Asia Pacific Breast Biopsy Devices Market

Market Size in USD Million

CAGR :

%

USD

132.79 Million

USD

266.54 Million

2024

2032

USD

132.79 Million

USD

266.54 Million

2024

2032

| 2025 –2032 | |

| USD 132.79 Million | |

| USD 266.54 Million | |

|

|

|

|

Asia-Pacific Breast Biopsy Devices Market Size

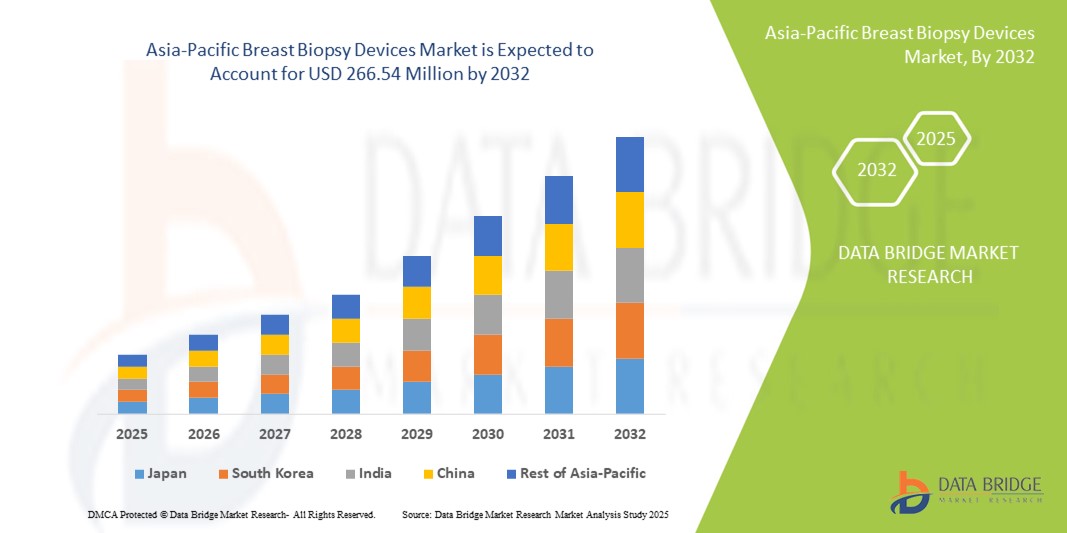

- The Asia-Pacific breast biopsy devices market size was valued at USD 132.79 million in 2024 and is expected to reach USD 266.54 million by 2032, at a CAGR of 9.1% during the forecast period

- The market growth is largely fueled by the rising prevalence of breast cancer, growing awareness regarding early cancer detection, and expanding government as well as private healthcare initiatives, which are driving higher adoption of advanced diagnostic technologies across the region

- Furthermore, increasing demand for minimally invasive diagnostic procedures, coupled with technological advancements in imaging-guided biopsy systems, is positioning breast biopsy devices as a critical tool in modern oncology care. These converging factors are accelerating the adoption of breast biopsy devices, thereby significantly boosting the industry's growth

Asia-Pacific Breast Biopsy Devices Market Analysis

- Breast biopsy devices, enabling precise tissue sampling for accurate cancer diagnosis, are becoming increasingly vital in oncology care across Asia-Pacific due to rising breast cancer prevalence, greater emphasis on early detection, and the growing integration of advanced imaging and minimally invasive technologies in diagnostic workflows

- The escalating demand for breast biopsy devices is primarily fueled by the increasing awareness of breast cancer screening, expanding government and private healthcare initiatives, and rising preference for minimally invasive biopsy procedures that reduce patient discomfort while ensuring diagnostic accuracy

- China dominated the Asia-Pacific breast biopsy devices market with the largest revenue share of 38.4% in 2024, supported by a vast patient pool, rapid expansion of healthcare infrastructure, and increased investments in diagnostic imaging technologies, with Japan and India also showing strong adoption through government-driven cancer awareness programs and the entry of international device manufacturers

- India is expected to be the fastest-growing country in the Asia-Pacific breast biopsy devices market during the forecast period, driven by its growing healthcare expenditure, rising breast cancer incidence, and the accelerating adoption of advanced diagnostic equipment in both urban and semi-urban healthcare facilities

- Core needle biopsy segment dominated the Asia-Pacific breast biopsy devices market with a market share of 37.2% in 2024, driven by its widespread clinical acceptance, high diagnostic accuracy, and minimally invasive approach, which aligns with the rising demand for patient-friendly diagnostic solutions

Report Scope and Asia-Pacific Breast Biopsy Devices Market Segmentation

|

Attributes |

Asia-Pacific Breast Biopsy Devices Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

Asia-Pacific

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Asia-Pacific Breast Biopsy Devices Market Trends

Rising Adoption of Minimally Invasive and Imaging-Guided Techniques

- A significant and accelerating trend in the Asia-Pacific breast biopsy devices market is the growing shift toward minimally invasive and imaging-guided biopsy procedures such as ultrasound, MRI, and stereotactic techniques, which enhance diagnostic accuracy while reducing patient discomfort

- For instance, Hologic’s imaging-guided biopsy platforms are gaining traction in China and Japan, enabling precise lesion localization and tissue sampling with lower risk compared to traditional surgical biopsy methods

- Integration of advanced imaging in biopsy devices allows oncologists to achieve early detection of breast cancer, optimize diagnostic workflows, and minimize unnecessary surgical interventions, thereby supporting improved patient outcomes across the region

- The adoption of biopsy markers and advanced guidance systems is also expanding, enabling accurate follow-up of suspicious lesions and ensuring consistency in diagnosis during subsequent imaging procedures

- This trend towards imaging-based minimally invasive solutions is reshaping the biopsy landscape in Asia-Pacific, driving hospitals and diagnostic centers to invest in modern biopsy equipment and shifting patient preference away from invasive surgical approaches

- The demand for such advanced biopsy solutions is increasing rapidly across both developed and emerging Asia-Pacific markets, as healthcare providers prioritize early detection and cost-effective oncology care

Asia-Pacific Breast Biopsy Devices Market Dynamics

Driver

Rising Breast Cancer Prevalence and Expanding Screening Programs

- The increasing prevalence of breast cancer across Asia-Pacific, coupled with the rapid expansion of government- and NGO-led screening programs, is a significant driver for the heightened adoption of breast biopsy devices

- For instance, in March 2024, the Indian Ministry of Health expanded its National Cancer Screening Program to include breast cancer early detection, boosting demand for biopsy devices across public hospitals and diagnostic centers

- As awareness campaigns gain momentum, more women are undergoing regular mammography and ultrasound screening, creating a higher pool of patients requiring confirmatory biopsy procedures for accurate diagnosis

- Furthermore, the growth of healthcare infrastructure in China, India, and Southeast Asia is making advanced diagnostic devices more accessible, supporting a strong uptake of minimally invasive biopsy systems

- The availability of core needle biopsy and MRI-guided biopsy systems that combine diagnostic accuracy with patient comfort is further propelling adoption in both public and private healthcare facilities across the region

- Rising healthcare expenditure, combined with supportive reimbursement initiatives in developed countries such as Japan and Australia, is strengthening the market potential for breast biopsy devices

Restraint/Challenge

High Procedure Costs and Limited Access to Advanced Technologies

- The relatively high cost of advanced biopsy devices and guided imaging systems poses a significant challenge to their broader penetration in Asia-Pacific, especially in lower-income and rural populations where affordability remains a barrier

- For instance, in countries such as Indonesia and Vietnam, limited access to high-end imaging-guided biopsy systems restricts adoption to urban tertiary care hospitals, leaving many patients dependent on conventional diagnostic approaches

- The lack of trained radiologists and oncologists with expertise in advanced biopsy procedures further compounds this challenge, leading to delays in diagnosis and reliance on surgical biopsy in resource-constrained settings

- In addition, the uneven distribution of healthcare infrastructure across Asia-Pacific results in disparities in patient access, particularly in semi-urban and rural regions where diagnostic facilities are scarce

- While some companies are working to introduce cost-effective solutions, the high upfront investment required for advanced biopsy equipment remains a major deterrent for smaller healthcare providers

- Overcoming these challenges will require greater public-private partnerships, expanded training programs, and affordable product innovations tailored to emerging Asian markets

Asia-Pacific Breast Biopsy Devices Market Scope

The market is segmented on the basis of product, technique type, guidance technology, and end user.

- By Product

On the basis of product, the Asia-Pacific breast biopsy devices market is segmented into biopsy needles, biopsy tables, biopsy wires, guidance systems, and others. The biopsy needles segment dominated the market with the largest revenue share in 2024, driven by their widespread clinical adoption, relatively lower cost, and compatibility with a variety of imaging-guided techniques. Core and fine biopsy needles are highly preferred due to their minimally invasive approach, accurate tissue sampling, and shorter patient recovery times compared to surgical biopsy methods. Hospitals and diagnostic centers across China, Japan, and India have made biopsy needles a standard diagnostic tool, which continues to sustain their leadership. Furthermore, product innovations such as vacuum-assisted biopsy needles are adding value by improving tissue yield and reducing repeat procedures, enhancing overall diagnostic accuracy. Their reliability, ease of use, and integration into routine oncology workflows position biopsy needles as the dominant segment across Asia-Pacific.

The guidance systems segment is anticipated to witness the fastest growth during the forecast period, driven by increasing adoption of advanced imaging-guided biopsy procedures. Guidance systems integrate ultrasound, MRI, and stereotactic technologies to precisely localize suspicious lesions, reducing sampling errors and improving diagnostic outcomes. Rising breast cancer screening programs and demand for early detection in countries such as India and Southeast Asia are encouraging healthcare providers to invest in modern guidance systems. In addition, the rising affordability of imaging platforms and training of radiologists are expected to support rapid growth. The growing need for precision, combined with patient preference for less invasive diagnostic methods, makes guidance systems the fastest expanding product category in this market.

- By Technique Type

On the basis of technique type, the Asia-Pacific breast biopsy devices market is segmented into fine needle aspiration biopsy, core needle biopsy, biopsy markers, MRI-guided core needle biopsy, surgical biopsy, wire localization, and sentinel node biopsy. The core needle biopsy segment dominated the market with the largest share of 37.2% in 2024, due to its widespread clinical acceptance, superior diagnostic accuracy, and ability to extract larger tissue samples compared to fine needle aspiration. Core needle biopsy procedures are increasingly used in both hospitals and diagnostic centers across Asia-Pacific as they balance diagnostic reliability with a minimally invasive approach. Their adoption is particularly strong in China and Japan, where advanced imaging infrastructure supports these procedures. In addition, rising awareness about early-stage breast cancer detection has fueled demand for this technique, as it reduces unnecessary surgeries while ensuring precise diagnosis. Clinical guidelines in multiple countries also recommend core needle biopsy as a standard for breast cancer confirmation, further strengthening its dominance.

The MRI-guided core needle biopsy segment is expected to register the fastest growth during the forecast period, driven by its ability to detect and accurately sample lesions that are not visible on mammography or ultrasound. This advanced technique is gaining traction in urban hospitals and specialized cancer centers, especially in Japan, South Korea, and Australia, where MRI adoption is high. The growing number of high-risk breast cancer patients and expansion of advanced imaging facilities are also boosting this segment. Although cost-intensive, MRI-guided biopsy is increasingly being reimbursed in developed Asian countries, encouraging greater uptake. With improved accuracy and the ability to detect early-stage cancers missed by conventional methods, MRI-guided core needle biopsy is projected to expand rapidly in Asia-Pacific markets.

- By Guidance Technology

On the basis of guidance technology, the Asia-Pacific breast biopsy devices market is segmented into ultrasound-guided, mammography-guided, magnetic resonance, CT-guided biopsy, and other image-guided breast biopsy. The ultrasound-guided biopsy segment dominated the market in 2024, driven by its wide accessibility, relatively low cost, and suitability for real-time imaging in breast cancer diagnosis. Ultrasound-guided procedures are widely adopted in both developed and emerging economies across Asia-Pacific because they require less infrastructure compared to MRI or CT systems. The technique offers minimal patient discomfort, high diagnostic accuracy for palpable and non-palpable lesions, and quick procedural times, making it a standard choice for hospitals and diagnostic centers. Furthermore, the growing availability of portable ultrasound systems has expanded access to rural and semi-urban healthcare facilities, contributing to the dominance of this segment.

The MRI-guided biopsy segment is anticipated to grow at the fastest rate during the forecast period, due to its ability to detect lesions that are challenging to identify using mammography or ultrasound. MRI-guided biopsies are particularly useful for high-risk patients with dense breast tissue, a condition prevalent in parts of Asia-Pacific. The rising availability of MRI machines in urban hospitals in China, Japan, and India is driving this trend. As patient awareness and demand for early and accurate diagnosis grow, healthcare providers are increasingly adopting MRI-guided biopsy systems despite higher costs. The improved reimbursement landscape in developed Asian markets is also supporting its uptake, making MRI-guided biopsies the fastest growing guidance technology segment.

- By End User

On the basis of end user, the Asia-Pacific breast biopsy devices market is segmented into hospitals, ambulatory surgical centers, diagnostic centers, and others. The hospitals segment dominated the market with the largest revenue share in 2024, owing to the availability of advanced imaging infrastructure, multidisciplinary oncology teams, and greater patient trust in hospital-based diagnostics. Large hospitals in China, Japan, India, and South Korea are major adopters of advanced breast biopsy systems, particularly core needle and imaging-guided devices. The presence of skilled oncologists and radiologists further strengthens hospitals’ role as primary centers for breast cancer diagnosis. Hospitals also benefit from government and private screening programs, which direct patients for confirmatory biopsies in hospital settings. Their strong purchasing power allows adoption of advanced biopsy platforms, reinforcing their leadership in this segment.

The diagnostic centers segment is projected to witness the fastest growth during the forecast period, driven by the growing trend of outpatient and preventive screening services. Diagnostic centers are expanding rapidly across urban and semi-urban regions of Asia-Pacific, particularly in India and Southeast Asia, offering convenient and affordable diagnostic solutions. With rising awareness about breast cancer and increased referrals from general practitioners, more patients are visiting diagnostic centers for imaging and biopsy services. These centers are increasingly investing in advanced biopsy needles and imaging-guided systems to provide accurate results while keeping costs lower than hospitals. The shift toward outpatient cancer diagnostics and growing private investment in standalone diagnostic centers are expected to accelerate this segment’s growth.

Asia-Pacific Breast Biopsy Devices Market Regional Analysis

- China dominated the Asia-Pacific breast biopsy devices market with the largest revenue share of 38.4% in 2024, supported by a vast patient pool, rapid expansion of healthcare infrastructure, and increased investments in diagnostic imaging technologies, with Japan and India also showing strong adoption through government-driven cancer awareness programs and the entry of international device manufacturers

- Patients and healthcare providers in China highly value the accuracy, minimally invasive features, and integration of biopsy devices with imaging technologies such as ultrasound, mammography, and MRI, which are increasingly available in leading hospitals and cancer centers

- This strong adoption is further supported by government-led cancer screening initiatives, rising healthcare expenditure, and growing awareness of early detection, establishing China as the leading market for breast biopsy devices within the Asia-Pacific region

The China Breast Biopsy Devices Market Insight

The China breast biopsy devices market captured the largest revenue share of 38.4% in Asia-Pacific in 2024, fueled by the country’s vast patient pool, rising breast cancer incidence, and strong investments in healthcare infrastructure. Hospitals and diagnostic centers are increasingly adopting advanced biopsy needles, guidance systems, and imaging technologies to improve early detection and diagnostic accuracy. Government-led cancer screening initiatives and expanding insurance coverage are further supporting market adoption. The presence of both international players and domestic manufacturers enhances product availability, making China the leading market in the region.

Japan Breast Biopsy Devices Market Insight

The Japan breast biopsy devices market is gaining momentum due to its advanced healthcare infrastructure, strong emphasis on early cancer detection, and high patient awareness. Japanese hospitals and cancer centers are adopting core needle and MRI-guided biopsy techniques to improve diagnostic precision. Integration with advanced imaging systems ensures improved workflow efficiency and patient comfort. Moreover, favorable reimbursement policies and government support for preventive screening programs are fueling demand. Japan’s strong inclination toward cutting-edge technology makes it a high-value market within Asia-Pacific.

India Breast Biopsy Devices Market Insight

The India breast biopsy devices market is anticipated to grow at the fastest CAGR within Asia-Pacific, supported by rising breast cancer prevalence, expanding healthcare expenditure, and increasing awareness of early detection. The country’s growing middle class and rapid expansion of private diagnostic centers are boosting adoption of biopsy needles and ultrasound-guided procedures. Government-led awareness campaigns and the rollout of cancer screening programs across urban and semi-urban areas are further driving market demand. The presence of both international device suppliers and cost-effective local manufacturers positions India as a rapidly expanding market.

South Korea Breast Biopsy Devices Market Insight

The South Korea breast biopsy devices market is expanding steadily, driven by high healthcare expenditure, rising breast cancer cases, and widespread adoption of advanced diagnostic imaging systems. The country’s technologically sophisticated hospitals and diagnostic centers are early adopters of MRI- and ultrasound-guided biopsy techniques, improving accuracy in cancer detection. In addition, government-backed cancer awareness campaigns, coupled with a preference for minimally invasive diagnostic procedures, are expected to strengthen South Korea’s position as a key growth contributor in the Asia-Pacific breast biopsy devices market.

Asia-Pacific Breast Biopsy Devices Market Share

The Asia-Pacific Breast Biopsy Devices industry is primarily led by well-established companies, including:

- Hologic, Inc. (U.S.)

- BD (U.S.)

- FUJIFILM Holdings Corporation (Japan)

- Siemens Healthineers AG (Germany)

- Medtronic (Ireland)

- Olympus Corporation (Japan)

- GE HealthCare (U.S.)

- Boston Scientific Corporation (U.S.)

- Johnson & Johnson Services, Inc. (U.S.)

- Argon Medical Devices, Inc. (U.S.)

- Cook (U.S.)

- Planmed Oy (Finland)

- Scion Medical Technologies, LLC (U.S.)

- SOMATEX Medical Technologies GmbH (Germany)

- Trivitron Healthcare (India)

- Cigna Healthcare (U.S.)

- Cardinal Health, Inc. (U.S.)

- MEDAX S.R.L. Unipersonale (Italy)

What are the Recent Developments in Asia-Pacific Breast Biopsy Devices Market?

- In September 2025, the Kalyan Singh Super Specialty Cancer Institute in Lucknow, India installed a Hologic Selenia Dimensions 3D digital mammography unit with stereotactic and tomosynthesis-guided biopsy capability, enhancing precision for lesion detection and biopsy sampling

- In November 2024, Mammotome launched the AutoCore™ Single Insertion Spring-Loaded Core Biopsy System, a novel automated core needle device designed for simplified ultrasound-guided biopsies and improved ergonomics

- In September 2023, Hologic and Bayer announced an international partnership to deliver a comprehensive contrast-enhanced mammography package to breast imaging facilities. This collaboration aims to enhance breast cancer detection by combining Hologic's imaging systems with Bayer's contrast agents, providing clinicians with improved diagnostic capabilities

- In September 2021, Medtronic launched its Hugo™ robotic-assisted surgery (RAS) system in India, marking a significant step in the Asia-Pacific market. While this is a general surgery platform, its introduction is a major development for the region's adoption of advanced robotic technology for minimally invasive procedures, which has implications for various surgical fields, including breast biopsies

- In January 2021, Hologic, a leading medical technology company, announced the acquisition of SOMATEX Medical Technologies GmbH, a leader in biopsy site markers and localization technologies. This acquisition was a strategic move to strengthen Hologic's breast marker portfolio and expand its presence in the breast health solutions market, including in the Asia-Pacific region

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.