy in handling digital payments, catering to industries ranging from e-commerce to financial services.

Pro/Self-Hosted Master Card Market Dynamics

Drivers

- Rising Inclination of Customers Towards Cashless and Card-Less Payments

The rise in the inclination of customers towards cashless and card-less payments is a key driver in the growth of the pro/self-hosted master card market. According to a 2023 report by the World Bank, the number of people using digital payment methods has surged globally, with over 2.7 billion people making online purchases in 2022 alone, and the trend is accelerating. Consumers, especially in regions such as Asia-Pacific and North America, are increasingly preferring mobile wallets, QR code payments, and direct bank transfers, as they offer convenience, speed, and enhanced security compared to traditional payment methods. For instance, Alipay and WeChat Pay in China have dramatically shifted the payment landscape, with millions of daily transactions conducted without physical cards. This growing demand for cashless and card-less transactions is fueling the need for self-hosted payment systems, where businesses can independently manage secure and scalable digital payment solutions, aligning with the global shift towards digitalization and secure online payments.

- Increasing penetration of smartphones into consumer lifestyle

The rise in the penetration of smartphones into consumer lifestyle is a significant driver for the growth of the pro/self-hosted master card market. As smartphones become essential tools for everyday activities, mobile payments have gained widespread adoption. According to Statista, the global number of smartphone users is expected to surpass 7.7 billion by 2025, further expanding the market for mobile payment solutions. This widespread smartphone use has led to the adoption of mobile wallets such as Apple Pay, Google Pay, and Samsung Pay, enabling consumers to make quick, secure, and card-less payments directly from their devices. For instance, in 2023, Google Pay alone processed over USD 2 trillion in payments globally, illustrating the growing reliance on smartphones for digital transactions. This shift towards mobile payments is pushing businesses to adopt self-hosted payment systems to provide seamless, secure, and personalized payment experiences, driving demand for flexible payment gateways that integrate directly with smartphone platforms. As smartphones continue to dominate consumer behavior, this trend accelerates the need for scalable and secure payment solutions in the pro/self-hosted master card market.

Opportunities

- Rise in Research and Development (R&D) Activities

The rise in research and development (R&D) activities within the financial technology sector presents a significant market opportunity for the pro/self-hosted master card market. As companies invest more in innovation, new technologies such as artificial intelligence (AI), blockchain, and biometric authentication are being integrated into payment systems, enhancing security and efficiency. For instance, Visa and Mastercard have heavily invested in R&D to develop AI-powered fraud detection systems, which significantly reduce fraudulent transactions and improve consumer trust. In addition, R&D in blockchain is helping to create more secure, transparent, and cost-effective payment solutions for cross-border transactions. As businesses seek cutting-edge payment technologies, the demand for self-hosted payment systems that can be customized and scaled to meet these innovations grows. This surge in R&D activities opens up new avenues for businesses to adopt advanced, self-managed payment systems, making it a critical opportunity for market expansion and the development of next-generation payment solutions.

- Increasing Demand in Emerging Economies

The rise in demand from emerging economies presents a significant market opportunity for the pro/self-hosted master card market, driven by the rapid digitalization and growing middle class in regions such as Asia-Pacific, Latin America, and Africa. As these economies experience increased smartphone penetration and internet connectivity, there is a surge in the adoption of digital payments. For instance, India's digital payment market has grown substantially, with over 7 billion transactions processed via UPI (Unified Payments Interface) in 2023 alone. This growth is fueled by government initiatives such as Digital India, which aim to promote cashless transactions. As a result, businesses in emerging markets are seeking customizable, secure, and scalable payment solutions, creating a high demand for pro/self-hosted payment systems. These systems enable businesses to independently manage transactions while offering a seamless experience to the growing number of tech-savvy consumers. With emerging economies rapidly adopting digital payment methods, the pro/self-hosted master card market is positioned for significant expansion in these regions.

Restraints/Challenges

- Security Concerns

Security concerns remain a major challenge in the pro/self-hosted master card market, despite advancements in payment security technologies. Self-hosted systems require businesses to manage sensitive customer data, including credit card details and personal information, which makes them a target for cyberattacks and data breaches. For instance, in 2020, the American Medical Collection Agency (AMCA) suffered a massive breach, exposing the personal and financial information of over 20 million consumers. Such incidents highlight the vulnerability of self-hosted payment systems, where businesses must ensure robust security measures such as encryption, firewalls, and continuous monitoring to safeguard data. However, many smaller businesses may lack the resources to implement these measures, leaving them exposed to potential breaches. As a result, security remains a critical concern for businesses adopting pro/self-hosted systems, posing a significant market challenge. The growing threat of cyberattacks could hinder the adoption of these solutions, as companies seek more secure, fully hosted options from established payment providers.

- High Initial Investment

High initial investment is a significant challenge in the pro/self-hosted Mastercard market, as developing and maintaining self-hosted payment gateways requires substantial upfront capital for technology, infrastructure, and skilled personnel. Businesses must invest in building secure and scalable payment systems, which can involve costs for hardware, software development, cybersecurity, and compliance with regulatory standards. For instance, a company looking to implement a self-hosted payment gateway must purchase or rent the necessary infrastructure and hire specialized IT staff to design, implement, and maintain the system. An instance of this can be seen in companies such as Stripe or PayPal, which offer hosted payment solutions that offload these heavy investments, making it easier for businesses to adopt without the upfront costs. Smaller businesses, in particular, may struggle with these high costs, as they lack the financial resources to invest in the complex infrastructure required. This challenge of high initial investment makes it harder for businesses, especially SMEs, to embrace self-hosted systems, thus limiting market growth in this segment.

This market report provides details of new recent developments, trade regulations, import-export analysis, production analysis, value chain optimization, market share, impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, strategic market growth analysis, market size, category market growths, application niches and dominance, product approvals, product launches, geographic expansions, technological innovations in the market. To gain more info on the market contact Data Bridge Market Research for an Analyst Brief, our team will help you take an informed market decision to achieve market growth.

Pro/Self-Hosted Master Card Market Scope

The market is segmented on the basis of application and end user. The growth amongst these segments will help you analyze meagre growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Application

- Micro and Small Enterprises

- Large Enterprises

- Mid-Size Enterprises

End User

- E-commerce Store Owners

- Customers

- Others

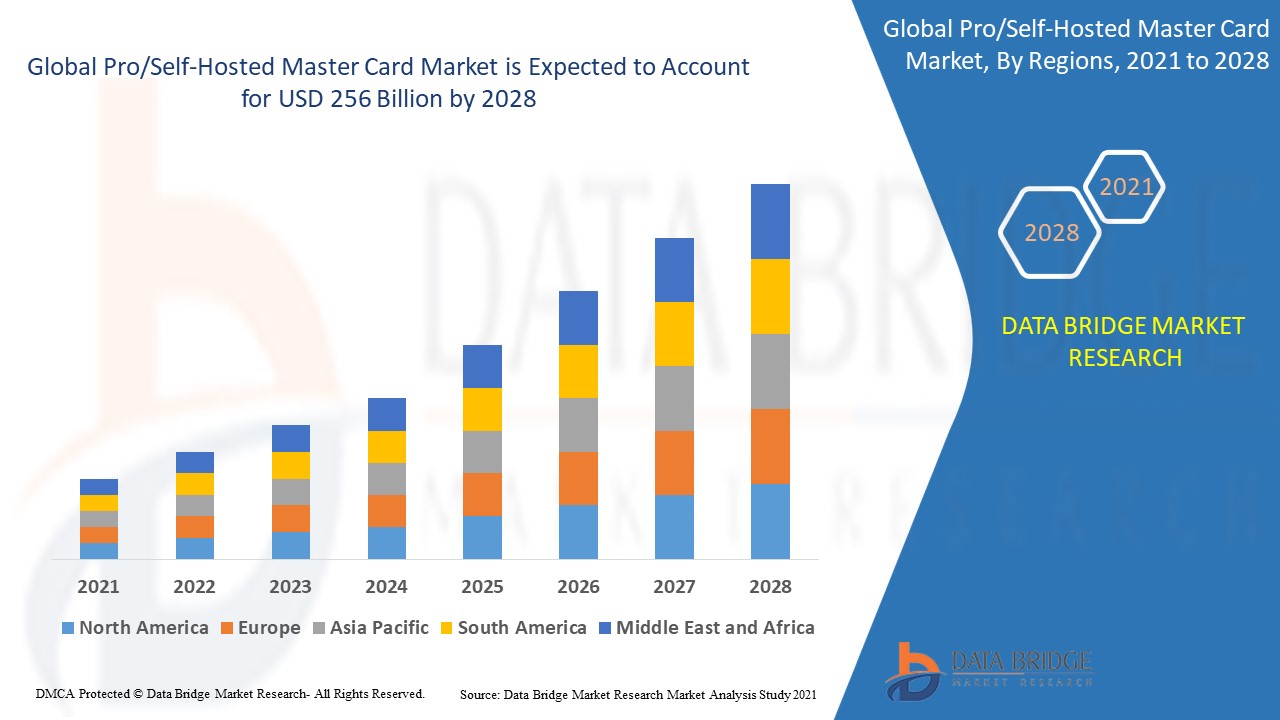

Pro/Self-Hosted Master Card Market Regional Analysis

The market is analyzed and market size insights and trends are provided by country, application, and end user as referenced above.

The countries covered in the market report are U.S., Canada, Mexico in North America, Germany, Sweden, Poland, Denmark, Italy, U.K., France, Spain, Netherland, Belgium, Switzerland, Turkey, Russia, Rest of Europe in Europe, Japan, China, India, South Korea, New Zealand, Vietnam, Australia, Singapore, Malaysia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in Asia-Pacific (APAC), Brazil, Argentina, Rest of South America as a part of South America, U.A.E, Saudi Arabia, Oman, Qatar, Kuwait, South Africa, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA).

Asia-Pacific is anticipated to lead the pro/self-hosted master card market during the forecast period. This dominance is driven by a growing preference among consumers for cashless and cardless payment solutions, fueled by advancements in digital payment technologies. In addition, the region is witnessing a significant rise in research and development activities aimed at enhancing payment systems, further bolstering market growth. These factors collectively position Asia-Pacific as a key hub for innovation and adoption in this sector.

North America is expected to experience highest growth rate in the pro/self-hosted master card market. This growth is attributed to the widespread adoption of cashless and cardless payment methods, driven by advanced digital infrastructure and high consumer awareness. The region's strong emphasis on convenience and security in payment systems further accelerates this trend. These factors position North America as a thriving market with significant opportunities for innovation and expansion in digital payment solutions.

The country section of the report also provides individual market impacting factors and changes in market regulation that impact the current and future trends of the market. Data points such as down-stream and upstream value chain analysis, technical trends and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of global brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

Pro/Self-Hosted Master Card Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

Pro/Self-Hosted Master Card Market Leaders Operating in the Market Are:

- Fiserv, Inc. (U.S.)

- Adyen (Netherlands)

- CashU (United Arab Emirates)

- Stripe (U.S.)

- GMO Payment Gateway, Inc. (Japan)

- Verizon (U.S.)

- Alibaba (China)

- Verifone (U.S.)

- Visa (U.S.)

- CCBill, LLC (U.S.)

- SecurePay (Australia)

- NASPERS (South Africa)

- Global Payments Inc. (U.S.)

- Capital One (U.S.)

- American Express Company (U.S.)

- Mastercard (U.S.)

- Citigroup Inc. (U.S.)

- PayPal (U.S.)

- State Bank of India (India)

SKU-

Obtenha acesso online ao relatório sobre a primeira nuvem de inteligência de mercado do mundo

- Painel interativo de análise de dados

- Painel de análise da empresa para oportunidades de elevado potencial de crescimento

- Acesso de analista de pesquisa para personalização e customização. consultas

- Análise da concorrência com painel interativo

- Últimas notícias, atualizações e atualizações Análise de tendências

- Aproveite o poder da análise de benchmark para um rastreio abrangente da concorrência

Metodologia de Investigação

A recolha de dados e a análise do ano base são feitas através de módulos de recolha de dados com amostras grandes. A etapa inclui a obtenção de informações de mercado ou dados relacionados através de diversas fontes e estratégias. Inclui examinar e planear antecipadamente todos os dados adquiridos no passado. Da mesma forma, envolve o exame de inconsistências de informação observadas em diferentes fontes de informação. Os dados de mercado são analisados e estimados utilizando modelos estatísticos e coerentes de mercado. Além disso, a análise da quota de mercado e a análise das principais tendências são os principais fatores de sucesso no relatório de mercado. Para saber mais, solicite uma chamada de analista ou abra a sua consulta.

A principal metodologia de investigação utilizada pela equipa de investigação do DBMR é a triangulação de dados que envolve a mineração de dados, a análise do impacto das variáveis de dados no mercado e a validação primária (especialista do setor). Os modelos de dados incluem grelha de posicionamento de fornecedores, análise da linha de tempo do mercado, visão geral e guia de mercado, grelha de posicionamento da empresa, análise de patentes, análise de preços, análise da quota de mercado da empresa, normas de medição, análise global versus regional e de participação dos fornecedores. Para saber mais sobre a metodologia de investigação, faça uma consulta para falar com os nossos especialistas do setor.

Personalização disponível

A Data Bridge Market Research é líder em investigação formativa avançada. Orgulhamo-nos de servir os nossos clientes novos e existentes com dados e análises que correspondem e atendem aos seus objetivos. O relatório pode ser personalizado para incluir análise de tendências de preços de marcas-alvo, compreensão do mercado para países adicionais (solicite a lista de países), dados de resultados de ensaios clínicos, revisão de literatura, mercado remodelado e análise de base de produtos . A análise de mercado dos concorrentes-alvo pode ser analisada desde análises baseadas em tecnologia até estratégias de carteira de mercado. Podemos adicionar quantos concorrentes necessitar de dados no formato e estilo de dados que procura. A nossa equipa de analistas também pode fornecer dados em tabelas dinâmicas de ficheiros Excel em bruto (livro de factos) ou pode ajudá-lo a criar apresentações a partir dos conjuntos de dados disponíveis no relatório.