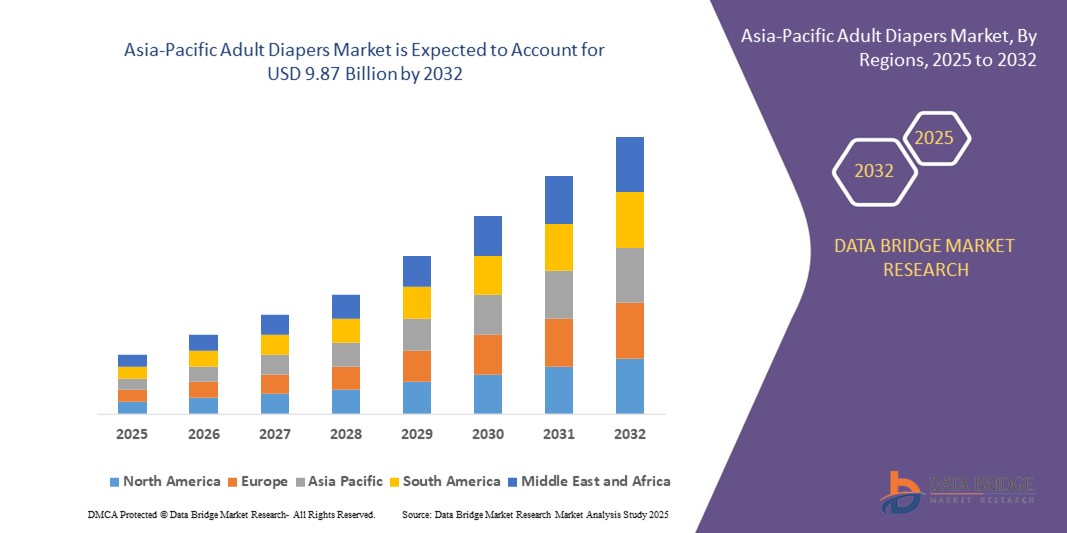

Asia Pacific Adult Diapers Market

Market Size in USD Billion

CAGR :

%

USD

6.63 Billion

USD

9.87 Billion

2024

2032

USD

6.63 Billion

USD

9.87 Billion

2024

2032

| 2025 –2032 | |

| USD 6.63 Billion | |

| USD 9.87 Billion | |

|

|

|

|

Asia-Pacific Adult Diapers Market Size

- The Asia-Pacific adult diapers market size was valued at USD 6.63 billion in 2024 and is expected to reach USD 9.87 billion by 2032, at a CAGR of 5.10% during the forecast period

- The market growth is largely fuelled by the increasing aging population, rising cases of incontinence, and growing awareness regarding personal hygiene among the elderly across countries such as Japan, China, and India

- Technological advancements in diaper materials, comfort, and absorption efficiency, coupled with the expansion of online retail platforms, are further accelerating the adoption of adult diapers among both institutional and home care users

Asia-Pacific Adult Diapers Market Analysis

- The demand for adult diapers is steadily increasing due to social destigmatization and a greater willingness among consumers to prioritize dignity and comfort in managing age-related health conditions

- The market is witnessing innovation-driven competition, with manufacturers introducing gender-specific, eco-friendly, and discreet designs to meet consumer preferences and gain a competitive edge across urban and semi-urban markets in the region

- China adult diapers market dominated in the Asia-Pacific region in 2024, driven by the country’s rapidly aging population and increasing focus on hygiene and elder care

- Japan is expected to witness the highest compound annual growth rate (CAGR) in the Asia-Pacific adult diapers market due to its advanced healthcare systems, high life expectancy, and early adoption of premium, technology-integrated hygiene products. The growing emphasis on elderly care and the strong cultural acceptance of adult diaper use are also contributing significantly to the country’s fast-paced market expansion

- The pad type diapers segment held the largest market revenue share in 2024, supported by its flexibility and comfort for users requiring light to moderate protection. These are commonly used in both institutional and home care settings due to their affordability and ease of disposal. Their discreet design and compatibility with regular underwear make them a preferred choice among mobile elderly users

Report Scope and Asia-Pacific Adult Diapers Market Segmentation

|

Attributes |

Asia-Pacific Adult Diapers Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

Asia-Pacific

|

|

Key Market Players |

• Unicharm Corporation (Japan) • Vinda International Holdings Limited (China) |

|

Market Opportunities |

• Expansion of Home Healthcare Services Across Emerging Markets |

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Asia-Pacific Adult Diapers Market Trends

Rising Focus on Discreet and Comfortable Diaper Designs

- The adult diapers market in Asia-Pacific is witnessing a notable shift toward products that combine functionality with discretion. Manufacturers are introducing ultra-thin, cloth-like materials and odor-locking technologies to address users’ need for comfort and confidence, especially among active elderly populations in urban regions

- Product innovation is increasingly centered on gender-specific designs and anatomical fit, which enhances comfort and absorption efficiency. Brands are targeting elderly users, post-surgery patients, and women with incontinence by offering discreet, underwear-style diapers that resemble regular garments

- The demand for high-absorbency products that support overnight use is growing, particularly in markets such as Japan, South Korea, and Australia. Elderly users and caregivers are prioritizing these features to reduce night-time changes and improve sleep quality, boosting repeat purchases of premium product lines

- For instance, in 2024, a leading Japanese brand introduced a new adult diaper range with “triple lock” anti-leakage layers and aloe vera-infused liners for skin health, gaining significant traction among users with sensitive skin and mobility concerns

- The continued rise of geriatric populations, coupled with increased consumer willingness to try discreet wellness products, is expected to accelerate the market's evolution. Brands investing in breathable, slimline, and highly absorbent products will likely hold a competitive edge across emerging economies

Asia-Pacific Adult Diapers Market Dynamics

Driver

Rapid Aging Population and Increasing Awareness of Incontinence Management

• The Asia-Pacific region is experiencing a demographic shift, with countries such as Japan, South Korea, China, and Thailand seeing significant growth in the elderly population. This aging demographic drives consistent demand for adult diapers, as age-related incontinence becomes more common. Governments and public health initiatives are also increasingly addressing elderly care, boosting product awareness

• Awareness campaigns and social destigmatization of incontinence are encouraging more users to seek out appropriate hygiene solutions. Adult diapers are no longer confined to hospital use but are increasingly integrated into daily life, particularly in markets where elderly citizens remain active and socially engaged

• The growth of private eldercare facilities and home care services is amplifying the demand for adult hygiene products. Many healthcare providers now view adult diapers as essential to quality care, supporting their widespread adoption even in mid-income consumer segments

• For instance, the Chinese government’s “Healthy China 2030” plan emphasizes senior health and long-term care, indirectly stimulating adult diaper demand by expanding institutional and community support systems for incontinence management

• While demand is rising, market players must address affordability, comfort, and supply chain reliability to effectively serve this growing population segment and maintain consumer loyalty across diverse markets

Restraint/Challenge

Environmental Impact and Cultural Stigma Around Usage

• One of the major restraints facing the Asia-Pacific adult diapers market is the growing concern around waste generation and environmental impact. Traditional disposable diapers contribute significantly to non-biodegradable waste, which poses challenges in densely populated regions struggling with waste management infrastructure

• In many conservative societies within Asia-Pacific, adult diaper usage still carries social stigma, particularly among men. This cultural sensitivity limits open discussions around incontinence and often delays adoption, especially in smaller towns and rural areas

• The limited availability of affordable and sustainable alternatives in price-sensitive markets further complicates the landscape. Biodegradable diaper options remain niche, often priced higher and lacking mass-market penetration due to manufacturing and material cost constraints

• For instance, studies in Southeast Asia have revealed that less than 15% of adult incontinence product users opt for eco-friendly variants due to price barriers and limited retail presence, despite rising environmental awareness

• Overcoming cultural stigma through education campaigns and increasing the accessibility of green products are critical next steps. Companies that prioritize biodegradable innovation, partner with local health services, and invest in inclusive marketing will be better positioned to address these barriers and unlock new market opportunities.

Asia-Pacific Adult Diapers Market Scope

The Asia-Pacific adult diapers market is segmented on the basis of product, distribution channel, material type, and end-use.

- By Product

On the basis of product, the market is segmented into pad type diapers, pant type diapers, contour cloth adult diapers, swim diapers, and tape type. The pad type diapers segment held the largest market revenue share in 2024, supported by its flexibility and comfort for users requiring light to moderate protection. These are commonly used in both institutional and home care settings due to their affordability and ease of disposal. Their discreet design and compatibility with regular underwear make them a preferred choice among mobile elderly users.

The pant type diapers segment is expected to witness the fastest growth from 2025 to 2032, driven by increasing demand from active elderly populations and individuals with incontinence who seek mobility and independence. The ease of wearing and removing pant-type diapers enhances user convenience, particularly in outpatient and at-home care scenarios. Their elastic waistbands and cloth-like texture appeal to users looking for regular underwear-like solutions.

- By Distribution Channel

On the basis of distribution channel, the market is segmented into offline and online. The offline segment held the highest revenue share in 2024, owing to widespread consumer reliance on pharmacies, supermarkets, and medical supply stores for healthcare products. In-store purchases allow users, especially the elderly, to receive product recommendations and compare brands in person. Brick-and-mortar stores also enable instant product availability without delivery wait times.

The online segment is expected to witness the fastest growth from 2025 to 2032, driven by rising internet penetration and the increasing comfort of consumers with e-commerce platforms. Online retail channels provide access to a broader variety of brands and bulk buying options, often at discounted prices. The convenience of discreet home delivery also supports rising adoption among urban and tech-savvy users.

- By Material Type

On the basis of material type, the market is segmented into cotton, non-woven fabric, micro fabric, fluff pulp, and others. In 2024, the non-woven fabric segment accounted for the largest share due to its breathable, soft, and absorbent properties, which enhance comfort for long-term wear. Non-woven materials are also lightweight and cost-effective, making them suitable for high-volume manufacturing.

The micro fabric segment is expected to witness the fastest growth from 2025 to 2032 due to its high absorption capacity and softness, particularly valued in premium adult diaper products. Micro fabric-based diapers offer enhanced skin protection and minimize irritation, which is essential for sensitive or aging skin. Their long-wear suitability supports demand in hospital and overnight use cases.

- By End-Use

On the basis of end-use, the market is segmented into hospitals, nursing homes, household, and others. The hospital segment dominated the market in 2024 due to the consistent need for incontinence care products among post-operative and bedridden patients. Hospitals prioritize high-absorbency and leak-proof diapers to ensure hygiene and patient comfort during extended stays.

The household segment is expected to witness the fastest growth from 2025 to 2032, driven by the increasing number of elderly individuals receiving care at home. Families and caregivers are adopting adult diapers to manage incontinence more conveniently and maintain dignity for aging relatives. Rising awareness of adult hygiene and easy access to quality products through online and offline channels is further boosting household adoption.

Asia-Pacific Adult Diapers Market Regional Analysis

- China adult diapers market dominated in the Asia-Pacific region in 2024, driven by the country’s rapidly aging population and increasing focus on hygiene and elder care

- The growing awareness regarding adult incontinence and the rising healthcare standards are pushing both consumers and care facilities to adopt reliable diaper solutions

- In addition, urbanization and the shift toward nuclear family structures are increasing demand for convenient and comfortable adult hygiene products

- Domestic manufacturers are expanding product lines with breathable, discreet, and skin-friendly options, further stimulating market growth across urban and semi-urban regions

Japan Adult Diapers Market Insight

The Japan adult diapers market is expected to witness the fastest growth from 2025 to 2032, supported by the country’s demographic trends, particularly its large elderly population. The market benefits from innovations such as ultra-thin, highly absorbent materials and odor-control technologies, which cater to the needs of active seniors. Moreover, a strong cultural acceptance of adult diapers and advanced caregiving infrastructure encourage widespread usage in both home and institutional care settings. Japanese brands also emphasize eco-friendly and biodegradable materials, aligning with the nation’s sustainability goals while ensuring comfort and reliability for users.

Asia-Pacific Adult Diapers Market Share

The Asia-Pacific Adult Diapers industry is primarily led by well-established companies, including:

• Unicharm Corporation (Japan)

• Kao Corporation (Japan)

• Daio Paper Corporation (Japan)

• Hengan International Group Company Limited (China)

• Zuiko Corporation (Japan)

• Vinda International Holdings Limited (China)

• Wipro Enterprises Private Limited (India)

• LG Household & Health Care Ltd. (South Korea)

• Ontex Group Asia (Malaysia)

• Friends Adult Diapers by Nobel Hygiene (India)

Latest Developments in Asia-Pacific Adult Diapers Market

- In May 2023, Nobel Hygiene Pvt Ltd. launched a new product development by introducing Friends UltraThinz, a slim disposable underpant designed for younger users experiencing light incontinence due to obesity, prostate issues, and postpartum conditions. The product also supports those facing heavy blood flow caused by menopause or endometriosis. This launch caters to an underserved demographic, offering discreet protection, enhancing user comfort and convenience, and expanding the adult diaper market segment

- In 2022, Henkel Adhesive Technologies collaborated with Smartz AG in a strategic partnership to develop smart adult diapers equipped with sensors to signal optimal changing times. After a successful pilot in an Italian nursing home, the innovation was positioned to assist caregivers in improving care quality. This advancement brings a tech-driven solution to adult care, promoting hygiene, efficiency, and comfort, thereby creating a positive impact in healthcare and eldercare environments

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.