Asia Pacific Biologics Market

Market Size in USD Billion

CAGR :

%

USD

73.52 Billion

USD

175.63 Billion

2024

2032

USD

73.52 Billion

USD

175.63 Billion

2024

2032

| 2025 –2032 | |

| USD 73.52 Billion | |

| USD 175.63 Billion | |

|

|

|

|

Asia-Pacific Biologics Market Size

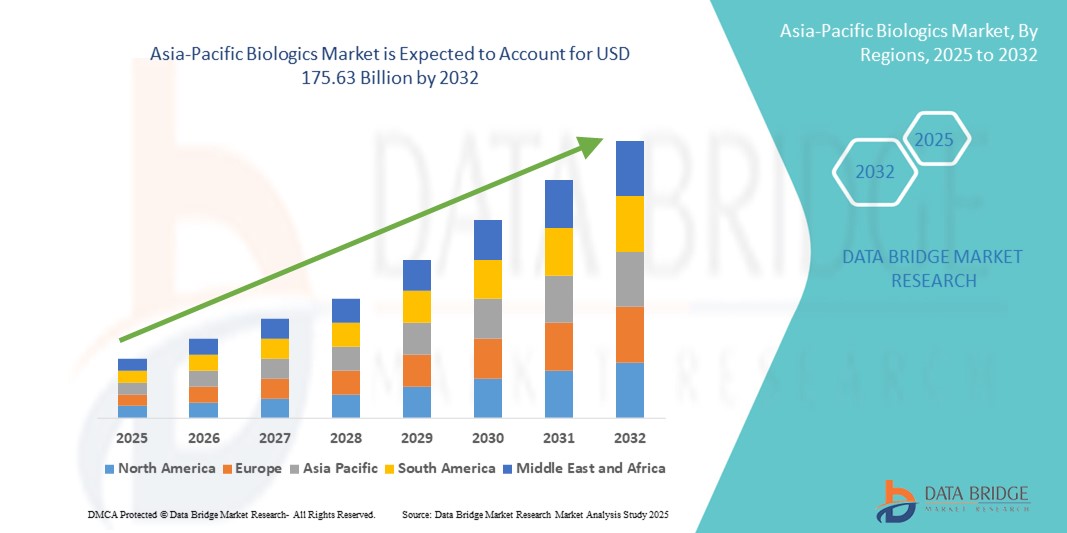

- The Asia-Pacific biologics market size was valued at USD 73.52 billion in 2024 and is expected to reach USD 175.63 billion by 2032, at a CAGR of 11.5% during the forecast period

- The market growth is largely driven by increasing investments in biopharmaceutical research, rising prevalence of chronic diseases, and expanding healthcare infrastructure across emerging economies in the region

- In addition, growing government support for biotechnology, rising adoption of personalized medicine, and technological advancements in biologic drug development are contributing to the rapid expansion of the biologics market in Asia-Pacific. These factors collectively enhance the availability and acceptance of biologic therapies, thereby accelerating market growth

Asia-Pacific Biologics Market Analysis

- Biologics, encompassing complex drugs derived from living cells for treating chronic and rare diseases, are becoming essential components of the Asia-Pacific healthcare sector due to rapid biotechnological advancements and increasing demand for targeted therapies

- The rising prevalence of chronic illnesses, expanding healthcare infrastructure, and growing healthcare spending across emerging economies are driving strong demand for biologics in the region

- China dominated the Asia-Pacific biologics market with a revenue share of 39.2% in 2024, supported by robust government initiatives, expanding patient base, and increasing adoption of both innovative biologics and biosimilars

- India is anticipated to be the fastest-growing country in the Asia-Pacific biologics market during the forecast period, owing to enhanced clinical research activities, improving regulatory environments, and growing biopharmaceutical manufacturing capabilities

- The monoclonal antibodies segment dominated the Asia-Pacific biologics market with a share of 46.1% in 2024, driven by extensive applications in oncology, autoimmune diseases, and ongoing innovation to improve treatment efficacy and safety

Report Scope and Asia-Pacific Biologics Market Segmentation

|

Attributes |

Asia-Pacific Biologics Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

Asia-Pacific

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Asia-Pacific Biologics Market Trends

Rapid Expansion Driven by Biotech Innovation and Personalized Medicine

- A prominent and accelerating trend in the Asia-Pacific biologics market is the surge in biotechnological innovations combined with the increasing adoption of personalized medicine approaches tailored to genetic and molecular patient profiles

- For instance, companies such as Biocon (India) and Shanghai Fosun Pharmaceutical are developing biosimilars and novel biologics targeting cancer, autoimmune diseases, and rare disorders, enhancing treatment accessibility and efficacy across the region

- Advances in cell and gene therapies, supported by improved manufacturing capabilities and collaborations between local biotech firms and global pharmaceutical companies, are driving innovation pipelines and expanding biologics portfolios

- Regulatory bodies across Asia-Pacific, including Japan’s PMDA and China’s NMPA, are streamlining approval processes for biologics and biosimilars, facilitating faster market entry and adoption

- This trend towards precision therapies and advanced biologics is reshaping patient care models, with increasing integration into national healthcare programs and insurance reimbursement schemes, particularly in China, Japan, and South Korea

- The demand for cutting-edge biologic treatments is growing rapidly due to their superior safety and efficacy profiles compared to traditional small-molecule drugs, fueling robust market expansion across both developed and emerging Asia-Pacific countries

Asia-Pacific Biologics Market Dynamics

Driver

Rising Chronic Disease Burden and Expanding Healthcare Infrastructure

- The escalating prevalence of chronic diseases such as cancer, diabetes, and autoimmune disorders in Asia-Pacific, coupled with expanding healthcare infrastructure and improved disease diagnosis rates, is a key driver for biologics market growth

- For instance, in March 2024, Samsung Biologics announced a significant capacity expansion in South Korea, aiming to meet the growing demand for biopharmaceutical manufacturing services, underscoring industry commitment to market needs

- Increasing patient awareness and improved healthcare access have accelerated biologic adoption, supported by government initiatives and insurance coverage improvements in countries such as China and India

- Moreover, investments in R&D and manufacturing by both local and multinational firms are enhancing the availability and affordability of biologic therapies, fostering market penetration

- Growing collaborations and partnerships between Asia-Pacific biotech firms and global pharmaceutical companies are accelerating innovation, technology transfer, and commercialization of biologics in the region

- Expansion of biosimilar markets is creating cost-effective alternatives to branded biologics, thereby increasing treatment accessibility and driving overall market growth

Restraint/Challenge

High Treatment Costs and Complex Regulatory Environment

- The relatively high cost of biologic therapies remains a significant barrier to widespread adoption in price-sensitive Asia-Pacific markets, limiting accessibility among lower-income patient segments

- For instance, despite biosimilars offering cost savings, stringent and varied regulatory requirements across different countries create delays and increase compliance costs for market entry

- Variability in intellectual property protections and lack of harmonized regulations pose additional challenges for manufacturers and hinder faster availability of biosimilars

- Furthermore, logistical complexities in biologics storage and distribution, especially in rural or underdeveloped areas, impact treatment continuity and scalability

- Limited skilled workforce and inadequate infrastructure in some emerging Asia-Pacific countries slow down clinical trials and biologics manufacturing scale-up

- Concerns about immunogenicity and long-term safety profiles of newer biologic products also contribute to cautious adoption among healthcare providers and patients

Asia-Pacific Biologics Market Scope

The market is segmented on the basis of class, type, route of administration, application, source material, end user, and distribution channel.

- By Class

On the basis of class, the Asia-Pacific biologics market is segmented into tumor necrosis Factor-α (TNF) inhibitors, B-cell inhibitors, Interleukin inhibitors, Selective Co-Stimulation Modulators (Abatacept), and others. The tumor necrosis Factor-α (TNF) inhibitors segment dominated the market with the largest revenue share of 37.5% in 2024, primarily due to its well-established role in treating autoimmune diseases such as rheumatoid arthritis and inflammatory bowel disease. This segment benefits from strong clinical adoption and extensive physician familiarity.

In contrast, the Interleukin inhibitors segment is expected to witness the fastest CAGR of 22.3% from 2025 to 2032, propelled by expanding therapeutic indications in dermatological conditions such as psoriasis and other autoimmune disorders, supported by ongoing innovation and regulatory approvals.

- By Type

On the basis of type, the Asia-Pacific biologics market is segmented into monoclonal antibodies (mAbs), therapeutic proteins, vaccines, cellular-based biologics, gene-based biologics, and others. The monoclonal antibodies segment dominated the market with a 46.1% share in 2024, attributed to their wide-ranging application in oncology and autoimmune diseases as well as continual technological enhancements improving specificity and safety

Meanwhile, the cellular-based biologics segment is expected to register the fastest growth with a CAGR of 23.1%, closely followed by gene-based biologics growing at 24.5%, both driven by breakthroughs in gene therapy and personalized medicine, along with increased clinical trial approvals across the Asia-Pacific region.

- By Route of Administration

On the basis of route of administration, the Asia-Pacific biologics market is segmented into injection and infusion. The injection segment dominated with 62.8% revenue share in 2024, favored for its convenience and suitability for outpatient treatment and self-administration, especially in chronic conditions.

The infusion segment, while smaller, is projected to grow steadily during forecast period, as it remains critical for hospital-based administration of complex biologics such as chemotherapy and immunotherapies requiring controlled delivery, particularly in oncology and autoimmune indications.

- By Application

On the basis of application, the Asia-Pacific biologics market is segmented into oncology, autoimmune diseases, diabetes, infectious diseases, cardiovascular diseases, ophthalmic conditions, dermatological diseases, and others. Oncology dominated the market with 39.7% revenue share in 2024, driven by rising cancer prevalence and the availability of targeted biologics addressing various tumor types

The autoimmune diseases segment is anticipated to witness the fastest growth rate at a CAGR of 21.4% during the forecast period, owing to increasing disease diagnosis rates and growing preference for biologics over conventional treatments due to better efficacy and safety profiles.

- By Source Material

On the basis of source material, the Asia-Pacific biologics market is segmented into humans, avian cell culture, yeast, bacteria, insect cell culture, transgenics, and others. Human-derived biologics dominated the market with 41.3% revenue share in 2024, preferred for their proven safety and compatibility with human physiology.

Yeast and bacterial expression systems are expected to record the fastest growth rates at CAGRs of 19.8% and 18.5% respectively during forecast period, driven by their cost-effectiveness and scalability in manufacturing biosimilars and novel biologics in emerging Asia-Pacific markets.

- End User

On the basis of end user, the Asia-Pacific biologics market is segmented into hospitals, specialty clinics, academic and research institutes, and others. Hospitals dominated with 52.1% revenue share in 2024, owing to their role as primary centers for administration of complex biologic therapies and conducting clinical trials.

Specialty clinics are projected to witness the fastest growth at a CAGR of 20.3% during forecast period, driven by increased accessibility of biologics in outpatient settings and rising patient preference for convenient treatment options.

- By Distribution Channel

On the basis of distribution channel, the Asia-Pacific biologics market is segmented into direct tender, retail sales, and third-party distribution. Direct tendering dominated the market with a 48.6% share in 2024, fueled by bulk procurement by government and private hospitals ensuring steady biologic supply.

Retail sales are expected to record the fastest CAGR of 18.7% during forecast period, supported by expanding pharmacy networks, increasing patient self-administration, and rising awareness. Third-party distribution remains critical for penetrating remote and underserved regions, facilitating wider market reach.

Asia-Pacific Biologics Market Regional Analysis

- China dominated the Asia-Pacific biologics market with a revenue share of 39.2% in 2024, supported by robust government initiatives, expanding patient base, and increasing adoption of both innovative biologics and biosimilars

- The country benefits from supportive policies promoting biopharmaceutical manufacturing, faster regulatory approvals, and growing adoption of both innovative biologics and biosimilars

- Rising chronic disease prevalence, increased healthcare spending, and expanding clinical research activities in China are further accelerating market growth, making it the regional leader in biologics development and consumption

The China Biologics Market Insight

The China biologics market dominated the Asia-Pacific market with a 42.5% revenue share in 2024, fueled by strong government initiatives promoting biotech innovation, streamlined regulatory approvals, and increased healthcare expenditure. The country’s growing patient base and rising demand for cost-effective biosimilars contribute significantly to market growth. China is also emerging as a manufacturing hub for biologics, attracting both local and multinational companies to expand R&D and production capabilities.

Japan Biologics Market Insight

The Japan biologics market is growing steadily due to its advanced healthcare system, high R&D investment, and aging population with increased demand for biologic therapies targeting chronic and age-related diseases. The country benefits from robust regulatory support and early adoption of innovative biologics, including cell and gene therapies. Integration of biologics into national health insurance schemes facilitates patient access, supporting sustained market expansion.

South Korea Biologics Market Insight

The South Korea biologics market is rapidly emerging as a key player in the Asia-Pacific biologics market, supported by strong government backing, substantial R&D investment, and a growing biopharmaceutical manufacturing sector. The country focuses heavily on innovative biologics and biosimilars development, with an increasing number of clinical trials and approvals. South Korea’s advanced infrastructure and skilled workforce enhance its competitive position, driving market growth in both domestic and export markets.

India Biologics Market Insight

The India biologics market holds a significant share in the Asia-Pacific biologics market, driven by a large population, growing middle class, and rising healthcare spending. The market benefits from increasing biosimilar production by domestic companies, improving access to biologic therapies at more affordable prices. Government initiatives promoting biotechnology startups and infrastructure development are fostering innovation and commercialization of new biologics, further accelerating market growth.

Australia Biologics Market Insight

The Australia’s biologics market is expanding steadily, supported by well-established healthcare infrastructure and increasing investment in biopharmaceutical research. Rising incidence of chronic diseases and growing patient awareness about advanced therapies are encouraging adoption. The country’s regulatory environment is evolving to support faster approvals of biosimilars and novel biologics, contributing to market growth in both public and private healthcare sectors.

Asia-Pacific Biologics Market Share

The Asia-Pacific Biologics industry is primarily led by well-established companies, including:

- Biocon Limited (India)

- Samsung Biologics (South Korea)

- Celltrion, Inc. (South Korea)

- Takeda Pharmaceutical Company Limited (Japan)

- AstraZeneca (U.K.)

- Fujifilm Diosynth Biotechnologies (Japan)

- Wuxi Biologics (China)

- GenScript Biotech Corporation (China)

- Zhejiang Hisun Pharmaceutical Co., Ltd. (China)

- Suzhou Hengrui Pharmaceuticals Co., Ltd. (China)

- Dr. Reddy’s Laboratories (India)

- LG Chem Life Sciences (South Korea)

- Lilly (U.S.)

- Chugai Pharmaceutical Co., Ltd. (Japan)

- Jubilant Life Sciences Limited (India)

- Harbin Pharmaceutical Group Co., Ltd. (China)

- Mabpharm Inc. (South Korea)

- Hualan Biological Engineering Inc. (China)

- Shanghai Fosun Pharmaceutical Group (China)

- Sino Biopharmaceutical Limited (China)

What are the Recent Developments in Asia-Pacific Biologics Market?

- In August 2025, India approved Roche’s subcutaneous version of the cancer drug Atezolizumab, marketed as Tecentriq. This new method allows for a quicker administration time of just seven minutes, offering a more convenient alternative to traditional intravenous infusions. The approval was granted by a technical committee overseeing clinical trials of new chemical entities. However, it is contingent on the completion of a Phase IV trial in India, which typically assesses the drug’s efficacy and safety after it has entered the market

- In August 2025, Biocon Biologics announced plans to focus on GLP-1 weight-loss therapy as a key area for future growth. The company sees significant potential in the growing market for GLP-1 therapies, which are gaining attention globally for their effectiveness in weight management. This strategic pivot suggests Biocon is aligning with emerging trends in healthcare and obesity treatment to diversify and enhance its product pipeline

- In August 2025, Agilent Technologies inaugurated a new biopharma experience center in Hyderabad, India. The facility is designed to accelerate the development of life-saving medicines by offering cutting-edge technologies in chromatography, mass spectrometry, cell analysis, and lab informatics. It aims to foster collaboration between industry and academia, simulate real lab environments, and support faster research and development while adhering to international regulatory standards

- In July 2025, South Korea announced plans to invest 100 billion won over the next 3–5 years to enhance AI-driven drug development. This initiative aims to accelerate the discovery and development of new biologic therapies, positioning South Korea as a leader in innovative biopharmaceutical research

- In July 2025, Aragen announced plans to commence Good Manufacturing Practice (GMP) manufacturing at its Bangalore biologics facility. The facility will utilize an intensified fed-batch platform with productivity exceeding 25 g/L. This move aims to support flexible production with single-use 2-KL bioreactors and integrated downstream capabilities for rapid scale-up or multi-client projects, catering to the growing global demand for biologics

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.