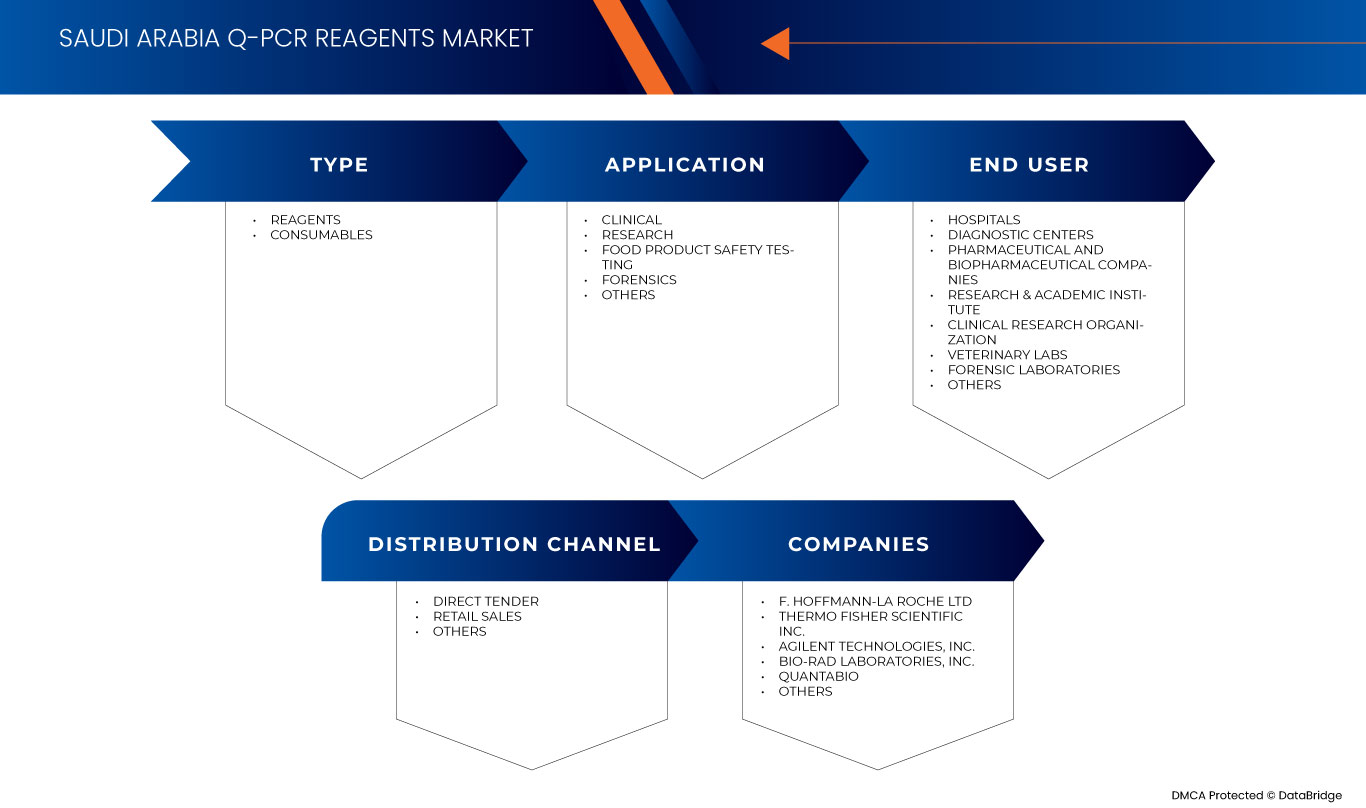

Saudi Arabia q-PCR Reagents Market, By Type (Reagents and Consumables), Application (Clinical, Research, Food Product Safety Testing, Forensics, and Others), End User (Hospitals, Diagnostic Centres, Pharmaceutical and Biopharmaceutical Companies, Research and Academic Institute, Clinical Research Organization, Veterinary Labs, Forensic Laboratories, and Others), Distribution Channel (Direct Tenders, Retail Sales, and Others) - Industry Trends and Forecast to 2030.

Saudi Arabia q-PCR Reagents Market Analysis and Insights

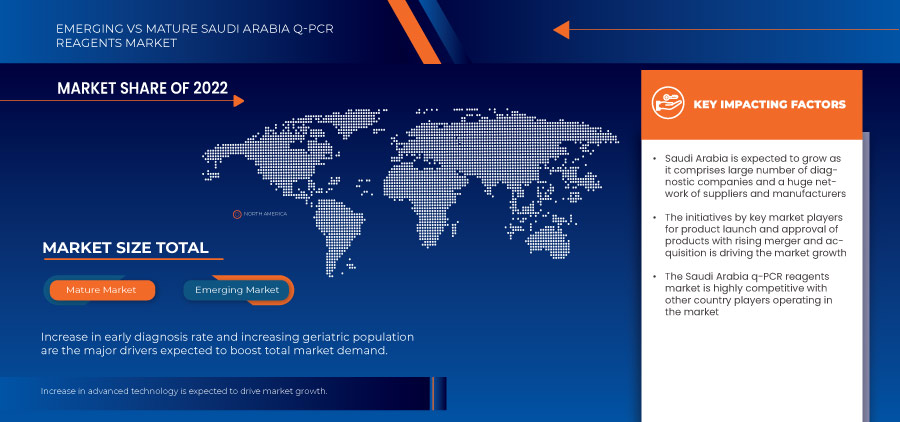

The rising public awareness regarding chronic and communicable disorders has enhanced the demand for the market. The major market players focus on various product launches and approvals during this crucial period. In addition, the increase in improved and advanced technology also contributes to the rising demand for the market.

The Saudi Arabia q-PCR Reagents market is expected to grow in the forecast period of 2023 to 2030 due to the rise in chronic diseases. The high funding for research activities by the government and other bodies is also expected to drive market growth. Along with this, manufacturers are engaged in R&D activity for launching novel products in the market. However, the high cost of the products is expected to restrain the market growth. The growing demand for better quality healthcare for communicable disorders and the rising adoption of personalized medicine is expected to boost the market growth. However, the operational barriers faced in conducting diagnostic tests are expected to challenge market growth.

Data Bridge Market Research analyzes that the Saudi Arabia q-PCR reagents market is expected to reach a value of USD 41,798.44 thousand by 2030, at a CAGR of 8.3% during the forecast period of 2023 to 2030.

|

Report Metric |

Details |

|

Forecast Period |

2023 to 2030 |

|

Base Year |

2022 |

|

Historic Years |

2021 (Customizable to 2015–2020) |

|

Quantitative Units |

Revenue in USD Thousand |

|

Segments Covered |

Type (Reagents and Consumables), Application (Clinical, Research, Food Product Safety Testing, Forensics, and Others), End User (Hospitals, Diagnostic Centres, Pharmaceutical and Biopharmaceutical Companies, Research and Academic Institute, Clinical Research Organization, Veterinary Labs, Forensic Laboratories, and Others), Distribution Channel (Direct Tenders, Retail Sales, and Others) |

|

Country Covered |

Saudi Arabia |

|

Market Players Covered |

F. Hoffmann-La Roche Ltd, Thermo Fisher Scientific Inc., Agilent Technologies, Inc., Bio-Rad Laboratories, Inc., Quantabio, Sino Biological Inc., QIAGEN, TAKARA HOLDINGS INC, Enzo Biochem Inc., meridian BIOSCIENCE, Tonbo Biosciences (A subsidiary of Cytek Biosciences), Norgen Biotek Corp. |

Market Definition

q-PCR reagents are used in the simultaneous amplification and detection/quantification of nucleic acids using the polymerase chain reaction (PCR). These reagents are used in different applications such as research, diagnosis, and forensics. They are also used for the detection of viruses, genetic stability testing, and others. The main advantage of qPCR is that it allows you to determine the initial number of copies of template DNA (the amplification target sequence) with accuracy and high sensitivity over a wide dynamic range.

Saudi Arabia q-PCR Reagents Market Dynamics

This section deals with the understanding of market drivers, advantages, opportunities, restraints, and challenges. All of this is discussed in detail below:

Drivers

- Increasing Prevalence of Chronic and Communicable Diseases

Chronic diseases include cardiac diseases, cancer, and diabetes, which are the leading causes of death and disability in many countries around the globe. q-PCR reagents are essential for the diagnosis of chronic diseases such as human Immuno Deficiency Virus (HIV) and malaria. Both conditions have non-specific symptoms. The q-PCR kits and mixers contain all the necessary PCR reagents for rapid, sensitive, and reproducible real-time detection of HIV and other diseases using highly specific primer pairs.

- Increase in Geriatric Population

The geriatric population is susceptible to chronic and malignant diseases. The non-specific antibodies are more common in the elderly population. The diagnosis through q-PCR reagents is important for the elderly population as it provides early diagnosis which is crucial to prevent the extensive spread of the disease since the test is non-invasive and aids in determining antigen detection in infectious chronic diseases. Since the geriatric population is increasing, the need for q-PCR reagents will also increase.

Restraint

- Stringent Rules and Regulation

The commercialization of reagents and products by various key market players is facilitated by compliance with the regulatory frameworks established in the country. The rapid development of privacy policies and regulations being made by SFDA is restraining the market growth. The regulatory authority in charge of regulating the registration and endorsement of medical equipment, including PCR reagents, in Saudi Arabia is known as the Saudi Food and Drug Authority. The SFDA has rules for product registration, labeling, and quality control that manufacturers and distributors of PCR reagents must follow, which restrains market growth.

Opportunity

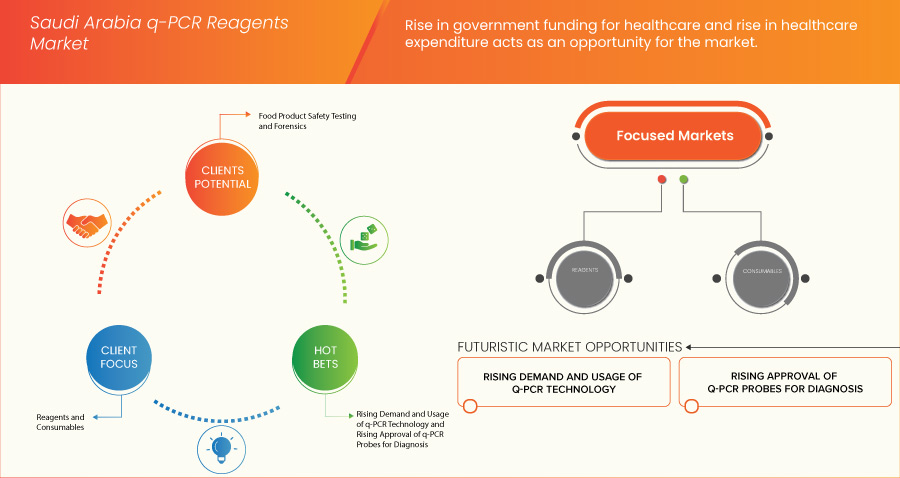

- Rise in Government Funding for Healthcare

The government, federations, and major market players are creating opportunities across developing countries. These initiatives by the players and government are helping the users to reach out to take advantage of the policies made for low-income and developing nations and making them aware of the diseases that are preventable if diagnosed earlier.

Investments in medical R&D may increase as healthcare spending rises. More studies are conducted in the areas of genetic research, illness monitoring, and diagnostics, which may increase demand for q-PCR reagents. Healthcare facilities may increase the number and type of clinical tests they offer as they develop and enhance their services, which provides the opportunity for market growth.

Challenge

- Lack of Skilled Workforce

q-PCR technology is continuously advancing and manufacturers are continuously engaged in R&D activities for launching advanced q-PCR which require highly skilled and certified professionals to operate it. Handling reagents and maintaining the PCR reactions is not a simple task. It is a vast process that requires proper knowledge, and experience so that the result conducted will be accurate and proper. However, this shortage in the professional and skilled workforce has decreased the market for q-PCR reagents.

The requirement for skilled and certified professionals is a big challenge for the market. The q-PCR is a complex process and the devices have advanced features that require skilled professionals to operate them to provide safe such as effective services to patients.

Recent Developments

- In December 2021, Thermo Fisher Scientific Inc. announced that they have completed the acquisition of PPD, Inc. a leading Saudi Arabia provider of clinical research services to the biopharma and biotech industry. This acquisition has helped the company to increase its product portfolio and sales.

- In September 2021, Agilent Technologies, Inc. announced the signing of a worldwide distribution agreement with Visiopharm, enabling Agilent to co-market Visiopharm’s portfolio of CE-IVD marked artificial intelligence (AI)-driven precision pathology software and other products. This has increased the company’s product reach.

- In September 2021, Bio-Rad Laboratories, Inc. announced the partnership with Seegene, Inc., a Saudi Arabia leader in multiplex molecular diagnostics, for the clinical development and commercialization of infectious disease molecular diagnostic products. This has increased the company’s product portfolio.

- In June 2021, Agilent Technologies, Inc. announced the launch of three InfinityLab Bio LC systems specifically developed to meet the needs of the biopharma industry which include instruments, columns, reagents, and supplies that seamlessly integrate with Agilent OpenLab and MassHunter software, and CrossLab services to maximize efficiency in biopharma labs. This has increased the company’s sales and product portfolio.

- In July 2020, Thermo Fisher Scientific Inc. announced the launch of the Applied Biosystems QuantStudio Absolute Q Digital PCR System, the first fully integrated digital PCR (dPCR) system designed to provide highly accurate and consistent results within 90 minutes. This has increased the company’s revenue and product portfolio.

Saudi Arabia q-PCR Reagents Market Scope

The Saudi Arabia q-PCR reagents market is segmented into four notable segments based on type, application, end user, and distribution channel. The growth among segments helps you analyze niche pockets of growth and strategies to approach the market and determine your core application areas and the difference in your target markets.

Type

- Reagents

- Consumables

On the basis of type, the market is segmented into reagents and consumables.

Application

- Clinical

- Research

- Food Product Safety Testing

- Forensics

- Others

On the basis of application, the market is segmented into clinical, research, food product safety testing, forensics, and others.

End User

- Hospitals

- Diagnostic Centres

- Pharmaceutical and Biopharmaceutical Companies

- Research & Academic Institute

- Clinical Research Organization

- Veterinary Labs

- Forensic Laboratories

- Others

On the basis of end user, the market is segmented into hospitals, diagnostic centres, pharmaceutical and biopharmaceutical companies, research & academic institute, clinical research organization, veterinary labs, forensic laboratories, and others.

Distribution Channel

- Direct Tender

- Retail Sales

- Others

On the basis of distribution channel, the market is segmented into direct tender, retail sales, and others.

Competitive Landscape and Saudi Arabia q-PCR Reagents Market Share Analysis

The Saudi Arabia q-PCR reagents market competitive landscape provides details of competitors. Details included are company overview, company financials, revenue generated, market potential, investment in R&D, new market initiatives, production sites and facilities, company strengths and weaknesses, product launch, product trials pipelines, product approvals, patents, product width and breath, application dominance, and technology lifeline curve. The above data points provided are only related to the company’s focus on the Saudi Arabia q-PCR reagents market.

Some of the major market players operating in the Saudi Arabia q-PCR reagents market are F. Hoffmann-La Roche Ltd, Thermo Fisher Scientific Inc., Agilent Technologies, Inc., Bio-Rad Laboratories, Inc., Quantabio, Sino Biological Inc., QIAGEN, TAKARA HOLDINGS INC, Enzo Biochem Inc., meridian BIOSCIENCE, Tonbo Biosciences (A subsidiary of Cytek Biosciences), Norgen Biotek Corp., among others.

SKU-

Obtenha acesso online ao relatório sobre a primeira nuvem de inteligência de mercado do mundo

- Painel interativo de análise de dados

- Painel de análise da empresa para oportunidades de elevado potencial de crescimento

- Acesso de analista de pesquisa para personalização e customização. consultas

- Análise da concorrência com painel interativo

- Últimas notícias, atualizações e atualizações Análise de tendências

- Aproveite o poder da análise de benchmark para um rastreio abrangente da concorrência

Índice

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF SAUDI ARABIA Q-PCR REAGENTS MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELLING

2.7 PRODUCTS LIFELINE CURVE

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 MARKET END USER COVERAGE GRID

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHT

4.1 PESTEL ANALYSIS

4.2 PORTER’S FIVE FORCES

4.3 GLOBAL QPCR REAGENTS MARKET, PRICING ANALYSIS

5 COST ANALYSIS BREAKDOWN

6 HEALTHCARE ECONOMY

7 INDUSTRY INSIGHTS

8 INNOVATION TRACKER AND STRATEGIC ANALYSIS

9 TECHNOLOGY ROADMAP

10 VALUE CHAIN ANALYSIS

11 REGULATIONS

12 MARKET OVERVIEW

12.1 DRIVERS

12.1.1 INCREASING PREVALENCE OF CHRONIC AND COMMUNICABLE DISEASES

12.1.2 INCREASE IN GERIATRIC POPULATION

12.1.3 INCREASE IN EARLY DIAGNOSIS RATE

12.1.4 INCREASE IN ADVANCED TECHNOLOGY

12.2 RESTRAINTS

12.2.1 STRINGENT RULES AND REGULATIONS

12.2.2 HIGH COST OF PRODUCT

12.3 OPPORTUNITIES

12.3.1 RISE IN GOVERNMENT FUNDING FOR HEALTHCARE

12.3.2 RISE IN HEALTHCARE EXPENDITURE

12.4 CHALLENGES

12.4.1 LACK OF SKILLED WORKFORCE

12.4.2 OPERATIONAL BARRIERS FACED IN CONDUCTING DIAGNOSTIC TESTS

13 SAUDI ARABIA QPCR REAGENTS MARKET, BY TYPE

13.1 OVERVIEW

13.2 REAGENTS

13.2.1 MASTER MIX

13.2.1.1 DNA

13.2.1.2 RNA

13.2.2 PRIMERS AND DNTPS

13.2.3 ASSAY

13.2.4 NUCLEIC ACID GEL STAIN

13.2.5 DNASE BUFFER

13.2.6 OTHERS

13.2. CONSUMABLES

13.2.1. PIPETTE TIPS

13.2.2. TUBES

13.2.3. PLATES

13.2.3.1. STANDARD

13.2.3.2. CUSTOM

13.2.4. SEALING FOILS

13.2.5. TUBE STRIPS

13.2.6. OTHERS

14 SAUDI ARABIA QPCR REAGENTS MARKET, BY APPLICATION

14.2. OVERVIEW

14.3. CLINICAL

13.3 HUMAN DIAGNOSTICS

14.3.1.1. HOSPITALS

14.3.1.2. DIAGNOSTIC CENTERS

14.3.1.3. PATHOLOGY LABS

14.3.1.4. OTHERS

13.4 VETERINARY DIAGNOSTICS

14.3.1.5. VETERINARY HOSPITALS

14.3.1.6. DIAGNOSTIC CENTERS

14.3.1.7. VETERINARY LABORATORY

14.3.1.8. VETERINARY CLINICS

14.4. RESEARCH

14.4.1. GENE EXPRESSION ANALYSIS

14.4.1.1. RESEARCH & ACADEMIC INSTITUTES

14.4.1.2. PHARMACEUTICAL & BIOTECHNOLOGY COMPANIES

14.4.1.3. OTHERS

14.4.2. GENOTYPING

14.4.2.1. RESEARCH & ACADEMIC INSTITUTES

14.4.2.2. PHARMACEUTICAL & BIOTECHNOLOGY COMPANIES

14.4.2.3. OTHERS

14.4.3. MICROBE AND PATHOGEN DETECTION

14.4.3.1. RESEARCH & ACADEMIC INSTITUTES

14.4.3.2. PHARMACEUTICAL & BIOTECHNOLOGY COMPANIES

14.4.3.3. OTHERS

14.4.4. SINGLE NUCLEOTIDE POLYMORPHISM (SNP) DETECTION

14.4.4.1. RESEARCH & ACADEMIC INSTITUTES

14.4.4.2. PHARMACEUTICAL & BIOTECHNOLOGY COMPANIES

14.4.4.3. OTHERS

14.4.5. DRUG DEVELOPMENT

14.4.5.1. PHARMACEUTICAL & BIOTECHNOLOGY COMPANIES

14.4.5.2. CLINICAL RESEARCH ORGANIZATION

14.4.5.3. RESEARCH & ACADEMIC INSTITUTES

14.4.5.4. OTHERS

14.4.6. DRUG DISCOVERY

14.4.6.1. PHARMACEUTICAL & BIOTECHNOLOGY COMPANIES

14.4.6.2. CLINICAL RESEARCH ORGANIZATION

14.4.6.3. RESEARCH & ACADEMIC INSTITUTES

14.4.6.4. OTHERS

14.4.7. OTHERS

14.5. FOOD PRODUCT SAFETY TESTING

14.5.1. FOOD REGULATORY AGENCIES

14.5.2. FOOD TESTING LABORATORIES

14.5.3. FOOD COMPANIES

14.5.4. OTHERS

14.6. FORENSICS

14.6.1. PRIVATE FORENSIC LABORATORIES

14.6.2. PUBLIC FORENSIC LABORATORIES

14.7. OTHERS

15 SAUDI ARABIA QPCR REAGENTS MARKET, BY END USER

15.2. OVERVIEW

15.3. HOSPITALS

15.4. DIAGNOSTIC CENTERS

15.5. PHARMACEUTICAL AND BIOPHARMACEUTICAL COMPANIES

15.6. RESEARCH & ACADEMIC INSTITUTE

15.7. CLINICAL RESEARCH ORGANIZATION

15.8. VETERINARY LABS

15.9. FORENSIC LABORATORIES

15.10. OTHERS

16 SAUDI ARABIA QPCR REAGENTS MARKET, BY DISTRIBUTION CHANNEL

16.2. OVERVIEW

16.3. DIRECT TENDER

16.4. RETAIL SALES

16.5. OTHERS

17 SAUDI ARABIA QPCR REAGENTS MARKET: COMPANY LANDSCAPE

17.2. COMPANY SHARE ANALYSIS: SAUDI ARABIA

18 SWOT ANALYSIS

19 COMPANY PROFILE

19.2. F. HOFFMANN-LA ROCHE LTD

19.2.1. COMPANY SNAPSHOT

19.2.2. REVENUE ANALYSIS

19.2.3. PRODUCT PORTFOLIO

19.2.4. RECENT DEVELOPMENT

19.3. THERMO FISHER SCIENTIFIC INC.

19.3.1. COMPANY SNAPSHOT

19.3.2. REVENUE ANALYSIS

19.3.3. PRODUCT PORTFOLIO

19.3.4. RECENT DEVELOPMENTS

19.4. AGILENT TECHNOLOGIES, INC.

19.4.1. COMPANY SNAPSHOT

19.4.2. REVENUE ANALYSIS

19.4.3. PRODUCT PORTFOLIO

19.4.4. RECENT DEVELOPMENTS

19.4.4.1. DISTRIBUTION AGREEMENT

19.4.4.2. PRODUCT LAUNCH

19.5. BIO-RAD LABORATORIES, INC.

19.5.1. COMPANY SNAPSHOT

19.5.2. REVENUE ANALYSIS

19.5.3. PRODUCT PORTFOLIO

19.5.4. RECENT DEVELOPMENTS

19.6. QUANTABIO

19.6.1. COMPANY SNAPSHOT

19.6.2. PRODUCT PORTFOLIO

19.6.3. RECENT DEVELOPMENT

19.7. ENZO BIOCHEM INC

19.7.1. COMPANY SNAPSHOT

19.7.2. REVENUE ANALYSIS

19.7.3. PRODUCT PORTFOLIO

19.7.4. RECENT DEVELOPMENT

19.8. MERIDIAN BIOSCIENCE

19.8.1. COMPANY SNAPSHOT

19.8.2. PRODUCT PORTFOLIO

19.8.3. RECENT DEVELOPMENTS

19.9. NORGEN BIOTEK CORP

19.9.1. COMPANY SNAPSHOT

19.9.2. PRODUCT PORTFOLIO

19.9.3. RECENT DEVELOPMENT

19.10. QIAGEN

19.10.1. COMPANY SNAPSHOT

19.10.2. REVENUE ANALYSIS

19.10.3. PRODUCT PORTFOLIO

19.10.4. RECENT DEVELOPMENTS

19.11. SINO BIOLOGICAL INC.

19.11.1. COMPANY SNAPSHOT

19.11.2. PRODUCT PORTFOLIO

19.11.3. RECENT DEVELOPMENT

19.12. TAKARA HOLDINGS INC

19.12.1. COMPANY SNAPSHOT

19.12.2. REVENUE ANALYSIS

19.12.3. PRODUCT PORTFOLIO

19.12.4. RECENT DEVELOPMENTS

19.13. TONBO BIOSCIENCES (A SUBSIDIARY OF CYTEK BIOSCIENCES)

19.13.1. COMPANY SNAPSHOT

19.13.2. PRODUCT PORTFOLIO

19.13.3. RECENT DEVELOPMENT

20 QUESTIONNAIRE

21 RELATED REPORTS

Lista de Tabela

TABLE 1 THE FOLLOWING ARE THE PRICES OF PRODUCTS (CONSUMABLES AND REAGENTS) OFFERED BY THE COMPANIES

TABLE 2 MEDICAL DEVICE CLASSIFICATION SYSTEM:

TABLE 3 APPROVAL PROCESS OF MEDICAL DEVICES:

TABLE 4 SAUDI ARABIA QPCR REAGENTS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 5 SAUDI ARABIA REAGENTS IN QPCR REAGENTS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 6 SAUDI ARABIA MASTER MIX IN QPCR REAGENTS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 7 SAUDI ARABIA CONSUMABLES IN QPCR REAGENTS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 8 SAUDI ARABIA PLATES IN QPCR REAGENTS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 9 SAUDI ARABIA QPCR REAGENTS MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 10 SAUDI ARABIA CLINICAL IN QPCR REAGENTS MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 11 SAUDI ARABIA HUMAN DIAGNOSTICS IN QPCR REAGENTS MARKET, BY END USER, 2021-2030 (USD THOUSAND)

TABLE 12 SAUDI ARABIA VETERINARY DIAGNOSTICS IN QPCR REAGENTS MARKET, BY END USER, 2021-2030 (USD THOUSAND)

TABLE 13 SAUDI ARABIA RESEARCH IN QPCR REAGENTS MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 14 SAUDI ARABIA GENE EXPRESSION ANALYSIS IN QPCR REAGENTS MARKET, BY END USER, 2021-2030 (USD THOUSAND)

TABLE 15 SAUDI ARABIA GENOTYPING IN QPCR REAGENTS MARKET, BY END USER, 2021-2030 (USD THOUSAND)

TABLE 16 SAUDI ARABIA MICROBE AND PATHOGEN DETECTION IN QPCR REAGENTS MARKET, BY END USER, 2021-2030 (USD THOUSAND)

TABLE 17 SAUDI ARABIA SINGLE NUCLEOTIDE POLYMORPHISM (SNP) DETECTION IN QPCR REAGENTS MARKET, BY END USER, 2021-2030 (USD THOUSAND)

TABLE 18 SAUDI ARABIA DRUG DEVELOPMENT IN QPCR REAGENTS MARKET, BY END USER, 2021-2030 (USD THOUSAND)

TABLE 19 SAUDI ARABIA DRUG DISCOVERY IN QPCR REAGENTS MARKET, BY END USER, 2021-2030 (USD THOUSAND)

TABLE 20 SAUDI ARABIA FOOD PRODUCT SAFETY TESTING IN QPCR REAGENTS MARKET, BY END USER, 2021-2030 (USD THOUSAND)

TABLE 21 SAUDI ARABIA FORENSIC IN QPCR REAGENTS MARKET, BY END USER, 2021-2030 (USD THOUSAND)

TABLE 22 SAUDI ARABIA QPCR REAGENTS MARKET, BY END USER, 2021-2030 (USD THOUSAND)

TABLE 23 SAUDI ARABIA QPCR REAGENTS MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD THOUSAND)

Lista de Figura

FIGURE 1 SAUDI ARABIA Q-PCR REAGENTS MARKET: SEGMENTATION

FIGURE 2 SAUDI ARABIA Q-PCR REAGENTS MARKET: DATA TRIANGULATION

FIGURE 3 SAUDI ARABIA Q-PCR REAGENTS MARKET: DROC ANALYSIS

FIGURE 4 SAUDI ARABIA Q-PCR REAGENTS MARKET: GLOBAL VS REGIONAL MARKET ANALYSIS

FIGURE 5 SAUDI ARABIA Q-PCR REAGENTS MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 SAUDI ARABIA Q-PCR REAGENTS MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 SAUDI ARABIA Q-PCR REAGENTS MARKET: DBMR MARKET POSITION GRID

FIGURE 8 SAUDI ARABIA Q-PCR REAGENTS MARKET: MARKET END USER GRID

FIGURE 9 SAUDI ARABIA Q-PCR REAGENTS MARKET: SEGMENTATION

FIGURE 10 INCREASING GERIATRIC POPULATION AND INCREASE IN EARLY DIAGNOSIS RATE IS EXPECTED TO DRIVE THE GROWTH OF THE SAUDI ARABIA Q-PCR REAGENTS MARKET IN THE FORECAST PERIOD OF 2023 TO 2030

FIGURE 11 TYPE SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE SAUDI ARABIA Q-PCR REAGENTS MARKET FROM 2023 TO 2030

FIGURE 12 DRIVERS, RESTRAINTS, OPPORTUNITIES AND CHALLENGES OF SAUDI ARABIA Q-PCR REGANETS MARKET

FIGURE 13 SAUDI ARABIA QPCR REAGENTS MARKET: BY TYPE, 2022

FIGURE 14 SAUDI ARABIA QPCR REAGENTS MARKET: BY APPLICATION, 2022

FIGURE 15 SAUDI ARABIA QPCR REAGENTS MARKET: BY END USER, 2022

FIGURE 16 SAUDI ARABIA QPCR REAGENTS MARKET: BY DISTRIBUTION CHANNEL, 2022

FIGURE 17 SAUDI ARABIA Q-PCR REAGENTS MARKET: COMPANY SHARE 2022 (%)

Metodologia de Investigação

A recolha de dados e a análise do ano base são feitas através de módulos de recolha de dados com amostras grandes. A etapa inclui a obtenção de informações de mercado ou dados relacionados através de diversas fontes e estratégias. Inclui examinar e planear antecipadamente todos os dados adquiridos no passado. Da mesma forma, envolve o exame de inconsistências de informação observadas em diferentes fontes de informação. Os dados de mercado são analisados e estimados utilizando modelos estatísticos e coerentes de mercado. Além disso, a análise da quota de mercado e a análise das principais tendências são os principais fatores de sucesso no relatório de mercado. Para saber mais, solicite uma chamada de analista ou abra a sua consulta.

A principal metodologia de investigação utilizada pela equipa de investigação do DBMR é a triangulação de dados que envolve a mineração de dados, a análise do impacto das variáveis de dados no mercado e a validação primária (especialista do setor). Os modelos de dados incluem grelha de posicionamento de fornecedores, análise da linha de tempo do mercado, visão geral e guia de mercado, grelha de posicionamento da empresa, análise de patentes, análise de preços, análise da quota de mercado da empresa, normas de medição, análise global versus regional e de participação dos fornecedores. Para saber mais sobre a metodologia de investigação, faça uma consulta para falar com os nossos especialistas do setor.

Personalização disponível

A Data Bridge Market Research é líder em investigação formativa avançada. Orgulhamo-nos de servir os nossos clientes novos e existentes com dados e análises que correspondem e atendem aos seus objetivos. O relatório pode ser personalizado para incluir análise de tendências de preços de marcas-alvo, compreensão do mercado para países adicionais (solicite a lista de países), dados de resultados de ensaios clínicos, revisão de literatura, mercado remodelado e análise de base de produtos . A análise de mercado dos concorrentes-alvo pode ser analisada desde análises baseadas em tecnologia até estratégias de carteira de mercado. Podemos adicionar quantos concorrentes necessitar de dados no formato e estilo de dados que procura. A nossa equipa de analistas também pode fornecer dados em tabelas dinâmicas de ficheiros Excel em bruto (livro de factos) ou pode ajudá-lo a criar apresentações a partir dos conjuntos de dados disponíveis no relatório.