Global Medical Management Market

Market Size in USD Billion

CAGR :

%

USD

6.85 Billion

USD

11.86 Billion

2025

2033

USD

6.85 Billion

USD

11.86 Billion

2025

2033

| 2026 –2033 | |

| USD 6.85 Billion | |

| USD 11.86 Billion | |

|

|

|

|

Medical Management Market Size

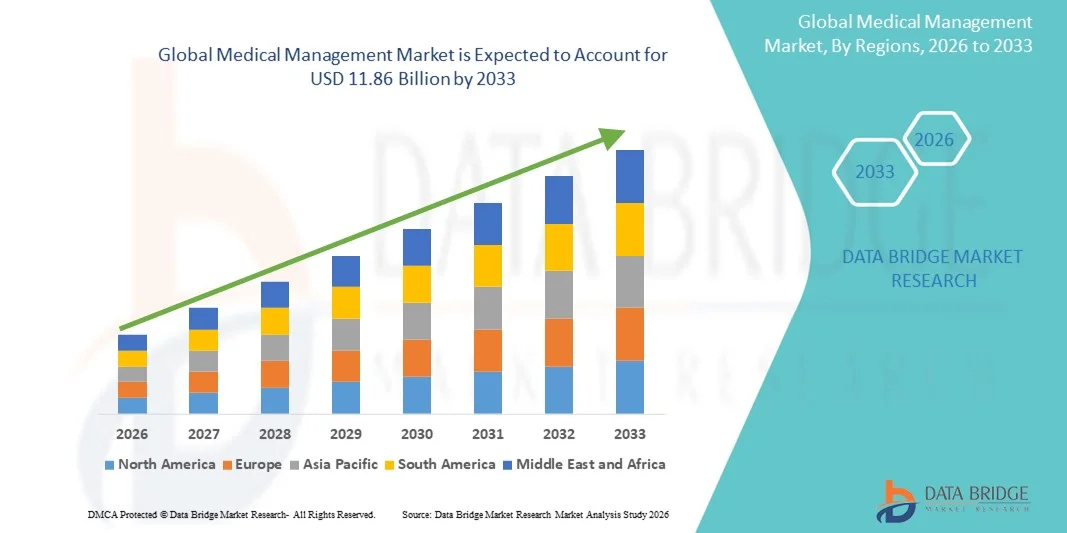

- The global medical management market size was valued at USD 6.85 billion in 2025 and is expected to reach USD 11.86 billion by 2033, at a CAGR of 7.11% during the forecast period

- The market growth is largely fueled by the increasing prevalence of chronic diseases, long‑term disabilities, and the ongoing integration of digital health platforms that enhance care coordination, case tracking, and personalized patient management across hospitals and home care settings

- Furthermore, rising demand for efficient, technology‑enabled case management services such as web‑based, telephonic, field, and bilingual case management coupled with expanded end‑user adoption in both clinical and home care environments, is driving significant uptake. These converging factors are accelerating the adoption of comprehensive medical management solutions, thereby significantly boosting the industry’s growth

Medical Management Market Analysis

- Medical management solutions, including electronic, telephonic, and field-based case management services, are increasingly vital components of modern healthcare systems in both hospitals and home care settings due to their ability to streamline care coordination, improve patient outcomes, and enable personalized case tracking across diverse medical conditions

- The escalating demand for medical management services is primarily fueled by the growing prevalence of chronic diseases, long-term disabilities, and increasing adoption of digital health platforms that enhance operational efficiency, reduce administrative burdens, and enable real-time patient monitoring

- North America dominated the medical management market with the largest revenue share of 38.2% in 2025, characterized by advanced healthcare infrastructure, high adoption of technology-enabled case management services, and a strong presence of leading industry players offering web-based, telephonic, and field case management solutions, with the U.S. experiencing substantial growth in both hospital and home care adoption, driven by innovations in digital health and integrated care solutions

- Asia-Pacific is expected to be the fastest growing region in the medical management market during the forecast period due to expanding healthcare infrastructure, rising investments in home care services, and growing awareness of technology-enabled case management solutions

- Web-based case management services segment dominated the market with a share of 35.8% in 2025, driven by their ability to provide remote monitoring, real-time data tracking, and seamless integration with hospital and home care workflows

Report Scope and Medical Management Market Segmentation

|

Attributes |

Medical Management Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework |

Medical Management Market Trends

Digital and AI-Enabled Care Coordination

- A significant and accelerating trend in the global medical management market is the integration of AI and digital health platforms to optimize patient case tracking, automate workflow management, and enhance personalized care delivery across hospitals and home care settings

- For instance, Medecision’s Aerial platform leverages AI to predict patient risks and prioritize interventions, allowing case managers to proactively reduce hospitalization and healthcare costs

- AI-enabled medical management solutions allow predictive analytics for patient outcomes, suggest optimal treatment plans, and trigger automated alerts for critical cases. For instance, certain HealthEC systems can identify patients at risk of chronic disease complications and notify care teams for timely intervention

- The seamless integration of case management software with electronic health records (EHRs) and telehealth platforms facilitates centralized control over patient data, care plans, and communication between multidisciplinary teams

- This trend toward more intelligent, automated, and integrated care management systems is fundamentally reshaping provider and patient expectations. Consequently, companies such as WellSky are developing AI-enabled platforms with features such as predictive care analytics and automated care plan adjustments

- The demand for digital and AI-driven case management solutions is growing rapidly across hospitals and home care providers, as stakeholders increasingly prioritize efficiency, risk mitigation, and personalized patient management

- Enhanced interoperability with pharmacy, laboratory, and insurance systems is emerging as a key trend, enabling real-time claims management, prescription tracking, and care coordination. For instance, some Mediware solutions integrate pharmacy data to automatically update patient care plans

- Mobile-first case management solutions are gaining traction, allowing care managers to monitor patients remotely, access real-time updates, and communicate via secure messaging. For instance, Casenet’s mobile platform allows field case managers to update care plans on the go

Medical Management Market Dynamics

Driver

Rising Prevalence of Chronic Diseases and Digital Health Adoption

- The increasing incidence of chronic diseases, long-term disabilities, and the rising adoption of digital health platforms are significant drivers for the growing demand for medical management services

- For instance, in March 2025, CaseNEX announced AI-powered expansion of its case management services for chronic care patients, aiming to integrate predictive analytics with telehealth solutions

- As healthcare providers seek to improve outcomes and reduce readmissions, medical management solutions offer features such as remote monitoring, automated alerts, and real-time patient tracking, providing a compelling alternative to traditional care coordination methods

- Furthermore, the growing penetration of home care services and telehealth platforms is making medical management services integral for efficient patient monitoring, care plan execution, and reporting

- The ability to manage cases across hospitals, clinics, and home care settings with AI-driven analytics, predictive modeling, and remote communication is propelling adoption in both developed and emerging markets

- Increasing investments by healthcare providers in population health management and value-based care initiatives are driving adoption, as these platforms enable better resource allocation and cost control. For instance, some hospitals are using case management solutions to monitor high-risk patient populations and reduce avoidable hospitalizations

- Strategic partnerships between case management software providers and insurance companies are expanding market opportunities, allowing integration of claims management and predictive care. For instance, certain InsurTech firms collaborate with medical management platforms to automate coverage verification and optimize care pathways

Restraint/Challenge

Data Security Concerns and Regulatory Compliance Hurdles

- Concerns surrounding patient data privacy, cybersecurity vulnerabilities of digital platforms, and compliance with healthcare regulations pose significant challenges to broader market penetration

- For instance, reports of EHR breaches and unauthorized access to patient management systems have made some healthcare providers hesitant to fully adopt cloud-based case management solutions

- Addressing these issues through robust encryption, secure authentication protocols, HIPAA compliance, and regular software updates is crucial for building trust among hospitals and home care providers

- In addition, the relatively high initial cost of advanced AI-driven medical management platforms compared to traditional methods can be a barrier for smaller providers or cost-sensitive regions, despite the long-term efficiency benefits

- While prices are gradually decreasing and cloud-based solutions are more accessible, perceived complexity and investment requirements can still hinder adoption, particularly for organizations without dedicated IT support

- Overcoming these challenges through enhanced data security measures, regulatory guidance, and cost-effective platform offerings will be vital for sustained growth in the medical management market

- Limited digital literacy among healthcare staff in certain regions can slow adoption, as care managers require training to effectively use advanced platforms. For instance, smaller clinics may need workshops to implement AI-enabled case tracking

- Variability in global healthcare regulations creates challenges for platform standardization and cross-border deployment. For instance, differing patient privacy laws in the EU and Asia-Pacific require localized compliance features in case management software

Medical Management Market Scope

The market is segmented on the basis of mode of service, end-user, and severity of case.

- By Mode of Service

On the basis of mode of service, the medical management market is segmented into web-based case management service, telephonic case management service, field case management service, bilingual field case management service, and other services. The Web-Based Case Management Service segment dominated the market with the largest revenue share of 35.8% in 2025, driven by the increasing reliance on digital platforms for care coordination, data tracking, and automated reporting. Web-based platforms allow care managers to access patient information in real time, create and update care plans remotely, and collaborate seamlessly across hospitals, clinics, and home care providers. These platforms also provide integration with electronic health records (EHRs), telehealth services, and predictive analytics, which enhances operational efficiency and patient outcomes. The growing adoption of cloud-based solutions further boosts the dominance of web-based services. Hospitals and home care agencies prefer web-based platforms for their scalability, multi-user access, and ability to monitor multiple patient cases simultaneously. Moreover, regulatory compliance and audit trails are easier to maintain with web-based systems.

The Telephonic Case Management Service segment is anticipated to witness the fastest growth with a CAGR of 15.2% from 2026 to 2033, fueled by the expanding need for remote patient support, chronic disease monitoring, and home care follow-ups. Telephonic services are especially valuable in regions with limited internet connectivity, serving as a reliable alternative to web-based solutions. They allow care managers to maintain direct communication with patients, provide counseling, schedule follow-ups, and ensure medication adherence. Telephonic case management also supports multilingual outreach, improving accessibility and patient engagement. As healthcare providers increasingly focus on patient-centered care and cost-effective monitoring, telephonic services gain traction. The combination of convenience, real-time guidance, and personalized care drives the rapid adoption of this mode of service.

- By End-User

On the basis of end-user, the medical management market is segmented into hospitals and home care settings. The Hospitals segment dominated the market with the largest share of 60% in 2025, owing to the critical need for structured case management for patients with chronic conditions, catastrophic injuries, and complex care requirements. Hospitals benefit from integrated platforms that enable workflow automation, predictive risk analysis, and coordinated treatment plans across departments. The high patient throughput, regulatory compliance requirements, and focus on reducing readmissions contribute to the strong preference for hospitals to adopt advanced medical management solutions. Hospitals also leverage AI and analytics tools to identify high-risk patients, prioritize interventions, and optimize resource allocation. Moreover, the presence of skilled care managers and IT infrastructure in hospitals supports the efficient deployment of these systems.

The Home Care Settings segment is expected to witness the fastest growth with a CAGR of 17.1% from 2026 to 2033, driven by the rising demand for remote patient monitoring, aging populations, and increasing chronic disease prevalence. Home care providers increasingly rely on digital platforms, telephonic support, and field services to deliver personalized care directly at patients’ residences. The convenience of real-time case updates, patient engagement, and remote intervention improves patient satisfaction and reduces hospitalization rates. Technological advancements, such as mobile-enabled platforms and wearable device integration, further accelerate adoption. In addition, government initiatives and insurance coverage for home care services are boosting market growth in this segment.

- By Severity of Case

On the basis of severity of case, the medical management market is segmented into catastrophic case management, chronic pain case management, independent medical examinations, short-term disability, and long-term disability. The Catastrophic Case Management segment dominated the market with the largest share of 30% in 2025, driven by the high complexity and cost of managing patients with severe injuries, major illnesses, or post-surgical recovery needs. These cases require intensive monitoring, multidisciplinary care coordination, and frequent updates to care plans. Advanced platforms help care managers track patient progress, schedule interventions, and communicate with multiple healthcare providers to minimize complications. The need for accurate documentation, compliance, and reimbursement management further reinforces adoption in this segment. Hospitals, insurers, and specialty care centers prefer dedicated case management solutions for catastrophic cases due to their potential impact on patient outcomes and healthcare costs.

The Chronic Pain Case Management segment is expected to witness the fastest growth with a CAGR of 16.4% from 2026 to 2033, fueled by the increasing prevalence of chronic pain conditions, musculoskeletal disorders, and long-term rehabilitation needs. Case management solutions for chronic pain focus on continuous monitoring, medication adherence, therapy tracking, and lifestyle management. Telephonic, web-based, and field services help care managers engage patients effectively, ensure treatment compliance, and reduce hospital readmissions. Integration with wearable devices and mobile health apps enhances patient engagement and data-driven care. Rising awareness of chronic pain management programs, reimbursement support, and preventive care initiatives contribute to the rapid growth of this segment.

Medical Management Market Regional Analysis

- North America dominated the medical management market with the largest revenue share of 38.2% in 2025, characterized by advanced healthcare infrastructure, high adoption of technology-enabled case management services, and a strong presence of leading industry players offering web-based, telephonic, and field case management solutions

- Healthcare providers and hospitals in the region highly value the efficiency, real-time patient tracking, and improved care coordination offered by medical management platforms, which help reduce readmissions and optimize resource allocation

- This widespread adoption is further supported by high healthcare IT investment, skilled care management professionals, and a focus on value-based care initiatives, establishing medical management solutions as a preferred approach for both hospitals and home care settings.

U.S. Medical Management Market Insight

The U.S. medical management market captured the largest revenue share of 42% in 2025, driven by advanced healthcare infrastructure, high adoption of AI-enabled case management solutions, and the presence of major industry players offering web-based, telephonic, and field case management services. Providers increasingly prioritize efficiency, predictive care analytics, and real-time patient monitoring to reduce readmissions and improve outcomes. The growing integration of electronic health records (EHRs) with case management platforms, alongside the expansion of home care services, is further propelling market growth. In addition, value-based care initiatives and robust reimbursement frameworks encourage hospitals and insurers to adopt advanced management solutions.

Europe Medical Management Market Insight

The Europe medical management market is projected to expand at a substantial CAGR during the forecast period, primarily driven by stringent healthcare regulations, growing chronic disease prevalence, and the rising need for streamlined care coordination across hospitals and home care settings. Increasing adoption of telehealth, digital patient monitoring, and integrated care platforms is fostering market growth. European healthcare providers also value platforms that enhance operational efficiency, reduce administrative burdens, and support compliance with regional standards. The market is witnessing significant growth across residential care, hospital networks, and specialized rehabilitation facilities.

U.K. Medical Management Market Insight

The U.K. medical management market is anticipated to grow at a noteworthy CAGR during the forecast period, driven by rising chronic disease incidence, a focus on patient-centered care, and increasing adoption of digital case management platforms. Concerns regarding hospital readmissions and care inefficiencies are motivating healthcare providers to implement AI-enabled management solutions. The U.K.’s strong healthcare IT infrastructure, supportive policies, and digital health initiatives continue to stimulate market growth. Hospitals, clinics, and home care agencies are increasingly leveraging web-based and telephonic case management solutions for enhanced patient monitoring and engagement.

Germany Medical Management Market Insight

The Germany medical management market is expected to expand at a considerable CAGR during the forecast period, fueled by rising awareness of care coordination, digital health adoption, and chronic disease management. Germany’s well-established healthcare infrastructure, focus on innovation, and emphasis on quality and compliance promote the deployment of advanced case management platforms. Integration with hospital information systems and home care services is becoming increasingly prevalent. Providers prioritize privacy, data security, and efficiency, driving demand for robust medical management solutions that support multidisciplinary patient care.

Asia-Pacific Medical Management Market Insight

The Asia-Pacific medical management market is poised to grow at the fastest CAGR of 18% during 2026–2033, driven by increasing healthcare infrastructure investments, rising chronic disease prevalence, and growing awareness of technology-enabled care coordination in countries such as China, Japan, and India. Government initiatives promoting digital health adoption, home care expansion, and telehealth services are accelerating market penetration. In addition, rising disposable incomes and healthcare IT investments are enabling broader adoption of AI-enabled platforms, predictive analytics, and remote patient monitoring solutions, particularly in urban centers.

Japan Medical Management Market Insight

The Japan medical management market is gaining momentum due to the country’s technologically advanced healthcare system, aging population, and growing demand for personalized, home-based, and hospital care management solutions. Integration of digital platforms with wearable health devices and EHRs supports continuous patient monitoring and proactive intervention. The increasing number of connected healthcare facilities and smart home-based care programs is fueling adoption. Providers and patients are seeking convenient, secure, and efficient case management solutions to address chronic diseases, rehabilitation, and long-term care needs.

India Medical Management Market Insight

The India medical management market accounted for the largest market revenue share in Asia-Pacific in 2025, attributed to the country’s expanding healthcare infrastructure, rising chronic disease burden, and high adoption of digital health platforms. India’s growing middle-class population, rapid urbanization, and government initiatives such as digital health and smart hospital programs are key factors driving market growth. The availability of cost-effective, mobile-friendly case management solutions, coupled with a rise in home care services and telehealth platforms, is further propelling the adoption of medical management solutions across hospitals, clinics, and residential care settings.

Medical Management Market Share

The Medical Management industry is primarily led by well-established companies, including:

- Epic Systems Corporation (U.S.)

- Veradigm LLC (U.S.)

- Oracle (U.S.)

- Merative L.P. (U.S.)

- eClinicalWorks LLC (U.S.)

- Health Catalyst, Inc. (U.S.)

- EXL Health (U.S.)

- ZeOmega Inc. (U.S.)

- Casenet LLC (U.S.)

- Medecision Inc. (U.S.)

- QHR Technologies Inc. (Canada)

- Tebra (U.S.)

- CompuGroup Medical SE & Co. KGaA (Germany)

- Omnicell, Inc. (U.S.)

- athenahealth, Inc. (U.S.)

- NextGen Healthcare, Inc. (U.S.)

- Greenway Health LLC (U.S.)

- Medical Information Technology, Inc. (U.S.)

- AdvancedMD, Inc. (U.S.)

- CareCloud, Inc. (U.S.)

What are the Recent Developments in Global Medical Management Market?

- In October 2025, Telehealth platform HealthTap announced its integration into LillyDirect, Eli Lilly’s digital health initiative, to provide virtual diabetes management services including medication management, lab reviews, and personalized preventive care enhancing digital medical management for chronic conditions such as diabetes

- In April 2025, Innovaccer Inc. announced the launch of its Agents of Care™ a suite of pre‑trained AI agents designed to automate repetitive tasks in case and care management, such as scheduling, intake, referrals, and authorization workflows, freeing up clinicians and care managers for higher‑value activities. The innovation integrates with existing healthcare systems and aims to improve operational efficiency and patient engagement

- In September 2024, Innovaccer introduced its Care Management Copilot, an AI‑powered tool that streamlines documentation, automates record summaries, and helps care managers spend more time engaging with patients significantly reducing administrative workload and enabling more proactive patient care planning

- In September 2024, MedRisk, a leader in managed healthcare services, finalized the acquisition of the Casualty Claims Solutions business (including StrataCare) from Conduent, expanding its medical bill review and clinical services portfolio a strategic move to broaden medical case and cost management offerings for insurers and employers

- In March 2023, MedRisk entered a strategic partnership in March 2023 to integrate telehealth services into its medical case management platform, enhancing remote care accessibility and hybrid delivery models reflecting broader adoption of virtual healthcare solutions

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.