Asia Pacific Epilepsy Monitoring Devices Market

Market Size in USD Billion

CAGR :

%

USD

415.28 Billion

USD

637.32 Billion

2024

2032

USD

415.28 Billion

USD

637.32 Billion

2024

2032

| 2025 –2032 | |

| USD 415.28 Billion | |

| USD 637.32 Billion | |

|

|

|

|

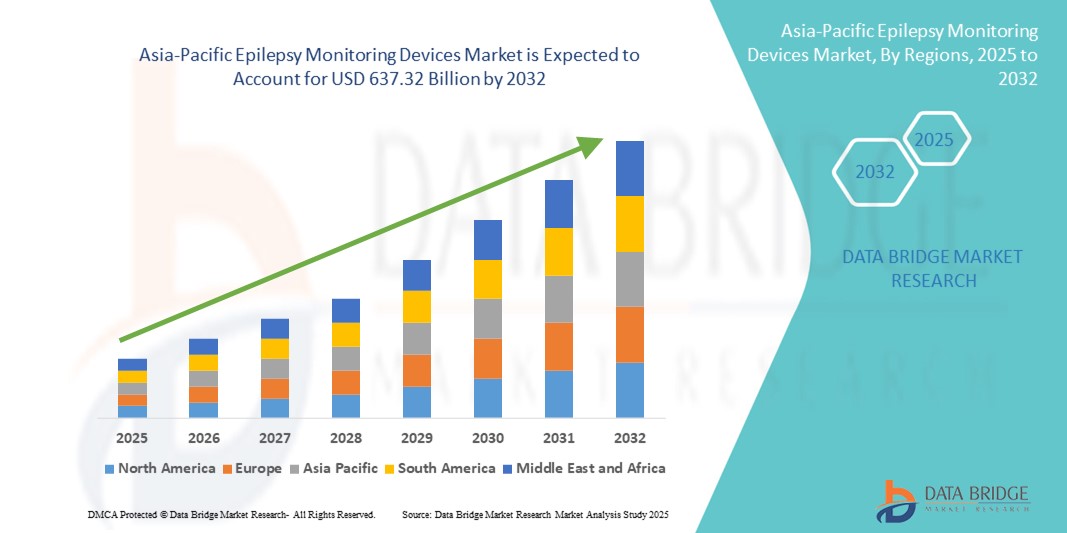

Asia-Pacific Epilepsy Monitoring Devices Market Size

- The Asia-Pacific epilepsy monitoring devices market size was valued at USD 415.28 billion in 2024 and is expected to reach USD 637.32 billion by 2032, at a CAGR of 5.50% during the forecast period

- The market growth is largely fueled by increasing awareness, rising healthcare access, and advancements in neurological monitoring technologies across Asia-Pacific, enabling timely diagnosis and management of epilepsy. The region is experiencing a surge in the adoption of continuous and ambulatory EEG monitoring, particularly in rapidly urbanizing countries such as India, China, and Indonesia, contributing to the growing utilization of advanced epilepsy monitoring devices

- Furthermore, escalating investments in healthcare infrastructure, expansion of neurology services in tier 2 and tier 3 cities, and increasing public-private partnerships are driving innovation and availability of state-of-the-art epilepsy monitoring solutions. Government initiatives supporting early diagnosis of neurological disorders, coupled with the growing presence of international medical device companies and local manufacturing capabilities, are significantly boosting the growth of the Asia-Pacific epilepsy monitoring devices market

Asia-Pacific Epilepsy Monitoring Devices Market Analysis

- The Asia-Pacific epilepsy monitoring devices market is witnessing strong growth, driven by increasing prevalence of epilepsy, rising awareness about neurological disorders, and the adoption of continuous monitoring technologies across hospitals and home-care settings. Countries such as China, India, Japan, and South Korea are seeing higher rates of epilepsy diagnosis, fueling demand for advanced monitoring solutions

- The growing preference for wearable and non-invasive monitoring devices is supported by improvements in sensor technology, remote patient monitoring capabilities, and integration with digital health platforms. In addition, the rising influence of telemedicine and home healthcare in countries like India and China is further accelerating the adoption of epilepsy monitoring devices

- China dominated the Asia-Pacific epilepsy monitoring devices market, accounting for the largest revenue share of 35.1% in 2024, driven by a large patient population, well-established healthcare infrastructure, and widespread integration of advanced monitoring devices in tertiary care hospitals

- India is projected to register the fastest CAGR of 13.6% in the Asia-Pacific epilepsy monitoring devices market during the forecast period, fueled by increasing demand for affordable and accessible neurological care, rising awareness about epilepsy management, and expansion of local manufacturing and distribution channels. Government initiatives such as Ayushman Bharat and rising private investments in neurology centers are supporting market growth across both urban and semi-urban regions

- The Focal Seizures segment dominated the Asia-Pacific epilepsy monitoring devices market with a share at 62.1% in 2024, owing to the higher prevalence of partial-onset epilepsy in the region and the increasing use of ambulatory EEG and wearable sensors for continuous detection

Report Scope and Asia-Pacific Epilepsy Monitoring Devices Market Segmentation

|

Attributes |

Asia-Pacific Epilepsy Monitoring Devices Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

Asia-Pacific

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Asia-Pacific Epilepsy Monitoring Devices Market Trends

Innovations Driving Precision Epilepsy Monitoring

- A significant and accelerating trend in the Asia-Pacific epilepsy monitoring devices market is the increasing focus on therapeutic innovations and clinical research—particularly targeting improved seizure detection accuracy, patient comfort, and integration with digital health ecosystems

- For instance, several medical device companies and research institutes in the region are investing in next-generation wearable and smart epilepsy monitoring devices equipped with AI-driven seizure prediction algorithms, advanced biosensors, and real-time data analytics for remote physician access

- The growing adoption of personalized epilepsy care models across hospitals, neurology centers, and homecare settings is enabling better clinical outcomes. These models integrate multi-parameter monitoring—such as EEG, heart rate, and movement tracking—tailored to each patient’s seizure profile and lifestyle

- Collaborations between medtech firms, academic institutions, and government health programs are helping to expand access to advanced epilepsy monitoring technologies by improving reimbursement policies, enhancing supply chain efficiency, and providing specialized training to neurologists and caregivers

- As Asia-Pacific continues to prioritize precision neurology and value-based healthcare delivery, the epilepsy monitoring devices market is set for sustained growth—driven by innovation, improved diagnostic accuracy, and rising demand for continuous seizure management solutions among both pediatric and geriatric populations

Asia-Pacific Epilepsy Monitoring Devices Market Dynamics

Driver

Growing Need Due to Rising Diagnosis Rates and Advancements in Genetic Research

- The rising prevalence of epilepsy across Asia-Pacific, coupled with increased awareness and improved diagnostic capabilities, is significantly boosting demand for epilepsy monitoring devices. Countries such as China, India, Japan, and South Korea are expanding their neurological care infrastructure and implementing large-scale screening programs, enabling earlier diagnosis and more effective long-term management of epilepsy

- For instance, in April 2024, several regional research groups reported progress in developing next-generation seizure detection algorithms and wearable EEG systems that improve real-time monitoring accuracy. These technological advancements are expected to accelerate adoption of epilepsy monitoring devices throughout Asia-Pacific in the coming years

- The growing focus on precision medicine, combined with the availability of advanced genetic and biomarker-based diagnostic tools, is driving a market shift from conventional seizure observation methods to more personalized, data-driven solutions

- Regulatory bodies such as Japan’s Pharmaceuticals and Medical Devices Agency (PMDA) and China’s National Medical Products Administration (NMPA) are increasingly prioritizing the approval and clinical trial support for innovative neurological monitoring systems, enabling faster market entry for advanced solutions

- Collaborations between medical device manufacturers, neuroscience research centers, and regional epilepsy associations are strengthening the innovation ecosystem, improving patient access to advanced monitoring technologies, and enhancing awareness of early diagnosis and comprehensive epilepsy care across diverse populations

Restraint/Challenge

Infrastructure Gaps and Uneven Integration of Advanced Monitoring Technologies

- The high cost of advanced epilepsy monitoring devices—including continuous EEG systems, video EEG monitoring units, and implantable seizure detection technologies—remains a major barrier to adoption, especially in rural and underfunded healthcare settings in Asia-Pacific

- Even with government-backed innovation initiatives, these devices often require complex manufacturing, specialized installation, and trained staff for operation, making them less accessible to hospitals and clinics with limited resources

- Specialized epilepsy care teams—comprising neurologists, neurophysiologists, and epilepsy nurses—are often concentrated in urban centers, creating significant disparities in access. Patients in remote areas frequently face long travel distances or extended waiting periods for comprehensive evaluation and monitoring

- Another key challenge is the lack of standardized clinical protocols for device-based epilepsy monitoring across the region. Limited training programs and inconsistent physician familiarity with advanced devices contribute to uneven adoption, particularly in low-volume treatment centers

- Addressing these barriers will require policy reforms, targeted government funding, public–private partnerships, and the establishment of specialized epilepsy monitoring hubs across Asia-Pacific to ensure equitable access and sustainable growth of the market

Asia-Pacific Epilepsy Monitoring Devices Market Scope

The market is segmented on the basis of product type, type, patient type, end user, and distribution channel.

- By Product Type

On the basis of product type, the Asia-Pacific epilepsy monitoring devices market is segmented into wearable devices, smart devices, and conventional devices. The wearable devices segment dominated the market with the largest revenue share of 54.7% in 2024, primarily due to their portability, continuous monitoring capabilities, and patient-friendly design. These devices allow real-time seizure tracking outside hospital or clinic environments, significantly enhancing early detection and ongoing management of epilepsy. The growing adoption of connected wearables by both patients and healthcare providers is strengthening their market dominance.

The smart devices segment is projected to register the fastest CAGR of 9.6% during 2025–2032, driven by advancements such as AI-powered seizure prediction algorithms, cloud-based data storage, and integration with mobile health platforms. These technologies enable precise monitoring, improve diagnostic accuracy, and support personalized treatment strategies, making smart devices a critical growth area in the region.

- By Type

On the basis of type, the Asia-Pacific epilepsy monitoring devices market is segmented into focal seizures and generalized seizures. The focal seizures segment accounted for the highest market share of 62.1% in 2024, reflecting the high prevalence of partial-onset epilepsy in the Asia-Pacific population. The rising use of ambulatory EEG systems and wearable sensors for continuous seizure detection is further supporting demand in this category, as these devices help capture subtle seizure activity that might otherwise go unnoticed in clinical settings.

The generalized seizures segment is anticipated to record the fastest CAGR of 8.3% during 2025–2032, supported by technological progress in high-sensitivity EEG and multimodal monitoring devices. These innovations are enhancing the detection of multiple seizure types while minimizing false alarms, thereby expanding their use in both clinical and homecare applications.

- By Patient Type

On the basis of patient type, the Asia-Pacific epilepsy monitoring devices market is segmented into paediatric, geriatric, and adult patients. The adult segment accounted for the largest share of 51.8% in 2024, attributed to the rising incidence of adult-onset epilepsy, lifestyle-related neurological conditions, and growing awareness around early diagnosis and treatment. Increased availability of advanced diagnostic infrastructure for adult patients across hospitals and neurology centres also contributes to the segment’s dominance.

The paediatric segment is expected to experience the highest CAGR of 9.1% from 2025 to 2032, fueled by increasing demand for non-invasive, child-friendly monitoring solutions such as portable EEG headsets and wireless devices. Expanding pediatric neurology facilities, along with rising investments in specialized care for children with epilepsy, are expected to further accelerate growth in this segment.

- By End User

On the basis of end user, the Asia-Pacific epilepsy monitoring devices market is segmented into hospitals, homecare settings, neurology centres, diagnostic centres, ambulatory surgical centres & clinics, and others. The hospital segment held the largest share of 46.9% in 2024, driven by access to state-of-the-art EEG systems, neuroimaging equipment, and specialized multidisciplinary epilepsy care teams that manage diagnosis, monitoring, and long-term treatment. Hospitals remain the central hubs for both advanced testing and comprehensive care.

The homecare setting segment is projected to grow at the fastest CAGR of 10.5% during 2025–2032, as patients and caregivers increasingly adopt portable, user-friendly monitoring devices for long-term seizure tracking at home. The trend toward decentralization of epilepsy care, coupled with the availability of wireless devices that allow seamless data sharing with healthcare providers, is accelerating this shift toward home-based monitoring.

- By Distribution Channel

On the basis of distribution channel, the Asia-Pacific epilepsy monitoring devices market is segmented into retail sales, online sales, direct tenders, and others. The direct tender segment led the market with a share of 44.2% in 2024, underpinned by centralized procurement systems in public healthcare institutions, bulk purchasing by national epilepsy programs, and government-led initiatives to equip hospitals and diagnostic centres with advanced monitoring systems.

The online sales segment is forecasted to grow at the fastest CAGR of 11.2% from 2025 to 2032, supported by the rapid rise of e-commerce healthcare platforms, increasing patient comfort with digital purchasing, and the availability of device customization through online channels. This mode of distribution is making epilepsy monitoring devices more accessible to patients in remote or underserved regions, thus expanding overall market reach.

Asia-Pacific Epilepsy Monitoring Devices Market Regional Analysis

- Asia-Pacific held a market share of 30.3% in the global epilepsy monitoring devices market in 2024, driven by the rising prevalence of epilepsy, growing awareness about seizure management, and rapid adoption of advanced monitoring technologies such as video-EEG systems and wearable seizure detection devices

- Strong regulatory support, expanding reimbursement frameworks, and increased government investment in neurological health are fostering market growth across both public and private healthcare sectors. In addition, public–private initiatives aimed at improving diagnostic accuracy and reducing epilepsy treatment gaps are accelerating technology adoption

- The region also hosts several leading neurodiagnostic device manufacturers and research institutions, enabling continuous product innovation, clinical validation, and integration of AI-driven seizure analysis tools

China Asia-Pacific Epilepsy Monitoring Devices Market Insight

The China epilepsy monitoring devices market held the largest share in the Asia-Pacific region at 35.1% in 2024, supported by its large patient base, increasing epilepsy awareness campaigns, and significant investment in hospital-based neurodiagnostic infrastructure. Government healthcare reforms and favorable reimbursement for epilepsy diagnostics are encouraging both domestic and international manufacturers to expand their presence. Local companies are actively developing cost-effective video-EEG and portable monitoring systems to improve accessibility in rural and semi-urban areas.

Japan Asia-Pacific Epilepsy Monitoring Devices Market Insight

The Japan epilepsy monitoring devices market accounted for 20.3% of the regional share in 2024, driven by its advanced healthcare infrastructure, high insurance coverage, and strong emphasis on early and accurate seizure diagnosis. Japan is at the forefront of integrating AI-based seizure detection algorithms and remote patient monitoring into clinical workflows. The country’s focus on patient quality of life, coupled with robust research output in epilepsy care, is solidifying its position as a leader in neurodiagnostic innovation.

India Asia-Pacific Epilepsy Monitoring Devices Market Insight

The India epilepsy monitoring devices market is projected to be the fastest-growing in Asia-Pacific with a CAGR of 13.6% from 2025 to 2032, fueled by rising awareness, increasing availability of diagnostic facilities, and greater affordability of monitoring technologies. National epilepsy control programs, expansion of neurodiagnostic labs into tier 2 and tier 3 cities, and growing collaborations between public health agencies and private healthcare providers are boosting adoption. India is also emerging as a cost-effective manufacturing hub for EEG and portable seizure monitoring devices, enhancing its competitive edge in the region.

Asia-Pacific Epilepsy Monitoring Devices Market Share

The Asia-Pacific epilepsy monitoring devices industry is primarily led by well-established companies, including:

- NIHON KOHDEN CORPORATION (Japan)

- Masimo (U.S.)

- Apple Inc. (U.S.)

- Natus Medical Incorporated (U.S.)

- Owlet (U.S.)

- Neurotech, LLC (U.S.)

- SmartMonitor (U.S.)

- Epilert (Tunisia)

Latest Developments in Asia-Pacific Epilepsy Monitoring Devices market

- In December 2022, NIHON KOHDEN CORPORATION announced that it would open a new sale branch of Nihon Kohden Singapore (NKS), one of its sales subsidiaries, aiming to apply for registration of medical devices smoothly and expand its sales in the Philippines

- In February 2022, Masimo announced its entry into a definitive merger agreement to acquire Viper Holdings Corporation, which owns Sound United (“Sound United”). This consumer technology company owns a portfolio of premium brands, including Bowers& Wilkins, Denon, Polk Audio and Marantz. Pursuant to the merger agreement, they had to pay approximately USD 1.025 billion, subject to adjustments, for the acquisition. This helps the organization generate more revenue

- In September 2022, Seer Medical received U.S. FDA 510(k) clearance for Seer Home, its at-home long-term video-EEG/ECG system that enables multi-day ambulatory diagnostic EEG monitoring outside the hospital

- In December 2021–through 2022, Compumedics expanded its footprint in China (including a major MEG order) and announced product rollouts targeting home/ambulatory EEG; the company later secured U.S. FDA 510(k) clearance for its Okti high-density ambulatory EEG amplifier in March 2023, enabling broader commercial activity across APAC and the U.S. markets

- In August 2023, Ceribell announced FDA 510(k) clearance for ClarityPro (its AI software for diagnosing electrographic status epilepticus) and obtained CMS NTAP reimbursement — a milestone that accelerates hospital adoption of point-of-care EEG solutions and is influential for APAC buyers benchmarking acute-care monitoring standards

- In October 2023, Ceribell commercially launched ClarityPro AI (the software product described above), making its point-of-care EEG + AI offering available to acute care providers — an offering that many APAC hospitals and networks evaluate when upgrading ICU/ED neurodiagnostics

- In November 2024, Nihon Kohden strengthened its neurology/epilepsy capabilities by acquiring a controlling stake in Ad-Tech Medical Instrument (a specialist in intracranial and neurodiagnostic electrodes), a strategic move that expands Nihon Kohden’s integrated epilepsy diagnostics and consumables offering across APAC

- In April 2025, Cadwell Industries announced a strategic investment in Australia’s Seer Medical to integrate Seer’s home-EEG technology with Cadwell’s neurodiagnostic portfolio — a transaction explicitly intended to scale home-based epilepsy diagnostics and expand access globally (including APAC)

- In April 2025, Ceribell received FDA 510(k) clearance for its next-generation Clarity algorithm for pediatric patients (age 1+), making it the first AI-powered point-of-care EEG cleared to detect electrographic seizures down to 1 year of age — a regulatory step that can influence pediatric monitoring adoption and guidelines internationally, including in APAC markets

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.