Global Core Needle Biopsy Market

Market Size in USD Million

CAGR :

%

USD

473.79 Million

USD

582.24 Million

2025

2033

USD

473.79 Million

USD

582.24 Million

2025

2033

| 2026 –2033 | |

| USD 473.79 Million | |

| USD 582.24 Million | |

|

|

|

|

Core Needle Biopsy Market Size

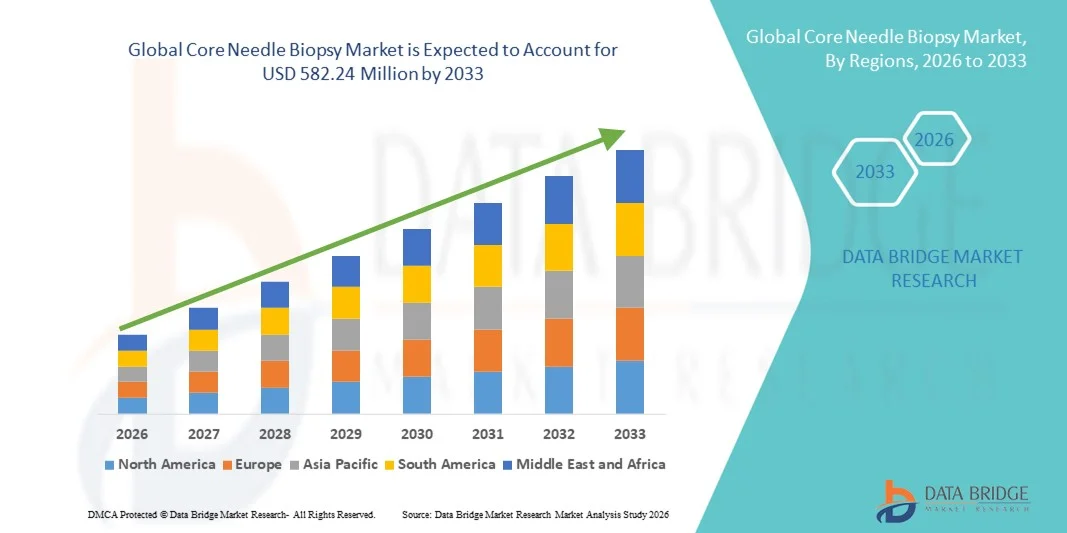

- The global core needle biopsy market size was valued at USD 473.79 million in 2025 and is expected to reach USD 582.24 million by 2033, at a CAGR of 2.61% during the forecast period

- The market growth is primarily driven by the increasing prevalence of cancer worldwide, rising awareness of early disease diagnosis, and the growing demand for minimally invasive diagnostic procedures across healthcare facilities

- Furthermore, advancements in biopsy needle design, improved imaging guidance technologies, and the expansion of healthcare infrastructure in emerging economies are reinforcing the adoption of core needle biopsy systems. These combined factors are accelerating market penetration and supporting steady global growth

Core Needle Biopsy Market Analysis

- Core needle biopsy, a minimally invasive diagnostic technique for obtaining tissue samples, plays a vital role in accurate cancer diagnosis and monitoring due to its efficiency, safety, and ability to deliver reliable histopathological results

- The market’s growth is primarily driven by the increasing global prevalence of cancer, rising awareness about early disease detection, and the growing preference for minimally invasive procedures over surgical alternatives in clinical and hospital settings

- North America dominated the core needle biopsy market with the largest revenue share of 40.2% in 2025, supported by advanced diagnostic infrastructure, strong adoption of automated biopsy systems, and the high frequency of cancer screening programs in the U.S. and Canada

- Asia-Pacific is projected to be the fastest-growing region during the forecast period, attributed to expanding healthcare access, government-led cancer awareness campaigns, and rapid technological advancements in biopsy guidance systems

- The full-automated core needle biopsy device segment dominated the market with the largest market share of 46.7% in 2025, driven by its enhanced precision, operational efficiency, and growing utilization in hospitals and diagnostic laboratories for high-volume biopsy procedures

Report Scope and Core Needle Biopsy Market Segmentation

|

Attributes |

Core Needle Biopsy Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework |

Core Needle Biopsy Market Trends

Technological Advancements in Automated and Image-Guided Biopsy Systems

- A key and accelerating trend in the global core needle biopsy market is the integration of advanced imaging technologies and automation, enhancing the precision, efficiency, and safety of biopsy procedures

- For instance, companies are developing full-automated biopsy devices that combine real-time ultrasound or MRI guidance, allowing physicians to target lesions with greater accuracy while reducing patient discomfort and procedure time

- The adoption of automated and image-guided systems enables consistent tissue sampling, minimizing operator dependency and improving diagnostic reliability, particularly in complex cancer cases

- Furthermore, the incorporation of digital imaging and robotic-assisted guidance enhances workflow efficiency and supports remote or AI-assisted diagnostics, particularly beneficial in high-volume clinical settings

- The seamless integration of these technologies with diagnostic imaging platforms facilitates faster analysis and improved patient outcomes, aligning with the growing demand for minimally invasive procedures

- This trend toward automation, precision, and integration is reshaping biopsy practices, prompting leading manufacturers such as BD and Hologic to expand their portfolios with AI-assisted, image-guided, and fully automated core biopsy systems

- The demand for technologically advanced biopsy devices is rapidly increasing across hospitals and diagnostic centers, as healthcare providers prioritize accuracy, efficiency, and patient safety in cancer diagnosis and tissue sampling

Core Needle Biopsy Market Dynamics

Driver

Rising Cancer Prevalence and Growing Preference for Minimally Invasive Diagnostics

- The escalating global burden of cancer and the rising awareness of early disease detection are key drivers fueling the demand for core needle biopsy procedures worldwide

- For instance, the World Health Organization reported over 20 million new cancer cases in 2024, prompting a surge in diagnostic procedures utilizing core needle biopsy as a standard approach for tissue analysis

- As healthcare systems increasingly prioritize early detection and precision diagnostics, core needle biopsy offers a safer, faster, and less invasive alternative to surgical biopsies, leading to higher patient acceptance rates

- Furthermore, the shift toward outpatient and day-care diagnostic settings has expanded the use of compact and automated biopsy devices that enhance efficiency and reduce recovery time

- The continuous innovation in device design, coupled with improved imaging compatibility, is further driving adoption across hospitals, clinics, and cancer specialty centers globally

- The rising demand for personalized medicine and molecular profiling is increasing the use of tissue-based diagnostics, directly supporting the uptake of core needle biopsy samples for genomic and biomarker testing

- Government initiatives promoting cancer screening and diagnostic infrastructure development, especially in emerging economies, are further amplifying market growth potential

Restraint/Challenge

Risk of Complications and Stringent Regulatory Requirements

- Despite its benefits, the core needle biopsy market faces challenges due to risks such as bleeding, infection, or tissue damage, which can affect patient confidence and clinical outcomes

- For instance, certain biopsy procedures involving delicate organs such as the liver or lung require advanced imaging and skilled operators to minimize complications, increasing procedural complexity and cost

- Strict regulatory approval processes for new biopsy devices, including requirements from the FDA and European MDR, can delay product launches and limit innovation speed in global markets

- In addition, variations in biopsy standards and reimbursement policies across regions create barriers for manufacturers seeking consistent market entry and expansion

- Overcoming these challenges through improved safety designs, clinical training programs, and faster regulatory pathways will be essential to ensuring sustainable market growth

- Limited access to skilled radiologists and interventional specialists in low- and middle-income countries continues to restrict the widespread adoption of advanced core biopsy devices

- High initial investment costs and lack of standardization across healthcare facilities further hinder the scalability of automated and image-guided biopsy systems in resource-constrained settings

Core Needle Biopsy Market Scope

The market is segmented on the basis of type, applications, disease, range, and distribution channel.

- By Type

On the basis of type, the core needle biopsy market is segmented into full-automated core needle biopsy devices and semi-automated core needle biopsy devices. The full-automated core needle biopsy device segment dominated the market with the largest market revenue share of 46.7% in 2025, driven by its superior accuracy, reduced operator dependency, and growing adoption in high-volume hospital settings. Full-automated systems offer consistent sample quality, shorter procedure times, and tighter integration with imaging modalities (ultrasound/MRI), which makes them preferred in tertiary care and oncology centers. They also reduce variability across operators, improving diagnostic reproducibility and enabling streamlined pathology workflows. Service contracts and bundled solutions from leading manufacturers further encourage hospital procurement of automated platforms.

The semi-automated core needle biopsy device segment is anticipated to witness the fastest growth rate of 5.8% from 2026 to 2033, supported by its lower capital cost, portability, and simpler maintenance requirements. Semi-automated devices are attractive to outpatient clinics, smaller hospitals, and mobile screening programs because they balance performance with affordability. Their ease of use allows surgeons and radiologists in resource-constrained settings to perform reliable biopsies without the overhead of full automation. Growing screening initiatives in emerging markets and the need for point-of-care diagnostics will further propel semi-automated adoption.

- By Applications

On the basis of applications, the market is divided into hospitals, clinics, and others. The hospitals segment dominated the market with the largest revenue share of 62.3% in 2025, due to concentrated patient volumes, availability of advanced imaging suites, and multidisciplinary teams that perform image-guided biopsies routinely. Hospitals benefit from integrated pathology services and reimbursement frameworks that support biopsy procedures, making them the primary end-users of both automated and semi-automated systems. Large hospitals also drive product adoption through clinical trials and partnerships with device manufacturers, accelerating clinician familiarity and trust. Access to specialists and peri-procedural care further cements hospitals as the dominant application setting.

The clinics segment is expected to register the fastest CAGR of 7.4% during 2026–2033, as outpatient and ambulatory care centers increasingly offer minimally invasive diagnostics to improve patient convenience and reduce healthcare costs. Clinics are investing in compact biopsy systems and training to handle higher case loads without hospital admission. This shift is supported by telepathology services and faster sample transport logistics that permit clinic-based diagnosis. As patient preference for same-day, lower-cost procedures grows, clinics will capture a rising share of routine biopsy volumes.

- By Disease

On the basis of disease, the market is categorized into lung cancer, liver cancer, breast cancer, and prostate cancer. The breast cancer segment dominated the market with the largest share of 41.5% in 2025, reflecting high screening rates, widespread availability of mammography/ultrasound guidance, and the preference for core needle biopsy as the diagnostic standard for suspicious breast lesions. Breast biopsy workflows are well-established across screening programs and specialist breast centers, driving consistent demand for compatible biopsy needles and devices. The need for tissue adequate for histopathology and receptor testing (ER/PR/HER2) further sustains core needle use in breast diagnostics.

The lung cancer segment is expected to witness the fastest growth with a CAGR of 6.1% from 2026 to 2033, driven by rising lung cancer incidence, improved CT- and bronchoscopy-guided biopsy techniques, and greater emphasis on obtaining tissue for molecular profiling. Advances in navigational bronchoscopy and percutaneous CT guidance reduce complication rates and expand the feasibility of lung biopsies. As targeted therapies and genomic testing proliferate, demand for high-quality lung tissue samples will grow, encouraging adoption of specialized needles and image-guided systems.

- By Range

On the basis of range, the market is segmented into 14G–18G, <14G, and >18G. The 14G–18G segment dominated the market in 2025 with the largest revenue share of 57.0%, because this gauge range offers an optimal trade-off between sample size and safety for common indications such as breast, prostate, and liver biopsies. Clinicians favor 14G–18G needles for routine histopathology and immunohistochemistry while maintaining acceptable complication profiles. Their compatibility with a wide array of automated and semi-automated guns and imaging guidance systems further cements their leading position. Standardization around these gauges simplifies inventory and training across institutions.

The <14G segment is projected to register the fastest growth rate of 8.0% over the forecast period, as oncology centers and molecular labs increasingly require larger core samples for next-generation sequencing, multigene panels, and advanced biomarker testing. Larger-gauge needles enable retrieval of higher-integrity tissue suitable for complex molecular assays, companion diagnostics, and research applications. As precision medicine expands, demand for <14G sampling in specialized centers will rise, especially where comprehensive genomic profiling is routine.

- By Distribution Channel

On the basis of distribution channel, the market is bifurcated into direct sales and distributor channels. The direct sales segment dominated the market with the largest revenue share of 68.4% in 2025, driven by major manufacturers preferring direct relationships with large hospital systems to offer bundled procurement, training, and long-term service agreements. Direct channels allow suppliers to ensure device performance, regulatory compliance, and tailored clinical support—important for high-value automated platforms. Exclusive contracts and integrated solutions reinforce manufacturer–hospital partnerships and lock in recurring service revenues.

The distributor channel segment is expected to record the fastest growth rate of 6.5% from 2026 to 2033, as regional distributors expand reach into small hospitals, clinics, and emerging markets where direct manufacturer presence is limited. Distributors provide localized inventory, flexible financing, and after-sales service that lower market entry barriers. Their networks help manufacturers scale quickly and address diverse procurement practices across geographies, making distributors essential for market penetration in underserved regions.

Core Needle Biopsy Market Regional Analysis

- North America dominated the core needle biopsy market with the largest revenue share of 40.2% in 2025, supported by advanced diagnostic infrastructure, strong adoption of automated biopsy systems, and the high frequency of cancer screening programs in the U.S. and Canada

- The region’s growth is further propelled by increasing awareness regarding early cancer detection and the presence of major medical device manufacturers investing in automated biopsy technologies

- Technological innovation and research collaborations between hospitals and diagnostic firms have also boosted the development and utilization of full-automated biopsy systems, consolidating North America’s leadership in this sector

U.S. Core Needle Biopsy Market Insight

The U.S. core needle biopsy market accounted for the majority of North America’s revenue in 2025, propelled by an increasing burden of breast, lung, and prostate cancers. The country’s strong focus on cancer research, combined with rapid adoption of full-automated biopsy systems, underpins market growth. Supportive healthcare policies, insurance coverage for diagnostic procedures, and ongoing clinical innovations continue to accelerate adoption in hospitals and diagnostic centers. Moreover, the integration of AI-based imaging tools and robotic-assisted biopsy devices is enhancing diagnostic precision and efficiency.

Europe Core Needle Biopsy Market Insight

The Europe core needle biopsy market is projected to expand at a steady CAGR during the forecast period, driven by the rising cancer prevalence, supportive government screening programs, and an increasing shift toward outpatient diagnostic services. Growing awareness of early detection, especially for breast and prostate cancer, is supporting the adoption of core biopsy systems across the region. European healthcare institutions are also investing in technologically advanced and patient-friendly biopsy solutions. Furthermore, collaborations between academic research centers and medical device firms are promoting the development of innovative, automated biopsy platforms.

U.K. Core Needle Biopsy Market Insight

The U.K. core needle biopsy market is anticipated to register notable growth throughout the forecast period, supported by robust cancer screening initiatives and NHS-led programs promoting early diagnosis. The country’s focus on improving diagnostic accuracy and reducing waiting times has encouraged the adoption of automated and image-guided biopsy devices in hospitals and specialized clinics. In addition, ongoing investments in healthcare digitalization and partnerships with global medtech firms are enhancing access to advanced biopsy technologies.

Germany Core Needle Biopsy Market Insight

The Germany core needle biopsy market is expected to expand at a significant CAGR through 2033, owing to the country’s strong healthcare infrastructure, high awareness of cancer diagnostics, and technological innovation. Germany’s emphasis on precision medicine and digital integration in diagnostic workflows has accelerated the use of full-automated biopsy systems. The adoption of image-guided and vacuum-assisted biopsy devices is particularly strong across oncology centers and hospitals. Continuous R&D investments and favorable government support for cancer screening programs further strengthen market growth.

Asia-Pacific Core Needle Biopsy Market Insight

The Asia-Pacific core needle biopsy market is poised to grow at the fastest CAGR of 6.9% during the forecast period (2026–2033), fueled by rising cancer incidence, improving healthcare accessibility, and rapid technological adoption in countries such as China, Japan, and India. Increasing healthcare expenditure, coupled with government-backed cancer awareness initiatives, is expanding the market’s diagnostic reach. The growing availability of affordable biopsy devices and the emergence of local manufacturers are enhancing penetration in emerging economies.

Japan Core Needle Biopsy Market Insight

The Japan core needle biopsy market is witnessing notable growth, supported by the country’s aging population and strong emphasis on early cancer detection. Hospitals are rapidly adopting image-guided and minimally invasive biopsy systems to improve diagnostic accuracy and patient comfort. Technological innovation, particularly in robotic and automated biopsy devices, is gaining traction among Japanese healthcare providers. The integration of biopsy tools with AI-based imaging platforms is also strengthening diagnostic capabilities across oncology departments.

India Core Needle Biopsy Market Insight

The India core needle biopsy market accounted for a substantial share of the Asia-Pacific region in 2025, driven by expanding cancer screening programs, increasing healthcare investment, and rapid urbanization. The growing number of diagnostic laboratories and hospitals adopting biopsy procedures, along with improved healthcare infrastructure, supports strong market growth. Domestic manufacturing of cost-effective biopsy devices is also contributing to market accessibility. Furthermore, rising awareness about early cancer detection and partnerships between global medtech companies and local distributors are fostering widespread adoption across the country.

Core Needle Biopsy Market Share

The Core Needle Biopsy industry is primarily led by well-established companies, including:

- Hologic, Inc. (U.S.)

- BD (U.S.)

- Cook (U.S.)

- B. Braun SE (Germany)

- Cardinal Health (U.S.)

- Merit Medical Systems, Inc. (U.S.)

- Devicor Medical Products, Inc. (U.S.)

- AngioDynamics, Inc. (U.S.)

- PAJUNK (Germany)

- NeoDynamics AB (Sweden)

- Limaca Medical Ltd. (Israel)

- Mermaid Medical System (Denmark)

- Argon Medical Devices, Inc. (U.S.)

- Olympus Corporation (Japan)

- Teleflex Incorporated (U.S.)

- Medline Industries, Inc. (U.S.)

- SOMATEX Medical Technologies GmbH (Germany)

- Xerus Medical Inc. (U.S.)

- Endomag Ltd. (U.K.)

- Invendo Medical GmbH (Germany)

What are the Recent Developments in Global Core Needle Biopsy Market?

- In June 2025, Mermaid Medical Group® announced the launch of its Full Core Biopsy Device, featuring millimeter-by-millimeter adjustable throw length, an ultra-lightweight design compatible with CT gantries, and an internal sample capture mechanism to minimize crush damage and preserve sample integrity. The device provides flexibility for clinicians across a wide range of tissue types, enabling tailored sampling depth and enhanced core quality

- In November 2024, Mammotome introduced the Mammotome AutoCore™ Single-Insertion Core Biopsy System in the U.S., offering one-button automated arming and simplified workflow to reduce steps and improve ultrasound-guided breast biopsy efficiency. The device enables clinicians to perform precise tissue sampling with reduced procedure time and improved ergonomic handling, making it suitable for high-volume clinical settings

- In September 2024, Mammotome expanded its HydroMARK™ Plus Breast Biopsy Site Marker portfolio by introducing the new “Hummingbird™” marker shape (in addition to Dragonfly™) to enhance ultrasound visibility and reduce displacement in breast biopsy localization. These new configurations improve post-procedure lesion identification and tracking for follow-up imaging, a crucial factor in personalized breast cancer management

- In September 2023, Limaca Medical Ltd. received U.S. FDA 510(k) clearance for its Precision-GI™ Endoscopic Ultrasound (EUS) Biopsy Device, developed to enhance gastrointestinal lesion sampling with improved automation. The Precision-GI™ device allows for continuous sample acquisition under ultrasound guidance, reducing the number of insertions and improving tissue integrity. Its automated vacuum-assisted system ensures consistent suction and reliable core collection, which supports more accurate pathological assessment

- In April 2023, NeoDynamics, Inc. announced the U.S. availability of NEONAVIA, the first pulse-technology biopsy system cleared for breast and axillary lymph node biopsies aiming to provide more controlled needle insertion and higher tissue yield from difficult lesions. The NEONAVIA system utilizes pulse-driven needle movements to achieve precise, consistent sampling and reduce tissue trauma during the procedure

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.