Middle East And Africa Nuts Market

Tamanho do mercado em biliões de dólares

CAGR :

%

USD

3.49 Billion

USD

5.11 Billion

2024

2032

USD

3.49 Billion

USD

5.11 Billion

2024

2032

| 2025 –2032 | |

| USD 3.49 Billion | |

| USD 5.11 Billion | |

|

|

|

|

Segmentação do mercado de nozes do Oriente Médio e África, por tipo de produto (nozes de árvore, nozes moídas, nozes híbridas/outras e outras), forma (inteira, manteiga, moída, metades, pedaços, óleo, leite, pasta, creme, pedaços torrados, revestidos, farinha, pó, picados, fatiados, em cubos, triturados, escaldados inteiros, congelados, secos por pulverização, encapsulados e outros), natureza (convencional e orgânica), método de processamento (cru, torrado, salgado, escaldado, aromatizado, sem sal, glaceado, cristalizado, caramelizado, defumado, germinado, fermentado, liofilizado, em conserva, frito a vácuo, desidratado e outros), grau (grau A (qualidade premium para exportação), grau B (uso doméstico de qualidade média), grau quebrado (uso em padaria e confeitaria), grau de óleo, grau industrial, grau rejeitado (ração animal)), prazo de validade (

Tamanho do mercado de nozes

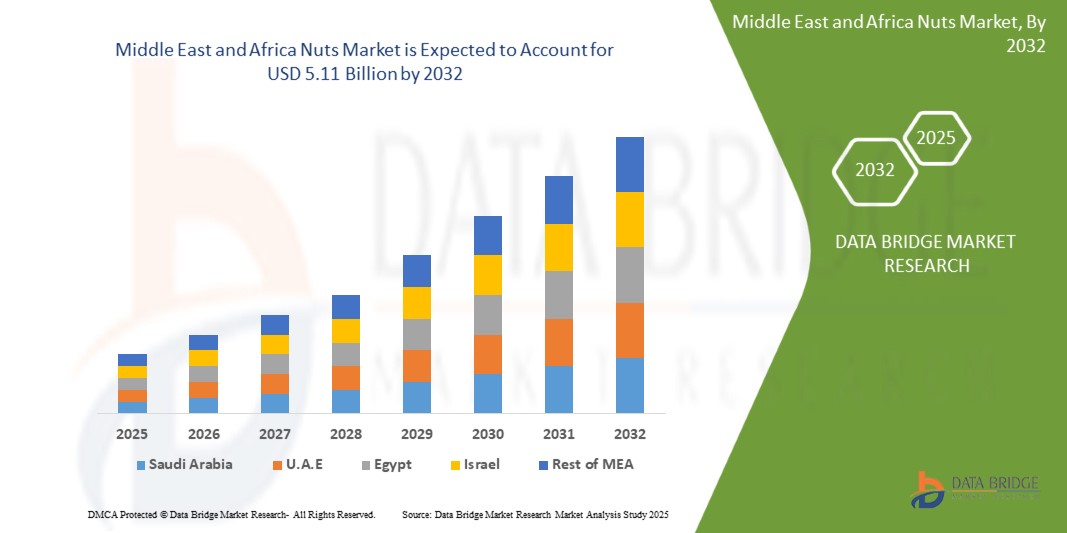

- O tamanho do mercado de nozes do Oriente Médio e da África foi avaliado em US$ 3,49 bilhões em 2024 e deve atingir US$ 5,11 bilhões até 2032 , com um CAGR de 5,0% durante o período previsto.

- O mercado de nozes é impulsionado principalmente pela crescente conscientização sobre seus benefícios à saúde, já que são ricas em fibras, proteínas, minerais, vitaminas e diversos outros antioxidantes. São uma boa fonte de gorduras saturadas e ajudam a manter o coração e o cérebro saudáveis. Os consumidores geralmente estão cientes das preferências por lanches veganos em todo o mundo.

Análise de Mercado de Nozes

- Uma noz é uma fruta composta por uma casca dura não comestível e uma semente comestível. Elas são uma boa fonte de gorduras boas, fibras e outros nutrientes benéficos. Cada tipo de noz oferece diferentes benefícios. As nozes estão entre as melhores fontes de proteínas vegetais. Uma dieta rica em nozes ajuda a prevenir fatores de risco, como inflamações ou algumas doenças crônicas.

- De muitas maneiras, comer nozes regularmente melhora a saúde, como reduzir o risco de diabetes e doenças cardíacas, além de diminuir os níveis de colesterol e triglicerídeos. Apesar do alto teor calórico, este tratamento nutritivo e rico em fibras também pode ajudar na perda de peso.

- Os Emirados Árabes Unidos são um dos principais mercados de castanhas no Oriente Médio, contribuindo significativamente para a receita regional. O alto consumo de castanhas durante o Ramadã e outras festividades culturais alimenta a demanda constante. Os consumidores preferem variedades de castanhas premium e saborizadas, incluindo pistaches, amêndoas e castanhas de caju torradas, frequentemente encontradas em redes de varejo, pacotes de presentes de luxo e no setor de hospitalidade.

- A Arábia Saudita representa uma fatia significativa do mercado de nozes do Oriente Médio, impulsionada por sua tradição de incluí-las em dietas diárias, eventos festivos e ofertas de hospitalidade. Tâmaras recheadas com amêndoas ou nozes são especialmente populares.

- Espera-se que o segmento de nozes domine o mercado devido à sua ampla disponibilidade, preço acessível e grande variedade de produtos.

Escopo do Relatório e Segmentação do Mercado de Nozes

|

Atributos |

Principais insights do mercado de nozes |

|

Segmentos abrangidos |

|

|

Países abrangidos |

Oriente Médio e África

|

|

Principais participantes do mercado |

|

|

Oportunidades de mercado |

|

|

Conjuntos de informações de dados de valor agregado |

Além dos insights sobre cenários de mercado, como valor de mercado, taxa de crescimento, segmentação, cobertura geográfica e principais participantes, os relatórios de mercado selecionados pela Data Bridge Market Research também incluem análises aprofundadas de especialistas, análises de preços, análises de participação de marca, pesquisas com consumidores, análises demográficas, análises da cadeia de suprimentos, análises da cadeia de valor, visão geral de matérias-primas/consumíveis, critérios de seleção de fornecedores, análise PESTLE, análise de Porter e estrutura regulatória. |

Tendências do mercado de nozes

“ Tendência crescente em direção a lanches mais saudáveis e escolhas nutritivas ”

- O mercado de nozes está crescendo rapidamente, impulsionado pela crescente tendência de lanches saudáveis. Os consumidores buscam lanches nutritivos e práticos, e as nozes atendem perfeitamente a essa demanda devido à sua riqueza em proteínas, fibras e gorduras saudáveis. Com o aumento da conscientização sobre bem-estar, as nozes estão se tornando a escolha preferida para lanches sem culpa, impulsionando o crescimento do mercado e incentivando a inovação na oferta de produtos.

- Um dos principais impulsionadores da popularidade das nozes como lanches é a crescente conscientização sobre saúde entre os consumidores. Valorizadas por seu conteúdo nutricional, as nozes são vistas como uma alternativa saudável aos lanches tradicionais. São ricas em vitaminas, minerais, fibras e proteínas essenciais, além de conter gorduras monoinsaturadas e poli-insaturadas, benéficas para o coração. Sua portabilidade e praticidade naturais as tornam ideais para estilos de vida agitados, oferecendo uma solução de lanche rápida e nutritiva ao longo do dia.

- Por exemplo, em junho de 2024, de acordo com a Business Standard Private Ltd., a Nutraj anunciou o lançamento de seu novo produto, o “NutrajSnackrite Daily Nutrition Pack”. Este pacote cuidadosamente projetado contém sachês práticos recheados com uma deliciosa e nutritiva mistura para trilhas, combinando uma variedade de nozes premium e frutas secas. Destinado a consumidores preocupados com a saúde, ele oferece uma opção perfeita de lanche para viagem, que fornece nutrientes essenciais e energia ao longo do dia, atendendo à crescente demanda por opções de lanches saudáveis e saborosos.

Dinâmica do Mercado de Nozes

Motorista

“Aumento no consumo diário de vários produtos de nozes”

- O mercado de nozes do Oriente Médio e da África está passando por um crescimento significativo, impulsionado principalmente pelo aumento do consumo mundial de nozes. Um dos principais fatores que impulsionam esse crescimento é a crescente conscientização dos consumidores sobre os benefícios das nozes para a saúde.

- Além disso, a mudança para estilos de vida baseados em vegetais e uma alimentação saudável tornou as nozes uma escolha popular como um lanche natural e saudável. A praticidade também desempenha um papel crucial, já que as nozes são fáceis de transportar e consumir em qualquer lugar, adaptando-se perfeitamente ao estilo de vida moderno e agitado. Além disso, a inovação em produtos, incluindo novos sabores, embalagens e opções prontas para consumo, ampliou o apelo, incentivando mais consumidores a incorporar nozes em suas dietas diárias e impulsionando a expansão do mercado no Oriente Médio e na África.

- Por exemplo, em setembro de 2024, de acordo com a Forbes Media LLC, a Daily Crunch levantou US$ 4 milhões em financiamento Série A para apoiar sua expansão no crescente mercado de lanches à base de nozes. O investimento está focado em aprimorar sua linha de lanches de nozes germinadas, como amêndoas, nozes e castanhas de caju, aumentando a produção e a disponibilidade no varejo para atender à crescente demanda no Oriente Médio e na África por produtos nutritivos e prontos para consumo.

Restrição/Desafio

“ Volatilidade dos preços restringe o crescimento do mercado de nozes ”

- A volatilidade dos preços é um fator importante que restringe o crescimento do mercado de castanhas do Oriente Médio e da África. A flutuação dos preços, impulsionada por eventos climáticos imprevisíveis, como secas, inundações e geadas, interrompe as cadeias de suprimentos e cria incerteza tanto para produtores quanto para compradores. Por exemplo, condições adversas em importantes regiões produtoras levaram à redução da produtividade e a fortes aumentos de preços, dificultando a manutenção da estabilidade dos custos dos produtos pelos fabricantes.

- Além disso, as tensões comerciais e as tarifas variáveis agravam ainda mais a instabilidade dos preços, limitando a expansão do mercado. Essa imprevisibilidade desestimula o investimento e desafia o planejamento de longo prazo do setor. Como resultado, os consumidores podem enfrentar preços mais altos ou disponibilidade reduzida, o que pode reduzir a demanda. Lidar com a volatilidade dos preços é crucial para garantir o crescimento estável e a sustentabilidade do mercado de castanhas do Oriente Médio e da África.

- Por exemplo, em junho de 2024, de acordo com o SGGP, a Associação Vietnamita do Caju (VINACAS) criou uma força-tarefa dedicada a combater as flutuações de preços da castanha de caju in natura. Este grupo colabora com o governo e os ministérios para estabilizar os preços, com o objetivo de reduzir as interrupções na cadeia de suprimentos e apoiar o crescimento sustentável da indústria de caju do Vietnã.

Escopo do mercado de nozes

O mercado de nozes do Oriente Médio e da África é segmentado em doze segmentos notáveis com base no tipo de produto, forma, natureza, método de processamento, qualidade, prazo de validade, certificação, embalagem, tamanho da embalagem, faixa de preço, uso final e canal de distribuição.

- Por tipo de produto

Com base no tipo de produto, o mercado de nozes é segmentado em nozes de árvore, amendoim, nozes híbridas/outras e outras. A projeção é de que o segmento de nozes de árvore domine o mercado, com uma participação de mercado de 52,39% em 2025, impulsionado pela ampla popularidade e disponibilidade de amêndoas, castanhas de caju, nozes, pistaches e outras variedades. Seu papel consolidado nas dietas globais, aliado ao alto valor nutricional e ao uso crescente em lanches saudáveis, faz das nozes de árvore a categoria preferida.

- Por Formulário

Com base na forma, o mercado é segmentado em: inteiros, manteiga, moídos, metades, pedaços, óleo, leite, pasta, creme, pedaços torrados, revestidos, farinha, pó, picados, fatiados, em cubos, triturados, inteiros escaldados, congelados, secos por pulverização, encapsulados e outros. Em 2025, espera-se que o segmento inteiro lidere o segmento de formas, com uma participação de mercado de 11,99%, impulsionado pela crescente conscientização sobre a saúde e pela preferência do consumidor por alimentos não processados e com rótulos limpos. As castanhas inteiras oferecem conveniência, apelo visual e frescor perceptível, tornando-as uma escolha preferencial tanto para consumo direto quanto para aplicações culinárias.

- Por natureza

Com base na natureza, o mercado de nozes é segmentado em convencionais e orgânicos. Espera-se que o segmento convencional domine o mercado, com uma participação de mercado de 61,71% em 2025, devido à sua acessibilidade, facilidade de fornecimento e forte presença nos principais canais de varejo. Em regiões em desenvolvimento e sensíveis a preços, as nozes convencionais continuam a deter uma participação significativa devido à familiaridade, qualidade consistente e maior disponibilidade em comparação com alternativas orgânicas premium.

- Por método de processamento

O mercado é segmentado por método de processamento em cru, torrado, salgado, escaldado, aromatizado, sem sal, glaceado, cristalizado, caramelizado, defumado, germinado, fermentado, liofilizado, em conserva, frito a vácuo, desidratado e outros. Prevê-se que o segmento cru domine o mercado, com uma participação de mercado de 12,64% em 2025, à medida que as tendências de consumo mudam para alimentos minimamente processados e ricos em nutrientes. As nozes cruas retêm enzimas e nutrientes naturais, atraindo fortemente comunidades preocupadas com a saúde, veganas e adeptas de uma alimentação saudável.

- Por grau

Com base na classificação, o mercado é categorizado em grau A (qualidade premium para exportação), grau B (uso doméstico de qualidade média), grau quebrado (uso em panificação e confeitaria), grau para óleo, grau industrial e grau rejeitado (ração animal). A projeção é de que o segmento grau A domine o mercado, com uma participação de mercado de 33,92% em 2025, principalmente devido à crescente demanda internacional por nozes de alta qualidade e visualmente consistentes.

- Por prazo de validade

O mercado é segmentado por prazo de validade em <6 meses, 6 a 12 meses, 13 a 18 meses, 18 meses e mais de 18 meses. Prevê-se que o segmento <6 meses domine o mercado, com uma participação de mercado de 36,41% em 2025, refletindo uma demanda crescente por nozes mais frescas e recém-colhidas. Consumidores premium, especialmente nos setores de varejo e saúde, associam prazo de validade curto a melhor sabor, textura e valor nutricional.

- Por Certificação

Com base na certificação, o mercado inclui ISO 22000/HACCP, USDA Organic, EU Organic, Non-GMO Verified, Gluten-Free Certified, Kosher, Halal, Vegan Certified, Fair Trade, Rainforest Alliance, Carbon Neutral Certified, entre outros. O segmento ISO 22000/HACCP deverá liderar o mercado com uma participação de mercado de 20,43% em 2025, devido ao aumento das regulamentações globais de segurança alimentar e à demanda do consumidor por produtos de nozes rastreáveis, higiênicos e com garantia de qualidade.

- Por embalagem

Os tipos de embalagem incluem sachês plásticos, embalagens seladas a vácuo, potes de PET, sacos de papel, latas compostas, sacos de tecido a granel, potes de vidro, sachês/unidades, caixas de presente, embalagens de base biológica/compostáveis, latas de metal, potes ecológicos resseláveis, barras embaladas em papel alumínio, embalagens recarregáveis e outros. Em 2025, espera-se que o segmento de sachês plásticos domine o mercado, com uma participação de mercado de 20,41%, impulsionado por sua conveniência, portabilidade, custo-benefício e benefícios de prazo de validade. Subsegmentos como embalagens com zíper também atendem bem às vitrines modernas do varejo e ao uso do consumidor.

- Por tamanho da embalagem

O mercado é segmentado em 101g–250g, 251g–500g, 51g–100g, 25g–50g, 501g–1kg, 1,1kg–2,5kg, 2,6kg–5kg, 5,1kg–10kg, 10,1kg–25kg, 25,1kg–50kg, 50kg e <25g. Em 2025, espera-se que o segmento de 101g–250g domine o mercado, com uma participação de mercado de 15,49%, atendendo ao consumo em movimento, compras de teste e lanches saudáveis. Essa linha equilibra conveniência e valor, tornando-se atraente tanto no varejo moderno quanto nos canais online.

- Por faixa de preço

As faixas de preço incluem econômica/econômica (US$ 1,00 a US$ 6,00 por kg), intermediária (US$ 6,01 a US$ 12,00 por kg), premium (US$ 12,01 a US$ 20,00 por kg) e superpremium/gourmet (acima de US$ 20,00 por kg). A projeção é de que o segmento econômico/econômico domine o mercado, com uma participação de mercado de 39,08% em 2025, devido à demanda impulsionada pela acessibilidade em mercados emergentes, compradores institucionais e canais de varejo de massa.

- Por uso final

O mercado é segmentado em consumo direto, snacks, manteigas e pastas de nozes, indústria de panificação, indústria de confeitaria, fabricação de cereais e granola, nutrição funcional, alternativas lácteas, indústria de bebidas, carnes vegetais, culinária, extração industrial de óleo, panificação sem farinha e glúten, produtos de higiene pessoal, usos de base biológica e agroindustriais, aditivos para alimentos para animais de estimação, ração animal e outros. Em 2025, prevê-se que o segmento de consumo direto domine o mercado, com uma quota de mercado de 13,09%, devido à crescente procura por snacks práticos e nutritivos. A ascensão de estilos de vida saudáveis e dietas ricas em proteínas impulsiona ainda mais este segmento nos canais de retalho, online e de viagens.

- Por canal de distribuição

Com base no canal de distribuição, o mercado é segmentado em B2B e B2C. O B2C é ainda dividido em canais offline e online. O offline inclui supermercados/hipermercados, lojas de conveniência, lojas de produtos naturais, padarias, lojas especializadas, HoReCa, lojas duty-free e companhias aéreas. O online inclui marketplaces de e-commerce e sites de marcas próprias. Espera-se que o segmento B2B domine o mercado, com uma participação de mercado de 53,74% em 2025, impulsionado pela ampla disponibilidade de produtos, confiança no varejo físico e comportamento de compra por impulso, especialmente em mercados tradicionais e emergentes.

Análise regional do mercado de nozes

Os Emirados Árabes Unidos são um dos principais mercados de nozes no Oriente Médio, contribuindo significativamente para a receita regional. O alto consumo de nozes durante o Ramadã e outras festividades culturais alimenta a demanda constante. Os consumidores preferem variedades de nozes premium e saborizadas, incluindo pistaches, amêndoas e castanhas de caju torradas, frequentemente encontradas em redes de varejo, pacotes de presentes de luxo e no setor de hospitalidade. A crescente conscientização sobre saúde e tendências alimentares como as dietas cetogênica e paleo também estão impulsionando a popularidade de produtos de nozes sem sal e orgânicos. A forte base de importação do país garante a disponibilidade de diversas opções de nozes durante todo o ano.

Visão geral do mercado de nozes da Arábia Saudita

A Arábia Saudita representa uma fatia significativa do mercado de nozes do Oriente Médio, impulsionada por sua tradição de incluí-las em dietas diárias, eventos festivos e ofertas de hospitalidade. Tâmaras recheadas com amêndoas ou nozes são especialmente populares. O mercado está testemunhando uma demanda crescente por produtos de nozes embalados e com valor agregado, como mixes de trilha, manteigas de nozes e nozes com cobertura de chocolate. Os consumidores urbanos estão demonstrando interesse crescente por alternativas saudáveis de lanches, o que é ainda mais apoiado pela expansão de plataformas modernas de varejo e e-commerce.

Participação no mercado de nozes

A indústria de nozes é liderada principalmente por empresas bem estabelecidas, incluindo:

- Olam Group (Singapura)

- ADM (EUA)

- BORGES AGRICULTURAL & INDUSTRIAL NUTS, SA (Espanha)

- Barry Callebaut (Suíça)

- GRUPO INTERSNACK (Alemanha)

- COLHEITAS SELECIONADAS (Austrália)

- Blue Diamond Growers (EUA)

Últimos desenvolvimentos no mercado de nozes do Oriente Médio e da África

- Em abril de 2024, o Olam Group anunciou uma grande expansão de sua capacidade de processamento de castanhas na Nigéria, com o objetivo de aumentar os volumes de processamento de castanha de caju para consumo interno e exportação. Este investimento está alinhado à estratégia da Olam de fortalecer sua presença em produtos agrícolas de valor agregado e apoiar as economias locais por meio da criação de empregos e do desenvolvimento de capacidades em mercados emergentes.

- Em março de 2024, a Blue Diamond Growers lançou uma nova linha de snacks proteicos à base de amêndoas sob a marca "Nut-Thins", com foco em opções de snacks ricos em proteína e sem glúten. Este lançamento atende à crescente demanda dos consumidores por opções de snacks saudáveis para levar e reforça a posição da Blue Diamond no segmento de snacks funcionais da indústria de nozes.

- Em fevereiro de 2024, a Select Harvests anunciou a aquisição de pomares de amêndoas adicionais em Victoria para aumentar sua capacidade de produção. Espera-se que essa mudança estratégica melhore a integração vertical e garanta um fornecimento estável de amêndoas de alta qualidade, fortalecendo a competitividade da empresa no Oriente Médio e na África em meio à crescente demanda dos mercados regionais.

- Em janeiro de 2024, a Wonderful Pistachios LLC lançou uma campanha de marketing para o Oriente Médio e a África intitulada "O Poder dos Pistaches", destacando os benefícios do consumo de pistache para a saúde. A campanha tem como alvo os principais mercados internacionais, incluindo o Oriente Médio, e conta com o apoio de parcerias de marketing de influência e conscientização nutricional.

- Em dezembro de 2023, a John B. Sanfilippo & Son, Inc. investiu em automação e digitalização em sua unidade de processamento em Illinois para aumentar a eficiência e garantir qualidade consistente em suas linhas de produtos de amendoim e nozes. A atualização inclui sistemas de triagem com tecnologia de IA e medidas de sustentabilidade aprimoradas em embalagens e uso de água.

- Em novembro de 2023, a Borges Agricultural & Industrial Nuts, SA anunciou uma parceria com uma plataforma de blockchain para implementar a rastreabilidade completa em suas cadeias de suprimentos de amêndoas e nozes. Esta iniciativa visa garantir transparência, certificação de comércio justo e a confiança do consumidor nos mercados europeus.

SKU-

Obtenha acesso online ao relatório sobre a primeira nuvem de inteligência de mercado do mundo

- Painel interativo de análise de dados

- Painel de análise da empresa para oportunidades de elevado potencial de crescimento

- Acesso de analista de pesquisa para personalização e customização. consultas

- Análise da concorrência com painel interativo

- Últimas notícias, atualizações e atualizações Análise de tendências

- Aproveite o poder da análise de benchmark para um rastreio abrangente da concorrência

Índice

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELING

2.7 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.8 DBMR MARKET POSITION GRID

2.9 MARKET END-USE COVERAGE GRID

2.1 DBMR VENDOR SHARE ANALYSIS

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 VALUE CHAIN

4.1.1 PRODUCTION:

4.1.2 PROCESSING:

4.1.3 MARKETING/DISTRIBUTION:

4.1.4 BUYERS:

4.2 SUPPLY CHAIN ANALYSIS

4.3 PORTER’S FIVE FORCES ANALYSIS

4.4 RAW MATERIAL SOURCING ANALYSIS

4.5 OVERVIEW OF TECHNOLOGICAL INNOVATIONS

4.6 GROWTH STRATEGIES ADOPTED BY KEY MARKET PLAYERS

4.7 FACTORS INFLUENCING PURCHASING DECISION OF END-USERS

4.8 IMPACT OF ECONOMIC SLOW DOWN ON MARKET

4.8.1 IMPACT ON PRICE

4.8.2 IMPACT ON SUPPLY CHAIN

4.8.3 IMPACT ON SHIPMENT

4.8.4 IMPACT ON COMPANY’S STRATEGIC DECISIONS

4.9 REGULATORY FRAMEWORK AND GUIDELINES

4.9.1 COST ANALYSIS BREAKDOWN

4.1 INNOVATION TRACKER AND STRATEGIC ANALYSIS

4.10.1 MAJOR DEALS AND STRATEGIC ALLIANCES ANALYSIS

4.10.1.1 JOINT VENTURES

4.10.1.2 MERGERS AND ACQUISITIONS

4.10.1.3 LICENSING AND PARTNERSHIP

4.10.1.4 TECHNOLOGY COLLABORATIONS

4.10.1.5 STRATEGIC DIVESTMENTS

4.10.2 NUMBER OF PRODUCTS IN DEVELOPMENT

4.10.3 STAGE OF DEVELOPMENT

4.10.4 TIMELINES AND MILESTONES

4.10.5 INNOVATION STRATEGIES AND METHODOLOGIES

4.10.6 RISK ASSESSMENT AND MITIGATION

4.10.7 FUTURE OUTLOOK

4.11 TARIFFS & IMPACT ON THE MARKET

4.11.1 CURRENT TARIFF RATE (S) IN TOP-5 COUNTRY MARKETS

4.11.2 OUTLOOK: LOCAL PRODUCTION V/S IMPORT RELIANCE

4.11.3 VENDOR SELECTION CRITERIA DYNAMICS

4.11.4 IMPACT ON SUPPLY CHAIN

4.11.4.1 RAW MATERIAL PROCUREMENT

4.11.4.2 MANUFACTURING AND PRODUCTION

4.11.4.3 LOGISTICS AND DISTRIBUTION

4.11.4.4 PRICE PITCHING AND POSITION OF MARKET

4.11.5 INDUSTRY PARTICIPANTS: PROACTIVE MOVES

4.11.5.1 SUPPLY CHAIN OPTIMIZATION

4.11.5.2 JOINT VENTURE ESTABLISHMENTS

4.11.6 IMPACT ON PRICES

4.11.7 REGULATORY INCLINATION

4.11.7.1 GEOPOLITICAL SITUATION

4.11.7.2 TRADE PARTNERSHIPS BETWEEN THE COUNTRIES

4.11.7.2.1 FREE TRADE AGREEMENTS

4.11.7.2.2 ALLIANCES ESTABLISHMENTS

4.11.7.3 STATUS ACCREDITION (INCLUDING MFTN)

4.11.7.4 DOMESTIC COURSE OF CORRECTION

4.11.7.4.1 INCENTIVE SCHEMES TO BOOST PRODUCTION OUTPUTS

4.11.7.4.2 ESTABLISHMENT OF SPECIAL ECONOMIC ZONES/INDUSTRIAL PARKS

4.12 BRAND OUTLOOK

4.12.1 COMPARATIVE BRAND ANALYSIS

4.12.2 PRODUCT AND BRAND OVERVIEW

4.13 SUPPLY CHAIN ANALYSIS

4.13.1 OVERVIEW

4.13.2 LOGISTIC COST SCENARIO

4.13.3 IMPORTANCE OF LOGISTICS SERVICE PROVIDERS

4.14 PRODUCTION CONSUMPTION ANALYSIS

4.15 IMPORT-EXPORT ANALYSIS

4.16 PATENT ANALYSIS

4.16.1 PATENT QUALITY AND STRENGTH

4.16.2 PATENT FAMILIES

4.16.3 NUMBER OF INTERNATIONAL PATENT FAMILIES BY PUBLICATION YEAR

4.17 LICENSING AND COLLABORATIONS

4.17.1 COMPANY PATENT LANDSCAPE

4.18 REGION PATENT LANDSCAPE

4.19 IP STRATEGY AND MANAGEMENT

4.2 PATENT ANALYSIS

4.21 PROFIT MARGINS SCENARIO

4.22 PRICING ANALYSIS

4.23 INDUSTRY ECOSYSTEM ANALYSIS

4.23.1 PROMINENT COMPANIES

4.23.2 SMALL & MEDIUM SIZE COMPANIES

4.23.3 END USERS

4.24 IMPACT OF ECONOMIC SLOWDOWN ON MIDDLE EAST AND AFRICA NUTS MARKET

4.24.1 IMPACT ON PRICES

4.24.2 IMPACT ON SUPPLY CHAIN

4.24.3 IMPACT ON SHIPMENT

4.24.4 IMPACT ON DEMAND

4.24.5 IMPACT ON STRATEGIC DECISIONS

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 GROWING MIDDLE EAST AND AFRICA TREND TOWARD HEALTHIER SNACKING AND NUTRITIOUS CHOICES

5.1.2 RISE IN DAILY CONSUMPTION OF VARIOUS NUT PRODUCTS

5.1.3 INCREASING MIDDLE EAST AND AFRICA DEMAND TOWARD PLANT-BASED DIETS

5.1.4 E-COMMERCE GROWTH BOOSTING NUT PRODUCT ACCESSIBILITY

5.2 RESTRAINTS

5.2.1 PRICE VOLATILITY RESTRAINING GROWTH IN THE NUTS MARKET

5.2.2 SUPPLY CHAIN DISRUPTIONS

5.2.3 IMPACT OF CLIMATE CHANGE ON MARKET STABILITY

5.3 OPPORTUNITIES

5.3.1 INNOVATION IN FLAVORED AND READY-TO-EAT NUT PRODUCTS

5.3.2 MODIFICATION IN THE NUT PRODUCTION

5.3.3 INCREASING USE OF NUTS IN BAKERY AND CONFECTIONERY PRODUCTS

5.4 CHALLENGES

5.4.1 RISING DROUGHTS, HEATWAVES, AND UNPREDICTABLE RAINFALL THREATEN CROP YIELDS AND QUALITY

5.4.2 LABOR SHORTAGES IN HARVESTING SEASONS AND RELIANCE ON MANUAL LABOR RAISE BOTH COST AND COMPLIANCE CHALLENGES

6 MIDDLE EAST AND AFRICA NUTS MARKET, BY PRODUCT TYPE

6.1 OVERVIEW

6.2 TREE NUTS

6.2.1 TREE NUTS, BY TYPE

6.2.1.1 Almonds

6.2.1.2 Cashews

6.2.1.3 Walnuts

6.2.1.4 Pistachios

6.2.1.5 Hazelnuts

6.2.1.6 Pecans

6.2.1.7 Macadamias

6.2.1.8 Pine Nuts

6.2.1.9 Brazil Nuts

6.2.1.10 Chestnuts

6.2.1.11 Pili Nuts

6.2.1.12 Barukas Nuts

6.2.1.13 Others

6.3 GROUND NUTS

6.3.1 GROUND NUTS, BY PEANUTS

6.3.1.1 Runner

6.3.1.2 Virginia

6.3.1.3 Spanish

6.3.1.4 Valencia

6.3.1.5 Others

6.4 HYBRID/OTHER NUTS

6.4.1 HYBRID/OTHER NUTS, BY TYPE

6.4.1.1 Coconuts

6.4.1.2 Betel Nuts

6.4.1.3 Tiger Nuts

6.4.1.4 Ginkgo Nuts

6.4.1.5 Others

6.5 OTHERS

7 MIDDLE EAST AND AFRICA NUTS MARKET, FORM

7.1 OVERVIEW

7.2 WHOLE

7.3 BUTTER

7.4 GROUND

7.5 HALVES

7.6 PIECES

7.7 OIL

7.8 MILK

7.9 PASTE

7.1 CREAM

7.11 ROASTED PIECES

7.12 COATED

7.13 FLOUR

7.14 POWDER

7.15 CHOPPED

7.16 SLICED

7.17 DICED

7.18 CRUSHED

7.19 BLANCHED WHOLE

7.2 FROZEN

7.21 SPRAY-DRIED

7.22 ENCAPSULATED

7.23 OTHERS

8 MIDDLE EAST AND AFRICA NUTS MARKET, BY NATURE

8.1 OVERVIEW

8.2 CONVENTIONAL

8.3 ORGANIC

9 MIDDLE EAST AND AFRICA NUTS MARKET, BY PROCESSING METHOD

9.1 OVERVIEW

9.2 RAW

9.3 ROASTED

9.3.1 ROASTED, BY TYPE

9.3.1.1 DRY ROASTED

9.3.1.2 OIL ROASTED

9.4 SALTED

9.5 BLANCHED

9.6 FLAVORED

9.6.1 FLAVORED, BY TYPE

9.6.1.1 Sweetened

9.6.1.2 Spiced

9.6.1.3 Chocolate-Coated

9.6.1.4 Herb-Infused

9.6.1.5 Yogurt-Coated

9.6.1.6 Others

9.7 UNSALTED

9.8 GLAZED

9.9 CANDIED

9.1 CARAMELIZED

9.11 SMOKED

9.12 SPROUTED

9.13 FERMENTED

9.14 FREEZE-DRIED

9.15 PICKLED

9.16 VACUUM-FRIED

9.17 DEHYDRATED

9.18 OTHERS

10 MIDDLE EAST AND AFRICA NUTS MARKET, BY GRADE

10.1 OVERVIEW

10.2 A GRADE (PREMIUM EXPORT QUALITY)

10.3 B GRADE (MID-QUALITY DOMESTIC USE)

10.4 BROKEN GRADE (BAKERY & CONFECTIONERY USE)

10.5 OIL-GRADE

10.6 INDUSTRIAL GRADE

10.7 REJECTED GRADE (ANIMAL FEED)

11 MIDDLE EAST AND AFRICA NUTS MARKET, BY SHELF LIFE

11.1 OVERVIEW

11.2 <6 MONTHS

11.3 6–12 MONTHS

11.4 13–18 MONTHS

11.5 18 MONTHS

11.6 MORE THAN 18 MONTHS

12 MIDDLE EAST AND AFRICA NUTS MARKET, BY CERTIFICATION

12.1 OVERVIEW

12.2 ISO 22000/HACCP

12.3 USDA ORGANIC

12.4 EU ORGANIC

12.5 NON-GMO VERIFIED

12.6 GLUTEN-FREE CERTIFIED

12.7 KOSHER

12.8 HALAL

12.9 VEGAN CERTIFIED

12.1 FAIR TRADE

12.11 RAINFOREST ALLIANCE

12.12 CARBON NEUTRAL CERTIFIED

12.13 OTHERS

13 MIDDLE EAST AND AFRICA NUTS MARKET, PACKAGING

13.1 OVERVIEW

13.2 PLASTIC POUCHES

13.2.1 PLASTIC POUCHES, BY TYPE

13.2.1.1 Stand-Up Zipper Packs

13.2.1.2 Pillow Packs

13.3 VACUUM-SEALED PACKS

13.4 PET JARS

13.5 PAPER BAGS

13.6 COMPOSITE CANS

13.7 BULK WOVEN SACKS

13.8 GLASS JARS

13.9 SACHETS/SINGLE-SERVE

13.1 GIFT BOXES

13.11 BIO-BASED/COMPOSTABLE

13.12 METAL TINS

13.13 RESEALABLE ECO-TUBS

13.14 FOIL-WRAPPED BARS

13.15 REFILL PACKS

13.16 OTHERS

14 MIDDLE EAST AND AFRICA NUTS MARKET, BY PACKAGING SIZE

14.1 OVERVIEW

14.2 101G–250G

14.3 251G–500G

14.4 51G–100G

14.5 25G–50G

14.6 501G–1KG

14.7 1.1KG–2.5KG

14.8 2.6KG–5KG

14.9 5.1KG–10KG

14.1 10.1KG–25KG

14.11 25.1KG–50KG

14.12 50KG

14.13 <25G

15 MIDDLE EAST AND AFRICA NUTS MARKET, BY PRICE RANGE

15.1 OVERVIEW

15.2 ECONOMY/BUDGET (USD 1.00-6.00 PER KG)

15.3 MID-RANGE (USD 6.01-12.00 PER KG)

15.4 PREMIUM (USD 12.01-20.00 PER KG)

15.5 SUPER-PREMIUM/GOURMET (ABOVE USD 20.00 PER KG)

16 MIDDLE EAST AND AFRICA NUTS MARKET, BY END-USE

16.1 OVERVIEW

16.2 DIRECT CONSUMPTION

16.3 SNACKS

16.4 NUT BUTTERS & SPREADS

16.5 BAKERY INDUSTRY

16.6 CONFECTIONERY INDUSTRY

16.7 CEREAL & GRANOLA MANUFACTURING

16.8 FUNCTIONAL NUTRITION

16.8.1 FUNCTIONAL NUTRITION, BY TYPE

16.8.1.1 Protein Bars

16.8.1.2 Meal Replacements

16.8.1.3 Supplements

16.8.1.4 Others

16.9 DAIRY ALTERNATIVES

16.1 BEVERAGE INDUSTRY

16.10.1 BEVERAGE INDUSTRY, BY TYPE

16.10.1.1 Nut Milk

16.10.1.2 Nut-Based Protein Drinks

16.10.1.3 Fermented Nut Beverages

16.10.1.4 Others

16.11 PLANT-BASED MEATS

16.12 CULINARY

16.12.1 CULINARY, BY TYPE

16.12.1.1 Garnishing

16.12.1.2 Sauces

16.12.1.3 Condiments

16.12.1.4 Others

16.13 INDUSTRIAL OIL EXTRACTION

16.14 FLOUR & GLUTEN-FREE BAKING

16.15 PERSONAL CARE PRODUCTS

16.15.1 PERSONAL CARE PRODUCTS, BY TYPE

16.15.1.1 Skin Care

16.15.1.2 Hair Oil

16.15.1.3 Exfoliants

16.15.1.4 Others

16.16 BIO-BASED & AGRO-INDUSTRIAL USES

16.16.1 BIO-BASED & AGRO-INDUSTRIAL USES, BY TYPE

16.16.1.1 Activated Carbon

16.16.1.2 Abrasives

16.16.1.3 Biofuel Additives

16.16.1.4 Others

16.17 PET FOOD ADDITIVES

16.18 ANIMAL FEED

16.18.1 ANIMAL FEED, BY TYPE

16.18.1.1 Meal Residue

16.18.1.2 Shells

16.18.1.3 Others

16.19 OTHERS

17 MIDDLE EAST AND AFRICA NUTS MARKET, BY DISTRIBUTION CHANNEL

17.1 OVERVIEW

17.2 B2B

17.3 B2C

17.3.1 B2C, BY TYPE

17.3.1.1 Offline

17.3.1.1.1 Supermarkets/Hypermarkets

17.3.1.1.2 Convenience Stores

17.3.1.1.3 Health Food Stores

17.3.1.1.4 Bakeries

17.3.1.1.5 Specialty Stores

17.3.1.1.6 HoReCa

17.3.1.1.7 Duty-Free Stores

17.3.1.1.8 Airlines

17.3.1.1.9 Others

17.3.1.2 Online

17.3.1.2.1 E-Commerce Marketplaces

17.3.1.2.2 Brand-Owned Websites

18 MIDDLE EAST AND AFRICA NUTS MARKET, BY REGION

18.1 MIDDLE EAST AND AFRICA

18.1.1 U.A.E.

18.1.2 SAUDI ARABIA

18.1.3 EGYPT

18.1.4 SOUTH AFRICA

18.1.5 ISRAEL

18.1.6 KUWAIT

18.1.7 OMAN

18.1.8 BAHRAIN

18.1.9 QATAR

18.1.10 REST OF MIDDLE EAST AND AFRICA

19 MIDDLE EAST AND AFRICA NUTS MARKET COMPANY LANDSCAPE

19.1 COMPANY SHARE ANALYSIS: GLOBAL

20 SWOT ANALYSIS

21 COMPANY PROFILES

21.1 ADM

21.1.1 COMPANY SNAPSHOT

21.1.2 REVENUE ANALYSIS

21.1.3 COMPANY SHARE ANALYSIS

21.1.4 PRODUCT PORTFOLIO

21.1.5 RECENT DEVELOPMENT

21.2 OLAM GROUP

21.2.1 COMPANY SNAPSHOT

21.2.2 REVENUE ANALYSIS

21.2.3 COMPANY SHARE ANALYSIS

21.2.4 PRODUCT PORTFOLIO

21.2.5 RECENT DEVELOPMENT

21.3 BARRY CALLEBAUT

21.3.1 COMPANY SNAPSHOT

21.3.2 REVENUE ANALYSIS

21.3.3 COMPANY SHARE ANALYSIS

21.3.4 PRODUCT PORTFOLIO

21.3.5 RECENT DEVELOPMENT

21.4 BLUE DIAMOND GROWERS.

21.4.1 COMPANY SNAPSHOT

21.4.2 COMPANY SHARE ANALYSIS

21.4.3 PRODUCT PORTFOLIO

21.4.4 RECENT DEVELOPMENTS/NEWS

21.5 JOHN B. SANFILIPPO & SON, INC.

21.5.1 COMPANY SNAPSHOT

21.5.2 REVENUE ANALYSIS

21.5.3 COMPANY SHARE ANALYSIS

21.5.4 PRODUCT PORTFOLIO

21.5.5 RECENT DEVELOPMENTS

21.6 BORGES AGRICULTURAL & INDUSTRIAL NUTS, S.A.

21.6.1 COMPANY SNAPSHOT

21.6.2 REVENUE ANALYSIS

21.6.3 PRODUCT PORTFOLIO

21.6.4 RECENT DEVELOPMENTS/NEWS

21.7 DEL ALBA.

21.7.1 COMPANY SNAPSHOT

21.7.2 PRODUCT PORTFOLIO

21.7.3 RECENT DEVELOPMENT/NEWS

21.8 DIAMOND FOODS

21.8.1 COMPANY SNAPSHOT

21.8.2 PRODUCT PORTFOLIO

21.8.3 RECENT DEVELOPMENTS/NEWS

21.9 GOLDEN PEANUT COMPANY, LLC

21.9.1 COMPANY SNAPSHOT

21.9.2 PRODUCT PORTFOLIO

21.9.3 RECENT DEVELOPMENTS

21.1 GOURMET NUT

21.10.1 COMPANY SNAPSHOT

21.10.2 PRODUCT PORTFOLIO

21.10.3 RECENT DEVELOPMENTS/NEWS

21.11 HINES NUT COMPANY

21.11.1 COMPANY SNAPSHOT

21.11.2 PRODUCT PORTFOLIO

21.12 HORMEL FOODS CORPORATION

21.12.1 COMPANY SNAPSHOT

21.12.2 REVENUE ANALYSIS

21.12.3 PRODUCT PORTFOLIO

21.12.4 RECENT DEVELOPMENTS/NEWS

21.13 INTERSNACK GROUP GMBH & CO. KG

21.13.1 COMPANY SNAPSHOT

21.13.2 PRODUCT PORTFOLIO

21.13.3 RECENT DEVELOPMENTS

21.14 JINDAL COCOA

21.14.1 COMPANY SNAPSHOT

21.14.2 PRODUCT PORTFOLIO

21.14.3 RECENT DEVELOPMENTS

21.15 MARIANI NUT COMPANY

21.15.1 COMPANY SNAPSHOT

21.15.2 PRODUCT PORTFOLIO

21.15.3 RECENT DEVELOPMENTS

21.16 MOUNT FRANKLIN FOODS

21.16.1 COMPANY SNAPSHOT

21.16.2 PRODUCT PORTFOLIO

21.16.3 RECENT DEVELOPMENTS

21.17 NOW FOODS

21.17.1 COMPANY SNAPSHOT

21.17.2 PRODUCT PORTFOLIO

21.17.3 RECENT DEVELOPMENTS/NEWS

21.18 NUTLAND

21.18.1 COMPANY SNAPSHOT

21.18.2 PRODUCT PORTFOLIO

21.18.3 RECENT DEVELOPMENTS

21.19 NUTWORK HANDELSGESELLSCHAFT MBH

21.19.1 COMPANY SNAPSHOT

21.19.2 PRODUCT PORTFOLIO

21.19.3 RECENT DEVELOPMENTS/NEWS

21.2 POINDEXTER NUT COMPANY

21.20.1 COMPANY SNAPSHOT

21.20.2 PRODUCT PORTFOLIO

21.20.3 RECENT DEVELOPMENTS

21.21 ROYAL NUT COMPANY

21.21.1 COMPANY SNAPSHOT

21.21.2 PRODUCT PORTFOLIO

21.21.3 RECENT DEVELOPMENTS

21.22 SAHALE SNACKS

21.22.1 COMPANY SNAPSHOT

21.22.2 PRODUCT PORTFOLIO

21.22.3 RECENT DEVELOPMENTS

21.23 SANTÉ NUTS

21.23.1 COMPANY SNAPSHOT

21.23.2 PRODUCT PORTFOLIO

21.23.3 RECENT DEVELOPMENTS/NEWS

21.24 SELECT HARVESTS LIMITED

21.24.1 COMPANY SNAPSHOT

21.24.2 REVENUE ANALYSIS

21.24.3 PRODUCT PORTFOLIO

21.24.4 RECENT DEVELOPMENTS/NEWS

21.25 SETTON PISTACHIO OF TERRA BELLA, INC.

21.25.1 COMPANY SNAPSHOT

21.25.2 PRODUCT PORTFOLIO

21.25.3 RECENT DEVELOPMENTS

21.26 TERRANUT

21.26.1 COMPANY SNAPSHOT

21.26.2 PRODUCT PORTFOLIO

21.26.3 RECENT DEVELOPMENTS/NEW

21.27 TREEHOUSE CALIFORNIA ALMONDS, LLC

21.27.1 COMPANY SNAPSHOT

21.27.2 PRODUCT PORTFOLIO

21.27.3 RECENT DEVELOPMENT

21.28 THE DAILY NUT CO.

21.28.1 COMPANY SNAPSHOT

21.28.2 PRODUCT PORTFOLIO

21.28.3 RECENT DEVELOPMENTS/NEWS

21.29 WONDERFUL PISTACHIOS LLC

21.29.1 COMPANY SNAPSHOT

21.29.2 PRODUCT PORTFOLIO

21.29.3 RECENT DEVELOPMENTS/NEWS

21.3 WESTERN NUT COMPANY INC.

21.30.1 COMPANY SNAPSHOT

21.30.2 PRODUCT PORTFOLIO

21.30.3 RECENT DEVELOPMENTS/NEWS

22 QUESTIONNAIRE

23 RELATED REPORTS

Lista de Tabela

TABLE 1 REGULATORY FRAMEWORK AND GUIDELINES

TABLE 2 COST FOR KEY EQUIPMENT AND THE OVERALL CASHEW NUTS PROCESSING PLANTS

TABLE 3 RECENT DEVELOPMENTS IN THE NUT, HIGHLIGHTING NEW PRODUCT LAUNCHES, INNOVATIONS, AND TRENDS

TABLE 4 TIMELINES AND MILESTONES IN THE NUTS INDUSTRY

TABLE 5 NUT IMPORT TARIFF RATES IN TOP 5 MARKETS (2024)

TABLE 6 LOCAL PRODUCTION V/S IMPORT RELIANCE

TABLE 7 REGULATORY INCLINATION

TABLE 8 TRADE PARTNERSHIPS BETWEEN THE COUNTRIES

TABLE 9 ALLIANCES ESTABLISHMENTS

TABLE 10 ESTABLISHMENT OF SPECIAL ECONOMIC ZONES (SEZS) AND INDUSTRIAL PARKS

TABLE 11 COMPARATIVE BRAND ANALYSIS

TABLE 12 PRODUCTION

TABLE 13 CONSUMPTION

TABLE 14 CONSUMER BUYING BEHAVIOUR

TABLE 15 EXPORT DATA SETS

TABLE 16 IMPORT DATA SETS

TABLE 17 CONSUMER BUYING BEHAVIOUR

TABLE 18 MIDDLE EAST AND AFRICA NUTS MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 19 MIDDLE EAST AND AFRICA NUTS MARKET, BY PRODUCT TYPE, 2018-2032 (THOUSAND TONS)

TABLE 20 MIDDLE EAST AND AFRICA TREE NUTS IN NUTS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 21 MIDDLE EAST AND AFRICA TREE NUTS IN NUTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 22 MIDDLE EAST AND AFRICA GROUND NUTS IN NUTS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 23 MIDDLE EAST AND AFRICA GROUND NUTS IN NUTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 24 MIDDLE EAST AND AFRICA HYBRID/OTHER NUTS IN NUTS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 25 MIDDLE EAST AND AFRICA HYBRID/OTHER NUTS IN NUTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 26 MIDDLE EAST AND AFRICA OTHERS IN NUTS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 27 MIDDLE EAST AND AFRICA NUTS MARKET, BY FORM, 2018-2032 (USD THOUSAND)

TABLE 28 MIDDLE EAST AND AFRICA WHOLE IN NUTS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 29 MIDDLE EAST AND AFRICA BUTTER IN NUTS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 30 MIDDLE EAST AND AFRICA GROUND IN NUTS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 31 MIDDLE EAST AND AFRICA HALVES IN NUTS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 32 MIDDLE EAST AND AFRICA PIECES IN NUTS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 33 MIDDLE EAST AND AFRICA OIL IN NUTS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 34 MIDDLE EAST AND AFRICA MILK IN NUTS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 35 MIDDLE EAST AND AFRICA PASTE IN NUTS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 36 MIDDLE EAST AND AFRICA CREAM IN NUTS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 37 MIDDLE EAST AND AFRICA ROASTED PIECES IN NUTS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 38 MIDDLE EAST AND AFRICA COATED IN NUTS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 39 MIDDLE EAST AND AFRICA FLOUR IN NUTS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 40 MIDDLE EAST AND AFRICA POWDER IN NUTS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 41 MIDDLE EAST AND AFRICA CHOPPED IN NUTS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 42 MIDDLE EAST AND AFRICA SLICED IN NUTS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 43 MIDDLE EAST AND AFRICA DICED IN NUTS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 44 MIDDLE EAST AND AFRICA CRUSHED IN NUTS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 45 MIDDLE EAST AND AFRICA BLANCHED WHOLE IN NUTS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 46 MIDDLE EAST AND AFRICA FROZEN IN NUTS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 47 MIDDLE EAST AND AFRICA SPRAY-DRIED IN NUTS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 48 MIDDLE EAST AND AFRICA ENCAPSULATED IN NUTS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 49 MIDDLE EAST AND AFRICA OTHERS IN NUTS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 50 MIDDLE EAST AND AFRICA NUTS MARKET, BY NATURE, 2018-2032 (USD THOUSAND)

TABLE 51 MIDDLE EAST AND AFRICA CONVENTIONAL IN NUTS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 52 MIDDLE EAST AND AFRICA ORGANIC IN NUTS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 53 MIDDLE EAST AND AFRICA NUTS MARKET, BY PROCESSING METHOD, 2018-2032 (USD THOUSAND)

TABLE 54 MIDDLE EAST AND AFRICA RAW IN NUTS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 55 MIDDLE EAST AND AFRICA ROASTED IN NUTS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 56 MIDDLE EAST AND AFRICA ROASTED IN NUTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 57 MIDDLE EAST AND AFRICA SALTED IN NUTS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 58 MIDDLE EAST AND AFRICA BLANCHED IN NUTS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 59 MIDDLE EAST AND AFRICA FLAVORED IN NUTS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 60 MIDDLE EAST AND AFRICA FLAVORED IN NUTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 61 MIDDLE EAST AND AFRICA UNSALTED IN NUTS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 62 MIDDLE EAST AND AFRICA GLAZED IN NUTS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 63 MIDDLE EAST AND AFRICA CANDIED IN NUTS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 64 MIDDLE EAST AND AFRICA CARAMELIZED IN NUTS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 65 MIDDLE EAST AND AFRICA SMOKED IN NUTS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 66 MIDDLE EAST AND AFRICA SPROUTED IN NUTS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 67 MIDDLE EAST AND AFRICA FERMENTED IN NUTS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 68 MIDDLE EAST AND AFRICA FREEZE-DRIED IN NUTS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 69 MIDDLE EAST AND AFRICA PICKLED IN NUTS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 70 MIDDLE EAST AND AFRICA VACUUM-FRIED IN NUTS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 71 MIDDLE EAST AND AFRICA DEHYDRATED IN NUTS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 72 MIDDLE EAST AND AFRICA OTHERS IN NUTS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 73 MIDDLE EAST AND AFRICA NUTS MARKET, BY GRADE, 2018-2032 (USD THOUSAND)

TABLE 74 MIDDLE EAST AND AFRICA A GRADE (PREMIUM EXPORT QUALITY) IN NUTS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 75 MIDDLE EAST AND AFRICA B GRADE (MID-QUALITY DOMESTIC USE) IN NUTS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 76 MIDDLE EAST AND AFRICA BROKEN GRADE (BAKERY & CONFECTIONERY USE) IN NUTS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 77 MIDDLE EAST AND AFRICA OIL-GRADE IN NUTS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 78 MIDDLE EAST AND AFRICA INDUSTRIAL GRADE IN NUTS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 79 MIDDLE EAST AND AFRICA REJECTED GRADE (ANIMAL FEED) IN NUTS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 80 MIDDLE EAST AND AFRICA NUTS MARKET, BY SHELF LIFE, 2018-2032 (USD THOUSAND)

TABLE 81 MIDDLE EAST AND AFRICA <6 MONTHS IN NUTS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 82 MIDDLE EAST AND AFRICA 6–12 MONTHS IN NUTS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 83 MIDDLE EAST AND AFRICA I13–18 MONTHS N NUTS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 84 MIDDLE EAST AND AFRICA 18 MONTHS IN NUTS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 85 MIDDLE EAST AND AFRICA MORE THAN 18 MONTHS IN NUTS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 86 MIDDLE EAST AND AFRICA NUTS MARKET, BY CERTIFICATION, 2018-2032 (USD THOUSAND)

TABLE 87 MIDDLE EAST AND AFRICA ISO 22000/HACCP IN NUTS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 88 MIDDLE EAST AND AFRICA USDA ORGANIC IN NUTS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 89 MIDDLE EAST AND AFRICA EU ORGANIC IN NUTS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 90 MIDDLE EAST AND AFRICA NON-GMO VERIFIED IN NUTS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 91 MIDDLE EAST AND AFRICA GLUTEN-FREE CERTIFIED IN NUTS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 92 MIDDLE EAST AND AFRICA KOSHER IN NUTS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 93 MIDDLE EAST AND AFRICA HALAL IN NUTS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 94 MIDDLE EAST AND AFRICA VEGAN CERTIFIED IN NUTS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 95 MIDDLE EAST AND AFRICA FAIR TRADE IN NUTS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 96 MIDDLE EAST AND AFRICA RAINFOREST ALLIANCE IN NUTS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 97 MIDDLE EAST AND AFRICA CARBON NEUTRAL CERTIFIED IN NUTS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 98 MIDDLE EAST AND AFRICA OTHERS IN NUTS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 99 MIDDLE EAST AND AFRICA NUTS MARKET, BY PACKAGING, 2018-2032 (USD THOUSAND)

TABLE 100 MIDDLE EAST AND AFRICA PLASTIC POUCHES IN NUTS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 101 TABLE 14 MIDDLE EAST AND AFRICA PLASTIC POUCHES IN NUTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 102 MIDDLE EAST AND AFRICA VACUUM-SEALED PACKS IN NUTS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 103 MIDDLE EAST AND AFRICA PET JARS IN NUTS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 104 MIDDLE EAST AND AFRICA PAPER BAGS IN NUTS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 105 MIDDLE EAST AND AFRICA COMPOSITE CANS IN NUTS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 106 MIDDLE EAST AND AFRICA BULK WOVEN SACKS IN NUTS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 107 MIDDLE EAST AND AFRICA GLASS JARS IN NUTS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 108 MIDDLE EAST AND AFRICA SACHETS/SINGLE-SERVE IN NUTS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 109 MIDDLE EAST AND AFRICA GIFT BOXES IN NUTS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 110 MIDDLE EAST AND AFRICA BIO-BASED/COMPOSTABLE IN NUTS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 111 MIDDLE EAST AND AFRICA METAL TINS IN NUTS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 112 MIDDLE EAST AND AFRICA RESEALABLE ECO-TUBS IN NUTS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 113 MIDDLE EAST AND AFRICA FOIL-WRAPPED BARS IN NUTS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 114 MIDDLE EAST AND AFRICA REFILL PACKS IN NUTS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 115 MIDDLE EAST AND AFRICA OTHERS IN NUTS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 116 MIDDLE EAST AND AFRICA NUTS MARKET, BY PACKAGING SIZE, 2018-2032 (USD THOUSAND)

TABLE 117 MIDDLE EAST AND AFRICA 101G–250G IN NUTS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 118 MIDDLE EAST AND AFRICA 251G–500G IN NUTS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 119 MIDDLE EAST AND AFRICA 51G–100G IN NUTS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 120 MIDDLE EAST AND AFRICA 25G–50G IN NUTS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 121 MIDDLE EAST AND AFRICA 501G–1KG IN NUTS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 122 MIDDLE EAST AND AFRICA 1.1KG–2.5KG IN NUTS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 123 MIDDLE EAST AND AFRICA 2.6KG–5KG IN NUTS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 124 MIDDLE EAST AND AFRICA 5.1KG–10KG IN NUTS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 125 MIDDLE EAST AND AFRICA 10.1KG–25KG IN NUTS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 126 MIDDLE EAST AND AFRICA 25.1KG–50KG IN NUTS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 127 MIDDLE EAST AND AFRICA 50KG IN NUTS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 128 MIDDLE EAST AND AFRICA <25G IN NUTS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 129 MIDDLE EAST AND AFRICA NUTS MARKET, BY PRICE RANGE, 2018-2032 (USD THOUSAND)

TABLE 130 MIDDLE EAST AND AFRICA ECONOMY/BUDGET (USD 1.00-6.00 PER KG) IN NUTS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 131 MIDDLE EAST AND AFRICA MID-RANGE (USD 6.01-12.00 PER KG) IN NUTS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 132 MIDDLE EAST AND AFRICA PREMIUM (USD 12.01-20.00 PER KG) IN NUTS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 133 MIDDLE EAST AND AFRICA SUPER-PREMIUM/GOURMET (ABOVE USD 20.00 PER KG) IN NUTS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 134 MIDDLE EAST AND AFRICA NUTS MARKET, BY END-USE, 2018-2032 (USD THOUSAND)

TABLE 135 MIDDLE EAST AND AFRICA DIRECT CONSUMPTION IN NUTS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 136 MIDDLE EAST AND AFRICA SNACKS IN NUTS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 137 MIDDLE EAST AND AFRICA NUT BUTTERS & SPREADS IN NUTS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 138 MIDDLE EAST AND AFRICA BAKERY INDUSTRY IN NUTS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 139 MIDDLE EAST AND AFRICA CONFECTIONERY INDUSTRY IN NUTS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 140 MIDDLE EAST AND AFRICA CEREAL & GRANOLA MANUFACTURING IN NUTS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 141 MIDDLE EAST AND AFRICA FUNCTIONAL NUTRITION IN NUTS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 142 MIDDLE EAST AND AFRICA FUNCTIONAL NUTRITION IN NUTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 143 MIDDLE EAST AND AFRICA DAIRY ALTERNATIVES IN NUTS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 144 MIDDLE EAST AND AFRICA BEVERAGE INDUSTRY IN NUTS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 145 MIDDLE EAST AND AFRICA BEVERAGE INDUSTRY IN NUTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 146 MIDDLE EAST AND AFRICA PLANT-BASED MEATS IN NUTS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 147 MIDDLE EAST AND AFRICA CULINARY IN NUTS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 148 MIDDLE EAST AND AFRICA CULINARY IN NUTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 149 MIDDLE EAST AND AFRICA INDUSTRIAL OIL EXTRACTION IN NUTS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 150 MIDDLE EAST AND AFRICA FLOUR & GLUTEN-FREE BAKING IN NUTS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 151 MIDDLE EAST AND AFRICA PERSONAL CARE PRODUCTS IN NUTS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 152 MIDDLE EAST AND AFRICA PERSONAL CARE PRODUCTS IN NUTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 153 MIDDLE EAST AND AFRICA BIO-BASED & AGRO-INDUSTRIAL USES IN NUTS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 154 MIDDLE EAST AND AFRICA BIO-BASED & AGRO-INDUSTRIAL USES IN NUTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 155 MIDDLE EAST AND AFRICA PET FOOD ADDITIVES IN NUTS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 156 MIDDLE EAST AND AFRICA ANIMAL FEED IN NUTS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 157 MIDDLE EAST AND AFRICA ANIMAL FEED IN NUTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 158 MIDDLE EAST AND AFRICA OTHERS IN NUTS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 159 MIDDLE EAST AND AFRICA NUTS MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 160 MIDDLE EAST AND AFRICA B2B IN NUTS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 161 MIDDLE EAST AND AFRICA B2C IN NUTS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 162 MIDDLE EAST AND AFRICA B2C IN NUTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 163 MIDDLE EAST AND AFRICA OFFLINE IN NUTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 164 MIDDLE EAST AND AFRICA ONLINE IN NUTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 165 MIDDLE EAST AND AFRICA NUTS MARKET, BY COUNTRY, 2018-2032 (USD THOUSAND)

TABLE 166 MIDDLE EAST AND AFRICA NUTS MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 167 MIDDLE EAST AND AFRICA NUTS MARKET, BY PRODUCT TYPE, 2018-2032 (THOUSAND TONS)

TABLE 168 MIDDLE EAST AND AFRICA TREE NUTS IN NUTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 169 MIDDLE EAST AND AFRICA GROUND NUTS IN NUTS MARKET, BY PEANUTS, 2018-2032 (USD THOUSAND)

TABLE 170 MIDDLE EAST AND AFRICA HYBRID/OTHER NUTS IN NUTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 171 MIDDLE EAST AND AFRICA NUTS MARKET, BY FORM, 2018-2032 (USD THOUSAND)

TABLE 172 MIDDLE EAST AND AFRICA NUTS MARKET, BY NATURE, 2018-2032 (USD THOUSAND)

TABLE 173 MIDDLE EAST AND AFRICA NUTS MARKET, BY PROCESSING METHOD, 2018-2032 (USD THOUSAND)

TABLE 174 MIDDLE EAST AND AFRICA ROASTED IN NUTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 175 MIDDLE EAST AND AFRICA FLAVORED IN NUTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 176 MIDDLE EAST AND AFRICA NUTS MARKET, BY GRADE, 2018-2032 (USD THOUSAND)

TABLE 177 MIDDLE EAST AND AFRICA NUTS MARKET, BY SHELF LIFE, 2018-2032 (USD THOUSAND)

TABLE 178 MIDDLE EAST AND AFRICA NUTS MARKET, BY CERTIFICATION, 2018-2032 (USD THOUSAND)

TABLE 179 MIDDLE EAST AND AFRICA NUTS MARKET, BY PACKAGING, 2018-2032 (USD THOUSAND)

TABLE 180 MIDDLE EAST AND AFRICA PLASTIC POUCHES IN NUTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 181 MIDDLE EAST AND AFRICA NUTS MARKET, BY PACKAGING SIZE, 2018-2032 (USD THOUSAND)

TABLE 182 MIDDLE EAST AND AFRICA NUTS MARKET, BY PRICE RANGE, 2018-2032 (USD THOUSAND)

TABLE 183 MIDDLE EAST AND AFRICA NUTS MARKET, BY END-USE, 2018-2032 (USD THOUSAND)

TABLE 184 MIDDLE EAST AND AFRICA FUNCTIONAL NUTRITION IN NUTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 185 MIDDLE EAST AND AFRICA BEVERAGE INDUSTRY IN NUTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 186 MIDDLE EAST AND AFRICA CULINARY IN NUTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 187 MIDDLE EAST AND AFRICA PERSONAL CARE PRODUCTS IN NUTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 188 MIDDLE EAST AND AFRICA BIO-BASED & AGRO-INDUSTRIAL USES IN NUTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 189 MIDDLE EAST AND AFRICA ANIMAL FEED IN NUTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 190 MIDDLE EAST AND AFRICA NUTS MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 191 MIDDLE EAST AND AFRICA B2C IN NUTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 192 MIDDLE EAST AND AFRICA OFFLINE IN NUTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 193 MIDDLE EAST AND AFRICA ONLINE IN NUTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 194 U.A.E. NUTS MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 195 U.A.E. NUTS MARKET, BY PRODUCT TYPE, 2018-2032 (THOUSAND TONS)

TABLE 196 U.A.E. TREE NUTS IN NUTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 197 U.A.E. GROUND NUTS IN NUTS MARKET, BY PEANUTS, 2018-2032 (USD THOUSAND)

TABLE 198 U.A.E. HYBRID/OTHER NUTS IN NUTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 199 U.A.E. NUTS MARKET, BY FORM, 2018-2032 (USD THOUSAND)

TABLE 200 U.A.E. NUTS MARKET, BY NATURE, 2018-2032 (USD THOUSAND)

TABLE 201 U.A.E. NUTS MARKET, BY PROCESSING METHOD, 2018-2032 (USD THOUSAND)

TABLE 202 U.A.E. ROASTED IN NUTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 203 U.A.E. FLAVORED IN NUTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 204 U.A.E. NUTS MARKET, BY GRADE, 2018-2032 (USD THOUSAND)

TABLE 205 U.A.E. NUTS MARKET, BY SHELF LIFE, 2018-2032 (USD THOUSAND)

TABLE 206 U.A.E. NUTS MARKET, BY CERTIFICATION, 2018-2032 (USD THOUSAND)

TABLE 207 U.A.E. NUTS MARKET, BY PACKAGING, 2018-2032 (USD THOUSAND)

TABLE 208 U.A.E. PLASTIC POUCHES IN NUTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 209 U.A.E. NUTS MARKET, BY PACKAGING SIZE, 2018-2032 (USD THOUSAND)

TABLE 210 U.A.E. NUTS MARKET, BY PRICE RANGE, 2018-2032 (USD THOUSAND)

TABLE 211 U.A.E. NUTS MARKET, BY END-USE, 2018-2032 (USD THOUSAND)

TABLE 212 U.A.E. FUNCTIONAL NUTRITION IN NUTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 213 U.A.E. BEVERAGE INDUSTRY IN NUTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 214 U.A.E. CULINARY IN NUTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 215 U.A.E. PERSONAL CARE PRODUCTS IN NUTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 216 U.A.E. BIO-BASED & AGRO-INDUSTRIAL USES IN NUTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 217 U.A.E. ANIMAL FEED IN NUTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 218 U.A.E. NUTS MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 219 U.A.E. B2C IN NUTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 220 U.A.E. OFFLINE IN NUTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 221 U.A.E. ONLINE IN NUTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 222 SAUDI ARABIA NUTS MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 223 SAUDI ARABIA NUTS MARKET, BY PRODUCT TYPE, 2018-2032 (THOUSAND TONS)

TABLE 224 SAUDI ARABIA TREE NUTS IN NUTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 225 SAUDI ARABIA GROUND NUTS IN NUTS MARKET, BY PEANUTS, 2018-2032 (USD THOUSAND)

TABLE 226 SAUDI ARABIA HYBRID/OTHER NUTS IN NUTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 227 SAUDI ARABIA NUTS MARKET, BY FORM, 2018-2032 (USD THOUSAND)

TABLE 228 SAUDI ARABIA NUTS MARKET, BY NATURE, 2018-2032 (USD THOUSAND)

TABLE 229 SAUDI ARABIA NUTS MARKET, BY PROCESSING METHOD, 2018-2032 (USD THOUSAND)

TABLE 230 SAUDI ARABIA ROASTED IN NUTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 231 SAUDI ARABIA FLAVORED IN NUTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 232 SAUDI ARABIA NUTS MARKET, BY GRADE, 2018-2032 (USD THOUSAND)

TABLE 233 SAUDI ARABIA NUTS MARKET, BY SHELF LIFE, 2018-2032 (USD THOUSAND)

TABLE 234 SAUDI ARABIA NUTS MARKET, BY CERTIFICATION, 2018-2032 (USD THOUSAND)

TABLE 235 SAUDI ARABIA NUTS MARKET, BY PACKAGING, 2018-2032 (USD THOUSAND)

TABLE 236 SAUDI ARABIA PLASTIC POUCHES IN NUTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 237 SAUDI ARABIA NUTS MARKET, BY PACKAGING SIZE, 2018-2032 (USD THOUSAND)

TABLE 238 SAUDI ARABIA NUTS MARKET, BY PRICE RANGE, 2018-2032 (USD THOUSAND)

TABLE 239 SAUDI ARABIA NUTS MARKET, BY END-USE, 2018-2032 (USD THOUSAND)

TABLE 240 SAUDI ARABIA FUNCTIONAL NUTRITION IN NUTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 241 SAUDI ARABIA BEVERAGE INDUSTRY IN NUTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 242 SAUDI ARABIA CULINARY IN NUTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 243 SAUDI ARABIA PERSONAL CARE PRODUCTS IN NUTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 244 SAUDI ARABIA BIO-BASED & AGRO-INDUSTRIAL USES IN NUTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 245 SAUDI ARABIA ANIMAL FEED IN NUTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 246 SAUDI ARABIA NUTS MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 247 SAUDI ARABIA B2C IN NUTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 248 SAUDI ARABIA OFFLINE IN NUTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 249 SAUDI ARABIA ONLINE IN NUTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 250 EGYPT NUTS MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 251 EGYPT NUTS MARKET, BY PRODUCT TYPE, 2018-2032 (THOUSAND TONS)

TABLE 252 EGYPT TREE NUTS IN NUTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 253 EGYPT GROUND NUTS IN NUTS MARKET, BY PEANUTS, 2018-2032 (USD THOUSAND)

TABLE 254 EGYPT HYBRID/OTHER NUTS IN NUTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 255 EGYPT NUTS MARKET, BY FORM, 2018-2032 (USD THOUSAND)

TABLE 256 EGYPT NUTS MARKET, BY NATURE, 2018-2032 (USD THOUSAND)

TABLE 257 EGYPT NUTS MARKET, BY PROCESSING METHOD, 2018-2032 (USD THOUSAND)

TABLE 258 EGYPT ROASTED IN NUTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 259 EGYPT FLAVORED IN NUTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 260 EGYPT NUTS MARKET, BY GRADE, 2018-2032 (USD THOUSAND)

TABLE 261 EGYPT NUTS MARKET, BY SHELF LIFE, 2018-2032 (USD THOUSAND)

TABLE 262 EGYPT NUTS MARKET, BY CERTIFICATION, 2018-2032 (USD THOUSAND)

TABLE 263 EGYPT NUTS MARKET, BY PACKAGING, 2018-2032 (USD THOUSAND)

TABLE 264 EGYPT PLASTIC POUCHES IN NUTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 265 EGYPT NUTS MARKET, BY PACKAGING SIZE, 2018-2032 (USD THOUSAND)

TABLE 266 EGYPT NUTS MARKET, BY PRICE RANGE, 2018-2032 (USD THOUSAND)

TABLE 267 EGYPT NUTS MARKET, BY END-USE, 2018-2032 (USD THOUSAND)

TABLE 268 EGYPT FUNCTIONAL NUTRITION IN NUTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 269 EGYPT BEVERAGE INDUSTRY IN NUTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 270 EGYPT CULINARY IN NUTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 271 EGYPT PERSONAL CARE PRODUCTS IN NUTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 272 EGYPT BIO-BASED & AGRO-INDUSTRIAL USES IN NUTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 273 EGYPT ANIMAL FEED IN NUTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 274 EGYPT NUTS MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 275 EGYPT B2C IN NUTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 276 EGYPT OFFLINE IN NUTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 277 EGYPT ONLINE IN NUTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 278 SOUTH AFRICA NUTS MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 279 SOUTH AFRICA NUTS MARKET, BY PRODUCT TYPE, 2018-2032 (THOUSAND TONS)

TABLE 280 SOUTH AFRICA TREE NUTS IN NUTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 281 SOUTH AFRICA GROUND NUTS IN NUTS MARKET, BY PEANUTS, 2018-2032 (USD THOUSAND)

TABLE 282 SOUTH AFRICA HYBRID/OTHER NUTS IN NUTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 283 SOUTH AFRICA NUTS MARKET, BY FORM, 2018-2032 (USD THOUSAND)

TABLE 284 SOUTH AFRICA NUTS MARKET, BY NATURE, 2018-2032 (USD THOUSAND)

TABLE 285 SOUTH AFRICA NUTS MARKET, BY PROCESSING METHOD, 2018-2032 (USD THOUSAND)

TABLE 286 SOUTH AFRICA ROASTED IN NUTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 287 SOUTH AFRICA FLAVORED IN NUTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 288 SOUTH AFRICA NUTS MARKET, BY GRADE, 2018-2032 (USD THOUSAND)

TABLE 289 SOUTH AFRICA NUTS MARKET, BY SHELF LIFE, 2018-2032 (USD THOUSAND)

TABLE 290 SOUTH AFRICA NUTS MARKET, BY CERTIFICATION, 2018-2032 (USD THOUSAND)

TABLE 291 SOUTH AFRICA NUTS MARKET, BY PACKAGING, 2018-2032 (USD THOUSAND)

TABLE 292 SOUTH AFRICA PLASTIC POUCHES IN NUTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 293 SOUTH AFRICA NUTS MARKET, BY PACKAGING SIZE, 2018-2032 (USD THOUSAND)

TABLE 294 SOUTH AFRICA NUTS MARKET, BY PRICE RANGE, 2018-2032 (USD THOUSAND)

TABLE 295 SOUTH AFRICA NUTS MARKET, BY END-USE, 2018-2032 (USD THOUSAND)

TABLE 296 SOUTH AFRICA FUNCTIONAL NUTRITION IN NUTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 297 SOUTH AFRICA BEVERAGE INDUSTRY IN NUTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 298 SOUTH AFRICA CULINARY IN NUTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 299 SOUTH AFRICA PERSONAL CARE PRODUCTS IN NUTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 300 SOUTH AFRICA BIO-BASED & AGRO-INDUSTRIAL USES IN NUTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 301 SOUTH AFRICA ANIMAL FEED IN NUTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 302 SOUTH AFRICA NUTS MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 303 SOUTH AFRICA B2C IN NUTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 304 SOUTH AFRICA OFFLINE IN NUTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 305 SOUTH AFRICA ONLINE IN NUTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 306 ISRAEL NUTS MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 307 ISRAEL NUTS MARKET, BY PRODUCT TYPE, 2018-2032 (THOUSAND TONS)

TABLE 308 ISRAEL TREE NUTS IN NUTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 309 ISRAEL GROUND NUTS IN NUTS MARKET, BY PEANUTS, 2018-2032 (USD THOUSAND)

TABLE 310 ISRAEL HYBRID/OTHER NUTS IN NUTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 311 ISRAEL NUTS MARKET, BY FORM, 2018-2032 (USD THOUSAND)

TABLE 312 ISRAEL NUTS MARKET, BY NATURE, 2018-2032 (USD THOUSAND)

TABLE 313 ISRAEL NUTS MARKET, BY PROCESSING METHOD, 2018-2032 (USD THOUSAND)

TABLE 314 ISRAEL ROASTED IN NUTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 315 ISRAEL FLAVORED IN NUTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 316 ISRAEL NUTS MARKET, BY GRADE, 2018-2032 (USD THOUSAND)

TABLE 317 ISRAEL NUTS MARKET, BY SHELF LIFE, 2018-2032 (USD THOUSAND)

TABLE 318 ISRAEL NUTS MARKET, BY CERTIFICATION, 2018-2032 (USD THOUSAND)

TABLE 319 ISRAEL NUTS MARKET, BY PACKAGING, 2018-2032 (USD THOUSAND)

TABLE 320 ISRAEL PLASTIC POUCHES IN NUTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 321 ISRAEL NUTS MARKET, BY PACKAGING SIZE, 2018-2032 (USD THOUSAND)

TABLE 322 ISRAEL NUTS MARKET, BY PRICE RANGE, 2018-2032 (USD THOUSAND)

TABLE 323 ISRAEL NUTS MARKET, BY END-USE, 2018-2032 (USD THOUSAND)

TABLE 324 ISRAEL FUNCTIONAL NUTRITION IN NUTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 325 ISRAEL BEVERAGE INDUSTRY IN NUTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 326 ISRAEL CULINARY IN NUTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 327 ISRAEL PERSONAL CARE PRODUCTS IN NUTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 328 ISRAEL BIO-BASED & AGRO-INDUSTRIAL USES IN NUTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 329 ISRAEL ANIMAL FEED IN NUTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 330 ISRAEL NUTS MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 331 ISRAEL B2C IN NUTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 332 ISRAEL OFFLINE IN NUTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 333 ISRAEL ONLINE IN NUTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 334 KUWAIT NUTS MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 335 KUWAIT NUTS MARKET, BY PRODUCT TYPE, 2018-2032 (THOUSAND TONS)

TABLE 336 KUWAIT TREE NUTS IN NUTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 337 KUWAIT GROUND NUTS IN NUTS MARKET, BY PEANUTS, 2018-2032 (USD THOUSAND)

TABLE 338 KUWAIT HYBRID/OTHER NUTS IN NUTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 339 KUWAIT NUTS MARKET, BY FORM, 2018-2032 (USD THOUSAND)

TABLE 340 KUWAIT NUTS MARKET, BY NATURE, 2018-2032 (USD THOUSAND)

TABLE 341 KUWAIT NUTS MARKET, BY PROCESSING METHOD, 2018-2032 (USD THOUSAND)

TABLE 342 KUWAIT ROASTED IN NUTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 343 KUWAIT FLAVORED IN NUTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 344 KUWAIT NUTS MARKET, BY GRADE, 2018-2032 (USD THOUSAND)

TABLE 345 KUWAIT NUTS MARKET, BY SHELF LIFE, 2018-2032 (USD THOUSAND)

TABLE 346 KUWAIT NUTS MARKET, BY CERTIFICATION, 2018-2032 (USD THOUSAND)

TABLE 347 KUWAIT NUTS MARKET, BY PACKAGING, 2018-2032 (USD THOUSAND)

TABLE 348 KUWAIT PLASTIC POUCHES IN NUTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 349 KUWAIT NUTS MARKET, BY PACKAGING SIZE, 2018-2032 (USD THOUSAND)

TABLE 350 KUWAIT NUTS MARKET, BY PRICE RANGE, 2018-2032 (USD THOUSAND)

TABLE 351 KUWAIT NUTS MARKET, BY END-USE, 2018-2032 (USD THOUSAND)

TABLE 352 KUWAIT FUNCTIONAL NUTRITION IN NUTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 353 KUWAIT BEVERAGE INDUSTRY IN NUTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 354 KUWAIT CULINARY IN NUTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 355 KUWAIT PERSONAL CARE PRODUCTS IN NUTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 356 KUWAIT BIO-BASED & AGRO-INDUSTRIAL USES IN NUTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 357 KUWAIT ANIMAL FEED IN NUTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 358 KUWAIT NUTS MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 359 KUWAIT B2C IN NUTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 360 KUWAIT OFFLINE IN NUTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 361 KUWAIT ONLINE IN NUTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 362 OMAN NUTS MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 363 OMAN NUTS MARKET, BY PRODUCT TYPE, 2018-2032 (THOUSAND TONS)

TABLE 364 OMAN TREE NUTS IN NUTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 365 OMAN GROUND NUTS IN NUTS MARKET, BY PEANUTS, 2018-2032 (USD THOUSAND)

TABLE 366 OMAN HYBRID/OTHER NUTS IN NUTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 367 OMAN NUTS MARKET, BY FORM, 2018-2032 (USD THOUSAND)

TABLE 368 OMAN NUTS MARKET, BY NATURE, 2018-2032 (USD THOUSAND)

TABLE 369 OMAN NUTS MARKET, BY PROCESSING METHOD, 2018-2032 (USD THOUSAND)

TABLE 370 OMAN ROASTED IN NUTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 371 OMAN FLAVORED IN NUTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 372 OMAN NUTS MARKET, BY GRADE, 2018-2032 (USD THOUSAND)

TABLE 373 OMAN NUTS MARKET, BY SHELF LIFE, 2018-2032 (USD THOUSAND)

TABLE 374 OMAN NUTS MARKET, BY CERTIFICATION, 2018-2032 (USD THOUSAND)

TABLE 375 OMAN NUTS MARKET, BY PACKAGING, 2018-2032 (USD THOUSAND)

TABLE 376 OMAN PLASTIC POUCHES IN NUTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 377 OMAN NUTS MARKET, BY PACKAGING SIZE, 2018-2032 (USD THOUSAND)

TABLE 378 OMAN NUTS MARKET, BY PRICE RANGE, 2018-2032 (USD THOUSAND)

TABLE 379 OMAN NUTS MARKET, BY END-USE, 2018-2032 (USD THOUSAND)

TABLE 380 OMAN FUNCTIONAL NUTRITION IN NUTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 381 OMAN BEVERAGE INDUSTRY IN NUTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 382 OMAN CULINARY IN NUTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 383 OMAN PERSONAL CARE PRODUCTS IN NUTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 384 OMAN BIO-BASED & AGRO-INDUSTRIAL USES IN NUTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 385 OMAN ANIMAL FEED IN NUTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 386 OMAN NUTS MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 387 OMAN B2C IN NUTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 388 OMAN OFFLINE IN NUTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 389 OMAN ONLINE IN NUTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 390 BAHRAIN NUTS MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 391 BAHRAIN NUTS MARKET, BY PRODUCT TYPE, 2018-2032 (THOUSAND TONS)

TABLE 392 BAHRAIN TREE NUTS IN NUTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 393 BAHRAIN GROUND NUTS IN NUTS MARKET, BY PEANUTS, 2018-2032 (USD THOUSAND)

TABLE 394 BAHRAIN HYBRID/OTHER NUTS IN NUTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 395 BAHRAIN NUTS MARKET, BY FORM, 2018-2032 (USD THOUSAND)

TABLE 396 BAHRAIN NUTS MARKET, BY NATURE, 2018-2032 (USD THOUSAND)

TABLE 397 BAHRAIN NUTS MARKET, BY PROCESSING METHOD, 2018-2032 (USD THOUSAND)

TABLE 398 BAHRAIN ROASTED IN NUTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 399 BAHRAIN FLAVORED IN NUTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 400 BAHRAIN NUTS MARKET, BY GRADE, 2018-2032 (USD THOUSAND)

TABLE 401 BAHRAIN NUTS MARKET, BY SHELF LIFE, 2018-2032 (USD THOUSAND)

TABLE 402 BAHRAIN NUTS MARKET, BY CERTIFICATION, 2018-2032 (USD THOUSAND)

TABLE 403 BAHRAIN NUTS MARKET, BY PACKAGING, 2018-2032 (USD THOUSAND)

TABLE 404 BAHRAIN PLASTIC POUCHES IN NUTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 405 BAHRAIN NUTS MARKET, BY PACKAGING SIZE, 2018-2032 (USD THOUSAND)

TABLE 406 BAHRAIN NUTS MARKET, BY PRICE RANGE, 2018-2032 (USD THOUSAND)

TABLE 407 BAHRAIN NUTS MARKET, BY END-USE, 2018-2032 (USD THOUSAND)

TABLE 408 BAHRAIN FUNCTIONAL NUTRITION IN NUTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 409 BAHRAIN BEVERAGE INDUSTRY IN NUTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 410 BAHRAIN CULINARY IN NUTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 411 BAHRAIN PERSONAL CARE PRODUCTS IN NUTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 412 BAHRAIN BIO-BASED & AGRO-INDUSTRIAL USES IN NUTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 413 BAHRAIN ANIMAL FEED IN NUTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 414 BAHRAIN NUTS MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 415 BAHRAIN B2C IN NUTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 416 BAHRAIN OFFLINE IN NUTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 417 BAHRAIN ONLINE IN NUTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 418 QATAR NUTS MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 419 QATAR NUTS MARKET, BY PRODUCT TYPE, 2018-2032 (THOUSAND TONS)

TABLE 420 QATAR TREE NUTS IN NUTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 421 QATAR GROUND NUTS IN NUTS MARKET, BY PEANUTS, 2018-2032 (USD THOUSAND)

TABLE 422 QATAR HYBRID/OTHER NUTS IN NUTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 423 QATAR NUTS MARKET, BY FORM, 2018-2032 (USD THOUSAND)

TABLE 424 QATAR NUTS MARKET, BY NATURE, 2018-2032 (USD THOUSAND)

TABLE 425 QATAR NUTS MARKET, BY PROCESSING METHOD, 2018-2032 (USD THOUSAND)

TABLE 426 QATAR ROASTED IN NUTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 427 QATAR FLAVORED IN NUTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 428 QATAR NUTS MARKET, BY GRADE, 2018-2032 (USD THOUSAND)

TABLE 429 QATAR NUTS MARKET, BY SHELF LIFE, 2018-2032 (USD THOUSAND)

TABLE 430 QATAR NUTS MARKET, BY CERTIFICATION, 2018-2032 (USD THOUSAND)

TABLE 431 QATAR NUTS MARKET, BY PACKAGING, 2018-2032 (USD THOUSAND)

TABLE 432 QATAR PLASTIC POUCHES IN NUTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 433 QATAR NUTS MARKET, BY PACKAGING SIZE, 2018-2032 (USD THOUSAND)

TABLE 434 QATAR NUTS MARKET, BY PRICE RANGE, 2018-2032 (USD THOUSAND)

TABLE 435 QATAR NUTS MARKET, BY END-USE, 2018-2032 (USD THOUSAND)

TABLE 436 QATAR FUNCTIONAL NUTRITION IN NUTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 437 QATAR BEVERAGE INDUSTRY IN NUTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 438 QATAR CULINARY IN NUTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 439 QATAR PERSONAL CARE PRODUCTS IN NUTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 440 QATAR BIO-BASED & AGRO-INDUSTRIAL USES IN NUTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 441 QATAR ANIMAL FEED IN NUTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 442 QATAR NUTS MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 443 QATAR B2C IN NUTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 444 QATAR OFFLINE IN NUTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 445 QATAR ONLINE IN NUTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 446 REST OF MIDDLE EAST AND AFRICA NUTS MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 447 REST OF MIDDLE EAST AND AFRICA NUTS MARKET, BY PRODUCT TYPE, 2018-2032 (THOUSAND TONS)

Lista de Figura

FIGURE 1 MIDDLE EAST AND AFRICA NUTS MARKET

FIGURE 2 MIDDLE EAST AND AFRICA NUTS MARKET: DATA TRIANGULATION

FIGURE 3 MIDDLE EAST AND AFRICA NUTS MARKET: DROC ANALYSIS

FIGURE 4 MIDDLE EAST AND AFRICA NUTS MARKET: MIDDLE EAST AND AFRICA VS REGIONAL MARKET ANALYSIS

FIGURE 5 MIDDLE EAST AND AFRICA NUTS MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 MIDDLE EAST AND AFRICA NUTS MARKET: MULTIVARIATE MODELLING

FIGURE 7 MIDDLE EAST AND AFRICA NUTS MARKET TIME LINE CURVE

FIGURE 8 MIDDLE EAST AND AFRICA NUTS MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 9 MIDDLE EAST AND AFRICA NUTS MARKET: DBMR MARKET POSITION GRID

FIGURE 10 MIDDLE EAST AND AFRICA NUTS MARKET: MARKET END-USE COVERAGE GRID

FIGURE 11 MIDDLE EAST AND AFRICA NUTS MARKET: VENDOR SHARE ANALYSIS

FIGURE 12 MIDDLE EAST AND AFRICA NUTS MARKET: SEGMENTATION

FIGURE 13 EXECUTIVE SUMMARY

FIGURE 14 MIDDLE EAST AND AFRICA NUTS MARKET STRATEGIC DEVELOPMENT

FIGURE 15 FOUR SEGMENTS COMPRISE THE MIDDLE EAST AND AFRICA NUTS MARKET, BY PRODUCT TYPE

FIGURE 16 GROWING MIDDLE EAST AND AFRICA TREND TOWARD HEALTHIER SNACKING AND NUTRITIOUS CHOICES IS EXPECTED TO DRIVE THE MIDDLE EAST AND AFRICA NUTS MARKET IN THE FORECAST PERIOD

FIGURE 17 TREE NUT SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE MIDDLE EAST AND AFRICA NUTS MARKET IN 2025 AND 2032

FIGURE 18 NUTS MARKET VALUE CHAIN

FIGURE 19 NUTS MARKET SUPPLY CHAIN ANALYSIS

FIGURE 20 TOTAL NUMBER OF DEALS

FIGURE 21 DEALS BY TYPE

FIGURE 22 DEALS BY SEGMENT

FIGURE 23 PRODUCTION CAPACITY OUTLOOK

FIGURE 24 PRODUCT AND BRAND OVERVIEW

FIGURE 25 PATENT FAMILIES

FIGURE 26 PATENT FAMILIES

FIGURE 27 COMPANY EVALUATION QUADRANT

FIGURE 28 PRICE TREND ANALYSIS, 2018-2032 (USD/KG)