Asia Pacific Aesthetic And Cosmetic Surgery Devices Market

Market Size in USD Billion

CAGR :

%

USD

606.97 Billion

USD

1,157.18 Billion

2025

2033

USD

606.97 Billion

USD

1,157.18 Billion

2025

2033

| 2026 –2033 | |

| USD 606.97 Billion | |

| USD 1,157.18 Billion | |

|

|

|

|

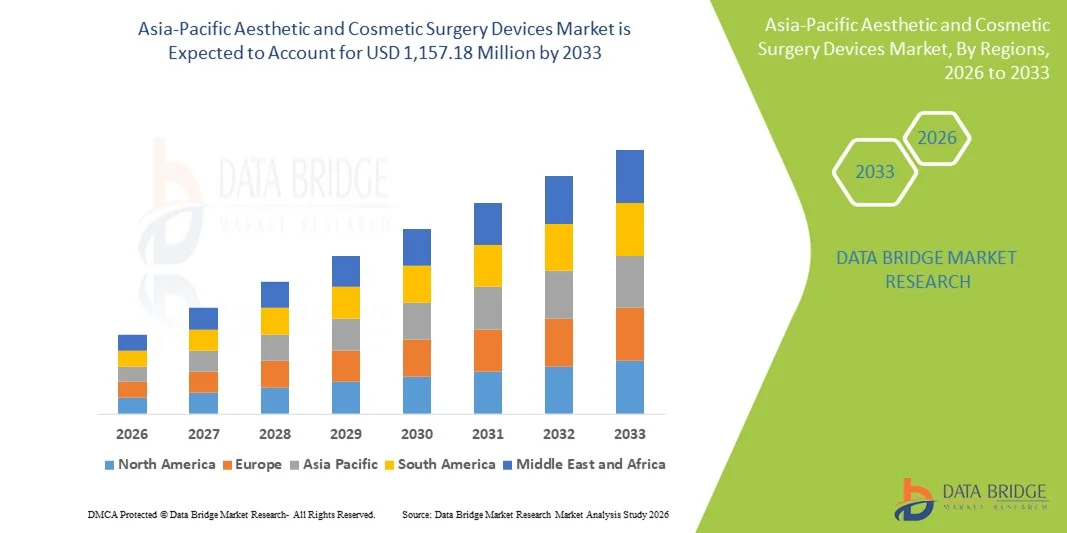

Asia-Pacific Aesthetic and Cosmetic Surgery Devices Market Size

- The Asia-Pacific aesthetic and cosmetic surgery devices market size was valued at USD 606.97 million in 2025 and is expected to reach USD 1,157.18 million by 2033, at a CAGR of 8.4% during the forecast period

- The market growth is largely driven by rising disposable incomes, increasing awareness of cosmetic procedures, and advancements in minimally invasive and non-invasive technologies across the region

- Furthermore, the growing demand for anti-aging treatments, body contouring, and skin rejuvenation procedures is positioning aesthetic devices as essential tools in both medical and cosmetic practices. These factors are collectively propelling the adoption of innovative cosmetic surgery devices, thereby significantly enhancing market growth in Asia-Pacific

Asia-Pacific Aesthetic and Cosmetic Surgery Devices Market Analysis

- Aesthetic and cosmetic surgery devices, including breast implants, body implants, and custom-made implants, are increasingly vital components of medical and cosmetic practices in countries such as China, India, and South Korea due to their ability to enhance patient outcomes, provide tailored solutions, and support both reconstructive and cosmetic procedures

- The escalating demand for these devices is primarily fueled by growing awareness of cosmetic procedures, rising disposable incomes, and a cultural shift toward body image enhancement and preventive aesthetic care

- China dominated the Asia-Pacific market with the largest revenue share of 38.5% in 2025, characterized by a strong healthcare infrastructure, high patient acceptance of cosmetic procedures, and the presence of key medical device manufacturers, with urban centers such as Beijing and Shanghai witnessing substantial growth in device adoption across clinics and hospitals

- India is expected to be the fastest-growing markets in the region during the forecast period, driven by increasing medical tourism, technological advancements in implants, and expanding availability of specialized cosmetic clinics

- Breast Implant/Mammary Implants segment dominated the market in 2025 with a market share of 42.3%, driven by its established use in both cosmetic and reconstructive surgeries, growing patient preference for safe and durable implants, and the increasing number of trained surgeons performing these procedures

Report Scope and Asia-Pacific Aesthetic and Cosmetic Surgery Devices Market Segmentation

|

Attributes |

Asia-Pacific Aesthetic and Cosmetic Surgery Devices Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

Asia-Pacific

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework |

Asia-Pacific Aesthetic and Cosmetic Surgery Devices Market Trends

Rising Adoption of Minimally Invasive and Customizable Implants

- A significant and accelerating trend in the Asia-Pacific aesthetic and cosmetic surgery devices market is the growing preference for minimally invasive procedures and customizable implants, enhancing patient comfort and recovery times

- For instance, advanced breast and body implants now allow surgeons to tailor size, shape, and material properties to individual patient anatomy, improving both cosmetic and reconstructive outcomes

- Innovations such as 3D-printed custom implants and improved polymer or biomaterial-based devices are enabling highly precise procedures, reducing complications and recovery periods

- The integration of digital imaging and pre-surgical planning software with implant selection allows surgeons to simulate results and optimize outcomes, improving patient satisfaction and confidence

- Growing collaboration between device manufacturers and leading hospitals is enabling knowledge transfer and faster adoption of next-generation aesthetic technologies across the region

- Increasing use of AI and digital analytics in patient consultation and post-surgery monitoring is helping clinics provide personalized care and enhance procedural success rates

- This trend towards personalized, minimally invasive devices is reshaping patient expectations, encouraging clinics and hospitals to invest in advanced equipment and training to stay competitive

- The demand for advanced, patient-specific, and minimally invasive cosmetic surgery devices is growing rapidly across both metropolitan and emerging healthcare markets in Asia-Pacific, as consumers increasingly prioritize safety, effectiveness, and aesthetic outcomes

Asia-Pacific Aesthetic and Cosmetic Surgery Devices Market Dynamics

Driver

Increasing Awareness, Disposable Incomes, and Medical Tourism

- The rising awareness of cosmetic procedures, coupled with increasing disposable incomes and expanding medical tourism, is a significant driver of heightened demand for aesthetic and cosmetic surgery devices

- For instance, in 2025, South Korea continued to attract international patients seeking advanced cosmetic procedures, boosting demand for specialized implants and surgery devices

- As consumers become more informed about options such as breast, body, and custom implants, they are willing to invest in advanced procedures, encouraging clinics and hospitals to adopt state-of-the-art devices

- Furthermore, the expansion of urban healthcare infrastructure and rising numbers of specialized cosmetic clinics in China, India, and South Korea are facilitating greater access to these technologies

- Growing interest in minimally invasive procedures, combined with improved safety and efficacy of devices, is positioning aesthetic surgery equipment as essential for clinics seeking to attract high-value patients

- Rising investments by global medical device manufacturers in Asia-Pacific are accelerating product launches, clinical training programs, and regional distribution networks, driving market growth

- Increased social media influence and celebrity endorsements in the region are also motivating consumers to seek cosmetic procedures, indirectly boosting demand for advanced aesthetic devices

Restraint/Challenge

Regulatory Compliance and High Device Costs

- Stringent regulatory requirements and approval processes for medical implants and devices pose a significant challenge to market expansion across Asia-Pacific, potentially delaying product launches

- For instance, compliance with varying medical device regulations in India, China, and South Korea can require lengthy clinical trials, certifications, and adherence to strict quality standards

- In addition, the high cost of advanced implants and surgery devices can limit adoption among budget-conscious patients or smaller clinics that cannot afford premium equipment

- Addressing these challenges through streamlined regulatory approvals, local manufacturing partnerships, and gradual cost reductions is critical for broader adoption

- While prices are gradually decreasing, the perceived premium of high-end or custom implants can still hinder market penetration, particularly in emerging economies where awareness may be growing faster than affordability

- Overcoming these hurdles through regulatory harmonization, patient education, and cost-effective device offerings will be vital for sustained market growth across Asia-Pacific

- Supply chain constraints, such as delays in raw materials such as polymers and metals for implants, can disrupt production and slow market expansion

- Limited trained surgeons in certain countries or regions may also restrict the adoption of advanced procedures, creating a gap between demand and available services.

Asia-Pacific Aesthetic and Cosmetic Surgery Devices Market Scope

The market is segmented on the basis of type, raw material, end user, and distribution channel.

- By Type

On the basis of type, the Asia-Pacific aesthetic and cosmetic surgery devices market is segmented into breast implant/mammary implants, implants for the body, and custom-made implants. The breast implant/mammary implant segment dominated the market with the largest revenue share of 42.3% in 2025, driven by its widespread adoption in both cosmetic augmentation and reconstructive surgeries. Growing awareness of breast reconstruction post-mastectomy and rising demand for aesthetic enhancements are key factors supporting its dominance. Clinics and hospitals prefer these implants due to standardized sizes, ease of availability, and proven safety profiles. Advanced silicone and cohesive gel implants further increase patient confidence and procedure success rates. Leading manufacturers in China, India, and South Korea focus heavily on breast implants, which supports both domestic demand and medical tourism. The segment’s integration with minimally invasive procedures also enhances patient recovery, further boosting adoption.

The custom-made implant segment is expected to witness the fastest growth rate of 13.5% from 2026 to 2033, fueled by increasing demand for personalized and complex reconstructive procedures. Custom implants, often produced using 3D printing technology, allow surgeons to match patient-specific anatomy for optimal outcomes in both cosmetic and corrective surgeries. Rising awareness among affluent patients seeking tailored aesthetic solutions is driving this growth. Hospitals and specialized cosmetic clinics are investing in these advanced implants to differentiate services and attract high-value patients. In addition, the trend of combining imaging software with pre-surgical planning enhances procedural accuracy, accelerating the adoption of custom implants. Medical tourism in South Korea and India also boosts the demand for custom-made implants, as international patients seek advanced, patient-specific solutions.

- By Raw Material

On the basis of raw material, the market is segmented into polymers, metals, and biomaterials. The polymers segment dominated the market with a revenue share of 45.2% in 2025, driven by the high biocompatibility, flexibility, and safety of polymer-based implants such as silicone, polyurethane, and polyethylene. Polymers are widely used in breast and body implants due to their ability to mimic natural tissue texture, reducing patient complications. Their cost-effectiveness and regulatory approval across Asia-Pacific countries make them the preferred choice for clinics and hospitals. Polymers are also compatible with minimally invasive procedures, further supporting their dominance. Leading manufacturers continuously innovate polymer-based products to enhance durability and patient satisfaction. The material’s lightweight nature and lower risk of allergic reactions also boost surgeon and patient confidence.

The biomaterials segment is expected to witness the fastest CAGR of 12.8% from 2026 to 2033, propelled by growing interest in implants made from advanced bioactive and regenerative materials. Biomaterials, including bioresorbable scaffolds and tissue-engineered constructs, support faster healing and integration with the patient’s own tissue. Increasing research collaborations between hospitals and manufacturers are driving adoption of biomaterials in complex reconstructive surgeries. Rising awareness about long-term safety and effectiveness of biomaterial implants among patients further boosts demand. Customization options using biomaterials are increasingly popular in South Korea and India, especially in high-end cosmetic procedures. Regulatory approvals and improved manufacturing processes are making biomaterials more accessible, contributing to rapid growth.

- By End User

On the basis of end user, the market is segmented into clinics, hospitals, dermatology clinics, and others. The clinics segment dominated the market with the largest revenue share of 48.1% in 2025, driven by the proliferation of specialized cosmetic and aesthetic clinics offering targeted procedures. Clinics provide high patient throughput, shorter procedure times, and personalized care, which makes them ideal for breast, body, and custom implant surgeries. Rising disposable incomes and urbanization in China, India, and South Korea support the growth of clinic-based services. Clinics also often adopt the latest devices faster than hospitals, enhancing their competitive advantage. Cosmetic clinics increasingly invest in advanced implants to meet growing patient demand for minimally invasive procedures. The focus on patient experience and post-operative care also strengthens the clinics’ market position.

The hospitals segment is expected to witness the fastest CAGR of 11.9% from 2026 to 2033, fueled by the rising number of reconstructive surgeries, complex procedures, and medical tourism-driven demand. Hospitals offer comprehensive infrastructure, surgical expertise, and advanced post-operative care required for high-risk or multi-stage implant procedures. Increasing collaborations between hospitals and global device manufacturers enhance access to innovative implants. Government initiatives and healthcare investments in countries such as India and China further support hospital adoption of these devices. Hospitals are also a preferred choice for patients seeking combined aesthetic and medical procedures, contributing to rapid growth.

- By Distribution Channel

On the basis of distribution channel, the market is segmented into direct tender and retail pharmacies. The direct tender segment dominated the market with a revenue share of 52.4% in 2025, driven by bulk procurement by hospitals and large clinic chains for implants and surgery devices. Direct tender agreements ensure better pricing, consistent supply, and regulatory compliance for healthcare providers. Leading manufacturers in Asia-Pacific often prioritize direct sales channels to establish long-term contracts with hospitals and specialty clinics. The segment’s dominance is also supported by medical tourism and multi-procedure centers requiring reliable supply chains. Manufacturers provide training and technical support under direct tender contracts, further strengthening the channel. This ensures the proper use of implants, reducing complications and enhancing market confidence.

The retail pharmacy segment is expected to witness the fastest CAGR of 10.7% from 2026 to 2033, fueled by increasing demand for minimally invasive and patient-administered aesthetic devices, as well as postoperative care products. Retail channels are becoming popular for clinics and smaller practices due to convenience and flexibility in procurement. Growing awareness among patients about device safety and availability at local pharmacies contributes to segment growth. Expanding distribution networks in urban and semi-urban areas of India, China, and South Korea are further supporting this channel. Retail pharmacies also provide opportunities for manufacturers to promote smaller-scale devices and consumables directly to clinics and end users.

Asia-Pacific Aesthetic and Cosmetic Surgery Devices Market Regional Analysis

- China dominated the Asia-Pacific market with the largest revenue share of 38.5% in 2025, characterized by a strong healthcare infrastructure, high patient acceptance of cosmetic procedures, and the presence of key medical device manufacturers, with urban centers such as Beijing and Shanghai witnessing substantial growth in device adoption across clinics and hospitals

- Patients and clinics in the region highly value advanced implants, minimally invasive procedures, and customizable options, which enhance procedural outcomes and reduce recovery time

- This widespread adoption is further supported by growing disposable incomes, urbanization, and a surge in medical tourism, particularly in metropolitan cities such as Beijing, Shanghai, and Guangzhou, establishing China as a leading market for aesthetic and cosmetic surgery devices in Asia-Pacific

The China Aesthetic & Cosmetic Surgery Devices Market Insight

The China aesthetic and cosmetic surgery devices market captured the largest revenue share of 38.5% in 2025 within Asia-Pacific, driven by rising awareness of cosmetic procedures, expanding healthcare infrastructure, and increasing demand for both reconstructive and aesthetic surgeries. Patients and clinics highly value advanced implants, minimally invasive procedures, and customizable options that improve outcomes and reduce recovery times. The growing medical tourism industry, particularly in metropolitan cities such as Beijing, Shanghai, and Guangzhou, is further boosting demand. Moreover, government initiatives supporting healthcare modernization and investment in hospital-based aesthetic centers are contributing to market expansion. The presence of leading domestic and international manufacturers ensures accessibility of advanced implants, supporting sustained growth.

India Aesthetic & Cosmetic Surgery Devices Market Insight

The India aesthetic and cosmetic surgery devices market accounted for the largest growth potential in Asia-Pacific in 2025, driven by the expanding middle class, rapid urbanization, and increasing acceptance of cosmetic procedures. India is emerging as a hub for medical tourism, attracting patients seeking high-quality but cost-effective aesthetic surgeries. Clinics and hospitals are increasingly adopting advanced breast, body, and custom implants to meet growing patient demand. Government programs promoting smart cities and healthcare infrastructure are further enabling access to modern surgical devices. In addition, the availability of affordable implants and strong domestic manufacturing are key factors propelling market growth. Rising awareness campaigns and social media influence also encourage patients to seek advanced aesthetic treatments.

Japan Aesthetic & Cosmetic Surgery Devices Market Insight

The Japan aesthetic and cosmetic surgery devices market is gaining momentum due to the country’s high-tech healthcare infrastructure, an aging population, and strong demand for minimally invasive procedures. Patients in Japan increasingly prioritize safety, efficiency, and post-operative recovery, driving adoption of advanced breast, body, and custom implants. Clinics and hospitals focus on integrating digital imaging and pre-surgical planning technologies with implant selection to enhance precision and outcomes. The market benefits from continuous innovations by domestic and international manufacturers, as well as government support for advanced medical technologies. Moreover, rising medical tourism from neighboring countries seeking specialized procedures is fueling further demand. Japan’s focus on patient-specific and high-quality aesthetic outcomes positions it as a key market in the region.

South Korea Aesthetic & Cosmetic Surgery Devices Market Insight

The South Korea aesthetic and cosmetic surgery devices market is expanding rapidly, supported by the country’s reputation as a global hub for cosmetic procedures, particularly breast and facial surgeries. Patients highly value advanced implants, minimally invasive techniques, and personalized solutions, encouraging clinics and hospitals to invest in next-generation devices. Medical tourism continues to be a strong growth driver, attracting international patients seeking high-quality procedures. Integration of digital planning tools and patient-specific implants further enhances procedural success and adoption. In addition, government regulations ensuring device safety and quality, along with strong domestic manufacturing capabilities, support market reliability. South Korea’s innovative aesthetic practices and high patient acceptance make it one of the fastest-growing markets in Asia-Pacific.

Asia-Pacific Aesthetic and Cosmetic Surgery Devices Market Share

The Asia-Pacific Aesthetic and Cosmetic Surgery Devices industry is primarily led by well-established companies, including:

- Merz Aesthetics (Germany)

- GALDERMA (Switzerland)

- AbbVie (U.S.)

- Sientra, Inc. (U.S.)

- GC Aesthetics (Ireland)

- Establishment Labs Holdings Inc. (Costa Rica)

- HansBiomed Co., Ltd. (South Korea)

- Sebbin (France)

- POLYTECH Health & Aesthetics GmbH (Germany)

- Mentor Worldwide LLC (U.S.)

- Lumenis (Israel)

- Alma Lasers (Israel)

- Fotona d.o.o. (Slovenia)

- Sciton, Inc. (U.S.)

- Venus Concept (Canada)

- CLASSYS Inc. (South Korea)

- Lutronic Corporation (South Korea)

- Jeisys Medical (South Korea)

- Won Tech Co., Ltd. (South Korea)

- Hugel, Inc. (South Korea)

What are the Recent Developments in Asia-Pacific Aesthetic and Cosmetic Surgery Devices Market?

- In February 2025, industry data highlighted rising demand for non-surgical aesthetic procedures such as Botox and hyaluronic-acid fillers across Asia-Pacific, reflecting millions of procedures performed and accelerated consumer adoption of injectables and energy-based treatments as core components of minimally invasive cosmetic care

- In October 2024, Galderma hosted the Galderma Aesthetic Injector Network (GAIN) JPAC event in Asia-Pacific, bringing together over 650 healthcare professionals to explore evolving trends in aesthetic medicine. The two-day forum highlighted regional growth, future technologies, and key product rollouts including Restylane® VOLYME in China and other product approvals, demonstrating industry commitment to clinician education and market expansion across APAC

- In October 2024, Galderma hosted the Galderma Aesthetic Injector Network (GAIN) event across Asia-Pacific, convening over 650 healthcare professionals from 14 countries to share clinical insights, highlight future aesthetic trends, and spotlight innovative product developments in injectables and treatment techniques. This event underlines the region’s rapid clinical uptake of advanced aesthetic modalities and ongoing training emphasis

- In September 2024, Allergan Aesthetics launched BOTOX® Cosmetic for the treatment of masseter muscle prominence (MMP) in China, marking the first neurotoxin approved for this aesthetic indication in the country. The approval by the China National Medical Product Administration offers a minimally invasive option for lower-face contouring, addressing a significant aesthetic concern among Asian patients seeking slimmer jawline appearances. This launch reflects rising demand for tailored injectable solutions in Asia-Pacific’s cosmetic surgery landscape

- In September 2024, GC Aesthetics (GCA) launched its YOUTHLY brand, including new premium breast implant collections, in China, aiming to meet rising demand for advanced breast aesthetic solutions among Chinese patients and surgeons. The launch strengthens GCA’s presence in one of the region’s largest aesthetic markets and supports broader adoption of high-quality implant technologies across Asia-Pacific

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.