Asia-Pacific Atomic Layer Deposition Market Analysis and Insights

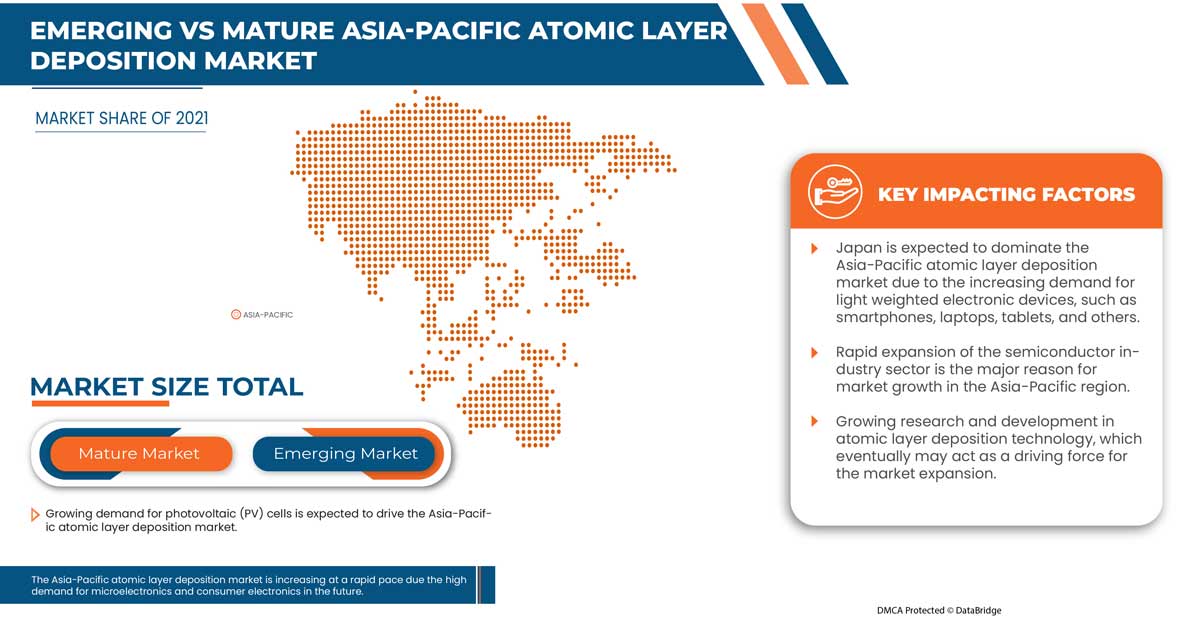

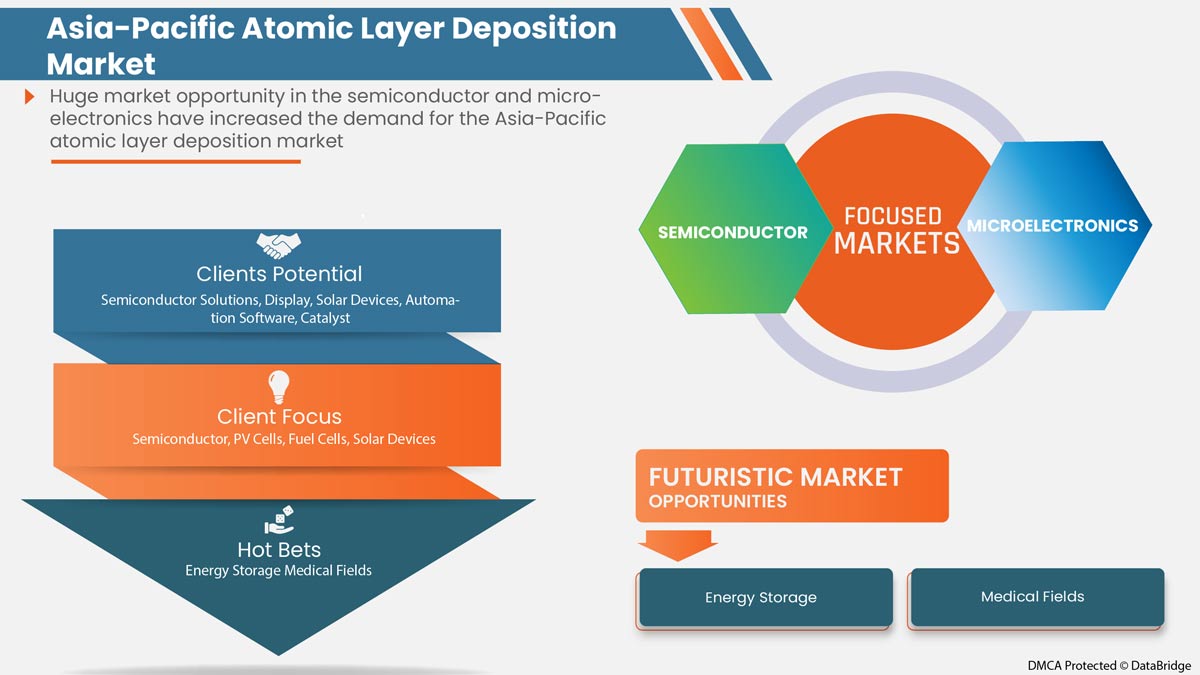

The Asia-Pacific atomic layer deposition market is expected to drive due to an increase in demand for semiconductor industries. As semiconductor is the main component or application of ALD, the increase in demand for semiconductor help increases the demand for ALD. Some other factors expected to drive the market growth are raising concerns about energy harvesting results in the high growth of photovoltaic (PV) cells.

The primary factor anticipated to limit the market is the high initial investment cost in producing ALD, which has affected the market growth.

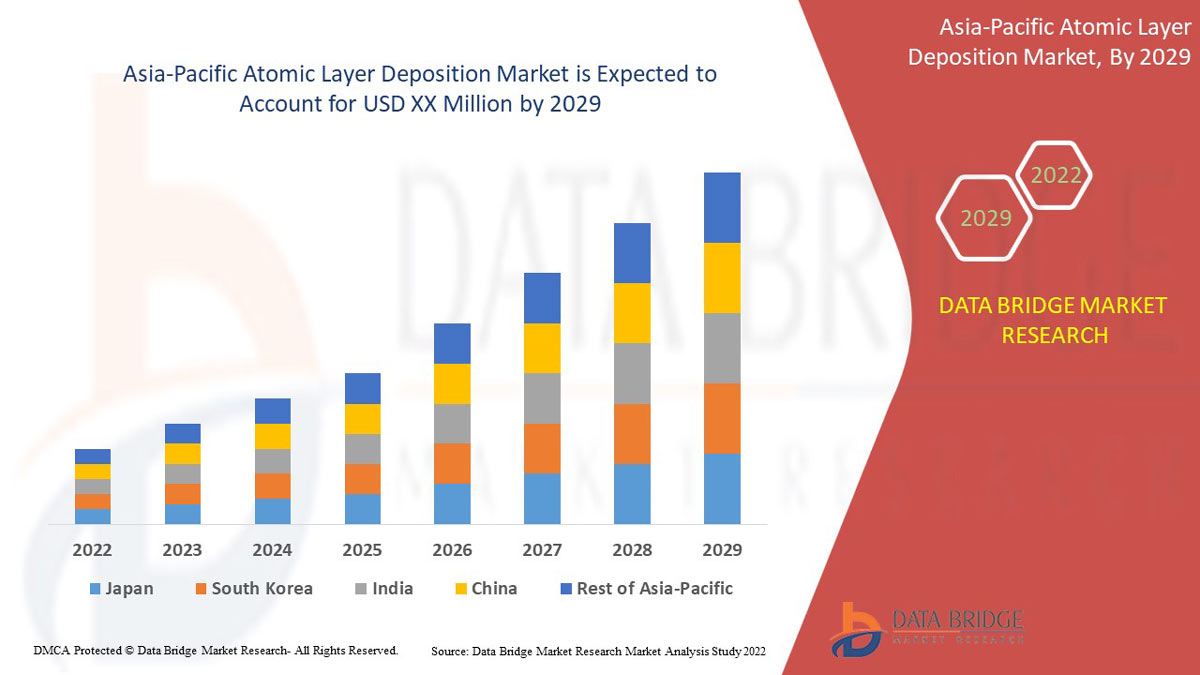

Data Bridge Market Research analyses that the Asia-Pacific atomic layer deposition market will grow at a CAGR of 15.4% during the forecast period of 2022 to 2029.

|

Report Metric |

Details |

|

Forecast Period |

2022 to 2029 |

|

Base Year |

2021 |

|

Historic Years |

2020 (Customizable to 2019 - 2015) |

|

Quantitative Units |

Revenue in USD Million, Pricing in USD |

|

Segments Covered |

By Product Type (Metal ALD, Aluminium Oxide ALD, Plasma Enhanced ALD, Catalytic ALD, Others), Application (Semiconductors, Solar Devices, Electronics, Medical Equipment, Research & Development Facilities, Fuel Cells, Optical Devices, Thermoelectric Materials, Magnetic Heads, Sensors, Barrier Layers, Primer Layers, Non—IC Application, Others). |

|

Countries Covered |

China, India, Japan, South Korea, Australia, Thailand, Malaysia, Indonesia, Singapore, Philippines, and the Rest Of Asia-Pacific. |

|

Market Players Covered |

ADEKA CORPORATION, AIXTRON, Applied Materials, Inc., ASM International, LAM RESEARCH CORPORATION, Tokyo Electron Limited, Kurt J. Lesker Company, ANRIC TECH., SENTECH Instruments GmbH, Oxford Instruments, Forge Nano Inc., Veeco Instruments Inc., Merck KGaA, HZO, Inc., Picosun Oy., among others. |

Market Definition

Atomic layer deposition (ALD) refers to the process of deposition of precursor materials on substrates for improving or modifying properties such as chemical resistance, strength, and conductivity. The process is considered a sub-division of chemical vapor deposition (CVD) in atomic layer deposition. Most of the time, two chemicals are utilized for the reaction, generally called precursors.

Asia-Pacific Atomic Layer Deposition Market Dynamics

This section deals with understanding the market drivers, opportunities, restraints, and challenges. All of this is discussed in detail below:

Drivers:

- RAPID EXPANSION OF THE SEMICONDUCTOR INDUSTRY

Most of the electronic devices used daily are based on semiconductor materials as they have properties such as a rise in temperature resulting in a rise in conductivity. A decline in temperature results decline in the conductivity semiconductor industry is growing rapidly due to its wide range of products such as all integrated circuits, keyboards, mouse, all types of microprocessors and micro-controllers, memory chips, transistors, and others.

- RAISING CONCERN ON ENERGY HARVESTING RESULTS IN HIGH GROWTH OF PHOTOVOLTAIC (PV) CELLS

Photovoltaic (PV) is commonly called an energy harvesting technology, and the technology is used to convert solar energy into electric energy, which is electricity. The demand for photovoltaic cells has been increasing due to the relatively low price and wide range of applications such as solar traffic lights, solar power pumps, solar lamps, solar power calculators, and others.

Restraint

- HIGH INITIAL INVESTMENT COSTS

Atomic layer deposition (ALD) is the deposition of precursor materials on substrates to improve/modify properties such as conductivity, chemical resistance, and strength. To provide ALD services, the provider has to buy equipment for the atomic layer deposition process, such as Cambridge NanoTech Fiji F200 Atomic Layer Deposition System, Open Load ALD System: OpAL, ALD 200L Series from Kurt J. Lesker Company, Cambridge NanoTech Savannah Series Atomic Layer Deposition System, Plasma & Thermal ALD System: FlexAL, Ion Beam Deposition System: IonFab IBD and Cambridge NanoTech Savannah Series Atomic Layer Deposition System.

The price of each piece of equipment is around USD 10000, and the provider must buy all equipment to provide all types of atomic layer deposition services. The equipment cost would be very high to provide all types of atomic layer deposition services. Thus, many buyers will avoid buying due to the high cost compared to regular furniture.

Opportunity

- GROWING RESEARCH AND DEVELOPMENT IN ATOMIC LAYER DEPOSITION TECHNOLOGY

An atomic layer deposition process is a type of vapor phase technique that produces thin films of various materials. Everyone uses micro or nanotechnology to provide smaller, low-weighted devices or products. The atomic layer deposition process is very useful for micro or nanotechnology devices as it can control thickness at the angstrom level, produce a thin and uniform film, and have high efficiency for semiconductor materials. Hence, most atomic layer deposition service providers invest in research & development.

Challenge

- ALTERNATIVES OF ATOMIC LAYER DEPOSITION

The chemical vapor deposition process is widely used to produce high-quality, high-performance thin films. The chemical vapor deposition process is commonly used in the semiconductor industry. On the other hand, physical vapor deposition (PVD) is a method used to produce thin films and coatings with high temperature, high strength, excellent abrasion resistance, and others. Chemical vapor deposition and physical vapor deposition can be used as alternatives to atomic layer deposition due to the below advantages over atomic layer deposition.

- Chemical vapor deposition has a higher deposition rate than atomic layer deposition

- In chemical vapor deposition, deposit material is hard to evaporate

- The physical vapor deposition process can operate in low temperatures as compared to atomic layer deposition

- Physical vapor deposition can control the chemical composition

Recent Developments

- In June 2021, Applied Materials developed an Endura Copper Barrier Seed IMS engineering solution that combines ALD, PVD, CVD, copper reflow, surface treatment, interface engineering, and metrology. These seven technologies are in one system. This helped in the replacement of conformal ALD with selective ALD that helped in the elimination of high resistivity barrier.

- In June 2022, Tokyo Electron Limited launched the new Ulucus L, a Laser Edge Trimming System which is used in edge-trimming operations with laser control technology. This eco solution is productive and suitable for the environment.

Asia-Pacific Atomic Layer Deposition Market Scope

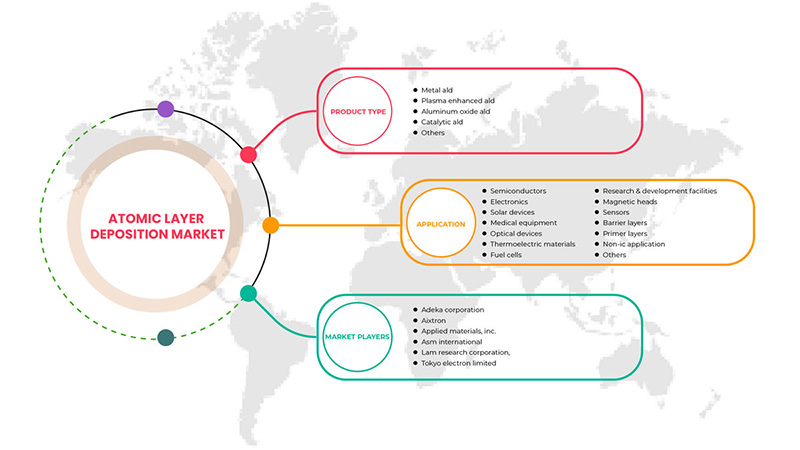

The Asia-Pacific atomic layer deposition market is segmented based on product type, and application. The growth amongst these segments will help you analyze major growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Product Type

- Metal ALD

- Aluminium Oxide ALD

- Plasma Enhanced ALD

- Catalytic ALD

- Others

On the basis of product type, the Asia-Pacific atomic layer deposition market is classified into metal ALD, aluminium oxide ALD, plasma enhanced ALD, catalytic ALD, and others.

Application

- Semiconductors

- Electronics

- Solar Devices

- Medical Equipment

- Optical Devices

- Thermoelectric Materials

- Fuel Cells

- Research & Development Facilities

- Magnetic Heads

- Sensors

- Barrier Layers

- Primer Layers

- Non-IC Application

- Others

On the basis of application, the Asia-Pacific atomic layer deposition market is classified into semiconductors, solar devices, electronics, medical equipment, research & development facilities, fuel cells, optical devices, thermoelectric materials, magnetic heads, sensors, barrier layers, primer layers, non—IC application, and others.

Asia-Pacific Atomic Layer Deposition Market Regional Analysis/Insights

The Asia-Pacific atomic layer deposition market is analyzed, and market size insights and trends are provided based on country, product type, and application, as referenced above.

Some countries covered in the Asia-Pacific atomic layer deposition market are China, India, Japan, South Korea, Australia, Thailand, Malaysia, Indonesia, Singapore, Philippines, Rest of the Asia-Pacific.

Japan is expected to dominate the Asia-Pacific atomic layer deposition market in terms of market share and revenue. It is estimated to maintain its dominance during the forecast period due to the growing demand for the semiconductor industry.

The region section of the report also provides individual market-impacting factors and changes in regulations that impact the market's current and future trends. Data points, such as new and replacement sales, country demographics, disease epidemiology, and import-export tariffs, are some of the major pointers used to forecast the market scenario for individual countries. In addition, the presence and availability of Asia-Pacific brands and their challenges faced due to high competition from local and domestic brands and the impact of sales channels are considered while providing forecast analysis of the country data.

Competitive Landscape and Asia-Pacific Atomic Layer Deposition Market Share Analysis

The competitive Asia-Pacific atomic layer deposition market provides details about the competitors. Details include company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, Asia-Pacific presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, and application dominance. The above data points are only related to the companies' focus on the Asia-Pacific atomic layer deposition market.

Some of the major players operating in the Asia-Pacific atomic layer deposition market are ADEKA CORPORATION, AIXTRON, Applied Materials, Inc., ASM International, LAM RESEARCH CORPORATION, Tokyo Electron Limited, Kurt J. Lesker Company, ANRIC TECH., SENTECH Instruments GmbH, Oxford Instruments, Forge Nano Inc., Veeco Instruments Inc., Merck KGaA, HZO, Inc., Picosun Oy., among others.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The market data is analyzed and estimated using market statistical and coherent models. In addition, market share analysis and key trend analysis are the major success factors in the market report. The key research methodology used by the DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market, and primary (industry expert) validation. Apart from this, data models include Vendor Positioning grids, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Company Market Share Analysis, Standards of Measurement, Asia-Pacific Vs Regional, and Vendor Share Analysis. Please request an analyst call in case of further inquiry.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF ASIA PACIFIC ATOMIC LAYER DEPOSITION MARKET

1.4 LIMITATION

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 PRODUCT TYPE LIFE LINE CURVE

2.7 MULTIVARIATE MODELING

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 MARKET APPLICATION COVERAGE GRID

2.11 DBMR MARKET CHALLENGE MATRIX

2.12 DBMR VENDOR SHARE ANALYSIS

2.13 SECONDARY SOURCES

2.14 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 HIGH DEMAND FOR MICROELECTRONICS AND CONSUMER ELECTRONICS

5.1.2 RAISING CONCERN ON ENERGY HARVESTING RESULTS IN HIGH GROWTH OF PHOTOVOLTAIC (PV) CELLS

5.1.3 RAPID EXPANSION OF THE SEMICONDUCTOR INDUSTRY

5.2 RESTRAINT

5.2.1 HIGH INITIAL INVESTMENT COSTS

5.3 OPPORTUNITIES

5.3.1 TREND OF MINIATURIZATION

5.3.2 GROWING RESEARCH AND DEVELOPMENT IN ATOMIC LAYER DEPOSITION TECHNOLOGY

5.4 CHALLENGE

5.4.1 ALTERNATIVES OF ATOMIC LAYER DEPOSITION

6 ASIA PACIFIC ATOMIC LAYER DEPOSITION MARKET, BY PRODUCT TYPE

6.1 OVERVIEW

6.2 METAL ALD

6.3 ALUMINUM OXIDE ALD

6.4 PLASMA ENHANCED ALD

6.5 CATALYTIC ALD

6.6 OTHERS

7 ASIA PACIFIC ATOMIC LAYER DEPOSITION MARKET, BY APPLICATION

7.1 OVERVIEW

7.2 SEMICONDUCTORS

7.2.1 METAL ALD

7.2.2 ALUMINUM OXIDE ALD

7.2.3 CATALYTIC ALD

7.2.4 PLASMA ENHANCED ALD

7.2.5 OTHERS

7.3 ELECTRONICS

7.3.1 METAL ALD

7.3.2 ALUMINUM OXIDE ALD

7.3.3 CATALYTIC ALD

7.3.4 PLASMA ENHANCED ALD

7.3.5 OTHERS

7.4 SOLAR DEVICES

7.4.1 ALUMINUM OXIDE ALD

7.4.2 PLASMA ENHANCED ALD

7.4.3 METAL ALD

7.4.4 CATALYTIC ALD

7.4.5 OTHERS

7.5 MEDICAL EQUIPMENT

7.5.1 METAL ALD

7.5.2 ALUMINUM OXIDE ALD

7.5.3 CATALYTIC ALD

7.5.4 PLASMA ENHANCED ALD

7.5.5 OTHERS

7.6 OPTICAL DEVICES

7.6.1 METAL ALD

7.6.2 ALUMINUM OXIDE ALD

7.6.3 CATALYTIC ALD

7.6.4 PLASMA ENHANCED ALD

7.6.5 OTHERS

7.7 THERMOELECTRIC MATERIALS

7.7.1 METAL ALD

7.7.2 ALUMINUM OXIDE ALD

7.7.3 CATALYTIC ALD

7.7.4 PLASMA ENHANCED ALD

7.7.5 OTHERS

7.8 MAGNETIC HEADS

7.8.1 METAL ALD

7.8.2 ALUMINUM OXIDE ALD

7.8.3 CATALYTIC ALD

7.8.4 PLASMA ENHANCED ALD

7.8.5 OTHERS

7.9 RESEARCH & DEVELOPMENT FACILITIES

7.9.1 METAL ALD

7.9.2 ALUMINUM OXIDE ALD

7.9.3 CATALYTIC ALD

7.9.4 PLASMA ENHANCED ALD

7.9.5 OTHERS

7.1 FUEL CELLS

7.10.1 METAL ALD

7.10.2 ALUMINUM OXIDE ALD

7.10.3 CATALYTIC ALD

7.10.4 PLASMA ENHANCED ALD

7.10.5 OTHERS

7.11 SENSORS

7.11.1 METAL ALD

7.11.2 ALUMINUM OXIDE ALD

7.11.3 CATALYTIC ALD

7.11.4 PLASMA ENHANCED ALD

7.11.5 OTHERS

7.12 BARRIER LAYERS

7.12.1 METAL ALD

7.12.2 ALUMINUM OXIDE ALD

7.12.3 CATALYTIC ALD

7.12.4 PLASMA ENHANCED ALD

7.12.5 OTHERS

7.13 PRIMER LAYERS

7.13.1 METAL ALD

7.13.2 ALUMINUM ALD

7.13.3 CATALYTIC ALD

7.13.4 PLASMA ENHANCED ALD

7.13.5 OTHERS

7.14 NON-IC APPLICATION

7.14.1 METAL ALD

7.14.2 ALUMINUM ALD

7.14.3 CATALYTIC ALD

7.14.4 PLASMA ENHANCED ALD

7.14.5 OTHERS

7.15 OTHERS

7.15.1 METAL ALD

7.15.2 ALUMINUM ALD

7.15.3 CATALYTIC ALD

7.15.4 PLASMA ENHANCED ALD

7.15.5 OTHERS

8 ASIA PACIFIC ATOMIC LAYER DEPOSITION MARKET, BY REGION

8.1 ASIA-PACIFIC

8.1.1 JAPAN

8.1.2 CHINA

8.1.3 SOUTH KOREA

8.1.4 INDIA

8.1.5 AUSTRALIA

8.1.6 SINGAPORE

8.1.7 THAILAND

8.1.8 MALAYSIA

8.1.9 INDONESIA

8.1.10 PHILIPPINES

8.1.11 REST OF ASIA-PACIFIC

9 COMPANY LANDSCAPE: ASIA PACIFIC ATOMIC LAYER DEPOSITION MARKET

9.1 COMPANY SHARE ANALYSIS: ASIA PACIFIC

9.2 NEW PRODUCT LAUNCH

9.3 MERGERS,AWARDS AND ACQUISITIONS

10 SWOT ANALYSIS

11 COMPANY PROFILE

11.1 LAM RESEARCH CORPORATION.

11.1.1 COMPANY SNAPSHOT

11.1.2 RECENT FINANCIALS

11.1.3 COMPANY SHARE ANALYSIS

11.1.4 PRODUCT PORTFOLIO

11.1.5 RECENT UPDATE

11.2 APPLIED MATERIALS, INC.

11.2.1 COMPANY SNAPSHOT

11.2.2 RECENT FINANCIALS

11.2.3 COMPANY SHARE ANALYSIS

11.2.4 PRODUCT PORTFOLIO

11.2.5 RECENT UPDATES

11.3 TOKYO ELECTRON LIMITED

11.3.1 COMPANY SNAPSHOT

11.3.2 REVENUE ANALYSIS

11.3.3 COMPANY SHARE ANALYSIS

11.3.4 PRODUCT PORTFOLIO

11.3.5 RECENT UPDATES

11.4 ASM INTERNATIONAL

11.4.1 COMPANY SNAPSHOT

11.4.2 RECENT FINANCIALS

11.4.3 COMPANY SHARE ANALYSIS

11.4.4 PRODUCT PORTFOLIO

11.4.5 RECENT UPDATE

11.5 AIXTRON

11.5.1 COMPANY SNAPSHOT

11.5.2 RECENT FINANCIALS

11.5.3 COMPANY SHARE ANALYSIS

11.5.4 PRODUCT PORTFOLIO

11.5.5 RECENT UPDATE

11.6 ADEKA CORPORATION

11.6.1 COMPANY SNAPSHOT

11.6.2 RECENT FINANCIALS

11.6.3 PRODUCT PORTFOLIO

11.6.4 RECENT UPDATE

11.7 ANRIC TECH.

11.7.1 COMPANY SNAPSHOT

11.7.2 PRODUCT PORTFOLIO

11.7.3 RECENT UPDATES

11.8 BENEQ

11.8.1 COMPANY SNAPSHOT

11.8.2 PRODUCT PORTFOLIO

11.8.3 RECENT UPDATES

11.9 ENCAPSULIX

11.9.1 COMPANY SNAPSHOT

11.9.2 PRODUCT PORTFOLIO

11.9.3 RECENT UPDATE

11.1 FORGE NANO INC.

11.10.1 COMPANY SNAPSHOT

11.10.2 PRODUCT PORTFOLIO

11.10.3 RECENT UPDATES

11.11 HZO INC.

11.11.1 COMPANY SNAPSHOT

11.11.2 PRODUCT PORTFOLIO

11.11.3 RECENT UPDATE

11.12 KURT J. LESKER COMPANY

11.12.1 COMPANY SNAPSHOT

11.12.2 PRODUCT PORTFOLIO

11.12.3 RECENT UPDATE

11.13 MERCK KGAA

11.13.1 COMPANY SNAPSHOT

11.13.2 RECENT FINANCIALS

11.13.3 PRODUCT PORTFOLIO

11.13.4 RECENT UPDATES

11.14 OXFORD INSTRUMENTS

11.14.1 COMPANY SNAPSHOT

11.14.2 RECENT FINANCIALS

11.14.3 PRODUCT PORTFOLIO

11.14.4 RECENT UPDATE

11.15 PICOSUN OY.

11.15.1 COMPANY SNAPSHOT

11.15.2 PRODUCT PORTFOLIO

11.15.3 RECENT UPDATES

11.16 SENTECH INSTRUMENTS GMBH

11.16.1 COMPANY SNAPSHOT

11.16.2 PRODUCT PORTFOLIO

11.16.3 RECENT UPDATE

11.17 VEECO INSTRUMENTS INC.

11.17.1 COMPANY SNAPSHOT

11.17.2 RECENT FINANCIALS

11.17.3 PRODUCT PORTFOLIO

11.17.4 RECENT UPDATES

12 QUESTIONNAIRE

13 RELATED REPORT

List of Table

TABLE 1 ASIA PACIFIC ATOMIC LAYER DEPOSITION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 2 ASIA PACIFIC METAL ALD IN ATOMIC LAYER DEPOSITION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 3 ASIA PACIFIC ALUMINUM OXIDE ALD IN ATOMIC LAYER DEPOSITION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 4 ASIA PACIFIC PLASMA ENHANCED ALD IN ATOMIC LAYER DEPOSITION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 5 ASIA PACIFIC CATALYTIC ALD IN ATOMIC LAYER DEPOSITION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 6 ASIA PACIFIC OTHERS IN ATOMIC LAYER DEPOSITION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 7 ASIA PACIFIC ATOMIC LAYER DEPOSITION MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 8 ASIA PACIFIC SEMICONDUCTORS IN ATOMIC LAYER DEPOSITION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 9 ASIA PACIFIC SEMICONDUCTORS IN ATOMIC LAYER DEPOSITION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 10 ASIA PACIFIC ELECTRONICS IN ATOMIC LAYER DEPOSITION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 11 ASIA PACIFIC ELECTRONICS IN ATOMIC LAYER DEPOSITION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 12 ASIA PACIFIC SOLAR DEVICES IN ATOMIC LAYER DEPOSITION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 13 ASIA PACIFIC SOLAR DEVICES IN ATOMIC LAYER DEPOSITION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 14 ASIA PACIFIC MEDICAL EQUIPMENT IN ATOMIC LAYER DEPOSITION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 15 ASIA PACIFIC MEDICAL EQUIPMENT IN ATOMIC LAYER DEPOSITION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 16 ASIA PACIFIC OPTICAL DEVICES IN ATOMIC LAYER DEPOSITION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 17 ASIA PACIFIC OPTICAL DEVICES IN ATOMIC LAYER DEPOSITION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 18 ASIA PACIFIC THERMOELECTRIC MATERIALS IN ATOMIC LAYER DEPOSITION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 19 ASIA PACIFIC THERMOELECTRIC MATERIALS IN ATOMIC LAYER DEPOSITION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 20 ASIA PACIFIC MAGNETIC HEADS IN ATOMIC LAYER DEPOSITION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 21 ASIA PACIFIC MAGNETIC HEADS ATOMIC LAYER DEPOSITION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 22 ASIA PACIFIC RESEARCH & DEVELOPMENT FACILITIES IN ATOMIC LAYER DEPOSITION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 23 ASIA PACIFIC RESEARCH & DEVELOPMENT FACILITIES IN ATOMIC LAYER DEPOSITION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 24 ASIA PACIFIC FUEL CELLS IN ATOMIC LAYER DEPOSITION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 25 ASIA PACIFIC FUEL CELLS IN ATOMIC LAYER DEPOSITION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 26 ASIA PACIFIC SENSORS IN ATOMIC LAYER DEPOSITION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 27 ASIA PACIFIC SENSORS IN ATOMIC LAYER DEPOSITION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 28 ASIA PACIFIC BARRIER LAYERS IN ATOMIC LAYER DEPOSITION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 29 ASIA PACIFIC BARRIER LAYERS IN ATOMIC LAYER DEPOSITION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 30 ASIA PACIFIC PRIMER LAYERS IN ATOMIC LAYER DEPOSITION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 31 ASIA PACIFIC PRIMER LAYERS IN ATOMIC LAYER DEPOSITION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 32 ASIA PACIFIC NON-IC APPLICATION IN ATOMIC LAYER DEPOSITION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 33 ASIA PACIFIC NON-IC APPLICATION IN ATOMIC LAYER DEPOSITION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 34 ASIA PACIFIC OTHERS IN ATOMIC LAYER DEPOSITION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 35 ASIA PACIFIC OTHERS IN ATOMIC LAYER DEPOSITION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 36 ASIA-PACIFIC ATOMIC LAYER DEPOSITION MARKET, BY COUNTRY, 2020-2029 (USD MILLION)

TABLE 37 ASIA-PACIFIC ATOMIC LAYER DEPOSITION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 38 ASIA-PACIFIC ATOMIC LAYER DEPOSITION MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 39 ASIA-PACIFIC SEMICONDUCTORS IN ATOMIC LAYER DEPOSITION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 40 ASIA-PACIFIC ELECTRONICS IN ATOMIC LAYER DEPOSITION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 41 ASIA-PACIFIC SOLAR DEVICES IN ATOMIC LAYER DEPOSITION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 42 ASIA-PACIFIC MEDICAL EQUIPMENT IN ATOMIC LAYER DEPOSITION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 43 ASIA-PACIFIC OPTICAL DEVICES IN ATOMIC LAYER DEPOSITION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 44 ASIA-PACIFIC THERMOELECTRIC MATERIALS IN ATOMIC LAYER DEPOSITION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 45 ASIA-PACIFIC FUEL CELLS IN ATOMIC LAYER DEPOSITION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 46 ASIA-PACIFIC RESEARCH AND DEVELOPMENT FACILITIES IN ATOMIC LAYER DEPOSITION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 47 ASIA-PACIFIC MAGNETIC HEADS IN ATOMIC LAYER DEPOSITION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 48 ASIA-PACIFIC SENSORS IN ATOMIC LAYER DEPOSITION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 49 ASIA-PACIFIC BARRIER LAYERS IN ATOMIC LAYER DEPOSITION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 50 ASIA-PACIFIC PRIMER LAYERS IN ATOMIC LAYER DEPOSITION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 51 ASIA-PACIFIC NON-IC APPLICATION IN ATOMIC LAYER DEPOSITION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 52 ASIA-PACIFIC OTHERS IN ATOMIC LAYER DEPOSITION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 53 JAPAN ATOMIC LAYER DEPOSITION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 54 JAPAN ATOMIC LAYER DEPOSITION MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 55 JAPAN SEMICONDUCTORS IN ATOMIC LAYER DEPOSITION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 56 JAPAN ELECTRONICS IN ATOMIC LAYER DEPOSITION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 57 JAPAN SOLAR DEVICES IN ATOMIC LAYER DEPOSITION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 58 JAPAN MEDICAL EQUIPMENT IN ATOMIC LAYER DEPOSITION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 59 JAPAN OPTICAL DEVICES IN ATOMIC LAYER DEPOSITION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 60 JAPAN THERMOELECTRIC MATERIALS IN ATOMIC LAYER DEPOSITION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 61 JAPAN FUEL CELLS IN ATOMIC LAYER DEPOSITION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 62 JAPAN RESEARCH AND DEVELOPMENT FACILITIES IN ATOMIC LAYER DEPOSITION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 63 JAPAN MAGNETIC HEADS IN ATOMIC LAYER DEPOSITION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 64 JAPAN SENSORS IN ATOMIC LAYER DEPOSITION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 65 JAPAN BARRIER LAYERS IN ATOMIC LAYER DEPOSITION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 66 JAPAN PRIMER LAYERS IN ATOMIC LAYER DEPOSITION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 67 JAPAN NON-IC APPLICATION IN ATOMIC LAYER DEPOSITION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 68 JAPAN OTHERS IN ATOMIC LAYER DEPOSITION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 69 CHINA ATOMIC LAYER DEPOSITION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 70 CHINA ATOMIC LAYER DEPOSITION MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 71 CHINA SEMICONDUCTORS IN ATOMIC LAYER DEPOSITION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 72 CHINA ELECTRONICS IN ATOMIC LAYER DEPOSITION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 73 CHINA SOLAR DEVICES IN ATOMIC LAYER DEPOSITION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 74 CHINA MEDICAL EQUIPMENT IN ATOMIC LAYER DEPOSITION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 75 CHINA OPTICAL DEVICES IN ATOMIC LAYER DEPOSITION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 76 CHINA THERMOELECTRIC MATERIALS IN ATOMIC LAYER DEPOSITION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 77 CHINA FUEL CELLS IN ATOMIC LAYER DEPOSITION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 78 CHINA RESEARCH AND DEVELOPMENT FACILITIES IN ATOMIC LAYER DEPOSITION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 79 CHINA MAGNETIC HEADS IN ATOMIC LAYER DEPOSITION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 80 CHINA SENSORS IN ATOMIC LAYER DEPOSITION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 81 CHINA BARRIER LAYERS IN ATOMIC LAYER DEPOSITION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 82 CHINA PRIMER LAYERS IN ATOMIC LAYER DEPOSITION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 83 CHINA NON-IC APPLICATION IN ATOMIC LAYER DEPOSITION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 84 CHINA OTHERS IN ATOMIC LAYER DEPOSITION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 85 SOUTH KOREA ATOMIC LAYER DEPOSITION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 86 SOUTH KOREA ATOMIC LAYER DEPOSITION MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 87 SOUTH KOREA SEMICONDUCTORS IN ATOMIC LAYER DEPOSITION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 88 SOUTH KOREA ELECTRONICS IN ATOMIC LAYER DEPOSITION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 89 SOUTH KOREA SOLAR DEVICES IN ATOMIC LAYER DEPOSITION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 90 SOUTH KOREA MEDICAL EQUIPMENT IN ATOMIC LAYER DEPOSITION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 91 SOUTH KOREA OPTICAL DEVICES IN ATOMIC LAYER DEPOSITION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 92 SOUTH KOREA THERMOELECTRIC MATERIALS IN ATOMIC LAYER DEPOSITION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 93 SOUTH KOREA FUEL CELLS IN ATOMIC LAYER DEPOSITION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 94 SOUTH KOREA RESEARCH AND DEVELOPMENT FACILITIES IN ATOMIC LAYER DEPOSITION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 95 SOUTH KOREA MAGNETIC HEADS IN ATOMIC LAYER DEPOSITION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 96 SOUTH KOREA SENSORS IN ATOMIC LAYER DEPOSITION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 97 SOUTH KOREA BARRIER LAYERS IN ATOMIC LAYER DEPOSITION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 98 SOUTH KOREA PRIMER LAYERS IN ATOMIC LAYER DEPOSITION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 99 SOUTH KOREA NON-IC APPLICATION IN ATOMIC LAYER DEPOSITION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 100 SOUTH KOREA OTHERS IN ATOMIC LAYER DEPOSITION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 101 INDIA ATOMIC LAYER DEPOSITION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 102 INDIA ATOMIC LAYER DEPOSITION MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 103 INDIA SEMICONDUCTORS IN ATOMIC LAYER DEPOSITION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 104 INDIA ELECTRONICS IN ATOMIC LAYER DEPOSITION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 105 INDIA SOLAR DEVICES IN ATOMIC LAYER DEPOSITION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 106 INDIA MEDICAL EQUIPMENT IN ATOMIC LAYER DEPOSITION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 107 INDIA OPTICAL DEVICES IN ATOMIC LAYER DEPOSITION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 108 INDIA THERMOELECTRIC MATERIALS IN ATOMIC LAYER DEPOSITION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 109 INDIA FUEL CELLS IN ATOMIC LAYER DEPOSITION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 110 INDIA RESEARCH AND DEVELOPMENT FACILITIES IN ATOMIC LAYER DEPOSITION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 111 INDIA MAGNETIC HEADS IN ATOMIC LAYER DEPOSITION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 112 INDIA SENSORS IN ATOMIC LAYER DEPOSITION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 113 INDIA BARRIER LAYERS IN ATOMIC LAYER DEPOSITION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 114 INDIA PRIMER LAYERS IN ATOMIC LAYER DEPOSITION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 115 INDIA NON-IC APPLICATION IN ATOMIC LAYER DEPOSITION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 116 INDIA OTHERS IN ATOMIC LAYER DEPOSITION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 117 AUSTRALIA ATOMIC LAYER DEPOSITION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 118 AUSTRALIA ATOMIC LAYER DEPOSITION MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 119 AUSTRALIA SEMICONDUCTORS IN ATOMIC LAYER DEPOSITION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 120 AUSTRALIA ELECTRONICS IN ATOMIC LAYER DEPOSITION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 121 AUSTRALIA SOLAR DEVICES IN ATOMIC LAYER DEPOSITION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 122 AUSTRALIA MEDICAL EQUIPMENT IN ATOMIC LAYER DEPOSITION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 123 AUSTRALIA OPTICAL DEVICES IN ATOMIC LAYER DEPOSITION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 124 AUSTRALIA THERMOELECTRIC MATERIALS IN ATOMIC LAYER DEPOSITION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 125 AUSTRALIA FUEL CELLS IN ATOMIC LAYER DEPOSITION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 126 AUSTRALIA RESEARCH AND DEVELOPMENT FACILITIES IN ATOMIC LAYER DEPOSITION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 127 AUSTRALIA MAGNETIC HEADS IN ATOMIC LAYER DEPOSITION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 128 AUSTRALIA SENSORS IN ATOMIC LAYER DEPOSITION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 129 AUSTRALIA BARRIER LAYERS IN ATOMIC LAYER DEPOSITION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 130 AUSTRALIA PRIMER LAYERS IN ATOMIC LAYER DEPOSITION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 131 AUSTRALIA NON-IC APPLICATION IN ATOMIC LAYER DEPOSITION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 132 AUSTRALIA OTHERS IN ATOMIC LAYER DEPOSITION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 133 SINGAPORE ATOMIC LAYER DEPOSITION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 134 SINGAPORE ATOMIC LAYER DEPOSITION MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 135 SINGAPORE SEMICONDUCTORS IN ATOMIC LAYER DEPOSITION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 136 SINGAPORE ELECTRONICS IN ATOMIC LAYER DEPOSITION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 137 SINGAPORE SOLAR DEVICES IN ATOMIC LAYER DEPOSITION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 138 SINGAPORE MEDICAL EQUIPMENT IN ATOMIC LAYER DEPOSITION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 139 SINGAPORE OPTICAL DEVICES IN ATOMIC LAYER DEPOSITION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 140 SINGAPORE THERMOELECTRIC MATERIALS IN ATOMIC LAYER DEPOSITION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 141 SINGAPORE FUEL CELLS IN ATOMIC LAYER DEPOSITION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 142 SINGAPORE RESEARCH AND DEVELOPMENT FACILITIES IN ATOMIC LAYER DEPOSITION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 143 SINGAPORE MAGNETIC HEADS IN ATOMIC LAYER DEPOSITION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 144 SINGAPORE SENSORS IN ATOMIC LAYER DEPOSITION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 145 SINGAPORE BARRIER LAYERS IN ATOMIC LAYER DEPOSITION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 146 SINGAPORE PRIMER LAYERS IN ATOMIC LAYER DEPOSITION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 147 SINGAPORE NON-IC APPLICATION IN ATOMIC LAYER DEPOSITION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 148 SINGAPORE OTHERS IN ATOMIC LAYER DEPOSITION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 149 THAILAND ATOMIC LAYER DEPOSITION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 150 THAILAND ATOMIC LAYER DEPOSITION MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 151 THAILAND SEMICONDUCTORS IN ATOMIC LAYER DEPOSITION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 152 THAILAND ELECTRONICS IN ATOMIC LAYER DEPOSITION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 153 THAILAND SOLAR DEVICES IN ATOMIC LAYER DEPOSITION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 154 THAILAND MEDICAL EQUIPMENT IN ATOMIC LAYER DEPOSITION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 155 THAILAND OPTICAL DEVICES IN ATOMIC LAYER DEPOSITION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 156 THAILAND THERMOELECTRIC MATERIALS IN ATOMIC LAYER DEPOSITION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 157 THAILAND FUEL CELLS IN ATOMIC LAYER DEPOSITION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 158 THAILAND RESEARCH AND DEVELOPMENT FACILITIES IN ATOMIC LAYER DEPOSITION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 159 THAILAND MAGNETIC HEADS IN ATOMIC LAYER DEPOSITION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 160 THAILAND SENSORS IN ATOMIC LAYER DEPOSITION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 161 THAILAND BARRIER LAYERS IN ATOMIC LAYER DEPOSITION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 162 THAILAND PRIMER LAYERS IN ATOMIC LAYER DEPOSITION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 163 THAILAND NON-IC APPLICATION IN ATOMIC LAYER DEPOSITION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 164 THAILAND OTHERS IN ATOMIC LAYER DEPOSITION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 165 MALAYSIA ATOMIC LAYER DEPOSITION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 166 MALAYSIA ATOMIC LAYER DEPOSITION MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 167 MALAYSIA SEMICONDUCTORS IN ATOMIC LAYER DEPOSITION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 168 MALAYSIA ELECTRONICS IN ATOMIC LAYER DEPOSITION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 169 MALAYSIA SOLAR DEVICES IN ATOMIC LAYER DEPOSITION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 170 MALAYSIA MEDICAL EQUIPMENT IN ATOMIC LAYER DEPOSITION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 171 MALAYSIA OPTICAL DEVICES IN ATOMIC LAYER DEPOSITION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 172 MALAYSIA THERMOELECTRIC MATERIALS IN ATOMIC LAYER DEPOSITION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 173 MALAYSIA FUEL CELLS IN ATOMIC LAYER DEPOSITION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 174 MALAYSIA RESEARCH AND DEVELOPMENT FACILITIES IN ATOMIC LAYER DEPOSITION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 175 MALAYSIA MAGNETIC HEADS IN ATOMIC LAYER DEPOSITION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 176 MALAYSIA SENSORS IN ATOMIC LAYER DEPOSITION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 177 MALAYSIA BARRIER LAYERS IN ATOMIC LAYER DEPOSITION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 178 MALAYSIA PRIMER LAYERS IN ATOMIC LAYER DEPOSITION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 179 MALAYSIA NON-IC APPLICATION IN ATOMIC LAYER DEPOSITION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 180 MALAYSIA OTHERS IN ATOMIC LAYER DEPOSITION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 181 INDONESIA ATOMIC LAYER DEPOSITION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 182 INDONESIA ATOMIC LAYER DEPOSITION MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 183 INDONESIA SEMICONDUCTORS IN ATOMIC LAYER DEPOSITION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 184 INDONESIA ELECTRONICS IN ATOMIC LAYER DEPOSITION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 185 INDONESIA SOLAR DEVICES IN ATOMIC LAYER DEPOSITION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 186 INDONESIA MEDICAL EQUIPMENT IN ATOMIC LAYER DEPOSITION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 187 INDONESIA OPTICAL DEVICES IN ATOMIC LAYER DEPOSITION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 188 INDONESIA THERMOELECTRIC MATERIALS IN ATOMIC LAYER DEPOSITION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 189 INDONESIA FUEL CELLS IN ATOMIC LAYER DEPOSITION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 190 INDONESIA RESEARCH AND DEVELOPMENT FACILITIES IN ATOMIC LAYER DEPOSITION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 191 INDONESIA MAGNETIC HEADS IN ATOMIC LAYER DEPOSITION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 192 INDONESIA SENSORS IN ATOMIC LAYER DEPOSITION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 193 INDONESIA BARRIER LAYERS IN ATOMIC LAYER DEPOSITION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 194 INDONESIA PRIMER LAYERS IN ATOMIC LAYER DEPOSITION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 195 INDONESIA NON-IC APPLICATION IN ATOMIC LAYER DEPOSITION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 196 INDONESIA OTHERS IN ATOMIC LAYER DEPOSITION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 197 PHILIPPINES ATOMIC LAYER DEPOSITION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 198 PHILIPPINES ATOMIC LAYER DEPOSITION MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 199 PHILIPPINES SEMICONDUCTORS IN ATOMIC LAYER DEPOSITION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 200 PHILIPPINES ELECTRONICS IN ATOMIC LAYER DEPOSITION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 201 PHILIPPINES SOLAR DEVICES IN ATOMIC LAYER DEPOSITION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 202 PHILIPPINES MEDICAL EQUIPMENT IN ATOMIC LAYER DEPOSITION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 203 PHILIPPINES OPTICAL DEVICES IN ATOMIC LAYER DEPOSITION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 204 PHILIPPINES THERMOELECTRIC MATERIALS IN ATOMIC LAYER DEPOSITION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 205 PHILIPPINES FUEL CELLS IN ATOMIC LAYER DEPOSITION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 206 PHILIPPINES RESEARCH AND DEVELOPMENT FACILITIES IN ATOMIC LAYER DEPOSITION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 207 PHILIPPINES MAGNETIC HEADS IN ATOMIC LAYER DEPOSITION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 208 PHILIPPINES SENSORS IN ATOMIC LAYER DEPOSITION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 209 PHILIPPINES BARRIER LAYERS IN ATOMIC LAYER DEPOSITION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 210 PHILIPPINES PRIMER LAYERS IN ATOMIC LAYER DEPOSITION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 211 PHILIPPINES NON-IC APPLICATION IN ATOMIC LAYER DEPOSITION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 212 PHILIPPINES OTHERS IN ATOMIC LAYER DEPOSITION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 213 REST OF ASIA-PACIFIC ATOMIC LAYER DEPOSITION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

List of Figure

FIGURE 1 ASIA PACIFIC ATOMIC LAYER DEPOSITION MARKET: SEGMENTATION

FIGURE 2 ASIA PACIFIC ATOMIC LAYER DEPOSITION MARKET: DATA TRIANGULATION

FIGURE 3 ASIA PACIFIC ATOMIC LAYER DEPOSITION MARKET: DROC ANALYSIS

FIGURE 4 ASIA PACIFIC ATOMIC LAYER DEPOSITION MARKET: ASIA PACIFIC VS REGIONAL MARKET ANALYSIS

FIGURE 5 ASIA PACIFIC ATOMIC LAYER DEPOSITION MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 ASIA PACIFIC ATOMIC LAYER DEPOSITION MARKET: THE PRODUCT TYPE LIFE LINE CURVE

FIGURE 7 ASIA PACIFIC ATOMIC LAYER DEPOSITION MARKET: MULTIVARIATE MODELLING

FIGURE 8 ASIA PACIFIC ATOMIC LAYER DEPOSITION MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 9 ASIA PACIFIC ATOMIC LAYER DEPOSITION MARKET: DBMR MARKET POSITION GRID

FIGURE 10 ASIA PACIFIC ATOMIC LAYER DEPOSITION MARKET: MARKET APPLICATION COVERAGE GRID

FIGURE 11 ASIA PACIFIC ATOMIC LAYER DEPOSITION MARKET: THE MARKET CHALLENGE MATRIX

FIGURE 12 ASIA PACIFIC ATOMIC LAYER DEPOSITION MARKET: VENDOR SHARE ANALYSIS

FIGURE 13 ASIA PACIFIC ATOMIC LAYER DEPOSITION MARKET: SEGMENTATION

FIGURE 14 HIGH DEMAND FOR MICROELECTRONICS AND CONSUMER ELECTRONICS IS EXPECTED TO DRIVE THE ASIA PACIFIC ATOMIC LAYER DEPOSITION MARKET IN THE FORECAST PERIOD

FIGURE 15 METAL ALD SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE ASIA PACIFIC ATOMIC LAYER DEPOSITION MARKET IN 2022 & 2029

FIGURE 16 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE ASIA PACIFIC ATOMIC LAYER DEPOSITION MARKET

FIGURE 17 ASIA PACIFIC ATOMIC LAYER DEPOSITION MARKET: BY PRODUCT TYPE, 2021

FIGURE 18 ASIA PACIFIC ATOMIC LAYER DEPOSITION MARKET: BY APPLICATION, 2021

FIGURE 19 ASIA-PACIFIC ATOMIC LAYER DEPOSITION MARKET: SNAPSHOT (2021)

FIGURE 20 ASIA-PACIFIC ATOMIC LAYER DEPOSITION MARKET: BY COUNTRY (2021)

FIGURE 21 ASIA-PACIFIC ATOMIC LAYER DEPOSITION MARKET: BY COUNTRY (2022 & 2029)

FIGURE 22 ASIA-PACIFIC ATOMIC LAYER DEPOSITION MARKET: BY COUNTRY (2021 & 2029)

FIGURE 23 ASIA-PACIFIC ATOMIC LAYER DEPOSITION MARKET: BY PRODUCT TYPE (2022 - 2029)

FIGURE 24 ASIA PACIFIC ATOMIC LAYER DEPOSITION MARKET: COMPANY SHARE 2021 (%)

Asia Pacific Atomic Layer Deposition Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Asia Pacific Atomic Layer Deposition Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Asia Pacific Atomic Layer Deposition Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.