Asia Pacific Hunter Syndrome Treatment Market

Market Size in USD Million

CAGR :

%

USD

452.73 Million

USD

908.74 Million

2025

2033

USD

452.73 Million

USD

908.74 Million

2025

2033

| 2026 –2033 | |

| USD 452.73 Million | |

| USD 908.74 Million | |

|

|

|

|

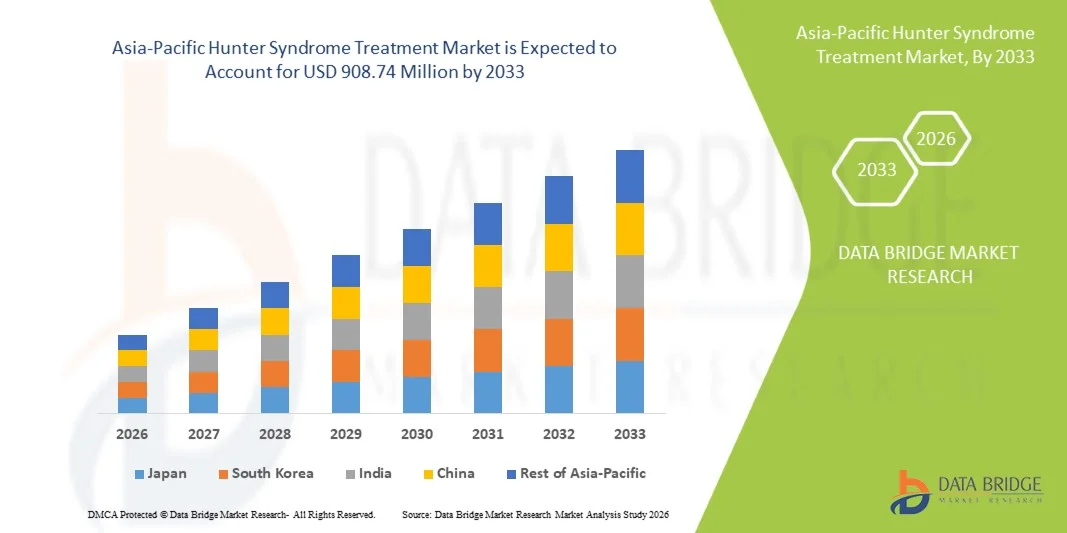

Asia-Pacific Hunter Syndrome Treatment Market Size

- The Asia-Pacific Hunter Syndrome treatment market size was valued at USD 452.73 million in 2025 and is expected to reach USD 908.74 million by 2033, at a CAGR of 9.1% during the forecast period

- The market expansion is primarily driven by increasing awareness of rare genetic disorders, improving diagnostic capabilities, and rising access to enzyme replacement therapies across emerging economies in the region

- Moreover, supportive government healthcare policies, growing investment in rare disease research, and rising demand for advanced, effective therapeutic options are positioning Hunter syndrome treatments as a crucial focus area. These converging factors are accelerating therapy adoption, thereby significantly boosting the market’s overall growth

Asia-Pacific Hunter Syndrome Treatment Market Analysis

- Hunter Syndrome treatments, particularly enzyme replacement therapies and emerging targeted approaches, are becoming essential components of rare disease management across Asia-Pacific as healthcare systems increasingly prioritize early diagnosis, improved clinical outcomes, and long-term patient care for individuals with mucopolysaccharidosis II (MPS II)

- The rising demand for Hunter Syndrome therapies is primarily driven by expanding rare disease awareness programs, improving access to advanced genetic testing, and the growing willingness of healthcare providers and families to adopt innovative treatment options that can slow disease progression and enhance quality of life

- Japan dominated the Asia-Pacific Hunter Syndrome treatment market with the largest revenue share of 38.6% in 2025, supported by strong healthcare infrastructure, early adoption of rare disease therapies, and robust government reimbursement frameworks, while research collaborations within the country continue to drive advancements in MPS II treatment and patient management

- China is expected to be the fastest-growing market during the forecast period, together contributing a rapid rise in regional market share as expanding healthcare investments, growing rare disease registries, and increasing availability of specialized treatment centers strengthen therapy adoption

- The enzyme replacement therapy (ERT) segment dominated the Asia-Pacific Hunter Syndrome treatment market with a 71.9% market share in 2025, driven by its established clinical efficacy, widespread physician familiarity, and expanding uptake in countries improving rare disease treatment accessibility

Report Scope and Asia-Pacific Hunter Syndrome Treatment Market Segmentation

|

Attributes |

Asia-Pacific Hunter Syndrome Treatment Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

Asia-Pacific

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework |

Asia-Pacific Hunter Syndrome Treatment Market Trends

“Advancements in Precision Therapies and Digital Disease Management”

- A significant and accelerating trend in the Asia-Pacific Hunter SYNDROME treatment market is the rapid advancement of precision therapies and their integration with digital rare-disease management platforms, significantly improving early detection, treatment monitoring, and long-term patient support across the region

- For instance, Japan’s Ministry of Health has supported early access initiatives for advanced therapies, enabling faster availability of next-generation treatments such as optimized enzyme replacement therapies and investigational gene-based approaches across major clinical centers

- AI-enabled platforms are increasingly utilized to support earlier diagnosis and ongoing care by analyzing genetic data, monitoring symptoms remotely, and predicting disease progression; for instance, several hospitals in South Korea are deploying AI-driven genetic analytics systems that help clinicians identify MPS II variants more accurately

- The seamless integration of digital health tools with therapy administration enables families and clinicians to track infusion adherence, manage side effects, and maintain centralized medical records, creating a unified and technology-enhanced rare-disease ecosystem across the region

- This trend toward more personalized, digital, and interconnected treatment pathways is fundamentally reshaping patient expectations and clinical practices. Consequently, companies operating in Asia-Pacific are increasingly investing in advanced biologics and companion digital tools that support automated treatment scheduling and remote patient management

- The demand for technologically enhanced, personalized care solutions is accelerating in both developed and emerging Asia-Pacific markets, as patients and caregivers increasingly prioritize improved clinical outcomes, convenience, and comprehensive disease-management functionality

Asia-Pacific Hunter Syndrome Treatment Market Dynamics

Driver

“Growing Need Due to Rising Diagnosis Rates and Expanded Rare Disease Policies”

- The increasing prevalence of diagnosed cases of Hunter syndrome, coupled with the expansion of national rare-disease policies across Asia-Pacific, is a major driver accelerating the adoption of advanced treatment options in the region

- For instance, in March 2025, China's National Healthcare Security Administration advanced reimbursement pathways for rare genetic disorders, supporting broader access to enzyme replacement therapy and establishing strategic partnerships with treatment developers

- As awareness programs expand and genetic screening capabilities improve, more patients are being diagnosed earlier, increasing the demand for treatments that offer measurable improvements in functional outcomes and long-term disease management

- Furthermore, rapid growth in specialized rare-disease clinics and the integration of genetic counseling services are making Hunter syndrome management more accessible, supporting coordinated care across tertiary hospitals and national referral networks

- The availability of home-infusion models, improved monitoring options, and caregiver-support programs are key factors propelling therapy adoption across both urban and semi-urban areas. The shift toward patient-centric delivery models and better reimbursement frameworks further contributes to market growth

Restraint/Challenge

“High Treatment Costs and Complex Regulatory Approval Pathways”

- Concerns surrounding the extremely high cost of enzyme replacement therapies and emerging genetic treatments pose a significant challenge to broader adoption across the region, especially in countries with limited reimbursement systems

- For instance, reports on affordability gaps in middle-income Asia-Pacific economies have made policymakers cautious about widespread coverage for ultra-orphan therapies, creating delays in reimbursement approvals and impacting treatment accessibility

- Addressing these challenges through pricing reforms, expanded insurance coverage, and early-access programs is crucial for improving patient uptake. Companies providing Hunter syndrome therapies emphasize their patient-assistance programs and collaborative reimbursement initiatives to enhance affordability for families. In addition, the complex and lengthy regulatory evaluation process for rare-disease biologics creates hurdles for timely approvals across emerging markets

- While regulatory harmonization efforts are underway, variations in approval requirements across countries still hinder rapid market entry, especially for novel therapies such as gene-editing or next-generation ERT candidates

- Overcoming these challenges through policy alignment, improved cost-sharing mechanisms, clinician training, and broader government support will be essential for ensuring long-term and sustainable market expansion

Asia-Pacific Hunter Syndrome Treatment Market Scope

The market is segmented on the basis of severity, type, complications, end user, and distribution channel.

- By Severity

On the basis of severity, the market is segmented into mild to moderate and moderate to severe. The mild to moderate segment dominated the market in 2025 due to a higher number of diagnosed cases and earlier identification through improving newborn screening programs. Patients in this category respond more positively to enzyme replacement therapy, which is widely accessible across Asia-Pacific. Countries such as Japan and South Korea emphasize early-stage disease management, strengthening the dominance of this segment. Expanding rare-disease registries and improved genetic counseling are also contributing to the higher detection rates of mild cases. Healthcare systems increasingly focus on early intervention to reduce long-term complications. As diagnostic networks grow across China and India, the mild to moderate category continues to represent the majority of newly identified cases.

The moderate to severe segment is expected to witness the fastest growth from 2026 to 2033, driven by rising detection of advanced-stage patients and improved availability of specialized care facilities. These patients often require intensive intervention including surgical procedures, respiratory support, and neurological follow-up. Growth is further fueled by increasing awareness campaigns that help uncover previously undiagnosed severe cases. Advances in high-dose ERT regimens and investigational gene therapies are raising treatment adoption in this segment. Developing nations are strengthening rare-disease funding, which enhances affordability for severe cases. Regional hospitals are also expanding multidisciplinary rare-disease programs, boosting segment growth.

- By Type

On the basis of type, the market is categorized into enzyme replacement therapy, stem cell transplant, surgical treatment, and others. The ERT segment dominated the market in 2025 with a market share of 71.9% due to its long-established clinical efficacy and the presence of strong reimbursement programs in Japan, South Korea, and Australia. ERT remains the primary standard of care for slowing disease progression and improving functional outcomes in patients. Investment in infusion centers and cold-chain networks across China and India has expanded its accessibility. Clinicians prefer ERT because of its extensive safety profile and proven benefits across multiple organ systems. Biopharmaceutical companies have developed strong logistical support for ERT delivery across the region. Ongoing optimization of dosing protocols continues to reinforce its dominant position in the treatment landscape.

The stem cell transplant segment is projected to be the fastest growing during 2026–2033, supported by advances in transplant procedures and growing interest in addressing neurological symptoms that ERT cannot fully treat. Increasing availability of pediatric transplant units in China, India, and Japan is improving access to this option. Families and clinicians are expressing rising interest in curative or long-lasting therapeutic approaches. For instance, several Asia-Pacific hospitals have launched regenerative medicine programs focusing on rare genetic diseases. Research collaborations integrating transplant techniques with gene therapy are also contributing to growth. As procedure risks decline with medical advancements, this segment is expected to expand rapidly.

- By Complications

On the basis of complications, the market is segmented into respiratory disorders, neurological disorders, gastrointestinal, cardiovascular, ophthalmic, audiologic, dental, musculoskeletal, and others. Respiratory disorders accounted for the largest share in 2025 due to their high prevalence among Hunter syndrome patients and the requirement for frequent clinical monitoring. Chronic airway obstruction, recurrent infections, and sleep apnea make respiratory complications the most commonly managed condition. Hospitals across Japan and South Korea have strong pulmonary diagnostic facilities, supporting early identification and ongoing treatment. ERT usage significantly helps reduce airway-related symptoms, reinforcing segment dominance. Families are more aware of respiratory red flags, contributing to higher treatment demand. Multidisciplinary care models focusing on respiratory management further drive the prominence of this segment.

Neurological disorders are expected to experience the fastest growth during the forecast period due to rising recognition of cognitive decline, behavioral issues, and seizure disorders in affected children. These complications are a major unmet need because current ERT options have limited ability to cross the blood–brain barrier. Hospitals in China and Japan are expanding neuro-metabolic departments to support early neurological evaluation. For instance, several centers are adopting advanced neuroimaging and behavioral assessment tools. Rising research investment in CNS-targeted therapies and gene-based approaches is accelerating clinical focus on neurological outcomes. Advocacy organizations are also increasing awareness of neurocognitive symptoms, boosting segment expansion.

- By End User

On the basis of end user, the market is segmented into hospitals, clinics, home healthcare, and others. Hospitals dominated the market in 2025 due to their central role in providing ERT infusions, managing complications, and delivering multidisciplinary care. They remain the primary treatment centers for rare diseases across Japan, China, and South Korea. Hospitals offer comprehensive diagnostic services, genetic testing, respiratory care, neurological monitoring, and surgical interventions. The presence of trained specialists and advanced infrastructure ensures better patient outcomes. Families rely on hospitals for structured follow-ups and emergency management. The availability of infusion rooms and cold-chain facilities further secures hospital dominance in this segment.

Home healthcare is expected to grow the fastest from 2026 to 2033 due to rising adoption of home-based ERT infusion programs in developed Asia-Pacific countries. These models significantly reduce hospital visits, increase convenience, and improve adherence among pediatric patients. Digital telehealth systems allow clinicians to closely monitor infusion schedules, side effects, and clinical parameters from a distance. For instance, home infusion pilot initiatives have gained traction in Japan and Australia with strong caregiver satisfaction. Partnerships between specialty pharmacies and home healthcare providers are expanding availability. As comfort-oriented care becomes a priority for families, demand for home-based services is accelerating.

- By Distribution Channel

On the basis of distribution channel, the market is segmented into hospital pharmacy, retail pharmacy, online pharmacy, and others. The hospital pharmacy segment dominated the market in 2025 because most ERT infusions and supportive medications are dispensed through hospital-controlled channels. Hospital pharmacies ensure strict regulatory compliance and proper handling of temperature-sensitive biologics. They coordinate closely with clinicians to ensure timely drug availability during scheduled infusion visits. Countries such as Japan and South Korea rely heavily on hospital-based dispensing due to reimbursement frameworks. Hospital pharmacies also supply medications for associated complications, reinforcing demand for this channel. Their strong integration with treatment teams makes them the primary distribution route for Hunter syndrome therapies.

The online pharmacy segment is projected to grow the fastest during 2026–2033 due to increasing digital health adoption across Asia-Pacific and expanding regulatory approval for e-pharmacy operations. Families prefer online ordering for supportive medications such as respiratory aids, pain management drugs, and nutrition supplements. For instance, several Asia-Pacific nations have introduced digital prescription systems enabling rare-disease drug delivery through regulated e-pharmacy platforms. Improved logistics and partnerships between specialty distributors and online pharmacies are strengthening supply reliability. Rising preference for door-step delivery and reduced hospital dependency is accelerating segment momentum. Digital healthcare growth in emerging economies further supports rapid expansion.

Asia-Pacific Hunter Syndrome Treatment Market Regional Analysis

- Japan dominated the Asia-Pacific Hunter syndrome treatment market with the largest revenue share of 38.6% in 2025, supported by strong healthcare infrastructure, early adoption of rare disease therapies, and robust government reimbursement frameworks, while research collaborations within the country continue to drive advancements in MPS II treatment and patient management

- Japanese healthcare providers and specialists demonstrate high adoption of ERT and emerging treatment modalities, supported by sophisticated pediatric genetic centers and long-established clinical expertise in metabolic disorders

- Favorable regulatory pathways, including accelerated approvals and strong collaboration between Japanese research institutions and global biopharmaceutical companies, further strengthen the country’s leadership in the region

The Japan Hunter Syndrome Treatment Market Insight

The Japan Hunter syndrome treatment market dominated the Asia-Pacific region in 2025, supported by its advanced rare disease care ecosystem and highly structured patient management pathways. Japan demonstrates strong adoption of ERT due to its comprehensive insurance coverage, established pediatric genetic centers, and rapid access to approved orphan drugs. Continuous collaboration between Japanese research institutions and global pharmaceutical innovators is accelerating clinical development and improving patient outcomes. In addition, the country’s strong emphasis on early diagnosis through nationwide screening programs and robust patient registries enhances treatment precision and long-term management. With rising awareness among clinicians, well-developed healthcare infrastructure, and consistent government support, Japan continues to lead the region in both treatment accessibility and rare disease innovation.

China Hunter Syndrome Treatment Market Insight

The China Hunter Syndrome Treatment market is expanding significantly, driven by improving diagnostic capabilities and increasing government focus on rare diseases within national healthcare strategies. Growing investments in genetic testing, coupled with the rapid modernization of pediatric and metabolic disease departments across major hospitals, are supporting early identification and treatment initiation. China is also witnessing rising participation in global clinical trials, enabling faster patient access to emerging therapies. In addition, improvements in reimbursement pathways and the inclusion of more orphan drugs in provincial insurance lists are helping expand access to ERT. As China continues strengthening rare disease policies and expanding specialist centers, it remains one of the fastest-evolving markets in the region.

India Hunter Syndrome Treatment Market Insight

The India Hunter Syndrome Treatment market is gaining traction, driven by increasing awareness of lysosomal storage disorders and improving access to advanced diagnostic technologies. The country is witnessing a rising number of genetic testing laboratories and specialist metabolic clinics, enabling earlier detection of Hunter syndrome. Although treatment access remains limited compared to developed nations, government-supported rare disease initiatives, charitable funding programs, and patient-advocacy-driven awareness campaigns are improving access to ERT for eligible patients. India’s expanding healthcare infrastructure and growing collaborations with global pharmaceutical firms are further enhancing treatment availability. With rising rare disease recognition and expanding pediatric specialty centers, India represents one of the high-potential growth markets in Asia-Pacific.

South Korea Hunter Syndrome Treatment Market Insight

The South Korea Hunter Syndrome treatment market is experiencing steady growth, supported by the country’s strong healthcare infrastructure and increasing emphasis on rare disease management. South Korea has well-established genetic testing capabilities, enabling timely diagnosis and effective treatment planning for patients with lysosomal storage disorders. Government-backed reimbursement schemes and rare disease support policies are improving access to enzyme replacement therapy, easing the financial burden on affected families. In addition, South Korea’s active participation in global clinical research and partnerships with multinational pharmaceutical companies are enhancing treatment availability and fostering innovation. With rising awareness among clinicians and expanding patient support networks, South Korea continues to strengthen its position as a key emerging market in Asia-Pacific for Hunter syndrome therapies

Asia-Pacific Hunter Syndrome Treatment Market Share

The Asia-Pacific Hunter Syndrome Treatment industry is primarily led by well-established companies, including:

- Takeda Pharmaceutical Company Limited (Japan)

- JCR Pharmaceuticals Co., Ltd. (Japan)

- REGENXBIO (U.S.)

- NIPPON SHINYAKU CO., LTD. (Japan)

- Sumitomo Pharma Co., Ltd. (Japan)

- GC Corp. (South Korea)

- Denali Therapeutics (U.S.)

- AVROBIO, Inc. (U.S.)

- Homology Medicines, Inc. (U.S.)

- ArmaGen Technologies, Inc. (U.S.)

- Capsida Biotherapeutics (U.S.)

- Sangamo Therapeutics (U.S.)

- Amicus Therapeutics, Inc. (U.S.)

- CANbridge Life Sciences Ltd. (China)

- BioMarin (U.S.)

- Inventiva Pharma (France)

- Abeona Therapeutics, Inc. (U.S.)

- Arcturus Therapeutics, Inc. (U.S.)

What are the Recent Developments in Asia-Pacific Hunter Syndrome Treatment Market?

- In January 2025, REGENXBIO and Nippon Shinyaku announced a major partnership worth up to USD 810 million to develop and commercialize the promising AAV-based gene therapy RGX-121 for Hunter syndrome within the U.S. and Asia, including Japan

- In April 2023, JCR Pharmaceuticals and Sumitomo Pharma entered a strategic co-promotion agreement in Japan for IZCARGO® IV infusion 10 mg, enhancing awareness and accelerating uptake of this first-in-class BBB-penetrating therapy. The collaboration focuses on expanding physician education, improving patient access, and strengthening commercial outreach across Japan, which remains the largest and most advanced MPS II market in Asia-Pacific

- In September 2021, Takeda Pharmaceutical Company Limited entered into a significant global commercialization and licensing agreement with JCR Pharmaceuticals to expand international access to pabinafusp alfa (JR-141). The deal enables Takeda to commercialize this next-generation BBB-penetrating Hunter syndrome therapy across regions outside Japan and selected APAC countries, accelerating its potential availability worldwide

- In March 2021, JCR Pharmaceuticals announced the Japanese approval of IZCARGO® (pabinafusp alfa), the world’s first intravenous enzyme replacement therapy capable of crossing the blood–brain barrier (BBB) via JCR’s proprietary J-Brain Cargo® technology. This approval represented a major breakthrough, offering a single therapy that simultaneously addresses somatic and neurological symptoms of Hunter syndrome something no prior ERT could achieve

- In January 2021, GC Pharma (South Korea) and Clinigen K.K. (Japan) announced Japan’s official approval of Hunterase ICV (intracerebroventricular) injection 15 mg, the world’s first enzyme replacement therapy designed to directly target central nervous system manifestations of Hunter syndrome

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.