Asia Pacific Otoscope Devices Market

Market Size in USD Million

CAGR :

%

USD

49.14 Million

USD

72.60 Million

2025

2033

USD

49.14 Million

USD

72.60 Million

2025

2033

| 2026 –2033 | |

| USD 49.14 Million | |

| USD 72.60 Million | |

|

|

|

|

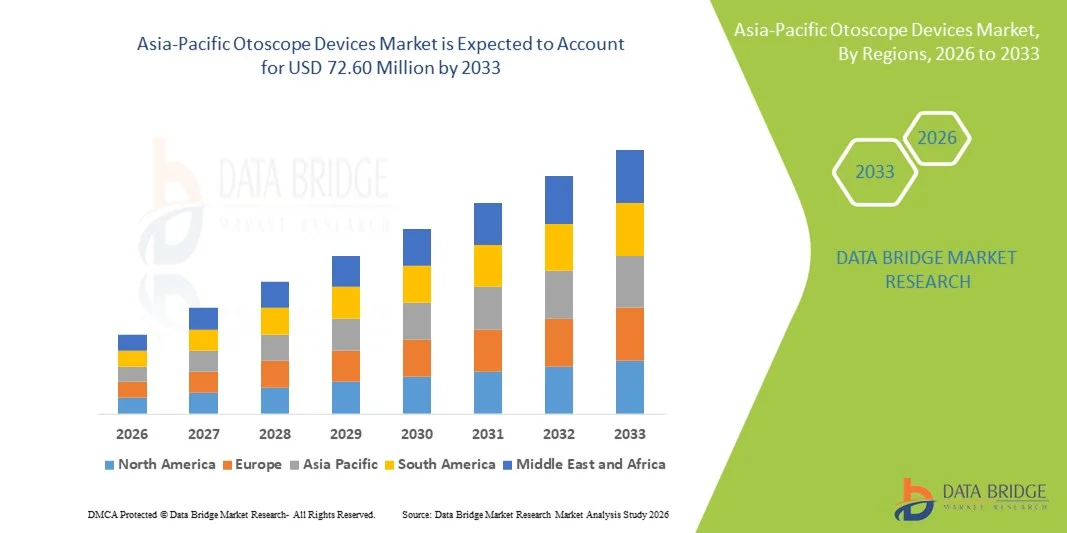

Asia-Pacific Otoscope Devices Market Size

- The Asia-Pacific otoscope devices market size was valued at USD 49.14 million in 2025 and is expected to reach USD 72.60 million by 2033, at a CAGR of 5.0% during the forecast period

- The market growth is largely fueled by expanding healthcare infrastructure across emerging economies, rising prevalence of ear and hearing disorders, and increasing awareness among clinicians and patients regarding early diagnostic care, which together are driving demand for more advanced and user‑friendly otoscope solutions

- Furthermore, technological adoption in portable and digital otoscope variants offering enhanced visualization and connectivity with electronic health records alongside broader ENT care integration in clinics and hospitals, is strengthening the region’s position as a rapidly growing segment within the global otoscope devices market

Asia-Pacific Otoscope Devices Market Analysis

- Otoscope devices, used for examining the ear canal and eardrum, are increasingly vital components of modern ENT care in both hospitals and clinics due to their diagnostic accuracy, portability, and integration with digital imaging and electronic health record systems

- The escalating demand for otoscope devices is primarily fueled by expanding healthcare infrastructure, rising prevalence of ear and hearing disorders, and growing awareness among clinicians and patients about the importance of early diagnosis and preventive care

- China dominated the Asia-Pacific otoscope devices market with a revenue share of 25.7% in 2025, characterized by large patient populations, rapid development of healthcare facilities, and increasing adoption of modern ENT diagnostic technologies

- Japan is expected to be the fastest growing country in the Asia-Pacific market during the forecast period due to advanced healthcare systems, early adoption of portable and video otoscopes, and rising focus on improving outpatient ENT services

- Video Otoscope segment dominated the Asia-Pacific otoscope devices market with a market share of 45.9% in 2025, driven by enhanced visualization, recording capabilities, and increasing use in both clinical and surgical applications

Report Scope and Asia-Pacific Otoscope Devices Market Segmentation

|

Attributes |

Asia-Pacific Otoscope Devices Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

Asia-Pacific

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework |

Asia-Pacific Otoscope Devices Market Trends

Digital Integration and Tele-ENT Adoption

- A significant and accelerating trend in the Asia-Pacific otoscope devices market is the growing integration of video-enabled and connected otoscopes with digital health platforms and telemedicine solutions, enhancing remote diagnostics and patient monitoring

- For instance, video otoscopes with Wi-Fi connectivity allow ENT specialists in urban hospitals to remotely examine patients in rural clinics, enabling timely diagnosis and consultation without physical travel

- Digital integration enables features such as storing high-resolution ear images in electronic health records, sharing data across departments, and providing AI-assisted diagnostic support for early detection of ear disorders

- The seamless connection of otoscopes with telehealth platforms allows healthcare providers to manage ENT diagnostics alongside other patient data, creating a unified and efficient clinical workflow

- This trend towards connected, intuitive, and remotely accessible otoscope devices is reshaping expectations for ENT diagnostics, prompting companies to develop tele-ENT compatible video otoscopes with cloud storage and AI-assisted analysis

- The demand for digitally integrated otoscope devices is growing rapidly across hospitals, ENT centers, and clinics, as healthcare providers prioritize accurate, fast, and remote diagnostic capabilities

- Increasing focus on minimally invasive diagnostics and combined ENT-surgical solutions is driving innovation in multifunctional otoscope devices across Asia-Pacific markets

Asia-Pacific Otoscope Devices Market Dynamics

Driver

Rising Prevalence of Ear Disorders and Expanding Healthcare Infrastructure

- The increasing incidence of ear infections, hearing loss, and related disorders, combined with investments in modern healthcare infrastructure, is a major driver for otoscope device adoption

- For instance, in March 2025, a leading hospital network in India announced deployment of connected video otoscopes across rural clinics to improve early diagnosis of ear conditions

- As clinicians seek accurate and efficient diagnostic tools, otoscopes offer features such as high-resolution imaging, LED illumination, and portability, providing a substantial upgrade over traditional examination methods

- Furthermore, the rising emphasis on preventive healthcare and early screening programs in countries such as China, Japan, and Australia is making otoscopes an integral part of routine ENT care

- The ease of use, portability, and compatibility with electronic health records, along with growing awareness among healthcare providers and patients, are key factors driving adoption in hospitals, ENT centers, and clinics

- Government initiatives to expand hearing screening in schools and community health centers are creating new demand channels for otoscope devices

- Increasing investments by private clinics in urban centers for advanced diagnostic tools are boosting the adoption of digital and video otoscopes

Restraint/Challenge

High Costs and Limited Awareness in Rural Areas

- The relatively high cost of advanced video and digital otoscopes poses a challenge to broader adoption in price-sensitive markets within Asia-Pacific, especially in rural areas

- For instance, smaller clinics in remote regions of India and Indonesia face budget constraints that limit access to high-end diagnostic devices despite growing healthcare needs

- Addressing affordability through low-cost portable models and government subsidies is essential for expanding market penetration across underserved regions

- Additionally, limited awareness and training among clinicians in rural areas regarding digital otoscope capabilities can hinder effective utilization and adoption

- Overcoming these challenges through awareness campaigns, professional training programs, and affordable device options will be vital for sustained growth in the Asia-Pacific otoscope devices market

- Inconsistent regulatory standards across Asia-Pacific countries for medical diagnostic devices can slow product approvals and market entry

- Maintenance requirements and the need for regular calibration of high-end digital otoscopes can deter adoption among smaller clinics with limited technical staff

Asia-Pacific Otoscope Devices Market Scope

The market is segmented on the basis of product, portability, type, mobility, application, end user, and distribution channel.

- By Product

On the basis of product, the Asia-Pacific otoscope devices market is segmented into pocket otoscope, full size otoscope, and video otoscope. The Video Otoscope segment dominated the market with a market share of 45.9% in 2025, driven by its enhanced visualization, real-time imaging, and growing adoption in both clinical and surgical applications. Clinicians prefer video otoscopes for their ability to connect with digital platforms, store high-resolution images, and enable remote consultations in tele-ENT programs. Rising awareness of early detection of hearing and ear disorders, particularly in urban and semi-urban areas, is fueling the demand. Integration with electronic health records, Wi-Fi connectivity, and AI-assisted diagnostic tools further strengthens its market leadership. The increasing use of video otoscopes in teaching hospitals and ENT training programs also contributes to their dominance.

The Full Size Otoscope segment is anticipated to witness the fastest growth rate from 2026 to 2033, fueled by its ergonomic design, robust performance, and continued preference in hospitals and ENT centers for high-volume diagnostic workflows. Full-size otoscopes are also valued for compatibility with a range of accessories and lighting options, enhancing clinical efficiency and diagnostic accuracy. The segment also benefits from compatibility with a wide range of accessories, including specula and lighting options, which enhances diagnostic accuracy. Its widespread adoption in surgical and diagnostic applications further cements its market leadership. The demand is further supported by training programs in medical colleges that use full-size models for teaching purposes. Hospitals and specialty ENT centers prioritize full-size otoscopes for their reliability and proven clinical effectiveness

- By Portability

On the basis of portability, the market is segmented into wall-mounted, hand-held, and standalone. The Hand-Held segment dominated the market in 2025, owing to its flexibility, ease of use, and portability across different hospital departments and outpatient clinics. Hand-held otoscopes allow clinicians to examine patients in various settings, including bedside consultations and mobile health camps, making them highly preferred. The segment is also widely used in routine check-ups and preventive screenings, enhancing its adoption. Ergonomic designs and lightweight construction further contribute to clinician comfort during extended use. Compatibility with different lighting options and diagnostic tools strengthens the hand-held otoscope’s dominance. Hospitals and ENT centers in high-volume regions rely heavily on hand-held models for efficiency and practicality.

The Standalone segment is expected to witness the fastest CAGR from 2026 to 2033, driven by the growing need for portable, self-contained devices that can function independently in rural or remote healthcare setups. Standalone otoscopes with integrated imaging and wireless connectivity allow clinicians to conduct examinations without relying on external power sources or complex setups. Rising demand from telemedicine programs and mobile health initiatives in countries such as India and China further accelerates growth. The convenience of standalone devices in outreach and community health programs makes this segment highly attractive for rapid deployment.

- By Type

On the basis of type, the market is segmented into wired and wireless otoscopes. The Wired segment dominated the market in 2025 due to its reliability, consistent power supply, and superior image quality, which is critical for surgical and high-precision diagnostic applications. Wired otoscopes are widely used in hospitals and ENT centers where uninterrupted operation is essential. Their durability and compatibility with multiple accessories make them preferred for long-term clinical use. Training institutions also favor wired otoscopes for hands-on teaching. The segment’s strong presence in established medical facilities ensures continued market dominance. Maintenance and repair networks are more mature for wired devices, providing additional assurance to healthcare providers.

The Wireless segment is anticipated to witness the fastest growth from 2026 to 2033, fueled by increasing adoption of portable digital otoscopes and tele-ENT applications. Wireless otoscopes enable mobility, remote consultations, and easy integration with smartphones or cloud platforms, which is highly appealing in remote and semi-urban areas. Rising interest from private clinics and home healthcare providers further drives adoption. The segment benefits from innovations in battery efficiency, compact design, and seamless wireless connectivity. Wireless devices are also preferred for outreach programs and mobile screening initiatives, enhancing their growth potential.

- By Mobility

On the basis of mobility, the market is segmented into rigid and flexible otoscopes. The Rigid segment dominated the market in 2025 due to its precise control, durability, and standard use in hospitals and ENT centers. Rigid otoscopes provide consistent diagnostic results and are widely utilized in both clinical and surgical applications. Their compatibility with high-intensity light sources and imaging accessories makes them suitable for detailed examination. Rigid devices are preferred in teaching hospitals for training and practice. High adoption in routine ENT checkups and outpatient procedures ensures strong market share. Reliability and long lifespan reinforce dominance in institutional settings.

The Flexible segment is expected to witness the fastest growth from 2026 to 2033, driven by advancements in miniaturization and endoscopic technologies. Flexible otoscopes allow better navigation in complex ear structures, improving diagnostic accuracy for specific ENT disorders. Rising adoption in specialized ENT clinics and surgical centers fuels market expansion. Growth is also supported by technological improvements in image resolution and maneuverability. Flexible otoscopes are increasingly used in telemedicine setups and remote diagnostic programs. Clinicians value flexible otoscopes for patient comfort and enhanced procedural capabilities.

- By Application

On the basis of application, the market is segmented into diagnosis and surgical. The Diagnosis segment dominated the market in 2025 due to the large volume of routine ear examinations in hospitals, clinics, and ENT centers. Diagnostic otoscopes are widely used for early detection of ear infections, hearing loss, and other ear-related disorders. They are essential tools in preventive healthcare and school or community screening programs. Compatibility with digital and video imaging enhances their utility. High adoption in both urban and semi-urban areas sustains market dominance. The ease of use and lower cost compared to surgical otoscopes further support their wide usage.

The Surgical segment is expected to witness the fastest CAGR from 2026 to 2033, driven by increasing ENT surgeries and minimally invasive procedures in Asia-Pacific countries. Surgical otoscopes offer enhanced optics, precision, and integration with video systems for advanced procedures. Growing investments in hospital infrastructure and rising patient awareness of surgical interventions contribute to market growth. Integration with recording and telemedicine solutions for surgical training further fuels adoption. Advanced surgical otoscopes improve procedural outcomes and are increasingly used in high-volume ENT centers.

- By End User

On the basis of end user, the market is segmented into hospitals, ENT centres, and clinics. The Hospitals segment dominated the market in 2025 due to high patient inflow, investment capacity, and preference for advanced diagnostic tools. Hospitals utilize otoscopes across departments, including ENT, pediatrics, and general health checkups. Their purchasing power and maintenance capabilities favor adoption of high-end devices. Hospitals also lead in training programs for clinicians, increasing demand for full-featured otoscopes. Strong adoption in public and private hospitals ensures continued market leadership. Their integration with hospital information systems further enhances usage.

The ENT Centres segment is expected to witness the fastest growth from 2026 to 2033, fueled by the rise of specialized ENT clinics in urban centers and increasing awareness about ear and hearing care. ENT centers prioritize advanced video and digital otoscopes for precise diagnostics. Growth is supported by rising outpatient visits and focus on specialty care. Flexible and wireless devices are increasingly adopted in ENT centers. Expansion of private ENT chains in countries such as India, China, and Japan accelerates this segment’s growth.

- By Distribution Channel

On the basis of distribution channel, the market is segmented into direct tender and retail sales. The Direct Tender segment dominated the market in 2025 due to bulk procurement by hospitals, government health programs, and institutional buyers. Direct tenders allow large-scale purchases, cost advantages, and long-term maintenance contracts. Hospitals and ENT centers prefer direct tender procurement for standardized devices and consistent supply. Strong government and institutional participation ensures the dominance of this channel. Long-term contracts with manufacturers enhance service reliability and reduce operational risks.

The Retail Sales segment is expected to witness the fastest growth from 2026 to 2033, driven by rising adoption in private clinics, small hospitals, and individual ENT practitioners. Retail channels provide flexibility, smaller order quantities, and access to a wide variety of models. Online retail platforms and e-commerce availability are boosting accessibility. Private clinics increasingly rely on retail purchases for faster procurement. Expansion of telemedicine and home healthcare solutions contributes to retail growth.

Asia-Pacific Otoscope Devices Market Regional Analysis

- China dominated the Asia-Pacific otoscope devices market with a revenue share of 25.7% in 2025, characterized by large patient populations, rapid development of healthcare facilities, and increasing adoption of modern ENT diagnostic technologies

- Healthcare providers in China highly value the accuracy, portability, and integration of otoscope devices with digital imaging and telemedicine platforms, which enhance patient care, diagnostic efficiency, and remote consultations

- This widespread adoption is further supported by rising disposable incomes, government initiatives promoting early detection and preventive ear care, and the growing presence of private ENT clinics, establishing otoscope devices as the preferred diagnostic solution across both public and private healthcare settings

The China Otoscope Devices Market Insight

The China otoscope devices market captured the largest revenue share of 25.7% in 2025, fueled by rapid urbanization, expanding healthcare infrastructure, and increasing patient awareness of ear and hearing disorders. Hospitals and ENT centers in China are increasingly adopting video and digital otoscopes for accurate diagnosis and integration with telemedicine platforms. Rising disposable incomes, government initiatives promoting preventive healthcare, and strong investments in both public and private healthcare facilities are driving market growth. Moreover, the presence of domestic manufacturers offering cost-effective solutions enhances accessibility across urban and semi-urban regions.

Japan Otoscope Devices Market Insight

The Japan otoscope devices market is witnessing steady growth, driven by a high-tech healthcare system, advanced ENT diagnostics, and increasing focus on outpatient and preventive care. Japanese hospitals and clinics are adopting portable, wireless, and video otoscopes for routine examinations and surgical procedures. The integration of otoscopes with electronic health records and tele-ENT platforms is improving workflow efficiency. Additionally, Japan’s aging population increases demand for accessible and precise diagnostic tools, while rising awareness of hearing health in schools and elderly care centers further supports adoption.

India Otoscope Devices Market Insight

The India otoscope devices market accounted for the largest revenue share in Asia-Pacific after China in 2025, attributed to rapid urbanization, a growing middle class, and increasing access to modern healthcare facilities. Hospitals, clinics, and ENT centers are adopting digital and video otoscopes to improve diagnostic accuracy and patient care. Government initiatives promoting community screening programs and telemedicine services in rural areas are expanding the reach of otoscope devices. Furthermore, rising technological adoption and domestic manufacturing of affordable otoscopes make these devices increasingly accessible across residential and clinical settings.

South Korea Otoscope Devices Market Insight

The South Korea otoscope devices market is expected to witness moderate growth, fueled by advanced healthcare infrastructure, rising ENT specialty clinics, and high adoption of digital health technologies. Hospitals and clinics in urban centers are increasingly integrating wireless and video otoscopes for precise diagnostic and surgical applications. The government’s emphasis on preventive healthcare and telemedicine programs is further supporting market expansion. In addition, rising awareness about hearing disorders and the availability of modern, user-friendly devices are encouraging widespread adoption in both hospitals and private clinics.

Asia-Pacific Otoscope Devices Market Share

The Asia-Pacific Otoscope Devices industry is primarily led by well-established companies, including:

- Welch Allyn, Inc. (U.S.)

- American Diagnostic Corporation (U.S.)

- HEINE Optotechnik GmbH & Co. KG (Germany)

- Rudolf Riester GmbH (Germany)

- 3M (U.S.)

- Olympus Corporation (Japan)

- GF Health Products, Inc. (U.S.)

- Luxamed GmbH & Co. KG (Germany)

- Kirchner & Wilhelm GmbH + Co. KG (KaWe) (Germany)

- SyncVision Technology Corporation (Canada)

- Firefly Global Ltd. (U.K.)

- CellScope, Inc. (U.S.)

- Inventis SRL (Italy)

- Zumax Medical Co., Ltd. (China)

- Orlvision GmbH (Germany)

- Mindmark Corporation (U.S.)

- Optomic España S.A. (Spain)

- Medline Industries, Inc. (U.S.)

- Dr. Mom Otoscopes (U.S.)

What are the Recent Developments in Asia-Pacific Otoscope Devices Market?

- In August 2025, digital otoscopes with advanced precision imaging and wireless connectivity were highlighted as increasingly central to ENT diagnostics and telehealth consultations, reflecting broader adoption trends of high‑definition and connected otoscopic technology in modern ear health care settings

- In June 2025, an MDPI‑published clinical evaluation study of a pen‑shaped otoscope designed for telemedicine and office‑based otologic exams demonstrated its feasibility and patient acceptability, highlighting how new form factors are entering real‑world clinical workflows, particularly relevant for countries with growing tele‑ENT adoption in Asia‑Pacific

- In February 2025, JEDMED and Otologic Tech collaborated to launch an AI‑enabled digital otoscope that integrates real‑time analysis of ear conditions, streamlining ENT examinations and helping healthcare providers in telemedicine and clinical care improve diagnostic accuracy

- In August 2024, researchers reported the development of a new OCT‑integrated otoscope that combines traditional otoscopy with optical coherence tomography (OCT) to provide deeper imaging of ear structures, improving diagnostic capabilities for hearing clinics. This advancement has potential to enhance ear disease diagnosis and support clinicians in Asia‑Pacific diagnostic settings

- In March 2024, Otorion Medical and Philips announced a strategic collaboration to integrate AI‑enhanced otoscope imaging into Philips’ diagnostic solutions, aiming to improve clinician diagnostic capabilities with higher‑precision otoscopic imaging paired with broader clinical hardware and software systems

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.