Global Orthopedic Implants Market

Market Size in USD Million

CAGR :

%

USD

53.35 Million

USD

83.76 Million

2024

2032

USD

53.35 Million

USD

83.76 Million

2024

2032

| 2025 –2032 | |

| USD 53.35 Million | |

| USD 83.76 Million | |

|

|

|

|

Orthopedic Implants Market Size

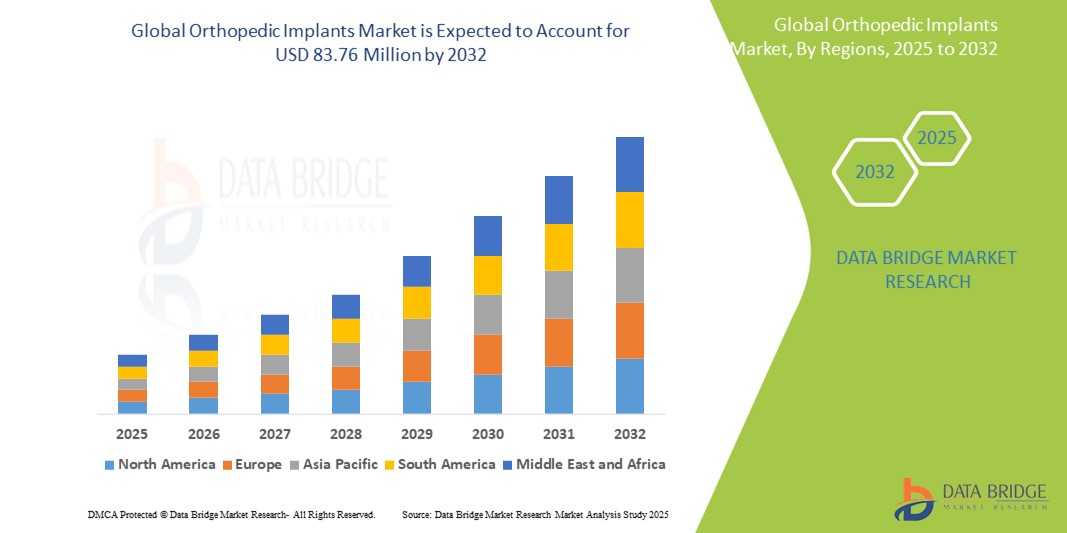

- The global orthopedic implants market size was valued at USD 53.35 million in 2024 and is expected to reach USD 83.76 million by 2032, at a CAGR of 5.80% during the forecast period

- The market growth is largely fueled by the increasing prevalence of orthopedic disorders such as osteoarthritis, rheumatoid arthritis, and osteoporosis, combined with the growing aging population globally. Advancements in implant materials and surgical techniques are also driving innovation and adoption across developed and emerging markets

- Furthermore, rising patient awareness, improved reimbursement policies, and the surge in demand for minimally invasive surgeries are establishing orthopedic implants as the go-to solution for long-term mobility and pain relief. These converging factors are accelerating the uptake of orthopedic implant solutions, thereby significantly boosting the industry's growth

Orthopedic Implants Market Analysis

- Orthopedic implants, used to support or replace damaged bones and joints, are increasingly vital components in modern surgical interventions for musculoskeletal disorders due to their ability to restore mobility, reduce pain, and improve the quality of life in both trauma and chronic orthopedic conditions

- The escalating demand for orthopedic implants is primarily fueled by the growing global burden of osteoarthritis, an expanding geriatric population, and an increase in sports-related injuries and road accidents

- North America dominates the orthopedic implants market with the largest revenue share of 45.74% in 2024, characterized by advanced healthcare infrastructure, high healthcare expenditure, and strong presence of leading orthopedic device manufacturers

- Asia-Pacific is expected to be the fastest growing region in the orthopedic implants market during the forecast period due to rapid urbanization, rising healthcare investments, and an increasing patient base for orthopedic surgeries

- Metallic Biomaterials segment dominates the orthopedic implants market with a market share of 46.43% in 2024, driven by its superior mechanical strength, biocompatibility, and proven durability in load-bearing orthopedic applications

Report Scope and Orthopedic Implants Market Segmentation

|

Attributes |

Orthopedic Implants Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Orthopedic Implants Market Trends

“Technological Advancements in Customization and Minimally Invasive Solutions”

- A significant and accelerating trend in the global orthopedic implants market is the advancement in patient-specific and minimally invasive implant technologies, which are enhancing surgical precision, reducing recovery time, and improving overall patient outcomes

- For instance, companies such as Zimmer Biomet and Stryker have introduced 3D-printed orthopedic implants tailored to individual patient anatomies, enabling better fit and functionality. Similarly, Conformis offers customized knee implants designed using patient-specific CT scans, leading to more accurate alignment and improved post-surgical mobility

- Minimally invasive surgical (MIS) techniques are increasingly being adopted, facilitated by the development of smaller, more anatomically adapted implants and advanced surgical tools. These innovations reduce tissue disruption, lower infection risk, and shorten hospital stays. Robotic-assisted surgeries—such as those offered through Stryker's Mako System—are allowing for precise implant placement with minimal invasiveness

- The integration of digital health tools and navigation systems with orthopedic procedures is further elevating surgical accuracy. Technologies such as intraoperative imaging, augmented reality, and real-time data analytics are becoming more common in joint and spine surgeries

- This trend towards personalized, data-driven, and less invasive orthopedic solutions is redefining clinical standards and patient expectations. As a result, manufacturers are investing in R&D to develop implants that combine biomechanical performance with digital compatibility and improved procedural workflows

- The demand for technologically advanced orthopedic implants is rising rapidly across both developed and emerging healthcare markets, driven by the need for enhanced patient care, surgeon efficiency, and long-term implant performance

Orthopedic Implants Market Dynamics

Driver

“Rising Incidence of Musculoskeletal Disorders and Aging Population”

- The increasing global incidence of musculoskeletal disorders, including osteoarthritis, osteoporosis, and degenerative joint diseases, coupled with the growing aging population, is a significant driver for the rising demand for orthopedic implants

- For instance, according to the World Health Organization (2024), musculoskeletal conditions affect over 1.7 billion people globally, making them the leading contributor to disability worldwide. The need for joint reconstruction, fracture fixation, and spinal stabilization is expected to rise correspondingly

- As life expectancy increases, particularly in developed and emerging economies, the prevalence of age-related orthopedic conditions such as hip fractures and joint degeneration is also rising, necessitating the use of durable and effective orthopedic implants

- Furthermore, the growing awareness among patients and healthcare professionals about the benefits of early surgical intervention and the availability of advanced implant materials and designs are making orthopedic procedures more accessible and attractive

- Technological advancements, including robotics, AI-assisted surgical planning, and 3D-printed customized implants, are enhancing surgical outcomes and accelerating patient recovery, further strengthening the appeal and adoption of orthopedic implants

- The expanding healthcare infrastructure in developing countries and increasing public and private investments in orthopedic care also contribute to market growth, creating new opportunities for implant manufacturers and healthcare providers worldwide

Restraint/Challenge

“High Cost of Implants and Surgical Procedures, and Risk of Post-Operative Complications”

- The high cost associated with orthopedic implants and related surgical procedures poses a significant challenge to broader adoption, especially in low- and middle-income countries. These expenses include not only the implant devices themselves but also hospital stays, surgical equipment, and post-operative rehabilitation

- For instance, total joint replacement surgeries—such as hip or knee arthroplasty—can cost tens of thousands of dollars in developed countries, making them inaccessible for many uninsured or underinsured patients. The affordability gap remains a major concern in expanding orthopedic care globally

- In addition, orthopedic implant surgeries carry the risk of post-operative complications such as infections, implant loosening, allergic reactions to implant materials, or the need for revision surgeries. These clinical concerns can affect patient confidence and hinder market growth, especially in regions with limited surgical infrastructure or follow-up care Regulatory and reimbursement hurdles further compound these challenges. Complex approval processes, variability in reimbursement policies, and cost-containment measures in public health systems can delay the introduction of innovative implants and limit their widespread use

- While advancements in biocompatible materials, sterilization protocols, and surgical techniques are addressing some of these issues, the perception of risk and the financial burden still serve as barriers to the adoption of orthopedic implants, particularly among aging populations in emerging markets

- Overcoming these challenges will require coordinated efforts from implant manufacturers, healthcare providers, and policymakers to enhance affordability, ensure procedural safety, and educate both surgeons and patients on the long-term benefits and risks of orthopedic implant interventions

Orthopedic Implants Market Scope

The market is segmented on the basis of product type, biomaterial, procedure, device type, application, and end user.

- By Product Type

On the basis of product type, the orthopedic implants market is segmented into reconstructive joint replacements, spinal implants, dental implants, orthobiologics, trauma and craniomaxillofacial implants, and others. The reconstructive joint replacements segment dominates the largest market revenue share in 2024, driven by the high prevalence of osteoarthritis and an aging population seeking improved mobility and quality of life. Hip and knee replacements lead this segment, supported by advancements in minimally invasive surgical techniques and implant design.

The spinal implants segment is anticipated to witness the fastest growth rate from 2025 to 2032, fueled by increasing cases of spinal disorders, sedentary lifestyles, and a rising number of spinal fusion surgeries. Growing demand for motion-preserving devices and the integration of navigation-assisted surgeries are key contributors to this trend.

- By Biomaterial

On the basis of biomaterial, the orthopedic implants market is segmented into ceramic biomaterials, metallic biomaterials, polymeric biomaterials, and natural biomaterials. The metallic biomaterials segment dominates with the largest market share of 46.43% in 2024, driven by their superior mechanical strength, corrosion resistance, and long-term durability in load-bearing orthopedic applications. Titanium and stainless steel remain the most commonly used materials due to their biocompatibility and reliability.

The polymeric biomaterials segment is expected to grow steadily during forecast period, particularly in joint and spinal implants, due to their flexibility, lower weight, and ability to reduce wear in articulating surfaces.

- By Procedure

On the basis of the procedure, the orthopedic implants market is segmented into open surgery, minimally invasive surgery (MIS), and others. The open surgery segment continues to account for the highest market share in 2024 due to its widespread use in complex orthopedic reconstructions and fracture fixations.

The minimally invasive surgery (MIS) segment is expected to expand at the highest CAGR from 2025 to 2032, propelled by rising demand for quicker recovery times, reduced surgical trauma, and better cosmetic outcomes. The integration of robotic-assisted systems and real-time imaging is further supporting this trend.

- By Device Type

On the basis of device type, the orthopedic implants market is segmented into internal fixation devices and external fixation devices. Internal fixation devices dominate the market with the largest share in 2024, driven by their effectiveness in stabilizing fractures, shorter healing times, and wide application in trauma and orthopedic reconstructive surgeries.

External fixation devices are expected to witness fastest growth during forecast period, particularly in acute trauma cases and corrective orthopedic procedures, due to their non-invasive nature and adjustability during the healing process

By Application

On the basis of application, the orthopedic implants market is segmented into neck fracture, spine fracture, hip replacement, shoulder replacement, and others.The hip replacement segment holds the highest market share in 2024, attributed to the high prevalence of hip osteoarthritis and favorable outcomes of hip arthroplasty in elderly patients.

The spine fracture segment is projected to grow at the fastest pace during the forecast period due to increasing incidences of spinal injuries and advancements in spinal fusion technologies.

- By End User

On the basis of end user, the orthopedic implants market is segmented into hospitals, orthopedic clinics, home cares, and others. Hospitals dominate the market with the largest revenue share in 2024, driven by the availability of advanced surgical infrastructure, skilled professionals, and insurance coverage.

Orthopedic clinics are anticipated to grow rapidly during the forecast period, due to increasing specialization in orthopedic care, shorter patient wait times, and rising demand for outpatient surgical services

Orthopedic Implants Market Regional Analysis

- North America dominates the orthopedic implants market with the largest revenue share of 45.74% in 2024, driven by advanced healthcare infrastructure, high healthcare expenditure, and strong presence of leading orthopedic device manufacturers

- The region benefits from well-established healthcare infrastructure, strong reimbursement frameworks, and a high concentration of leading orthopedic device manufacturers such as Stryker, Zimmer Biomet, and Johnson & Johnson. These factors collectively contribute to robust demand and continuous innovation in implant technology

- Moreover, North American patients and healthcare providers show strong preferences for minimally invasive and robot-assisted surgical procedures, supporting the adoption of next-generation implants. The presence of a tech-savvy patient population and increasing elective surgical volumes further reinforce the region’s leadership in the global orthopedic implants market

U.S. Orthopedic Implants Market Insight

The U.S. orthopedic implants market captured the largest revenue share in North America in 2024, supported by a high burden of musculoskeletal disorders and an aging population requiring joint replacement and fracture fixation. Advanced healthcare infrastructure, favorable reimbursement scenarios, and the widespread adoption of robotic-assisted orthopedic surgeries have further bolstered market expansion. In addition, increasing sports injuries and obesity-related orthopedic complications continue to drive demand for various implants, particularly in hip and knee reconstruction.

Europe Orthopedic Implants Market Insight

The Europe orthopedic implants market is projected to expand at a steady CAGR throughout the forecast period, driven by a rising elderly population and increasing cases of degenerative joint diseases. Stringent regulatory standards for product safety and efficacy contribute to high-quality implant offerings across the region. Demand is rising for advanced, biocompatible implants as well as minimally invasive surgical solutions. The region is also witnessing growth in personalized orthopedic solutions, leveraging 3D printing and AI-assisted diagnostic

U.K. Orthopedic Implants Market Insight

The U.K. orthopedic implants market is expected to grow at a notable CAGR, fueled by a growing number of orthopedic procedures and rising awareness of joint health. NHS initiatives to reduce surgical wait times and promote orthopedic innovation are encouraging market growth. The increasing adoption of minimally invasive techniques and biologic implants, coupled with a rise in elective surgeries post-pandemic, is significantly contributing to market expansion. The presence of specialized orthopedic centers also supports innovation and demand.

Germany Orthopedic Implants Market Insight

The Germany orthopedic implants market is anticipated to grow steadily during the forecast period, supported by the country’s strong healthcare system and leadership in medical device manufacturing. Germany’s emphasis on quality care and early adoption of advanced surgical technologies is fueling demand for next-generation implants. In addition, an aging population and growing incidence of osteoporosis and fractures are key drivers. The market also benefits from significant investments in R&D and a preference for sustainable, biocompatible implant materials.

Asia-Pacific Orthopedic Implants Market Insight

The Asia-Pacific orthopedic implants market is poised to grow at the fastest CAGR of 8.9% during the forecast period of 2025 to 2032, driven by a rapidly aging population, expanding healthcare infrastructure, and rising disposable incomes. Increasing awareness of orthopedic conditions and government efforts to improve surgical access in countries such as China, India, and Japan are contributing to robust demand. In addition, the growth of local manufacturing and the entry of international players are enhancing affordability and access across the region.

Japan Orthopedic Implants Market Insight

The Japan orthopedic implants market is expanding steadily due to the country's large elderly population and emphasis on advanced medical technology. Japan’s healthcare system promotes innovation and minimally invasive surgeries, fostering demand for high-precision implants. Technological integration, such as robotic-assisted procedures and smart implants, is also gaining popularity. Moreover, Japan’s focus on geriatric care and rehabilitation services is reinforcing orthopedic implant usage in both hospital and outpatient settings.

India Orthopedic Implants Market Insight

The India orthopedic implants market accounted for one of the highest growth rates in Asia-Pacific in 2024, driven by rapid urbanization, a growing middle class, and rising awareness of orthopedic health. Increasing trauma cases, sports injuries, and a surge in joint replacement surgeries are fueling demand. Government initiatives to promote medical tourism and local manufacturing under “Make in India” are expanding market access and affordability. The presence of a large patient pool and a shift toward technologically advanced but cost-effective implants are key factors boosting growth

Orthopedic Implants Market Share

The Orthopedic Implants industry is primarily led by well-established companies, including:

- CONMED Corporation (U.S.)

- Stryker (U.S.)

- Medtronic (Ireland)

- Smith+Nephew (U.K.)

- Integra LifeSciences Corporation (U.S.)

- B. Braun SE (Germany)

- Arthrex, Inc. (U.S.)

- Baxter (U.S.)

- Medical Device Business Services, Inc. (U.S.)

- Globus Medical (U.S.)

- NuVasive, Inc. (U.S.)

- Flexicare (Group) Limited (U.K.)

- Agilent Technologies, Inc. (U.S.)

- Narang Medical Limited (India)

- Auxein (India)

- Implanet S.A. (France)

- Baumer S.A. (Brazil)

- Peter Brehm GmbH (Germany)

Latest Developments in Global Orthopedic Implants Market

- In September 2023, Enovis finalized its acquisition of LimaCorporate S.p.A., a prominent orthopedic implant manufacturer, for approximately EUR 800 million. This strategic move enhances Enovis's capabilities in providing innovative implant solutions and strengthens its position in the global orthopedic market

- In July 2023, Smith+Nephew introduced the REGENETEN Bioinductive Implant in India to address the growing demand for rotator cuff repair solutions. This implant is designed to enhance the healing process and improve outcomes for individuals undergoing rotator cuff surgeries

- In May 2023, Zimmer Biomet launched the Persona OsseoTi Keel Tibia, a new cementless knee implant. This innovative product allows surgeons the flexibility to decide whether cement is necessary during the procedure, depending on the patient's bone quality, thereby enhancing surgical options and patient outcomes in knee replacement surgeries

- In February 2023, CurvaFix introduced a smaller-diameter (7.5mm) intramedullary implant designed to simplify surgical procedures for small-boned patients. This implant offers strong and stable curved fixation, addressing the unique needs of this patient population and improving surgical outcomes

- In April 2022, The Orthopaedic Implant Company (OIC) obtained FDA approval for its High-Value Wrist Fracture Plating System. This milestone is expected to enhance OIC's global product portfolio and expand its offerings in the orthopedic market, underscoring the company's commitment to delivering innovative solutions for wrist fracture treatment

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.