Asia Pacific Contrast Media Injectors Market

Market Size in USD Million

CAGR :

%

USD

346.00 Million

USD

603.44 Million

2024

2032

USD

346.00 Million

USD

603.44 Million

2024

2032

| 2025 –2032 | |

| USD 346.00 Million | |

| USD 603.44 Million | |

|

|

|

|

Asia-Pacific Contrast Media Injectors Market Size

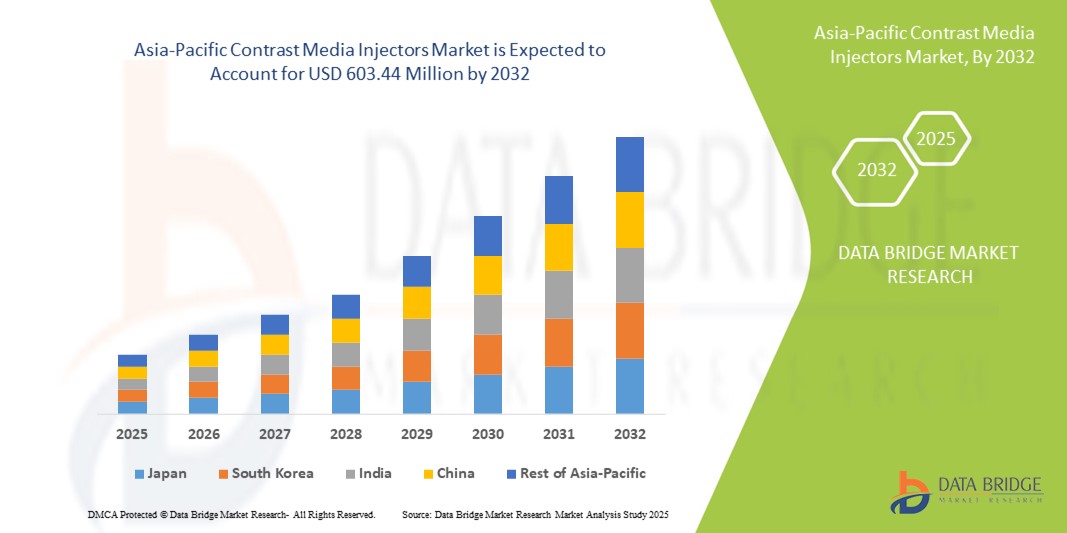

- The Asia-Pacific contrast media injectors market size was valued at USD 346.00 million in 2024 and is expected to reach USD 603.44 million by 2032, at a CAGR of 7.2% during the forecast period

- The market growth is largely fueled by the increasing prevalence of chronic diseases, rising healthcare investments, and technological advancements in diagnostic imaging, leading to greater adoption of contrast media injectors across hospitals and imaging center

- Furthermore, rising demand for accurate, safe, and efficient imaging procedures is establishing contrast media injectors as essential tools in modern radiology and diagnostic workflows. These converging factors are accelerating the uptake of contrast media injector solutions, thereby significantly boosting the industry's growth

Asia-Pacific Contrast Media Injectors Market Analysis

- Contrast media injectors, providing precise delivery of contrast agents during imaging procedures, are increasingly vital components of modern diagnostic imaging workflows in hospitals and imaging centers due to their enhanced accuracy, safety, and seamless integration with advanced imaging systems

- The escalating demand for contrast media injectors is primarily fueled by the rising prevalence of chronic diseases, growing adoption of advanced imaging modalities, and a need for efficient, reliable, and automated injection systems in diagnostic procedures

- China dominated the Asia-Pacific contrast media injectors market with the largest revenue share of 42.5% in 2024, driven by a rapidly expanding healthcare infrastructure, increasing number of diagnostic imaging centers, and strong government initiatives to improve medical services

- Japan is expected to be the fastest growing country in the Asia-Pacific contrast media injectors market during the forecast period due to early adoption of technologically advanced injector systems and high demand in private and specialty hospitals

- Injector systems segment dominated the Asia-Pacific contrast media injectors market with a market share of 47% in 2024, driven by their high accuracy, safety features, and compatibility with multiple imaging modalities such as CT and MRI

Report Scope and Asia-Pacific Contrast Media Injectors Market Segmentation

|

Attributes |

Asia-Pacific Contrast Media Injectors Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

Asia-Pacific

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Asia-Pacific Contrast Media Injectors Market Trends

Integration with Automated and AI-Enabled Imaging Systems

- A significant and accelerating trend in the Asia-Pacific contrast media injectors market is the integration of injectors with automated imaging systems and AI-assisted imaging protocols, enhancing precision, workflow efficiency, and patient safety

- For instance, the MEDRAD Stellant FLEX injector integrates seamlessly with CT and MRI systems to automate contrast delivery while minimizing manual intervention in hospitals and diagnostic centers

- AI-enabled injectors can optimize injection rates based on patient-specific parameters, provide predictive alerts for potential errors, and ensure more consistent imaging results. For instance, some Bracco injector models use AI to adjust injection protocols based on real-time imaging feedback

- Integration with hospital information systems allows centralized control and monitoring of multiple imaging devices, streamlining operations across diagnostic centers and improving scheduling efficiency

- This trend toward automated, intelligent, and interconnected injector systems is reshaping user expectations for imaging accuracy, with companies such as Bayer and Guerbet developing AI-compatible injectors for seamless operation across multiple modalities

- The demand for contrast media injectors with automated and AI-assisted integration is increasing rapidly across hospitals and diagnostic centers, as imaging departments seek efficiency, safety, and reduced human error

Asia-Pacific Contrast Media Injectors Market Dynamics

Driver

Rising Demand Due to Increasing Diagnostic Imaging and Chronic Diseases

- The rising prevalence of chronic diseases, coupled with growing patient volumes and increasing diagnostic imaging procedures, is a major driver of contrast media injector demand in Asia-Pacific

- For instance, in 2024, Siemens Healthineers launched initiatives to expand injector systems in high-volume imaging centers across China, focusing on hospitals managing growing cardiovascular and oncology cases

- As healthcare providers aim to improve imaging accuracy and operational efficiency, injectors provide precise, automated contrast delivery, reducing procedural errors and enhancing patient outcomes

- Furthermore, expanding healthcare infrastructure, increasing investments in diagnostic imaging, and the rising number of private and specialty hospitals are making contrast media injectors essential in modern imaging workflows

- The efficiency of automated injector systems, compatibility with multiple imaging modalities, and ease of operation for radiology staff are key factors propelling adoption across hospitals and diagnostic centers

- The growing focus on patient safety, standardized imaging protocols, and reduced procedural variability is further driving the uptake of contrast media injectors in Asia-Pacific

Restraint/Challenge

High Costs and Regulatory Compliance Hurdles

- The relatively high cost of advanced contrast media injectors and associated consumables, compared to manual injection methods, is a significant barrier to broader adoption in cost-sensitive hospitals

- For instance, smaller imaging centers in India and Southeast Asia may hesitate to invest in premium injector systems due to budget constraints despite their operational benefits

- Compliance with stringent regional and national medical device regulations, including approvals for safety and quality standards, adds complexity and delays to market entry for new injector models

- Addressing these challenges through cost optimization, flexible pricing models, and regulatory support is crucial for expanding market penetration and gaining the trust of healthcare providers

- While some manufacturers offer entry-level or refurbished injector models at lower costs, premium injectors with advanced automation and AI integration remain expensive, limiting adoption in emerging markets

- Overcoming cost and compliance challenges through innovative financing, regulatory guidance, and affordable product offerings will be vital for sustained growth in the Asia-Pacific contrast media injectors market

Asia-Pacific Contrast Media Injectors Market Scope

The market is segmented on the basis of product, type, application, and end use.

- By Product

On the basis of product, the Asia-Pacific contrast media injectors market is segmented into injector systems and consumables. Injector Systems dominated the market with the largest revenue share of 47% in 2024, driven by their critical role in delivering precise, automated contrast injections for CT, MRI, and other imaging procedures. Hospitals and diagnostic centers prioritize injector systems due to their accuracy, reliability, and compatibility with multiple imaging modalities. The segment benefits from advanced features such as programmable injection protocols, safety alerts, and integration with imaging software. Radiologists value injector systems for reducing manual errors and improving workflow efficiency. Ongoing technological innovations, including AI-assisted injection and dual-head systems, further enhance the adoption of injector systems. The segment’s dominance is reinforced by the willingness of healthcare providers to invest in high-quality, durable equipment for improved patient outcomes.

Consumables are anticipated to witness the fastest growth rate from 2025 to 2032, fueled by the rising number of imaging procedures and recurring demand for syringes, tubing sets, and contrast media cartridges. Consumables are essential for maintaining hygiene and preventing cross-contamination during injections. Hospitals and diagnostic centers frequently reorder consumables, creating a stable and growing revenue stream for manufacturers. Increasing patient volumes in emerging Asia-Pacific countries drive high consumption rates. The segment also benefits from innovations in pre-filled and ready-to-use consumables that improve procedural efficiency. Growing awareness of infection control and patient safety further accelerates the adoption of high-quality consumables across healthcare facilities.

- By Type

On the basis of type, the market is segmented into single-head injectors, dual-head injectors, and syringeless injectors. Single-Head Injectors dominated the Asia-Pacific market in 2024, owing to their simplicity, reliability, and lower cost compared to multi-head systems. Single-head injectors are widely used for standard CT and MRI imaging procedures, especially in hospitals with moderate imaging volumes. Their ease of operation allows radiology staff to efficiently administer contrast media while maintaining consistent results. The segment benefits from high compatibility with a broad range of imaging protocols. Single-head injectors are particularly preferred in diagnostic centers and small hospitals due to their low maintenance requirements. Manufacturers continue to optimize these injectors with safety sensors and programmable controls, further solidifying their market dominance.

Dual-Head Injectors are expected to witness the fastest growth rate from 2025 to 2032, driven by increasing demand for multi-contrast protocols and simultaneous administration of different agents. Dual-head injectors improve workflow efficiency in high-volume hospitals and interventional radiology departments. They allow precise contrast mixing, support complex imaging procedures, and reduce the need for repeated injections. The segment is gaining traction in advanced medical centers that prioritize time efficiency and patient comfort. Continuous technological improvements, including AI-assisted flow regulation and remote monitoring, enhance adoption. Growing investment in interventional procedures and the need for faster imaging in emergencies further propel the growth of dual-head injectors.

- By Application

On the basis of application, the market is segmented into radiology, interventional cardiology, and interventional radiology. Radiology dominated the market in 2024, accounting for the largest revenue share due to the high volume of routine imaging procedures such as CT and MRI scans. Radiology departments rely heavily on contrast media injectors for precise and reproducible results. The segment benefits from continuous technological upgrades, including AI-assisted injection protocols that enhance image quality. Hospitals and diagnostic centers prioritize injectors that ensure patient safety, minimize contrast waste, and streamline workflow. Radiology applications drive demand across both private and public healthcare facilities. Ongoing expansion of imaging infrastructure in emerging countries further reinforces this segment’s dominance.

Interventional Radiology is expected to witness the fastest growth rate from 2025 to 2032, fueled by increasing adoption of minimally invasive procedures and complex imaging-guided interventions. Interventional radiology requires highly accurate and controlled contrast delivery to ensure procedural success and patient safety. The segment benefits from dual-head and programmable injector systems that support multiple contrast agents. Rising incidence of cardiovascular diseases, oncology procedures, and vascular interventions contribute to growing demand. Hospitals and specialty centers are increasingly investing in advanced injector systems to meet procedural requirements. Continuous training and awareness programs for interventional staff also support the rapid adoption of injectors in this segment.

- By End Use

On the basis of end use, the market is segmented into hospitals, diagnostic centers, and ambulatory surgery centers. Hospitals dominated the market in 2024, with the largest revenue share, due to high patient volumes, multiple imaging departments, and the need for advanced diagnostic capabilities. Hospitals prefer automated and dual-head injector systems for efficiency, accuracy, and workflow management. Investments in large-scale imaging infrastructure and high demand for routine and emergency imaging procedures drive adoption. The hospital segment benefits from long-term maintenance contracts and service support offered by injector manufacturers. High reliability and safety standards further solidify hospitals as the key end users. Advanced hospitals also leverage AI-assisted injectors for improved procedural outcomes, enhancing patient satisfaction.

Diagnostic Centers are expected to witness the fastest growth rate from 2025 to 2032, fueled by the rapid expansion of outpatient imaging facilities and growing demand for convenient, cost-effective diagnostic services. Diagnostic centers increasingly adopt automated injector systems to handle higher patient throughput and ensure consistent imaging quality. The segment benefits from rising healthcare awareness, medical tourism, and increased insurance coverage for diagnostic procedures. Prevalence of chronic diseases and the growing need for early diagnosis are driving investments in advanced injectors. Manufacturers are targeting diagnostic centers with compact, easy-to-use, and cost-effective injector solutions. The convenience, efficiency, and safety offered by injectors make them a preferred choice for diagnostic centers across the Asia-Pacific region.

Asia-Pacific Contrast Media Injectors Market Regional Analysis

- China dominated the Asia-Pacific contrast media injectors market with the largest revenue share of 42.5% in 2024, driven by a rapidly expanding healthcare infrastructure, increasing number of diagnostic imaging centers, and strong government initiatives to improve medical services

- Healthcare providers in the region prioritize accuracy, safety, and automation in imaging procedures, leading to high adoption of advanced injector systems that integrate with CT, MRI, and interventional radiology equipment

- This widespread adoption is further supported by rising patient volumes, increasing awareness of early diagnosis, and growing investments in both public and private hospitals, establishing contrast media injectors as essential tools in modern diagnostic workflows

The China Contrast Media Injectors Market Insight

The China contrast media injectors market captured the largest revenue share in Asia-Pacific in 2024, driven by rapid expansion of healthcare infrastructure and increasing number of diagnostic imaging centers. Hospitals and specialty clinics are prioritizing precision, safety, and automation in imaging procedures. The government’s initiatives to modernize healthcare and promote early diagnosis are further boosting adoption. Rising patient volumes and growing investments in both public and private hospitals enhance demand. Moreover, integration with advanced CT, MRI, and interventional radiology systems is driving growth. China’s position as a manufacturing hub also improves affordability and accessibility of injector systems.

Japan Contrast Media Injectors Market Insight

The Japan contrast media injectors market is gaining momentum due to high-tech healthcare facilities, rapid urbanization, and strong demand for precise diagnostic imaging. Hospitals and specialty centers increasingly adopt automated and AI-assisted injector systems to enhance workflow efficiency and patient safety. Integration with CT, MRI, and interventional radiology equipment supports widespread adoption. Japan’s focus on innovation, high-quality standards, and technologically advanced healthcare infrastructure ensures the use of state-of-the-art injector solutions. The growing elderly population is also fueling demand for easier-to-use, accurate, and safe injector systems.

India Contrast Media Injectors Market Insight

The India contrast media injectors market accounted for a significant revenue share in 2024, driven by rapid urbanization, expanding healthcare infrastructure, and increasing imaging centers. Rising awareness of preventive healthcare and early diagnosis is boosting adoption of automated injector systems. Cost-effective injector solutions, combined with strong domestic manufacturing, support growth across metropolitan and tier-2 cities. Hospitals and diagnostic centers are increasingly implementing injector systems to improve procedural accuracy, efficiency, and patient safety. Government initiatives promoting smart hospital infrastructure further accelerate market penetration.

South Korea Contrast Media Injectors Market Insight

The South Korea contrast media injectors market is expected to grow steadily, fueled by advanced healthcare facilities and increasing demand for minimally invasive imaging procedures. Hospitals and specialty imaging centers are adopting AI-enabled and dual-head injector systems to enhance workflow efficiency and precision. Rising healthcare investments and technological innovations contribute to the adoption of advanced injector solutions. Integration with modern imaging modalities such as CT and MRI ensures accurate and safe contrast delivery. Government support for healthcare modernization and growing patient awareness further drive market growth.

Asia-Pacific Contrast Media Injectors Market Share

The Asia-Pacific Contrast Media Injectors industry is primarily led by well-established companies, including:

- APOLLO RT Co. Ltd. (Hong Kong)

- Bayer AG (Germany)

- Bracco Imaging S.p.A. (Italy)

- GE HealthCare (U.S.)

- Guerbet (France)

- MEDTRON AG (Germany)

- Nemoto Kyorindo Co., Ltd. (Japan)

- Shenzhen Anke High-tech Co., Ltd. (China)

- Sino Medical-Device Technology Co., Ltd. (China)

- Ulrich GmbH & Co. KG (Germany)

- Vygon Group (France)

- Leriva (India)

- Spectrum Medical Technologies LLP (U.K.)

- AngioDynamics (U.S.)

- Vivid Imaging Solutions (Australia)

- IVD Technologies (India)

- Shenzhen Mindray Bio-Medical Electronics Co., Ltd. (China)

- Siemens Healthineers AG (Germany)

- Hitachi Medical Corporation (Japan)

What are the Recent Developments in Asia-Pacific Contrast Media Injectors Market?

- In August 2024, Bayer launched the MEDRAD Stellant FLEX Computed Tomography Injection System. This product launch is part of a global strategy and its features, such as smaller syringe sizes for less contrast waste and automated documentation, are directly relevant to the growing demand for efficiency and sustainability in the Asia-Pacific market

- In December 2024, Bracco Diagnostics Inc. announced that its Max 3™ Syringeless Injector for MRI received FDA clearance. This innovative, syringeless design is a significant development as it reduces plastic waste and improves workflow efficiency in radiology departments. While the initial clearance is for the US market, this technology is a major breakthrough that will influence and such asly be introduced to other key markets, including Asia-Pacific, given the growing demand for sustainable and efficient medical solutions

- In April 2024, the Bracco Group announced the establishment of a new, fully autonomous company, Bracco Japan. This strategic move strengthens Bracco's direct presence in the Japanese market, where it aims to better serve local doctors and patients by providing "cutting-edge contrast agents, technologies and services for diagnostic imaging, and enhancing our offer with injectors and other products

- In December 2022, GE HealthCare announced an agreement with ulrich medical to offer a GE HealthCare-branded multi-dose contrast media injector in the U.S. This collaboration for the "CT motion" injector, which is a syringeless technology, highlights the trend of major players partnering to bring innovative, workflow-efficient solutions to the market. This type of collaboration and technology introduction often sets a precedent for other global regions, including Asia-Pacific

- In November 2022, Sunnybrook Health Sciences Centre and Bayer announced the launch and installation of the MEDRAD Centargo CT Injection System in Canada. This launch, the first in North America, highlights the rollout of advanced, workflow-optimizing injector systems by major companies such as Bayer, which directly impacts and sets trends for the Asia-Pacific market

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.