Asia Pacific Enteral Feeding Formula Market

Market Size in USD Million

CAGR :

%

USD

667.77 Million

USD

1,173.34 Million

2024

2032

USD

667.77 Million

USD

1,173.34 Million

2024

2032

| 2025 –2032 | |

| USD 667.77 Million | |

| USD 1,173.34 Million | |

|

|

|

|

Asia-Pacific Enteral Feeding Formula Market Size

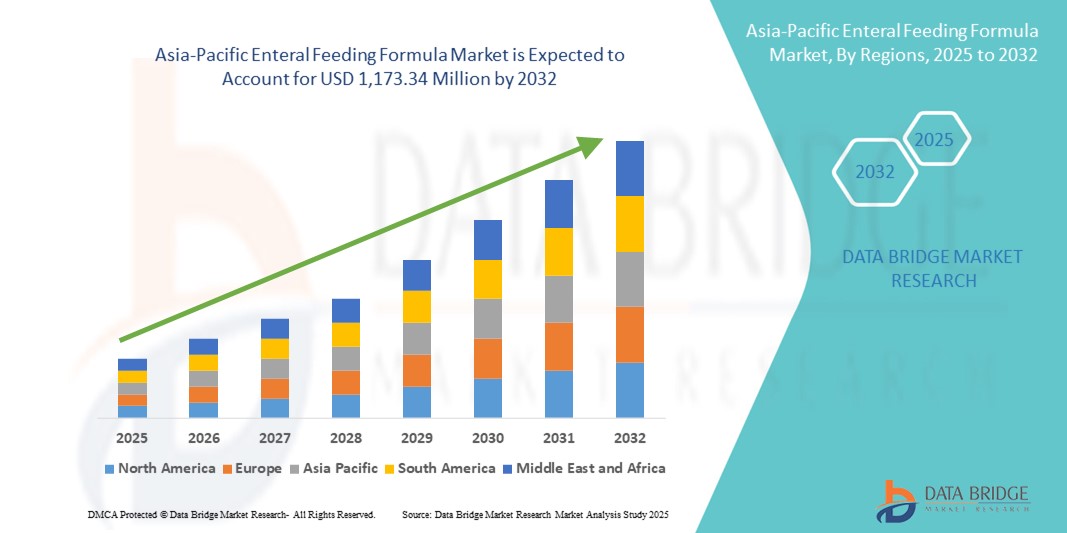

- The Asia-Pacific enteral feeding formula market size was valued at USD 667.77 million in 2024 and is expected to reach USD 1,173.34 million by 2032, at a CAGR of 7.30% during the forecast period

- The market growth is largely driven by the rising prevalence of chronic diseases, aging population, and increasing hospital admissions, which have led to a higher demand for clinical nutritional support across the region

- Furthermore, the growing awareness of enteral nutrition benefits, improvements in healthcare infrastructure, and government initiatives promoting home healthcare are propelling the adoption of enteral feeding formulas, thereby accelerating market expansion in Asia-Pacific

Asia-Pacific Enteral Feeding Formula Market Analysis

- Enteral feeding formulas, designed to deliver essential nutrients directly into the digestive system, are becoming increasingly important in clinical and home care settings across Asia-Pacific, particularly for patients unable to consume food orally due to chronic illnesses, surgeries, or age-related conditions

- The growing demand for enteral feeding formulas is primarily driven by rising incidences of cancer, gastrointestinal disorders, and neurological conditions, alongside increasing awareness about the importance of medical nutrition in patient recovery and long-term care

- China dominated the Asia-Pacific enteral feeding formula market with the largest revenue share of 38.1% in 2024, supported by a rapidly aging population, expanding healthcare infrastructure, and growing government focus on improving nutrition care, especially for elderly and critically ill patients

- India is expected to be the fastest-growing country in the Asia-Pacific enteral feeding formula market during the forecast period due to improving access to healthcare facilities, rising disposable incomes, and increasing prevalence of lifestyle-related diseases

- Standard formula segment dominated the Asia-Pacific enteral feeding formula market with a share of 42.4% in 2024, favored for its cost-effectiveness and suitability for a broad patient base requiring nutritional support in hospitals and home care environments

Report Scope and Asia-Pacific Enteral Feeding Formula Market Segmentation

|

Attributes |

Asia-Pacific Enteral Feeding Formula Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

Asia-Pacific

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Asia-Pacific Enteral Feeding Formula Market Trends

Rising Shift Toward Disease-Specific and Personalized Nutrition

- A significant and accelerating trend in the Asia-Pacific enteral feeding formula market is the increasing preference for disease-specific and personalized nutrition formulations, tailored to meet the unique dietary requirements of patients with chronic or acute conditions such as cancer, diabetes, renal disorders, and gastrointestinal diseases

- For instance, companies such as Nestlé Health Science and Abbott Laboratories offer specialized enteral formulas such as Glucerna for diabetes management or Peptamen for patients with impaired digestion providing targeted nutritional support that aligns with specific clinical needs

- This shift is fueled by heightened awareness among healthcare professionals and caregivers about the benefits of condition-specific nutrition, leading to better patient outcomes and reduced hospital stay durations. In addition, advancements in clinical research are enabling the development of more precise nutrient compositions, further supporting this trend

- Personalized enteral nutrition is also gaining traction in home care settings, particularly among the aging population and post-operative patients, where tailored formulas are administered based on nutritional assessments and patient health profiles

- The growing collaboration between hospitals, nutritionists, and manufacturers to develop and prescribe customized feeding regimens is reshaping clinical nutrition practices across the region

- This trend towards specialized and personalized formulas is expected to drive innovation and product diversification in the market, helping manufacturers differentiate their offerings and cater to a broader spectrum of patients

Asia-Pacific Enteral Feeding Formula Market Dynamics

Driver

Increasing Chronic Disease Burden and Geriatric Population

- The rising incidence of chronic illnesses such as cancer, stroke, and neurological disorders, coupled with the rapidly growing geriatric population across Asia-Pacific, is a major driver boosting the demand for enteral feeding formulas

- For instance, Japan and China have among the world’s highest aging populations, where a large segment of elderly individuals requires long-term nutritional support due to difficulties in oral intake or disease-related complications

- In addition, improvements in critical care, post-operative recovery protocols, and the expansion of healthcare access in emerging economies such as India, Vietnam, and Indonesia are contributing to increased adoption of enteral nutrition in both hospital and home care settings

- The integration of enteral feeding into standard treatment protocols by healthcare professionals and supportive government policies for elderly and chronic disease care further amplify market growth

- The availability of both polymeric and disease-specific formulas tailored to patient needs supports clinical outcomes, making enteral feeding a preferred method of nutrition therapy in many healthcare systems across the region

Restraint/Challenge

Limited Awareness and Infrastructure for Home-Based Nutritional Care

- Despite the increasing demand, limited awareness about enteral nutrition and inadequate infrastructure for home-based care remain significant challenges in parts of the Asia-Pacific region, particularly in rural or low-income areas

- In many emerging economies, healthcare professionals and patients may lack adequate training or guidance on the safe and effective use of enteral feeding formulas outside clinical settings, leading to underutilization of these products

- For instance, a 2023 report by the Indian Society for Parenteral and Enteral Nutrition (ISPEN) revealed that over 40% of patients in Tier-2 and Tier-3 Indian cities lacked access to trained personnel or nutritional counseling for home-based enteral care, resulting in increased hospital readmissions due to feeding complications

- In addition, logistical barriers such as inconsistent supply chains, lack of refrigeration, and minimal reimbursement policies for home enteral nutrition further hinder adoption

- High costs of imported or specialty enteral formulas can also limit access for economically disadvantaged populations, where affordability remains a key concern

- Addressing these barriers will require stronger public-private partnerships, investments in home healthcare infrastructure, and targeted educational campaigns to raise awareness about the benefits and safe usage of enteral nutrition

Asia-Pacific Enteral Feeding Formula Market Scope

The market is segmented on the basis of product, application, type of tube feeding, stage, and end user.

- By Product

On the basis of product, the Asia-Pacific enteral feeding formula market is segmented into standard formulas, diabetic formula, renal formula, hepatic formula, pulmonary formula, peptide-based formula, other disease-specific formula, and disease-specific formulas. The standard formulas segment dominated the market with the largest market revenue share of 42.4% in 2024 due to their broad clinical applicability, cost-effectiveness, and widespread usage in both acute and chronic care settings. These formulas are typically used for patients with functional digestive systems and serve as the foundation for general enteral nutrition support.

The diabetic formula segment is anticipated to witness the fastest growth rate from 2025 to 2032, fueled by the rising prevalence of diabetes in the region and growing demand for glycemic-control-specific nutritional solutions. These formulas are formulated with complex carbohydrates, fiber, and healthy fats, helping maintain stable blood sugar levels in diabetic patients requiring enteral feeding.

- By Application

On the basis of application, the Asia-Pacific enteral feeding formula market is segmented into oncology, neurology, critical care, diabetes, gastroenterology, and others. The oncology segment held the largest market revenue share in 2024, driven by the increasing incidence of cancer and the essential need for nutritional support during chemotherapy, radiation, and post-surgical recovery. Enteral feeding plays a vital role in improving treatment tolerance and overall outcomes for cancer patients.

The neurology segment is expected to witness the fastest growth rate from 2025 to 2032, supported by the rising prevalence of neurological disorders such as stroke, Parkinson’s disease, and ALS, which often impair the ability to swallow and necessitate long-term enteral feeding solutions.

- By Type of Tube Feeding

On the basis of type of tube feeding, the Asia-Pacific enteral feeding formula market is segmented into gastric tube feeding, nasogastric tube feeding, gastrostomy tube feeding, and duodenal or jejunal tube feeding. The nasogastric tube feeding segment dominated the market with the highest market share in 2024, attributed to its ease of use, non-invasive nature, and suitability for short-term nutrition delivery in hospital settings. It is commonly used in acute care for patients with temporary swallowing difficulties.

The gastrostomy tube feeding segment is projected to register the fastest growth rate from 2025 to 2032, driven by its effectiveness in delivering long-term nutritional support, particularly among pediatric and elderly patients with chronic conditions requiring sustained enteral feeding.

- By Stage

On the basis of stage, the Asia-Pacific enteral feeding formula market is segmented into adult and pediatric. The adult segment accounted for the largest market revenue share in 2024 due to the higher burden of chronic diseases, post-operative nutritional needs, and a growing aging population across Asia-Pacific. Adults form the largest patient demographic requiring enteral nutrition, especially in critical and long-term care.

The pediatric segment is expected to grow steadily over the forecast period, supported by increasing healthcare focus on early-life nutrition, rising incidences of congenital anomalies, and greater clinical adoption of enteral feeding in neonatal intensive care units (NICUs) and pediatric hospitals.

- By End User

On the basis of end user, the Asia-Pacific enteral feeding formula market is segmented into hospitals, nursing homes, assisted living facilities, home care agencies, and hospices and long-term care facilities. The hospitals segment dominated the market with the largest revenue share in 2024, as hospitals are the primary centers for critical care, post-surgical recovery, and initiation of nutritional therapy, especially in oncology and neurology departments.

The home care agencies segment is anticipated to witness the fastest growth rate from 2025 to 2032, driven by the increasing trend toward home-based healthcare, patient preference for comfort and convenience, and expanding availability of portable enteral feeding equipment enabling effective nutritional support outside clinical environments.

Asia-Pacific Enteral Feeding Formula Market Regional Analysis

- China dominated the Asia-Pacific enteral feeding formula market with the largest revenue share of 38.1% in 2024, supported by a rapidly aging population, expanding healthcare infrastructure, and growing government focus on improving nutrition care, especially for elderly and critically ill patients

- The country's strong healthcare infrastructure, expanding hospital network, and government-led initiatives to improve elderly care and nutrition are key factors contributing to the widespread adoption of enteral feeding formulas

- In addition, increasing awareness among healthcare professionals, rising disposable incomes, and greater access to advanced, disease-specific formulas have positioned China as the leading market within Asia-Pacific, with continued growth expected through both urban and rural healthcare expansion

The China Enteral Feeding Formula Market Insight

The China enteral feeding formula market captured the largest revenue share in Asia-Pacific in 2024, driven by the country’s aging population, rising chronic disease burden, and expanding access to healthcare. With strong government support for elderly and long-term care, along with robust investments in hospital infrastructure, enteral nutrition is increasingly being integrated into standard medical treatment. In addition, the growing availability of disease-specific formulas and the development of local manufacturing capabilities are making advanced nutritional care more accessible and cost-effective across urban and rural regions.

Japan Enteral Feeding Formula Market Insight

The Japan enteral feeding formula market is witnessing steady growth, supported by the country’s advanced healthcare system, rapidly aging demographic, and strong focus on clinical nutrition. Japan’s medical community has long embraced enteral feeding for both acute and long-term care, and demand continues to rise with the increase in age-related conditions such as dementia, stroke, and cancer. Technological innovation and high standards in nutritional formulation contribute to the widespread use of both standard and disease-specific formulas, particularly in hospitals and elder care facilities.

India Enteral Feeding Formula Market Insight

The India enteral feeding formula market is expected to grow at the fastest CAGR during the forecast period, fueled by rising awareness of clinical nutrition, increasing prevalence of chronic diseases, and expanding healthcare accessibility. India’s growing middle-class population and healthcare reforms are accelerating the adoption of enteral feeding in hospitals and home care settings. While standard formulas dominate due to affordability, there is rising demand for specialized formulations tailored to diabetic, renal, and oncology patients. Government focus on improving nutrition in public health programs is also contributing to market growth.

South Korea Enteral Feeding Formula Market Insight

The South Korea enteral feeding formula market is expanding steadily, supported by a modern healthcare infrastructure, high health awareness, and a growing elderly population. The increasing burden of chronic diseases and post-surgical care needs are driving the demand for both standard and disease-specific enteral nutrition. South Korean hospitals are increasingly adopting advanced nutritional protocols, while home care services are on the rise, boosting demand for easily administered and well-tolerated formulas.

Asia-Pacific Enteral Feeding Formula Market Share

The Asia-Pacific Enteral Feeding Formula industry is primarily led by well-established companies, including:

- Nutricia (Netherlands)

- Hormel Foods Corporation (U.S)

- Medline Industries, Inc. (U.S)

- Mead Johnson & Company, LLC. (U.S)

- Nestlé Health Science (Switzerland)

- Abbott (U.S)

- Meiji Holdings Co., Ltd. (Japan)

- Fresenius Kabi AG (Germany)

- B. Braun SE (Germany)

- Trovita Health Science (U.S)

- Victus Inc. (U.S)

- Avanos Medical Inc. (U.S)

- Cardinal Health (U.S)

- Moog Inc (U.S)

- Conmed Corporation (U.S)

- Cook Medical (India)

- Danone S.A. (France)

- Nestlé S.A. (Switzerland)

- Real Food Blends (U.S.)

- Smartfish AS (Norway)

What are the Recent Developments in Asia-Pacific Enteral Feeding Formula Market?

- In January 2025, Alcresta Therapeutics announced FDA expanded use clearance for its RELiZORB immobilized lipase cartridge for pediatric patients aged one year and older. This next-generation device, introduced in May 2024, offers broader formula compatibility and increased daily usage, supporting both continuous and bolus feeding setups. The expanded clearance aims to enhance nutritional support for pediatric patients with fat malabsorption

- In September 2024, EN Otsuka Pharmaceutical Co., Ltd. obtained marketing approval for its semi-solid enteral nutrition formula in Japan. This product is designed to meet the nutritional needs of patients requiring less maintenance energy, providing an appropriate balance of major nutrients, vitamins, and trace elements based on typical Japanese dietary patterns. It aims to improve patient compliance and ease of administration

- In May 2024, Danone completed the acquisition of Functional Formularies, a leading whole foods tube feeding business in the U.S. This strategic move allows Danone to expand its presence in the U.S. enteral nutrition market by offering organic, plant-based feeding options. Functional Formularies' products align with growing consumer demand for clean-label, whole-food nutrition solutions

- In September 2023, Abbott Nutrition launched an immune-enhanced enteral formula aimed at improving protein delivery by 36% and accelerating wound closure in 48% of users. This innovation underscores Abbott's commitment to advancing patient care through targeted nutritional solutions

- In September 2023, Cardinal Health launched the Kangaroo OMNI enteral feeding pump. This next-generation device delivers nutrition and hydration from hospital to home, enhancing patient care continuity. The Kangaroo OMNI pump offers advanced features for both hospital and home settings, supporting a wide range of patient needs

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF ASIA-PACIFIC ENTERAL FEEDING FORMULA MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATION

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 KEY TAKEAWAYS

2.2 ARRIVING AT THE ASIA-PACIFIC ENTERAL FEEDING FORMULA MARKET SIZE

2.2.1 VENDOR POSITIONING GRID

2.2.2 TECHNOLOGY LIFE LINE CURVE

2.2.3 TRIPOD DATA VALIDATION MODEL

2.2.4 MARKET GUIDE

2.2.5 MULTIVARIATE MODELLING

2.2.6 TOP TO BOTTOM ANALYSIS

2.2.7 CHALLENGE MATRIX

2.2.8 APPLICATION COVERAGE GRID

2.2.9 STANDARDS OF MEASUREMENT

2.2.10 VENDOR SHARE ANALYSIS

2.2.11 DATA POINTS FROM KEY PRIMARY INTERVIEWS

2.2.12 DATA POINTS FROM KEY SECONDARY DATABASES

2.3 ASIA-PACIFIC ENTERAL FEEDING FORMULA MARKET: RESEARCH SNAPSHOT

2.4 ASSUMPTIONS

3 MARKET OVERVIEW

3.1 DRIVERS

3.2 RESTRAINTS

3.3 OPPORTUNITIES

3.4 CHALLENGES

4 EXECUTIVE SUMMARY

5 PREMIUM INSIGHTS

5.1 PESTEL ANALYSIS

5.2 PORTER'S FIVE FORCES MODEL

6 INDUSTRY INSIGHTS

6.1 MICRO AND MACRO ECONOMIC FACTORS

6.2 PENETRATION AND GROWTH PROSPECT MAPPING

6.3 KEY PRICING STRATEGIES

6.4 INTERVIEWS WITH SPECIALIST

6.5 ANALYSIS AND RECOMMENDATIONS

7 INTELLECTUAL PROPERTY (IP) PORTFOLIO

7.1 PATENT QUALITY AND STRENGTH

7.2 PATENT FAMILIES

7.3 LICENSING AND COLLABORATIONS

7.4 COMPETITIVE LANDSCAPE

7.5 IP STRATEGY AND MANAGEMENT

7.6 OTHER

8 COST ANALYSIS BREAKDOWN

9 TECHNOLOGY ROADMAP

10 INNOVATION TRACKER AND STRATEGIC ANALYSIS

10.1 MAJOR DEALS AND STRATEGIC ALLIANCES ANALYSIS

10.1.1 JOINT VENTURES

10.1.2 MERGERS AND ACQUISITIONS

10.1.3 LICENSING AND PARTNERSHIP

10.1.4 TECHNOLOGY COLLABORATIONS

10.1.5 STRATEGIC DIVESTMENTS

10.2 NUMBER OF PRODUCTS IN DEVELOPMENT

10.3 STAGE OF DEVELOPMENT

10.4 TIMELINES AND MILESTONES

10.5 INNOVATION STRATEGIES AND METHODOLOGIES

10.6 RISK ASSESSMENT AND MITIGATION

10.7 MERGERS AND ACQUISITIONS

10.8 FUTURE OUTLOOK

11 EPIDEMIOLOGY

11.1 INCIDENCE OF ALL BY GENDER

11.2 TREATMENT RATE

11.3 MORTALITY RATE

11.4 DRUG ADHERENCE AND THERAPY SWITCH MODEL

11.5 PATIENT TREATMENT SUCCESS RATES

12 REGULATORY COMPLIANCE

12.1 REGULATORY AUTHORITIES

12.2 REGULATORY CLASSIFICATIONS

12.2.1 CLASS I

12.2.2 CLASS II

12.2.3 CLASS III

12.3 REGULATORY SUBMISSIONS

12.4 INTERNATIONAL HARMONIZATION

12.5 COMPLIANCE AND QUALITY MANAGEMENT SYSTEMS

12.6 REGULATORY CHALLENGES AND STRATEGIES

TABLE 1 CLINICAL TRIAL MARKET

Company Name Product Name

XX XX

XX XX

XX XX

XX XX

XX XX

XX XX

XX XX

Sources: Press Releases, Annual Reports, SEC Filings, Investor Presentations, Other Government Sources, Analysis Based on Inputs from Secondary, Expert Interviews

TABLE 2 DISTRIBUTION OF PRODUCTS AND PROJECTS BY PHASE

Phase Number of Projects

Preclinical/Research Projects XX

Clinical Development XX

Phase I XX

Phase II XX

Phase III XX

U.S. Filed/Approved but Not Yet Marketed XX

Total XX

Sources: Press Releases, Annual Reports, SEC Filings, Investor Presentations, Other Government Sources, Analysis Based on Inputs from Secondary, Expert Interviews

TABLE 3 DISTRIBUTION OF PROJECTS BY THERAPEUTIC AREA AND PHASE

Therapeutic Area Preclinical/ Research Project

XX XX

XX XX

XX XX

XX XX

XX XX

Total Projects XX

Sources: Press Releases, Annual Reports, SEC Filings, Investor Presentations, Other Government Sources, Analysis Based on Inputs from Secondary, Expert Interviews

TABLE 4 DISTRIBUTION OF PROJECTS BY SCIENTIFIC APPROACH AND PHASE

Technology Preclinical/ Research Project

XX XX

XX XX

XX XX

XX XX

XX XX

Total Projects XX

Sources: Press Releases, Annual Reports, SEC Filings, Investor Presentations, Other Government Sources, Analysis Based on Inputs from Secondary, Expert Interviews

FIGURE 1 TOP ENTITIES BASED ON R&D GLANCE

Sources: Press Releases, Annual Reports, SEC Filings, Investor Presentations, Other Government Sources, Analysis Based on Inputs from Secondary, Expert Interviews

13 REIMBURSEMENT FRAMEWORK

14 OPPUTUNITY MAP ANALYSIS

15 VALUE CHAIN ANALYSIS

16 HEALTHCARE ECONOMY

16.1 HEALTHCARE EXPENDITURE

16.2 CAPITAL EXPENDITURE

16.3 CAPEX TRENDS

16.4 CAPEX ALLOCATION

16.5 FUNDING SOURCES

16.6 INDUSTRY BENCHMARKS

16.7 GDP RATION IN OVERALL GDP

16.8 HEALTHCARE SYSTEM STRUCTURE

16.9 GOVERNMENT POLICIES

16.1 ECONOMIC DEVELOPMENT

17 ASIA-PACIFIC ENTERAL FEEDING FORMULA MARKET, BY PRODUCT

17.1 OVERVIEW

17.2 STANDARD FORMULAS

17.2.1 CALORIE

17.2.1.1. 1.0 KCAL/ML

17.2.1.2. 1.2 KCAL/ML

17.2.1.3. 1.5 KCAL/ML

17.2.1.4. 2.0KCAL/ML

17.2.2 DISEASE

17.2.2.1. DIABETIC FORMULAS

17.2.2.2. RENAL FORMULAS

17.2.2.3. HEPATIC FORMULAS

17.2.2.4. PULMONARY FORMULAS

17.2.2.5. OTHERS

17.3 PEPTIDES FORMULAS

17.3.1 CALORIE

17.3.1.1. 1.0 KCAL/ML

17.3.1.1.1. MARKET VALUE(USD MILLION)

17.3.1.1.2. MARKET VOLUME(UNITS)

17.3.1.1.3. AVERAGE SELLING PRICE(USD)

17.3.1.2. 1.2 KCAL/ML

17.3.1.2.1. MARKET VALUE(USD MILLION)

17.3.1.2.2. MARKET VOLUME(UNITS)

17.3.1.2.3. AVERAGE SELLING PRICE(USD)

17.3.1.3. 1.5 KCAL/ML

17.3.1.3.1. MARKET VALUE(USD MILLION)

17.3.1.3.2. MARKET VOLUME(UNITS)

17.3.1.3.3. AVERAGE SELLING PRICE(USD)

17.3.1.4. 2.0KCAL/ML

17.3.1.4.1. MARKET VALUE(USD MILLION)

17.3.1.4.2. MARKET VOLUME(UNITS)

17.3.1.4.3. AVERAGE SELLING PRICE(USD)

17.3.2 DISEASE

17.3.2.1. DIABETIC FORMULAS

17.3.2.2. RENAL FORMULAS

17.3.2.3. HEPATIC FORMULAS

17.3.2.4. PULMONARY FORMULAS

17.3.2.5. OTHERS

17.4 SPECIALISED FORMULAS

17.4.1 CALORIE

17.4.1.1. 1.0 KCAL/ML

17.4.1.1.1. MARKET VALUE(USD MILLION)

17.4.1.1.2. MARKET VOLUME(UNITS)

17.4.1.1.3. AVERAGE SELLING PRICE(USD)

17.4.1.2. 1.2 KCAL/ML

17.4.1.2.1. MARKET VALUE(USD MILLION)

17.4.1.2.2. MARKET VOLUME(UNITS)

17.4.1.2.3. AVERAGE SELLING PRICE(USD)

17.4.1.3. 1.5 KCAL/ML

17.4.1.3.1. MARKET VALUE(USD MILLION)

17.4.1.3.2. MARKET VOLUME(UNITS)

17.4.1.3.3. AVERAGE SELLING PRICE(USD)

17.4.1.4. 2.0KCAL/ML

17.4.1.4.1. MARKET VALUE(USD MILLION)

17.4.1.4.2. MARKET VOLUME(UNITS)

17.4.1.4.3. AVERAGE SELLING PRICE(USD)

17.4.2 DISEASE

17.4.2.1. DIABETIC FORMULAS

17.4.2.2. RENAL FORMULAS

17.4.2.3. HEPATIC FORMULAS

17.4.2.4. PULMONARY FORMULAS

17.4.2.5. OTHERS

18 ASIA-PACIFIC ENTERAL FEEDING FORMULA MARKET, BY APPLICATION

18.1 OVERVIEW

18.2 CRITICAL CARE

18.3 GASTROENTEROLOGY

18.4 ONCOLOGY

18.5 NEUROLOGY

18.6 DIABETES

18.7 OTHERS

19 ASIA-PACIFIC ENTERAL FEEDING FORMULA MARKET, BY TYPE OF TUBE FEEDING

19.1 OVERVIEW

19.2 GASTRIC TUBE FEEDING

19.3 NASOGASTRIC TUBE FEEDING

19.4 GASTROTOMY TUBE FEEDING

19.5 DUODENAL OR JEJUNAL TUBE FEEDING

20 ASIA-PACIFIC ENTERAL FEEDING FORMULA MARKET, BY STAGE

20.1 OVERVIEW

20.2 ADULT

20.3 PEDIATRIC

20.3.1 METABOLIC COMPICATIONS

20.3.2 FOOD ALLERGY

20.3.3 GASTROINTESTINAL DYSMOTILITY

20.3.4 INTRACTABLE DIARRHEA

20.3.5 INFECTIOUS COMPLICATIONS

20.3.6 BURN INJURY

20.3.7 CYSTIC FIBROSIS

20.3.8 CONGENITAL HEART DISEASE

20.3.9 CHRONIC RENAL/ PULMONARY DISEASE

20.3.10 CROHN’S DISEASE

20.3.11 OTHERS

21 ASIA-PACIFIC ENTERAL FEEDING FORMULA MARKET, BY END USER

21.1 OVERVIEW

21.2 HOSPITALS

21.3 LONG TERM CARE FACILITIES

21.3.1 HOME CARE AGENCIES AND HOSPICES

21.3.2 NURSING HOMES

21.3.3 ASSISTED LIVING FACILITIES

22 ASIA-PACIFIC ENTERAL FEEDING FORMULA MARKET, BY COUNTRY

22.1 ASIA-PACIFIC ENTERAL FEEDING FORMULA MARKET (ALL SEGMENTATION PROVIDED ABOVE IS REPRESENTED IN THIS CHAPTER BY COUNTRY)

22.1.1 ASIA-PACIFIC

22.1.1.1. JAPAN

22.1.1.2. CHINA

22.1.1.3. SOUTH KOREA

22.1.1.4. INDIA

22.1.1.5. AUSTRALIA

22.1.1.6. SINGAPORE

22.1.1.7. THAILAND

22.1.1.8. MALAYSIA

22.1.1.9. INDONESIA

22.1.1.10. PHILIPPINES

22.1.1.11. VIETNAM

22.1.1.12. REST OF ASIA-PACIFIC

23 KEY PRIMARY INSIGHTS: BY MAJOR COUNTRIES ASIA-PACIFIC ENTERAL FEEDING FORMULA MARKET, COMPANY LANDSCAPE

23.1 COMPANY SHARE ANALYSIS: ASIA-PACIFIC

23.2 MERGERS & ACQUISITIONS

23.3 NEW PRODUCT DEVELOPMENT & APPROVALS

23.4 EXPANSIONS

23.5 REGULATORY CHANGES

23.6 PARTNERSHIP AND OTHER STRATEGIC DEVELOPMENTS

24 ASIA-PACIFIC ENTERAL FEEDING FORMULA MARKET, SWOT AND DBR ANALYSIS

25 ASIA-PACIFIC ENTERAL FEEDING FORMULA MARKET, COMPANY PROFILE

25.1 ABBOTT

25.1.1 COMPANY OVERVIEW

25.1.2 REVENUE ANALYSIS

25.1.3 GEOGRAPHIC PRESENCE

25.1.4 PRODUCT PORTFOLIO

25.1.5 RECENT DEVELOPMENTS

25.2 NESTLÉ

25.2.1 COMPANY OVERVIEW

25.2.2 REVENUE ANALYSIS

25.2.3 GEOGRAPHIC PRESENCE

25.2.4 PRODUCT PORTFOLIO

25.2.5 RECENT DEVELOPMENTS

25.3 MEIJI HOLDINGS CO., LTD.

25.3.1 COMPANY OVERVIEW

25.3.2 REVENUE ANALYSIS

25.3.3 GEOGRAPHIC PRESENCE

25.3.4 PRODUCT PORTFOLIO

25.3.5 RECENT DEVELOPMENTS

25.4 B. BRAUN MELSUNGEN AG

25.4.1 COMPANY OVERVIEW

25.4.2 REVENUE ANALYSIS

25.4.3 GEOGRAPHIC PRESENCE

25.4.4 PRODUCT PORTFOLIO

25.4.5 RECENT DEVELOPMENTS

25.5 DANONE NUTRICIA

25.5.1 COMPANY OVERVIEW

25.5.2 REVENUE ANALYSIS

25.5.3 GEOGRAPHIC PRESENCE

25.5.4 PRODUCT PORTFOLIO

25.5.5 RECENT DEVELOPMENTS

25.6 FRESENIUS SE & CO. KGAA

25.6.1 COMPANY OVERVIEW

25.6.2 REVENUE ANALYSIS

25.6.3 GEOGRAPHIC PRESENCE

25.6.4 PRODUCT PORTFOLIO

25.6.5 RECENT DEVELOPMENTS

25.7 OTSUKA PHARMACEUTICAL CO., LTD.

25.7.1 COMPANY OVERVIEW

25.7.2 REVENUE ANALYSIS

25.7.3 GEOGRAPHIC PRESENCE

25.7.4 PRODUCT PORTFOLIO

25.7.5 RECENT DEVELOPMENTS

25.8 GLOBAL HEALTH PRODUCTS, INC.

25.8.1 COMPANY OVERVIEW

25.8.2 REVENUE ANALYSIS

25.8.3 GEOGRAPHIC PRESENCE

25.8.4 PRODUCT PORTFOLIO

25.8.5 RECENT DEVELOPMENTS

25.9 HORMEL FOODS, LLC

25.9.1 COMPANY OVERVIEW

25.9.2 REVENUE ANALYSIS

25.9.3 GEOGRAPHIC PRESENCE

25.9.4 PRODUCT PORTFOLIO

25.9.5 RECENT DEVELOPMENTS

25.1 MEAD JOHNSON & COMPANY, LLC.

25.10.1 COMPANY OVERVIEW

25.10.2 REVENUE ANALYSIS

25.10.3 GEOGRAPHIC PRESENCE

25.10.4 PRODUCT PORTFOLIO

25.10.5 RECENT DEVELOPMENTS

25.11 MEDLINE INDUSTRIES, INC

25.11.1 COMPANY OVERVIEW

25.11.2 REVENUE ANALYSIS

25.11.3 GEOGRAPHIC PRESENCE

25.11.4 PRODUCT PORTFOLIO

25.11.5 RECENT DEVELOPMENTS

25.12 MEDTRITION, INC.

25.12.1 COMPANY OVERVIEW

25.12.2 REVENUE ANALYSIS

25.12.3 GEOGRAPHIC PRESENCE

25.12.4 PRODUCT PORTFOLIO

25.12.5 RECENT DEVELOPMENTS

NOTE: THE COMPANIES PROFILED IS NOT EXHAUSTIVE LIST AND IS AS PER OUR PREVIOUS CLIENT REQUIREMENT. WE PROFILE MORE THAN 100 COMPANIES IN OUR STUDY AND HENCE THE LIST OF COMPANIES CAN BE MODIFIED OR REPLACED ON REQUEST RELATED REPORTS

26 CONCLUSION

27 QUESTIONNAIRE

28 ABOUT DATA BRIDGE MARKET RESEARCH

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.