Asia Pacific Cell Based Assays Market

Market Size in USD Billion

CAGR :

%

USD

4.07 Billion

USD

10.90 Billion

2025

2033

USD

4.07 Billion

USD

10.90 Billion

2025

2033

| 2026 –2033 | |

| USD 4.07 Billion | |

| USD 10.90 Billion | |

|

|

|

|

Asia-Pacific Cell Based Assays Market Size

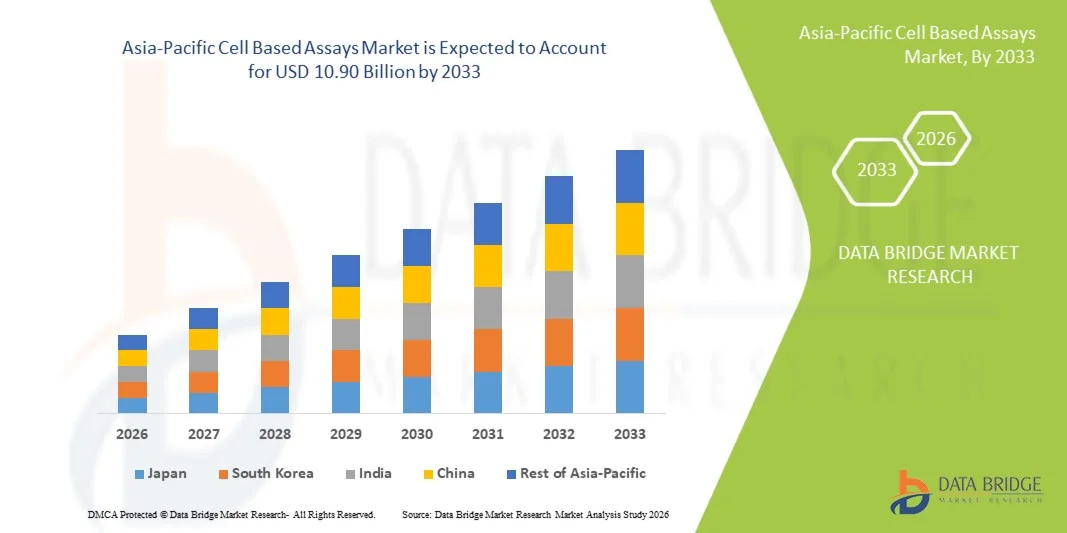

- The Asia-Pacific cell based assays market size was valued at USD 4.07 billion in 2025 and is expected to reach USD 10.90 billion by 2033, at a CAGR of 13.1% during the forecast period

- The market growth is largely fueled by increasing investments in pharmaceutical and biotech R&D, rising adoption of cell-based assays for drug discovery, toxicity testing, and diagnostics, and the expansion of research infrastructure across the region

- Furthermore, growing outsourcing of research services to Asia-Pacific countries, coupled with technological advancements in assay platforms and increasing prevalence of chronic diseases, is driving demand for reliable, efficient, and scalable cell-based assay solutions, thereby accelerating the market’s growth

Asia-Pacific Cell Based Assays Market Analysis

- Cell-based assays, providing reliable platforms for drug discovery, toxicity testing, and disease modeling, are increasingly vital components of pharmaceutical, biotechnology, and academic research in Asia-Pacific countries due to their ability to deliver physiologically relevant results, scalability, and compatibility with high-throughput screening systems

- The escalating demand for cell-based assays is primarily fueled by rising investments in R&D, growing prevalence of chronic and lifestyle-related diseases, and increasing adoption of advanced assay technologies such as 3D cell culture and high-content screening

- China dominated the Asia-Pacific cell-based assays market with the largest revenue share of 42% in 2025, characterized by strong government support for biotechnology, rapidly expanding pharmaceutical manufacturing, and a growing network of contract research organizations (CROs), with India and Japan also experiencing substantial growth driven by increased outsourcing of research services and advanced laboratory infrastructure

- India is expected to be the fastest-growing country in the Asia-Pacific cell-based assays market during the forecast period due to increasing pharmaceutical and biotech research activities, rising healthcare expenditure, and expanding adoption of automated and high-throughput assay platforms

- Cell Viability Assay segment dominated the Asia-Pacific cell-based assays market with a market share of 38.5% in 2025, driven by its widespread use in drug discovery and toxicity testing, ease of standardization, and critical role in assessing cell health and functionality across diverse research applications

Report Scope and Asia-Pacific Cell Based Assays Market Segmentation

|

Attributes |

Asia-Pacific Cell Based Assays Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

Asia-Pacific

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework |

Asia-Pacific Cell Based Assays Market Trends

“Advancements Through 3D Cell Culture and High-Content Screening”

- A significant and accelerating trend in the Asia-Pacific cell-based assays market is the increasing adoption of 3D cell culture models and high-content screening technologies, providing more physiologically relevant and high-throughput solutions for drug discovery and toxicity testing

- For instance, Corning’s 3D spheroid culture plates enable researchers in China and India to perform scalable 3D assays for oncology and cardiotoxicity studies, improving predictive accuracy over traditional 2D models

- High-content screening integration allows automated imaging and multiparametric analysis, helping researchers obtain detailed cellular responses and enabling more efficient lead optimization in pharmaceutical pipelines

- The seamless combination of advanced cell culture techniques with automated analysis platforms facilitates centralized assay workflows, reducing manual errors and increasing reproducibility across research labs

- Increasing adoption of label-free detection technologies is allowing real-time monitoring of cellular responses without interfering with cell viability or function, enhancing assay reliability

- The trend toward integrating AI-based image analysis and predictive modeling is helping researchers interpret complex datasets faster, accelerating drug discovery cycles

- This trend toward more physiologically relevant and automated assay platforms is reshaping expectations in preclinical research, driving companies such as STEMCELL Technologies to develop enhanced 3D-compatible reagents and imaging solutions

- The demand for advanced 3D and high-content screening-based assays is growing rapidly across pharmaceutical, biotech, and academic institutions, as researchers increasingly prioritize predictive, scalable, and reproducible experimental systems

Asia-Pacific Cell Based Assays Market Dynamics

Driver

“Increasing Pharmaceutical R&D and Biotech Investments”

- The rising investments in pharmaceutical and biotechnology research in Asia-Pacific countries are a major driver of the growing demand for cell-based assays

- For instance, in March 2025, WuXi AppTec expanded its preclinical R&D services in China, incorporating high-throughput cell-based assay platforms for drug screening, enhancing service offerings for international clients

- Governments and private organizations are increasing funding for innovative therapeutics, driving adoption of reliable, scalable assay platforms to accelerate drug discovery and translational research

- Growing prevalence of chronic diseases, oncology research, and regenerative medicine initiatives are creating higher demand for advanced assays capable of producing physiologically relevant data

- The convenience of outsourcing assays to CROs equipped with automated and high-throughput platforms further fuels adoption across both pharmaceutical and academic sectors

- Expanding collaborations between universities, biotech startups, and pharma companies in countries such as India and Japan are fostering innovation and broader implementation of cell-based assays

- Increasing awareness of personalized medicine approaches is driving demand for patient-derived cell models, further accelerating the uptake of advanced cell-based assay platforms

Restraint/Challenge

“High Costs and Technical Complexity”

- The relatively high cost of advanced cell-based assay reagents, instruments, and automated platforms presents a significant barrier to widespread adoption, especially for smaller research labs

- For instance, high-content imaging systems or specialized 3D culture kits from companies such as PerkinElmer can be prohibitively expensive for early-stage biotech firms in India or Southeast Asia

- Technical complexity and the requirement for skilled personnel to operate sophisticated assay platforms limit accessibility in some emerging markets, slowing adoption rates despite increasing demand

- Ensuring standardization, reproducibility, and compliance with regulatory guidelines across multiple laboratories is a challenge, particularly when outsourcing assays to contract research organizations

- Variability in regulatory frameworks across Asia-Pacific countries can delay market entry of novel assay technologies, increasing time-to-market and operational complexity

- Limited availability of high-quality human cell lines and patient-derived samples in some regions restricts the scope of assay applications and experimental reproducibility

- Overcoming these challenges through cost-effective assay kits, training programs, and collaborative research initiatives will be vital to sustain growth and maximize the potential of the Asia-Pacific cell-based assays market

Asia-Pacific Cell Based Assays Market Scope

The market is segmented on the basis of type, product and services, technology, application, end user, and distribution channel.

- By Type

On the basis of type, the Asia-Pacific cell-based assays market is segmented into cell viability assay, cytotoxicity assay, cell death assay, cell proliferation assay, and others. The Cell Viability Assay segment dominated the market with the largest revenue share of 38.5% in 2025, driven by its critical role in assessing cell health, proliferation, and cytotoxicity in drug discovery and preclinical studies. These assays are widely used in oncology, cardiotoxicity, and neurotoxicity studies, providing reliable and reproducible results for both pharmaceutical and academic research. The segment benefits from easy standardization and compatibility with multiple cell types and assay platforms. High adoption is further supported by increasing use in high-throughput and 3D cell culture models. Major suppliers in China, India, and Japan are expanding reagent and kit portfolios to meet growing demand. Overall, the reliability and versatility of cell viability assays make them the preferred choice for large-scale research applications.

The Cell Proliferation Assay segment is expected to witness the fastest growth rate of 14.2% CAGR from 2026 to 2033, driven by rising adoption in oncology, regenerative medicine, and stem cell research. Proliferation assays provide critical insights into cell growth and replication, supporting early-stage drug screening and mechanistic studies. Increasing investment in research infrastructure in China and India fuels segment growth. Personalized medicine and patient-derived cell models are creating higher demand for proliferation assays. Integration with automated and high-content platforms further accelerates adoption. Collaborations between academic institutions and pharma companies are also promoting use in high-throughput workflows.

- By Product and Services

On the basis of product and services, the market is segmented into consumables, services, instruments, and software. The Consumables segment dominated the market with a share of 41% in 2025, as reagents, assay kits, plates, and culture media are essential for assay consistency and reproducibility. Consumables are critical for high-throughput and 3D cell culture applications, widely used across pharmaceutical, biotech, and academic research. Suppliers in Asia-Pacific are expanding offerings to meet both small and large laboratory needs. The segment benefits from increasing automation in assay workflows, reducing manual errors. Availability of standardized kits compatible with multiple assay types enhances adoption. Overall, consumables remain indispensable for efficient and reliable cell-based research.

The Instruments segment is expected to witness the fastest CAGR of 13.5% from 2026 to 2033, driven by growing adoption of automated platforms, high-content imaging systems, and flow cytometers. Instruments enable high-throughput, multiparametric analysis and reduce human error in complex assays. Rising investments in laboratory infrastructure in China, India, and Japan support segment growth. Integration with AI and digital platforms enhances data acquisition and analytics. Pharmaceutical and biotech companies are increasingly investing in advanced instruments to accelerate drug discovery. Adoption is further fueled by the growing use of 3D and patient-derived cell models.

- By Technology

On the basis of technology, the market is segmented into flow cytometry, high throughput screening, high content screening, and label-free detection. The High Throughput Screening (HTS) segment dominated the market with a share of 36% in 2025, due to its ability to screen thousands of compounds rapidly in drug discovery and toxicity studies. HTS is widely used in pharmaceutical labs and CROs across Asia-Pacific. Automation and robotics in HTS increase reproducibility and efficiency. The segment benefits from large compound libraries and combinatorial chemistry trends. Countries such as China and India are expanding HTS infrastructure in CROs and pharma R&D. Overall, HTS enables fast and reliable preclinical research, reinforcing its dominance.

The High Content Screening (HCS) segment is expected to witness the fastest CAGR of 15% from 2026 to 2033, driven by demand for detailed cellular and subcellular analysis. HCS platforms allow multiparametric imaging and analysis, essential for phenotypic screening and mechanistic studies. Growth is supported by adoption of 3D culture models and organ-on-chip systems in China and India. Integration with AI-based image analysis enhances throughput and data interpretation. HCS is increasingly used in personalized medicine and patient-derived cell research. Pharmaceutical and academic labs are investing in HCS to accelerate drug discovery.

- By Application

On the basis of application, the market is segmented into drug discovery, basic research, and others. The Drug Discovery segment dominated the market with a share of 44% in 2025, due to its role in preclinical testing, target validation, and compound screening. Pharmaceutical companies use these assays to reduce attrition rates and predict clinical outcomes. Growth is supported by oncology, cardiotoxicity, and neurotoxicity research in China, India, and Japan. Expansion of CRO services enhances market penetration. Standardized platforms and automation improve reproducibility and efficiency. Overall, drug discovery remains the key driver of cell-based assay adoption.

The Basic Research segment is expected to witness the fastest CAGR of 12.8% from 2026 to 2033, driven by increasing funding for academic studies, regenerative medicine, and stem cell research. Collaborations between universities, research institutes, and biotech firms promote adoption. Countries such as India and Japan are investing heavily in high-throughput and high-content platforms. Growth is further supported by translational research trends and mechanistic studies. Academic labs increasingly adopt automated systems for reproducibility. Personalized medicine research is also creating higher demand for advanced assay platforms.

- By End User

On the basis of end user, the market is segmented into pharmaceutical and biotechnology companies, contract research organizations (CROs), academic and research institutions, government organizations, and others. The Pharmaceutical and Biotechnology Companies segment dominated the market with a share of 46% in 2025, due to high demand for preclinical screening, toxicity testing, and lead optimization. Large R&D budgets in China, India, and Japan support adoption. Advanced automated platforms and standardized kits enhance efficiency. Growth is driven by biologics, gene therapy, and small molecule research. Reproducibility and scalability are key factors. Pharmaceutical adoption reinforces market dominance.

The CROs segment is expected to witness the fastest CAGR of 14% from 2026 to 2033, fueled by rising outsourcing of preclinical research in Asia-Pacific. CROs provide scalable solutions reducing in-house infrastructure needs. Facilities in China, India, and Southeast Asia are equipped with high-throughput and high-content platforms. Partnerships between CROs and pharma companies accelerate growth. The segment benefits from cost-effective services and specialized expertise. Expansion of contract research offerings further drives adoption.

- By Distribution Channel

On the basis of distribution channel, the market is segmented into direct and indirect. The Direct segment dominated the market with a share of 52% in 2025, as companies prefer procurement directly from manufacturers to ensure authenticity, quality, and technical support. Bulk purchasing by large labs and CROs supports dominance. Manufacturers provide installation, training, and after-sales support. Direct channels enhance customer trust and reliability. The segment is critical for high-value instruments and high-throughput platforms. Strong manufacturer presence in China, India, and Japan reinforces market share.

The Indirect segment is expected to witness the fastest CAGR of 13% from 2026 to 2033, driven by collaborations with distributors, resellers, and e-commerce platforms to expand reach in tier-2 cities and remote regions. Indirect channels provide smaller labs and academic institutions easier access to assay products. Digital B2B marketplaces in India, China, and Japan enhance availability. Indirect distribution ensures timely delivery and localized support. Growth is supported by rising biotech startups in emerging markets. Partnerships with specialized distributors accelerate adoption.

Asia-Pacific Cell Based Assays Market Regional Analysis

- China dominated the Asia-Pacific cell-based assays market with the largest revenue share of 42% in 2025, characterized by strong government support for biotechnology, rapidly expanding pharmaceutical manufacturing, and a growing network of contract research organizations (CROs)

- Researchers and institutions in the country highly value the reliability, scalability, and reproducibility offered by advanced cell-based assays for drug discovery, toxicity testing, and disease modeling

- This widespread adoption is further supported by strong government support for biotechnology initiatives, increasing private investments, and the rising prevalence of chronic and lifestyle-related diseases, establishing cell-based assays as a critical tool for both pharmaceutical companies and academic research centers

The China Cell-Based Assays Market Insight

The China cell-based assays market captured the largest revenue share in Asia-Pacific in 2025, fueled by robust government support for biotechnology initiatives, increasing private investments in pharmaceutical R&D, and expansion of CROs offering high-throughput and high-content screening services. Researchers and institutions in China prioritize reliable and scalable assay platforms for drug discovery, toxicity testing, and disease modeling. The growing prevalence of chronic diseases, oncology research, and regenerative medicine programs further accelerates adoption. Major suppliers are expanding reagent, kit, and instrument portfolios to meet increasing demand. Automation and advanced assay technologies enhance reproducibility and efficiency, reinforcing China’s market dominance in the region.

India Cell-Based Assays Market Insight

The India cell-based assays market accounted for a significant revenue share in Asia-Pacific in 2025, driven by rapid growth in pharmaceutical and biotechnology research, increasing healthcare expenditure, and rising adoption of automated assay platforms. India’s expanding network of CROs, academic research institutions, and biotech startups is fostering higher demand for advanced assay platforms, including 3D and high-content screening systems. Government initiatives supporting biotech innovation, combined with affordable assay solutions from domestic manufacturers, are further propelling market growth. The rising focus on personalized medicine and patient-derived cell models is increasing demand for sophisticated cell-based assays. In addition, collaborations between Indian research institutions and global pharma companies are accelerating adoption and technological advancement.

Japan Cell-Based Assays Market Insight

The Japan cell-based assays market is witnessing steady growth due to the country’s advanced pharmaceutical industry, focus on precision medicine, and high investment in life sciences research. Adoption is driven by increasing use of automated platforms, high-content screening, and organ-on-chip technologies for drug discovery and preclinical testing. Japan’s emphasis on translational research and regenerative medicine is further fueling demand for reliable and reproducible cell-based assays. Researchers prioritize advanced instruments and standardized reagents to enhance data quality and efficiency. Aging population trends are also contributing to increased focus on disease modeling and drug development applications. Integration of AI-based analysis and high-throughput platforms supports both commercial and academic research initiatives.

South Korea Cell-Based Assays Market Insight

The South Korea cell-based assays market is growing steadily, supported by strong government funding for biotechnology research and a rapidly expanding pharmaceutical sector. Adoption is driven by increasing use of high-content and high-throughput screening platforms in drug discovery and preclinical studies. South Korean researchers focus on precision medicine, regenerative medicine, and oncology studies, increasing demand for reliable cell-based assays. Collaborations with global pharmaceutical companies and CROs are fostering technology transfer and advanced assay adoption. Availability of high-quality reagents, kits, and instruments ensures accessibility across academic, biotech, and pharmaceutical research labs. The emphasis on innovation and development of automated platforms is accelerating the growth of South Korea’s cell-based assays market.

Asia-Pacific Cell Based Assays Market Share

The Asia-Pacific Cell Based Assays industry is primarily led by well-established companies, including:

- Thermo Fisher Scientific Inc. (U.S.)

- Bio-Rad Laboratories, Inc. (U.S.)

- BD (U.S.)

- Corning, Inc. (U.S.)

- Merck KGaA, (Germany)

- PerkinElmer (U.S.)

- Lonza (Switzerland)

- Promega Corporation (U.S.)

- Cell Signaling Technology, Inc. (U.S.)

- Charles River Laboratories (U.S.)

- Danaher (U.S.)

- Agilent Technologies, Inc. (U.S.)

- Eurofins Scientific SE (Luxembourg)

- Sartorius AG (Germany)

- BioTek Instruments, Inc. (U.S.)

- Enzo Biochem, Inc. (U.S.)

- Tecan Group Ltd., (Switzerland)

- GE Healthcare (U.K.)

- Miltenyi Biotec (Germany)

- QIAGEN (Netherlands)

What are the Recent Developments in Asia-Pacific Cell Based Assays Market?

- In July 2025, Sartorius AG launched the Incucyte CX3 Live‑Cell Analysis System a high‑throughput live‑cell analysis instrument with confocal fluorescence imaging designed for 3D cell models, enabling real-time monitoring of complex cell cultures with much greater throughput than previous systems

- In June 2025, Thermo Fisher Scientific expanded its cell‑based assay service offerings to include advanced 3D culture models and multiplex readout technologies, aimed at supporting more complex drug efficacy and safety testing signaling increasing commercial service capacity in Asia-Pacific and globally

- In March 2025, the global cell-based assays industry report highlighted a growing shift across the sector toward automation, 3D‑culture adoption and precision medicine, estimating rising demand in Asia-Pacific, particularly for drug discovery and toxicity testing using cell-based assays

- In January 2025, Eurofins DiscoverX launched a next-generation G‑protein-coupled receptor (GPCR) screening solution combining cell-based assays with novel reporter constructs enhancing receptor profiling accuracy across multiple therapeutic classes and broadening assay capabilities for drug developer

- In December 2024, Bio‑Techne Corporation expanded its cell‑based assay product line by launching validated assays for cytokine signaling and checkpoint inhibitor research enabling researchers to better support immunotherapy development and cell‑based functional assays in the Asia‑Pacific region and beyond

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.