Asia Pacific Cosmetic Pigments And Dyes Market

Market Size in USD Billion

CAGR :

%

USD

1.20 Billion

USD

1.68 Billion

2024

2032

USD

1.20 Billion

USD

1.68 Billion

2024

2032

| 2025 –2032 | |

| USD 1.20 Billion | |

| USD 1.68 Billion | |

|

|

|

|

Cosmetic Pigments and Dyes Market Size

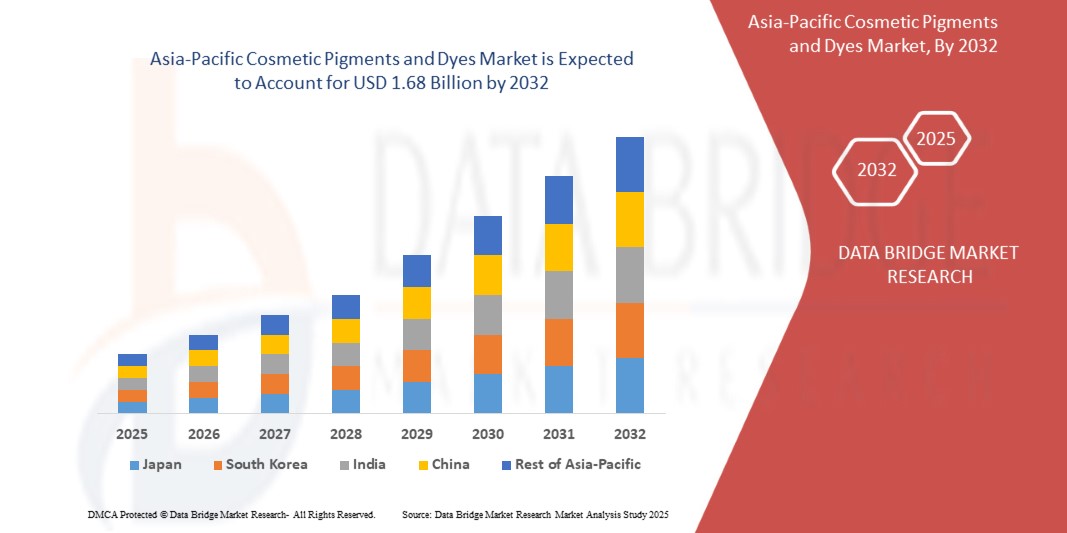

- The Asia-Pacific Cosmetic Pigments and Dyes market size was valued at USD 1.20 billion in 2024 and is projected to reach USD 1.68 billion by 2032, growing at a CAGR of 4.4% during the forecast period.

- This growth is primarily fuelled by rising consumer demand for clean, vegan, and natural cosmetics, particularly in countries like France, Germany, and the UK, where regulatory frameworks like REACH compliance drive manufacturers toward safer and more sustainable ingredients

Cosmetic Pigments and Dyes Market Analysis

- Cosmetic pigments and dyes are the chemical additives that are added to the cosmetic products such as hair oil, lotions, lipsticks, nail enamels, soaps, and eye colors

- Rising modernization and globalization are the major factors fostering the growth of the market. Growing shift in consumer buying trends, rise in the research and development activities and surge in the usage of cosmetic dyes in toiletries, skin care, and hair care products across the globe are some other indirect market growth determinants

- China dominates the Cosmetic Pigments and Dyes market, accounting for the largest regional share of approximately 29.65% in 2024, driven by its robust cosmetics industry, strict regulatory compliance, and a long-standing reputation for innovation and luxury in beauty.

- China is expected to witness the highest growth rate in the Asian Cosmetic Pigments and Dyes market, projected to register a CAGR of 4.7% during the forecast period. This growth is fueled by the rapid development of local beauty brands, increasing exports of cosmetic products, government support for clean and sustainable manufacturing, and growing demand for affordable yet innovative color cosmetics among its urban and youth population

- In 2025, the Inorganic Pigments segment is projected to dominate the Asia-Pacific Cosmetic Pigments and Dyes market with the largest share of 26.56% in the Elemental Composition segment. This dominance is driven by the widespread use of inorganic pigments like titanium dioxide, iron oxides, and zinc oxide, which offer superior color stability, opacity, and UV protection, making them ideal for use in a variety of cosmetic products

Report Scope and Cosmetic Pigments and Dyes Market Segmentation

|

Attributes |

Cosmetic Pigments and Dyes Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

Asia-Pacific

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Cosmetic Pigments and Dyes Market Trends

“Increasing Demand for Sustainable and Eco-Friendly Pigments in the Cosmetic Industry”

- A prominent trend in the Asia-Pacific Cosmetic Pigments and Dyes market is the rising consumer and industry demand for sustainable, eco-friendly pigments. As consumers become more environmentally conscious, there is an increased preference for pigments that are derived from natural sources or produced using environmentally friendly methods, avoiding toxic chemicals and heavy metals

- Manufacturers are responding by focusing on sustainable sourcing, green chemistry, and biodegradable pigments, aligning with the growing demand for clean, green, and ethical beauty products

- For instance, in January 2025, Shiseido (Japan) launched a botanical pigment range for color cosmetics, utilizing extracts from sakura petals and rice bran oil, emphasizing the company’s commitment to biodegradable and non-toxic formulations.

- This trend not only promotes environmental responsibility but also opens up new market opportunities for brands to enhance their sustainability credentials, tapping into a growing segment of eco-conscious consumers while complying with stricter regulations around cosmetic ingredients and environmental impact

Cosmetic Pigments and Dyes Market Dynamics

Driver

“Growing Consumer Demand for Clean and Natural Beauty Products”

- A major driver in the Asia-Pacific Cosmetic Pigments and Dyes market is the increasing consumer demand for clean, natural, and non-toxic beauty products. Consumers are becoming more aware of the harmful effects of synthetic chemicals and artificial pigments in cosmetic products, leading to a shift toward natural alternatives

- This awareness is especially prominent among eco-conscious and health-focused consumers who prefer beauty products with transparent ingredient lists, free from harsh chemicals, parabens, and artificial dyes

- As a result, cosmetic brands are increasingly opting for natural, mineral-based pigments and dyes that are safe, sustainable, and effective, meeting the growing demand for non-toxic and ethically produced products

For instance,

- In February 2025, India-based VedaPigments introduced a range of Ayurvedic-certified natural colorants extracted from turmeric, hibiscus, and indigo, aimed at clean beauty manufacturers in Southeast Asia and Australia.

- This trend not only drives growth in the market but also creates opportunities for innovation in product formulations, offering brands a chance to align with consumer preferences for safe, clean, and sustainable beauty products

Opportunity

“Rising Demand for Eco-Friendly and Sustainable Cosmetic Solutions”

- A key opportunity in the Cosmetic Pigments and Dyes market is the increasing consumer demand for eco-friendly, sustainable, and cruelty-free beauty products. As consumers become more environmentally conscious, there is a growing preference for products made with natural, renewable ingredients and those that minimize environmental impact, including biodegradable packaging and ethically sourced pigments

- This demand is influencing the beauty industry to shift towards plant-based, mineral, and organic cosmetic pigments that not only align with sustainability goals but also cater to health-conscious consumers seeking non-toxic options

For instance,

- In March 2025, Amorepacific (South Korea) collaborated with KAIST (Korea Advanced Institute of Science and Technology) to develop algae-based bio-pigments with natural UV-protective properties for use in sunscreens and tinted moisturizers

- This trend presents an opportunity for manufacturers to innovate in creating eco-friendly and sustainable cosmetic offerings, which can lead to increased brand loyalty and market penetration as more consumers seek out environmentally responsible beauty solutions

Restraint/Challenge

“Regulatory Challenges and Consumer Skepticism Over Artificial Sweeteners”

- The Cosmetic Pigments and Dyes market faces a significant challenge due to regulatory scrutiny and consumer skepticism regarding the long-term health and environmental impacts of synthetic pigments and dyes. Regulatory agencies in various regions, such as the European Chemicals Agency (ECHA) and the U.S. Food and Drug Administration (FDA), continue to evaluate the safety of certain synthetic pigments, leading to increased regulations and bans in some markets

- Additionally, consumers are becoming more cautious about the potential adverse effects of synthetic chemicals in cosmetics, including allergies, skin irritation, and environmental damage, which can hinder the widespread adoption of products containing these pigments and dyes

For instance,

In April 2025, Japan’s Pharmaceuticals and Medical Devices Agency (PMDA) issued revised guidelines limiting the use of coal tar-derived dyes in cosmetics, leading to a surge in reformulations among domestic and imported brands.

-

This challenge emphasizes the need for manufacturers to focus on natural, sustainable, and safe alternatives for cosmetic pigments and dyes to align with consumer preferences and regulatory requirements, thus maintaining market competitiveness and trust

Cosmetic Pigments and Dyes Market Scope

The market is segmented on the basis of elemental composition, type, technology and application

|

Segmentation |

Sub-Segmentation |

|

By Elemental Composition |

|

|

By type |

|

|

By Technology |

|

|

By Application |

|

In 2025, the Inorganic Pigments segment is projected to dominate the market with a largest share in Elemental Composition segment

In 2025, the Inorganic Pigments segment is projected to dominate the Elemental Composition segment of the Asia-Pacific Cosmetic Pigments and Dyes market with the largest share of 26.56% This dominance is driven by the increasing demand for highly stable and skin-safe pigments, such as titanium dioxide and iron oxide, which are favored for their opacity, UV protection, and long-lasting effects in cosmetic products. These pigments are extensively used in facial makeup (foundations, concealers) and eye makeup due to their reliable performance and safe application

The Facial Makeup is expected to account for the largest share during the forecast period in Application market

In 2025, the Facial Makeup segment is projected to dominate the Asia-Pacific Cosmetic Pigments and Dyes market in the Application segment with the largest share of 21.35%. This growth is fueled by the rising demand for innovative, skin-safe formulations in makeup products like foundations, blushes, and highlighters. The increasing focus on personal grooming, inclusive shade ranges, and natural, long-lasting makeup solutions is expected to drive the segment's dominance and significant market growth during the forecast period

Cosmetic Pigments and Dyes Market Regional Analysis

“China Holds the Largest Share in the Cosmetic Pigments and Dyes Market”

- In 2024, China held the largest share of the Asia-Pacific Cosmetic Pigments and Dyes market, contributing approximately 29.65% due to its well-established manufacturing ecosystem and massive domestic consumption of color cosmetics.

- The country’s dominance is driven by a strong base of cosmetic manufacturers, global export competitiveness, and adherence to international quality standards like EU REACH.

- Major Chinese brands and OEM producers continue to boost their pigment innovation capacity, catering to both domestic demand and global partnerships with European and American beauty labels

“China is Projected to Register the Highest CAGR in the Cosmetic Pigments and Dyes Market”

- China is projected to witness the highest CAGR of 4.7% in the Asia-Pacific Cosmetic Pigments and Dyes market between 2024 and 2032, driven by growing beauty consciousness among its urban youth population.

- The rapid expansion of local beauty brands, combined with rising popularity of e-commerce and social media-driven beauty trends, is accelerating the use of innovative pigments and dyes.

- Government incentives promoting green chemistry and sustainable manufacturing practices are encouraging companies to develop safer, more eco-friendly pigment alternatives.

Cosmetic Pigments and Dyes Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, Asia-Pacific presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- LANXESS (Germany)

- BASF SE (Germany)

- Clariant (Switzerland)

- Dayglo Color Corp (U.S.)

- ECKART GmbH (Germany)

- Sun Chemical (U.S.)

- Sandream Specialties (U.S.)

- Rakuten Kobo Inc. (Japan)

- LI PIGMENTS (U.S.)

- Merck KGaA (Germany)

- Miyoshi Kasei, Inc. (Japan)

- Toyal Asia-Pacific (France)

Latest Developments in Asia-Pacific Cosmetic Pigments and Dyes Market

- In February 2025, Kose Corporation (Japan) launched a new skincare-infused color line using marine-derived pigments extracted from seaweed and microalgae. This innovation supports Japan’s “Blue Beauty” initiative, which emphasizes ocean-safe and reef-friendly formulations

- In March 2025, LG H&H (South Korea) unveiled a new range of cruelty-free, water-dispersible pigments for use in hybrid beauty products like tinted sunscreens and BB creams. The move targets rising Gen Z demand for multi-functional, vegan products.

- In December 2024, BotaniColor (India) announced the expansion of its plant-based pigment production facility in Tamil Nadu, aiming to scale exports to ASEAN and Australia. The new plant focuses on zero-waste processing and solar-powered manufacturing.

- In January 2025, Australis Cosmetics (Australia) partnered with CSIRO (Commonwealth Scientific and Industrial Research Organisation) to develop eco-certified colorants from native Australian botanicals like Kakadu plum and finger lime, meeting COSMOS and ACO standards

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.