Market Analysis and Size

Corn is widely used in a variety of applications, including human food to increase nutritional value, livestock feed, chemicals and biofuel, as a commodity, and many others.

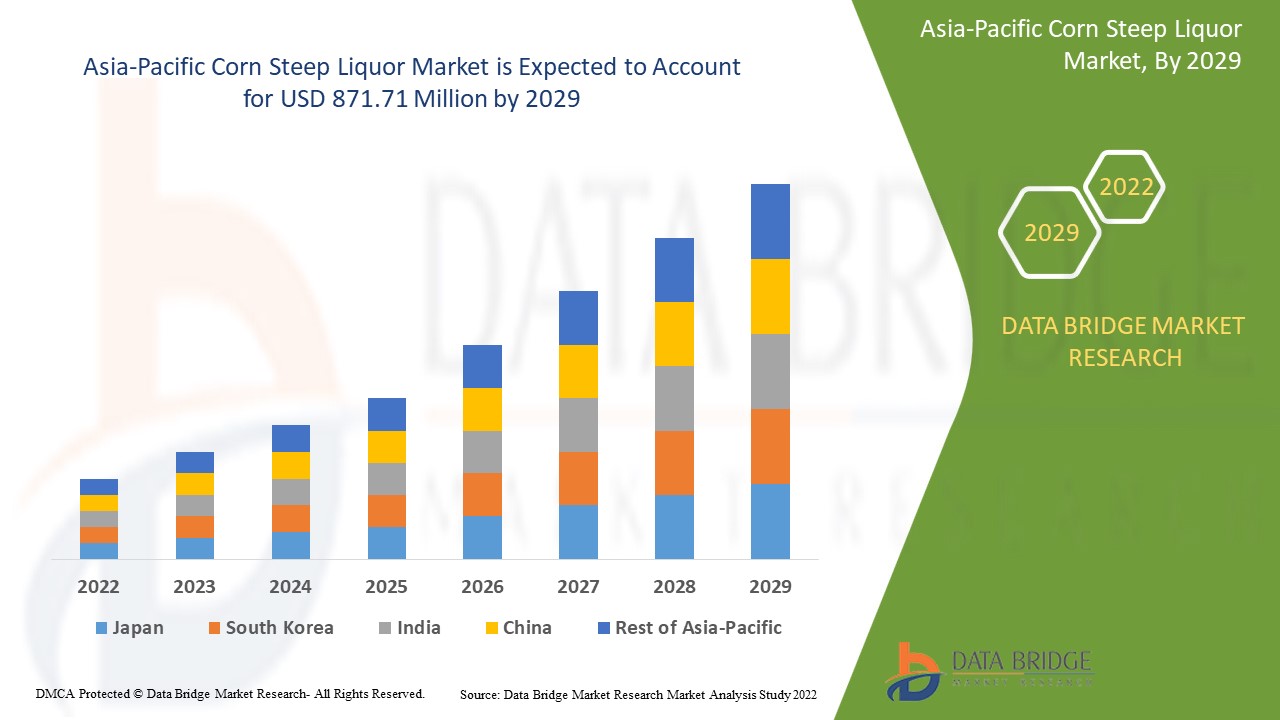

Data Bridge Market Research analyses that the corn steep liquor market which was growing at a value of 555.25 million in 2021 and is expected to reach the value of USD 871.71 million by 2029, at a CAGR of 5.8% during the forecast period of 2022-2029. In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, patent analysis and consumer behaviour.

Report Scope and Market Segmentation

|

Report Metric |

Details |

|

Forecast Period |

2022 to 2029 |

|

Base Year |

2021 |

|

Historic Years |

2020 (Customizable to 2014 - 2019) |

|

Quantitative Units |

Revenue in USD Million, Volumes in Units, Pricing in USD |

|

Segments Covered |

Product Type (Inorganic/Conventional, Organic), Form (Powder, Liquid), Application (Animal Feed, Fertilizers, Fermented Products, Pharmaceutical Industries, Fishing Bait, Other Industrial Applications) |

|

Countries Covered |

China, India, Japan, South Korea, Indonesia, Philippines, Vietnam, Thailand, Australia, New Zealand, Malaysia, , Singapore, Rest of Asia-Pacific |

|

Market Players Covered |

Cargill Incorporated (U.S), DuPont (U.S), Bluestar Adisseo Co. Ltd (China), BASF SE (Germany), Kemin Industries, Inc. (U.S), DSM (Netherlands), Associated British Foods plc (U.K), Novozymes (U.S), Biocatalysts Ltd. (U.K), Amano Enzyme Inc. (Japan), Kerry Group plc (Ireland), Jiangsu Boli Bioproducts Co.Ltd. (China), AUM Enzymes (India), Antozyme Biotech Pvt Ltd (India), Xike Biotechnology Co. Ltd. (China), SUNSON Industry Group Co.Ltd (China) |

|

Opportunities |

|

Market Definition

Corn, also known as maize, is a cereal grain that is widely grown around the world. Corn steep liquor, a by-product of corn wet milling, is high in amino acids, minerals, and vitamins. Corn wet milling is the process of breaking down corn kernels into individual elements such as protein, oil, starch, and so on. Corn steep liquor is a thick yellowish liquid used in the growth of microorganisms during the manufacture of antibiotics and other fermented products.

Corn Steep Liquor Market Dynamics

Drivers

- Industrial uses of corn steep liquor drives market demand

Corn steep liquor has a variety of industrial applications, including crude oil biodegradation, concrete crack treatment, and post-conversion of municipal waste maize for use in organic farming. These benefits and applications are expected to increase consumer adoption of corn steep liquor, driving market growth during the forecast period.

- The growing demand for animal protein and animal derived products

With a constantly growing Asia-Pacific population and rising protein demand due to rising per capita income, meat and meat products have never been higher. To meet the rising demand for meat and meat products, livestock producers must rely on proper nutrition to ensure optimal growth and high-quality meat.

Corn steep liquor is an example of an additive that can provide the necessary nutritional profile at a fraction of the cost of premium nutrition products. Because feed costs account for the majority of the costs associated with livestock operations, lowering them is critical for business owners, making corn steep liquor the additive of choice for livestock rearers.

Opportunity

Rising research and development expenditures, growth and expansion of the animal feed industry in developing economies, and rising consumption of meat and meat-related products will all contribute to market value growth.

Restraints

However, the widespread availability of substitutes will pose a significant challenge to market growth. High costs associated with R&D capabilities and increased competition among manufacturers will also impede market growth. Improper distribution and disruptions in supply chain management will derail market growth once more.

This corn steep liquor market report provides details of new recent developments, trade regulations, import-export analysis, production analysis, value chain optimization, market share, impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, strategic market growth analysis, market size, category market growths, application niches and dominance, product approvals, product launches, geographic expansions, technological innovations in the market. To gain more info on the Corn Steep Liquor market contact Data Bridge Market Research for an Analyst Brief, our team will help you take an informed market decision to achieve market growth.

COVID-19 Impact on Corn Steep Liquor Market

During the COVID-19 situation, agriculture and food production have been identified as critical sectors in Asia-Pacific. As a result, farmers have continued to provide high-quality nutrition to farm animals in order to feed an increasing number of Asia-Pacific consumers. However, the most significant factor affecting the animal feed market is supply chain disruption. China is a major producer and exporter of animal feed, and it stockpiled enough product for 2-3 months' supply during the emergence of the COVID-19 situation while businesses were closed for the Lunar New Year. Furthermore, logistics issues have hampered the supply of containers and vessels, as well as the transportation of specific micro-ingredients.

Recent Development

- TEREOS STARCH & SWEETENERS EUROPE launched their offering in the China market in April. Tereos, Starch & Sweeteners' business division attended the Food Ingredients China exhibition in Shanghai. This allowed the company to convey their product offering to Chinese consumers, allowing it to expand its customer base.

Asia-Pacific Corn Steep Liquor Market Scope

The corn steep liquor market is segmented on the basis of form, product type and application. The growth amongst these segments will help you analyze meagre growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Form

- Powder

- Liquid

Product type

- Inorganic/Conventional

- organic

Application

- Animal Feed

- Fertilizers

- Fermented Products

- Pharmaceutical Industries

- Fishing Bait

- Other Industrial Applications

Corn Steep Liquor Market Regional Analysis/Insights

The corn steep liquor market is analysed and market size insights and trends are provided by country, form, product type and application as referenced above.

The countries covered in the corn steep liquor market report are China, India, Japan, South Korea, Indonesia, Philippines, Vietnam, Thailand, Australia, New Zealand, Malaysia, , Singapore, Rest of Asia-Pacific.

China dominates the market for corn steep liquor, which is in high demand for various applications such as animal nutrition, fertilisers, and others due to its high nutritional value and low cost. A number of manufacturers are also involved in bringing the product to market. As corn production in India is high and manufacturers can produce the product at a high level, India accounts for the second largest share. Indonesia accounts for the third largest share of corn production after China and India, allowing manufacturers to easily produce products. Furthermore, corn steep liquor is in high demand in a variety of industries, including feed additives and fertilisers.

The country section of the report also provides individual market impacting factors and changes in market regulation that impact the current and future trends of the market. Data points like down-stream and upstream value chain analysis, technical trends and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of Asia-Pacific brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

Competitive Landscape and Corn Steep Liquor Market Share Analysis

The corn steep liquor market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, Asia-Pacific presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to corn steep liquor market.

Some of the major players operating in the corn steep liquor market are:

- Cargill Incorporated (U.S)

- DuPont (U.S)

- Bluestar Adisseo Co. Ltd (China)

- BASF SE (Germany)

- Kemin Industries, Inc. (U.S)

- DSM (Netherlands)

- Associated British Foods plc (U.K)

- Novozymes (U.S)

- Biocatalysts Ltd. (U.K)

- Amano Enzyme Inc. (Japan)

- Kerry Group plc (Ireland)

- Jiangsu Boli Bioproducts Co.Ltd. (China)

- AUM Enzymes (India)

- Antozyme Biotech Pvt Ltd (India)

- Xike Biotechnology Co. Ltd. (China)

- SUNSON Industry Group Co.Ltd (China)

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF ASIA-PACIFIC CORN STEEP LIQUOR MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHIC SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.7 DBMR MARKET POSITION GRID

2.8 MULTIVARIATE MODELING

2.9 PRODUCT TIMELINE CURVE

2.1 SECONDARY SOURCES

2.11 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 MULTIPLE BENEFITS OF CORN STEEP LIQUOR IN DIFFERENT SECTORS

5.1.2 HIGH DEMAND FOR ANIMAL NUTRITION PRODUCTS

5.2 RESTRAINT

5.2.1 VARIABILITY IN CHEMICAL COMPOSITION

5.3 OPPORTUNITY

5.3.1 GROWING TREND FOR ORGANIC AGRICULTURE

5.4 CHALLENGE

5.4.1 LOW PENETRATION RATE AGAINST CHEMICAL FERTILIZERS

6 ASIA-PACIFIC CORN STEEP LIQUOR MARKET, BY FORM

6.1 OVERVIEW

6.2 POWDER

6.3 LIQUID

7 ASIA-PACIFIC CORN STEEP LIQUOR MARKET, BY APPLICATION

7.1 OVERVIEW

7.2 ANIMAL FEED

7.2.1 SWINE

7.2.2 POULTRY

7.2.3 RUMINANTS

7.2.4 PETS

7.2.5 OTHERS

7.3 FERTILIZERS

7.4 FERMENTED PRODUCTS

7.4.1 YEASTS

7.4.2 BEER

7.4.3 LEAVENED DOUGH PRODUCTS

7.5 PHARMACEUTICAL INDUSTRY

7.6 FISHING BAIT

7.7 OTHER INDUSTRIAL APPLICATIONS

8 ASIA-PACIFIC CORN STEEP LIQUOR MARKET, BY PRODUCT TYPE

8.1 OVERVIEW

8.2 INORGANIC/CONVENTIONAL

8.3 ORGANIC

9 ASIA-PACIFIC CORN STEEP LIQUOR MARKET, BY COUNTRY

9.1 CHINA

9.2 INDIA

9.3 INDONESIA

9.4 PHILIPPINES

9.5 VIETNAM

9.6 THAILAND

9.7 AUSTRALIA

9.8 NEW ZEALAND

9.9 SOUTH KOREA

9.1 MALAYSIA

9.11 JAPAN

9.12 SINGAPORE

9.13 REST OF ASIA-PACIFIC

10 ASIA-PACIFIC CORN STEEP LIQUOR MARKET, COMPANY LANDSCAPE

11 SWOT & DBMR ANALYSIS

11.1 DATA BRIDGE MARKET RESEARCH ANALYSIS

12 COMPANY PROFILE

12.1 GLOBAL BIO-CHEM TECHNOLOGY GROUP COMPANY LIMITED

12.1.1 COMPANY SNAPSHOT

12.1.2 REVENUE ANALYSIS

12.1.3 PRODUCT PORTFOLIO

12.1.4 RECENT DEVELOPMENT

12.2 TEREOS

12.2.1 COMPANY SNAPSHOT

12.2.2 REVENUE ANALYSIS

12.2.3 PRODUCT PORTFOLIO

12.2.4 RECENT DEVELOPMENT

12.3 MERCK KGAA

12.3.1 COMPANY SNAPSHOT

12.3.2 REVENUE ANALYSIS

12.3.3 PRODUCT PORTFOLIO

12.3.4 RECENT DEVELOPMENT

12.4 ROQUETTE FRÈRES

12.4.1 COMPANY SNAPSHOT

12.4.2 PRODUCT PORTFOLIO

12.4.3 RECENT DEVELOPMENT

12.5 BAOLINGBAO BIOLOGY CO.,LTD.

12.5.1 COMPANY SNAPSHOT

12.5.2 PRODUCT & SERVICE PORTFOLIO

12.5.3 RECENT DEVELOPMENT

12.6 FRIENDSHIP CORN STARCH CO., LTD.

12.6.1 COMPANY SNAPSHOT

12.6.2 PRODUCT PORTFOLIO

12.6.3 RECENT DEVELOPMENT

12.7 GULSHAN POLYOLS LTD.

12.7.1 COMPANY SNAPSHOT

12.7.2 REVENUE ANALYSIS

12.7.3 PRODUCT & SERVICE PORTFOLIO

12.7.4 RECENT DEVELOPMENT

12.8 JUCI CORN BIOTECHNOLOGY CO.,LTD

12.8.1 COMPANY SNAPSHOT

12.8.2 PRODUCT PORTFOLIO

12.8.3 RECENT DEVELOPMENT

12.9 SANSTAR BIO – POLYMERS LTD.

12.9.1 COMPANY SNAPSHOT

12.9.2 PRODUCT PORTFOLIO

12.9.3 RECENT DEVELOPMENT

12.1 SHANDONG SHANSHI CHEMICAL CO., LTD.

12.10.1 COMPANY SNAPSHOT

12.10.2 PRODUCT PORTFOLIO

12.10.3 RECENT DEVELOPMENT

12.11 YANTAI LU SHUN HUITONG BIOLOGICAL TECHNOLOGY CO.,LTD

12.11.1 COMPANY SNAPSHOT

12.11.2 PRODUCT PORTFOLIO

12.11.3 RECENT DEVELOPMENT

13 CONCLUSION

14 QUESTIONNAIRE

15 RELATED REPORTS

List of Table

LIST OF TABLES

TABLE 1 ASIA-PACIFIC CORN STEEP LIQUOR MARKET, BY FORM, 2018-2027 (USD MILLION)

TABLE 2 ASIA-PACIFIC CORN STEEP LIQUOR MARKET, BY APPLICATION, 2018-2027 (USD MILLION)

TABLE 3 ASIA-PACIFIC ANIMAL FEED IN CORN STEEP LIQUOR MARKET, BY APPLICATION, 2018-2027 (USD MILLION)

TABLE 4 ASIA-PACIFIC FERMENTED PRODUCTS IN CORN STEEP LIQUOR MARKET, BY APPLICATION, 2018-2027 (USD MILLION)

TABLE 5 ASIA-PACIFIC CORN STEEP LIQUOR MARKET, BY PRODUCT TYPE, 2018-2027 (USD MILLION)

TABLE 6 ASIA-PACIFIC CORN STEEP LIQUOR MARKET, BY COUNTRY, 2018-2027 (USD MILLION)

TABLE 7 CHINA CORN STEEP LIQUOR MARKET, BY PRODUCT TYPE, 2018-2027 (USD MILLION)

TABLE 8 CHINA CORN STEEP LIQUOR MARKET, BY FORM, 2018-2027 (USD MILLION)

TABLE 9 CHINA CORN STEEP LIQUOR MARKET, BY APPLICATION, 2018-2027 (USD MILLION)

TABLE 10 CHINA FERMENTED PRODUCTS IN CORN STEEP LIQUOR MARKET, BY APPLICATION, 2018-2027 (USD MILLION)

TABLE 11 CHINA ANIMAL FEED IN CORN STEEP LIQUOR MARKET, BY APPLICATION, 2018-2027 (USD MILLION)

TABLE 12 INDIA CORN STEEP LIQUOR MARKET, BY PRODUCT TYPE, 2018-2027 (USD MILLION)

TABLE 13 INDIA CORN STEEP LIQUOR MARKET, BY FORM, 2018-2027 (USD MILLION)

TABLE 14 INDIA CORN STEEP LIQUOR MARKET, BY APPLICATION, 2018-2027 (USD MILLION)

TABLE 15 INDIA FERMENTED PRODUCTS IN CORN STEEP LIQUOR MARKET, BY APPLICATION, 2018-2027 (USD MILLION)

TABLE 16 INDIA ANIMAL FEED IN CORN STEEP LIQUOR MARKET, BY APPLICATION, 2018-2027 (USD MILLION)

TABLE 17 INDONESIA CORN STEEP LIQUOR MARKET, BY PRODUCT TYPE, 2018-2027 (USD MILLION)

TABLE 18 INDONESIA CORN STEEP LIQUOR MARKET, BY FORM, 2018-2027 (USD MILLION)

TABLE 19 INDONESIA CORN STEEP LIQUOR MARKET, BY APPLICATION, 2018-2027 (USD MILLION)

TABLE 20 INDONESIA FERMENTED PRODUCTS IN CORN STEEP LIQUOR MARKET, BY APPLICATION, 2018-2027 (USD MILLION)

TABLE 21 INDONESIA ANIMAL FEED IN CORN STEEP LIQUOR MARKET, BY APPLICATION, 2018-2027 (USD MILLION)

TABLE 22 PHILIPPINES CORN STEEP LIQUOR MARKET, BY PRODUCT TYPE, 2018-2027 (USD MILLION)

TABLE 23 PHILIPPINES CORN STEEP LIQUOR MARKET, BY FORM, 2018-2027 (USD MILLION)

TABLE 24 PHILIPPINES CORN STEEP LIQUOR MARKET, BY APPLICATION, 2018-2027 (USD MILLION)

TABLE 25 PHILIPPINES FERMENTED PRODUCTS IN CORN STEEP LIQUOR MARKET, BY APPLICATION, 2018-2027 (USD MILLION)

TABLE 26 PHILIPPINES ANIMAL FEED IN CORN STEEP LIQUOR MARKET, BY APPLICATION, 2018-2027 (USD MILLION)

TABLE 27 VIETNAM CORN STEEP LIQUOR MARKET, BY PRODUCT TYPE, 2018-2027 (USD MILLION)

TABLE 28 VIETNAM CORN STEEP LIQUOR MARKET, BY FORM, 2018-2027 (USD MILLION)

TABLE 29 VIETNAM CORN STEEP LIQUOR MARKET, BY APPLICATION, 2018-2027 (USD MILLION)

TABLE 30 VIETNAM FERMENTED PRODUCTS IN CORN STEEP LIQUOR MARKET, BY APPLICATION, 2018-2027 (USD MILLION)

TABLE 31 VIETNAM ANIMAL FEED IN CORN STEEP LIQUOR MARKET, BY APPLICATION, 2018-2027 (USD MILLION)

TABLE 32 THAILAND CORN STEEP LIQUOR MARKET, BY PRODUCT TYPE, 2018-2027 (USD MILLION)

TABLE 33 THAILAND CORN STEEP LIQUOR MARKET, BY FORM, 2018-2027 (USD MILLION)

TABLE 34 THAILAND CORN STEEP LIQUOR MARKET, BY APPLICATION, 2018-2027 (USD MILLION)

TABLE 35 THAILAND FERMENTED PRODUCTS IN CORN STEEP LIQUOR MARKET, BY APPLICATION, 2018-2027 (USD MILLION)

TABLE 36 THAILAND ANIMAL FEED IN CORN STEEP LIQUOR MARKET, BY APPLICATION, 2018-2027 (USD MILLION)

TABLE 37 AUSTRALIA CORN STEEP LIQUOR MARKET, BY PRODUCT TYPE, 2018-2027 (USD MILLION)

TABLE 38 AUSTRALIA CORN STEEP LIQUOR MARKET, BY FORM, 2018-2027 (USD MILLION)

TABLE 39 AUSTRALIA CORN STEEP LIQUOR MARKET, BY APPLICATION, 2018-2027 (USD MILLION)

TABLE 40 AUSTRALIA FERMENTED PRODUCTS IN CORN STEEP LIQUOR MARKET, BY APPLICATION, 2018-2027 (USD MILLION)

TABLE 41 AUSTRALIA ANIMAL FEED IN CORN STEEP LIQUOR MARKET, BY APPLICATION, 2018-2027 (USD MILLION)

TABLE 42 NEW ZEALAND CORN STEEP LIQUOR MARKET, BY PRODUCT TYPE, 2018-2027 (USD MILLION)

TABLE 43 NEW ZEALAND CORN STEEP LIQUOR MARKET, BY FORM, 2018-2027 (USD MILLION)

TABLE 44 NEW ZEALAND CORN STEEP LIQUOR MARKET, BY APPLICATION, 2018-2027 (USD MILLION)

TABLE 45 NEW ZEALAND FERMENTED PRODUCTS IN CORN STEEP LIQUOR MARKET, BY APPLICATION, 2018-2027 (USD MILLION)

TABLE 46 NEW ZEALAND ANIMAL FEED IN CORN STEEP LIQUOR MARKET, BY APPLICATION, 2018-2027 (USD MILLION)

TABLE 47 SOUTH KOREA CORN STEEP LIQUOR MARKET, BY PRODUCT TYPE, 2018-2027 (USD MILLION)

TABLE 48 SOUTH KOREA CORN STEEP LIQUOR MARKET, BY FORM, 2018-2027 (USD MILLION)

TABLE 49 SOUTH KOREA CORN STEEP LIQUOR MARKET, BY APPLICATION, 2018-2027 (USD MILLION)

TABLE 50 SOUTH KOREA FERMENTED PRODUCTS IN CORN STEEP LIQUOR MARKET, BY APPLICATION, 2018-2027 (USD MILLION)

TABLE 51 SOUTH KOREA ANIMAL FEED IN CORN STEEP LIQUOR MARKET, BY APPLICATION, 2018-2027 (USD MILLION)

TABLE 52 MALAYSIA CORN STEEP LIQUOR MARKET, BY PRODUCT TYPE, 2018-2027 (USD MILLION)

TABLE 53 MALAYSIA CORN STEEP LIQUOR MARKET, BY FORM, 2018-2027 (USD MILLION)

TABLE 54 MALAYSIA CORN STEEP LIQUOR MARKET, BY APPLICATION, 2018-2027 (USD MILLION)

TABLE 55 MALAYSIA FERMENTED PRODUCTS IN CORN STEEP LIQUOR MARKET, BY APPLICATION, 2018-2027 (USD MILLION)

TABLE 56 MALAYSIA ANIMAL FEED IN CORN STEEP LIQUOR MARKET, BY APPLICATION, 2018-2027 (USD MILLION)

TABLE 57 JAPAN CORN STEEP LIQUOR MARKET, BY PRODUCT TYPE, 2018-2027 (USD MILLION)

TABLE 58 JAPAN CORN STEEP LIQUOR MARKET, BY FORM, 2018-2027 (USD MILLION)

TABLE 59 JAPAN CORN STEEP LIQUOR MARKET, BY APPLICATION, 2018-2027 (USD MILLION)

TABLE 60 JAPAN FERMENTED PRODUCTS IN CORN STEEP LIQUOR MARKET, BY APPLICATION, 2018-2027 (USD MILLION)

TABLE 61 JAPAN ANIMAL FEED IN CORN STEEP LIQUOR MARKET, BY APPLICATION, 2018-2027 (USD MILLION)

TABLE 62 SINGAPORE CORN STEEP LIQUOR MARKET, BY PRODUCT TYPE, 2018-2027 (USD MILLION)

TABLE 63 SINGAPORE CORN STEEP LIQUOR MARKET, BY FORM, 2018-2027 (USD MILLION)

TABLE 64 SINGAPORE CORN STEEP LIQUOR MARKET, BY APPLICATION, 2018-2027 (USD MILLION)

TABLE 65 SINGAPORE FERMENTED PRODUCTS IN CORN STEEP LIQUOR MARKET, BY APPLICATION, 2018-2027 (USD MILLION)

TABLE 66 SINGAPORE ANIMAL FEED IN CORN STEEP LIQUOR MARKET, BY APPLICATION, 2018-2027 (USD MILLION)

TABLE 67 REST OF ASIA-PACIFIC CORN STEEP LIQUOR MARKET, BY PRODUCT TYPE, 2018-2027 (USD MILLION)

List of Figure

LIST OF FIGURES

FIGURE 1 ASIA-PACIFIC CORN STEEP LIQUOR MARKET: SEGMENTATION

FIGURE 2 ASIA-PACIFIC CORN STEEP LIQUOR MARKET: DATA TRIANGULATION

FIGURE 3 ASIA-PACIFIC CORN STEEP LIQUOR MARKET: DROC ANALYSIS

FIGURE 4 ASIA-PACIFIC CORN STEEP LIQUOR MARKET: REGIONAL VS COUNTRY MARKET ANALYSIS

FIGURE 5 ASIA-PACIFIC CORN STEEP LIQUOR MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 ASIA-PACIFIC CORN STEEP LIQUOR MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 ASIA-PACIFIC CORN STEEP LIQUOR MARKET: DBMR MARKET POSITION GRID

FIGURE 8 ASIA-PACIFIC CORN STEEP LIQUOR MARKET: SEGMENTATION

FIGURE 9 HIGH DEMAND FOR ANIMAL NUTRITION PRODUCTS AND MULTIPLE BENEFITS OF CORN STEEP LIQUOR IN DIFFERENT SECTORS ARE THE MAJOR FACTORS TO DRIVE THE MARKET FOR CORN STEEP LIQUOR IN THE FORECAST PERIOD OF 2020 TO 2027

FIGURE 10 INORGANIC/CONVENTIONAL IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF ASIA-PACIFIC CORN STEEP LIQUOR MARKET IN 2020 & 2027

FIGURE 11 DRIVERS, RESTRAINT, OPPORTUNITES AND CHALLENGE OF ASIA-PACIFIC CORN STEEP LIQUOR MARKET

FIGURE 12 ASIA-PACIFIC CORN STEEP LIQUOR MARKET: BY FORM, 2019

FIGURE 13 ASIA-PACIFIC CORN STEEP LIQUOR MARKET: BY APPLICATION, 2019

FIGURE 14 ASIA-PACIFIC CORN STEEP LIQUOR MARKET: BY PRODUCT TYPE, 2019

FIGURE 15 ASIA-PACIFIC CORN STEEP LIQUOR MARKET: SNAPSHOT (2019)

FIGURE 16 ASIA-PACIFIC CORN STEEP LIQUOR MARKET: BY COUNTRY (2019)

FIGURE 17 ASIA-PACIFIC CORN STEEP LIQUOR MARKET: BY COUNTRY (2020 & 2027)

FIGURE 18 ASIA-PACIFIC CORN STEEP LIQUOR MARKET: BY COUNTRY (2019 & 2027)

FIGURE 19 ASIA-PACIFIC CORN STEEP LIQUOR MARKET: BY PRODUCT TYPE (2020-2027)

FIGURE 20 ASIA-PACIFIC CORN STEEP LIQUOR MARKET: COMPANY SHARE 2019 (%)

Asia Pacific Corn Steep Liquor Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Asia Pacific Corn Steep Liquor Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Asia Pacific Corn Steep Liquor Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.