Middle East And Africa Ready To Eat Food Market

Tamanho do mercado em biliões de dólares

CAGR :

%

USD

22.59 Billion

USD

43.82 Billion

2024

2032

USD

22.59 Billion

USD

43.82 Billion

2024

2032

| 2025 –2032 | |

| USD 22.59 Billion | |

| USD 43.82 Billion | |

|

|

|

|

Segmentação do mercado de alimentos prontos para consumo no Oriente Médio e África, por tipo de produto (produtos cárneos, produtos à base de cereais, laticínios, produtos de panificação, doces salgados, produtos de confeitaria, produtos à base de vegetais, sopas instantâneas, salgadinhos salgados, alimentos refrigerados, salgadinhos de carne à base de plantas e refeições prontas para consumo), categoria (convencional e especial), tipo de embalagem (bolsas/sachês, latas, potes e recipientes, garrafas, caixas e outros), tamanho da embalagem (menos de 250 gramas, 251-500 gramas, 501-750 gramas, 751-1000 gramas e mais de 1000 gramas), tecnologia de embalagem (eliminadores de oxigênio, controle de umidade, antimicrobianos, indicadores de tempo e temperatura e filmes comestíveis), tipo de armazenamento (congelado/refrigerado, estável em prateleira, enlatado e outros), canal de distribuição (canal baseado em loja e não baseado em loja), usuário final (Serviços da Indústria Alimentar, Residências e Outros) – Tendências e Previsão da Indústria até 2032

Análise do mercado de alimentos prontos para consumo no Oriente Médio e na África

O mercado de alimentos prontos para consumo (RTE) no Oriente Médio e na África está em constante crescimento, impulsionado pela crescente demanda dos consumidores por opções de refeições práticas e que economizem tempo. A urbanização, o estilo de vida agitado e a mudança nos hábitos alimentares são fatores-chave que influenciam essa mudança. Refeições congeladas, lanches instantâneos e produtos prontos para consumo embalados estão ganhando popularidade em diversos grupos demográficos. Enquanto a América do Norte e a Europa lideram o mercado, a Ásia-Pacífico está emergindo como uma forte concorrente devido ao aumento da renda disponível e à evolução das preferências alimentares. Consumidores preocupados com a saúde buscam opções orgânicas, sem conservantes e nutritivas. A inovação em embalagens, sustentabilidade e qualidade dos ingredientes está moldando o futuro do mercado, apesar dos desafios da cadeia de suprimentos.

Tamanho do mercado de alimentos prontos para consumo no Oriente Médio e na África

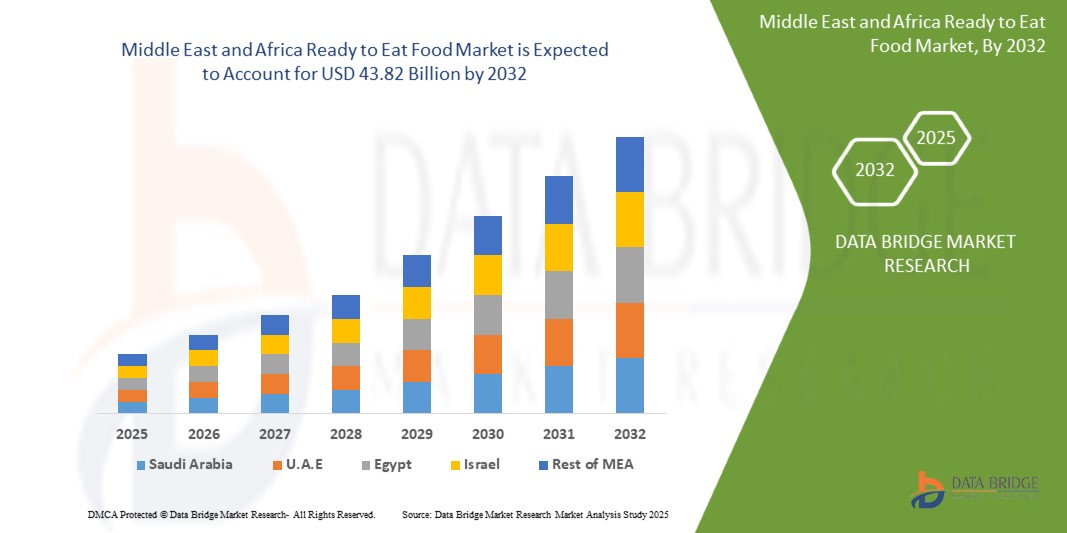

O tamanho do mercado de alimentos prontos para consumo do Oriente Médio e da África foi avaliado em US$ 22,59 bilhões em 2024 e está projetado para atingir US$ 43,82 bilhões até 2032, com um CAGR de 9,48% durante o período previsto de 2025 a 2032. Além dos insights sobre cenários de mercado, como valor de mercado, taxa de crescimento, segmentação, cobertura geográfica e principais participantes, os relatórios de mercado selecionados pela Data Bridge Market Research também incluem análises aprofundadas de especialistas, análise de preços, análise de participação de marca, pesquisa com consumidores, análise demográfica, análise da cadeia de suprimentos, análise da cadeia de valor, visão geral de matérias-primas/consumíveis, critérios de seleção de fornecedores, análise PESTLE, análise de Porter e estrutura regulatória.

Tendências do mercado de alimentos prontos para consumo no Oriente Médio e na África

“Aumento das horas de trabalho e estilos de vida acelerados”

À medida que as pessoas se esforçam para equilibrar compromissos profissionais e pessoais, a demanda por soluções práticas para refeições aumentou exponencialmente. De acordo com um relatório da Organização Internacional do Trabalho (OIT), a jornada média de trabalho no Oriente Médio e na África aumentou aproximadamente 8% na última década, evidenciando a crescente pressão sobre a gestão do tempo. Consequentemente, os consumidores estão optando por opções de refeições rápidas e descomplicadas, que exigem preparo mínimo e oferecem economia de tempo substancial.

O mercado de alimentos prontos para consumo se beneficiou muito dessa mudança, visto que esses produtos atendem às necessidades de pessoas ocupadas que buscam refeições práticas, nutritivas e de consumo instantâneo. A tendência de estilo de vida acelerado é particularmente prevalente entre as populações urbanas, onde a rotina agitada deixa pouco tempo para o preparo tradicional de refeições. Isso levou os fabricantes a inovar e lançar uma ampla gama de produtos prontos para consumo que atendem a diversas preferências de paladar e necessidades dietéticas.

Além disso, o número crescente de famílias com dupla renda contribuiu para a expansão do mercado. Em países como os EUA e o Reino Unido, mais de 60% das famílias agora têm ambos os parceiros empregados, deixando menos tempo para cozinhar refeições elaboradas. Essa mudança demográfica levou a um aumento na demanda por produtos prontos para consumo, que podem ser consumidos convenientemente no trabalho, durante o trajeto ou em casa após longas horas de trabalho.

Por exemplo,

- Em março de 2023, a Organização Internacional do Trabalho (OIT) do Camboja relatou uma média de aproximadamente 2.456 horas de trabalho por ano em 2017, o equivalente a quase 47 horas por semana, a maior entre 66 países estudados. Isso indica uma restrição de tempo substancial para o preparo de refeições, impulsionando a demanda por produtos alimentícios prontos para consumo.

Em países como o México e a República Checa, os funcionários costumam trabalhar mais de 2.000 horas por ano, o que leva a uma forte preferência por opções de refeições rápidas e descomplicadas, incluindo produtos prontos para consumo.

À medida que estilos de vida agitados se tornam mais comuns no mundo todo, o mercado de alimentos prontos para consumo está pronto para um crescimento robusto, impulsionado pela necessidade inabalável de soluções de refeições rápidas, acessíveis e satisfatórias.

Escopo do Relatório e Segmentação de Mercado

|

Atributos |

Principais insights de mercado de alimentos prontos para consumo no Oriente Médio e na África |

|

Segmentos abrangidos |

|

|

Países abrangidos |

Arábia Saudita, Emirados Árabes Unidos, África do Sul, Egito, Kuwait, Omã, Catar, Bahrein e resto do Oriente Médio e África |

|

Principais participantes do mercado |

Mondelēz International, Inc. (EUA), The Kraft Heinz Company (EUA), General Mills Inc (EUA), Nestlé (Suíça), Kellanova (EUA), McCain Foods Limited (Canadá), Hormel Foods, LLC (EUA), Unilever (Reino Unido), Lamb Weston, Inc. (EUA), Simplot (EUA), Tyson Foods, Inc. (EUA), Nomad Foods (Inglaterra), Greencore Group plc (Irlanda), 2 Sisters Food Group (Inglaterra), ITC Limited (Índia), Agristo (Bélgica), Premier Foods plc (Reino Unido), Bakkavor Group plc (Reino Unido), The Hain Celestial Group, Inc. (EUA), Orkla (Noruega), Farm Frites (Holanda), Haldiram's (Índia), Greenyard (Bélgica), Agrarfrost GmbH (Alemanha), Regal Kitchen Foods (Índia), GODREJ AGROVET LTD. (Índia), Gitsfood.com (Índia), LIGHT MASS (Brasil), Koyara Food (Índia), Genie Food Group (Índia), Himalaya Food International Ltd. (Índia), Vimal Agro Products Pvt Ltd (Índia), Vechem Organics (P) Limited (Índia), Eateasy New (Índia), Sankalpfoods.com (Índia), CSC Brands LP (Canadá) e Priya Foods (Ushodaya Enterprises Pvt Ltd) (Índia) |

|

Oportunidades de mercado |

|

|

Conjuntos de informações de dados de valor agregado |

Além dos insights sobre cenários de mercado, como valor de mercado, taxa de crescimento, segmentação, cobertura geográfica e principais participantes, os relatórios de mercado selecionados pela Data Bridge Market Research também incluem análises aprofundadas de especialistas, análises de preços, análises de participação de marca, pesquisas com consumidores, análises demográficas, análises da cadeia de suprimentos, análises da cadeia de valor, visão geral de matérias-primas/consumíveis, critérios de seleção de fornecedores, análise PESTLE, análise de Porter e estrutura regulatória. |

Definição do Mercado de Alimentos Prontos para Consumo no Oriente Médio e África

Alimentos prontos para consumo (RTE) referem-se a produtos alimentícios pré-cozidos, pré-embalados e que requerem pouca ou nenhuma preparação adicional antes do consumo. Esses alimentos são projetados para serem práticos e atendem a estilos de vida agitados, proporcionando soluções de refeições rápidas e fáceis sem comprometer o sabor ou a qualidade. Alimentos prontos para consumo incluem uma ampla variedade de produtos, como refeições congeladas, enlatados, itens refrigerados e refrigerados, além de lanches embalados com longa vida útil. Eles são comumente encontrados em supermercados, hipermercados, lojas de conveniência e plataformas de varejo online. Alimentos prontos para consumo são particularmente populares entre profissionais, estudantes e consumidores urbanos que buscam opções de refeições que economizem tempo.

Dinâmica do mercado de alimentos prontos para consumo no Oriente Médio e na África

Motoristas

- Aumento da renda disponível do consumidor e maior poder de compra

À medida que as economias continuam a se expandir, os consumidores desfrutam de maior estabilidade financeira, o que lhes permite gastar mais em produtos alimentícios práticos e premium. De acordo com o Banco Mundial, a renda disponível per capita no Oriente Médio e na África tem crescido consistentemente na última década, permitindo que os consumidores explorem uma variedade maior de opções alimentares que oferecem conveniência e qualidade.

Esse aumento na renda disponível levou a uma mudança nas preferências dos consumidores em direção a soluções de refeições que economizam tempo e facilitam a vida. À medida que mais pessoas podem comprar produtos prontos para consumo premium e mais caros, os fabricantes estão capitalizando essa tendência, oferecendo opções de refeições diversificadas e inovadoras que atendem a diversas preferências alimentares, incluindo variedades orgânicas, sem glúten e à base de plantas. O aumento da renda disponível é particularmente evidente em economias emergentes como China, Índia e Brasil, onde a crescente classe média está cada vez mais inclinada a escolhas alimentares convenientes em meio a estilos de vida urbanos agitados. Somente na China, a renda média disponível das famílias aumentou cerca de 5,3% em 2024, em comparação com os 5,1% do ano anterior, aumentando significativamente a demanda por produtos prontos para consumo.

Por exemplo,

- Em fevereiro de 2025, um artigo do The Economic Times destacou que a Adani Wilmar, conhecida por marcas como o arroz "Kohinoor" e os óleos de cozinha "Fortune", prevê um crescimento de 10% no volume de vendas no próximo ano fiscal. O CEO Angshu Mallick atribui esse crescimento esperado ao aumento dos gastos urbanos, impulsionado por cortes no imposto de renda pessoal e pela crescente demanda por aplicativos de entrega rápida de compras.

- Em 2023, a renda pessoal disponível na China subiu para 7,2 mil dólares, ante 6,9 mil dólares em 2022. No período de 1978 a 2023, a renda pessoal disponível na China atingiu uma média de 1,97 mil dólares, atingindo um pico de 7,2 mil dólares em 2023 e atingindo um recorde de baixa de 0,048 mil dólares em 1978.

Além disso, o maior poder de compra incentivou os consumidores a priorizar qualidade, sabor e nutrição, levando os fabricantes a desenvolver ofertas prontas para consumo com valor agregado. Com o aumento contínuo da renda disponível no Oriente Médio e na África, espera-se que o mercado de alimentos prontos para consumo prospere, impulsionado pela disposição dos consumidores em investir em soluções de refeições premium e práticas.

- Canais de varejo e comércio eletrônico em rápida expansão

Os fabricantes estão capitalizando formatos modernos de varejo e soluções de compras digitais para aumentar a visibilidade e a acessibilidade dos produtos, à medida que os consumidores continuam a adotá-los. A crescente presença de supermercados, hipermercados, lojas de conveniência e plataformas de compras online tornou os produtos alimentícios prontos para consumo (RTE) mais acessíveis, alinhando-se ao estilo de vida acelerado dos consumidores urbanos.

O comércio eletrônico, em particular, transformou o cenário do varejo de alimentos ao oferecer a conveniência de comprar refeições prontas para consumo no conforto de casa. Atualmente, cerca de 2,77 bilhões de pessoas em todo o mundo fazem compras online por meio de plataformas de comércio eletrônico dedicadas ou lojas de mídia social, refletindo uma preferência crescente por compras online. Essa tendência é ainda mais apoiada pela crescente penetração de smartphones e pela melhor conectividade com a internet, especialmente em economias emergentes. Gigantes do varejo e plataformas digitais estão capitalizando essa oportunidade expandindo seus portfólios de produtos prontos para consumo, incluindo refeições congeladas, lanches instantâneos e kits de refeições saudáveis. Colaborações estratégicas entre fabricantes de alimentos e plataformas de comércio eletrônico como Amazon, Walmart e players regionais como BigBasket na Índia e JD.com na China facilitaram o acesso dos consumidores a uma ampla variedade de opções prontas para consumo com apenas alguns cliques, o que agilizou a distribuição, reduziu os prazos de entrega e aumentou a satisfação do cliente. Além disso, a adoção do varejo omnicanal — integrando vendas físicas e digitais — provou ser altamente eficaz para atender às diversas demandas dos consumidores modernos.

Por exemplo,

- Os resultados da SellersCommerce indicam que, com mais de 33% da população mundial comprando online, o comércio eletrônico cresceu e se tornou uma indústria de US$ 6,8 trilhões, com projeção de atingir US$ 8 trilhões até 2027. Cerca de 2,77 bilhões de pessoas em todo o mundo fazem compras por meio de plataformas de comércio eletrônico dedicadas ou lojas de mídia social. A China e os EUA lideram as compras online, criando vastas oportunidades para marcas de alimentos prontos para consumo (RTE). À medida que os consumidores preferem cada vez mais compras sem complicações, os produtos prontos para consumo estão bem posicionados para prosperar.

- A BigBasket, plataforma líder de supermercados online na Índia, expandiu seu portfólio de produtos prontos para consumo (RTE) para atender à crescente demanda por opções de alimentos práticos. Com foco na entrega de produtos frescos e de alta qualidade, a empresa busca atender à crescente preferência do consumidor por refeições rápidas e práticas. Essa mudança estratégica posiciona a BigBasket para capitalizar a crescente popularidade dos alimentos prontos para consumo no mercado indiano.

- Na China, as lojas Hema Fresh do Alibaba combinam o varejo online e físico, permitindo que os consumidores peçam refeições prontas por meio de um aplicativo e as recebam em até 30 minutos. A Hema relatou um aumento de 20% nas vendas brutas em 2022.

Essa experiência de compra integrada, aliada a descontos atrativos e modelos de assinatura, tornou o e-commerce o canal preferido dos consumidores ocupados. Como resultado, os fabricantes estão cada vez mais fazendo parcerias com plataformas online para expandir seu alcance, impulsionando o crescimento e a inovação do mercado.

Oportunidades

- Crescente demanda por alimentos prontos para consumo, veganos e à base de plantas

A tendência de conscientização crescente sobre os benefícios para a saúde, a sustentabilidade ambiental e as considerações éticas associadas às dietas à base de plantas nos dias de hoje. À medida que mais consumidores adotam estilos de vida veganos ou flexitarianos, a demanda por refeições práticas e prontas para consumo que se alinhem a essas escolhas continua a crescer.

Os players do mercado estão capitalizando essa tendência com o lançamento de produtos prontos para consumo (RTE) inovadores, saborosos e ricos em nutrientes, derivados de ingredientes vegetais. De acordo com um relatório do Good Food Institute, o setor de alimentos à base de plantas apresentou crescimento de dois dígitos nos últimos anos, impulsionado pelo crescente interesse do consumidor e pela maior disponibilidade do produto. Grandes fabricantes de alimentos e startups, como a Food and Drug Administration (FDA), estão investindo cada vez mais em soluções de refeições veganas, desde curries e massas à base de plantas até sobremesas sem laticínios e saladas ricas em proteínas. As mídias sociais e as tendências alimentares impulsionadas por influenciadores também desempenharam um papel fundamental na promoção de refeições prontas para consumo (RTE) veganas, tornando-as mais populares e acessíveis. Além disso, a expansão dos canais de varejo e e-commerce impulsionou ainda mais a visibilidade e o alcance das ofertas à base de plantas.

Por exemplo,

- Em novembro de 2021, uma pesquisa da NielsenIQ revelou que 2,7 milhões de domicílios no Reino Unido tinham pelo menos um morador vegano ou vegetariano. Além disso, 10,5 milhões de domicílios optavam por alternativas veganas ou vegetarianas pelo menos uma vez por semana em vez de refeições à base de carne. Entre os entrevistados, 40% citaram os benefícios para a saúde como motivação, enquanto 31% acreditavam que era melhor para o planeta.

- Em 2022, uma pesquisa da Ipsos constatou que a crescente demanda por alimentos prontos para consumo (RTE) veganos e à base de plantas é evidente, à medida que os consumidores buscam cada vez mais opções mais saudáveis e sustentáveis. De acordo com a pesquisa da Ipsos, quase metade (46%) dos britânicos com idade entre 16 e 75 anos está considerando reduzir o consumo de produtos de origem animal, com 48% já utilizando alternativas de leite à base de plantas, como leite de amêndoa, aveia e coco. O mercado de RTE pode capitalizar essa tendência, oferecendo soluções de refeições práticas, nutritivas e à base de plantas.

- Em 2021, a Pesquisa Europeia de Consumidores sobre Alimentos Vegetais, realizada pela ProVeg International, destacou que o Reino Unido lidera a Europa na compra e no consumo de produtos à base de plantas, incluindo refeições veganas prontas e itens para viagem. À medida que os consumidores priorizam cada vez mais a saúde e a sustentabilidade, o mercado de alimentos prontos para consumo pode capitalizar essa tendência, oferecendo opções práticas e diversificadas de refeições à base de plantas.

Com consumidores preocupados com a saúde buscando opções alimentares nutritivas e éticas, há amplo espaço para os fabricantes inovarem e diversificarem seus portfólios de produtos. Colaborações com fornecedores de ingredientes à base de plantas e investimentos em pesquisa e desenvolvimento podem aumentar ainda mais o apelo dos alimentos veganos prontos para consumo. À medida que o mercado evolui, a adesão ao movimento plant-based apresenta uma oportunidade promissora de crescimento e lucratividade sustentados.

- Avanços tecnológicos no processamento e embalagem de alimentos

Inovações em métodos de processamento, como o processamento de alta pressão (HPP) e a esterilização térmica assistida por micro-ondas (MATS), permitiram aos fabricantes estender a vida útil dos produtos, preservando o frescor, o sabor e o valor nutricional. Essas técnicas de ponta atendem às demandas dos consumidores por produtos minimamente processados e sem aditivos, sem comprometer a segurança e a qualidade.

No setor de embalagens, a adoção de soluções inteligentes e sustentáveis está ganhando força. Tecnologias de embalagem ativas e inteligentes, incluindo removedores de oxigênio e indicadores de tempo e temperatura, aumentam a segurança do produto e mantêm a qualidade em toda a cadeia de suprimentos. Além disso, a mudança para materiais ecologicamente corretos, como embalagens biodegradáveis e recicláveis, está atraindo consumidores ambientalmente conscientes, ao mesmo tempo em que se alinha às metas de sustentabilidade do Oriente Médio e da África. A automação e a digitalização no processamento de alimentos também estão revolucionando a eficiência da produção. Sistemas automatizados de triagem, porcionamento e controle de qualidade reduzem os custos de mão de obra e garantem a consistência, permitindo que os fabricantes aumentem a produção, mantendo altos padrões. Além disso, máquinas avançadas de embalagem com recursos como selagem a vácuo e embalagem em atmosfera modificada (MAP) estão aumentando ainda mais o apelo do produto, mantendo a textura e o sabor por mais tempo.

A integração de soluções de rastreabilidade, incluindo tecnologia blockchain e QR codes nas embalagens, capacita os consumidores com informações em tempo real sobre a origem dos produtos e a garantia de qualidade. Essa transparência gera confiança e aumenta a fidelidade à marca, tornando os produtos prontos para consumo mais atraentes para clientes exigentes.

Por exemplo,

- A Tetra Pak revolucionou a embalagem de alimentos com sua tecnologia asséptica, permitindo que os produtos sejam armazenados sem refrigeração por longos períodos, preservando o valor nutricional e o sabor. Essa inovação foi fundamental para expandir a distribuição e o prazo de validade dos produtos prontos para consumo, especialmente em regiões sem infraestrutura de cadeia fria.

- A Esterilização Térmica Assistida por Micro-ondas (MATS) é uma tecnologia de ponta que utiliza uma combinação de água quente pressurizada e energia de micro-ondas de longo comprimento de onda para esterilizar produtos alimentícios. Ao contrário da esterilização convencional por retorta, a MATS reduz significativamente o tempo de processamento, minimizando a perda de nutrientes e preservando a qualidade dos alimentos. Líderes no Oriente Médio e na África, como a Eka Middle East and Africa, estão aproveitando essa inovação para aprimorar soluções de embalagem, atendendo às necessidades em constante evolução da indústria alimentícia.

- A tecnologia de sensores inteligentes está revolucionando o controle de qualidade no processamento de alimentos, fornecendo monitoramento em tempo real da temperatura, umidade e níveis de contaminação. Esses sensores detectam desvios instantaneamente, permitindo ajustes rápidos para manter a qualidade e a segurança do produto. O registro automatizado de dados garante a rastreabilidade e a conformidade com os padrões de segurança alimentar, tornando a produção mais confiável e eficiente.

Esses avanços não apenas aumentam o apelo dos produtos, mas também abrem novos mercados ao enfrentar desafios logísticos, especialmente em áreas remotas. Como resultado, as inovações tecnológicas estão impulsionando o crescimento, permitindo que os fabricantes atendam às crescentes demandas dos consumidores, mantendo a lucratividade.

Restrições/Desafios

- Alto custo de refeições prontas para consumo (RTE) em comparação com refeições caseiras

Consumidores, especialmente em regiões sensíveis a preços, costumam achar os alimentos prontos para consumo significativamente mais caros do que prepará-los do zero. Essa disparidade de custos pode ser atribuída a vários fatores, incluindo o uso de ingredientes premium, embalagem, processamento e custos de logística.

De acordo com o Bureau of Labor Statistics, o custo médio de uma refeição caseira nos EUA é de aproximadamente US$ 4 por porção, enquanto o custo de uma única refeição pronta para consumo pode variar de US$ 7 a US$ 15, dependendo da marca e dos ingredientes usados. Essa diferença de preço torna difícil para muitos consumidores, especialmente aqueles de grupos de renda média e baixa, justificar compras frequentes de produtos prontos para consumo. Além disso, a percepção de que as refeições prontas para consumo oferecem menor custo-benefício quando comparadas às refeições caseiras preparadas na hora limita ainda mais a penetração no mercado. À medida que os consumidores se tornam mais conscientes de seus gastos, especialmente em meio a incertezas econômicas, eles tendem a preferir opções de comida caseira e com preços acessíveis. Além disso, as preferências culturais por refeições preparadas na hora em muitos países continuam a influenciar as escolhas dos consumidores, já que as famílias priorizam pratos caseiros em vez de alternativas pré-embaladas. Essa tendência de optar por métodos de cozimento tradicionais representa um desafio para os fabricantes que buscam capturar uma fatia maior do mercado.

Por exemplo,

- Um artigo de janeiro de 2025 do New York Times destacou como indivíduos economizaram quantias substanciais anualmente ao reduzir a dependência de fast food e optar por refeições caseiras. Um indivíduo economizou quase US$ 11.000 em um ano ao optar por preparar refeições em casa em vez de comprar opções prontas.

- Em agosto de 2023, um estudo destacado pela Real Plans indica que os kits de entrega de refeições podem ser até três vezes mais caros do que comprar ingredientes em supermercados locais e preparar as refeições em casa

A Advance Financial relatou que o alto custo dos alimentos prontos para consumo (RTE) em comparação com as refeições caseiras continua sendo uma preocupação para muitos consumidores. Em média, uma refeição caseira custa entre US$ 4 e US$ 6 por pessoa, enquanto uma refeição em restaurante ou pronta para consumo pode custar de US$ 15 a US$ 20 ou mais. Essa diferença significativa de preço, de pelo menos US$ 10 por refeição, pode aumentar rapidamente, especialmente para compradores frequentes.

O alto custo dos produtos alimentícios prontos para consumo (RTE) em comparação com as refeições caseiras continua sendo uma barreira significativa ao crescimento do mercado. À medida que os consumidores priorizam cada vez mais opções econômicas e preparadas na hora, o mercado enfrenta restrições constantes para alcançar ampla aceitação, especialmente em regiões sensíveis a preços.

- Intensa competição de mercado entre grandes marcas de alimentos e players regionais

Grandes marcas multinacionais estão alavancando suas robustas redes de distribuição e patrimônio de marca estabelecido para manter o domínio, enquanto os players regionais estão capitalizando as preferências locais e as vantagens de custo. Essa competição está levando os fabricantes a inovar e diferenciar suas ofertas de produtos para capturar a atenção do consumidor. As marcas estão investindo cada vez mais em estratégias de marketing e diversificação de produtos para se destacar, muitas vezes introduzindo sabores únicos, ingredientes fortificados e fórmulas focadas em saúde. No entanto, manter a competitividade em meio a estratégias agressivas de preços e campanhas promocionais continua sendo um desafio significativo. Fabricantes menores e regionais muitas vezes lutam para igualar as economias de escala desfrutadas pelos gigantes do setor, resultando em margens de lucro mais estreitas. Além disso, o surgimento de produtos de marca própria de grandes redes de varejo está aumentando a pressão sobre os produtos de marca, à medida que os consumidores optam cada vez mais por alternativas acessíveis sem comprometer a qualidade.

Além disso, a evolução das preferências dos consumidores e a crescente popularidade de produtos dietéticos de nicho, como opções à base de plantas e sem glúten, estão forçando as marcas a se adaptarem e expandirem continuamente seus portfólios. Equilibrar inovação de produtos com custo-benefício continua sendo uma tarefa desafiadora, especialmente para empresas menores com recursos limitados.

Por exemplo,

- Em março de 2025, a Reuters publicou um artigo afirmando que os consumidores estão cada vez mais migrando para marcas de alimentos menores e independentes, frequentemente percebidas como oferecendo produtos menos processados e mais acessíveis. Essa mudança impactou grandes conglomerados como Unilever e Procter & Gamble, que viram suas fatias de mercado caírem à medida que os consumidores optam por alternativas como a maionese Duke's e a maionese Mike's Amazing em vez de marcas tradicionais como a Hellmann's.

- Um artigo de novembro de 2022 da Dow Jones & Company, Inc. (WALL STREET JOURNAL) destacou que os varejistas estão cada vez mais desenvolvendo seus próprios produtos alimentícios prontos para consumo de marca própria, oferecendo aos consumidores alternativas econômicas às marcas estabelecidas. Essa estratégia não só oferece aos consumidores mais opções, como também intensifica a concorrência, obrigando as grandes marcas a reavaliar seus preços e propostas de valor.

Em meio a essa competição intensa, manter a fidelidade à marca e sustentar a lucratividade tem se tornado cada vez mais desafiador, à medida que tanto os participantes estabelecidos quanto os emergentes navegam em um cenário em rápida evolução com expectativas elevadas dos consumidores.

Impacto e cenário atual do mercado de escassez de matéria-prima e atrasos no embarque

A Data Bridge Market Research oferece uma análise de mercado de alto nível e fornece informações considerando o impacto e o ambiente de mercado atual da escassez de matéria-prima e atrasos nas entregas. Isso se traduz na avaliação de possibilidades estratégicas, na criação de planos de ação eficazes e no auxílio às empresas na tomada de decisões importantes.

Além do relatório padrão, também oferecemos análises aprofundadas do nível de aquisição, desde atrasos previstos de remessa, mapeamento de distribuidores por região, análise de commodities, análise de produção, tendências de mapeamento de preços, fornecimento, análise de desempenho de categoria, soluções de gerenciamento de risco da cadeia de suprimentos, benchmarking avançado e outros serviços de aquisição e suporte estratégico.

Impacto esperado da desaceleração econômica nos preços e na disponibilidade de produtos

Quando a atividade econômica desacelera, os setores começam a sofrer. Os efeitos previstos da crise econômica sobre os preços e a acessibilidade dos produtos são levados em consideração nos relatórios de mercado e serviços de inteligência fornecidos pela DBMR. Com isso, nossos clientes podem, normalmente, se manter um passo à frente de seus concorrentes, projetar suas vendas e receitas e estimar suas despesas com lucros e perdas.

Escopo do mercado de alimentos prontos para consumo no Oriente Médio e na África

O mercado é segmentado com base no tipo de produto, categoria, tipo de embalagem, tamanho da embalagem, tecnologia de embalagem, tipo de armazenamento, canal de distribuição e usuário final. O crescimento entre esses segmentos ajudará você a analisar os segmentos de crescimento escasso nos setores e fornecerá aos usuários uma visão geral e insights valiosos do mercado para ajudá-los a tomar decisões estratégicas para identificar as principais aplicações de mercado.

Tipo de produto

- Produtos de carne

- Produtos à base de cereais

- Produtos lácteos

- Produtos de panificação

- Doces Salgados

- Produtos de Confeitaria

- Produtos à base de vegetais

- Sopas instantâneas, salgadinhos

- Alimentos refrigerados

- Lanches de carne à base de plantas

- Refeições prontas para comer

Categoria

- Convencional

- Especialidade

Tipo de embalagem

- Bolsas/Sachês

- Latas

- Potes e recipientes

- Garrafas

- Caixas

- Outros

Tamanho da embalagem

- Menos de 250 gramas

- 251-500 gramas

- 501-750 gramas

- 751-1000 gramas

- Mais de 1000 gramas

Tecnologia de Embalagem

- Catadores de oxigênio

- Controle de umidade

- Antimicrobianos

- Indicadores de temperatura de tempo

- Filmes Comestíveis

Tipo de fonte

- Congelado/Refrigerado

- Estável em prateleira

- Enlatado

- Outros

Canal de Distribuição

- Baseado em loja

- Canal não baseado em loja

Usuário final

- Serviços da Indústria Alimentar

- Famílias

- Outros

Análise regional do mercado de alimentos prontos para consumo no Oriente Médio e na África

O mercado é analisado e insights e tendências sobre o tamanho do mercado são fornecidos por país, tipo de produto, categoria, tipo de embalagem, tamanho da embalagem, tecnologia de embalagem, tipo de armazenamento, canal de distribuição e usuário final, conforme referenciado acima.

Os países abrangidos pelo mercado são Arábia Saudita, Emirados Árabes Unidos, África do Sul, Egito, Kuwait, Omã, Catar, Bahrein e o resto do Oriente Médio e África.

Espera-se que a Arábia Saudita domine o mercado de alimentos prontos para consumo (RTE) devido ao rápido crescimento populacional urbano, ao aumento da renda disponível e à crescente demanda por opções de refeições práticas. Um estilo de vida acelerado, a expansão da infraestrutura de varejo e a ascensão do comércio eletrônico impulsionam ainda mais o crescimento do mercado. Além disso, a presença de grandes fabricantes de alimentos, a forte preferência por alimentos halal embalados e as crescentes tendências de conscientização sobre saúde contribuem para a liderança do país no setor de alimentos prontos para consumo.

Espera-se que a Arábia Saudita seja o mercado de alimentos prontos para consumo (RTE) com crescimento mais rápido devido à crescente urbanização, ao aumento da renda disponível e à mudança para alimentos de conveniência. A expansão de supermercados, hipermercados e plataformas de e-commerce aumenta a acessibilidade aos produtos. Um estilo de vida agitado e a demanda por refeições embaladas com certificação halal impulsionam ainda mais a expansão do mercado. Além disso, a crescente conscientização sobre saúde está impulsionando a demanda por opções orgânicas e sem conservantes, enquanto a inovação contínua das marcas de alimentos fortalece o setor de alimentos prontos para consumo do país.

A seção sobre países do relatório também apresenta fatores individuais que impactam o mercado e mudanças na regulamentação do mercado doméstico, que impactam as tendências atuais e futuras do mercado. Pontos de dados como análise da cadeia de valor a montante e a jusante, tendências técnicas, análise das cinco forças de Porter e estudos de caso são alguns dos indicadores utilizados para prever o cenário de mercado para cada país. Além disso, a presença e a disponibilidade de marcas do Oriente Médio e da África e seus desafios enfrentados devido à concorrência forte ou escassa de marcas locais e nacionais, o impacto de tarifas domésticas e rotas comerciais são considerados na análise de previsão dos dados do país.

Participação no mercado de alimentos prontos para consumo no Oriente Médio e na África

O cenário competitivo do mercado fornece detalhes por concorrentes. Os detalhes incluem visão geral da empresa, finanças da empresa, receita gerada, potencial de mercado, investimento em pesquisa e desenvolvimento, novas iniciativas de mercado, presença no Oriente Médio e África, locais e instalações de produção, capacidades de produção, pontos fortes e fracos da empresa, lançamento de produto, abrangência e amplitude do produto e domínio da aplicação. Os pontos de dados fornecidos acima referem-se apenas ao foco das empresas em relação ao mercado.

Os líderes de mercado de alimentos prontos para consumo no Oriente Médio e na África que operam no mercado são:

- Lamb Weston (EUA)

- Simplot (EUA)

- Haldiram (Índia)

- Farm Frites (Holanda)

- Greenyard (Bélgica)

- Agrarfrost GmbH (Alemanha)

- Agristo (Bélgica)

- CSC Brands LP (Canadá)

- The Hain Celestial Group, Inc. (EUA)

- Bakkavor Group plc (Reino Unido)

- McCain Foods Limited (Canadá)

- Premier Foods plc (Reino Unido)

- gitsfood.com (Índia)

- Nomad Foods (Reino Unido)

- General Mills (EUA)

- Greencore Group plc (Irlanda)

- Orkla (Noruega)

- ITC Limited (Índia)

- Himalaya Food International Ltd. (Índia)

- Mondelēz International Group (EUA)

- Kraft Heinz (EUA)

- Tyson foods, inc. (EUA)

- Unilever Food Solutions (Reino Unido)

- Nestlé (Suíça)

- Missa Leve (Brasil)

- Kellanova (EUA)

- Hormel Foods, LLC. (EUA)

- Koyara Food (Índia)

- Priya Foods (Índia)

- Genie Food Group (Índia)

- Vechem Organics (P) Limited (Índia)

- Vimal Agro Products Pvt Ltd (Índia)

- sankalpfoods.com (Índia)

- Regal Kitchen Foods (Índia)

- eateasy new (Índia)

- GODREJ AGROVET LTD. (Índia)

- 2 Sisters Food Group (Reino Unido)

Últimos desenvolvimentos no mercado de alimentos prontos para consumo no Oriente Médio e na África

- Em janeiro de 2025, a OREO dará início a 2025 com o lançamento de seis novos sabores, incluindo produtos de edição limitada e permanentes. Entre os destaques estão os cookies OREO Game Day, que apresentam relevos inspirados em futebol, perfeitos para dias de jogos e festas de observação. Os novos cookies Loaded OREO, disponíveis permanentemente, oferecem creme Mega Stuf recheado com pedaços de OREO. Outras adições permanentes incluem Golden OREO Cakesters, OREO Irish Creme THINS e OREO Minis Peanut Butter. Os Golden OREO Cakesters apresentam bolinhos dourados com recheio de creme, os OREO Irish Creme THINS oferecem um toque rico de Irish Creme e os OREO Minis Peanut Butter combinam cookies de chocolate com creme suave de manteiga de amendoim. Além disso, guloseimas congeladas de OREO completam a nova linha de produtos.

- Em setembro de 2024, a parceria entre a OREO e a Coca-Cola apresenta uma colaboração divertida e emocionante chamada "Besties", celebrando o vínculo único da amizade. As marcas se uniram para oferecer dois produtos por tempo limitado: o OREO Coca-Cola Sandwich Cookie e o Coca-Cola OREO Zero Sugar Limited Edition. Ambos apresentam designs e embalagens distintos, combinando os elementos icônicos de ambas as marcas. O OREO Coca-Cola Sandwich Cookie combina bolos de base de chocolate com sabor inspirado na Coca-Cola e creme branco cravejado de glitter vermelho comestível, enquanto o Coca-Cola OREO Zero Sugar oferece um sabor refrescante de Coca-Cola com toques de OREO. A colaboração visa unir os fãs, criar novas experiências e celebrar a conexão e a união de uma forma divertida e inesperada.

- Em abril de 2024, a travessa SOUR PATCH KIDS uniu-se à OREO para uma colaboração divertida e inesperada, apresentando os biscoitos OREO SOUR PATCH KIDS de edição limitada. Esses biscoitos apresentam OREOs dourados com sabor SOUR PATCH KIDS, com inclusões coloridas e um recheio cremoso com açúcar azedo multicolorido para uma experiência agridoce. Junto com os biscoitos, as marcas estão lançando uma linha exclusiva de produtos, incluindo gola redonda, calças de moletom, chapéu bucket, bolsa transversal, presilhas de cabelo e meias. A coleção celebra o espírito lúdico de ambas as marcas, oferecendo aos fãs a chance de desfrutar da combinação agridoce definitiva, enquanto ostentam itens OREO e SOUR PATCH KIDS de edição limitada.

- Em fevereiro de 2023, a Mondelēz International está dando um passo significativo em direção à sua meta de 2050 de atingir zero emissões líquidas de gases de efeito estufa, ao anunciar um grande investimento em energia renovável a partir de usinas fotovoltaicas na Polônia. A empresa assinou um Contrato Virtual de Compra de Energia de 12 anos com a GoldenPeaks Capital, que fornecerá cerca de 126 gigawatts-hora de eletricidade renovável anualmente, proveniente de diversas usinas de energia solar na Polônia. Espera-se que este acordo economize mais de 1 milhão de toneladas métricas de CO2 e compense a pegada de carbono relacionada à eletricidade de oito usinas da Mondelēz na Polônia. A produção de energia está prevista para começar em março de 2023, marcando um marco importante no compromisso da Mondelēz com a sustentabilidade e a redução de sua pegada de emissões. Esta colaboração exemplifica a dedicação da empresa em construir um futuro mais sustentável, enquanto continua a entregar seus amados produtos, como Milka, Prince Polo e Delicje.

- Em fevereiro de 2025, a Capri Sun lançou sua primeira garrafa resselável em mais de 20 anos, oferecendo uma nova maneira conveniente para fãs de todas as idades desfrutarem de seus sabores icônicos em qualquer lugar. As garrafas de 355 ml, disponíveis nos sabores Fruit Punch, Pacific Cooler e Strawberry Kiwi, contêm o equivalente a duas embalagens e são feitas com ingredientes totalmente naturais, sem corantes ou adoçantes artificiais. Este lançamento atende à demanda do consumidor por porções maiores e foi projetado para atender às necessidades de famílias ocupadas, especialmente em lojas de conveniência, onde a Capri Sun era menos disponível anteriormente. A mudança expande o portfólio da Capri Sun, com base no sucesso de inovações anteriores, como as jarras Capri Sun Multi-Serve, e dá continuidade ao compromisso da marca em evoluir junto com as preferências do consumidor.

SKU-

Obtenha acesso online ao relatório sobre a primeira nuvem de inteligência de mercado do mundo

- Painel interativo de análise de dados

- Painel de análise da empresa para oportunidades de elevado potencial de crescimento

- Acesso de analista de pesquisa para personalização e customização. consultas

- Análise da concorrência com painel interativo

- Últimas notícias, atualizações e atualizações Análise de tendências

- Aproveite o poder da análise de benchmark para um rastreio abrangente da concorrência

Índice

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELING

2.7 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.8 DBMR MARKET POSITION GRID

2.9 MARKET APPLICATION COVERAGE GRID

2.1 DBMR VENDOR SHARE ANALYSIS

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PORTER’S FIVE FORCES

4.1.1 THREAT OF NEW ENTRANTS

4.1.2 THREAT OF SUBSTITUTES

4.1.3 BARGAINING POWER OF BUYERS

4.1.4 BARGAINING POWER OF SUPPLIERS

4.1.5 COMPETITIVE RIVALRY

4.2 IMPORT EXPORT SCENARIO

4.3 VALUE CHAIN ANALYSIS

4.3.1 RAW MATERIAL SOURCING

4.3.2 FOOD PROCESSING & MANUFACTURING

4.3.3 PACKAGING AND STORAGE

4.3.4 DISTRIBUTION AND LOGISTICS

4.3.5 MARKETING AND RETAILING

4.3.6 CONCLUSION

4.4 KEY FACTORS INFLUENCING PURCHASING DECISION OF END-USERS

4.4.1 CONVENIENCE AND TIME-SAVING

4.4.2 HEALTH AND NUTRITION AWARENESS

4.4.3 PRICE SENSITIVITY AND ECONOMIC FACTORS

4.4.4 BRAND REPUTATION AND TRUST

4.4.5 PACKAGING AND PRODUCT PRESENTATION

4.4.6 DIGITAL INFLUENCE AND ONLINE RETAILING

4.4.7 CULTURAL AND REGIONAL PREFERENCES

4.4.8 SUSTAINABILITY AND ETHICAL CONSIDERATIONS

4.5 GROWTH STRATEGIES ADOPTED BY KEY MARKET PLAYERS

4.5.1 PRODUCT INNOVATION AND DIVERSIFICATION

4.5.2 STRATEGIC ACQUISITIONS

4.5.3 INTERNATIONAL EXPANSION

4.5.4 TECHNOLOGICAL ADVANCEMENTS

4.6 INDUSTRY TRENDS AND FUTURE PERSPECTIVE

4.6.1 INDUSTRY TRENDS

4.6.1.1 GROWING CONSUMER DEMAND FOR CONVENIENCE

4.6.1.2 RISING POPULARITY OF HEALTHY AND NUTRITIOUS RTE FOODS

4.6.1.3 INNOVATIONS IN PACKAGING FOR EXTENDED SHELF LIFE

4.6.1.4 EXPANSION OF FROZEN AND CHILLED RTE SEGMENTS

4.6.1.5 RISE OF PLANT-BASED AND ALTERNATIVE PROTEIN OPTIONS

4.6.1.6 DIGITALIZATION AND E-COMMERCE GROWTH

4.6.1.7 FOCUS ON CLEAN LABEL AND TRANSPARENCY

4.6.2 FUTURE PERSPECTIVE

4.6.2.1 TECHNOLOGICAL ADVANCEMENTS IN FOOD PROCESSING

4.6.2.2 SUSTAINABLE AND ETHICAL FOOD CHOICES

4.6.2.3 PERSONALIZATION IN RTE MEALS

4.6.2.4 REGULATORY AND COMPLIANCE CHALLENGES

4.7 OVERVIEW OF TECHNOLOGICAL INNOVATIONS

4.7.1 ADVANCED FOOD PROCESSING TECHNOLOGIES

4.7.2 SMART PACKAGING AND SUSTAINABLE MATERIALS

4.7.3 AUTOMATION AND ROBOTICS IN FOOD PRODUCTION

4.7.4 NUTRITIONAL ENHANCEMENT AND FUNCTIONAL INGREDIENTS

4.7.5 AI & BIG DATA FOR PERSONALIZATION AND SUPPLY CHAIN OPTIMIZATION

4.7.6 3D FOOD PRINTING AND CUSTOMIZATION

4.7.7 E-COMMERCE, CLOUD KITCHENS, AND LAST-MILE DELIVERY INNOVATIONS

4.7.8 CONCLUSION

4.8 RAW MATERIAL COVERAGE

4.8.1 PROTEINS (MEAT, POULTRY, AND PLANT-BASED PROTEINS)

4.8.2 GRAINS AND CARBOHYDRATES

4.8.3 VEGETABLES AND FRUITS

4.8.4 PRESERVATIVES AND ADDITIVES

4.8.5 EMERGING TRENDS AND FUTURE SOURCING OPPORTUNITIES

4.8.6 CONCLUSION

4.9 SUPPLY CHAIN ANALYSIS

4.9.1 RAW MATERIAL SOURCING AND PROCUREMENT

4.9.2 PROCESSING AND MANUFACTURING

4.9.3 STORAGE AND INVENTORY MANAGEMENT

4.9.4 DISTRIBUTION AND LOGISTICS

4.9.5 RETAIL AND CONSUMER ACCESS

4.9.6 CHALLENGES IN THE RTE FOOD SUPPLY CHAIN

4.9.7 FUTURE TRENDS AND INNOVATIONS

4.9.8 CONCLUSION

4.1 PRICING ANALYSIS

4.11 PRODUCTION CAPACITY OF KEY MANUFACTURERS

4.12 BRAND OUTLOOK

4.12.1 BRAND COMPARATIVE ANALYSIS

4.12.2 PRODUCT VS BRAND OVERVIEW

4.12.2.1 PRODUCT OVERVIEW

4.12.2.2 BRAND OVERVIEW

4.12.2.3 CONCLUSION

5 REGULATORY FRAMEWORK AND GUIDELINES

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 INCREASING WORK HOURS AND FAST-PACED LIFESTYLES

6.1.2 RISING CONSUMER DISPOSABLE INCOME AND HIGHER PURCHASING POWER

6.1.3 RAPIDLY EXPANDING RETAIL AND E-COMMERCE CHANNELS

6.1.4 RISING DEMAND FOR HEALTHY, ORGANIC AND FORTIFIED READY-TO-EAT FOODS

6.2 RESTRAINTS

6.2.1 HEALTH CONCERNS RELATED TO PROCESSED FOODS

6.2.2 HIGH COST OF READY-TO-EAT (RTE) COMPARED TO HOME-COOKED MEALS

6.3 OPPORTUNITIES

6.3.1 RISING DEMAND FOR PLANT-BASED AND VEGAN READY-TO-EAT FOODS

6.3.2 TECHNOLOGICAL ADVANCEMENTS IN FOOD PROCESSING AND PACKAGING

6.3.3 CUSTOMIZATION AND PERSONALIZATION OF READY-TO-EAT FOODS

6.4 CHALLENGES

6.4.1 INTENSE MARKET COMPETITION AMONGST MAJOR FOOD BRANDS AND REGIONAL PLAYERS

6.4.2 CONSUMER PERCEPTION OF ARTIFICIAL INGREDIENTS AND FLAVORS IN READY-TO-EAT FOODS

7 MIDDLE EAST AND AFRICA READY TO EAT FOOD MARKET, BY PRODUCT TYPE

7.1 OVERVIEW

7.2 MEAT PRODUCTS

7.3 CEREAL BASED PRODUCTS

7.4 DAIRY PRODUCTS

7.5 BAKERY PRODUCTS

7.6 SAVORY SWEETS

7.7 CONFECTIONERY PRODUCTS

7.8 VEGETABLES BASED PRODUCTS

7.9 INSTANT SOUPS

7.1 SAVORY SNACKS

7.11 REFRIGERATED FOODS

7.12 PLANT BASED MEAT SNACKS

7.13 READY TO EAT MEALS

8 MIDDLE EAST AND AFRICA READY TO EAT FOOD MARKET, BY CATEGORY

8.1 OVERVIEW

8.2 CONVENTIONAL

8.3 SPECIALTY

9 MIDDLE EAST AND AFRICA READY TO EAT FOOD MARKET, BY PACKAGING TYPE

9.1 OVERVIEW

9.2 POUCHES/SACHETS

9.3 CANS

9.4 JARS & CONTAINERS

9.5 BOTTLES

9.6 BOXES

9.7 OTHERS

10 MIDDLE EAST AND AFRICA READY TO EAT FOOD MARKET, BY PACKAGING SIZE

10.1 OVERVIEW

10.2 LESS THAN 250 GRAMS

10.3 251-500 GRAMS

10.4 501-750 GRAMS

10.5 751-1000 GRAMS

10.6 MORE THAN 1000 GRAMS

11 MIDDLE EAST AND AFRICA READY TO EAT FOOD MARKET, BY PACKAGING TECHNOLOGY

11.1 OVERVIEW

11.2 OXYGEN SCAVENGERS

11.3 MOISTURE CONTROL

11.4 ANTIMICROBIALS

11.5 TIME TEMPERATURE INDICATORS

11.6 EDIBLE FILMS

12 MIDDLE EAST AND AFRICA READY TO EAT FOOD MARKET, BY STORAGE TYPE

12.1 OVERVIEW

12.2 FROZEN/REFRIGERATED

12.3 SHELF-STABLE

12.4 CANNED

12.5 OTHERS

13 MIDDLE EAST AND AFRICA READY TO EAT FOOD MARKET, BY DISTRIBUTION CHANNEL

13.1 OVERVIEW

13.2 STORE-BASED

13.3 NON-STORE BASED

14 MIDDLE EAST AND AFRICA READY TO EAT FOOD MARKET, BY END USER

14.1 OVERVIEW

14.2 FOOD INDUSTRY SERVICES

14.3 HOUSEHOLDS

14.4 OTHERS

15 MIDDLE EAST AND AFRICA READY TO EAT FOOD MARKET, BY REGION

15.1 MIDDLE EAST AND AFRICA

15.1.1 SAUDI ARABIA

15.1.2 U.A.E.

15.1.3 SOUTH AFRICA

15.1.4 EGYPT

15.1.5 KUWAIT

15.1.6 OMAN

15.1.7 QATAR

15.1.8 BAHRAIN

15.1.9 REST OF MIDDLE EAST AND AFRICA

16 MIDDLE EAST AND AFRICA READY TO EAT FOOD MARKET: COMPANY LANDSCAPE

16.1 COMPANY SHARE ANALYSIS: GLOBAL

17 SWOT ANALYSIS

18 COMPANY PROFILES

18.1 MONDELĒZ INTERNATIONAL, INC.

18.1.1 COMPANY SNAPSHOT

18.1.2 RECENT FINANCIALS

18.1.3 COMPANY SHARE ANALYSIS

18.1.4 PRODUCT PORTFOLIO

18.1.5 RECENT DEVELOPMENT

18.2 THE KRAFT HEINZ COMPANY

18.2.1 COMPANY SNAPSHOT

18.2.2 RECENT FINANCIALS

18.2.3 COMPANY SHARE ANALYSIS

18.2.4 PRODUCT PORTFOLIO

18.2.5 RECENT DEVELOPMENT

18.3 GENERAL MILLS INC

18.3.1 COMPANY SNAPSHOT

18.3.2 RECENT FINANCIALS

18.3.3 COMPANY SHARE ANALYSIS

18.3.4 PRODUCT PORTFOLIO

18.3.5 RECENT DEVELOPMENT

18.4 NESTLÉ

18.4.1 COMPANY SNAPSHOT

18.4.2 REVENUE ANALYSIS

18.4.3 COMPANY SHARE ANALYSIS

18.4.4 PRODUCT PORTFOLIO

18.4.5 RECENT DEVELOPMENTS

18.5 KELLANOVA

18.5.1 COMPANY SNAPSHOT

18.5.2 REVENUE ANALYSIS

18.5.3 COMPANY SHARE ANALYSIS

18.5.4 PRODUCT PORTFOLIO

18.5.5 RECENT DEVELOPMENT

18.6 AGRISTO

18.6.1 COMPANY SNAPSHOT

18.6.2 PRODUCT PORTFOLIO

18.6.3 RECENT DEVELOPMENT

18.7 2 SISTERS FOOD GROUP

18.7.1 COMPANY SNAPSHOT

18.7.2 PRODUCT PORTFOLIO

18.7.3 RECENT NEWS

18.8 AGRARFROST GMBH

18.8.1 COMPANY SNAPSHOT

18.8.2 PRODUCT PORTFOLIO

18.8.3 RECENT DEVELOPMENT

18.9 BAKKAVOR GROUP PLC

18.9.1 COMPANY SNAPSHOT

18.9.2 RECENT FINANCIALS

18.9.3 PRODUCT PORTFOLIO

18.9.4 RECENT DEVELOPMENT

18.1 CSC BRANDS LP

18.10.1 COMPANY SNAPSHOT

18.10.2 PRODUCT PORTFOLIO

18.10.3 RECENT DEVELOPMENT

18.11 EATEASY NEW.

18.11.1 COMPANY SNAPSHOT

18.11.2 PRODUCT PORTFOLIO

18.11.3 RECENT DEVELOPMENT

18.12 FARM FRITES

18.12.1 COMPANY SNAPSHOT

18.12.2 PRODUCT PORTFOLIO

18.12.3 RECENT DEVELOPMENT

18.13 GENIE FOOD GROUP

18.13.1 COMPANY SNAPSHOT

18.13.2 PRODUCT PORTFOLIO

18.13.3 RECENT DEVELOPMENT

18.14 GITSFOOD.COM

18.14.1 COMPANY SNAPSHOT

18.14.2 PRODUCT PORTFOLIO

18.14.3 RECENT DEVELOPMENT

18.15 GODREJ AGROVET LIMITED

18.15.1 COMPANY SNAPSHOT

18.15.2 REVENUE ANALYSIS

18.15.3 PRODUCT PORTFOLIO

18.15.4 RECENT DEVELOPMENT

18.16 GREENCORE GROUP PLC

18.16.1 COMPANY SNAPSHOT

18.16.2 RECENT FINANCIALS

18.16.3 PRODUCT PORTFOLIO

18.16.4 NEWS TYPE

18.17 GREENYARD

18.17.1 COMPANY SNAPSHOT

18.17.2 REVENUE ANALYSIS

18.17.3 PRODUCT PORTFOLIO

18.17.4 RECENT DEVELOPMENT

18.18 HALDIRAM’S

18.18.1 COMPANY SNAPSHOTS

18.18.2 PRODUCT PORTFOLIO

18.18.3 RECENT DEVELOPMENT

18.19 HIMALAYA FOOD INTERNATIONAL LTD.

18.19.1 COMPANY SNAPSHOT

18.19.2 REVENUE ANALYSIS

18.19.3 PRODUCT PORTFOLIO

18.19.4 RECENT DEVELOPMENT

18.2 HORMEL FOODS CORPORATION.

18.20.1 COMPANY SNAPSHOT

18.20.2 REVENUE ANALYSIS

18.20.3 PRODUCT PORTFOLIO

18.20.4 RECENT DEVELOPMENT

18.21 ITC LIMITED

18.21.1 COMPANY SNAPSHOT

18.21.2 REVENUE ANALYSIS

18.21.3 PRODUCT PORTFOLIO

18.21.4 RECENT DEVELOPMENTS

18.22 KOYARA FOODS

18.22.1 COMPANY SNAPSHOT

18.22.2 PRODUCT PORTFOLIO

18.22.3 RECENT DEVELOPMENT

18.23 LAMB WESTON, INC.

18.23.1 COMPANY SNAPSHOT

18.23.2 REVENUE ANALYSIS

18.23.3 PRODUCT PORTFOLIO

18.23.4 RECENT DEVELOPMENT

18.24 LIGHT MASS

18.24.1 COMPANY SNAPSHOT

18.24.2 PRODUCT PORTFOLIO

18.24.3 RECENT DEVELOPMENT

18.25 MCCAIN FOODS LIMITED

18.25.1 COMPANY SNAPSHOT

18.25.2 PRODUCT PORTFOLIO

18.25.3 RECENT DEVELOPMENT

18.26 NOMAD FOODS

18.26.1 COMPANY SNAPSHOT

18.26.2 RECENT FINANCIALS

18.26.3 PRODUCT PORTFOLIO

18.26.4 RECENT DEVELOPMENT

18.27 ORKLA

18.27.1 COMPANY SNAPSHOT

18.27.2 RECENT FINANCIALS

18.27.3 PRODUCT PORTFOLIO

18.27.4 RECENT DEVELOPMENT

18.28 PREMIER FOODS PLC

18.28.1 COMPANY SNAPSHOT

18.28.2 RECENT FINANCIALS

18.28.3 PRODUCT PORTFOLIO

18.28.4 RECENT DEVELOPMENT

18.29 PRIYA FOODS

18.29.1 COMPANY SNAPSHOT

18.29.2 PRODUCT PORTFOLIO

18.29.3 RECENT DEVELOPMENT

18.3 REGAL KITCHEN FOODS

18.30.1 COMPANY SNAPSHOT

18.30.2 PRODUCT PORTFOLIO

18.30.3 RECENT DEVELOPMENT

18.31 SANKALPFOODS.COM

18.31.1 COMPANY SNAPSHOT

18.31.2 PRODUCT PORTFOLIO

18.31.3 RECENT DEVELOPMENT/ NEWS TYPE

18.32 J.R. SIMPLOT COMPANY.

18.32.1 COMPANY SNAPSHOT

18.32.2 PRODUCT PORTFOLIO

18.32.3 RECENT DEVELOPMENT

18.33 THE HAIN CELESTIAL GROUP, INC.

18.33.1 COMPANY SNAPSHOT

18.33.2 REVENUE ANALYSIS

18.33.3 PRODUCT PORTFOLIO

18.33.4 RECENT DEVELOPMENTS

18.34 TYSON FOODS, INC.

18.34.1 COMPANY SNAPSHOT

18.34.2 RECENT FINANCIALS

18.34.3 PRODUCT PORTFOLIO

18.34.4 RECENT DEVELOPMENT

18.35 UNILEVER

18.35.1 COMPANY SNAPSHOT

18.35.2 REVENUE ANALYSIS

18.35.3 PRODUCT PORTFOLIO

18.35.4 RECENT DEVELOPMENTS

18.36 VECHEM ORGANICS (P) LIMITED

18.36.1 COMPANY SNAPSHOT

18.36.2 PRODUCT PORTFOLIO

18.36.3 RECENT DEVELOPMENT

18.37 VIMAL AGRO PRODUCTS PVT LTD

18.37.1 COMPANY SNAPSHOT

18.37.2 PRODUCT PORTFOLIO

18.37.3 RECENT DEVELOPMENT

19 QUESTIONNAIRE

20 RELATED REPORTS

Lista de Tabela

TABLE 1 ESTIMATED PRODUCTION CAPACITY OF KEY MANUFACTURERS

TABLE 2 REGULATORY COVERAGE

TABLE 3 INCREASING DISPOSABLE INCOMES

TABLE 4 ESTIMATED SAVINGS USING READY TO EAT FOODS

TABLE 5 MIDDLE EAST AND AFRICA READY TO EAT FOOD MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 6 MIDDLE EAST AND AFRICA READY TO EAT FOOD MARKET, BY PRODUCT TYPE, 2018-2032 (TONS)

TABLE 7 MIDDLE EAST AND AFRICA READY TO EAT FOOD MARKET, BY PRODUCT TYPE, 2018-2032 (USD/KG)

TABLE 8 MIDDLE EAST AND AFRICA MEAT PRODUCTS IN READY TO EAT FOOD MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 9 MIDDLE EAST AND AFRICA MEAT PRODUCTS IN READY TO EAT FOOD MARKET, BY REGION, 2018-2032, (TONS)

TABLE 10 MIDDLE EAST AND AFRICA MEAT PRODUCTS IN READY TO EAT FOOD MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 11 MIDDLE EAST AND AFRICA MEAT PRODUCTS IN READY TO EAT FOOD MARKET, BY TYPE, 2018-2032 (TONS)

TABLE 12 MIDDLE EAST AND AFRICA MEAT PRODUCTS IN READY TO EAT FOOD MARKET, BY TYPE, 2018-2032 (USD/KG)

TABLE 13 MIDDLE EAST AND AFRICA CEREAL BASED PRODUCTS IN READY TO EAT FOOD MARKET, BY REGION 2018-2032, (USD THOUSAND)

TABLE 14 MIDDLE EAST AND AFRICA CEREAL BASED PRODUCTS IN READY TO EAT FOOD MARKET, BY REGION, 2018-2032, (TONS)

TABLE 15 MIDDLE EAST AND AFRICA CEREAL BASED PRODUCTS IN READY TO EAT FOOD MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 16 MIDDLE EAST AND AFRICA CEREAL BASED PRODUCTS IN READY TO EAT FOOD MARKET, BY TYPE, 2018-2032 (TONS)

TABLE 17 MIDDLE EAST AND AFRICA CEREAL BASED PRODUCTS IN READY TO EAT FOOD MARKET, BY TYPE, 2018-2032 (USD/KG)

TABLE 18 MIDDLE EAST AND AFRICA DAIRY PRODUCTS IN READY TO EAT FOOD MARKET, BY REGION, 2018-2032, (USD THOUSAND)

TABLE 19 MIDDLE EAST AND AFRICA DAIRY PRODUCTS IN READY TO EAT FOOD MARKET, REGION, 2018-2032, (TONS)

TABLE 20 MIDDLE EAST AND AFRICA DAIRY PRODUCTS IN READY TO EAT FOOD MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 21 MIDDLE EAST AND AFRICA DAIRY PRODUCTS IN READY TO EAT FOOD MARKET, BY TYPE, 2018-2032 (TONS)

TABLE 22 MIDDLE EAST AND AFRICA DAIRY PRODUCTS IN READY TO EAT FOOD MARKET, BY TYPE, 2018-2032 (USD/KG)

TABLE 23 MIDDLE EAST AND AFRICA CHEESE IN READY TO EAT FOOD MARKET, BY FORM, 2018-2032 (USD THOUSAND)

TABLE 24 MIDDLE EAST AND AFRICA CHEESE IN READY TO EAT FOOD MARKET, BY FORM, 2018-2032 (TONS)

TABLE 25 MIDDLE EAST AND AFRICA CHEESE IN READY TO EAT FOOD MARKET, BY FORM, 2018-2032 (USD/KG)

TABLE 26 MIDDLE EAST AND AFRICA CHEESE IN READY TO EAT FOOD MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 27 MIDDLE EAST AND AFRICA CHEESE IN READY TO EAT FOOD MARKET, BY TYPE, 2018-2032 (TONS)

TABLE 28 MIDDLE EAST AND AFRICA CHEESE IN READY TO EAT FOOD MARKET, BY TYPE, 2018-2032 (TONS)

TABLE 29 MIDDLE EAST AND AFRICA ANIMAL BASED CHEESE IN READY TO EAT FOOD MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 30 MIDDLE EAST AND AFRICA PLANT BASED CHEESE IN READY TO EAT FOOD MARKET, BY TYPE (USD THOUSAND)

TABLE 31 MIDDLE EAST AND AFRICA ICE CREAMS IN READY TO EAT FOOD MARKET, BY TYPE, 2018-2032, 2018-2032 (USD THOUSAND)

TABLE 32 MIDDLE EAST AND AFRICA ICE CREAMS IN READY TO EAT FOOD MARKET, BY TYPE, 2018-2032 (TONS)

TABLE 33 MIDDLE EAST AND AFRICA ICE CREAMS IN READY TO EAT FOOD MARKET, BY TYPE, 2018-2032 (TONS)

TABLE 34 MIDDLE EAST AND AFRICA CURD IN READY TO EAT FOOD MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 35 MIDDLE EAST AND AFRICA CURD IN READY TO EAT FOOD MARKET, BY TYPE, 2018-2032 (TONS)

TABLE 36 MIDDLE EAST AND AFRICA CURD IN READY TO EAT FOOD MARKET, BY TYPE, 2018-2032 (USD/KG)

TABLE 37 MIDDLE EAST AND AFRICA PANEER IN READY TO EAT FOOD MARKET, BY TYPE, 2018-2032 (TONS)

TABLE 38 MIDDLE EAST AND AFRICA PANEER IN READY TO EAT FOOD MARKET, BY TYPE, 2018-2032 (TONS)

TABLE 39 MIDDLE EAST AND AFRICA PANEER IN READY TO EAT FOOD MARKET, BY TYPE, 2018-2032 (USD/KG)

TABLE 40 MIDDLE EAST AND AFRICA GHEE IN READY TO EAT FOOD MARKET, BY SOURCE, 2018-2032 (USD THOUSAND)

TABLE 41 MIDDLE EAST AND AFRICA GHEE IN READY TO EAT FOOD MARKET, BY SOURCE, 2018-2032 (TONS)

TABLE 42 MIDDLE EAST AND AFRICA GHEE IN READY TO EAT FOOD MARKET, BY SOURCE, 2018-2032 (USD/KG)

TABLE 43 MIDDLE EAST AND AFRICA BAKERY PRODUCTS IN READY TO EAT FOOD MARKET, BY REGION, 2018-2032, (USD THOUSAND)

TABLE 44 MIDDLE EAST AND AFRICA BAKERY PRODUCTS IN READY TO EAT FOOD MARKET, BY PRODUCT TYPE, 2018-2032, (TONS)

TABLE 45 MIDDLE EAST AND AFRICA BAKERY PRODUCTS IN READY TO EAT FOOD MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 46 MIDDLE EAST AND AFRICA BAKERY PRODUCTS IN READY TO EAT FOOD MARKET, BY TYPE, 2018-2032 (TONS)

TABLE 47 MIDDLE EAST AND AFRICA BAKERY PRODUCTS IN READY TO EAT FOOD MARKET, BY TYPE, 2018-2032 (USD/KG)

TABLE 48 MIDDLE EAST AND AFRICA SAVORY SWEETS IN READY TO EAT FOOD MARKET, BY REGION, 2018-2032, (USD THOUSAND)

TABLE 49 MIDDLE EAST AND AFRICA SAVORY SWEETS IN READY TO EAT FOOD MARKET, BY REGION, 2018-2032, (TONS)

TABLE 50 MIDDLE EAST AND AFRICA SAVORY SWEETS IN READY TO EAT FOOD MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 51 MIDDLE EAST AND AFRICA SAVORY SWEETS IN READY TO EAT FOOD MARKET, BY TYPE, 2018-2032 (TONS)

TABLE 52 MIDDLE EAST AND AFRICA SAVORY SWEETS IN READY TO EAT FOOD MARKET, BY TYPE, 2018-2032 (USD/KG)

TABLE 53 MIDDLE EAST AND AFRICA CONFECTIONERY PRODUCTS IN READY TO EAT FOOD MARKET, BY REGION TYPE, 2018-2032, (USD THOUSAND)

TABLE 54 MIDDLE EAST AND AFRICA CONFECTIONERY PRODUCTS IN READY TO EAT FOOD MARKET, BY REGION, 2018-2032, (TONS)

TABLE 55 MIDDLE EAST AND AFRICA CONFECTIONERY PRODUCTS IN READY TO EAT FOOD MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 56 MIDDLE EAST AND AFRICA CONFECTIONERY PRODUCTS IN READY TO EAT FOOD MARKET, BY TYPE, 2018-2032 (TONS)

TABLE 57 MIDDLE EAST AND AFRICA CONFECTIONERY PRODUCTS IN READY TO EAT FOOD MARKET, BY TYPE, 2018-2032 (TONS)

TABLE 58 MIDDLE EAST AND AFRICA VEGETABLES BASED PRODUCTS IN READY TO EAT FOOD MARKET, BY REGION, 2018-2032, (USD THOUSAND)

TABLE 59 MIDDLE EAST AND AFRICA VEGETABLES BASED PRODUCTS IN READY TO EAT FOOD MARKET, BY REGION, 2018-2032, (TONS)

TABLE 60 MIDDLE EAST AND AFRICA VEGETABLES BASED PRODUCTS IN READY TO EAT FOOD MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 61 MIDDLE EAST AND AFRICA VEGETABLES BASED PRODUCTS IN READY TO EAT FOOD MARKET, BY TYPE, 2018-2032 (TONS)

TABLE 62 MIDDLE EAST AND AFRICA VEGETABLES BASED PRODUCTS IN READY TO EAT FOOD MARKET, BY TYPE, 2018-2032 (TONS)

TABLE 63 MIDDLE EAST AND AFRICA INSTANT SOUPS IN READY TO EAT FOOD MARKET, BY REGION, 2018-2032, (USD THOUSAND)

TABLE 64 MIDDLE EAST AND AFRICA INSTANT SOUPS IN READY TO EAT FOOD MARKET, BY REGION, 2018-2032, (TONS)

TABLE 65 MIDDLE EAST AND AFRICA INSTANT SOUPS IN READY TO EAT FOOD MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 66 MIDDLE EAST AND AFRICA INSTANT SOUPS IN READY TO EAT FOOD MARKET, BY TYPE, 2018-2032 (TONS)

TABLE 67 MIDDLE EAST AND AFRICA INSTANT SOUPS IN READY TO EAT FOOD MARKET, BY TYPE, 2018-2032 (USD/KG)

TABLE 68 MIDDLE EAST AND AFRICA SAVORY SNACKS IN READY TO EAT FOOD MARKET, BY REGION, 2018-2032, (USD THOUSAND)

TABLE 69 MIDDLE EAST AND AFRICA SAVORY SNACKS IN READY TO EAT FOOD MARKET, BY REGION, 2018-2032, (TONS)

TABLE 70 MIDDLE EAST AND AFRICA SAVORY SNACKS IN READY TO EAT FOOD MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 71 MIDDLE EAST AND AFRICA SAVORY SNACKS IN READY TO EAT FOOD MARKET, BY TYPE, 2018-2032 (TONS)

TABLE 72 MIDDLE EAST AND AFRICA SAVORY SNACKS IN READY TO EAT FOOD MARKET, BY TYPE, 2018-2032 (USD/KG)

TABLE 73 MIDDLE EAST AND AFRICA CHIPS IN READY TO EAT FOOD MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 74 MIDDLE EAST AND AFRICA CHIPS IN READY TO EAT FOOD MARKET, BY TYPE, 2018-2032 (TONS)

TABLE 75 MIDDLE EAST AND AFRICA CHIPS IN READY TO EAT FOOD MARKET, BY TYPE, 2018-2032 (TONS)

TABLE 76 MIDDLE EAST AND AFRICA WAFERS IN READY TO EAT FOOD MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 77 MIDDLE EAST AND AFRICA WAFERS IN READY TO EAT FOOD MARKET, BY TYPE, 2018-2032 (TONS)

TABLE 78 MIDDLE EAST AND AFRICA WAFERS IN READY TO EAT FOOD MARKET, BY TYPE, 2018-2032 (USD/KG)

TABLE 79 MIDDLE EAST AND AFRICA NAMKEEN IN READY TO EAT FOOD MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 80 MIDDLE EAST AND AFRICA NAMKEEN IN READY TO EAT FOOD MARKET, BY TYPE, 2018-2032 (TONS)

TABLE 81 MIDDLE EAST AND AFRICA NAMKEEN IN READY TO EAT FOOD MARKET, BY TYPE, 2018-2032 (USD/KG)

TABLE 82 MIDDLE EAST AND AFRICA BISCUITS & COOKIES IN READY TO EAT FOOD MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 83 MIDDLE EAST AND AFRICA BISCUITS & COOKIES IN READY TO EAT FOOD MARKET, BY TYPE, 2018-2032 (TONS)

TABLE 84 MIDDLE EAST AND AFRICA BISCUITS & COOKIES IN READY TO EAT FOOD MARKET, BY TYPE, 2018-2032 (USD/KG)

TABLE 85 MIDDLE EAST AND AFRICA REFRIGERATED FOODS IN READY TO EAT FOOD MARKET, BY REGION, 2018-2032, (USD THOUSAND)

TABLE 86 MIDDLE EAST AND AFRICA REFRIGERATED FOODS IN READY TO EAT FOOD MARKET, BY REGION, 2018-2032, (TONS)

TABLE 87 MIDDLE EAST AND AFRICA REFRIGERATED FOODS IN READY TO EAT FOOD MARKET, BY TYPE (USD THOUSAND)

TABLE 88 MIDDLE EAST AND AFRICA REFRIGERATED FOODS IN READY TO EAT FOOD MARKET, BY TYPE (TONS)

TABLE 89 MIDDLE EAST AND AFRICA REFRIGERATED FOODS IN READY TO EAT FOOD MARKET, BY TYPE (USD/KG)

TABLE 90 MIDDLE EAST AND AFRICA PLANT BASED MEAT SNACKS IN READY TO EAT FOOD MARKET, BY REGION, 2018-2032, (USD THOUSAND)

TABLE 91 MIDDLE EAST AND AFRICA PLANT BASED MEAT SNACKS IN READY TO EAT FOOD MARKET, BY REGION, 2018-2032, (TONS)

TABLE 92 MIDDLE EAST AND AFRICA PLANT BASED MEAT SNACKS IN READY TO EAT FOOD MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 93 MIDDLE EAST AND AFRICA PLANT BASED MEAT SNACKS IN READY TO EAT FOOD MARKET, BY TYPE, 2018-2032 (TONS)

TABLE 94 MIDDLE EAST AND AFRICA PLANT BASED MEAT SNACKS IN READY TO EAT FOOD MARKET, BY TYPE, 2018-2032 (USD/KG)

TABLE 95 MIDDLE EAST AND AFRICA PLANT BASED MEAT SNACKS IN READY TO EAT FOOD MARKET, BY SOURCE, 2018-2032 (USD THOUSAND)

TABLE 96 MIDDLE EAST AND AFRICA PLANT BASED MEAT SNACKS IN READY TO EAT FOOD MARKET, BY SOURCE, 2018-2032 (TONS)

TABLE 97 MIDDLE EAST AND AFRICA PLANT BASED MEAT SNACKS IN READY TO EAT FOOD MARKET, BY SOURCE, 2018-2032 (USD/KG)

TABLE 98 MIDDLE EAST AND AFRICA READY TO EAT MEALS IN READY TO EAT FOOD MARKET, BY REGION, 2018-2032, (USD THOUSAND)

TABLE 99 MIDDLE EAST AND AFRICA READY TO EAT MEALS IN READY TO EAT FOOD MARKET, BY REGION 2018-2032, (TONS)

TABLE 100 MIDDLE EAST AND AFRICA READY TO EAT MEALS IN READY TO EAT FOOD MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 101 MIDDLE EAST AND AFRICA READY TO EAT MEALS IN READY TO EAT FOOD MARKET, BY TYPE, 2018-2032 (TONS)

TABLE 102 MIDDLE EAST AND AFRICA READY TO EAT MEALS IN READY TO EAT FOOD MARKET, BY TYPE, 2018-2032 (USD/KG)

TABLE 103 MIDDLE EAST AND AFRICA READY TO EAT FOOD MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 104 MIDDLE EAST AND AFRICA CONVENTIONAL IN READY TO EAT FOOD MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 105 MIDDLE EAST AND AFRICA SPECIALITY IN READY TO EAT FOOD MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 106 MIDDLE EAST AND AFRICA SPECIALTY IN READY TO EAT FOOD MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 107 MIDDLE EAST AND AFRICA READY TO EAT FOOD MARKET, BY PACKAGING TYPE, 2018-2032 (USD THOUSAND)

TABLE 108 MIDDLE EAST AND AFRICA POUCHES/SACHETS IN CONVENTIONAL IN READY TO EAT FOOD MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 109 MIDDLE EAST AND AFRICA CANS IN CONVENTIONAL IN READY TO EAT FOOD MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 110 MIDDLE EAST AND AFRICA JARS & CONTAINERS IN CONVENTIONAL IN READY TO EAT FOOD MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 111 MIDDLE EAST AND AFRICA BOTTLES IN CONVENTIONAL IN READY TO EAT FOOD MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 112 MIDDLE EAST AND AFRICA BOTTLES IN CONVENTIONAL IN READY TO EAT FOOD MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 113 MIDDLE EAST AND AFRICA BOXES IN CONVENTIONAL IN READY TO EAT FOOD MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 114 MIDDLE EAST AND AFRICA OTHERS IN CONVENTIONAL IN READY TO EAT FOOD MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 115 MIDDLE EAST AND AFRICA READY TO EAT FOOD MARKET, BY PACKAGING SIZE, 2018-2032 (USD THOUSAND)

TABLE 116 MIDDLE EAST AND AFRICA LESS THAN 250 GRAMS IN CONVENTIONAL IN READY TO EAT FOOD MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 117 MIDDLE EAST AND AFRICA 251-500 GRAMS IN CONVENTIONAL IN READY TO EAT FOOD MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 118 MIDDLE EAST AND AFRICA 501-750 GRAMS IN CONVENTIONAL IN READY TO EAT FOOD MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 119 MIDDLE EAST AND AFRICA 751-1000 GRAMS IN CONVENTIONAL IN READY TO EAT FOOD MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 120 MIDDLE EAST AND AFRICA MORE THAN 1000 GRAMS IN CONVENTIONAL IN READY TO EAT FOOD MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 121 MIDDLE EAST AND AFRICA READY TO EAT FOOD MARKET, BY PACKAGING TECHNOLOGY, 2018-2032 (USD THOUSAND)

TABLE 122 MIDDLE EAST AND AFRICA OXYGEN SCAVENGERS IN CONVENTIONAL IN READY TO EAT FOOD MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 123 MIDDLE EAST AND AFRICA MOISTURE CONTROL IN CONVENTIONAL IN READY TO EAT FOOD MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 124 MIDDLE EAST AND AFRICA ANTIMICROBIALS IN CONVENTIONAL IN READY TO EAT FOOD MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 125 MIDDLE EAST AND AFRICA TIME TEMPERATURE INDICATORS IN CONVENTIONAL IN READY TO EAT FOOD MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 126 MIDDLE EAST AND AFRICA EDIBLE FILMS IN CONVENTIONAL IN READY TO EAT FOOD MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 127 MIDDLE EAST AND AFRICA READY TO EAT FOOD MARKET, BY STORAGE TYPE, 2018-2032 (USD THOUSAND)

TABLE 128 MIDDLE EAST AND AFRICA FROZEN/REFRIGERATED IN READY TO EAT FOOD MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 129 MIDDLE EAST AND AFRICA SHELF-STABLE IN READY TO EAT FOOD MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 130 MIDDLE EAST AND AFRICA CANNED IN READY TO EAT FOOD MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 131 MIDDLE EAST AND AFRICA OTHERS IN READY TO EAT FOOD MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 132 MIDDLE EAST AND AFRICA READY TO EAT FOOD MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 133 MIDDLE EAST AND AFRICA STORE-BASED IN READY TO EAT FOOD MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 134 MIDDLE EAST AND AFRICA STORE-BASED IN READY TO EAT FOOD MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 135 MIDDLE EAST AND AFRICA NON-STORE BASED IN READY TO EAT FOOD MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 136 MIDDLE EAST AND AFRICA NON-STORE-BASED IN READY TO EAT FOOD MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 137 MIDDLE EAST AND AFRICA READY TO EAT FOOD MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 138 MIDDLE EAST AND AFRICA FOOD INDUSTRY SERVICES IN READY TO EAT FOOD MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 139 MIDDLE EAST AND AFRICA FOOD INDUSTRY SERVICES IN READY TO EAT FOOD MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 140 MIDDLE EAST AND AFRICA RESTAURANTS IN READY TO EAT FOOD MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 141 MIDDLE EAST AND AFRICA HOUSEHOLDS IN READY TO EAT FOOD MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 142 MIDDLE EAST AND AFRICA OTHERS IN READY TO EAT FOOD MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 143 MIDDLE EAST AND AFRICA READY TO EAT FOOD MARKET, BY COUNTRY, 2018-2032 (USD THOUSAND)

TABLE 144 MIDDLE EAST AND AFRICA READY TO EAT FOOD MARKET, BY COUNTRY, 2018-2032 (TONS)

TABLE 145 MIDDLE EAST AND AFRICA READY TO EAT FOOD MARKET, BY COUNTRY, 2018-2032 (USD/ KG)

TABLE 146 MIDDLE EAST AND AFRICA READY TO EAT FOOD MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 147 MIDDLE EAST AND AFRICA READY TO EAT FOOD MARKET, BY PRODUCT TYPE, 2018-2032 (TONS)

TABLE 148 MIDDLE EAST AND AFRICA READY TO EAT FOOD MARKET, BY PRODUCT TYPE, 2018-2032 (USD/KG)

TABLE 149 MIDDLE EAST AND AFRICA MEAT PRODUCTS IN READY TO EAT FOOD MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 150 MIDDLE EAST AND AFRICA MEAT PRODUCTS IN READY TO EAT FOOD MARKET, BY TYPE, 2018-2032 (TONS)

TABLE 151 MIDDLE EAST AND AFRICA MEAT PRODUCTS IN READY TO EAT FOOD MARKET, BY TYPE, 2018-2032 (USD/KG)

TABLE 152 MIDDLE EAST AND AFRICA CEREAL BASED PRODUCTS IN READY TO EAT FOOD MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 153 MIDDLE EAST AND AFRICA CEREAL BASED PRODUCTS IN READY TO EAT FOOD MARKET, BY TYPE, 2018-2032 (TONS)

TABLE 154 MIDDLE EAST AND AFRICA CEREAL BASED PRODUCTS IN READY TO EAT FOOD MARKET, BY TYPE, 2018-2032 (USD/KG)

TABLE 155 MIDDLE EAST AND AFRICA DAIRY PRODUCTS IN READY TO EAT FOOD MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 156 MIDDLE EAST AND AFRICA DAIRY PRODUCTS IN READY TO EAT FOOD MARKET, BY TYPE, 2018-2032 (TONS)

TABLE 157 MIDDLE EAST AND AFRICA DAIRY PRODUCTS IN READY TO EAT FOOD MARKET, BY TYPE, 2018-2032 (USD/KG)

TABLE 158 MIDDLE EAST AND AFRICA CHEESE IN READY TO EAT FOOD MARKET, BY FORM, 2018-2032 (USD THOUSAND)

TABLE 159 MIDDLE EAST AND AFRICA CHEESE IN READY TO EAT FOOD MARKET, BY FORM, 2018-2032 (TONS)

TABLE 160 MIDDLE EAST AND AFRICA CHEESE IN READY TO EAT FOOD MARKET, BY FORM, 2018-2032 (USD/KG)

TABLE 161 MIDDLE EAST AND AFRICA CHEESE IN READY TO EAT FOOD MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 162 MIDDLE EAST AND AFRICA CHEESE IN READY TO EAT FOOD MARKET, BY TYPE, 2018-2032 (TONS)

TABLE 163 MIDDLE EAST AND AFRICA CHEESE IN READY TO EAT FOOD MARKET, BY TYPE, 2018-2032 (USD/KG)

TABLE 164 MIDDLE EAST AND AFRICA ANIMAL BASED CHEESE IN READY TO EAT FOOD MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 165 MIDDLE EAST AND AFRICA PLANT BASED CHEESE IN READY TO EAT FOOD MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 166 MIDDLE EAST AND AFRICA ICE CREAMS IN READY TO EAT FOOD MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 167 MIDDLE EAST AND AFRICA ICE CREAMS IN READY TO EAT FOOD MARKET, BY TYPE, 2018-2032 (TONS)

TABLE 168 MIDDLE EAST AND AFRICA ICE CREAMS IN READY TO EAT FOOD MARKET, BY TYPE, 2018-2032 (USD/KG)

TABLE 169 MIDDLE EAST AND AFRICA CURD IN READY TO EAT FOOD MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 170 MIDDLE EAST AND AFRICA CURD IN READY TO EAT FOOD MARKET, BY TYPE, 2018-2032 (TONS)

TABLE 171 MIDDLE EAST AND AFRICA CURD IN READY TO EAT FOOD MARKET, BY TYPE, 2018-2032 (USD/KG)

TABLE 172 MIDDLE EAST AND AFRICA PANEER IN READY TO EAT FOOD MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 173 MIDDLE EAST AND AFRICA PANEER IN READY TO EAT FOOD MARKET, BY TYPE, 2018-2032 (TONS)

TABLE 174 MIDDLE EAST AND AFRICA PANEER IN READY TO EAT FOOD MARKET, BY TYPE, 2018-2032 (USD/KG)

TABLE 175 MIDDLE EAST AND AFRICA GHEE IN READY TO EAT FOOD MARKET, BY SOURCE, 2018-2032 (USD THOUSAND)

TABLE 176 MIDDLE EAST AND AFRICA GHEE IN READY TO EAT FOOD MARKET, BY SOURCE, 2018-2032 (TONS)

TABLE 177 MIDDLE EAST AND AFRICA GHEE IN READY TO EAT FOOD MARKET, BY SOURCE, 2018-2032 (USD/KG)

TABLE 178 MIDDLE EAST AND AFRICA BAKERY PRODUCTS IN READY TO EAT FOOD MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 179 MIDDLE EAST AND AFRICA BAKERY PRODUCTS IN READY TO EAT FOOD MARKET, BY TYPE, 2018-2032 (TONS)

TABLE 180 MIDDLE EAST AND AFRICA BAKERY PRODUCTS IN READY TO EAT FOOD MARKET, BY TYPE, 2018-2032 (USD/KG)

TABLE 181 MIDDLE EAST AND AFRICA SAVORY SWEETS IN READY TO EAT FOOD MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 182 MIDDLE EAST AND AFRICA SAVORY SWEETS IN READY TO EAT FOOD MARKET, BY TYPE, 2018-2032 (TONS)

TABLE 183 MIDDLE EAST AND AFRICA SAVORY SWEETS IN READY TO EAT FOOD MARKET, BY TYPE, 2018-2032 (USD/KG)

TABLE 184 MIDDLE EAST AND AFRICA CONFECTIONERY PRODUCTS IN READY TO EAT FOOD MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 185 MIDDLE EAST AND AFRICA CONFECTIONERY PRODUCTS IN READY TO EAT FOOD MARKET, BY TYPE, 2018-2032 (TONS)

TABLE 186 MIDDLE EAST AND AFRICA CONFECTIONERY PRODUCTS IN READY TO EAT FOOD MARKET, BY TYPE, 2018-2032 (USD/KG)

TABLE 187 MIDDLE EAST AND AFRICA VEGETABLES BASED PRODUCTS IN READY TO EAT FOOD MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 188 MIDDLE EAST AND AFRICA VEGETABLES BASED PRODUCTS IN READY TO EAT FOOD MARKET, BY TYPE, 2018-2032 (TONS)

TABLE 189 MIDDLE EAST AND AFRICA VEGETABLES BASED PRODUCTS IN READY TO EAT FOOD MARKET, BY TYPE, 2018-2032 (USD/KG)

TABLE 190 MIDDLE EAST AND AFRICA INSTANT SOUPS IN READY TO EAT FOOD MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 191 MIDDLE EAST AND AFRICA INSTANT SOUPS IN READY TO EAT FOOD MARKET, BY TYPE, 2018-2032 (TONS)

TABLE 192 MIDDLE EAST AND AFRICA INSTANT SOUPS IN READY TO EAT FOOD MARKET, BY TYPE, 2018-2032 (USD/KG)

TABLE 193 MIDDLE EAST AND AFRICA SAVORY SNACKS IN READY TO EAT FOOD MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 194 MIDDLE EAST AND AFRICA SAVORY SNACKS IN READY TO EAT FOOD MARKET, BY TYPE, 2018-2032 (TONS)

TABLE 195 MIDDLE EAST AND AFRICA SAVORY SNACKS IN READY TO EAT FOOD MARKET, BY TYPE, 2018-2032 (USD/KG)

TABLE 196 MIDDLE EAST AND AFRICA CHIPS IN READY TO EAT FOOD MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 197 MIDDLE EAST AND AFRICA CHIPS IN READY TO EAT FOOD MARKET, BY TYPE, 2018-2032 (TONS)

TABLE 198 MIDDLE EAST AND AFRICA CHIPS IN READY TO EAT FOOD MARKET, BY TYPE, 2018-2032 (USD/KG)

TABLE 199 MIDDLE EAST AND AFRICA WAFERS IN READY TO EAT FOOD MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 200 MIDDLE EAST AND AFRICA WAFERS IN READY TO EAT FOOD MARKET, BY TYPE, 2018-2032 (TONS)

TABLE 201 MIDDLE EAST AND AFRICA WAFERS IN READY TO EAT FOOD MARKET, BY TYPE, 2018-2032 (USD/KG)

TABLE 202 MIDDLE EAST AND AFRICA NAMKEENS IN READY TO EAT FOOD MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 203 MIDDLE EAST AND AFRICA NAMKEENS IN READY TO EAT FOOD MARKET, BY TYPE, 2018-2032 (TONS)

TABLE 204 MIDDLE EAST AND AFRICA NAMKEENS IN READY TO EAT FOOD MARKET, BY TYPE, 2018-2032 (USD/KG)

TABLE 205 MIDDLE EAST AND AFRICA BISCUITS & COOKIES IN READY TO EAT FOOD MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 206 MIDDLE EAST AND AFRICA BISCUITS & COOKIES IN READY TO EAT FOOD MARKET, BY TYPE, 2018-2032 (TONS)

TABLE 207 MIDDLE EAST AND AFRICA BISCUITS & COOKIES IN READY TO EAT FOOD MARKET, BY TYPE, 2018-2032 (USD/KG)

TABLE 208 MIDDLE EAST AND AFRICA REFRIGERATED FOODS IN READY TO EAT FOOD MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 209 MIDDLE EAST AND AFRICA REFRIGERATED FOODS IN READY TO EAT FOOD MARKET, BY TYPE, 2018-2032 (TONS)

TABLE 210 MIDDLE EAST AND AFRICA REFRIGERATED FOODS IN READY TO EAT FOOD MARKET, BY TYPE, 2018-2032 (USD/KG)

TABLE 211 MIDDLE EAST AND AFRICA PLANT BASED MEAT SNACKS IN READY TO EAT FOOD MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 212 MIDDLE EAST AND AFRICA PLANT BASED MEAT SNACKS IN READY TO EAT FOOD MARKET, BY TYPE, 2018-2032 (TONS)

TABLE 213 MIDDLE EAST AND AFRICA PLANT BASED MEAT SNACKS IN READY TO EAT FOOD MARKET, BY TYPE, 2018-2032 (USD/KG)

TABLE 214 MIDDLE EAST AND AFRICA PLANT BASED MEAT SNACKS IN READY TO EAT FOOD MARKET, BY SOURCE, 2018-2032 (USD THOUSAND)

TABLE 215 MIDDLE EAST AND AFRICA PLANT BASED MEAT SNACKS IN READY TO EAT FOOD MARKET, BY SOURCE, 2018-2032 (TONS)

TABLE 216 MIDDLE EAST AND AFRICA PLANT BASED MEAT SNACKS IN READY TO EAT FOOD MARKET, BY SOURCE, 2018-2032 (USD/KG)

TABLE 217 MIDDLE EAST AND AFRICA READY TO EAT MEALS IN READY TO EAT FOOD MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 218 MIDDLE EAST AND AFRICA READY TO EAT MEALS IN READY TO EAT FOOD MARKET, BY TYPE, 2018-2032 (TONS)

TABLE 219 MIDDLE EAST AND AFRICA READY TO EAT MEALS IN READY TO EAT FOOD MARKET, BY TYPE, 2018-2032 (USD/KG)

TABLE 220 MIDDLE EAST AND AFRICA READY TO EAT FOOD MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 221 MIDDLE EAST AND AFRICA SPECIALTY IN READY TO EAT FOOD MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 222 MIDDLE EAST AND AFRICA READY TO EAT FOOD MARKET, BY PACKAGING TYPE, 2018-2032 (USD THOUSAND)

TABLE 223 MIDDLE EAST AND AFRICA BOTTLES IN READY TO EAT FOOD MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 224 MIDDLE EAST AND AFRICA READY TO EAT FOOD MARKET, BY PACKAGING SIZE, 2018-2032 (USD THOUSAND)

TABLE 225 MIDDLE EAST AND AFRICA READY TO EAT FOOD MARKET, BY PACKAGING TECHNOLOGY, 2018-2032 (USD THOUSAND)

TABLE 226 MIDDLE EAST AND AFRICA READY TO EAT FOOD MARKET, BY STORAGE TYPE, 2018-2032 (USD THOUSAND)