Asia Pacific Obsessive Compulsive Disorder Ocd Drugs Market

Market Size in USD Million

CAGR :

%

USD

173.91 Million

USD

378.25 Million

2025

2033

USD

173.91 Million

USD

378.25 Million

2025

2033

| 2026 –2033 | |

| USD 173.91 Million | |

| USD 378.25 Million | |

|

|

|

|

Asia-Pacific Obsessive-Compulsive Disorder (OCD) Drugs Market Size

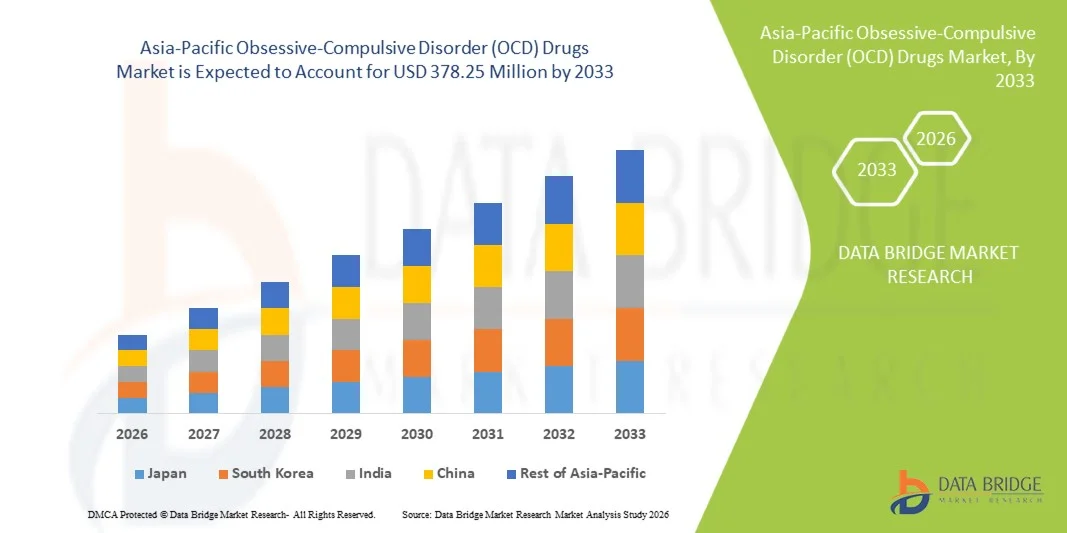

- The Asia-Pacific Obsessive-Compulsive Disorder (OCD) drugs market size was valued at USD 173.91 million in 2025 and is expected to reach USD 378.25 million by 2033, at a CAGR of 10.2% during the forecast period

- The market growth is largely fueled by the increasing diagnosis and treatment of OCD, rising mental health awareness, and innovation in drug therapies including antidepressants, antipsychotics, and NMDA‑blockers, leading to improved access in both adult and paediatric populations

- Furthermore, rising demand for effective, user-friendly, and integrated pharmaceutical solutions for OCD, along with growing adoption in hospitals and specialty clinics, is establishing drug therapies as the modern standard of care. These converging factors are accelerating the uptake of OCD drugs, thereby significantly boosting the industry's growth

Asia-Pacific Obsessive-Compulsive Disorder (OCD) Drugs Market Analysis

- OCD drugs, offering pharmacological treatment for obsessive-compulsive disorder, are increasingly vital components of mental health management in both adult and pediatric populations in Asia-Pacific due to their effectiveness in symptom reduction, improvements in quality of life, and integration with hospital and clinic-based care pathways

- The escalating demand for OCD drugs is primarily fueled by rising mental health awareness, increased diagnosis rates, growing adoption of antidepressants, antipsychotics, and NMDA blockers, and a preference for clinically proven pharmaceutical therapies over alternative interventions

- Japan dominated the Asia-Pacific OCD drugs market with the largest revenue share of 38.4% in 2025, characterized by well-established healthcare infrastructure, high awareness of mental health disorders, and strong presence of key pharmaceutical players, with hospitals and specialty clinics driving substantial growth in prescriptions, particularly for moderate to severe OCD cases

- China is expected to be the fastest-growing market in the region during the forecast period due to increasing urbanization, rising disposable incomes, and expanding access to hospital pharmacies, retail pharmacies, and online pharmacy channels

- Antidepressants segment dominated the OCD drugs market with a market share of 52.6% in 2025, driven by their established efficacy, safety profile, and wide adoption as first-line therapy

Report Scope and Asia-Pacific Obsessive-Compulsive Disorder (OCD) Drugs Market Segmentation

|

Attributes |

Asia-Pacific Obsessive-Compulsive Disorder (OCD) Drugs Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

Asia-Pacific

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework |

Asia-Pacific Obsessive-Compulsive Disorder (OCD) Drugs Market Trends

“Digital Health Integration and Telepsychiatry Expansion”

- A significant and accelerating trend in the Asia-Pacific OCD drugs market is the integration of digital health platforms and telepsychiatry services, enhancing treatment adherence and monitoring in both adult and pediatric populations

- For instance, telepsychiatry platforms in Japan and India are enabling psychiatrists to remotely adjust antidepressant dosages and monitor patient response, reducing hospital visits and improving continuity of care

- Digital tools integrated with OCD treatment allow real-time symptom tracking, medication reminders, and AI-driven insights into patient progress, improving personalized therapy outcomes

- Integration of AI-driven patient monitoring systems is helping identify early relapses and adjust treatment plans, improving therapy effectiveness and long-term adherence

- Telehealth-based consultations, combined with prescription delivery services, facilitate seamless access to OCD drugs across urban and semi-urban regions, particularly where specialist clinics are limited

- This trend toward digital integration and remote care is reshaping patient expectations, encouraging pharmaceutical companies to develop mobile-compatible solutions and connected therapy programs

- The demand for OCD treatments integrated with telepsychiatry and digital health monitoring is growing rapidly across hospitals, specialty clinics, and home healthcare, as patients prioritize convenience, adherence, and comprehensive mental health support.

Asia-Pacific Obsessive-Compulsive Disorder (OCD) Drugs Market Dynamics

Driver

“Increasing Diagnosis and Awareness of Mental Health Disorders”

- The rising mental health awareness campaigns and government initiatives promoting psychiatric screening are significant drivers for higher demand for OCD drugs

- For instance, in April 2025, Japan’s Ministry of Health expanded mental health outreach programs in schools and workplaces, increasing early detection of OCD and prescriptions of antidepressants and antipsychotics

- As patients and caregivers become more aware of OCD symptoms and available therapies, pharmaceutical treatments are increasingly adopted as first-line intervention

- Growing access to hospitals, specialty clinics, and pharmacy networks in countries such as China and India supports the distribution and uptake of OCD medications. The convenience of oral administration, broad approval of SSRIs, and the availability of telemedicine follow-ups are key factors propelling the adoption of OCD drugs in the Asia-Pacific region

- Increasing investment in R&D by pharmaceutical companies to develop novel therapies, including NMDA blockers for treatment-resistant OCD, is further driving market growth

- Partnerships between hospitals, specialty clinics, and online pharmacy platforms are expanding reach and improving patient access to OCD medications

- Rising government funding and insurance coverage for mental health treatments are reducing financial barriers, increasing affordability and adoption of OCD drugs across the region

Restraint/Challenge

“Side Effects and Treatment Adherence Concerns”

- Concerns regarding side effects, drug interactions, and long-term adherence pose significant challenges to market growth in Asia-Pacific

- For instance, high incidence of nausea, insomnia, or weight gain associated with SSRIs has led some patients to discontinue treatment prematurely, impacting overall therapy effectiveness

- Addressing these concerns through patient education, regular monitoring, and development of improved drug formulations is crucial for sustained adoption

- The relatively high cost of newer antipsychotics or NMDA-blocker therapies compared to conventional options can be a barrier for patients in developing regions, particularly for long-term treatment regimens

- While generic alternatives are available, patient reluctance due to perceived efficacy differences still hinders widespread uptake, especially in rural or price-sensitive markets

- Overcoming these challenges through enhanced patient support programs, affordable treatment options, and improved drug tolerability will be vital for sustained growth of the OCD drugs market in Asia-Pacific

- Limited availability of mental health specialists in remote areas restricts timely diagnosis and therapy initiation, constraining market expansion

- Regulatory delays in drug approvals and inconsistent insurance reimbursement policies across countries pose additional challenges for OCD drug adoption in Asia-Pacific

Asia-Pacific Obsessive-Compulsive Disorder (OCD) Drugs Market Scope

The market is segmented on the basis of severity, sub-type, drugs, route of administration, population type, end user, and distribution channel.

- By Severity

On the basis of severity, the OCD drugs market is segmented into mild to moderate and moderate to severe. The moderate to severe segment dominated the market with the largest revenue share of 60% in 2025, driven by higher prevalence of treatment-resistant cases and the need for intensive pharmacological therapy. Patients with moderate to severe OCD often require combination therapies such as SSRIs with antipsychotics or NMDA blockers, increasing prescription volumes and overall market value. Hospitals and specialty clinics typically prefer evidence-backed therapies for these patients, further boosting the segment. Government mental health programs in Japan, China, and India focus on early intervention for severe cases, supporting higher adoption of drugs. The chronic nature of moderate to severe OCD ensures continuous treatment cycles, contributing to recurring revenue for pharmaceutical companies. Pharmaceutical companies also invest in clinical trials targeting moderate to severe OCD, further consolidating this segment’s dominance.

The mild to moderate segment is expected to witness the fastest CAGR of ~14% from 2026 to 2033, fueled by rising mental health awareness and early diagnosis initiatives in urban and semi-urban Asia-Pacific regions. Increasing access to telepsychiatry platforms and online pharmacies enables patients with mild to moderate OCD to receive prescriptions conveniently, enhancing market penetration. Awareness campaigns and primary care screening programs are promoting early intervention, leading to greater adoption of antidepressants and behavioral therapies combined with drugs. Growth is also supported by government insurance schemes that increasingly cover mental health treatments, reducing cost barriers for mild cases. Pharmaceutical companies are developing safer, low-dose oral therapies suitable for mild to moderate OCD, improving patient adherence. The convenience and perceived safety of treating mild OCD pharmacologically encourage first-time users to adopt these medications, driving rapid growth.

- By Sub-Type

On the basis of sub-type, the market is segmented into contamination obsessions with washing/cleaning compulsions, harm obsessions with checking compulsions, obsessions without visible compulsions, symmetry obsessions with ordering, arranging and counting compulsions, hoarding, and others. The contamination obsessions with washing/cleaning compulsions segment dominated the market with 28% share in 2025, as it represents one of the most common and recognizable forms of OCD in Asia-Pacific. Patients often seek pharmacological therapy combined with cognitive behavioral therapy to manage symptoms, driving prescription volumes. The segment benefits from extensive clinical guidance for antidepressant selection, particularly SSRIs, ensuring standardized treatment protocols. High patient awareness and early recognition of symptoms in schools and workplaces contribute to consistent demand. Telehealth programs in Japan, China, and India have improved monitoring for this sub-type, boosting adherence and repeat prescriptions. Pharmaceutical companies often target this sub-type in clinical trials due to predictable symptom patterns and measurable outcomes.

The harm obsessions with checking compulsions segment is expected to witness the fastest CAGR of 15% from 2026 to 2033, fueled by rising recognition of non-visible OCD symptoms and better psychiatric screening programs. Early detection in pediatric and adult populations encourages timely pharmacological intervention, increasing drug adoption. The growth is further supported by telepsychiatry and digital health apps that help track compulsive checking behavior. Awareness campaigns highlighting the psychological impact of harm obsessions are increasing patient and caregiver engagement. Pharmaceutical research targeting treatment-resistant subtypes in this category is driving innovation in antipsychotics and NMDA blockers. Hospitals and specialty clinics increasingly emphasize personalized treatment for this sub-type, expanding its market potential.

- By Drugs

On the basis of drugs, the market is segmented into antidepressants, antipsychotics, NMDA blockers, and others. The antidepressants segment dominated the market with 52.6% share in 2025, driven by their established efficacy as first-line therapy for OCD across adult and pediatric populations. SSRIs and SNRIs are widely prescribed due to safety profiles, availability of generics, and strong clinical guidelines. Hospitals, specialty clinics, and telemedicine platforms predominantly recommend antidepressants for both mild and severe cases. Patient adherence programs and digital reminders improve treatment continuity, increasing prescription volumes. Growing awareness campaigns and insurance coverage for antidepressants further support market dominance. Pharmaceutical companies also invest in new formulations, such as extended-release or combination therapies, reinforcing the segment’s leadership.

The NMDA blockers segment is expected to witness the fastest CAGR of 16% from 2026 to 2033, fueled by rising focus on treatment-resistant OCD cases and clinical trials exploring innovative mechanisms. Adoption is increasing in tertiary hospitals and specialty clinics treating moderate to severe patients. NMDA blockers complement existing antidepressant regimens, expanding their utility in resistant cases. Awareness among psychiatrists about non-SSRI options is improving prescription rates. Research funding for NMDA blockers is growing in Japan, China, and India, accelerating product availability. This segment benefits from being positioned as a novel therapy for challenging OCD cases, creating high growth potential.

- By Route of Administration

On the basis of route of administration, the market is segmented into oral and parenteral. The oral administration segment dominated the market with 75% share in 2025, driven by ease of use, patient compliance, and broad availability in retail and hospital pharmacies. Oral formulations of antidepressants, antipsychotics, and NMDA blockers are preferred for long-term therapy, particularly for moderate to severe OCD cases. Telemedicine platforms often prescribe oral medications, simplifying access in remote regions. Patient adherence is higher due to convenience, portability, and minimal clinical supervision required. Pharmaceutical companies focus on improving oral bioavailability and tolerability, further reinforcing dominance. Government and insurance programs frequently cover oral therapies, enhancing accessibility.

The parenteral segment is expected to witness the fastest CAGR of 13% from 2026 to 2033, fueled by increasing adoption in treatment-resistant or acute OCD cases in hospitals and specialty clinics. Parenteral administration enables rapid onset of action and targeted therapy for severe patients. Hospitals with specialized psychiatric care units prefer injectable NMDA blockers and antipsychotics for controlled dosing. Growth is supported by rising awareness among psychiatrists about parenteral efficacy in refractory cases. Clinical research and hospital trials continue to expand the scope of parenteral therapies. The segment is also benefiting from training programs and hospital initiatives to administer injections safely and efficiently.

- By Population Type

On the basis of population type, the market is segmented into pediatrics and adults. The adult population segment dominated the market with 68% share in 2025, due to higher prevalence of diagnosed OCD in adults and consistent long-term treatment requirements. Adults are more such asly to seek hospital-based care, specialty clinics, and telepsychiatry services, contributing to higher prescription volumes. Awareness campaigns targeting workplace mental health and stress management also drive drug adoption. Insurance coverage and government schemes typically favor adult patients, improving affordability. Pharmaceutical companies invest in adult-focused clinical trials for novel antidepressants and NMDA blockers. Continuity of therapy in adults ensures recurring prescriptions, sustaining revenue streams.

The pediatrics segment is expected to witness the fastest CAGR of 14% from 2026 to 2033, fueled by rising diagnosis rates in schools and early intervention programs. Telepsychiatry and parental education programs improve adherence to therapy in children. Pediatric-friendly formulations such as liquid SSRIs and low-dose tablets are gaining popularity. Government mental health programs focusing on youth are expanding drug accessibility. Specialty clinics and pediatric hospitals increasingly adopt standardized treatment protocols. Awareness campaigns highlighting early detection benefits encourage caregivers to initiate pharmacological therapy, driving market growth.

- By End User

On the basis of end user, the market is segmented into hospitals, specialty clinics, home healthcare, and others. The hospitals segment dominated the market with 60% share in 2025, driven by high patient inflow, availability of psychiatric specialists, and access to advanced therapies. Hospitals manage both mild and severe OCD cases, providing prescription oversight and therapy monitoring. Integration of telepsychiatry in hospital settings enhances treatment continuity. Hospitals also participate in clinical trials, increasing access to newer antidepressants and NMDA blockers. Insurance coverage for hospital-prescribed drugs improves affordability. Government mental health initiatives often route patients through hospitals first, boosting their market dominance.

The home healthcare segment is expected to witness the fastest CAGR of 15% from 2026 to 2033, fueled by rising adoption of telepsychiatry, digital health apps, and remote monitoring. Patients with mild to moderate OCD increasingly prefer treatment at home due to convenience and reduced stigma. Home healthcare services provide medication delivery, adherence support, and remote follow-ups. Technological advancements in remote symptom tracking enhance market appeal. Pharmaceutical companies partner with home healthcare providers to expand drug reach. Growing awareness and affordability further accelerate adoption in urban and semi-urban regions.

- By Distribution Channel

On the basis of distribution channel, the market is segmented into hospital pharmacy, retail pharmacy, online pharmacy, and others. The hospital pharmacy segment dominated the market with ~40% share in 2025, driven by direct access to psychiatrists, integration with patient monitoring systems, and insurance reimbursement schemes. Hospitals ensure adherence to prescribed therapies and offer full drug portfolio options including antidepressants, antipsychotics, and NMDA blockers. Patients with moderate to severe OCD predominantly rely on hospital pharmacies for consistent drug supply. Telemedicine prescriptions are often routed through hospital pharmacies. Government initiatives supporting hospital-based psychiatric care further reinforce dominance. Hospitals also facilitate clinical trials and early access programs, sustaining revenue share.

The online pharmacy segment is expected to witness the fastest CAGR of 18% from 2026 to 2033, fueled by increasing digital health adoption, telepsychiatry consultations, and the convenience of doorstep delivery. Online platforms are particularly attractive for mild to moderate OCD patients and urban tech-savvy populations. Digital adherence tools, subscription-based medication deliveries, and telephonic pharmacist support enhance convenience. Expansion of online pharmacies in India, China, and Japan accelerates market penetration. Partnerships with telepsychiatry platforms drive prescriptions through digital channels. Rising awareness of mental health and ease of home delivery contribute to rapid adoption of online pharmacy channels.

Asia-Pacific Obsessive-Compulsive Disorder (OCD) Drugs Market Regional Analysis

- Japan dominated the Asia-Pacific OCD drugs market with the largest revenue share of 38.4% in 2025, characterized by well-established healthcare infrastructure, high awareness of mental health disorders, and strong presence of key pharmaceutical players, with hospitals and specialty clinics driving substantial growth in prescriptions, particularly for moderate to severe OCD cases

- Patients and caregivers in the region increasingly value the efficacy, safety, and availability of pharmacological therapies, including antidepressants, antipsychotics, and NMDA blockers, for both adult and pediatric OCD populations

- This widespread adoption is further supported by growing government initiatives, telepsychiatry services, and expanding pharmacy networks, establishing OCD drugs as the preferred treatment solution across residential, clinical, and hospital settings in Asia-Pacific

The Japan Obsessive-Compulsive Disorder (OCD) Drugs Market Insight

The Japan OCD drugs market is gaining momentum due to high mental health awareness, advanced healthcare infrastructure, and early adoption of telepsychiatry and digital health platforms. Patients and caregivers increasingly value effective pharmacological therapies, including SSRIs and NMDA blockers, for both adult and pediatric populations. Hospitals and specialty clinics play a central role in prescribing and monitoring therapy. Moreover, government programs supporting mental health screening and early intervention are driving adoption. Japan's aging population is also such asly to increase demand for accessible and easy-to-administer OCD drug treatments in residential and clinical settings.

India Obsessive-Compulsive Disorder (OCD) Drugs Market Insight

The India OCD drugs market accounted for the largest revenue share in Asia-Pacific in 2025, attributed to rising mental health awareness, rapid urbanization, and improving access to psychiatric care. India has a growing base of hospitals, specialty clinics, and online pharmacy platforms, which enhances accessibility and treatment adherence. The expanding middle class, coupled with increasing acceptance of pharmacological therapy for OCD, is propelling market growth. Furthermore, government initiatives, telepsychiatry expansion, and mental health campaigns in schools and workplaces are improving diagnosis rates. Affordable drug options, growing local pharmaceutical manufacturing, and rising insurance coverage further support the uptake of OCD medications in residential and clinical populations.

China Obsessive-Compulsive Disorder (OCD) Drugs Market Insight

The China OCD drugs market is expected to expand at a considerable CAGR during the forecast period, fueled by rising mental health awareness, increasing prevalence of OCD, and growing access to specialty clinics and hospitals. Patients increasingly prioritize effective treatments such as SSRIs, antipsychotics, and NMDA blockers, supported by government mental health initiatives and insurance coverage. Urbanization, digital health platforms, and online pharmacy services enhance accessibility and adherence, particularly in metropolitan regions. Moreover, the expansion of mental health infrastructure, including telepsychiatry services, is contributing to sustained growth in drug prescriptions.

South Korea Obsessive-Compulsive Disorder (OCD) Drugs Market Insight

The South Korea OCD drugs market is witnessing steady growth, driven by high mental health awareness, advanced healthcare infrastructure, and early adoption of digital health solutions. Hospitals and specialty clinics play a central role in prescribing antidepressants and antipsychotics, while telepsychiatry platforms are improving patient access and adherence. For instance, government-supported mental health programs in schools and workplaces are identifying OCD symptoms earlier, increasing the uptake of pharmacological treatments. In addition, rising urbanization, increasing disposable incomes, and cultural acceptance of psychiatric therapy are driving the market. The availability of affordable drugs and well-established insurance coverage further support sustained growth in both adult and pediatric populations.

Asia-Pacific Obsessive-Compulsive Disorder (OCD) Drugs Market Share

The Asia-Pacific Obsessive-Compulsive Disorder (OCD) Drugs industry is primarily led by well-established companies, including:

- Pfizer Inc., (U.S.)

- GSK plc, (U.K.)

- H. Lundbeck A/S (Denmark)

- Sun Pharmaceutical Industries Ltd. (India)

- Eli Lilly and Company (U.S.)

- AbbVie (U.S.)

- Takeda Pharmaceutical Company Limited, (Japan)

- Novartis AG (Switzerland)

- Lupin (India)

- Dr. Reddy’s Laboratories Ltd., (India)

- Teva Pharmaceutical Industries Ltd., (Israel)

- Zydus Group (India)

- Aurobindo Pharma Limited (India)

- Alvogen (U.S.)

- Par Health (U.S.)

- Apotex Inc (Canada)

- Wockhardt (India)

- Amneal Pharmaceuticals LLC (U.S.)

- Sebela Pharmaceuticals Inc. (U.S.)

- Otsuka Pharmaceutical Co., Ltd., (Japan)

What are the Recent Developments in Asia-Pacific Obsessive-Compulsive Disorder (OCD) Drugs Market?

- In June 2025, a peer‑reviewed study in Japan found that patients with the “self‑contamination” subtype of OCD showed markedly poorer treatment response to standard SSRIs + CBT compared to other contamination or checking subtypes. This has important implications for regional drug development and regimen personalization in Asia‑Pacific markets

- In April 2024, India’s regulatory & health policy documents noted an increased focus on mental‑health drug launches and greater prioritization of psychiatric conditions including OCD through revised essential medicine lists and screening programmes in urban/rural settings this bolsters access to OCD drugs and signals growing market opportunity for India and the broader region

- In January 2024, a translational research article from Japan reported that proton‑pump inhibitors (PPIs) reduced incidence of OCD‑such as behaviour in real‑world data and animal models, highlighting a novel mechanistic pathway that could inspire new pharmacologic approaches for treatment‑resistant OCD in Asia‑Pacific

- In December 2023, Otsuka Pharmaceutical Co., Ltd. announced approval in Japan for the antipsychotic brexpiprazole for an additional indication of adjunctive treatment in depression for patients with inadequate response to antidepressants. While not directly approved for OCD, this expansion signals Japanese regulator openness to broader psychiatric indications and may pave the way for future OCD‑adjunct applications

- In April 2023, an Asia‑Pacific meta‑analysis assessed the efficacy of the SSRI fluvoxamine in OCD patients and found significant superiority over placebo in reducing symptoms in trials covering 1,745 OCD patients, including Asian cohorts validating the first‑line role of SSRIs in the region and reinforcing the therapeutic base for the drug class

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.