Asia Pacific Medical Device Sterilization Market

Market Size in USD Billion

CAGR :

%

USD

1.20 Billion

USD

2.33 Billion

2024

2032

USD

1.20 Billion

USD

2.33 Billion

2024

2032

| 2025 –2032 | |

| USD 1.20 Billion | |

| USD 2.33 Billion | |

|

|

|

|

Asia-Pacific Medical Device Sterilization Market Size

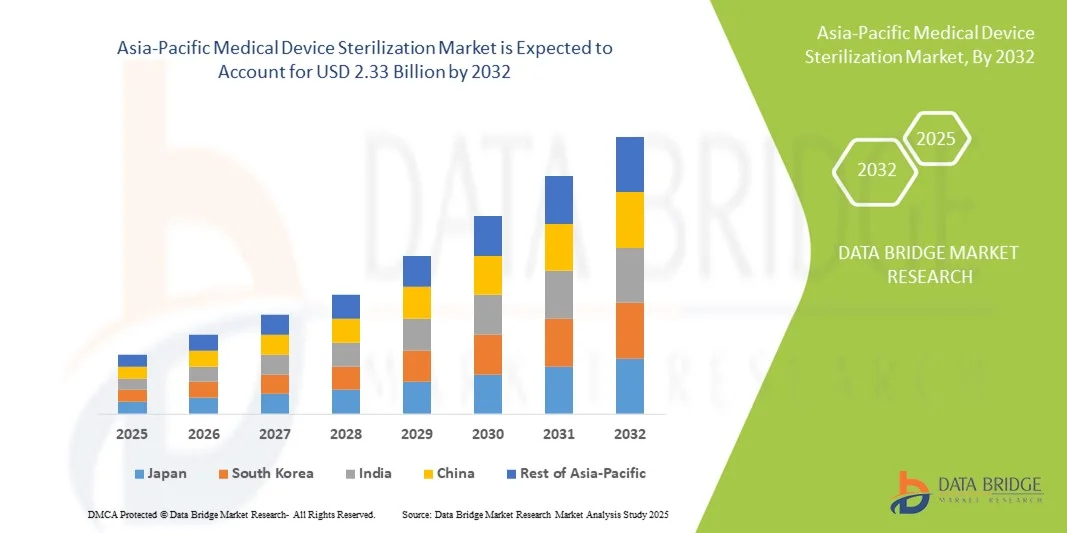

- The Asia-Pacific medical device sterilization market size was valued at USD 1.20 billion in 2024 and is expected to reach USD 2.33 billion by 2032, at a CAGR of 8.60% during the forecast period

- The market growth is largely fueled by the rising prevalence of healthcare-associated infections (HAIs) and the increasing demand for safe and sterile medical equipment across hospitals, clinics, and diagnostic centers

- Furthermore, ongoing technological advancements in sterilization methods such as low-temperature sterilization, hydrogen peroxide plasma, and ethylene oxide techniques are enhancing efficiency and safety, driving adoption across the region. These converging factors are accelerating the uptake of Asia-Pacific medical device sterilization solutions, thereby significantly boosting the industry's growth

Asia-Pacific Medical Device Sterilization Market Analysis

- Medical device sterilization solutions, ensuring safe and germ-free medical equipment, are increasingly vital components of healthcare infrastructure in hospitals, clinics, and diagnostic centers due to their critical role in infection control, patient safety, and regulatory compliance

- The escalating demand for medical device sterilization is primarily fueled by the rising prevalence of healthcare-associated infections (HAIs), increasing healthcare expenditures, and growing awareness of hygiene and patient safety standards among healthcare providers

- China dominated the Asia-Pacific medical device sterilization market with the largest revenue share of 45.5% in 2024, characterized by rapid expansion of hospitals, increasing government healthcare investments, and widespread adoption of advanced sterilization technologies

- India is expected to be the fastest-growing country during the forecast period due to rising healthcare facilities, growing medical tourism, and strong demand for modern sterilization solutions in both public and private hospitals

- Gas and Chemical Sterilization segment dominated the Asia-Pacific medical device sterilization market with a share of 38.5% in 2024, driven by its effectiveness for heat-sensitive instruments and increasing preference over traditional sterilization methods across hospitals and laboratories

Report Scope and Asia-Pacific Medical Device Sterilization Market Segmentation

|

Attributes |

Asia-Pacific Medical Device Sterilization Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

Asia-Pacific

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Asia-Pacific Medical Device Sterilization Market Trends

Advancements in Low-Temperature and Chemical Sterilization

- A significant and accelerating trend in the Asia-Pacific medical device sterilization market is the adoption of low-temperature and gas/chemical sterilization technologies, enhancing safety for heat-sensitive medical instruments

- For instance, hydrogen peroxide plasma sterilization is being increasingly used in hospitals and laboratories for surgical instruments, ensuring rapid turnaround without compromising device integrity

- Adoption of advanced sterilization technologies enables better compliance with stringent infection control standards and reduces risks of healthcare-associated infections across healthcare facilities. For instance, automated sterilization systems now integrate sensors and monitoring software to track sterilization cycles and provide real-time alerts in case of process deviations

- The seamless integration of sterilization systems with hospital digital management platforms allows centralized monitoring of equipment sterilization, improving workflow efficiency and reducing human errors

- This trend towards more intelligent, automated, and safer sterilization methods is reshaping expectations among healthcare providers, with companies such as Steris and Matachana developing advanced solutions to meet rising demand

Asia-Pacific Medical Device Sterilization Market Dynamics

Driver

Increasing Healthcare-Associated Infections and Regulatory Compliance

- The rising prevalence of healthcare-associated infections (HAIs) and stricter infection control regulations are significant drivers for the demand for medical device sterilization in the region

- For instance, in April 2024, a leading hospital network in India implemented centralized sterilization units using hydrogen peroxide plasma to reduce postoperative infections, driving adoption of advanced sterilization technologies

- Awareness of patient safety and the need for compliance with ISO and FDA sterilization standards are compelling hospitals and clinics to invest in modern sterilization solutions. For instance, hospitals in China are adopting fully automated sterilization monitoring systems to ensure compliance and improve audit readiness

- Growing healthcare infrastructure, increasing surgical procedures, and rising medical device manufacturing in Asia-Pacific further propel the adoption of advanced sterilization system

- For instance, expanding private hospital chains in Southeast Asia are procuring outsourced sterilization services for cost efficiency and adherence to infection control protocols

Restraint/Challenge

High Capital Costs and Technical Expertise Requirements

- The relatively high initial investment and operational costs of advanced sterilization equipment pose challenges for adoption in smaller hospitals and clinics across Asia-Pacific

- For instance, smaller clinics in India and Indonesia may defer upgrading to automated sterilization due to limited budgets despite infection control needs

- The need for skilled personnel to operate and maintain sterilization equipment creates operational hurdles for some healthcare providers in the region. For instance, training requirements for hydrogen peroxide plasma sterilizers and automated monitoring systems can delay deployment in newly built hospitals

- While ongoing technological advancements reduce operating costs, perceived high capital expenditure and workforce skill gaps continue to restrain market penetration

- For instance, hospitals in emerging markets are cautious about investments in premium sterilization technologies until ROI and staff training are adequately addressed

Asia-Pacific Medical Device Sterilization Market Scope

The market is segmented on the basis of product, technology, end user, and distribution channel.

- By Product

On the basis of product, the Asia-Pacific medical device sterilization market is segmented into instruments, reagents, and services. Instruments segment dominated the market with the largest revenue share in 2024, driven by the widespread requirement of sterilizing reusable surgical instruments in hospitals and clinics. Healthcare facilities prioritize high-quality sterilization instruments to ensure compliance with infection control standards and prevent healthcare-associated infections. The growing number of surgical procedures across China, India, and Japan is increasing demand for advanced sterilization instruments. Hospitals also prefer instruments compatible with multiple sterilization technologies, including gas, chemical, and low-temperature methods. Reusable instrument sterilization ensures cost efficiency, further boosting adoption. The segment benefits from innovations in automated sterilization cycles, reducing human errors and operational time.

Services segment is expected to witness the fastest growth during the forecast period due to the rising outsourcing of sterilization needs by smaller hospitals and diagnostic labs. Outsourced sterilization services provide cost-effective solutions, especially in countries with limited healthcare budgets. For instance, third-party sterilization providers offer standardized protocols that ensure regulatory compliance across multiple healthcare facilities. Growth in medical device manufacturing in Asia-Pacific further increases demand for commercial sterilization services. The segment also benefits from the increasing adoption of single-use devices requiring specialized sterilization before distribution. Rising awareness of hygiene and patient safety is driving hospitals to prefer reliable service providers over in-house sterilization in emerging markets.

- By Technology

On the basis of technology, the market is segmented into thermal sterilization, ionizing radiation sterilization, filtration sterilization, and gas & chemical sterilization. Gas & Chemical Sterilization dominated the market in 2024 with a market share of 38.5%, driven by its suitability for heat-sensitive medical devices and instruments. Hospitals and laboratories favor this technology for items that cannot withstand high-temperature sterilization. Gas and chemical sterilization methods, such as hydrogen peroxide plasma and ethylene oxide, ensure thorough sterilization while maintaining device integrity. The ability to automate and monitor these processes digitally reduces errors and enhances compliance with stringent infection control standards. Its flexibility across various instrument types and compatibility with high-volume operations make it a preferred choice for healthcare facilities. Increasing awareness of patient safety and hospital accreditation standards further reinforces its dominance.

Filtration Sterilization is projected to witness the fastest growth due to the rising demand in pharmaceutical and laboratory applications. Filtration is critical for sterilizing liquids and gases without affecting their chemical composition or activity. The growing pharmaceutical manufacturing sector in India and China is driving adoption of high-efficiency filtration systems. For instance, biotech and research laboratories require sterile filtration for culture media and injectable drugs, creating steady demand. This technology also reduces contamination risks, supporting compliance with Good Manufacturing Practices (GMP). As more academic and research institutes invest in advanced labs, filtration sterilization adoption is expected to rise significantly.

- By End User

On the basis of end user, the market is segmented into pharmaceutical companies, hospitals, clinics, laboratories, academic & research institutes, medical device manufacturers, and others. Hospitals segment dominated the market in 2024, driven by the need for sterilization of surgical instruments, diagnostic equipment, and reusable devices. Hospitals invest in high-capacity sterilization systems to manage increasing patient volumes and complex surgical procedures. Strict infection control standards and hospital accreditation requirements ensure ongoing demand for advanced sterilization technologies. Large hospitals prefer centralized sterilization units for better efficiency and consistent quality. Continuous expansion of hospital infrastructure across Asia-Pacific further supports market dominance. For instance, multi-specialty hospitals in China and India are adopting automated gas and chemical sterilization systems to enhance workflow and patient safety.

Laboratories segment is expected to witness the fastest growth during the forecast period due to increasing research activities in biotechnology, pharmaceuticals, and diagnostics. Research and academic labs require specialized sterilization methods for culture media, reagents, and sensitive instruments. For instance, pharmaceutical R&D centers in India and Singapore are investing heavily in filtration and gas sterilization for sterile production lines. Growing clinical trials, biopharma startups, and academic research institutes further drive demand. The segment also benefits from stringent regulatory guidelines requiring sterilization validation and documentation. Rising government funding for research infrastructure in Asia-Pacific accelerates adoption in this subsegment.

- By Distribution Channel

On the basis of distribution channel, the market is segmented into direct tenders, retail sales, and third-party distributors. Direct Tenders segment dominated the market in 2024, driven by bulk procurement by large hospitals, healthcare chains, and government hospitals. Direct tendering ensures cost advantages, contractual reliability, and timely delivery of sterilization equipment. Healthcare facilities prefer direct procurement from manufacturers such as Steris, Matachana, and STERISYS for large-scale orders. Compliance with government procurement policies and long-term service agreements further reinforces this channel. Large-scale hospitals benefit from manufacturer training programs and maintenance contracts provided through direct tenders. For instance, hospital chains in China and Japan often prefer this channel to standardize sterilization protocols across multiple facilities.

Third-Party Distributors segment is projected to witness the fastest growth during the forecast period, due to increasing penetration in tier-2 and tier-3 cities across Asia-Pacific. Distributors provide access to smaller hospitals, clinics, and laboratories that lack direct procurement capabilities. For instance, distributors in India and Southeast Asia supply sterilization instruments and reagents to remote healthcare facilities. They also offer maintenance services and flexible financing, making advanced sterilization technology accessible to smaller end users. Rising awareness of patient safety and the growth of private clinics in emerging markets boost the reliance on third-party distribution. Distributors often bundle equipment, reagents, and consumables, enhancing adoption in regions with limited infrastructure.

Asia-Pacific Medical Device Sterilization Market Regional Analysis

- China dominated the Asia-Pacific medical device sterilization market with the largest revenue share of 45.5% in 2024, characterized by rapid expansion of hospitals, increasing government healthcare investments, and widespread adoption of advanced sterilization technologies

- Healthcare facilities in China increasingly prioritize sterilization to ensure patient safety, comply with strict regulatory standards, and prevent healthcare-associated infections, boosting adoption of both traditional and modern sterilization solutions

- This widespread adoption is further supported by rising surgical procedures, growth in medical device manufacturing, and high hospital infrastructure development, establishing China as the largest contributor to the regional market

The China Medical Device Sterilization Market Insight

China dominated the Asia-Pacific market with the largest revenue share of 45% in 2024, driven by high healthcare expenditure, rapid hospital expansion, and widespread adoption of advanced sterilization technologies such as gas, chemical, and low-temperature sterilization. The growing number of surgical procedures, coupled with stringent regulatory requirements, compels hospitals to implement robust sterilization protocols. China’s strong domestic medical device manufacturing sector also boosts demand for sterilization services and equipment. Government initiatives to improve patient safety standards and accreditation compliance further support market dominance. For instance, multi-specialty hospital chains are increasingly investing in automated sterilization units for operational efficiency.

India Medical Device Sterilization Market Insight

India is expected to be the fastest-growing country in the Asia-Pacific region during the forecast period due to rising healthcare infrastructure, expansion of private hospitals, and growth in medical tourism. The increasing adoption of advanced sterilization technologies, such as hydrogen peroxide plasma and filtration sterilization, is meeting the needs of both public and private healthcare facilities. Government programs promoting smart hospitals and improved infection control protocols are further driving growth. For instance, hospitals in metro cities are upgrading in-house sterilization facilities, while smaller clinics rely on third-party sterilization services. Rising awareness of patient safety and cost-effective sterilization solutions is boosting adoption across urban and semi-urban regions.

Japan Medical Device Sterilization Market Insight

The Japan medical device sterilization market is witnessing steady growth, supported by advanced healthcare infrastructure, stringent regulatory standards, and high technological adoption. Hospitals and research institutes prioritize sterilization of surgical instruments and laboratory equipment to maintain compliance with ISO and JIS standards. For instance, automated sterilization monitoring systems are increasingly deployed in Japanese hospitals to enhance workflow efficiency. The market is further supported by ongoing investments in hospital modernization and an aging population requiring higher surgical care, leading to consistent demand for sterilization solutions in both residential and commercial healthcare sectors.

South Korea Medical Device Sterilization Market Insight

The South Korea medical device sterilization market is experiencing steady growth, driven by advanced hospital infrastructure, stringent infection control regulations, and increasing demand for high-quality medical services. Hospitals and clinics are investing in automated sterilization systems and outsourced services to ensure compliance with regulatory standards and patient safety protocols. For instance, major tertiary hospitals in Seoul are adopting hydrogen peroxide plasma and gas sterilization technologies to manage surgical instruments efficiently. The country’s focus on medical tourism and high adoption of advanced medical devices further fuels demand. In addition, integration of sterilization solutions with hospital digital management platforms enhances operational efficiency and reduces risks of healthcare-associated infections.

Asia-Pacific Medical Device Sterilization Market Share

The Asia-Pacific Medical Device Sterilization industry is primarily led by well-established companies, including:

- ASP (U.S.)

- Nanosonics (Australia)

- HOGY Medical Asia Pacific (Japan)

- Unison Healthcare Group (Taiwan)

- Wellell, Inc. (Taiwan)

- Nordion Inc. (Canada)

- Meril Life Sciences (India)

- Terumo Corporation (Japan)

- NIHON KOHDEN CORPORATION (Japan)

- Device Technologies (Australia)

- APACMed (Singapore)

- AMMI (Malaysia)

- Olie Medical (Australia)

- MMM Group (Germany)

- Johnson & Johnson Services, Inc. (U.S.)

- BD (U.S.)

- 3M (U.S.)

- Getinge AB (Sweden)

- STERIS (U.S.)

- SciMed (Singapore)

What are the Recent Developments in Asia-Pacific Medical Device Sterilization Market?

- In October 2025, ten companies are set to commence production at the Madhya Pradesh Medical Devices Park in Ujjain, India. This initiative aims to boost India's self-reliance in medical equipment manufacturing and develop Ujjain into a global hub for medical technology. The park offers several investor incentives and is expected to reduce healthcare costs, encourage foreign exchange savings, and create high-skilled employment.

- In September 2025, IBA and industry partners, including Steris AST, Futeng Irradiation, Johnson & Johnson, BSI, and Jiehao Medical, hosted the China X-ray Medical Device Sterilization Launch at Medtec China 2025. This event marked a significant step in introducing advanced sterilization technologies tailored for the Chinese medical device sector

- In July 2025, the Central Drugs Standard Control Organization (CDSCO) in India allowed medical device manufacturers to outsource sterilization without a loan license, provided specific conditions are met. This regulatory change aims to streamline the sterilization process and enhance the efficiency of medical device manufacturing in the country

- In June 2025, Singapore and Malaysia signed a Memorandum of Understanding (MOU) to fast-track medical device market access. This collaboration aims to streamline regulatory processes and enhance the availability of medical devices in both countries, fostering growth in the medical technology sector

- In March 2024, the U.S. Environmental Protection Agency (EPA) introduced new federal regulations restricting the use of ethylene oxide (EtO), a chemical essential for sterilizing medical devices. The rule aims to reduce EtO emissions from commercial sterilization facilities by 90%, while providing an extended compliance timeline to mitigate potential disruptions in the medical supply chain

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.