Global Serine Amino Acids Market

Tamanho do mercado em biliões de dólares

CAGR :

%

USD

164.83 Million

USD

258.78 Million

2024

2032

USD

164.83 Million

USD

258.78 Million

2024

2032

| 2025 –2032 | |

| USD 164.83 Million | |

| USD 258.78 Million | |

|

|

|

|

Global Serine Amino Acids Market – By Type (Natural and Synthetic), Application (Pharmaceuticals, Food and Beverages, Cosmetics and Personal Care, and Animal Feed), End-User Industry (Pharmaceutical industry, Food and Beverage Industry, Cosmetics and Personal Care Industry, and Animal Feed Industry), Distribution Channel (Direct and Non-Direct Sales) - Industry Trends and Forecast to 2031.

Serine Amino Acids Market Analysis and Size

Serine is a considered as a vital component in the production of pharmaceuticals, including drugs for neurological disorders, cancer treatments, and cardiovascular medications. The growing health conditions globally drives the demand for serine amino acids in pharmaceutical formulations is expected to fuel the growth of the Market. Serine Amino acids play a significant role as constituents of medicines designed to treat neurological disorders, metabolic disorders and skin problems.

Regulatory frameworks governing the production and use of amino acids, including serine, can pose challenges for market players. Compliance with stringent regulations regarding quality standards, labeling requirements, and safety assessments adds complexity and costs to the manufacturing process, which are the potential restraints hampering the overall market. However, Technological advancements in biotechnology and fermentation processes have made the production of serine amino acids more efficient and cost-effective. This drives down production costs, making serine more accessible for various applications and stimulating market growth, further fuelling market growth offers favorable growth opportunities.

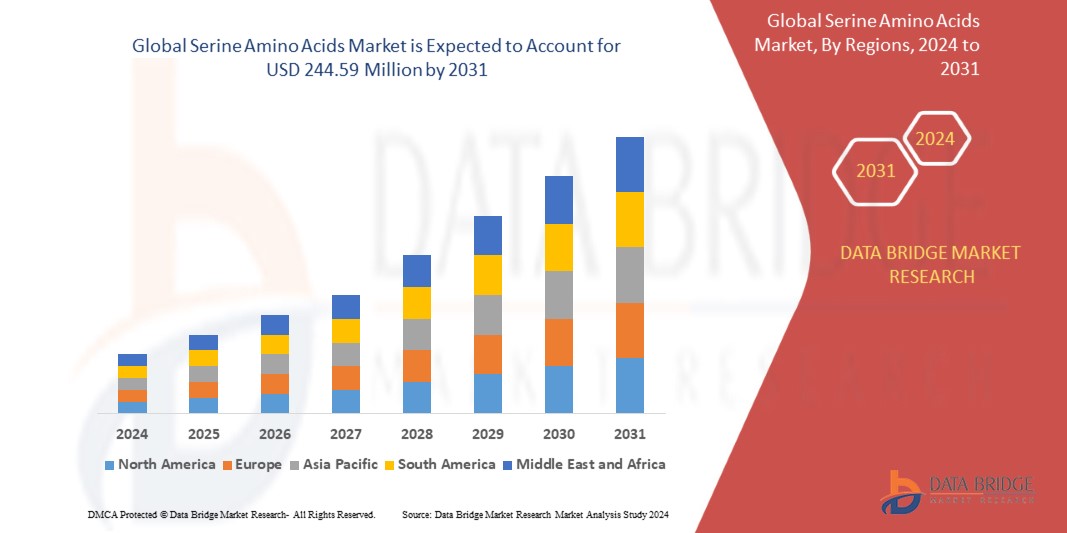

Data Bridge Market Research analyses that the global serine amino acids market was valued at USD 155.8 Million in 2023 is expected to reach the value of USD 244.59 Million by 2031, at a CAGR of 5.8% during the forecast period of 2024 to 2031. In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, geographically represented company-wise production and capacity, network layouts of distributors and partners, detailed and updated price trend analysis and deficit analysis of supply chain and demand.

Report Scope and Market Segmentation

|

Report Metric |

Details |

|

Forecast Period |

2024 to 2031 |

|

Base Year |

2023 |

|

Historic Years |

2022 (Customizable to 2016-2021) |

|

Quantitative Units |

Revenue in USD Million, Volumes in Units, Pricing in USD |

|

Segments Covered |

Type (Natural and Synthetic), Application (Pharmaceuticals, Food and Beverages, Cosmetics and Personal Care, and Animal Feed), End-User Industry (Pharmaceutical industry, Food and Beverage Industry, Cosmetics and Personal Care Industry, and Animal Feed Industry), Distribution Channel (Direct and Non-Direct Sales) |

|

Countries Covered |

U.S., Canada, Mexico, Germany, Sweden, Poland, Denmark, Italy, U.K., France, Spain, Netherlands, Belgium, Switzerland, Turkey, Russia, Rest of Europe, Japan, China, India, South Korea, New Zealand, Vietnam, Australia, Singapore, Malaysia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific, Brazil, Argentina, Rest of South America, U.A.E., Saudi Arabia, Oman, Qatar, Kuwait, South Africa, and Rest of Middle East and Africa |

|

Market Players Covered |

Ajinomoto Co., Inc. (Japan), CJ CheilJedang Corporation (South Korea), Evonik Industries AG (Germany), Kyowa Hakko Bio Co., Ltd. (Japan), Sumitomo Chemical Company, Limited (Japan), Meihua Holdings Group Co., Ltd. (China), Shine Star (Hubei) Biological Engineering Co., Ltd. (China), Cargill, Incorporated (U.S.), and Royal DSM N.V. (Netherlands) |

|

Market Opportunities |

|

Market Definition

Serine amino acids are organic compounds essential for protein synthesis and serve as building blocks for various biological processes in humans, animals, and plants. This market encompasses serine amino acids derived from both natural sources, such as proteins in foods, and synthetic sources produced through chemical synthesis or biotechnological methods. Key industries driving demand for serine amino acids include pharmaceuticals, nutraceuticals, cosmetics, personal care, and animal feed. The market involves manufacturers, suppliers, distributors, and end-users collaborating to meet the growing demand for serine amino acids while adhering to regulatory standards and quality requirements.

Serine Amino Acids Market Dynamics

Driver

- Growing Demand in the Pharmaceutical Sector

The pharmaceutical sector is experiencing a surge in demand for serine, a crucial ingredient used in producing medications for neurological disorders, cancer treatments, and cardiovascular diseases. This rise in demand is propelled by the rising incidence of these health conditions on a global scale. Serine amino acids play a pivotal role in the formulation of pharmaceuticals, contributing to their effectiveness in combating various medical ailments. As the prevalence of such conditions continues to grow worldwide, the pharmaceutical industry increasingly relies on serine to meet the escalating need for innovative and productive treatments, reflecting its indispensable significance in drug development.

- Expanding Nutraceutical Industry

With the growing demand for nutraceutical industry, serine gains prominence for its multifaceted benefits. It is widely known for its enhancing brain health, promoting muscle growth, and aiding digestion.Serine amino acids are increasingly sought after in supplements and functional foods. The rising demand for natural and functional ingredients drives the incorporation of serine into various nutraceutical products. Its diverse health-promoting properties align with consumer preferences for holistic wellness solutions, further fueling market growth. Serine's versatility and efficacy make it a valuable component in the nutraceutical sector, catering to the growing consumer interest in products that support overall health and well-being through natural and scientifically-backed ingredients.

Opportunities

- Advancements in Biotechnology

Recent advancements in biotechnology and fermentation techniques have revolutionized the production of serine amino acids, enhanced efficiency and reducing costs significantly. These advancements optimize the synthesis process, leading to higher yields and streamlined production, consequently driving down overall production costs. As a result, serine becomes more economically acceptable for a wide range of applications across various end-use industries. The increased accessibility of serine opens up opportunities for its incorporation into various products, including pharmaceuticals, nutraceuticals, and industrial applications. This cost-effectiveness fosters market growth by expanding the potential uses of serine and encouraging its integration into diverse sectors, fueling innovation and economic development.

- Rising Use of personal care products

Serine amino acids are gaining traction in the cosmetics and personal care industry due to their hydrating and skin-nourishing attributes. As consumers increasingly prioritize natural and sustainable ingredients in skincare and haircare products, serine's incorporation as a prominent component propels market growth. Serine's ability to moisturize and condition the skin and hair aligns with the demand for effective yet gentle formulations. Its inclusion enhances product efficacy and appeals to eco-conscious consumers seeking clean beauty solutions. This rising use of serine in personal care products reflects the opportunities to meet evolving consumer preferences and driving innovation in natural ingredient-based formulations.

Restraints/Challenges

- Price Volatility of Raw Materials

The cost of raw materials utilized in serine amino acid production, such as sugars or fermentation substrates, often experiences volatility due to various factors such as changes in agricultural yields, weather patterns, or geopolitical circumstances. This instability in raw material prices can directly affect the production expenses, consequently impacting the overall pricing of serine amino acids. Fluctuations in these input costs pose challenges for manufacturers, requiring them to adapt production processes and pricing strategies accordingly. The unpredictable nature of raw material pricing underscores the need for proactive risk management and strategic planning within the serine amino acid production industry.

- Regulatory and Environmental Challenges

Adhering to strict standards for quality, labeling, and safety assessments imposes complexities and increased expenses on manufacturers. Compliance with these regulations necessitates meticulous monitoring of production processes, extensive documentation, and rigorous testing procedures. Updation in regulatory changes can further impact operations, requiring constant adaptation and investment in regulatory compliance measures. The stringent regulatory environment underscores the importance of robust quality management systems and proactive engagement with regulatory authorities to ensure adherence to evolving standards while sustaining market competitiveness.

This market report provides details of new recent developments, trade regulations, import-export analysis, production analysis, value chain optimization, market share, impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, strategic market growth analysis, market size, category market growths, application niches and dominance, product approvals, product launches, geographic expansions, technological innovations in the market. To gain more info on the serine amino acid market contact Data Bridge Market Research for an Analyst Brief, our team will help you take an informed market decision to achieve market growth.

Recent Development

- In April 2024, the amino acid L-serine shows efficacy in treating patients with mutations in GRIN genes. The results of the clinical trial led by the Institut de Recerca Sant Joan de Déu – SJD Barcelona Children’s Hospital have been published in the scientific journal Brain. The study involved researchers from the Institute of Neurosciences at the University of Barcelona and the August Pi i Sunyer Biomedical Research Institute (IDIBAPS), who conducted the experimental studies, along with the University of Vic – Central University of Catalonia, which conducted the computational models

Serine Amino Acid Market Scope

The market is segmented into type, application, end user industry and application. The growth amongst these segments will help you analyze meagre growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Type

- Natural

- Synthetic

Application

- Pharmaceuticals

- Food and Beverages

- Cosmetics and Personal Care

- Animal Feed

End-User Industry

- Pharmaceutical industry

- Food and Beverage Industry

- Cosmetics and Personal Care Industry

- Animal Feed Industry

Distribution Channel

- Direct

- Non-Direct

Serine Amino Acids Market Regional Analysis/Insights

The market is analyzed and market size insights and trends are provided by type, application, end user industry and application as referenced above.

The countries covered in the market report are U.S., Canada, Mexico, Germany, Sweden, Poland, Denmark, Italy, U.K., France, Spain, Netherland, Belgium, Switzerland, Turkey, Russia, Rest of Europe, Japan, China, India, South Korea, New Zealand, Vietnam, Australia, Singapore, Malaysia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific, Brazil, Argentina, Rest of South America, UAE, Saudi Arabia, Oman, Qatar, Kuwait, South Africa, and Rest of Middle East and Africa.

North America is the most dominating region in market, holding the highest share share as it has a highly developed biotechnology infrastructure, facilitating efficient production processes for serine amino acids.

The U.S is expected to dominate in the market as the U.S. is a hub for research and development in biotechnology, leading to continuous innovation and improvements in serine production technologies.

The country section of the report also provides individual market impacting factors and changes in market regulation that impact the current and future trends of the market. Data points such as down-stream and upstream value chain analysis, technical trends and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of global brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

Competitive Landscape and Serine Amino Acids Market Share Analysis

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to the market.

Some of the major players operating in the market are:

- Ajinomoto Co., Inc. (Japan)

- CJ CheilJedang Corporation (South Korea)

- Evonik Industries AG (Germany)

- Kyowa Hakko Bio Co., Ltd. (Japan)

- Sumitomo Chemical Company, Limited (Japan)

- Meihua Holdings Group Co., Ltd. (China)

- Shine Star (Hubei) Biological Engineering Co., Ltd. (China)

- Cargill, Incorporated (U.S.)

- Royal DSM N.V. (Netherlands)

SKU-

Obtenha acesso online ao relatório sobre a primeira nuvem de inteligência de mercado do mundo

- Painel interativo de análise de dados

- Painel de análise da empresa para oportunidades de elevado potencial de crescimento

- Acesso de analista de pesquisa para personalização e customização. consultas

- Análise da concorrência com painel interativo

- Últimas notícias, atualizações e atualizações Análise de tendências

- Aproveite o poder da análise de benchmark para um rastreio abrangente da concorrência

Metodologia de Investigação

A recolha de dados e a análise do ano base são feitas através de módulos de recolha de dados com amostras grandes. A etapa inclui a obtenção de informações de mercado ou dados relacionados através de diversas fontes e estratégias. Inclui examinar e planear antecipadamente todos os dados adquiridos no passado. Da mesma forma, envolve o exame de inconsistências de informação observadas em diferentes fontes de informação. Os dados de mercado são analisados e estimados utilizando modelos estatísticos e coerentes de mercado. Além disso, a análise da quota de mercado e a análise das principais tendências são os principais fatores de sucesso no relatório de mercado. Para saber mais, solicite uma chamada de analista ou abra a sua consulta.

A principal metodologia de investigação utilizada pela equipa de investigação do DBMR é a triangulação de dados que envolve a mineração de dados, a análise do impacto das variáveis de dados no mercado e a validação primária (especialista do setor). Os modelos de dados incluem grelha de posicionamento de fornecedores, análise da linha de tempo do mercado, visão geral e guia de mercado, grelha de posicionamento da empresa, análise de patentes, análise de preços, análise da quota de mercado da empresa, normas de medição, análise global versus regional e de participação dos fornecedores. Para saber mais sobre a metodologia de investigação, faça uma consulta para falar com os nossos especialistas do setor.

Personalização disponível

A Data Bridge Market Research é líder em investigação formativa avançada. Orgulhamo-nos de servir os nossos clientes novos e existentes com dados e análises que correspondem e atendem aos seus objetivos. O relatório pode ser personalizado para incluir análise de tendências de preços de marcas-alvo, compreensão do mercado para países adicionais (solicite a lista de países), dados de resultados de ensaios clínicos, revisão de literatura, mercado remodelado e análise de base de produtos . A análise de mercado dos concorrentes-alvo pode ser analisada desde análises baseadas em tecnologia até estratégias de carteira de mercado. Podemos adicionar quantos concorrentes necessitar de dados no formato e estilo de dados que procura. A nossa equipa de analistas também pode fornecer dados em tabelas dinâmicas de ficheiros Excel em bruto (livro de factos) ou pode ajudá-lo a criar apresentações a partir dos conjuntos de dados disponíveis no relatório.