Asia Pacific Molecular Diagnostics Services Market

Market Size in USD Million

CAGR :

%

USD

25.84 Million

USD

49.99 Million

2024

2032

USD

25.84 Million

USD

49.99 Million

2024

2032

| 2025 –2032 | |

| USD 25.84 Million | |

| USD 49.99 Million | |

|

|

|

|

Asia-Pacific Molecular Diagnostics Services Market Size

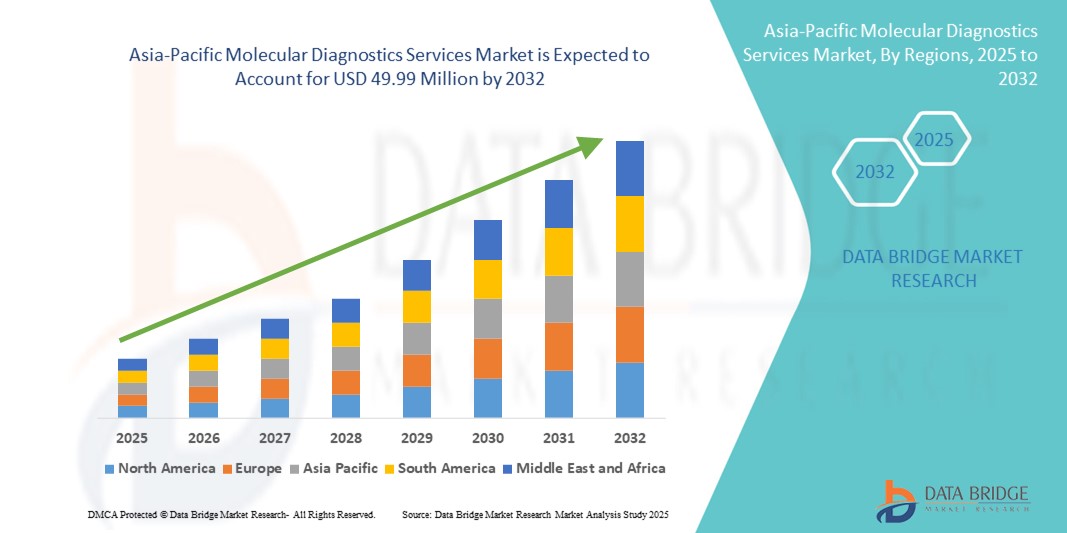

- The Asia-Pacific molecular diagnostics services market size was valued at USD 25.84 million in 2024 and is expected to reach USD 49.99 million by 2032, at a CAGR of 8.60% during the forecast period

- The market growth is largely fueled by increasing awareness, rising healthcare access, and advancements in diagnostic technologies across Asia-Pacific, enabling timely detection and management of a wide range of genetic, infectious, and chronic diseases. Countries such as India, China, and Indonesia are witnessing a surge in healthcare infrastructure development, contributing to the growing adoption of molecular diagnostics services

- Furthermore, escalating investments in laboratory facilities, expansion of diagnostic services in rural and semi-urban areas, and increasing public-private partnerships are driving innovation and availability of advanced molecular testing technologies. Government health initiatives, coupled with the growing presence of international diagnostic companies and local manufacturing capabilities, are significantly boosting the growth of the Asia-Pacific Molecular Diagnostics Services market

Asia-Pacific Molecular Diagnostics Services Market Analysis

- The Asia-Pacific molecular diagnostics services market is witnessing significant growth, driven by increasing investments in advanced diagnostic platforms, rising prevalence of infectious and genetic diseases, and the growing adoption of precision medicine initiatives. Countries like China, India, Japan, and South Korea are expanding their laboratory infrastructure and research capabilities, contributing to heightened demand for high-quality molecular diagnostic services

- The rising focus on personalized healthcare and clinical research in the region is supported by enhanced government funding, growing private healthcare investments, and expansion of specialized diagnostic centers. Increasing awareness about early disease detection, coupled with advancements in molecular testing technologies such as PCR, Real-Time PCR, and Next-Generation Sequencing (NGS), is driving broader adoption across hospitals and research institutes

- China dominated the Asia-Pacific molecular diagnostics services market, accounting for the largest revenue share of 35.1% in 2024, driven by its well-established hospital network, large patient population, and rapid integration of advanced molecular diagnostic technologies into clinical and research workflows

- India is projected to register the fastest CAGR of 13.6% in the Asia-Pacific molecular diagnostics services market during the forecast period, fueled by expanding healthcare access, rising demand for affordable molecular testing, and growing investment in laboratory infrastructure. Initiatives such as government-backed diagnostic programs and increased private-sector collaborations are accelerating the adoption of molecular diagnostics across urban and semi-urban regions

- PCR-based services dominated the Asia-Pacific molecular diagnostics services market with 36.5% share in 2024, due to their broad adoption for molecular testing in infectious diseases, genetic screenings, and routine diagnostic applications. PCR remains a cornerstone technology because of its reliability, affordability, and adaptability to multiple clinical workflows

Report Scope and Asia-Pacific Molecular Diagnostics Services Market Segmentation

|

Attributes |

Asia-Pacific Molecular Diagnostics Services Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

Asia-Pacific

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Asia-Pacific Molecular Diagnostics Services Market Trends

Advancing Therapeutics and Expanding Clinical Research in Asia-Pacific

- A significant and accelerating trend in the Asia-Pacific molecular diagnostics services market is the increasing focus on therapeutic innovations and clinical research—particularly in areas such as oncology, infectious diseases, and genetic disorders. Advanced molecular testing is enabling earlier diagnosis and more targeted treatment approaches

- For instance, various diagnostic companies and research institutes across Asia-Pacific are investing in next-generation sequencing (NGS), PCR-based assays, and multiplex biomarker panels. These developments aim to deliver faster, more accurate, and cost-effective diagnostic results, which are critical for personalized medicine and disease management

- The increasing adoption of precision medicine models across hospitals and specialty clinics is enabling more effective therapeutic interventions. These models leverage advanced molecular profiling and bioinformatics to guide treatment selection, monitor disease progression, and predict patient response

- Partnerships between diagnostic technology firms, academic research centers, and government-backed programs are also helping to expand access to molecular testing by improving reimbursement frameworks, standardizing laboratory practices, and enhancing clinician training

- As Asia-Pacific continues to prioritize precision healthcare and value-based outcomes, the molecular diagnostics services market is poised for sustained growth—driven by innovation, improved diagnostic accuracy, and rising demand for early detection and personalized therapeutic strategies

Asia-Pacific Molecular Diagnostics Services Market Dynamics

Driver

Growing Need Due to Rising Diagnosis Rates and Advancements in Genetic Research

- The increasing prevalence of complex and chronic diseases across Asia-Pacific, supported by growing awareness and improved diagnostic capabilities, is significantly driving market growth. Countries such as China, India, Japan, and South Korea are enhancing their healthcare infrastructure and diagnostic programs, enabling earlier detection and timely intervention for conditions such as cancer, infectious diseases, and genetic disorders

- For instance, in April 2024, Anavex Life Sciences reported positive progress in its Phase III clinical trial for Anavex 2-73 (blarcamesine), targeting neurodegenerative disorders through precision diagnostics and molecular biomarkers. Such innovations are expected to catalyze the adoption of advanced molecular diagnostics, thereby accelerating the Asia-Pacific Molecular Diagnostics Services market over the forecast period

- Rising interest in personalized medicine and the availability of next-generation molecular technologies—including PCR, real-time PCR, and next-generation sequencing—are prompting a market shift from conventional diagnostic methods to more accurate, patient-specific testing solutions

- Regulatory bodies across Asia-Pacific, such as the Pharmaceuticals and Medical Devices Agency (PMDA) in Japan and the National Medical Products Administration (NMPA) in China, are increasingly supporting diagnostic innovation through fast-track approvals, clinical trial support, and streamlined compliance guidelines, fostering rapid market access for advanced molecular diagnostic services

- Collaborations among regional biotech firms, academic research centers, and healthcare associations are strengthening the innovation ecosystem in Asia-Pacific. These partnerships are instrumental in expanding patient access to advanced molecular diagnostics, scaling clinical research initiatives, and enhancing awareness of early disease detection and genetic testing across diverse populations

Restraint/Challenge

Limited Infrastructure and Variability in Clinical Adoption

- The high cost associated with advanced molecular diagnostic services—including sophisticated instrumentation, reagents, and high-throughput sequencing—poses a substantial barrier to widespread adoption, especially in rural or underfunded areas

- Even when supported by government incentives, molecular diagnostic tests typically involve complex workflows, specialized personnel, and stringent quality control, making them less accessible for healthcare systems with constrained budgets

- Moreover, specialized laboratory facilities and trained personnel are often concentrated in urban centers, forcing patients in remote areas to travel long distances or experience delays in testing and reporting

- Another challenge is the lack of standardized protocols for certain molecular assays and genetic tests. Limited clinical experience and variable laboratory capabilities contribute to inconsistent adoption across healthcare providers

- To overcome these challenges, policy reforms, enhanced government funding, cross-border research collaboration, and the establishment of dedicated molecular diagnostic hubs across Asia-Pacific will be essential in expanding access and achieving sustainable growth in the Asia-Pacific molecular diagnostics services Market

Asia-Pacific Molecular Diagnostics Services Market Scope

The market is segmented on the basis of service type, technology, and end user.

- By Service Type

On the basis of service type, the Asia-Pacific molecular diagnostics services market is segmented into instrument repair services, training services, compliance services, calibration services, maintenance services, scalable automation services, turnkey services, instrument relocation services, hardware customization, performance assurance services, design and development services, supply chain solutions, new product introduction services, manufacturing services, environmental & regulatory services, medical management systems certification & auditing, clinical research services, consultative services, and other services. Maintenance Services dominated the market with the largest revenue share of 23.7% in 2024, owing to their essential role in ensuring the continuous and accurate functioning of molecular diagnostic instruments. These services are critical for minimizing downtime, extending equipment lifespan, and maintaining consistent diagnostic accuracy across hospital and laboratory networks.

Clinical research services are projected to witness the highest CAGR of 9.1% from 2025 to 2032, driven by the rising focus on translational and precision medicine research. This growth is supported by increased investments in biomarker discovery, genomics, and personalized healthcare initiatives, as well as expanding collaborations between research institutions and diagnostic service providers.

- By Technology

On the basis of technology, the Asia-Pacific molecular diagnostics services market is segmented into PCR, Real-Time PCR, Next-Generation Sequencing (NGS), and Other Technologies. PCR-based services led the market with a 36.5% share in 2024, due to their broad adoption for molecular testing in infectious diseases, genetic screenings, and routine diagnostic applications. PCR remains a cornerstone technology because of its reliability, affordability, and adaptability to multiple clinical workflows.

Next-Generation Sequencing (NGS) is projected to grow at the fastest CAGR of 14.2% from 2025 to 2032, fueled by the increasing demand for high-throughput genomic analysis, precision oncology, and comprehensive disease profiling. NGS enables researchers and clinicians to perform large-scale genomic studies with enhanced accuracy, supporting early diagnosis, treatment stratification, and personalized therapeutic approaches.

- By End User

On the basis of end user, the Asia-Pacific molecular diagnostics services market is segmented into hospitals, diagnostic centers, academic & research institutions, and others. Hospitals held the largest share at 41.8% in 2024, supported by their large patient volumes, integrated laboratory infrastructure, and consistent adoption of advanced molecular diagnostic platforms. Hospitals utilize these services not only for routine diagnostics but also to support specialized departments like oncology, infectious diseases, and genetic counseling.

Academic & Research Institutions are expected to grow at the fastest CAGR of 10.3% during the forecast period, driven by increased molecular research initiatives, government and private funding for genomics and clinical studies, and the adoption of high-end diagnostic technologies for translational research. These institutions play a crucial role in driving innovation and validating new molecular diagnostic solutions before commercialization.

Asia-Pacific Molecular Diagnostics Services Market Regional Analysis

- Asia-Pacific dominated the global molecular diagnostics services market with the largest revenue share of 32.5% in 2024, driven by the region's expanding healthcare infrastructure, rising prevalence of chronic and infectious diseases, and rapid adoption of advanced molecular diagnostic technologies. Investments in medical facilities, growing number of diagnostic centers, and government initiatives promoting early disease detection are further propelling market growth

- Strong regulatory frameworks, widespread insurance coverage, and high patient awareness are fostering growth across both public and private healthcare sectors. Increased government funding for diagnostic programs, coupled with public-private partnerships and post-pandemic healthcare initiatives, is accelerating the adoption of advanced molecular diagnostic services

- Furthermore, Asia-Pacific hosts several leading diagnostic service providers, academic institutions, and R&D centers, facilitating continuous innovation in assay development, clinical evaluation, and integration of next-generation technologies

China Asia-Pacific Molecular Diagnostics Services Market Insight

The China molecular diagnostics services market held the largest market share in the Asia-Pacific region at 35.1% in 2024, driven by a large population base, rising prevalence of infectious and genetic disorders, and expanding access to specialized diagnostic centers. Government healthcare reforms, increased insurance coverage, and favorable reimbursement policies are encouraging both domestic and international service providers to expand their molecular diagnostics offerings. Local companies are also investing heavily in R&D to meet the rising demand for advanced diagnostic solutions.

Japan Asia-Pacific Molecular Diagnostics Services Market Insight

The Japan molecular diagnostics services market accounted for 21.5% of the Asia-Pacific market share in 2024, supported by its highly developed healthcare infrastructure, strong insurance coverage, and technologically advanced laboratory environment. Rising adoption of next-generation sequencing (NGS), PCR-based testing, and other molecular diagnostic technologies, particularly among hospitals and research centers, is boosting market demand. Japan’s emphasis on early disease detection and precision medicine is reinforcing its leading position in the region.

India Asia-Pacific Molecular Diagnostics Services Market Insight

The India molecular diagnostics services market is projected to be the fastest-growing market in Asia-Pacific with a CAGR of 13.6% from 2025 to 2032, driven by increasing healthcare awareness, growing accessibility of diagnostic services, and rising disposable incomes. National programs for disease detection, expansion of diagnostic infrastructure in tier 2 and 3 cities, and growing private sector participation are accelerating adoption. India is also emerging as a hub for cost-effective molecular diagnostics, enhancing its regional competitiveness.

Asia-Pacific Molecular Diagnostics Services Market Share

The Asia-Pacific molecular diagnostics services industry is primarily led by well-established companies, including:

- F. Hoffmann-La Roche Ltd (Switzerland)

- Danaher Corporation (U.S.)

- BIOMÉRIEUX (France)

- QIAGEN N.V. (Netherlands)

- Thermo Fisher Scientific Inc. (U.S.)

- Bio-Rad Laboratories, Inc. (U.S.)

- Abbott (U.S.)

- DiaSorin S.p.A. (Italy)

- Hologic, Inc. (U.S.)

Latest Developments in Asia-Pacific Molecular Diagnostics Services market

- In August 2025, Chinese pharmaceutical R&D firms increasingly sourced laboratory reagents from domestic suppliers, such as Shanghai Titan Scientific and Nanjing Vazyme Biotech, to reduce costs and shorten delivery times. This shift was in response to rising import tariffs and concerns about supply chain reliability amid ongoing trade tensions with the U.S. Previously dominated by Western firms like Thermo Fisher and Merck, the USD 5.76 billion Chinese reagent market saw a significant move towards local companies

- In March 2025, Qiagen announced it would discontinue its NeuMoDx 96 and 288 Integrated PCR Testing Systems due to market developments and changing customer needs post-COVID-19 pandemic. The company initiated discussions with customers to understand the impact on 2024 sales and would support existing customers until 2025

- In February 2024, PlexBio showcased its advanced lung cancer detection technology at Medlab Dubai, highlighting its commitment to expanding molecular diagnostics capabilities in oncology

- In January 2024, Revvity, formerly part of PerkinElmer, significantly increased its investment in research, software, and internal operations following its split and rebranding. The company focused on enhancing its life sciences and diagnostics sectors, aiming to boost R&D spending and invest in operational efficiencies, including a new e-commerce platform and supply-chain optimization

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.