Asia Pacific Minimally Invasive Surgery Market

Market Size in USD Billion

CAGR :

%

USD

8.30 Billion

USD

17.92 Billion

2025

2033

USD

8.30 Billion

USD

17.92 Billion

2025

2033

| 2026 –2033 | |

| USD 8.30 Billion | |

| USD 17.92 Billion | |

|

|

|

|

Asia-Pacific Minimally Invasive Surgery Market Size

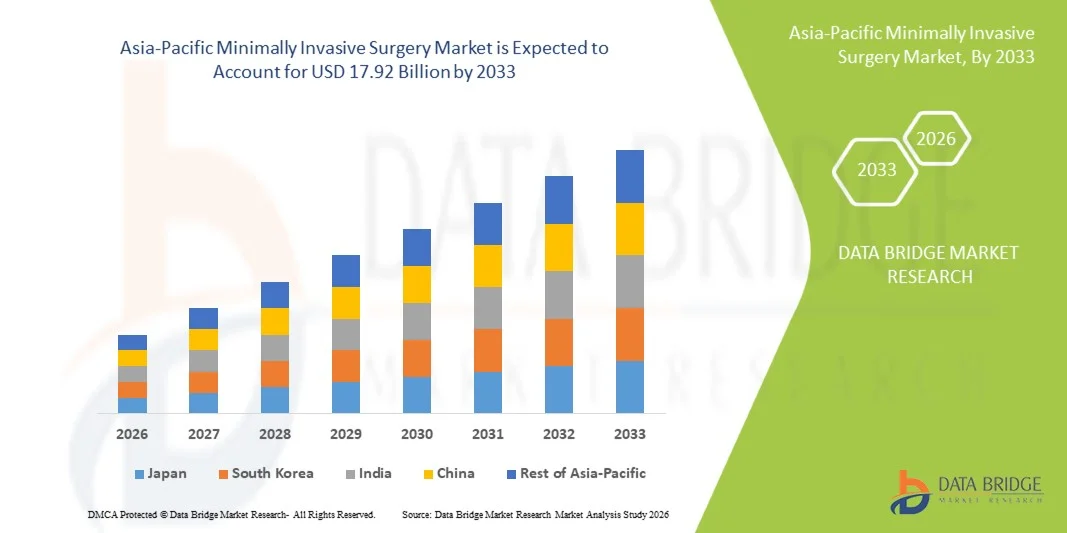

- The Asia-Pacific minimally invasive surgery market size was valued at USD 8.30 billion in 2025 and is expected to reach USD 17.92 billion by 2033, at a CAGR of 10.1% during the forecast period

- The market growth is largely fueled by the increasing adoption of minimally invasive procedures such as laparoscopic, endoscopic, and robot‑assisted surgeries driven by benefits including reduced hospital stays, faster recovery, lower complication risks, and rising healthcare investments across Asia‑Pacific

- Furthermore, technological advancements in surgical instruments, imaging systems, and robotics, alongside growing patient preference for less invasive treatment options and expanding healthcare infrastructure in countries such as China, India, Japan, and South Korea, are establishing minimally invasive surgery as a preferred clinical approach across hospitals and surgical centers in the region

Asia-Pacific Minimally Invasive Surgery Market Analysis

- Minimally invasive surgery (MIS), including laparoscopic, endoscopic, and robot-assisted procedures, is increasingly crucial in Asia-Pacific hospitals and surgical centers due to reduced patient recovery times, lower complication risks, and improved precision of surgical outcomes

- The growing demand for MIS is primarily fueled by rising patient preference for less invasive treatment options, increasing awareness of surgical benefits, and expanding investments in advanced surgical technologies and healthcare infrastructure across key Asia-Pacific countries

- China dominated the Asia-Pacific minimally invasive surgery market in 2025 with the largest country-level share of 38.1%, driven by high surgical volumes, rapid adoption of advanced and robotic-assisted procedures, and strong government and private investments in healthcare modernization

- India is expected to be the fastest-growing country market during the forecast period, supported by expanding private hospital networks, increasing medical tourism, rising disposable incomes, and growing access to minimally invasive surgical procedures in urban and semi-urban areas

- Laparoscopy Devices segment dominated the market with a market share 45.9% in 2025, driven by its widespread clinical acceptance, cost-effectiveness compared to robotic surgery, and extensive use across general surgery, gynecology, and urology in major Asia-Pacific countries

Report Scope and Asia-Pacific Minimally Invasive Surgery Market Segmentation

|

Attributes |

Asia-Pacific Minimally Invasive Surgery Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

Asia-Pacific

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework |

Asia-Pacific Minimally Invasive Surgery Market Trends

“Rising Adoption of Robotic-Assisted and Image-Guided Surgery”

- A significant and accelerating trend in the Asia-Pacific minimally invasive surgery market is the increasing adoption of robotic-assisted and advanced image-guided surgical systems, which are enhancing procedural precision, reducing surgeon fatigue, and improving patient outcomes across complex surgical interventions

- For instance, leading hospitals in China and Japan are increasingly deploying robotic surgical platforms for urology, gynecology, and colorectal procedures, enabling higher surgical accuracy and reduced post-operative recovery times compared to conventional open surgeries

- Technological advancements in high-definition visualization systems, 3D imaging, and AI-assisted navigation are enabling surgeons to perform complex procedures with improved control and consistency. For instance, image-guided laparoscopy systems are increasingly used to enhance intraoperative decision-making and reduce complication rates in high-volume surgical centers

- The integration of robotic systems with digital operating rooms and hospital information systems is facilitating streamlined workflows, data-driven surgical planning, and enhanced training capabilities. Through centralized platforms, surgeons can access imaging, patient data, and robotic controls within a unified surgical environment

- This trend toward technologically advanced, precision-driven minimally invasive procedures is reshaping surgical standards across Asia-Pacific. Consequently, companies such as Intuitive Surgical and regional medical device manufacturers are expanding their robotic portfolios and training programs to meet growing clinical demand

- The demand for robotic-assisted and image-guided minimally invasive surgery is rising rapidly across tertiary hospitals and specialty surgical centers, as healthcare providers increasingly prioritize precision, efficiency, and improved patient outcomes

Asia-Pacific Minimally Invasive Surgery Market Dynamics

Driver

“Growing Demand Due to Rising Chronic Disease Burden and Surgical Volumes”

- The increasing prevalence of chronic diseases such as cancer, cardiovascular disorders, and gastrointestinal conditions, coupled with rising surgical volumes across Asia-Pacific, is a major driver accelerating demand for minimally invasive surgical procedures

- For instance, in 2024, several leading hospital networks in India and Southeast Asia expanded their minimally invasive surgery departments to manage rising patient loads while reducing hospital stay durations and post-operative complications

- As healthcare systems face growing pressure to improve efficiency and patient throughput, minimally invasive surgery offers benefits such as shorter recovery times, reduced blood loss, and lower infection risks, making it a preferred alternative to traditional open surgeries

- Furthermore, expanding healthcare infrastructure, increasing government healthcare expenditure, and improved access to advanced surgical technologies are supporting the widespread adoption of minimally invasive procedures across public and private hospitals

- Increasing adoption of single-incision and natural orifice minimally invasive techniques is emerging as a notable trend, as surgeons seek to further reduce surgical trauma, scarring, and post-operative pain while improving cosmetic outcomes

- The growing availability of trained surgeons, increasing awareness among patients, and rising preference for faster recovery and improved cosmetic outcomes are key factors driving the adoption of minimally invasive surgery throughout the Asia-Pacific region

Restraint/Challenge

“High Capital Costs and Limited Access to Advanced Surgical Technologies”

- The high cost associated with advanced minimally invasive surgical systems, particularly robotic platforms and high-end imaging technologies, poses a significant challenge to market penetration across price-sensitive healthcare systems in Asia-Pacific

- For instance, smaller hospitals and secondary care centers in developing Asia-Pacific countries often face budget constraints that limit their ability to invest in robotic-assisted surgical systems and advanced minimally invasive equipment

- Addressing these cost barriers through flexible pricing models, equipment leasing, and government funding support is critical for broader adoption. Companies such as regional medical device manufacturers are focusing on developing cost-effective laparoscopic systems to improve affordability. In addition, the shortage of skilled surgeons trained in advanced minimally invasive techniques further restricts adoption in certain markets

- While training programs and surgical workshops are expanding, the learning curve associated with robotic and complex minimally invasive procedures can slow implementation and increase operational costs for healthcare providers

- Limited availability of standardized reimbursement policies for minimally invasive procedures across several Asia-Pacific countries presents a challenge, as inconsistent coverage can restrict patient access and hospital adoption

- Overcoming these challenges through expanded surgeon training initiatives, improved reimbursement policies, and the development of more affordable minimally invasive technologies will be essential for sustained market growth across Asia-Pacific

Asia-Pacific Minimally Invasive Surgery Market Scope

The market is segmented on the basis of product type, application, technology, and end users.

- By Product Type

On the basis of product type, the Asia-Pacific minimally invasive surgery market is segmented into surgical devices, monitoring & visualization systems, laparoscopy devices, endosurgical equipment, and electrosurgical equipment. The laparoscopy devices segment dominated the market with the largest revenue share of 45.9% in 2025, driven by its widespread clinical adoption across general surgery, gynecology, urology, and gastrointestinal procedures. Laparoscopic systems are well-established in both public and private hospitals due to their proven clinical efficacy, shorter recovery times, and lower complication rates compared to open surgery. The availability of cost-effective laparoscopic platforms and reusable instruments further supports their dominance in price-sensitive Asia-Pacific healthcare systems. In addition, continuous advancements in imaging quality and ergonomic instrument design have enhanced surgeon efficiency and patient outcomes.

The medical robotics segment (within advanced surgical devices) is expected to witness the fastest growth during the forecast period, fueled by increasing investments in robotic-assisted surgery across China, Japan, and South Korea. Growing demand for high-precision procedures, particularly in urology, oncology, and complex gynecological surgeries, is accelerating robotic system adoption. Expanding surgeon training programs and government-backed hospital modernization initiatives are further supporting rapid growth in this segment.

- By Application

On the basis of application, the market is segmented into gastrointestinal surgery, gynecology surgery, urology surgery, cosmetic surgery, thoracic surgery, vascular surgery, orthopedic & spine surgery, bariatric surgery, breast surgery, cardiac surgery, adrenalectomy surgery, anti-reflux surgery, cancer surgery, cholecystectomy surgery, colectomy surgery, colon & rectal surgery, ear, nose & throat surgery, and obesity surgery. The gastrointestinal surgery segment dominated the Asia-Pacific minimally invasive surgery market in 2025, driven by the high prevalence of gastrointestinal disorders and increasing procedural volumes across densely populated countries such as China and India. Minimally invasive techniques are widely preferred for gastrointestinal procedures due to reduced hospital stays, faster recovery, and lower post-operative complications. The availability of standardized laparoscopic techniques and broad surgeon familiarity further reinforces dominance in this segment. Rising screening rates and early diagnosis of gastrointestinal conditions are also contributing to sustained demand.

The oncology (cancer surgery) segment is expected to be the fastest-growing application during the forecast period, supported by the rising cancer burden across Asia-Pacific and increasing preference for minimally invasive tumor resection procedures. Advances in imaging, robotic-assisted systems, and precision instruments are enabling safer and more accurate cancer surgeries. Governments and healthcare providers are increasingly investing in advanced oncology care infrastructure, driving rapid adoption of minimally invasive cancer surgeries.

- By Technology

On the basis of technology, the market is segmented into transcatheter surgery, laparoscopy surgery, non-visual imaging, and medical robotics. The laparoscopy surgery segment held the dominant market share in 2025, owing to its extensive clinical acceptance and cost-effectiveness compared to other advanced surgical technologies. Laparoscopic procedures are widely performed across multiple specialties, making them the backbone of minimally invasive surgery in Asia-Pacific. The availability of skilled laparoscopic surgeons and established procedural guidelines further supports market dominance. In addition, laparoscopy offers a favorable balance between technological sophistication and affordability.

The medical robotics segment is projected to grow at the fastest rate during the forecast period, driven by increasing adoption of robotic-assisted surgery for complex and precision-demanding procedures. Countries such as Japan, China, and South Korea are leading adoption due to strong technological capabilities and healthcare investments. Improvements in robotic dexterity, visualization, and AI-assisted navigation are enhancing clinical outcomes and surgeon confidence, accelerating market expansion.

- By End Users

On the basis of end users, the market is segmented into hospital surgical departments, outpatient surgery patients, group practices, and individual surgeons. The hospital surgical department segment dominated the market in 2025, supported by the availability of advanced infrastructure, skilled surgical teams, and higher procedural volumes. Hospitals are primary adopters of capital-intensive minimally invasive technologies such as robotic systems and advanced imaging platforms. The presence of multidisciplinary teams and post-operative care facilities further strengthens hospital dominance. In addition, government and private funding initiatives are largely directed toward hospital-based surgical modernization.

The outpatient surgery centers segment is expected to witness the fastest growth during the forecast period, driven by the increasing shift toward same-day minimally invasive procedures. Rising demand for cost-effective care, reduced hospitalization, and faster patient turnover is supporting the expansion of outpatient surgical facilities. Improvements in anesthesia techniques and minimally invasive instruments are making complex procedures feasible in outpatient settings, particularly in urban Asia-Pacific markets.

Asia-Pacific Minimally Invasive Surgery Market Regional Analysis

- China dominated the Asia-Pacific minimally invasive surgery market in 2025 with the largest country-level share of 38.1%, driven by high surgical volumes, rapid adoption of advanced and robotic-assisted procedures, and strong government and private investments in healthcare modernization

- Healthcare providers across the region place strong emphasis on reduced hospital stays, faster patient recovery, and improved clinical outcomes, leading to higher preference for minimally invasive procedures over traditional open surgeries

- This growing adoption is further supported by expanding healthcare infrastructure, rising healthcare expenditure, increasing availability of trained surgeons, and ongoing investments in advanced surgical technologies, positioning minimally invasive surgery as a preferred treatment approach across both public and private healthcare facilities in Asia-Pacific

The China Minimally Invasive Surgery Market Insight

China captured the largest revenue share within the Asia-Pacific minimally invasive surgery market in 2025, supported by its vast population, high surgical demand, and rapid modernization of hospital infrastructure. The country has witnessed strong adoption of laparoscopic and robotic-assisted surgeries, particularly in oncology, urology, and gastrointestinal procedures. Government-backed healthcare reforms and increased funding for advanced medical technologies continue to strengthen China’s position as a leading market.

Japan Minimally Invasive Surgery Market Insight

The Japan minimally invasive surgery market is projected to grow at a steady CAGR during the forecast period, driven by the country’s advanced healthcare system, strong focus on technological innovation, and aging population. Japanese hospitals are early adopters of robotic-assisted and image-guided surgical technologies, especially for complex and precision-demanding procedures. The emphasis on patient safety, reduced recovery time, and high-quality clinical outcomes supports sustained market growth.

India Minimally Invasive Surgery Market Insight

The India minimally invasive surgery market is expected to witness a robust CAGR over the forecast period, fueled by expanding private hospital networks, rising healthcare expenditure, and increasing awareness of minimally invasive treatment benefits. The growing burden of lifestyle-related diseases and the rise in medical tourism are further boosting surgical volumes. Government initiatives to strengthen healthcare infrastructure and improve access to advanced surgical care are also contributing to market growth.

South Korea Minimally Invasive Surgery Market Insight

The South Korea minimally invasive surgery market is anticipated to expand at a notable CAGR, driven by high adoption of advanced medical technologies and strong demand for precision-based surgical procedures. The country is a regional leader in robotic-assisted surgery, particularly in oncology and urology. Well-developed healthcare infrastructure, skilled surgeons, and a strong emphasis on innovation continue to support market growth.

Asia-Pacific Minimally Invasive Surgery Market Share

The Asia-Pacific Minimally Invasive Surgery industry is primarily led by well-established companies, including:

- Intuitive Surgical Operations, Inc. (U.S.)

- Vivo Surgical (Singapore)

- Meril Life Sciences (India)

- Medtronic (Ireland)

- Olympus Corporation (Japan)

- Siemens Healthineers AG (Germany)

- Stryker (U.S.)

- Smith+Nephew (U.K.)

- Abbott (U.S.)

- Boston Scientific Corporation (U.S.)

- Zimmer Biomet (U.S.)

- Johnson & Johnson Services, Inc. (U.S.)

- CONMED Corporation (U.S.)

- GE Healthcare (U.S.)

- Koninklijke Philips N.V. (Netherlands)

- MicroPort Scientific Corporation (China)

- Genesis MedTech Co., Ltd. (Singapore)

- Shandong Weigao Group Medical Polymer Company, Ltd. (China)

- Appasamy Associates (India)

- Trivitron Healthcare Pvt. Ltd. (India)

What are the Recent Developments in Asia-Pacific Minimally Invasive Surgery Market?

- In December 2025, the Asian Institute of Nephrology and Urology (AINU) in Visakhapatnam inaugurated a new robotic surgery facility to enhance precision and outcomes in robotic-assisted nephrology and urology procedures, reflecting expanded clinical access to advanced MIS technologies in India

- In September 2025, HMI Medical Group introduced Japan’s Hinotori™ robotic-assisted surgery (RAS) system in Malaysia, marking the first deployment of this advanced RAS technology in Southeast Asia to enhance precision, control, and visibility for complex minimally invasive procedures across hospitals in Johor Bahru and Melaka

- In July 2025, King George’s Medical University (KGMU) in Lucknow announced construction of a state-of-the-art hybrid operating theatre that will enable advanced minimally invasive interventional radiology (pin-hole surgery) procedures for cancer, cardiovascular, and neurological conditions using imaging-guided techniques

- In March 2025, Chang Gung Memorial Hospital in Taiwan advanced minimally invasive surgery by expanding its use of Da Vinci Robotic Surgical Systems, having performed over 12,000 robotic surgeries by end-2024, and further developing a robotic surgical training hub in partnership with Intuitive Surgical Inc. for Asia-Pacific surgeons

- In September 2021, Medtronic and Apollo Hospitals Group announced the first clinical procedure in the Asia-Pacific region using the Hugo™ robotic-assisted surgery (RAS) system, performing a robotic prostatectomy at Apollo Hospitals in Chennai, India, marking a major milestone in expanding robotic minimally invasive surgery in the region

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.