Asia Pacific Active Pharmaceutical Ingredient Api Market

Market Size in USD Billion

CAGR :

%

USD

64.56 Billion

USD

115.14 Billion

2024

2032

USD

64.56 Billion

USD

115.14 Billion

2024

2032

| 2025 –2032 | |

| USD 64.56 Billion | |

| USD 115.14 Billion | |

|

|

|

|

Asia-Pacific Active Pharmaceutical Ingredients (API) Market Size

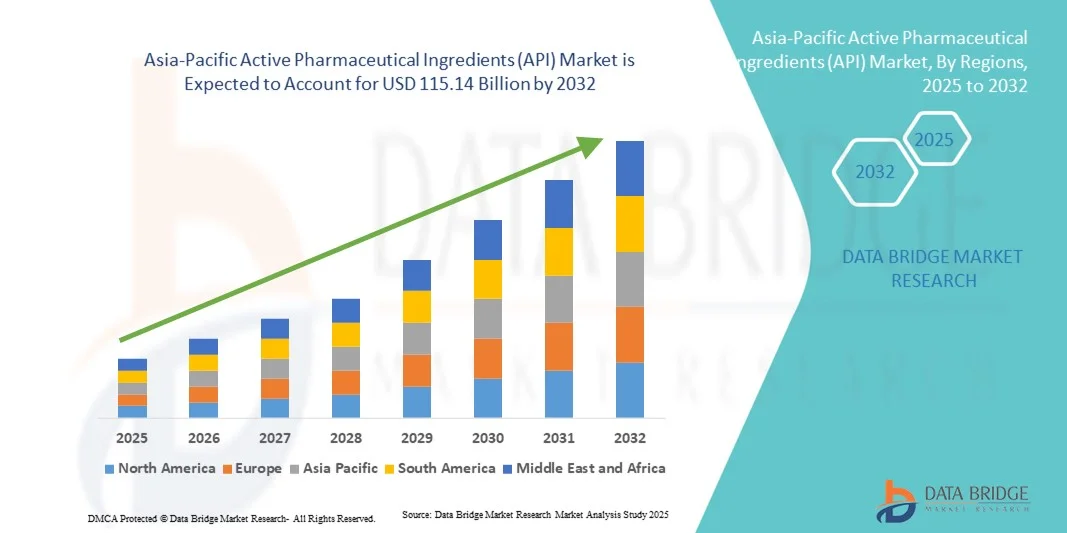

- The Asia-Pacific active pharmaceutical ingredients (API) market size was valued at USD 64.56 billion in 2024 and is expected to reach USD 115.14 billion by 2032, at a CAGR of 7.50% during the forecast period

- The market growth is largely fueled by the increasing demand for effective and high-quality drugs driven by the rising prevalence of chronic and infectious diseases, an aging global population, and the growing adoption of advanced therapeutic formulations

- Furthermore, continuous advancements in biotechnology, coupled with expanding pharmaceutical R&D activities and the rising outsourcing of API manufacturing to cost-efficient regions, are accelerating the uptake of Active Pharmaceutical Ingredients (API) solutions, thereby significantly boosting the industry's growth

Asia-Pacific Active Pharmaceutical Ingredients (API) Market Analysis

- The Active Pharmaceutical Ingredients (API) market plays a vital role in the pharmaceutical industry, serving as the key component responsible for the therapeutic effects of drugs used across diverse therapeutic areas such as oncology, cardiovascular diseases, and infectious disorders. The market is witnessing strong momentum due to technological advancements in synthesis, rising demand for biologics, and increasing focus on high-potency APIs (HPAPIs)

- The growing demand for APIs is primarily driven by the rising prevalence of chronic and lifestyle-related diseases, expansion of the generic drug sector, and the trend of pharmaceutical companies outsourcing API production to specialized manufacturers for cost efficiency and quality assurance

- China dominated the active pharmaceutical ingredients (API) market with the largest revenue share of 41.6% in 2024, supported by a well-established pharmaceutical manufacturing base, strong R&D infrastructure, and the presence of major market players.

- India is expected to be the fastest-growing region in the active pharmaceutical ingredients (API) market during the forecast period, attributed to expanding manufacturing capabilities, favorable government initiatives, and increasing demand for affordable generics

- The clinical segment dominated the largest revenue share of 68% in 2024, driven by the use of APIs in hospitals, specialty clinics, and patient treatment programs across multiple therapeutic areas

Report Scope and Active Pharmaceutical Ingredients (API) Market Segmentation

|

Attributes |

Active Pharmaceutical Ingredients (API) Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

Asia-Pacific

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework. |

Asia-Pacific Active Pharmaceutical Ingredients (API) Market Trends

Expansion of Biologics‑API and Specialty API Manufacturing

- A clear and accelerating trend in the API market is the shift beyond traditional small-molecule APIs toward biologic, peptide, oligonucleotide, and other high-value specialty APIs

- For instance, in 2023, a leading Chinese API firm announced the launch of a new biologic API production line for oncology drugs

- The synthetic small-molecule API segment still leads in terms of market share but growth momentum is shifting toward complex biologic APIs

- Many API manufacturers are investing in or converting plants to manufacture biologic APIs or other high-potency/complex APIs, enabling higher margins and differentiation in a crowded generics space

- Outsourcing trends are evolving: global pharmaceutical firms are increasingly looking not only for volume APIs but also for specialty and biosimilar API manufacturing partnerships in Asia‑Pacific

- Technology advances—such as continuous manufacturing, improved expression systems, and bioprocess scale-up—are facilitating specialty API production in the region

- Governments and regional policy-makers are supporting biologic and high-end API manufacturing (e.g., through incentives), which further reinforces this shift toward speciality

- Overall, this trend reflects a transformation of the API market from cost-volume bulk manufacturing to more complex, differentiated, high-value API production models

Asia-Pacific Active Pharmaceutical Ingredients (API) Market Dynamics

Driver

Rising Demand for Cost‑Effective API Production and Outsourcing

- The global Asia‑Pacific active pharmaceutical ingredients (API) market is being significantly driven by pharmaceutical companies and contract manufacturers seeking high‑quality and lower‑cost API supplies

- For instance, in 2023, a leading Indian API manufacturer expanded its production capacity to meet rising demand from global pharma companies

- The prevalence of chronic diseases, aging populations, and increased global healthcare spending are boosting demand for both generic and innovative APIs

- Government initiatives in several Asia‑Pacific countries are strengthening domestic production, reducing reliance on imports and enhancing global supply-chain roles

- Lower manufacturing costs, large skilled workforces, and established chemical/bioprocessing infrastructure in key Asia‑Pacific nations are attracting more outsourcing of API production from Western pharmaceutical firms

- Expansion in biologic and specialty APIs (e.g., for oncology, immunology) is creating new manufacturing and sourcing needs, further driving the region’s API market growth

- Many pharmaceutical companies are shifting parts of their API supply chain to Asia‑Pacific to achieve cost efficiency, faster time to market, and regulatory advantages

- The above multiple drivers collectively support strong growth momentum in the API market across Asia‑Pacific and globally

Restraint/Challenge

Regulatory Complexity, Supply‑Chain Risks and Price Pressure

- Stringent regulatory requirements for API quality, safety, and manufacturing practices pose significant cost and compliance burdens

- For instance, in 2022, a high-profile European pharmaceutical company faced delays due to additional API regulatory inspections

- Persistent supply-chain vulnerabilities—such as dependence on specific raw materials, single-country production hubs, or disruptions from geopolitical/logistical events—limit reliability

- Significant downward pressure on API pricing—especially for generics—reduces profitability for manufacturers and can discourage investment in capacity or innovation

- Environmental, health & safety concerns and the need to upgrade manufacturing to greener chemistry or more controlled biotech processes raise CAPEX and operating costs

- Fragmented global quality standards and varying inspection regimes across countries complicate global sourcing and hinder harmonization

- For smaller API producers, the combination of regulatory, cost, and market-price pressures may limit ability to scale or invest in specialty/biologic APIs

- These challenges must be managed for sustained market growth; companies and regulators need to coordinate on quality, resilience, and cost structures

Asia-Pacific Active Pharmaceutical Ingredients (API) Market Scope

The market is segmented on the basis of molecule, type, type of manufacturer, synthesis, chemical synthesis, type of drug, usage, potency, and therapeutic application.

- By Molecule

On the basis of molecule, the Asia-Pacific API market is segmented into small molecule and large molecule. The small molecule segment dominated the largest market revenue share of 62% in 2024, driven by their established use in pharmaceutical production, ease of synthesis, and proven clinical efficacy. Small molecules are widely used in prescription and over-the-counter drugs across multiple therapeutic areas such as cardiology, CNS, oncology, and gastrointestinal treatments. Their cost-effective production, scalability, and compatibility with conventional drug delivery methods make them highly preferred by manufacturers. Strong patent expirations and generic drug development further reinforce dominance. In addition, small molecules benefit from mature supply chains, wide regulatory acceptance, and availability of raw materials. The segment also sees robust adoption due to increasing demand for chronic disease treatments and high-volume production. Major pharmaceutical hubs in Asia-Pacific, including China and India, continue to strengthen their manufacturing capabilities, enhancing market share. Integration with traditional healthcare systems and established clinical pipelines further supports small molecule prevalence.

The large molecule segment is expected to witness the fastest CAGR of 21.5% from 2025 to 2032, driven by the rising demand for biologics, monoclonal antibodies, and recombinant proteins. Large molecules are increasingly preferred for complex therapies, including oncology, autoimmune, and rare disease treatments. Rapid advancements in biotechnology, expansion of biopharmaceutical pipelines, and government incentives for biologics accelerate growth. Improved manufacturing processes, cost reductions in biologics production, and increasing hospital and specialty clinic adoption further boost market potential. Growing emphasis on personalized medicine, biosimilars, and advanced therapeutics supports segment growth. Strategic collaborations between biotech companies and research institutes enhance access and innovation. The segment benefits from increasing clinical trials, regulatory approvals for biologics, and rising awareness of targeted therapies in the Asia-Pacific region. Adoption is also supported by the expansion of biotech infrastructure in emerging markets.

- By Type

On the basis of type, the market is segmented into innovative APIs and generic innovative APIs. The innovative API segment dominated with 58% revenue share in 2024 due to high demand for novel therapeutics, patent-protected drugs, and specialty formulations. Pharmaceutical companies are investing heavily in R&D to develop new chemical entities and targeted therapies, particularly in oncology, CNS, and cardiovascular indications. Regulatory approvals, clinical trial pipelines, and partnerships with research organizations reinforce its dominance. Innovative APIs also benefit from higher margins and strategic positioning in competitive therapeutic areas. The segment is supported by robust healthcare infrastructure, growing government focus on rare and complex diseases, and strong intellectual property protection frameworks. In addition, rising demand in emerging markets and expansion of hospitals and specialty clinics further solidify its market position. Continuous innovation in drug design, development, and delivery platforms ensures sustained adoption of innovative APIs across Asia-Pacific.

The generic innovative API segment is expected to witness the fastest CAGR of 22% from 2025 to 2032, fueled by increasing adoption of generics, cost-sensitive healthcare policies, and patent expirations. Generic APIs provide affordable alternatives to branded drugs, meeting growing demand in emerging markets. Manufacturers are expanding capacities, enhancing distribution networks, and engaging in contract manufacturing to support rapid growth. Strategic collaborations with hospitals, pharmacies, and healthcare providers further accelerate penetration. Rising government initiatives to improve drug accessibility, combined with technological advancements in manufacturing, contribute to faster adoption. Expansion of insurance coverage and public health programs also drives generic API consumption.

- By Type of Manufacturer

On the basis of type of manufacturer, the market is segmented into captive API manufacturers and merchant API manufacturers. The captive API manufacturer segment dominated with 55% revenue share in 2024, as in-house API production allows pharmaceutical companies to maintain quality control, reduce costs, and ensure regulatory compliance. Captive manufacturers benefit from integrated R&D, established distribution networks, and proprietary formulations. This segment sees strong demand in high-value therapeutic areas, including oncology and CNS. The stability of supply, vertical integration, and strategic market positioning support continued dominance.

The merchant API manufacturer segment is expected to witness the fastest CAGR of 21.8% from 2025 to 2032, driven by growing outsourcing trends, contract manufacturing opportunities, and global API demand. Merchant manufacturers provide flexible production capacity, cost-efficient solutions, and specialized APIs. Expansion into emerging markets and increasing clinical trial activity bolster segment growth. The rising focus on small biotech firms and startups outsourcing API production further accelerates adoption. In addition, advancements in manufacturing technologies and regulatory support for contract manufacturing enhance the segment’s competitiveness and attractiveness to global pharmaceutical companies.

- By Synthesis

On the basis of synthesis, the market is segmented into synthetic APIs and biotech APIs. The synthetic API segment held the largest revenue share of 60% in 2024, driven by its well-established production processes, lower manufacturing costs, and broad applicability across oral, injectable, and topical drugs. The segment’s dominance is reinforced by strong supply chains, extensive regulatory familiarity, and compatibility with multiple therapeutic areas, making it a preferred choice for pharmaceutical manufacturers. In addition, the mature infrastructure, steady availability of raw materials, and seamless integration with conventional pharmaceutical pipelines further strengthen its leading position. The widespread adoption of synthetic APIs in both branded and generic drugs, coupled with ongoing technological advancements, ensures sustained growth and continued market leadership.

The biotech API segment is expected to witness the fastest CAGR of 23% from 2025 to 2032, fueled by rapid development in biologics, recombinant proteins, and monoclonal antibodies. Rising investments in biopharmaceutical R&D, increasing hospital adoption, and government incentives for biotech innovation accelerate growth. The segment is supported by increased clinical trials, improved access to advanced therapies, and rising awareness of personalized medicine. Strategic collaborations between pharma and biotech firms further strengthen market penetration. Emerging biotech hubs in Asia-Pacific enhance production capacity and affordability of biologic APIs.

- By Chemical Synthesis

On the basis of chemical synthesis, the market is segmented into Acetaminophen, Artemisinin, Saxagliptin, Sodium Chloride, Ibuprofen, Losartan Potassium, Enoxaparin Sodium, Rufinamide, Naproxen, Tamoxifen, and Others. The Acetaminophen segment dominated the largest market revenue share of 44% in 2024, driven by its extensive use in analgesics, antipyretics, and combination drugs. High demand in over-the-counter medications, hospitals, and clinics reinforces dominance. Acetaminophen benefits from established manufacturing processes, low production costs, and wide distribution networks. Its compatibility with both pediatric and adult formulations, as well as integration in combination therapies, ensures consistent market adoption. Steady global demand, strong regulatory approval, and increasing healthcare expenditure in Asia-Pacific support continued dominance. Moreover, manufacturers leverage economies of scale and efficient supply chains to sustain production.

The Artemisinin segment is expected to witness the fastest CAGR of 21.5% from 2025 to 2032, driven by rising demand for antimalarial therapies and growing research in novel derivatives. Government programs promoting malaria treatment and global health initiatives contribute to growth. Expanding contract manufacturing and increasing biopharmaceutical investments in Southeast Asia further accelerate adoption. Artemisinin’s relevance in combination therapies, and ongoing R&D for improved efficacy, supports rapid market penetration. Partnerships with research institutions, increasing access to emerging markets, and technological advancements in production methods also reinforce segment growth.

- By Type of Drug

On the basis of type of drug, the market is segmented into prescription drugs and over-the-counter drugs. The prescription drug segment dominated the largest revenue share of 65% in 2024, driven by the high prevalence of chronic diseases, rising healthcare expenditure, and adoption of specialized therapies in cardiology, oncology, and CNS. Prescription APIs benefit from high regulatory standards, established clinical pipelines, and strong hospital and pharmacy distribution networks. The segment is further strengthened by increased research focus, patent-protected novel therapies, and growing demand for personalized medicine. Integration into healthcare systems, insurance coverage, and specialty clinics ensures continued adoption. Strong R&D investments, availability of high-quality APIs, and advanced formulation expertise maintain dominance.

The over-the-counter drug segment is expected to witness the fastest CAGR of 20.8% from 2025 to 2032, fueled by rising self-medication trends, increasing awareness of minor health management, and government initiatives to improve OTC accessibility. Consumer preference for convenience, cost-effectiveness, and ready availability drives segment growth. Expansion of retail pharmacy networks, online sales channels, and e-commerce platforms further accelerates adoption. Growing demand for analgesics, cold remedies, and vitamins also contributes to fast growth. Manufacturers are innovating in packaging and formulations to enhance consumer appeal.

- By Usage

On the basis of usage, the market is segmented into clinical and research. The clinical segment dominated the largest revenue share of 68% in 2024, driven by the use of APIs in hospitals, specialty clinics, and patient treatment programs across multiple therapeutic areas. Clinical adoption is supported by robust healthcare infrastructure, increasing patient population, and rising prevalence of chronic diseases. APIs in clinical applications ensure high quality, compliance with regulatory standards, and consistent therapeutic outcomes. Collaboration between pharmaceutical companies and hospitals further reinforces dominance. Expansion of healthcare access in Asia-Pacific countries, integration of advanced therapies, and adoption of standardized treatment protocols enhance market penetration.

The research segment is expected to witness the fastest CAGR of 22.2% from 2025 to 2032, fueled by growing R&D investments, clinical trial activity, and government funding for new drug discovery. Academic institutions, contract research organizations, and biotech firms are increasingly relying on APIs for experimental therapeutics. Rising interest in personalized medicine, rare diseases, and novel formulations further supports adoption. Expansion of laboratory infrastructure, availability of high-purity APIs, and collaborative innovation drive segment growth. Strategic partnerships between pharma and research institutions enhance pipeline development.

- By Potency

On the basis of potency, the market is segmented into low-to-moderate potency APIs and potent-to-highly potent APIs. The low-to-moderate potency API segment dominated the largest market revenue share of 61% in 2024, owing to widespread usage across common therapeutics such as analgesics, cardiovascular, and anti-infective drugs. Manufacturing efficiencies, cost-effectiveness, and established supply chains reinforce dominance. Low-to-moderate potency APIs are preferred for high-volume production and broad therapeutic applicability. Regulatory familiarity, scalable production processes, and integration in combination therapies further support adoption. Market growth is enhanced by increased hospital and pharmacy demand and strong regional production hubs.

The potent-to-highly potent API segment is expected to witness the fastest CAGR of 23.5% from 2025 to 2032, driven by growth in oncology, CNS, and specialty therapeutics requiring low-dose, high-efficacy drugs. Strict manufacturing standards, dedicated facilities, and increasing contract manufacturing partnerships contribute to segment growth. Rising focus on rare disease treatment, biologics, and precision medicine supports high-potency API adoption. Expansion of specialized manufacturing infrastructure, advanced containment technologies, and growing regulatory approvals accelerate segment penetration. Strong market interest in novel targeted therapies and clinical pipeline development further reinforces growth.

- By Therapeutic Application

On the basis of therapeutic application, the market is segmented into cardiology, CNS & neurology, oncology, orthopedic, endocrinology, pulmonology, gastroenterology, nephrology, ophthalmology, and other therapeutic applications. The oncology segment dominated the largest market revenue share of 32% in 2024, driven by increasing cancer prevalence, advanced targeted therapies, and high adoption of biologics. Oncology APIs benefit from strong R&D pipelines, government support, and collaboration with specialty hospitals and research institutes. Regulatory approvals for novel treatments, high patient demand, and multi-drug regimens further reinforce dominance. Increasing investment in cancer therapeutics, robust clinical trial activity, and integration of precision medicine enhance adoption across Asia-Pacific.

The CNS & neurology segment is expected to witness the fastest CAGR of 22% from 2025 to 2032, fueled by rising prevalence of neurological disorders, increasing demand for innovative therapies, and growing government support for rare disease treatment. Expansion of research centers, clinical trials, and hospital adoption of CNS APIs accelerates segment growth. Development of novel small and large molecule therapeutics, rising awareness of mental health, and integration of digital health technologies further support adoption. Partnerships between pharmaceutical companies and neurology-focused research institutes reinforce market expansion.

Asia-Pacific Active Pharmaceutical Ingredients (API) Market Regional Analysis

- The Asia-pacific active pharmaceutical ingredients (API) market is poised to grow at the fastest CAGR during the forecast period of 2025 to 2032

- Driven by increasing urbanization, rising disposable incomes, and technological advancements in countries such as China, Japan, and India

- The region’s growing pharmaceutical manufacturing base, supportive government initiatives, and focus on affordable generics are creating a favorable environment for market expansion

China Active Pharmaceutical Ingredients (API) Market Insight

China pharmaceutical ingredients (API) market dominated the Active Pharmaceutical Ingredients (API) market with the largest revenue share of 41.6% in 2024, supported by a well-established pharmaceutical manufacturing base, strong R&D infrastructure, and the presence of major market players. The country’s expanding middle class, rapid urbanization, and technological adoption further drive the API market. In addition, strong domestic manufacturing capabilities, government incentives for pharmaceutical production, and increasing demand for generics are key factors sustaining China’s market dominance.

India Active Pharmaceutical Ingredients (API) Market Insight

India pharmaceutical ingredients (API) market is expected to be the fastest-growing region in the Active Pharmaceutical Ingredients (API) market during the forecast period, attributed to expanding manufacturing capabilities, favorable government initiatives, and increasing demand for affordable generics. Rising foreign investments, strong export potential, and growing contract manufacturing opportunities also support India’s growth trajectory. The country’s emphasis on cost-effective production and scalable API manufacturing is attracting global pharmaceutical companies to source from India.

Asia-Pacific Active Pharmaceutical Ingredients (API) Market Share

The Active Pharmaceutical Ingredients (API) industry is primarily led by well-established companies, including:

- Cipla (India)

- Dr. Reddy’s Laboratories (India)

- Sun Pharmaceutical Industries (India)

- Aurobindo Pharma (India)

- Hanwha Chemical (South Korea)

- Toyama Chemical (Japan)

- Daiichi Sankyo (Japan)

- Hetero Labs (India)

- Lupin Limited (India)

Latest Developments in Asia-Pacific Active Pharmaceutical Ingredients (API) Market

- In May 2025, Xellia Pharmaceuticals, Europe's last manufacturer of key antibiotic ingredients, announced the closure of its largest domestic factory in Copenhagen, resulting in the loss of 500 jobs. The company cited unsustainable competition and plans to relocate some production to China. This move underscores the challenges faced by European pharmaceutical manufacturers in maintaining competitiveness against Asian counterparts

- In October 2025, the U.S. Food and Drug Administration (FDA) launched a pilot program aimed at expediting the review process for generic drugs manufactured and tested entirely within the United States. This initiative seeks to bolster domestic drug production and reduce reliance on foreign sources for active pharmaceutical ingredients

- In September 2025, Symbiotec Pharmalab, a global leader in the production of corticosteroid and hormone active pharmaceutical ingredients, announced plans to launch an initial public offering (IPO) within the next 12 months. The company aims for a valuation of approximately USD1 billion to strengthen its position in the specialty pharmaceutical market

- In June 2025, prices of active pharmaceutical ingredients (APIs) in India fell sharply, easing pressure on the country's pharmaceutical industry. The decline in API costs is expected to reduce production expenses for drugmakers, enhance profitability, and stabilize the supply chain within the sector

- In October 2025, Dr. Reddy's Laboratories reported that the U.S. Food and Drug Administration (FDA) issued a Form 483 with two observations after inspecting its API manufacturing facility in Middleburgh, New York. The company plans to address these observations in consultation with the FDA to ensure compliance with regulatory standards

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.