Global Organic Fertilizers Market

Market Size in USD Billion

CAGR :

%

USD

8.44 Billion

USD

18.09 Billion

2024

2032

USD

8.44 Billion

USD

18.09 Billion

2024

2032

| 2025 –2032 | |

| USD 8.44 Billion | |

| USD 18.09 Billion | |

|

|

|

|

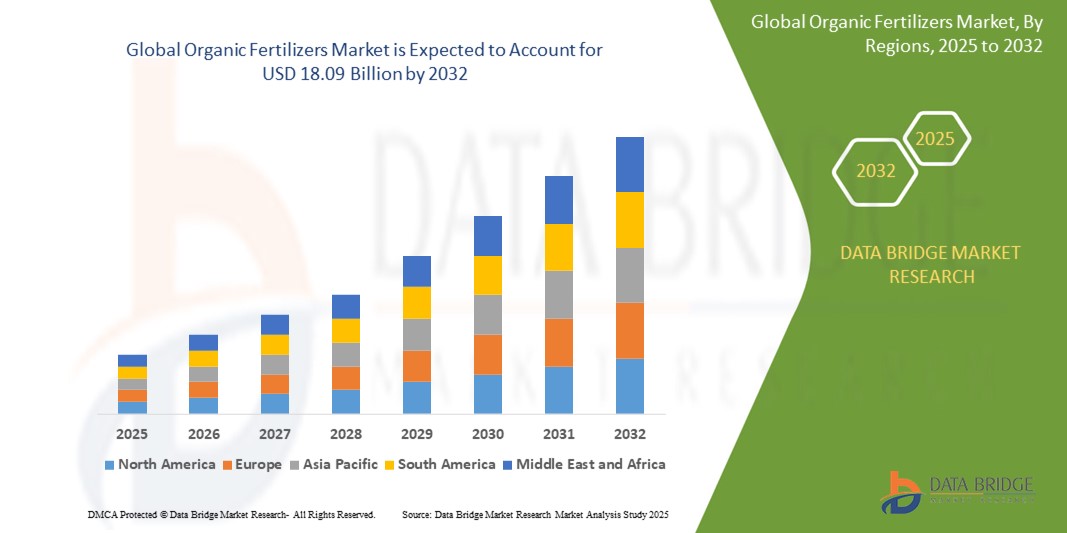

What is the Global Organic Fertilizers Market Size and Growth Rate?

- The global organic fertilizers market size was valued at USD 8.44 billion in 2024 and is expected to reach USD 18.09 billion by 2032, at a CAGR of 9.99% during the forecast period

- The organic fertilizers market is experiencing significant growth, driven by increasing demand for sustainable agriculture and the need to enhance soil health

- Recent advancements in technology, such as microbial inoculants and biostimulants, are revolutionizing the sector. These innovations enhance nutrient uptake and improve crop resilience against environmental stresses, leading to higher yields

What are the Major Takeaways of Organic Fertilizers Market?

- Precision agriculture technologies, such as soil sensors and drones, allow farmers to apply organic fertilizers more efficiently, optimizing nutrient delivery and minimizing waste. The rise of e-commerce platforms is also contributing to market growth, enabling farmers to access a wider range of organic fertilizers conveniently

- Furthermore, regulatory support for organic farming practices is boosting consumer confidence and encouraging more farmers to transition from synthetic to organic fertilizers

- Asia-Pacific dominated the organic fertilizers market with the largest revenue share of 30.8% in 2024, driven by the region's expanding organic agriculture sector, rising consumer awareness about food safety, and increasing demand for sustainable crop production

- Asia-Pacific organic fertilizers market is poised to grow at the fastest CAGR of 14.56% during the forecast period from 2025 to 2032, driven by rapid urbanization, rising incomes, and growing consumer awareness of food safety and organic products in countries such as China, India, and Japan

- The Plant-based segment dominated the organic fertilizers market with the largest market revenue share of 53.4% in 2024, driven by the widespread adoption of composted plant materials, crop residues, and green manure in organic farming

Report Scope and Organic Fertilizers Market Segmentation

|

Attributes |

Organic Fertilizers Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

What is the Key Trend in the Organic Fertilizers Market?

“Growing Focus on Regenerative Agriculture and Soil Health”

- A significant and rapidly emerging trend in the global Organic Fertilizers market is the increasing emphasis on regenerative agriculture practices and improving soil health to promote sustainable farming. Farmers and agribusinesses are adopting organic fertilizers not just for nutrient supply but to restore soil biodiversity, structure, and long-term productivity

- For instance, leading producers such as Italpollina and ILSA S.p.A. are launching bio-based fertilizers enriched with organic matter, amino acids, and microbial inoculants that support soil regeneration and reduce chemical dependency

- Organic Fertilizers are increasingly formulated to enhance soil fertility by promoting microbial activity, improving water retention, and boosting nutrient cycling, all of which contribute to higher crop yields and climate resilience. Companies such as Tata Chemicals Ltd. are focusing on sustainable soil management through innovative organic fertilizer solutions to meet global food security challenges

- This trend aligns with global efforts to combat soil degradation and mitigate the environmental impacts of intensive agriculture. Organic Fertilizers, often derived from compost, plant waste, animal manure, and renewable resources, contribute to carbon sequestration and reduce greenhouse gas emissions from farming

- Major players, including Coromandel International Limited and The Scotts Company LLC, are expanding their organic product lines to meet the growing demand for environmentally responsible agricultural inputs

- The shift toward regenerative, organic farming is reshaping market dynamics, positioning organic fertilizers as essential tools in building resilient, productive, and sustainable agricultural systems worldwide

What are the Key Drivers of Organic Fertilizers Market?

- The increasing demand for organic food products, rising awareness about soil health, and global focus on sustainable agriculture are primary factors driving the growth of the organic fertilizers market

- For instance, in March 2024, Fertikal N.V. introduced a new range of organic fertilizers derived from plant-based and animal waste materials, specifically designed to improve soil fertility and reduce chemical runoff, addressing both productivity and environmental concern

- Supportive government initiatives, including subsidies for organic farming, stricter environmental regulations, and international programs promoting climate-smart agriculture, are accelerating the adoption of Organic Fertilizers

- Growing consumer awareness about food safety, coupled with concerns over the harmful effects of synthetic fertilizers on human health and ecosystems, is pushing farmers to adopt organic alternatives that promote soil rejuvenation and crop quality

- The expansion of organic farming acreage, particularly across Europe, North America, and Asia-Pacific, and premium pricing for organically grown crops, offer strong economic incentives for growers to transition to organic fertilizers

Which Factor is challenging the Growth of the Organic Fertilizers Market?

- High production costs, raw material supply fluctuations, and performance limitations compared to conventional fertilizers remain significant challenges hindering the wider adoption of Organic Fertilizers, particularly in price-sensitive markets

- For instance, reliance on organic waste streams, such as composted manure or plant residues, often faces seasonal supply constraints and quality inconsistencies, impacting production volumes and price stability

- Certification complexities and regulatory compliance requirements for organic inputs increase operational costs for fertilizer manufacturers, especially for small and mid-sized companies lacking extensive resources

- Limited access to affordable, high-quality organic fertilizers in developing countries, along with lower immediate nutrient availability compared to synthetic products, can deter adoption among farmers prioritizing short-term yield gains

- However, ongoing innovation by companies such as Danfoss and Biostar Renewables, LLC, aimed at improving the nutrient efficiency and affordability of Organic Fertilizers, is expected to gradually mitigate these barriers and support long-term market growth

How is the Organic Fertilizers Market Segmented?

The market is segmented on the basis of source, form, certification, and crop type.

• By Source

On the basis of source, the organic fertilizers market is segmented into Plant, Animal, and Mineral. The Plant-based segment dominated the organic fertilizers market with the largest market revenue share of 53.4% in 2024, driven by the widespread adoption of composted plant materials, crop residues, and green manure in organic farming. Plant-based fertilizers are favored for their ability to improve soil structure, increase organic matter content, and support sustainable crop cultivation, particularly in regions promoting regenerative agriculture practices.

The Animal-based segment is expected to witness the fastest growth rate from 2025 to 2032, fueled by the rising use of animal-derived inputs such as bone meal, blood meal, and manure-based fertilizers, valued for their high nutrient content and ability to boost soil fertility naturally. The emphasis on waste utilization and circular agriculture further drives this segment's growth.

• By Form

On the basis of form, the organic fertilizers market is segmented into Dry and Liquid. The Dry segment held the largest market revenue share in 2024, accounting for 62.9%, supported by the ease of storage, transportation, and application of dry organic fertilizers such as compost, pellets, and powder forms. Dry fertilizers are highly preferred for large-scale farming operations due to their long shelf life and compatibility with conventional spreading equipment.

The Liquid segment is projected to witness the fastest CAGR from 2025 to 2032, as liquid organic fertilizers gain popularity among horticultural growers and organic fruit & vegetable producers for their fast nutrient availability, uniform application, and ease of integration with irrigation systems.

• By Crop Type

On the basis of crop type, the organic fertilizers market is segmented into Cereals and Grains, Oilseeds and Pulses, Fruits and Vegetables, and Others. The Cereals and Grains segment dominated the market with the largest revenue share of 44.5% in 2024, driven by the significant cultivation of staple crops such as wheat, rice, maize, and barley globally. The demand for organic cereals and grains is rising due to consumer preference for chemical-free staple foods, especially in North America and Europe.

The Fruits and Vegetables segment is expected to grow at the fastest rate from 2025 to 2032, supported by increasing organic farming practices in high-value crops, consumer demand for pesticide-free produce, and premium pricing for organically grown fruits and vegetables across global markets.

• By Certifications

On the basis of certifications, the organic fertilizers market is segmented into 100% Organic and 95% Organic. The 100% Organic segment accounted for the largest market revenue share of 57.2% in 2024, reflecting strong consumer trust and regulatory preference for fully organic-certified products, particularly in developed regions with stringent organic labeling requirements.

The 95% Organic segment is anticipated to witness the fastest growth from 2025 to 2032, driven by increased production of near-organic fertilizers that offer flexibility for farmers while maintaining compliance with organic certification standards, especially in emerging markets transitioning towards sustainable agriculture.

Which Region Holds the Largest Share of the Organic Fertilizers Market?

- Asia-Pacific dominated the organic fertilizers market with the largest revenue share of 30.8% in 2024, driven by the region's expanding organic agriculture sector, rising consumer awareness about food safety, and increasing demand for sustainable crop production

- Countries such as China, India, and Australia are witnessing significant growth in organic farming practices, supported by favorable government initiatives and growing middle-class populations seeking healthier food options

- The availability of vast arable land, coupled with the rising adoption of organic certifications and emphasis on soil health, is accelerating the demand for organic fertilizers across both smallholder and commercial farming operations in the region

China Organic Fertilizers Market Insight

The China organic fertilizers market captured the largest revenue share in Asia-Pacific in 2024, fueled by rapid urbanization, growing food safety concerns, and government support for organic agriculture development. Domestic manufacturers are expanding production capacity and offering affordable organic fertilizer solutions to meet increasing demand from fruit, vegetable, and grain producers. China's push towards sustainable farming practices and eco-friendly inputs continues to drive market growth.

India Organic Fertilizers Market Insight

The India organic fertilizers market is projected to grow at a substantial CAGR during the forecast period, supported by government policies promoting organic farming, soil health initiatives, and the growing awareness among farmers regarding the long-term benefits of organic inputs. Rising demand for organic food in both domestic and export markets is encouraging fertilizer manufacturers to innovate and expand their organic product portfolios.

Japan Organic Fertilizers Market Insight

The Japan organic fertilizers market is anticipated to grow steadily, driven by strong consumer preferences for safe, traceable food and the country's emphasis on sustainable agricultural practices. Japan's technologically advanced farming sector is adopting high-performance organic fertilizer solutions, particularly in horticulture and specialty crop production, supporting overall market growth.

Which Region is the Fastest Growing Region in the Organic Fertilizers Market?

North America is poised to grow at the fastest CAGR of 12.9% during the forecast period from 2025 to 2032, driven by increasing demand for organic, chemical-free agricultural produce and rising consumer awareness regarding soil health and sustainable farming. The region benefits from a well-developed organic farming infrastructure, stringent regulatory frameworks, and growing consumer willingness to pay premium prices for certified organic food products.

U.S. Organic Fertilizers Market Insight

The U.S. organic fertilizers market accounted for the largest revenue share in North America in 2024, supported by strong growth in organic crop cultivation, favorable government programs, and rising consumer demand for clean-label, non-GMO food. Fertilizer companies are increasingly introducing innovative, nutrient-dense organic formulations to meet the evolving needs of organic farmers across the country.

Canada Organic Fertilizers Market Insight

The Canada organic fertilizers market is experiencing significant growth, fueled by expanding organic farmland, consumer preference for sustainable food production, and supportive regulatory frameworks. The increasing adoption of organic practices among small- and medium-scale farmers is further boosting market demand.

Which are the Top Companies in Organic Fertilizers Market?

The organic fertilizers industry is primarily led by well-established companies, including:

- Tata Chemicals Ltd. (India)

- The Scotts Company LLC (U.S.)

- Coromandel International Limited (India)

- NATIONAL FERTILIZERS LIMITED (India)

- KRIBHCO (India)

- Midwestern BioAg (U.S.)

- Italpollina S.p.A. (Italy)

- ILSA S.p.A. (Italy)

- Perfect Blend, LLC (U.S.)

- Suståne Natural Fertilizer, Inc. (U.S.)

- Biostar Renewables, LLC (U.S.)

- AgroCare Canada, Inc. (Canada)

- Nature Safe (U.S.)

- Fertikal N.V. (Netherlands)

- Multiplex Group (U.S.)

What are the Recent Developments in Global Organic Fertilizers Market?

- In March 2023, Mirimichi Green announced the expansion of its 4-4-4 Organic Grain Fertilizer line, which features granular products composed entirely of organic ingredients. This OMRI-listed fertilizer enriches soil biology and is suitable for a wide range of applications, including residential and commercial lawns, container plants, vegetable gardens, ornamental plants, and trees. The expansion aims to meet the growing demand for eco-friendly gardening solutions

- In March 2023, Windfall Bio secured USD 9 million in seed funding, led by UNTITLED, to develop an innovative solution aimed at capturing climate-harmful methane emissions and converting them into living organic fertilizers. This funding will enable Windfall Bio to initiate on-farm pilot projects and enhance its research and development operations, positioning the company as a leader in sustainable agricultural practices and climate resilience

- In October 2022, ACI Biolife Fertilizer and the Bangladesh Institute of Nuclear Agriculture (BINA) entered into a memorandum of understanding to advance the development and testing of Trichoderma biofertilizers. ACI Fertilizer is establishing a dedicated Biofertilizer Lab in Jhikorgacha, Jessore, with support from BINA. This collaboration aims to enhance soil health and crop yields through the effective use of beneficial microorganisms, reinforcing sustainable agricultural practices in Bangladesh

- In September 2022, Corteva Agriscience expanded its biological portfolio by acquiring Symborg, a Spanish company specializing in microbiological technologies. This strategic acquisition is a key step for Corteva in its commitment to accelerating the development of integrated agricultural solutions. By incorporating Symborg's expertise, Corteva aims to enhance its product offerings, providing farmers with innovative, sustainable solutions that improve crop health and yield

- In October 2021, Qilian International Holding Group Limited successfully completed the first phase of its new organic fertilizer production plant expansion. This milestone allows the company to boost its production capacity to over 30,000 tons annually, significantly enhancing its competitiveness in the organic fertilizer market. The expansion reflects the growing demand for environmentally friendly fertilizers and the company’s commitment to sustainability in agricultural practices

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.