Asia-Pacific Electric Vehicle Heat Shrink Tubing Market Analysis and Size

Asia-Pacific electric vehicle heat shrink tubing can be applied in automotive tubing systems, including fuel line protection tubing, ABS tubing, air conditioning aluminum tubing, power steering return hoses, water drain tubing, ATF tubing formulated for automotive engines, water-cooling system tubing, fuel system tubing, and air conditioning hoses.

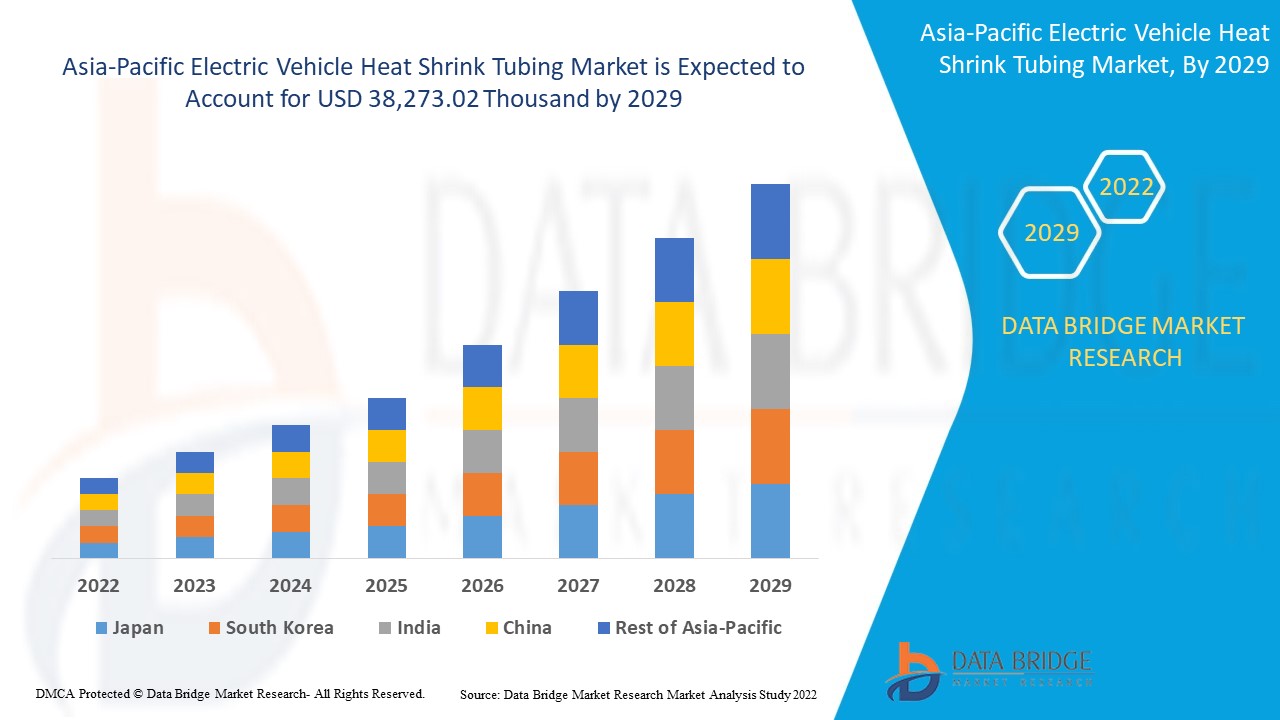

Data Bridge Market Research analyses that Asia-Pacific electric vehicle heat shrink tubing market is expected to reach the value of USD 38,273.02 thousand by 2029, at a CAGR of 7.9% during the forecast period. “Hoses" accounts for the most prominent application segment as this type of application is in demand and is the best option for increasing vehicle security.

|

Report Metric |

Details |

|

Forecast Period |

2022 to 2029 |

|

Base Year |

2021 |

|

Historic Years |

2020 (Customisable 2019-2014) |

|

Quantitative Units |

USD Thousand |

|

Segments Covered |

By Application (Hoses, Connectors, Ring Terminals, In-line Splices, Under Bonnet Cable Protection, Gas Pipes and Miniature Splices), Material (Polyolefin, Polytetrafluoroethylene, Fluorinated Ethylene Propylene, Perfluoroalkoxy Alkanes, Ethylene Tetrafluoroethylene and Others), Color (Red, Yellow and Others), Connector Application (HTAT, ATUM, CGPT, LSTT<150 C and Others), Type (Single Wall Shrink Tubing and Dual Wall Shrink Tubing), Voltage (Low Voltage, Medium Voltage and High Voltage), Sales Channel (OEM and Aftermarket), Vehicle Type (BEV(Battery Electric Vehicles), PHEV (Plug-In Hybrid Electric Vehicle), Hybrid Electric Vehicle (HEVS)) |

|

Countries Covered |

China, Japan, India, South Korea, Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines and Rest of Asia-Pacific |

|

Market Players Covered |

Sumitomo Electric Industries, Ltd., Dasheng , Inc., TE Connectivity, Shenzhen Woer Heat-Shrinkable Material Co., Ltd., SHAWCOR, ABB, Techflex, Inc., Paras Enterprises, HellermannTyton, Alpha Wire, WireMasters, Inc., Zeus Industrial Products, Inc., 3M, The Zippertubing, Panduit, Dee Five, Huizhou Guanghai Electronic Insulation Materials Co., Ltd., GREMCO GmbH, Qualtek Electronics Corp., Texcan, Autosparks, NELCO, Insultab, PEXCO, WiringProducts, Ltd., IS-Rayfast Ltd., Flex Wires Inc., Thermosleeve USA, Molex |

Market Definition

Heat shrink tubing is used to insulate wire providing abrasion resistance and environmental protection for the stranded solid wire conductors with connections, joints, and terminals in electrical work. In general, a tube with a lower shrink temperature will shrink faster. When heat shrink tubing is wrapped around wire arrays and electrical components, it collapses radially to fit the contours of the equipment, forming a protective layer. It can protect against abrasion, low impact, cuts, moisture, and dust by covering individual wires or encasing entire arrays. Plastic manufacturers begin by extruding a thermoplastic tube to create heat-shrink tubing. Heat shrink tubing materials vary depending on the intended application.

Asia-Pacific Electric Vehicle Heat Shrink Tubing Market Dynamics

This section deals with understanding the market drivers, advantages, opportunities, restraints, and challenges. All of this is discussed in detail below:

Drivers

- GROWING DEMAND FOR ELECTRIC VEHICLE WIRING HARNESS FOR SAFETY SYSTEMS

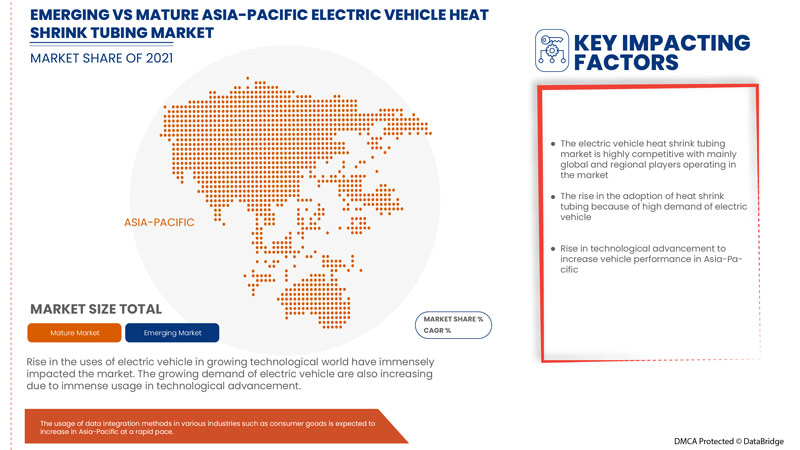

Electric vehicles are becoming highly connected as part of the internet of things and the internet of vehicles, transforming the vehicle into a seamless interface between our connected lives at home and work. The integration of screens and displays into almost any imaginable interior surface demonstrates the vehicle’s growing role as a hub for entertainment, communications, and productivity.

- RISE IN TECHNOLOGICAL ADVANCEMENT TO INCREASE VEHICLE PERFORMANCE

The automotive industry has worked with major technology companies in order to deliver the most advanced, safest, and most comfortable vehicles out there. Cars are becoming large smart devices with advanced emergency braking capabilities, mapping technology for autonomous driving, better fuel efficiency, and cars as a service as a form of transportation.

- INCREASING SALES AND DEMAND FOR ELECTRIC VEHICLES

One of the key drivers of the Asia-Pacific electric vehicle heat shrink tubing market is the rise in demand for electric vehicles and sales worldwide. Electric vehicle segments drove the surge in the company's sales during the month.

Opportunity

- INVOLVEMENT OF AUTOMATION IN HEAT SHRINK TUBING PROCESS

Heat shrink tubing is used in wire harnessing processes to insulate wire conductors, protect wires and create cable entry seals. Manually performing this sensitive process is time-consuming, the results are heavily reliant on the operator's expertise, and the process raises safety concerns

Restraint/ Challenge

- STRINGENT GOVERNMENT REGULATION ON EMISSION OF TOXIC GASES & INCREASE IN PRICES OF HEAT SHRINK TUBING RELATED RAW MATERIALS

Cybercrime/hacking and cybersecurity issues have increased by 600% during the pandemic across all sectors. Flaws in network or software security are weaknesses that hackers exploit to perform unauthorized actions within a system. According to Purple Sec LLC, in 2018, mobile malware variants for mobile have increased by 54% 2018, out of which 98% of mobile malware target Android devices. 25% of businesses are estimated to have been victims of crypto-jacking, including the security industry. On the other hand, the share of raw material prices in the total costs for heat shrink film depends upon the different materials a producer uses in his production. The price fluctuations affect the cable, wire, and connectivity products and materials being purchased or affect the outlook on budget projections in procurement, finance, supply chain management, or product development

Post COVID-19 Impact on Asia-Pacific Electric Vehicle Heat Shrink Tubing Market

COVID-19 created a negative impact on Asia-Pacific electric vehicle heat shrink tubing market as almost every country has opted for the shutdown of every production facility except the ones dealing in producing the essential goods. The government has taken strict actions, such as shutting down production and sale of non-essential goods, blocking international trade, and many more, to prevent the spread of COVID-19. The only business dealing in this pandemic situation is the essential services allowed to open and run the processes.

Recent Development

- In December 2021, Sumitomo Electric Industries, Ltd. launched cross-linked fluororesin FEX tape. The key feature of this product was its technology part, as it used two key technologies, fluorine processing technology, and electron beam irradiation technology, which offered 1,000 times more resistance to wear than conventional fluororesin (PTFE) tape. Moreover, it can be used in the automotive sector

- In April 2021, ABB launched a 25 ft. Shrink-Kon heat-shrinkable tubing. The key feature of this product was its 6.4 mm inner diameter expanded with 3.2 mm inner diameter recovered, wall thickness recovered of 0.6 mm and material used is Polyolefin

Asia-Pacific Electric Vehicle Heat Shrink Tubing Market Scope

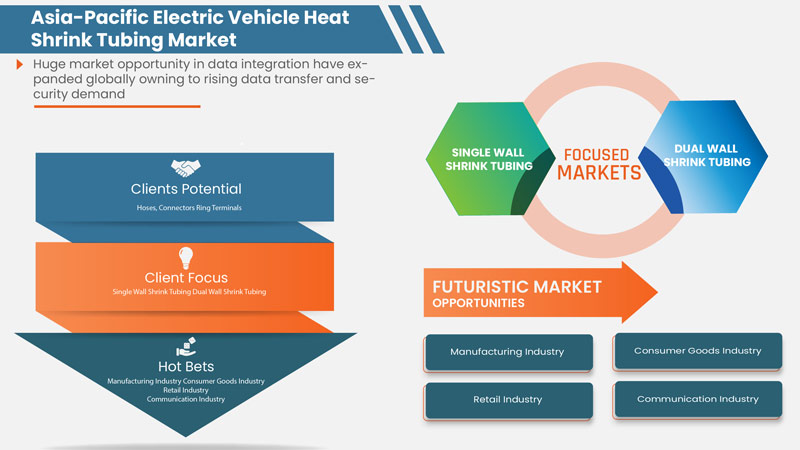

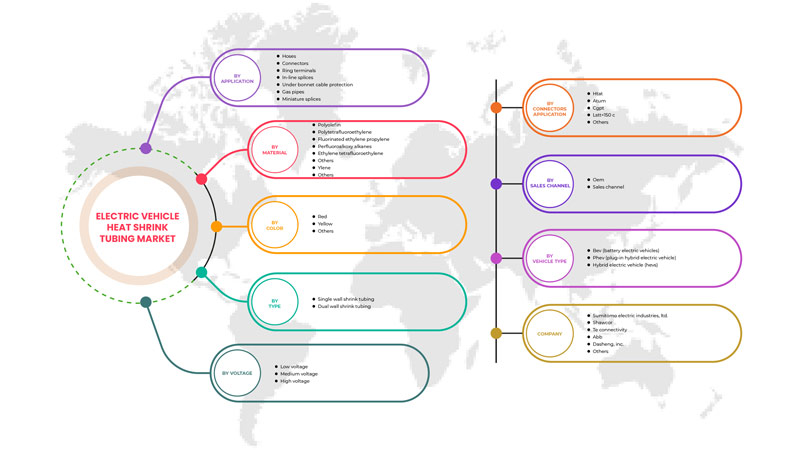

Asia-Pacific electric vehicle heat shrink tubing market is segmented on the basis of application, material, color, connector application, type, voltage, sales channel and vehicle type. The growth amongst these segments will help you analyze meagre growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

By Application

- Hoses

- Connectors

- Ring Terminals

- In-line Splices

- Under Bonnet Cable Protection

- Gas pipes

- Miniature Splices

On the basis of application, the electric vehicle heat shrink tubing market is segmented into hoses, connectors, ring terminals, in-line splices, under bonnet cable protection, gas pipes and miniature splices.

By Material

- Polyolefin

- Polytetrafluoroethylene

- Fluorinated Ethylene Propylene

- Perfluoroalkoxy Alkanes

- Ethylene Tetrafluoroethylene

- Others

On the basis of material, the electric vehicle heat shrink tubing market is segmented into polyolefin, polytetrafluoroethylene, fluorinated ethylene propylene, perfluoroalkoxy alkanes, ethylene tetrafluoroethylene and others.

By Color

- Red

- Yellow

- Others

On the basis of color, the electric vehicle heat shrink tubing market is segmented into red, yellow and others.

By Connector Application

- HTAT

- ATUM

- CGPT

- LSTT<150 C

- Others

On the basis of connector application, the electric vehicle heat shrink tubing market is segmented into HTAT, ATUM, CGPT, LSTT<150 C and Others.

By Type

- Single Wall Shrink Tubing

- Dual Wall Shrink Tubing

On the basis of type, the electric vehicle heat shrink tubing market is segmented into single wall shrink tubing and dual wall shrink tubing.

By Voltage

- Low Voltage

- Medium Voltage

- High Voltage

On the basis of voltage, the electric vehicle heat shrink tubing market is segmented into low voltage, medium voltage and high voltage.

By Sales Channel

- OEM

- Aftermarket

On the basis of sales channel, the electric vehicle heat shrink tubing market is segmented OEM and aftermarket.

By Vehicle Type

- BEV(Battery Electric Vehicles)

- PHEV (Plug-In Hybrid Electric Vehicle)

- Hybrid Electric Vehicle (HEVS)

On the basis of vehicle type, the electric vehicle heat shrink tubing market is segmented BEV (battery electric vehicles), PHEV (plug-in hybrid electric vehicle), HEVS (hybrid electric vehicle).

Asia-Pacific Electric Vehicle Heat Shrink Tubing Market Regional Analysis/Insights

Asia-Pacific electric vehicle heat shrink tubing market is analysed and market size insights and trends are provided by country, application, material, color, connector application, type, voltage, sales channel and vehicle type, as referenced above.

The countries covered in the electric vehicle heat shrink tubing market report are China, Japan, India, South Korea, Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines and Rest of Asia-Pacific.

China dominates the Asia-Pacific electric vehicle heat shrink tubing market. China is likely to be the fastest-growing Asia-Pacific electric vehicle heat shrink tubing market owing to factors such as increasing advancement in wire harnessing technology in the automobile sector.

The country section of the report also provides individual market-impacting factors and market regulation changes that impact the market's current and future trends. Data points like downstream and upstream value chain analysis, technical trends, porter's five forces analysis, and case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of Asia-Pacific brands and their challenges faced due to large or scarce competition from local and domestic brands, the impact of domestic tariffs, and trade routes are considered while providing forecast analysis of the country data.

Competitive Landscape and Asia-Pacific Electric Vehicle Heat Shrink Tubing Market Share Analysis

The electric vehicle heat shrink tubing Market competitive landscape provides details of the competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, Asia-Pacific presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, and application dominance. The above data points provided are only related to the companies' focus related to Asia-Pacific electric vehicle heat shrink tubing market.

Some of the major players operating in the electric vehicle heat shrink tubing market are Sumitomo Electric Industries, Ltd., Dasheng , Inc., TE Connectivity, Shenzhen Woer Heat-Shrinkable Material Co., Ltd., SHAWCOR, ABB, Techflex, Inc., Paras Enterprises, HellermannTyton, Alpha Wire, WireMasters, Inc., Zeus Industrial Products, Inc., 3M, The Zippertubing, Panduit, Dee Five, Huizhou Guanghai Electronic Insulation Materials Co.,Ltd., GREMCO GmbH, Qualtek Electronics Corp., Texcan, Autosparks, NELCO, Insultab, PEXCO, WiringProducts, Ltd., IS-Rayfast Ltd., Flex Wires Inc., Thermosleeve USA, Molex among others.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF ASIA PACIFIC ELECTRIC VEHICLE HEAT SHRINK TUBING MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 DBMR MARKET POSITION GRID

2.7 VENDOR SHARE ANALYSIS

2.8 MULTIVARIATE MODELING

2.9 APPLICATION TIMELINE CURVE

2.1 SECONDARY SOURCES

2.11 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 COMPARATIVE ANALYSIS OF HEAT SHRINK TUBING FOR ELECTRIC VEHICLE AND INTERNAL COMBUSTION

5 DBMR ANALYSIS

5.1 STRENGTH:

5.2 THREATS:

5.3 OPPORTUNITY:

5.4 WEAKNESS:

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 GROWING DEMAND FOR ELECTRIC VEHICLE WIRING HARNESS FOR SAFETY SYSTEMS

6.1.2 RISE IN TECHNOLOGICAL ADVANCEMENT TO INCREASE VEHICLE PERFORMANCE

6.1.3 INCREASING SALES AND DEMAND FOR ELECTRIC VEHICLES

6.1.4 INCREASING DEMAND FOR MICA-BASED INSULATING MATERIALS FOR PREVENTIVE MAINTENANCE

6.2 RESTRAINTS

6.2.1 STRINGENT GOVERNMENT REGULATION ON EMISSION OF TOXIC GASES

6.2.2 TRADE BARRIERS IN THE LEAST DEVELOPED COUNTRIES

6.3 OPPORTUNITIES

6.3.1 INVOLVEMENT OF AUTOMATION IN HEAT SHRINK TUBING PROCESS

6.3.2 INCREASE IN PENETRATION OF ELECTRIC VEHICLES ACROSS THE GLOBE

6.3.3 EASY PRODUCTION OF HEAT SHRINK TUBING-RELATED PRODUCTS

6.4 CHALLENGES

6.4.1 INCREASE IN PRICES OF HEAT SHRINK TUBING-RELATED RAW MATERIALS

6.4.2 LACK OF OPERATOR EXPERTISE FOR INSTALLATION OF HEAT SHRINKING TUBE IN ELECTRIC VEHICLES

7 ASIA PACIFIC ELECTRIC VEHICLE HEAT SHRINK TUBING MARKET, BY APPLICATION

7.1 OVERVIEW

7.2 HOSES

7.2.1 HEATING AND COOLING SYSTEM HOSES

7.2.2 BREAKING SYSTEM HOSES

7.2.3 POWER STEERING SYSTEM HOSES

7.2.4 FUEL DELIVERY SYSTEM HOSES

7.2.5 TURBOCHARGER HOSES

7.3 CONNECTORS

7.3.1 BY TYPE

7.3.1.1 WIRE TO WIRE

7.3.1.2 WIRE TO BOARD

7.3.1.3 BOARD TO BOARD

7.3.2 BY SYSTEM TYPE

7.3.2.1 UNSEALED

7.3.2.2 SEALED

7.4 RING TERMINALS

7.4.1 LESS THAN 10 GAUGE HEAT SHRINK RING TERMINALS

7.4.2 14-16 GAUGE HEAT SHRINK RING TERMINALS

7.4.3 18-20 GAUGE HEAT SHRINK RING TERMINALS

7.5 IN-LINE SPLICES

7.6 UNDER BONNET CABLE PROTECTION

7.7 GAS PIPES

7.8 MINIATURE SPLICES

8 ASIA PACIFIC ELECTRIC VEHICLE HEAT SHRINK TUBING MARKET, BY MATERIAL

8.1 OVERVIEW

8.2 POLYOLEFIN

8.3 POLYTETRAFLUOROETHYLENE

8.4 FLUORINATED ETHYLENE PROPYLENE

8.5 PERFLUOROALKOXY ALKANES

8.6 ETHYLENE TETRAFLUOROETHYLENE

8.7 OTHERS

9 ASIA PACIFIC ELECTRIC VEHICLE HEAT SHRINK TUBING MARKET, BY COLOR

9.1 OVERVIEW

9.2 RED

9.3 YELLOW

9.4 OTHERS

10 ASIA PACIFIC ELECTRIC VEHICLE HEAT SHRINK TUBING MARKET, BY CONNECTOR APPLICATION

10.1 OVERVIEW

10.2 HTAT

10.3 ATUM

10.4 CGPT

10.5 LSTT<150 C

10.6 OTHERS

11 ASIA PACIFIC ELECTRIC VEHICLE HEAT SHRINK TUBING MARKET, BY TYPE

11.1 OVERVIEW

11.2 SINGLE WALL SHRINK TUBING

11.3 DUAL WALL SHRINK TUBING

12 ASIA PACIFIC ELECTRIC VEHICLE HEAT SHRINK TUBING MARKET, BY VOLTAGE

12.1 OVERVIEW

12.2 LOW VOLTAGE

12.3 MEDIUM VOLTAGE

12.4 HIGH VOLTAGE

13 ASIA PACIFIC ELECTRIC VEHICLE HEAT SHRINK TUBING MARKET, BY SALES CHANNEL

13.1 OVERVIEW

13.2 OEM

13.3 AFTERMARKET

14 ASIA PACIFIC ELECTRIC VEHICLE HEAT SHRINK TUBING MARKET, BY VEHICLE TYPE

14.1 OVERVIEW

14.2 BEV (BATTERY ELECTRIC VEHICLES)

14.3 PHEV (PLUG-IN HYBRID ELECTRIC VEHICLE)

14.4 HYBRID ELECTRIC VEHICLE (HEVS)

15 ASIA PACIFIC ELECTRIC VEHICLE HEAT SHRINK TUBING MARKET, BY REGION

15.1 ASIA-PACIFIC

15.1.1 CHINA

15.1.2 SOUTH KOREA

15.1.3 JAPAN

15.1.4 INDIA

15.1.5 AUSTRALIA

15.1.6 SINGAPORE

15.1.7 THAILAND

15.1.8 MALAYSIA

15.1.9 INDONESIA

15.1.10 PHILIPPINES

15.1.11 REST OF ASIA-PACIFIC

16 ASIA PACIFIC ELECTRIC VEHICLE HEAT SHRINK TUBING MARKET, COMPANY LANDSCAPE

16.1 COMPANY SHARE ANALYSIS: ASIA PACIFIC

17 SWOT ANALYSIS

18 COMPANY PROFILE

18.1 SUMITOMO ELECTRIC INDUSTRIES, LTD.

18.1.1 COMPANY SNAPSHOT

18.1.2 REVENUE ANALYSIS

18.1.3 COMPANY SHARE ANALYSIS

18.1.4 PRODUCTS PORTFOLIO

18.1.5 RECENT DEVELOPMENTS

18.2 SHAWCOR

18.2.1 COMPANY SNAPSHOT

18.2.2 REVENUE ANALYSIS

18.2.3 COMPANY SHARE ANALYSIS

18.2.4 PRODUCTS PORTFOLIO

18.2.5 RECENT DEVELOPMENTS

18.3 TE CONNECTIVITY

18.3.1 COMPANY SNAPSHOT

18.3.2 REVENUE ANALYSIS

18.3.3 COMPANY SHARE ANALYSIS

18.3.4 PRODUCT PORTFOLIO

18.3.5 RECENT DEVELOPMENTS

18.4 ABB

18.4.1 COMPANY SNAPSHOT

18.4.2 REVENUE ANALYSIS

18.4.3 COMPANY SHARE ANALYSIS

18.4.4 PRODUCTS PORTFOLIO

18.4.5 RECENT DEVELOPMENTS

18.5 DASENGH, INC.

18.5.1 COMPANY SNAPSHOT

18.5.2 COMPANY SHARE ANALYSIS

18.5.3 PRODUCT PORTFOLIO

18.5.4 RECENT DEVELOPMENT

18.6 ALPHA WIRE

18.6.1 COMPANY SNAPSHOT

18.6.2 PRODUCT PORTFOLIO

18.6.3 RECENT DEVELOPMENTS

18.7 AUTOSPARKS

18.7.1 COMPANY SNAPSHOT

18.7.2 PRODUCT PORTFOLIO

18.7.3 RECENT DEVELOPMENT

18.8 DEE FIVE

18.8.1 COMPANY SNAPSHOT

18.8.2 PRODUCT PORTFOLIO

18.8.3 RECENT DEVELOPMENT

18.9 FLEX WIRES INC.

18.9.1 COMPANY SNAPSHOT

18.9.2 PRODUCT PORTFOLIO

18.9.3 RECENT DEVELOPMENT

18.1 GREMCO GMBH

18.10.1 COMPANY SNAPSHOT

18.10.2 PRODUCT PORTFOLIO

18.10.3 RECENT DEVELOPMENTS

18.11 HUIZHOU GUANGHAI ELECTRONIC INSULATION MATERIALS CO., LTD.

18.11.1 COMPANY SNAPSHOT

18.11.2 PRODUCT PORTFOLIO

18.11.3 RECENT DEVELOPMENTS

18.12 HELLERMANNTYTON

18.12.1 COMPANY SNAPSHOT

18.12.2 PRODUCT PORTFOLIO

18.12.3 RECENT DEVELOPMENTS

18.13 INSULTAB, PEXCO

18.13.1 COMPANY SNAPSHOT

18.13.2 PRODUCT PORTFOLIO

18.13.3 RECENT DEVELOPMENTS

18.14 IS-RAYFAST LTD

18.14.1 COMPANY SNAPSHOT

18.14.2 PRODUCT PORTFOLIO

18.14.3 RECENT DEVELOPMENT

18.15 MOLEX

18.15.1 COMPANY SNAPSHOT

18.15.2 PRODUCT PORTFOLIO

18.15.3 RECENT DEVELOPMENTS

18.16 3M

18.16.1 COMPANY SNAPSHOT

18.16.2 REVENUE ANALYSIS

18.16.3 RODUCT PORTFOLIO

18.16.4 RECENT DEVELOPMENT

18.17 NELCO

18.17.1 COMPANY SNAPSHOT

18.17.2 PRODUCT PORTFOLIO

18.17.3 RECENT DEVELOPMENTS

18.18 PARAS ENTERPRISES

18.18.1 COMPANY SNAPSHOT

18.18.2 PRODUCT PORTFOLIO

18.18.3 RECENT DEVELOPMENTS

18.19 PANDUIT

18.19.1 COMPANY SNAPSHOT

18.19.2 PRODUCT PORTFOLIO

18.19.3 RECENT DEVELOPMENTS

18.2 QUALTEK ELECTRONICS CORP.

18.20.1 COMPANY SNAPSHOT

18.20.2 PRODUCT PORTFOLIO

18.20.3 RECENT DEVELOPMENTS

18.21 SHENZHEN WOER HEAT - SHRINKABLE MATERIAL CO., LTD.

18.21.1 COMPANY SNAPSHOT

18.21.2 PRODUCT PORTFOLIO

18.21.3 RECENT DEVELOPMENTS

18.22 TECHFLEX, INC.

18.22.1 COMPANY SNAPSHOT

18.22.2 PRODUCT PORTFOLIO

18.22.3 RECENT DEVELOPMENTS

18.23 THE ZIPPERTUBING COMPANY

18.23.1 COMPANY SNAPSHOT

18.23.2 PRODUCT PORTFOLIO

18.23.3 RECENT DEVELOPMENTS

18.24 TEXCAN

18.24.1 COMPANY SNAPSHOT

18.24.2 PRODUCT PORTFOLIO

18.24.3 RECENT DEVELOPMENT

18.25 THERMOSLEEVE USA

18.25.1 COMPANY SNAPSHOT

18.25.2 PRODUCT PORTFOLIO

18.25.3 RECENT DEVELOPMENTS

18.26 WIREMASTERS, INC.

18.26.1 COMPANY SNAPSHOT

18.26.2 PRODUCT PORTFOLIO

18.26.3 RECENT DEVELOPMENT

18.27 WIRINGPRODUCTS, LTD

18.27.1 COMPANY SNAPSHOT

18.27.2 PRODUCT PORTFOLIO

18.27.3 RECENT DEVELOPMENT

18.28 ZEUS INDUSTRIAL PRODUCTS, INC.

18.28.1 COMPANY SNAPSHOT

18.28.2 PRODUCT PORTFOLIO

18.28.3 RECENT DEVELOPMENTS

19 QUESTIONNAIRE

20 RELATED REPORTS

List of Table

TABLE 1 ASIA PACIFIC ELECTRIC VEHICLE HEAT SHRINK TUBING MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 2 ASIA PACIFIC HOSES IN ELECTRIC VEHICLE HEAT SHRINK TUBING MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 3 ASIA PACIFIC HOSES IN ELECTRIC VEHICLE HEAT SHRINK TUBING MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 4 ASIA PACIFIC CONNECTORS IN ELECTRIC VEHICLE HEAT SHRINK TUBING MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 5 ASIA PACIFIC CONNECTORS IN ELECTRIC VEHICLE HEAT SHRINK TUBING MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 6 ASIA PACIFIC CONNECTORS IN ELECTRIC VEHICLE HEAT SHRINK TUBING MARKET, BY SYSTEM TYPE, 2020-2029 (USD THOUSAND)

TABLE 7 ASIA PACIFIC RING TERMINALS IN ELECTRIC VEHICLE HEAT SHRINK TUBING MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 8 ASIA PACIFIC RING TERMINAL IN ELECTRIC VEHICLE HEAT SHRINK TUBING MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 9 ASIA PACIFIC IN-LINE SPLICES IN ELECTRIC VEHICLE HEAT SHRINK TUBING MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 10 ASIA PACIFIC UNDER BONNET CABLE PROTECTION IN ELECTRIC VEHICLE HEAT SHRINK TUBING MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 11 ASIA PACIFIC GAS PIPES IN ELECTRIC VEHICLE HEAT SHRINK TUBING MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 12 ASIA PACIFIC MINIATURE SPLICES IN ELECTRIC VEHICLE HEAT SHRINK TUBING MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 13 ASIA PACIFIC ELECTRIC VEHICLE HEAT SHRINK TUBING MARKET, BY MATERIAL, 2020-2029 (USD THOUSAND)

TABLE 14 ASIA PACIFIC POLYOLEFIN IN ELECTRIC VEHICLE HEAT SHRINK TUBING MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 15 ASIA PACIFIC POLYTETRAFLUOROETHYLENE IN ELECTRIC VEHICLE HEAT SHRINK TUBING MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 16 ASIA PACIFIC FLUORINATED ETHYLENE PROPYLENE IN ELECTRIC VEHICLE HEAT SHRINK TUBING MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 17 ASIA PACIFIC PERFLUOROALKOXY ALKANES IN ELECTRIC VEHICLE HEAT SHRINK TUBING MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 18 ASIA PACIFIC ETHYLENE TETRAFLUOROETHYLENE IN ELECTRIC VEHICLE HEAT SHRINK TUBING MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 19 ASIA PACIFIC OTHERS IN ELECTRIC VEHICLE HEAT SHRINK TUBING MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 20 ASIA PACIFIC ELECTRIC VEHICLE HEAT SHRINK TUBING MARKET, BY COLOR, 2020-2029 (USD THOUSAND)

TABLE 21 ASIA PACIFIC RED IN ELECTRIC VEHICLE HEAT SHRINK TUBING MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 22 ASIA PACIFIC YELLOW IN ELECTRIC VEHICLE HEAT SHRINK TUBING MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 23 ASIA PACIFIC OTHERS IN ELECTRIC VEHICLE HEAT SHRINK TUBING MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 24 ASIA PACIFIC IN ELECTRIC VEHICLE HEAT SHRINK TUBING MARKET, BY CONNECTOR APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 25 ASIA PACIFIC HTAT IN ELECTRIC VEHICLE HEAT SHRINK TUBING MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 26 ASIA PACIFIC ATUM IN ELECTRIC VEHICLE HEAT SHRINK TUBING MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 27 ASIA PACIFIC CGPT IN ELECTRIC VEHICLE HEAT SHRINK TUBING MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 28 ASIA PACIFIC LSTT<150 C IN ELECTRIC VEHICLE HEAT SHRINK TUBING MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 29 ASIA PACIFIC OTHERS IN ELECTRIC VEHICLE HEAT SHRINK TUBING MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 30 ASIA PACIFIC ELECTRIC VEHICLE HEAT SHRINK TUBING MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 31 ASIA PACIFIC SINGLE WALL SHRINK TUBING IN ELECTRIC VEHICLE HEAT SHRINK TUBING MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 32 ASIA PACIFIC DUAL WALL SHRINK TUBING IN ELECTRIC VEHICLE HEAT SHRINK TUBING MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 33 ASIA PACIFIC ELECTRIC VEHICLE HEAT SHRINK TUBING MARKET, BY VOLTAGE, 2020-2029 (USD THOUSAND)

TABLE 34 ASIA PACIFIC LOW VOLTAGE IN ELECTRIC VEHICLE HEAT SHRINK TUBING MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 35 ASIA PACIFIC MEDIUM VOLTAGE IN ELECTRIC VEHICLE HEAT SHRINK TUBING MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 36 ASIA PACIFIC HIGH VOLTAGE IN ELECTRIC VEHICLE HEAT SHRINK TUBING MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 37 ASIA PACIFIC ELECTRIC VEHICLE HEAT SHRINK TUBING MARKET, BY SALES CHANNEL, 2020-2029 (USD THOUSAND)

TABLE 38 ASIA PACIFIC OEM IN ELECTRIC VEHICLE HEAT SHRINK TUBING MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 39 ASIA PACIFIC AFTERMARKET IN ELECTRIC VEHICLE HEAT SHRINK TUBING MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 40 ASIA PACIFIC ELECTRIC VEHICLE HEAT SHRINK TUBING MARKET, BY VEHICLE TYPE, 2020-2029 (USD THOUSAND)

TABLE 41 ASIA PACIFIC BEV (BATTERY ELECTRIC VEHICLES) IN ELECTRIC VEHICLE HEAT SHRINK TUBING MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 42 ASIA PACIFIC PHEV (PLUG-IN HYBRID ELECTRIC VEHICLE) IN ELECTRIC VEHICLE HEAT SHRINK TUBING MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 43 ASIA PACIFIC HYBRID ELECTRIC VEHICLE (HEVS) IN ELECTRIC VEHICLE HEAT SHRINK TUBING MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 44 ASIA-PACIFIC ELECTRIC VEHICLE HEAT SHRINK TUBING MARKET, BY COUNTRY, 2020-2029 (USD THOUSAND)

TABLE 45 ASIA-PACIFIC ELECTRIC VEHICLE HEAT SHRINK TUBING MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 46 ASIA-PACIFIC HOSES IN ELECTRIC VEHICLE HEAT SHRINK TUBING MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 47 ASIA-PACIFIC CONNECTORS IN ELECTRIC VEHICLE HEAT SHRINK TUBING MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 48 ASIA-PACIFIC CONNECTORS IN ELECTRIC VEHICLE HEAT SHRINK TUBING MARKET, BY SYSTEM TYPE, 2020-2029 (USD THOUSAND)

TABLE 49 ASIA-PACIFIC RING TERMINAL IN ELECTRIC VEHICLE HEAT SHRINK TUBING MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 50 ASIA-PACIFIC ELECTRIC VEHICLE HEAT SHRINK TUBING MARKET, BY MATERIAL, 2020-2029 (USD THOUSAND)

TABLE 51 ASIA-PACIFIC ELECTRIC VEHICLE HEAT SHRINK TUBING MARKET, BY COLOR, 2020-2029 (USD THOUSAND)

TABLE 52 ASIA-PACIFIC ELECTRIC VEHICLE HEAT SHRINK TUBING MARKET, BY CONNECTOR APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 53 ASIA-PACIFIC ELECTRIC VEHICLE HEAT SHRINK TUBING MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 54 ASIA-PACIFIC ELECTRIC VEHICLE HEAT SHRINK TUBING MARKET, BY VOLTAGE, 2020-2029 (USD THOUSAND)

TABLE 55 ASIA-PACIFIC ELECTRIC VEHICLE HEAT SHRINK TUBING MARKET, BY SALES CHANNEL, 2020-2029 (USD THOUSAND)

TABLE 56 ASIA-PACIFIC ELECTRIC VEHICLE HEAT SHRINK TUBING MARKET, BY VEHICLE TYPE, 2020-2029 (USD THOUSAND)

TABLE 57 CHINA ELECTRIC VEHICLE HEAT SHRINK TUBING MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 58 CHINA HOSES IN ELECTRIC VEHICLE HEAT SHRINK TUBING MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 59 CHINA CONNECTORS IN ELECTRIC VEHICLE HEAT SHRINK TUBING MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 60 CHINA CONNECTORS IN ELECTRIC VEHICLE HEAT SHRINK TUBING MARKET, BY SYSTEM TYPE, 2020-2029 (USD THOUSAND)

TABLE 61 CHINA RING TERMINAL IN ELECTRIC VEHICLE HEAT SHRINK TUBING MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 62 CHINA ELECTRIC VEHICLE HEAT SHRINK TUBING MARKET, BY MATERIAL, 2020-2029 (USD THOUSAND)

TABLE 63 CHINA ELECTRIC VEHICLE HEAT SHRINK TUBING MARKET, BY COLOR, 2020-2029 (USD THOUSAND)

TABLE 64 CHINA ELECTRIC VEHICLE HEAT SHRINK TUBING MARKET, BY CONNECTOR APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 65 CHINA ELECTRIC VEHICLE HEAT SHRINK TUBING MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 66 CHINA ELECTRIC VEHICLE HEAT SHRINK TUBING MARKET, BY VOLTAGE, 2020-2029 (USD THOUSAND)

TABLE 67 CHINA ELECTRIC VEHICLE HEAT SHRINK TUBING MARKET, BY SALES CHANNEL, 2020-2029 (USD THOUSAND)

TABLE 68 CHINA ELECTRIC VEHICLE HEAT SHRINK TUBING MARKET, BY VEHICLE TYPE, 2020-2029 (USD THOUSAND)

TABLE 69 SOUTH KOREA ELECTRIC VEHICLE HEAT SHRINK TUBING MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 70 SOUTH KOREA HOSES IN ELECTRIC VEHICLE HEAT SHRINK TUBING MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 71 SOUTH KOREA CONNECTORS IN ELECTRIC VEHICLE HEAT SHRINK TUBING MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 72 SOUTH KOREA CONNECTORS IN ELECTRIC VEHICLE HEAT SHRINK TUBING MARKET, BY SYSTEM TYPE, 2020-2029 (USD THOUSAND)

TABLE 73 SOUTH KOREA RING TERMINAL IN ELECTRIC VEHICLE HEAT SHRINK TUBING MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 74 SOUTH KOREA ELECTRIC VEHICLE HEAT SHRINK TUBING MARKET, BY MATERIAL, 2020-2029 (USD THOUSAND)

TABLE 75 SOUTH KOREA ELECTRIC VEHICLE HEAT SHRINK TUBING MARKET, BY COLOR, 2020-2029 (USD THOUSAND)

TABLE 76 SOUTH KOREA ELECTRIC VEHICLE HEAT SHRINK TUBING MARKET, BY CONNECTOR APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 77 SOUTH KOREA ELECTRIC VEHICLE HEAT SHRINK TUBING MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 78 SOUTH KOREA ELECTRIC VEHICLE HEAT SHRINK TUBING MARKET, BY VOLTAGE, 2020-2029 (USD THOUSAND)

TABLE 79 SOUTH KOREA ELECTRIC VEHICLE HEAT SHRINK TUBING MARKET, BY SALES CHANNEL, 2020-2029 (USD THOUSAND)

TABLE 80 SOUTH KOREA ELECTRIC VEHICLE HEAT SHRINK TUBING MARKET, BY VEHICLE TYPE, 2020-2029 (USD THOUSAND)

TABLE 81 JAPAN ELECTRIC VEHICLE HEAT SHRINK TUBING MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 82 JAPAN HOSES IN ELECTRIC VEHICLE HEAT SHRINK TUBING MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 83 JAPAN CONNECTORS IN ELECTRIC VEHICLE HEAT SHRINK TUBING MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 84 JAPAN CONNECTORS IN ELECTRIC VEHICLE HEAT SHRINK TUBING MARKET, BY SYSTEM TYPE, 2020-2029 (USD THOUSAND)

TABLE 85 JAPAN RING TERMINAL IN ELECTRIC VEHICLE HEAT SHRINK TUBING MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 86 JAPAN ELECTRIC VEHICLE HEAT SHRINK TUBING MARKET, BY MATERIAL, 2020-2029 (USD THOUSAND)

TABLE 87 JAPAN ELECTRIC VEHICLE HEAT SHRINK TUBING MARKET, BY COLOR, 2020-2029 (USD THOUSAND)

TABLE 88 JAPAN ELECTRIC VEHICLE HEAT SHRINK TUBING MARKET, BY CONNECTOR APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 89 JAPAN ELECTRIC VEHICLE HEAT SHRINK TUBING MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 90 JAPAN ELECTRIC VEHICLE HEAT SHRINK TUBING MARKET, BY VOLTAGE, 2020-2029 (USD THOUSAND)

TABLE 91 JAPAN ELECTRIC VEHICLE HEAT SHRINK TUBING MARKET, BY SALES CHANNEL, 2020-2029 (USD THOUSAND)

TABLE 92 JAPAN ELECTRIC VEHICLE HEAT SHRINK TUBING MARKET, BY VEHICLE TYPE, 2020-2029 (USD THOUSAND)

TABLE 93 INDIA ELECTRIC VEHICLE HEAT SHRINK TUBING MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 94 INDIA HOSES IN ELECTRIC VEHICLE HEAT SHRINK TUBING MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 95 INDIA CONNECTORS IN ELECTRIC VEHICLE HEAT SHRINK TUBING MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 96 INDIA CONNECTORS IN ELECTRIC VEHICLE HEAT SHRINK TUBING MARKET, BY SYSTEM TYPE, 2020-2029 (USD THOUSAND)

TABLE 97 INDIA RING TERMINAL IN ELECTRIC VEHICLE HEAT SHRINK TUBING MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 98 INDIA ELECTRIC VEHICLE HEAT SHRINK TUBING MARKET, BY MATERIAL, 2020-2029 (USD THOUSAND)

TABLE 99 INDIA ELECTRIC VEHICLE HEAT SHRINK TUBING MARKET, BY COLOR, 2020-2029 (USD THOUSAND)

TABLE 100 INDIA ELECTRIC VEHICLE HEAT SHRINK TUBING MARKET, BY CONNECTOR APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 101 INDIA ELECTRIC VEHICLE HEAT SHRINK TUBING MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 102 INDIA ELECTRIC VEHICLE HEAT SHRINK TUBING MARKET, BY VOLTAGE, 2020-2029 (USD THOUSAND)

TABLE 103 INDIA ELECTRIC VEHICLE HEAT SHRINK TUBING MARKET, BY SALES CHANNEL, 2020-2029 (USD THOUSAND)

TABLE 104 INDIA ELECTRIC VEHICLE HEAT SHRINK TUBING MARKET, BY VEHICLE TYPE, 2020-2029 (USD THOUSAND)

TABLE 105 AUSTRALIA ELECTRIC VEHICLE HEAT SHRINK TUBING MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 106 AUSTRALIA HOSES IN ELECTRIC VEHICLE HEAT SHRINK TUBING MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 107 AUSTRALIA CONNECTORS IN ELECTRIC VEHICLE HEAT SHRINK TUBING MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 108 AUSTRALIA CONNECTORS IN ELECTRIC VEHICLE HEAT SHRINK TUBING MARKET, BY SYSTEM TYPE, 2020-2029 (USD THOUSAND)

TABLE 109 AUSTRALIA RING TERMINAL IN ELECTRIC VEHICLE HEAT SHRINK TUBING MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 110 AUSTRALIA ELECTRIC VEHICLE HEAT SHRINK TUBING MARKET, BY MATERIAL, 2020-2029 (USD THOUSAND)

TABLE 111 AUSTRALIA ELECTRIC VEHICLE HEAT SHRINK TUBING MARKET, BY COLOR, 2020-2029 (USD THOUSAND)

TABLE 112 AUSTRALIA ELECTRIC VEHICLE HEAT SHRINK TUBING MARKET, BY CONNECTOR APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 113 AUSTRALIA ELECTRIC VEHICLE HEAT SHRINK TUBING MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 114 AUSTRALIA ELECTRIC VEHICLE HEAT SHRINK TUBING MARKET, BY VOLTAGE, 2020-2029 (USD THOUSAND)

TABLE 115 AUSTRALIA ELECTRIC VEHICLE HEAT SHRINK TUBING MARKET, BY SALES CHANNEL, 2020-2029 (USD THOUSAND)

TABLE 116 AUSTRALIA ELECTRIC VEHICLE HEAT SHRINK TUBING MARKET, BY VEHICLE TYPE, 2020-2029 (USD THOUSAND)

TABLE 117 SINGAPORE ELECTRIC VEHICLE HEAT SHRINK TUBING MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 118 SINGAPORE HOSES IN ELECTRIC VEHICLE HEAT SHRINK TUBING MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 119 SINGAPORE CONNECTORS IN ELECTRIC VEHICLE HEAT SHRINK TUBING MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 120 SINGAPORE CONNECTORS IN ELECTRIC VEHICLE HEAT SHRINK TUBING MARKET, BY SYSTEM TYPE, 2020-2029 (USD THOUSAND)

TABLE 121 SINGAPORE RING TERMINAL IN ELECTRIC VEHICLE HEAT SHRINK TUBING MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 122 SINGAPORE ELECTRIC VEHICLE HEAT SHRINK TUBING MARKET, BY MATERIAL, 2020-2029 (USD THOUSAND)

TABLE 123 SINGAPORE ELECTRIC VEHICLE HEAT SHRINK TUBING MARKET, BY COLOR, 2020-2029 (USD THOUSAND)

TABLE 124 SINGAPORE ELECTRIC VEHICLE HEAT SHRINK TUBING MARKET, BY CONNECTOR APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 125 SINGAPORE ELECTRIC VEHICLE HEAT SHRINK TUBING MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 126 SINGAPORE ELECTRIC VEHICLE HEAT SHRINK TUBING MARKET, BY VOLTAGE, 2020-2029 (USD THOUSAND)

TABLE 127 SINGAPORE ELECTRIC VEHICLE HEAT SHRINK TUBING MARKET, BY SALES CHANNEL, 2020-2029 (USD THOUSAND)

TABLE 128 SINGAPORE ELECTRIC VEHICLE HEAT SHRINK TUBING MARKET, BY VEHICLE TYPE, 2020-2029 (USD THOUSAND)

TABLE 129 THAILAND ELECTRIC VEHICLE HEAT SHRINK TUBING MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 130 THAILAND HOSES IN ELECTRIC VEHICLE HEAT SHRINK TUBING MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 131 THAILAND CONNECTORS IN ELECTRIC VEHICLE HEAT SHRINK TUBING MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 132 THAILAND CONNECTORS IN ELECTRIC VEHICLE HEAT SHRINK TUBING MARKET, BY SYSTEM TYPE, 2020-2029 (USD THOUSAND)

TABLE 133 THAILAND RING TERMINAL IN ELECTRIC VEHICLE HEAT SHRINK TUBING MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 134 THAILAND ELECTRIC VEHICLE HEAT SHRINK TUBING MARKET, BY MATERIAL, 2020-2029 (USD THOUSAND)

TABLE 135 THAILAND ELECTRIC VEHICLE HEAT SHRINK TUBING MARKET, BY COLOR, 2020-2029 (USD THOUSAND)

TABLE 136 THAILAND ELECTRIC VEHICLE HEAT SHRINK TUBING MARKET, BY CONNECTOR APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 137 THAILAND ELECTRIC VEHICLE HEAT SHRINK TUBING MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 138 THAILAND ELECTRIC VEHICLE HEAT SHRINK TUBING MARKET, BY VOLTAGE, 2020-2029 (USD THOUSAND)

TABLE 139 THAILAND ELECTRIC VEHICLE HEAT SHRINK TUBING MARKET, BY SALES CHANNEL, 2020-2029 (USD THOUSAND)

TABLE 140 THAILAND ELECTRIC VEHICLE HEAT SHRINK TUBING MARKET, BY VEHICLE TYPE, 2020-2029 (USD THOUSAND)

TABLE 141 MALAYSIA ELECTRIC VEHICLE HEAT SHRINK TUBING MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 142 MALAYSIA HOSES IN ELECTRIC VEHICLE HEAT SHRINK TUBING MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 143 MALAYSIA CONNECTORS IN ELECTRIC VEHICLE HEAT SHRINK TUBING MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 144 MALAYSIA CONNECTORS IN ELECTRIC VEHICLE HEAT SHRINK TUBING MARKET, BY SYSTEM TYPE, 2020-2029 (USD THOUSAND)

TABLE 145 MALAYSIA RING TERMINAL IN ELECTRIC VEHICLE HEAT SHRINK TUBING MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 146 MALAYSIA ELECTRIC VEHICLE HEAT SHRINK TUBING MARKET, BY MATERIAL, 2020-2029 (USD THOUSAND)

TABLE 147 MALAYSIA ELECTRIC VEHICLE HEAT SHRINK TUBING MARKET, BY COLOR, 2020-2029 (USD THOUSAND)

TABLE 148 MALAYSIA ELECTRIC VEHICLE HEAT SHRINK TUBING MARKET, BY CONNECTOR APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 149 MALAYSIA ELECTRIC VEHICLE HEAT SHRINK TUBING MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 150 MALAYSIA ELECTRIC VEHICLE HEAT SHRINK TUBING MARKET, BY VOLTAGE, 2020-2029 (USD THOUSAND)

TABLE 151 MALAYSIA ELECTRIC VEHICLE HEAT SHRINK TUBING MARKET, BY SALES CHANNEL, 2020-2029 (USD THOUSAND)

TABLE 152 MALAYSIA ELECTRIC VEHICLE HEAT SHRINK TUBING MARKET, BY VEHICLE TYPE, 2020-2029 (USD THOUSAND)

TABLE 153 INDONESIA ELECTRIC VEHICLE HEAT SHRINK TUBING MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 154 INDONESIA HOSES IN ELECTRIC VEHICLE HEAT SHRINK TUBING MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 155 INDONESIA CONNECTORS IN ELECTRIC VEHICLE HEAT SHRINK TUBING MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 156 INDONESIA CONNECTORS IN ELECTRIC VEHICLE HEAT SHRINK TUBING MARKET, BY SYSTEM TYPE, 2020-2029 (USD THOUSAND)

TABLE 157 INDONESIA RING TERMINAL IN ELECTRIC VEHICLE HEAT SHRINK TUBING MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 158 INDONESIA ELECTRIC VEHICLE HEAT SHRINK TUBING MARKET, BY MATERIAL, 2020-2029 (USD THOUSAND)

TABLE 159 INDONESIA ELECTRIC VEHICLE HEAT SHRINK TUBING MARKET, BY COLOR, 2020-2029 (USD THOUSAND)

TABLE 160 INDONESIA ELECTRIC VEHICLE HEAT SHRINK TUBING MARKET, BY CONNECTOR APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 161 INDONESIA ELECTRIC VEHICLE HEAT SHRINK TUBING MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 162 INDONESIA ELECTRIC VEHICLE HEAT SHRINK TUBING MARKET, BY VOLTAGE, 2020-2029 (USD THOUSAND)

TABLE 163 INDONESIA ELECTRIC VEHICLE HEAT SHRINK TUBING MARKET, BY SALES CHANNEL, 2020-2029 (USD THOUSAND)

TABLE 164 INDONESIA ELECTRIC VEHICLE HEAT SHRINK TUBING MARKET, BY VEHICLE TYPE, 2020-2029 (USD THOUSAND)

TABLE 165 PHILIPPINES ELECTRIC VEHICLE HEAT SHRINK TUBING MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 166 PHILIPPINES HOSES IN ELECTRIC VEHICLE HEAT SHRINK TUBING MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 167 PHILIPPINES CONNECTORS IN ELECTRIC VEHICLE HEAT SHRINK TUBING MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 168 PHILIPPINES CONNECTORS IN ELECTRIC VEHICLE HEAT SHRINK TUBING MARKET, BY SYSTEM TYPE, 2020-2029 (USD THOUSAND)

TABLE 169 PHILIPPINES RING TERMINAL IN ELECTRIC VEHICLE HEAT SHRINK TUBING MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 170 PHILIPPINES ELECTRIC VEHICLE HEAT SHRINK TUBING MARKET, BY MATERIAL, 2020-2029 (USD THOUSAND)

TABLE 171 PHILIPPINES ELECTRIC VEHICLE HEAT SHRINK TUBING MARKET, BY COLOR, 2020-2029 (USD THOUSAND)

TABLE 172 PHILIPPINES ELECTRIC VEHICLE HEAT SHRINK TUBING MARKET, BY CONNECTOR APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 173 PHILIPPINES ELECTRIC VEHICLE HEAT SHRINK TUBING MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 174 PHILIPPINES ELECTRIC VEHICLE HEAT SHRINK TUBING MARKET, BY VOLTAGE, 2020-2029 (USD THOUSAND)

TABLE 175 PHILIPPINES ELECTRIC VEHICLE HEAT SHRINK TUBING MARKET, BY SALES CHANNEL, 2020-2029 (USD THOUSAND)

TABLE 176 PHILIPPINES ELECTRIC VEHICLE HEAT SHRINK TUBING MARKET, BY VEHICLE TYPE, 2020-2029 (USD THOUSAND)

TABLE 177 REST OF ASIA-PACIFIC ELECTRIC VEHICLE HEAT SHRINK TUBING MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

List of Figure

FIGURE 1 ASIA PACIFIC ELECTRIC VEHICLE HEAT SHRINK TUBING MARKET: SEGMENTATION

FIGURE 2 ASIA PACIFIC ELECTRIC VEHICLE HEAT SHRINK TUBING MARKET: DATA TRIANGULATION

FIGURE 3 ASIA PACIFIC ELECTRIC VEHICLE HEAT SHRINK TUBING MARKET: DROC ANALYSIS

FIGURE 4 ASIA PACIFIC ELECTRIC VEHICLE HEAT SHRINK TUBING MARKET: ASIA PACIFIC VS REGIONAL MARKET ANALYSIS

FIGURE 5 ASIA PACIFIC ELECTRIC VEHICLE HEAT SHRINK TUBING MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 ASIA PACIFIC ELECTRIC VEHICLE HEAT SHRINK TUBING MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 ASIA PACIFIC ELECTRIC VEHICLE HEAT SHRINK TUBING MARKET: DBMR MARKET POSITION GRID

FIGURE 8 ASIA PACIFIC ELECTRIC VEHICLE HEAT SHRINK TUBING MARKET: VENDOR SHARE ANALYSIS

FIGURE 9 ASIA PACIFIC ELECTRIC VEHICLE HEAT SHRINK TUBING MARKET: SEGMENTATION

FIGURE 10 INNCREASING DEMANND FOR MICA-BASED INSULATINNG MMATERIALS FOR PREVENTIVE MAINTENENCE IS EXPECTED TO DRIVE THE ASIA PACIFIC ELECTRIC VEHICLE HEAT SHRINK TUBING MARKET IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 11 THE HOSES SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE ASIA PACIFIC ELECTRIC VEHICLE HEAT SHRINK TUBING MARKET IN 2022 & 2029

FIGURE 12 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES FOR THE ASIA PACIFIC ELECTRIC VEHICLE HEAT SHRINK TUBING MARKET

FIGURE 13 WIRING HARNESS DEVELOPMENT OFFERING

FIGURE 14 HEAT PUMP CYCLE IN ELECTRIC VEHICLES

FIGURE 15 ASIA PACIFIC ELECTRIC VEHICLE HEAT SHRINK TUBING MARKET: BY APPLICATION, 2021

FIGURE 16 ASIA PACIFIC ELECTRIC VEHICLE HEAT SHRINK TUBING MARKET: BY MATERIAL, 2021

FIGURE 17 ASIA PACIFIC ELECTRIC VEHICLE HEAT SHRINK TUBING MARKET: BY COLOR, 2021

FIGURE 18 ASIA PACIFIC ELECTRIC VEHICLE HEAT SHRINK TUBING MARKET: BY CONNECTOR APPLICATION, 2021

FIGURE 19 ASIA PACIFIC ELECTRIC VEHICLE HEAT SHRINK TUBING MARKET: BY TYPE, 2021

FIGURE 20 ASIA PACIFIC ELECTRIC VEHICLE HEAT SHRINK TUBING MARKET: BY VOLTAGE, 2021

FIGURE 21 ASIA PACIFIC ELECTRIC VEHICLE HEAT SHRINK TUBING MARKET: BY SALES CHANNEL, 2021

FIGURE 22 ASIA PACIFIC ELECTRIC VEHICLE HEAT SHRINK TUBING MARKET: BY VEHICLE TYPE, 2021

FIGURE 23 ASIA-PACIFIC ELECTRIC VEHICLE HEAT SHRINK TUBING MARKET: SNAPSHOT (2021)

FIGURE 24 ASIA-PACIFIC ELECTRIC VEHICLE HEAT SHRINK TUBING MARKET: BY COUNTRY (2021)

FIGURE 25 ASIA-PACIFIC ELECTRIC VEHICLE HEAT SHRINK TUBING MARKET: BY COUNTRY (2022 & 2029)

FIGURE 26 ASIA-PACIFIC ELECTRIC VEHICLE HEAT SHRINK TUBING MARKET: BY COUNTRY (2021 & 2029)

FIGURE 27 ASIA-PACIFIC ELECTRIC VEHICLE HEAT SHRINK TUBING MARKET: BY APPLICATION (2022-2029)

FIGURE 28 ASIA PACIFIC ELECTRIC VEHICLE HEAT SHRINK TUBING MARKET: COMPANY SHARE 2021 (%)

Asia Pacific Electric Vehicle Heat Shrink Tubing Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Asia Pacific Electric Vehicle Heat Shrink Tubing Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Asia Pacific Electric Vehicle Heat Shrink Tubing Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.