Asia Pacific Foot And Ankle Devices Market

Market Size in USD Million

CAGR :

%

USD

802.70 Million

USD

1,708.18 Million

2024

2032

USD

802.70 Million

USD

1,708.18 Million

2024

2032

| 2025 –2032 | |

| USD 802.70 Million | |

| USD 1,708.18 Million | |

|

|

|

|

Asia-Pacific Foot and Ankle Devices Market Size

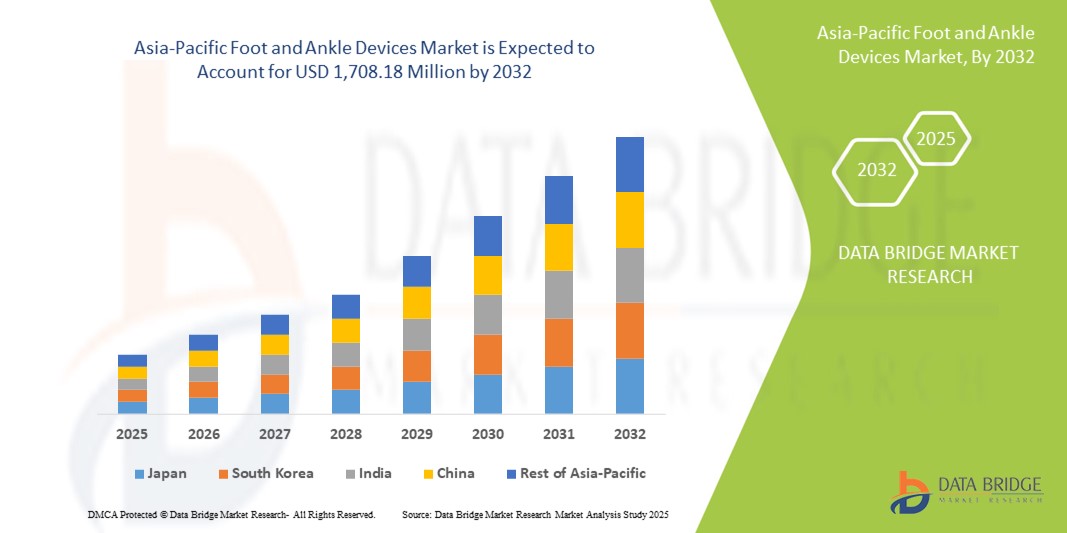

- The Asia-Pacific foot and ankle devices market size was valued at USD 802.70 million in 2024 and is expected to reach USD 1,708.18 million by 2032, at a CAGR of 9.90% during the forecast period

- The market growth is largely fueled by the aging population, rising prevalence of foot and ankle disorders, and technological advancements in treatment solutions, leading to increased adoption of specialized devices across the region

- Furthermore, growing sports activities, higher incidence of injuries, and rising consumer demand for effective and user-friendly solutions are establishing advanced foot and ankle devices as the preferred choice for both clinical and personal care settings. These converging factors are accelerating the uptake of such devices, thereby significantly boosting the industry's growth

Asia-Pacific Foot and Ankle Devices Market Analysis

- Foot and ankle devices, encompassing orthopedic implants and devices, bracing and support devices, and prostheses, are becoming essential components of modern orthopedic care in both hospitals and clinics due to their ability to improve mobility, reduce recovery time, and support minimally invasive procedures

- The growing demand for foot and ankle devices is primarily fueled by the increasing prevalence of foot and ankle disorders, rising sports-related injuries, and advancements in medical technologies that enhance treatment effectiveness and patient outcomes

- Japan dominated the Asia-Pacific foot and ankle devices market in 2024 with a market share of 29.2%, driven by advanced healthcare infrastructure, high healthcare spending, and the presence of leading orthopedic device manufacturers, with hospitals and trauma centers witnessing substantial adoption of implants and bracing devices

- China is expected to be the fastest-growing country in the Asia-Pacific foot and ankle devices market during the forecast period, due to rising geriatric population, increasing incidence of orthopedic conditions, and growing investments in healthcare facilities and surgical technologies

- Orthopedic implants and devices segment dominated the Asia-Pacific foot and ankle devices market with a market share of 47% in 2024, driven by their effectiveness in treating trauma, osteoarthritis, and other degenerative conditions while supporting rapid patient recovery

Report Scope and Asia-Pacific Foot and Ankle Devices Market Segmentation

|

Attributes |

Asia-Pacific Foot and Ankle Devices Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

Asia-Pacific

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Asia-Pacific Foot and Ankle Devices Market Trends

Advancements in Minimally Invasive and Smart Orthopedic Devices

- A significant and accelerating trend in the Asia-Pacific foot and ankle devices market is the adoption of minimally invasive surgical techniques and smart orthopedic devices equipped with sensors for improved surgical outcomes and patient monitoring. This fusion of technology and treatment is enhancing precision, recovery time, and post-operative care

- For instance, smart orthopedic braces embedded with pressure sensors can provide real-time feedback to both patients and physicians, helping optimize rehabilitation exercises and monitor weight-bearing activities. Similarly, 3D-printed customized implants are enabling better anatomical fit and faster recovery for patients undergoing reconstructive foot surgeries

- Integration of digital tracking and tele-rehabilitation features in foot and ankle devices allows clinicians to remotely monitor patient progress and adjust treatment plans, improving adherence and reducing hospital visits. Furthermore, sensor-enabled prostheses are enhancing mobility and comfort for patients with severe deformities or post-trauma conditions

- The seamless incorporation of wearable technology and smart devices into foot and ankle treatment workflows enables centralized monitoring of recovery metrics, patient activity levels, and compliance, facilitating a more personalized and efficient care experience

- This trend towards smarter, connected, and patient-centric orthopedic solutions is reshaping expectations for foot and ankle care. Consequently, companies are developing devices with integrated feedback systems and remote monitoring capabilities to support both clinical and home-based rehabilitation

- The demand for smart and minimally invasive foot and ankle devices is growing rapidly across hospitals, trauma centers, and specialty clinics, as patients and healthcare providers increasingly prioritize better outcomes, shorter recovery times, and improved convenience

Asia-Pacific Foot and Ankle Devices Market Dynamics

Driver

Rising Incidence of Foot and Ankle Disorders and Orthopedic Awareness

- The increasing prevalence of conditions such as osteoarthritis, rheumatoid arthritis, hammertoe, and trauma, coupled with rising awareness of orthopedic care and rehabilitation options, is a key driver of demand for foot and ankle devices

- For instance, initiatives by hospitals in China and India to improve orthopedic care infrastructure and patient education are encouraging adoption of advanced implants, bracing systems, and prostheses

- As the population ages and sports-related injuries rise, demand for advanced orthopedic devices that improve mobility, reduce recovery time, and support minimally invasive procedures continues to grow

- Furthermore, increasing investments in healthcare infrastructure, such as trauma centers and specialty clinics, are making foot and ankle treatments more accessible and effective, boosting the market for both implants and supportive devices

- The convenience of integrated rehabilitation solutions, customizable implants, and smart braces for remote monitoring is propelling adoption among patients and clinicians asuch as, across both urban and semi-urban healthcare settings

- Growing government and private sector focus on orthopedic research, training, and advanced surgical technologies is further strengthening the market by encouraging the use of innovative foot and ankle devices

Restraint/Challenge

High Device Costs and Limited Skilled Professionals

- The relatively high cost of advanced foot and ankle devices, including implants, smart braces, and prostheses, poses a significant challenge to widespread adoption, particularly in developing countries within the Asia-Pacific region

- For instance, hospitals and specialty clinics in emerging economies may face budget constraints, limiting their ability to procure cutting-edge implants or sensor-enabled devices, thereby slowing market growth

- A shortage of skilled orthopedic surgeons and trained rehabilitation professionals can hinder effective usage of advanced devices, affecting patient outcomes and confidence in the technology

- Furthermore, inconsistent reimbursement policies and lack of insurance coverage for advanced foot and ankle procedures can reduce affordability and limit patient access, especially for elective surgeries and rehabilitation programs

- While prices of basic orthopedic devices are gradually decreasing, premium devices with smart features and customized designs still carry a higher cost, affecting adoption among smaller hospitals and clinics

- Overcoming these challenges through training programs, government support, and cost-effective device development will be vital for sustaining growth and expanding access to foot and ankle care across the region

Asia-Pacific Foot and Ankle Devices Market Scope

The market is segmented on the basis of products, application, and end user.

- By Products

On the basis of products, the Asia-Pacific foot and ankle devices market is segmented into orthopedic implants and devices, bracing and support devices, and prostheses. Orthopedic Implants and Devices dominated the market with the largest share of 47% in 2024, driven by their widespread use in treating trauma, osteoarthritis, rheumatoid arthritis, and other degenerative conditions. These implants, including plates, screws, and intramedullary nails, are preferred by surgeons for their reliability, durability, and ability to support minimally invasive procedures. Hospitals and trauma centers often prioritize implants due to their proven outcomes in fracture stabilization and joint reconstruction. The segment also benefits from technological advancements such as 3D-printed patient-specific implants and bioactive coatings, enhancing recovery and reducing complications. Rising awareness of orthopedic care and increasing sports-related injuries in the Asia-Pacific region further support the demand for implants. The segment’s growth is reinforced by expanding healthcare infrastructure in countries such as Japan, China, and India, where high surgical volumes create consistent demand.

Bracing and Support Devices are anticipated to witness the fastest growth rate of 9.8% from 2025 to 2032. This growth is fueled by increasing adoption in rehabilitation centers, specialty clinics, and home care settings. Braces, orthoses, and support devices help in post-surgical recovery, weight management, and mobility enhancement, providing non-invasive solutions for patients with fractures, hammertoe, or osteoarthritis. Technological advancements such as smart braces with sensors for activity monitoring and tele-rehabilitation features are driving their adoption. Bracing devices are also preferred for their cost-effectiveness compared to implants and ease of use in elderly and sports-injury patients. Rising patient preference for outpatient care and home-based rehabilitation further accelerates segment growth.

- By Application

On the basis of application, the market is segmented into trauma, hammertoe, osteoarthritis, rheumatoid arthritis, osteoporosis, and others. Trauma dominated the market with a share of 38% in 2024, driven by the high prevalence of fractures, sports injuries, and accidents in the Asia-Pacific region. Trauma-related foot and ankle injuries require timely intervention with implants or supportive devices to restore mobility and prevent long-term disability. Hospitals and trauma centers are primary end users, ensuring access to advanced surgical tools and post-operative care solutions. Rising urbanization and higher participation in sports and physical activities contribute to the increasing number of trauma cases. Advanced trauma implants and fixation devices are increasingly being adopted due to their reliability and improved patient outcomes. The segment also benefits from training programs for orthopedic surgeons and the availability of minimally invasive surgical techniques.

Osteoarthritis is expected to witness the fastest growth with a CAGR of 8.9% from 2025 to 2032. This growth is driven by the increasing geriatric population and rising prevalence of degenerative joint disorders in countries such as China, India, and Japan. Orthopedic implants, bracing devices, and physiotherapy-focused supports are preferred for managing osteoarthritis-related mobility issues. Growing awareness of early intervention, coupled with advances in joint reconstruction and smart braces, enhances patient adherence and clinical outcomes. The segment also benefits from the rising focus on outpatient care and minimally invasive surgical solutions.

- By End User

On the basis of end user, the market is segmented into hospitals, trauma centers, ambulatory surgical centers, specialty clinics, and others. Hospitals dominated the market with a share of 52% in 2024, due to the availability of advanced surgical infrastructure, trained orthopedic specialists, and high patient throughput for trauma and degenerative conditions. Hospitals are the primary adopters of implants and complex bracing devices for post-operative rehabilitation and trauma care. Increasing investments in healthcare infrastructure across Asia-Pacific, especially in Japan, China, and India, drive hospital demand. Hospitals also benefit from the integration of tele-rehabilitation and digital patient monitoring systems, which support better outcomes and reduce recovery time. Rising incidence of sports injuries, fractures, and chronic orthopedic conditions ensures consistent demand.

Specialty Clinics are expected to witness the fastest growth rate of 10.2% from 2025 to 2032. These clinics focus on outpatient care, rehabilitation, and minimally invasive procedures, offering tailored solutions such as smart braces and customized orthoses. The increasing preference for home-based and clinic-based rehabilitation drives adoption of bracing and prosthetic devices. Specialty clinics also benefit from technological innovations such as sensor-enabled braces, patient-specific prostheses, and tele-rehabilitation systems. Rising consumer awareness, convenience of outpatient care, and cost-effectiveness compared to hospital procedures further fuel growth in this segment.

Asia-Pacific Foot and Ankle Devices Market Regional Analysis

- Japan dominated the Asia-Pacific foot and ankle devices market in 2024 with a market share of 29.2%, driven by advanced healthcare infrastructure, high healthcare spending, and the presence of leading orthopedic device manufacturers, with hospitals and trauma centers witnessing substantial adoption of implants and bracing devices

- Patients and healthcare providers in the region prioritize high-quality implants, bracing devices, and prostheses that offer improved surgical outcomes, faster recovery, and enhanced mobility, contributing to widespread adoption across hospitals and trauma centers

- This strong market presence is further supported by rising geriatric population, increasing incidence of foot and ankle disorders, and growing awareness of orthopedic care, establishing Japan as a key hub for foot and ankle device utilization and innovation in Asia-Pacific

The Japan Foot and Ankle Devices Market Insight

The Japan foot and ankle devices market dominated the region with the largest revenue share of 29.2% in 2024 due to the country’s advanced healthcare infrastructure, high healthcare expenditure, and strong adoption of innovative orthopedic treatments. Japanese hospitals and trauma centers prioritize high-quality implants, bracing systems, and prosthetic devices for managing trauma, osteoarthritis, and other foot disorders. The aging population, coupled with an increasing focus on outpatient rehabilitation and minimally invasive procedures, is driving demand. Moreover, Japan’s emphasis on precision medicine and technologically advanced devices supports sustained market growth across both clinical and home-based care settings.

South Korea Foot and Ankle Devices Market Insight

The South Korea foot and ankle devices market is also a dominant contributor in the Asia-Pacific region, driven by a well-established healthcare system, high adoption of advanced orthopedic procedures, and growing focus on geriatric and sports injury care. Hospitals and specialty clinics in South Korea are increasingly integrating implants, smart bracing devices, and prostheses to improve surgical outcomes and rehabilitation efficiency. Government support for advanced healthcare technologies and investment in orthopedic research further reinforce market growth. In addition, increasing patient awareness and preference for minimally invasive surgeries and digital rehabilitation solutions are driving adoption across clinical settings.

India Foot and Ankle Devices Market Insight

The India foot and ankle devices market accounted for a substantial revenue share in Asia-Pacific in 2024, attributed to the country’s expanding healthcare infrastructure, growing geriatric population, and rising awareness of orthopedic care. Hospitals, trauma centers, and specialty clinics are increasingly adopting orthopedic implants, braces, and prosthetic solutions for trauma, hammertoe, and osteoarthritis management. The push towards improved surgical capabilities, coupled with the availability of cost-effective devices and strong domestic manufacturing, is propelling market growth. In addition, increasing urbanization, rising disposable incomes, and government initiatives to strengthen healthcare access further boost adoption across residential and clinical settings.

China Foot and Ankle Devices Market Insight

The China foot and ankle devices market is expected to witness significant growth due to rapid urbanization, increasing incidence of trauma and degenerative foot conditions, and expanding hospital infrastructure. The country is investing heavily in orthopedic care, including advanced implants and minimally invasive surgical solutions. Growing awareness of preventive care and post-surgical rehabilitation is driving the adoption of bracing and support devices. Furthermore, China’s focus on digital healthcare technologies and tele-rehabilitation platforms supports the integration of smart orthopedic devices, enhancing patient monitoring and clinical outcomes across hospitals and specialty clinics.

Asia-Pacific Foot and Ankle Devices Market Share

The Asia-Pacific Foot and Ankle Devices industry is primarily led by well-established companies, including:

- Stryker (U.S.)

- Zimmer Biomet (U.S.)

- Johnson & Johnson Services, Inc. (U.S.)

- Smith & Nephew (U.K.)

- Enovis Corporation (U.S.)

- Acumed LLC (U.S.)

- Arthrex, Inc. (U.S.)

- Paragon 28, Inc. (U.S.)

- Orthofix Medical Inc. (U.S.)

- Medtronic (Ireland)

- Össur (Iceland)

- Canwell Medical (China)

- LMT Medical Systems GmbH (Germany)

- CarboFix Orthopedics Ltd. (Israel)

- Medacta International SA (Switzerland)

- Flower Orthopedics Corporation. (U.S.)

- Medartis AG (Switzerland)

- Corin (U.K.)

What are the Recent Developments in Asia-Pacific Foot and Ankle Devices Market?

- In September 2025, researchers at Sungkyunkwan University developed a modified glue gun capable of 3D printing synthetic bone grafts directly onto patients' living tissue during surgery. This innovation aims to improve bone healing and integration, offering a more personalized approach to foot and ankle reconstruction

- In July 2025, CARE Hospitals in Hyderabad introduced Stryker's Mako Robotic System, marking a significant advancement in precision orthopedic surgeries in India. This AI-powered system enhances the accuracy of joint replacement procedures, including those for foot and ankle conditions

- In June 2025, Stryker received FDA 510(k) clearance for its Incompass™ Total Ankle System, designed for patients with end-stage ankle arthritis. The system integrates technologies from Stryker’s Inbone® and Infinity® platforms, offering improved surgical efficiency and patient outcomes

- In September 2024, Medtronic launched its first Robotics Experience Studio in Southeast Asia, based in Singapore. The facility aims to accelerate the adoption of robotics and AI in healthcare across the region, enhancing the delivery of advanced foot and ankle surgical care

- In July 2021, Baptist Health News reported on the use of 3D printing technology in total ankle replacement surgeries. The approach allows for the creation of custom implants that conform to patients' exact anatomy, promoting better integration and faster recovery times

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.