Asia Pacific Grinding Machinery Market

Market Size in USD Billion

CAGR :

%

USD

2.13 Billion

USD

2.83 Billion

2024

2032

USD

2.13 Billion

USD

2.83 Billion

2024

2032

| 2025 –2032 | |

| USD 2.13 Billion | |

| USD 2.83 Billion | |

|

|

|

Grinding Machinery Market Analysis

The Asia-Pacific grinding machinery market is experiencing steady growth due to increasing demand across industries such as automotive, aerospace, and manufacturing. Technological advancements, including automation and precision grinding, are driving market expansion. The rise in the production of high-quality and complex components requires advanced grinding solutions. key players are focusing on product innovation, efficiency, and sustainability to cater to evolving customer needs and maintain a competitive edge.

Grinding Machinery Market Size

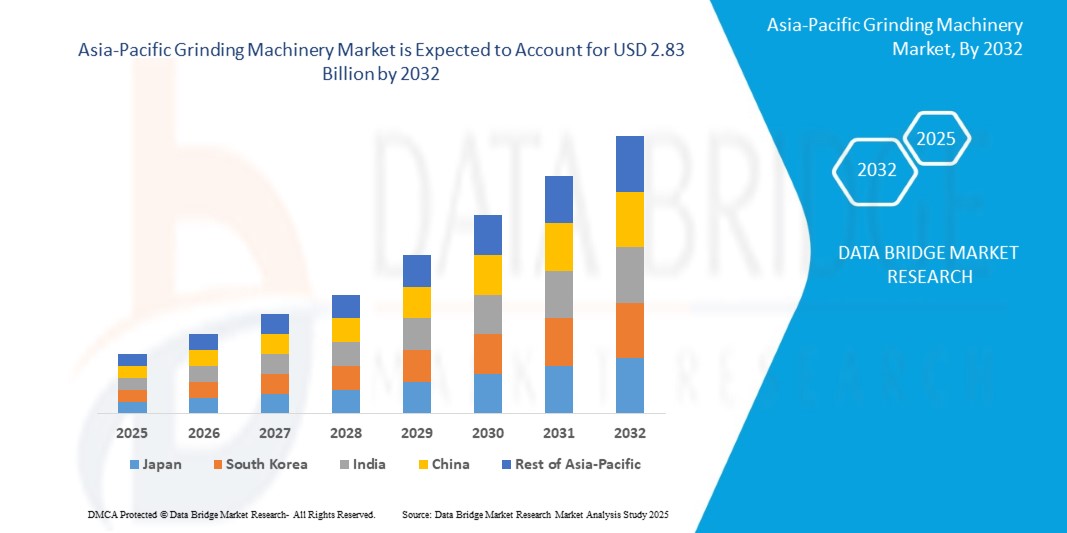

The Asia-Pacific grinding machinery market is expected to reach USD 2.83 billion by 2032 from USD 2.13 billion in 2024, growing with a substantial CAGR of 3.9% in the forecast period of 2025 to 2032.

Grinding Machinery Market Trends

Industry 4.0, often referred to as the fourth industrial revolution, emphasizes the integration of digital technologies, automation, and data exchange into manufacturing processes. This transformation has led to smarter, more efficient, and highly automated systems, which directly impact grinding machinery. As manufacturing operations increasingly rely on smart technologies such as the Internet of Things (IoT), big data analytics, Artificial Intelligence (AI), and machine learning, the demand for grinding machinery that can seamlessly integrate with these systems has risen. Smart manufacturing allows for real-time monitoring, predictive maintenance, and continuous process optimization, ensuring that grinding machines operate at peak performance with minimal downtime.

IoT-enabled grinding machines can collect and transmit data on machine performance, enabling manufacturers to track variables such as temperature, vibration, and tool wear. This data can be analyzed to predict potential issues before they cause failures, leading to improved operational efficiency and reduced maintenance costs. Additionally, AI and machine learning algorithms can optimize grinding parameters, such as speed, pressure, and feed rates, ensuring that the machines operate within the most efficient parameters for each specific task.

Report Scope and Grinding Machinery Market Segmentation

|

Attributes |

Grinding Machinery Market Insights |

|

Segments Covered |

|

|

Countries Covered |

China, India, Japan, South Korea, Indonesia, Thailand, Philippines, Australia, Malaysia, Singapore, Rest of Asia-Pacific |

|

Key Market Players |

AMADA MACHINERY CO., LTD. (Japan), Danobat (Japan), ANCA (Australia), JAINNHER MACHINE CO., LTD. (Taiwan) and KANZAKI KOKYUKOKI MFG. CO., LTD. (Japan) |

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, geographically represented company-wise production and capacity, network layouts of distributors and partners, detailed and updated price trend analysis and deficit analysis of supply chain and demand. |

Grinding Machinery Market Definition

A grinding machine is a power tool used for precision machining, typically to finish or shape materials like metal, wood, or plastic. It uses an abrasive wheel or disc to remove small amounts of material from a workpiece through friction and abrasion. Grinding machines are commonly used in manufacturing and metalworking for tasks such as sharpening, polishing, and smoothing surfaces to achieve high levels of accuracy and smoothness.

Grinding Machinery Market Dynamics

Drivers

- Growing Adoption of Industry 4.0 and Smart Manufacturing Processes

Industry 4.0, often referred to as the fourth industrial revolution, emphasizes the integration of digital technologies, automation, and data exchange into manufacturing processes. This transformation has led to smarter, more efficient, and highly automated systems, which directly impact grinding machinery. As manufacturing operations increasingly rely on smart technologies such as the Internet of Things (IoT), big data analytics, Artificial Intelligence (AI), and machine learning, the demand for grinding machinery that can seamlessly integrate with these systems has risen. Smart manufacturing allows for real-time monitoring, predictive maintenance, and continuous process optimization, ensuring that grinding machines operate at peak performance with minimal downtime.

IoT-enabled grinding machines can collect and transmit data on machine performance, enabling manufacturers to track variables such as temperature, vibration, and tool wear. This data can be analyzed to predict potential issues before they cause failures, leading to improved operational efficiency and reduced maintenance costs. Additionally, AI and machine learning algorithms can optimize grinding parameters, such as speed, pressure, and feed rates, ensuring that the machines operate within the most efficient parameters for each specific task.

For instance,

- In December 2021, according to an article published by Lean Transition Solutions Ltd, Industry 4.0 transforms businesses by integrating smart technologies such as automation, AI, and IoT. This revolution boosts productivity, reduces costs, and improves communication, enabling companies to stay competitive. Embracing these innovations ensures long-term sustainability and operational excellence in manufacturing.

Rising Demand for High-Precision Tools

As industries such as aerospace, automotive, medical devices, and electronics push the boundaries of design and performance, the need for tools that can achieve extreme accuracy and tight tolerances has become increasingly crucial. This growing demand for high-precision tools directly impacts the grinding machinery market, as grinding is one of the primary methods used to achieve these exacting standards. In industries like aerospace, components such as turbine blades, engine parts, and structural elements require exceptional precision due to their complex shapes and critical performance requirements. Even the smallest deviation in size or surface finish can lead to failure, compromising safety and functionality. Grinding machinery is essential in these industries, providing the accuracy needed to produce parts that meet stringent specifications.

For instance,

- In August 2024, according to an article published by Rainford Precision Ltd, High-precision cutting tools are essential in watchmaking for achieving micrometre-level accuracy. These tools, including lathe cutters, laser engravers, and CNC machines, ensure precise machining of intricate components, reduce errors, and enhance productivity, preserving the craftsmanship and functionality of timepieces

Opportunities

- Technological Advancements and Development of Advanced Grinding Technologies

As industries continue to prioritize precision, efficiency, and productivity, the ongoing evolution of grinding technology provides manufacturers with the tools needed to meet these increasing demands. These innovations offer new capabilities in terms of speed, precision, and versatility, enabling grinding machines to handle more complex tasks and work with a wider range of materials. One key opportunity lies in the integration of automation and smart technologies into grinding machinery. With the rise of Industry 4.0, grinding machines are increasingly being equipped with sensors, IoT connectivity, and artificial intelligence (AI) systems. These features allow for real-time monitoring, predictive maintenance, and process optimization, leading to higher efficiency and reduced downtime. Additionally, automated grinding machines can improve consistency and precision, reducing the margin for human error and increasing production rates.

The development of super abrasive materials such as Cubic Boron Nitride (CBN) and diamond also opens new opportunities in the grinding market. These materials offer superior hardness and wear resistance, enabling faster material removal and finer surface finishes. The ability to work with these advanced abrasives enhances the efficiency and capability of grinding machinery, making it highly attractive to industries such as aerospace, automotive, and medical devices that require intricate, high-precision components.

For instance,

- In February 2024, according to an article published by GCH Machinery, CNC grinding machines have advanced with technologies like direct drive spindles, linear motors, active wheel dressing, and in-process gauging, improving accuracy, productivity, and surface finishes. These innovations reduce operator intervention, enhance efficiency, and expand versatility across industries like aerospace, automotive, and medical

- Increasing Government Initiatives and Policies Encouraging Local Manufacturing and Industrial Growth

Governments around the world are focusing on strengthening domestic manufacturing sectors to boost economic growth, create jobs, and reduce dependency on imports. These efforts are particularly evident in emerging economies, where governments are investing in infrastructure, technology, and skill development to stimulate industrial activity. As a result, there is a growing demand for advanced manufacturing technologies, including grinding machinery.

Government initiatives, such as subsidies, tax incentives, and grants for domestic manufacturers, are encouraging businesses to invest in modern equipment and upgrade their manufacturing capabilities. These incentives make it more financially feasible for companies to adopt advanced grinding machinery, which can improve their efficiency and product quality. Local manufacturers, especially in sectors like automotive, aerospace, electronics, and medical devices, require high-precision grinding machines to meet international standards, and government support makes these investments more accessible.

For instance,

- In December 2022, according to an article published by the Ministry of Commerce & Industry, The Government of India has undertaken various initiatives to boost the manufacturing sector, such as the Make in India campaign, industrial corridor development, and Production Linked Incentive (PLI) schemes for key sectors. Other measures include improving ease of doing business, implementing the National Logistics Policy, promoting electric vehicle manufacturing, fostering economic growth and job creation.

Restraints/Challenges

- Intense Competition Amongst Numerous Players in the Industry

The grinding machinery market is highly fragmented, with a large number of established and emerging players competing for market share. This competitive environment drives pressure on pricing, innovation, and customer retention, making it difficult for companies to maintain profitability and sustain long-term growth.

One of the primary challenges in this competitive landscape is the need for constant innovation. As customer demands evolve, especially in high-precision industries like aerospace, automotive, and medical devices, companies must continuously improve their products to stay ahead of the competition. This often involves significant investment in research and development to create more efficient, precise, and cost-effective machines. Companies that fail to innovate may find themselves losing market share to competitors that can offer more advanced and adaptable solutions.

- Shortage of Skilled and Trained Workforce to Operate Advanced Grinding Machines

As grinding technology becomes increasingly complex, with innovations such as automation, CNC systems, and advanced sensors, the demand for highly skilled operators has grown. However, there is a growing gap between the need for such expertise and the availability of trained professionals. Many manufacturers face difficulties in finding workers with the necessary knowledge of advanced grinding machinery, including understanding its intricate operations, maintenance, and troubleshooting. The specialized nature of modern grinding machines requires a deep understanding of both mechanical and digital systems, which is not easily acquired through general training or on-the-job experience. This shortage can lead to several problems, such as increased downtime, inefficiencies, and higher operational costs due to improper machine handling or maintenance.

Furthermore, the lack of skilled workers also hinders innovation and the ability to fully exploit the capabilities of advanced grinding technologies. Companies may be forced to rely on external contractors or face delays in production, which can impact their competitiveness.

For instance,

In December 2023, according to an article published by Bennett, Coleman & Co. Ltd., A recent survey reveals that skilled labor shortages are significantly affecting Indian manufacturers, with 76% of companies reporting profitability impacts. Key challenges include production delays, employee burnout, and high attrition. To address these issues, companies are focusing on succession planning, reskilling, cross-training, and leveraging technology

Impact and Current Market Scenario of Raw Material Shortage and Shipping Delays

Data Bridge Market Research offers a high-level analysis of the market and delivers information by keeping in account the impact and current market environment of raw material shortage and shipping delays. This translates into assessing strategic possibilities, creating effective action plans, and assisting businesses in making important decisions.

Apart from the standard report, we also offer in-depth analysis of the procurement level from forecasted shipping delays, distributor mapping by region, commodity analysis, production analysis, price mapping trends, sourcing, category performance analysis, supply chain risk management solutions, advanced benchmarking, and other services for procurement and strategic support.

Expected Impact of Economic Slowdown on the Pricing and Availability of Products

When economic activity slows, industries begin to suffer. The forecasted effects of the economic downturn on the pricing and accessibility of the products are taken into account in the market insight reports and intelligence services provided by DBMR. With this, our clients can typically keep one step ahead of their competitors, project their sales and revenue, and estimate their profit and loss expenditures.

Grinding Machine Market Scope

The market is segmented on the basis of on type, application, and distribution channel and geography. The growth amongst these segments will help you analyze meagre growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Type

- Surface

- Cylindrical

- Gear

- Tools & Cutter

- Other Grinding Machinery

Application

- Automotive

- Aerospace & Defense

- Electrical & Electronics

- Shipbuilding

- Others

Distribution Channel

- Offline

- Online

Grinding Machinery Market Regional Analysis

The market is analyzed and market size insights and trends are provided by type, application, and distribution channel and geography as referenced above.

The countries covered in the market are China, India, Japan, South Korea, Indonesia, Thailand, Philippines, Australia, Malaysia, Singapore, rest of Asia-Pacific.

China is expected to dominate the Asia-Pacific grinding machinery market due to its strong manufacturing base, rapid industrialization, increasing demand for high-precision machinery, and technological advancements. The country's investments in automation and infrastructure further contribute to its market leadership.

China is expected to be the fastest-growing market for the grinding machinery market due to its booming manufacturing sector, high demand for precision equipment, rapid industrialization, and significant investments in automation and technology. Additionally, China's focus on advanced production techniques drives market expansion.

The country section of the report also provides individual market impacting factors and changes in regulation in the market domestically that impacts the current and future trends of the market. Data points like down-stream and upstream value chain analysis, technical trends and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of regional brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

Grinding Machinery Market Share

The market competitive landscape provides details by competitors. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, regional presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

Grinding Machinery Market Leaders Operating in the Market Are:

- Danpal (Israel)

- BEMO SYSTEMS GmbH (Germany)

- Middle East Insulation LLC (U.A.E.)

- Alubond U.S.A. (U.S.)

- Kingspan Group (Ireland)

- Al Dhahyan Aluminum Panels Factory (U.A.E.)

- Spanwall, Zamil Architectural Industries (ZAI) (Saudi Arabia)

- Facade Fyziks FZ-LLC (U.A.E.)

- Al Abbar Group (U.A.E.)

Latest Developments in Grinding Machinery Market:

- In October 2024, AMADA showcased new fiber laser machines with high-power oscillators At JIMTOF, EuroBLECH, and FABTECH 2024, expanding into new sectors. They also displayed advanced technologies in cutting, welding, grinding, and automation, demonstrating integrated solutions for future manufacturing

- In January 2024, Rieter Group acquired Petit Spare Parts SAS, a French supplier of spare parts, yarn guides, spindles, and belts. This acquisition strengthens Rieter's after-sales business and enhances Asia-Pacific service offerings through its extensive repair network

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELING

2.7 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.8 DBMR MARKET POSITION GRID

2.9 DBMR VENDOR SHARE ANALYSIS

2.1 MARKET APPLICATION COVERAGE GRID

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 GROWING ADOPTION OF INDUSTRY 4.0 AND SMART MANUFACTURING PROCESSES

5.1.2 RISING DEMAND FOR HIGH-PRECISION TOOLS

5.1.3 GROWTH IN MANUFACTURING AND AUTOMOTIVE SECTORS

5.1.4 RISING PREFERENCE FOR ENERGY-EFFICIENT GRINDING MACHINERY

5.2 RESTRAINTS

5.2.1 HIGH INITIAL INVESTMENTS FOR ADVANCED GRINDING MACHINES

5.2.2 FLUCTUATIONS AND VOLATILITY IN RAW MATERIAL PRICES

5.3 OPPORTUNITIES

5.3.1 TECHNOLOGICAL ADVANCEMENTS AND DEVELOPMENT OF ADVANCED GRINDING TECHNOLOGIES

5.3.2 INCREASING GOVERNMENT INITIATIVES AND POLICIES ENCOURAGING LOCAL MANUFACTURING AND INDUSTRIAL GROWTH

5.3.3 ADVANCEMENTS AND INNOVATIONS IN ABRASIVE MATERIALS AND TECHNOLOGIES

5.4 CHALLENGES

5.4.1 INTENSE COMPETITION AMONGST NUMEROUS PLAYERS IN THE INDUSTRY

5.4.2 SHORTAGE OF SKILLED AND TRAINED WORKFORCE TO OPERATE ADVANCED GRINDING MACHINES

6 ASIA-PACIFIC GRINDING MACHINERY MARKET, BY TYPE

6.1 OVERVIEW

6.2 SURFACE

6.3 CYLINDRICAL

6.4 GEAR

6.5 TOOLS & CUTTER

6.6 OTHER GRINDING MACHINERY

7 ASIA-PACIFIC GRINDING MACHINERY MARKET, BY APPLICATION

7.1 OVERVIEW

7.2 AUTOMOTIVE

7.3 AEROSPACE & DEFENSE

7.4 ELECTRICAL & ELECTRONICS

7.5 SHIPBUILDING

7.6 OTHERS

8 ASIA-PACIFIC GRINDING MACHINERY MARKET, BY DISTRIBUTION CHANNEL

8.1 OVERVIEW

8.2 OFFLINE

8.3 ONLINE

9 ASIA-PACIFIC GRINDING MACHINERY MARKET, BY REGION

9.1 ASIA-PACIFIC

9.1.1 CHINA

9.1.2 JAPAN

9.1.3 INDIA

9.1.4 SOUTH KOREA

9.1.5 THAILAND

9.1.6 INDONESIA

9.1.7 MALAYSIA

9.1.8 PHILIPPINES

9.1.9 AUSTRALIA

9.1.10 SINGAPORE

9.1.11 REST OF ASIA-PACIFIC

10 ASIA-PACIFIC GRINDING MACHINERY MARKET: COMPANY LANDSCAPE

10.1 COMPANY SHARE ANALYSIS: ASIA-PACIFIC

11 SWOT ANALYSIS

12 COMPANY PROFILES

12.1 AMADA MACHINERY CO., LTD.

12.1.1 COMPANY SNAPSHOT

12.1.2 REVENUE ANALYSIS

12.1.3 COMPANY SHARE ANALYSIS

12.1.4 PRODUCT PORTFOLIO

12.1.5 RECENT DEVELOPMENT

12.2 RIETER

12.2.1 COMPANY SNAPSHOT

12.2.2 REVENUE ANALYSIS

12.2.3 COMPANY SHARE ANALYSIS

12.2.4 PRODUCT PORTFOLIO

12.2.5 RECENT DEVELOPMENT

12.3 EMAG SYSTEMS GMBH

12.3.1 COMPANY SNAPSHOT

12.3.2 COMPANY SHARE ANALYSIS

12.3.3 PRODUCT PORTFOLIO

12.3.4 RECENT DEVELOPMENT

12.4 GLEASON CORPORATION

12.4.1 COMPANY SNAPSHOT

12.4.2 COMPANY SHARE ANALYSIS

12.4.3 PRODUCT PORTFOLIO

12.4.4 RECENT DEVELOPMENT

12.5 DANOBAT

12.5.1 COMPANY SNAPSHOT

12.5.2 COMPANY SHARE ANALYSIS

12.5.3 PRODUCT PORTFOLIO

12.5.4 RECENT DEVELOPMENT

12.6 ANCA

12.6.1 COMPANY SNAPSHOT

12.6.2 PRODUCT PORTFOLIO

12.6.3 RECENT DEVELOPMENT

12.7 JAINNHER MACHINE CO., LTD.

12.7.1 COMPANY SNAPSHOT

12.7.2 PRODUCT PORTFOLIO

12.7.3 RECENT DEVELOPMENT

12.8 KANZAKI KOKYUKOKI MFG. CO., LTD

12.8.1 COMPANY SNAPSHOT

12.8.2 PRODUCT PORTFOLIO

12.8.3 RECENT DEVELOPMENT

12.9 KENT INDUSTRIAL USA, INC.

12.9.1 COMPANY SNAPSHOT

12.9.2 PRODUCT PORTFOLIO

12.9.3 RECENT DEVELOPMENT

12.1 KLINGELNBERG

12.10.1 COMPANY SNAPSHOT

12.10.2 REVENUE ANALYSIS

12.10.3 PRODUCT PORTFOLIO

12.10.4 RECENT DEVELOPMENT

12.11 KNUTH WERKZEUGMASCHINEN GMBH

12.11.1 COMPANY SNAPSHOT

12.11.2 PRODUCT PORTFOLIO

12.11.3 RECENT DEVELOPMENT

12.12 WALTER MASCHINENBAU GMBH

12.12.1 COMPANY SNAPSHOT

12.12.2 PRODUCT PORTFOLIO

12.12.3 RECENT DEVELOPMENT

13 QUESTIONNAIRE

14 RELATED REPORTS

List of Table

TABLE 1 ASIA-PACIFIC GRINDING MACHINERY MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 2 ASIA-PACIFIC GRINDING MACHINERY MARKET, BY TYPE, 2018-2032 (THOUSAND UNITS)

TABLE 3 ASIA-PACIFIC SURFACE IN GRINDING MACHINERY MARKET, BY REGION, 2018-2032, (USD THOUSAND)

TABLE 4 ASIA-PACIFIC CYLINDRICAL IN GRINDING MACHINERY MARKET, BY REGION, 2018-2032, (USD THOUSAND)

TABLE 5 ASIA-PACIFIC GEAR IN GRINDING MACHINERY MARKET, BY REGION, 2018-2032, (USD THOUSAND)

TABLE 6 ASIA-PACIFIC TOOLS & CUTTER IN GRINDING MACHINERY MARKET, BY REGION, 2018-2032, (USD THOUSAND)

TABLE 7 ASIA-PACIFIC OTHER GRINDING MACHINERY IN GRINDING MACHINERY MARKET, BY REGION, 2018-2032, (USD THOUSAND)

TABLE 8 ASIA-PACIFIC GRINDING MACHINERY MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 9 ASIA-PACIFIC AUTOMOTIVE IN GRINDING MACHINERY MARKET, BY REGION, 2018-2032, (USD THOUSAND)

TABLE 10 ASIA-PACIFIC AEROSPACE & DEFENSE IN GRINDING MACHINERY MARKET, BY REGION, 2018-2032, (USD THOUSAND)

TABLE 11 ASIA-PACIFIC ELECTRICAL & ELECTRONICS IN GRINDING MACHINERY MARKET, BY REGION, 2018-2032, (USD THOUSAND)

TABLE 12 ASIA-PACIFIC SHIPBUILDING IN GRINDING MACHINERY MARKET, BY REGION, 2018-2032, (USD THOUSAND)

TABLE 13 ASIA-PACIFIC OTHERS IN GRINDING MACHINERY MARKET, BY REGION, 2018-2032, (USD THOUSAND)

TABLE 14 ASIA-PACIFIC GRINDING MACHINERY MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 15 ASIA-PACIFIC OFFLINE IN GRINDING MACHINERY MARKET, BY REGION, 2018-2032, (USD THOUSAND)

TABLE 16 ASIA-PACIFIC ONLINE IN GRINDING MACHINERY MARKET, BY REGION, 2018-2032, (USD THOUSAND)

TABLE 17 ASIA-PACIFIC GRINDING MACHINERY MARKET, BY COUNTRY, 2018-2032 (USD THOUSAND)

TABLE 18 ASIA-PACIFIC GRINDING MACHINERY MARKET, BY COUNTRY, 2018-2032 (THOUSAND UNITS)

TABLE 19 ASIA-PACIFIC GRINDING MACHINERY MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 20 ASIA-PACIFIC GRINDING MACHINERY MARKET, BY TYPE, 2018-2032 (THOUSAND UNITS)

TABLE 21 ASIA-PACIFIC GRINDING MACHINERY MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 22 ASIA-PACIFIC GRINDING MACHINERY MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 23 CHINA GRINDING MACHINERY MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 24 CHINA GRINDING MACHINERY MARKET, BY TYPE, 2018-2032 (THOUSAND UNITS)

TABLE 25 CHINA GRINDING MACHINERY MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 26 CHINA GRINDING MACHINERY MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 27 JAPAN GRINDING MACHINERY MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 28 JAPAN GRINDING MACHINERY MARKET, BY TYPE, 2018-2032 (THOUSAND UNITS)

TABLE 29 JAPAN GRINDING MACHINERY MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 30 JAPAN GRINDING MACHINERY MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 31 INDIA GRINDING MACHINERY MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 32 INDIA GRINDING MACHINERY MARKET, BY TYPE, 2018-2032 (THOUSAND UNITS)

TABLE 33 INDIA GRINDING MACHINERY MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 34 INDIA GRINDING MACHINERY MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 35 SOUTH KOREA GRINDING MACHINERY MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 36 SOUTH KOREA GRINDING MACHINERY MARKET, BY TYPE, 2018-2032 (THOUSAND UNITS)

TABLE 37 SOUTH KOREA GRINDING MACHINERY MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 38 SOUTH KOREA GRINDING MACHINERY MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 39 THAILAND GRINDING MACHINERY MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 40 THAILAND GRINDING MACHINERY MARKET, BY TYPE, 2018-2032 (THOUSAND UNITS)

TABLE 41 THAILAND GRINDING MACHINERY MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 42 THAILAND GRINDING MACHINERY MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 43 INDONESIA GRINDING MACHINERY MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 44 INDONESIA GRINDING MACHINERY MARKET, BY TYPE, 2018-2032 (THOUSAND UNITS)

TABLE 45 INDONESIA GRINDING MACHINERY MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 46 INDONESIA GRINDING MACHINERY MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 47 MALAYSIA GRINDING MACHINERY MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 48 MALAYSIA GRINDING MACHINERY MARKET, BY TYPE, 2018-2032 (THOUSAND UNITS)

TABLE 49 MALAYSIA GRINDING MACHINERY MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 50 MALAYSIA GRINDING MACHINERY MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 51 PHILIPPINES GRINDING MACHINERY MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 52 PHILIPPINES GRINDING MACHINERY MARKET, BY TYPE, 2018-2032 (THOUSAND UNITS)

TABLE 53 PHILIPPINES GRINDING MACHINERY MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 54 PHILIPPINES GRINDING MACHINERY MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 55 AUSTRALIA GRINDING MACHINERY MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 56 AUSTRALIA GRINDING MACHINERY MARKET, BY TYPE, 2018-2032 (THOUSAND UNITS)

TABLE 57 AUSTRALIA GRINDING MACHINERY MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 58 AUSTRALIA GRINDING MACHINERY MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 59 SINGAPORE GRINDING MACHINERY MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 60 SINGAPORE GRINDING MACHINERY MARKET, BY TYPE, 2018-2032 (THOUSAND UNITS)

TABLE 61 SINGAPORE GRINDING MACHINERY MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 62 SINGAPORE GRINDING MACHINERY MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 63 REST OF ASIA-PACIFIC GRINDING MACHINERY MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 64 REST OF ASIA-PACIFIC GRINDING MACHINERY MARKET, BY TYPE, 2018-2032 (THOUSAND UNITS)

List of Figure

FIGURE 1 ASIA-PACIFIC GRINDING MACHINERY MARKET

FIGURE 2 ASIA-PACIFIC GRINDING MACHINERY MARKET: DATA TRIANGULATION

FIGURE 3 ASIA-PACIFIC GRINDING MACHINERY MARKET: DROC ANALYSIS

FIGURE 4 ASIA-PACIFIC GRINDING MACHINERY MARKET: ASIA-PACIFIC VS REGIONAL MARKET ANALYSIS

FIGURE 5 ASIA-PACIFIC GRINDING MACHINERY MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 ASIA-PACIFIC GRINDING MACHINERY MARKET: MULTIVARIATE MODELLING

FIGURE 7 ASIA-PACIFIC GRINDING MACHINERY MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 8 ASIA-PACIFIC GRINDING MACHINERY MARKET: DBMR MARKET POSITION GRID

FIGURE 9 ASIA-PACIFIC GRINDING MACHINERY MARKET: VENDOR SHARE ANALYSIS

FIGURE 10 APPLICATION GRID

FIGURE 11 ASIA-PACIFIC GRINDING MACHINERY MARKET: SEGMENTATION

FIGURE 12 ASIA-PACIFIC GRINDING MACHINERY MARKET EXECUTIVE SUMMARY

FIGURE 13 STRATEGIC DECISIONS

FIGURE 14 FIVE SEGMENTS COMPRISE THE ASIA-PACIFIC GRINDING MACHINERY MARKET, BY TYPE

FIGURE 15 GROWING ADOPTION OF INDUSTRY 4.0 AND SMART MANUFACTURING PROCESSES IS EXPECTED TO DRIVE THE ASIA-PACIFIC GRINDING MACHINERY MARKET IN THE FORECAST PERIOD (2025-2032)

FIGURE 16 THE SURFACE SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE ASIA-PACIFIC GRINDING MACHINERY MARKET IN 2025 AND 2032

FIGURE 17 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES FOR ASIA-PACIFIC GRINDING MACHINERY MARKET

FIGURE 18 ASIA-PACIFIC GRINDING MACHINERY MARKET: BY TYPE, 2024

FIGURE 19 ASIA-PACIFIC GRINDING MACHINERY MARKET: BY APPLICATION, 2024

FIGURE 20 ASIA-PACIFIC GRINDING MACHINERY MARKET: BY DISTRIBUTION CHANNEL, 2024

FIGURE 21 ASIA-PACIFIC GRINDING MACHINERY MARKET: SNAPSHOT, 2024

FIGURE 22 ASIA-PACIFIC GRINDING MACHINERY MARKET: COMPANY SHARE 2024 (%)

Asia Pacific Grinding Machinery Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Asia Pacific Grinding Machinery Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Asia Pacific Grinding Machinery Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.