Asia Pacific Parasitology Identification Market

Market Size in USD Million

CAGR :

%

USD

873.20 Million

USD

1,445.15 Million

2025

2033

USD

873.20 Million

USD

1,445.15 Million

2025

2033

| 2026 –2033 | |

| USD 873.20 Million | |

| USD 1,445.15 Million | |

|

|

|

|

Asia-Pacific Parasitology Identification Market Size

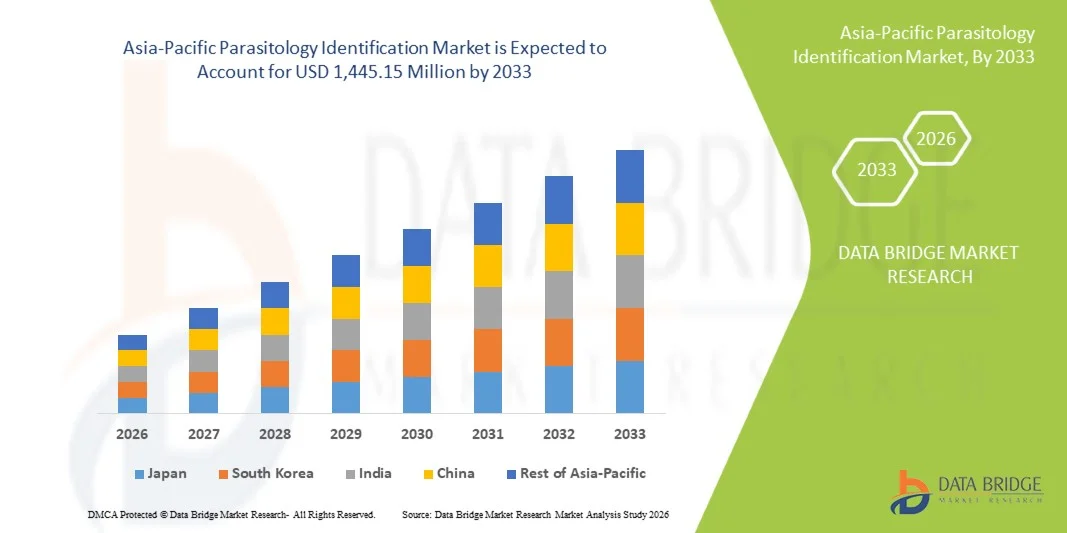

- The Asia-Pacific parasitology identification market size was valued at USD 873.20 million in 2025 and is expected to reach USD 1,445.15 million by 2033, at a CAGR of 6.5% during the forecast period

- The market growth is largely fueled by the rising prevalence of parasitic infections, increased adoption of advanced diagnostic techniques such as molecular diagnostics, and growing demand for accurate and rapid identification of parasites in both clinical and research settings

- Furthermore, expanding healthcare infrastructure, increased number of diagnostic laboratories, and rising awareness of parasitic diseases are establishing parasitology identification solutions as a key component of effective disease management in the region

Asia-Pacific Parasitology Identification Market Analysis

- Parasitology identification solutions, providing precise detection and characterization of parasites in clinical and research settings, are increasingly vital components of modern healthcare and diagnostic systems across hospitals, laboratories, and research institutions due to their enhanced accuracy, rapid results, and integration with advanced diagnostic platforms

- The escalating demand for parasitology identification solutions is primarily fueled by the rising prevalence of parasitic infections, growing awareness of parasitic diseases, and the adoption of advanced diagnostic techniques such as fecal identification, morphological identification, and immunological techniques

- China dominated the Asia‑Pacific parasitology identification market with the largest revenue share of 36.8% in 2025, characterized by well-established healthcare infrastructure, high government healthcare spending, and the presence of leading diagnostic companies, with hospitals and research centers experiencing substantial adoption of advanced parasitology testing solutions

- India is expected to be the fastest-growing country in the Asia‑Pacific parasitology identification market during the forecast period due to increasing healthcare infrastructure development, rising disposable incomes, and growing public health initiatives targeting parasitic diseases

- Fecal identification segment dominated the Asia‑Pacific parasitology identification market with a market share of 39.5% in 2025, driven by its widespread applicability, cost-effectiveness, and high demand for routine parasitic testing in both diagnostic centers and hospitals

Report Scope and Asia-Pacific Parasitology Identification Market Segmentation

|

Attributes |

Asia-Pacific Parasitology Identification Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

Asia-Pacific

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework |

Asia-Pacific Parasitology Identification Market Trends

“Adoption of Automated and AI-Assisted Diagnostic Tools”

- A significant and accelerating trend in the Asia‑Pacific parasitology identification market is the increasing adoption of automated and AI-assisted diagnostic tools, which enhance accuracy, reduce manual workload, and accelerate parasite detection

- For instance, AI-enabled microscopy systems can automatically identify parasite morphology in blood and fecal samples, minimizing human error and improving laboratory throughput

- AI integration in parasitology identification enables features such as learning sample patterns to optimize testing workflows and providing intelligent alerts for abnormal parasite counts. For instance, some automated fecal analysis systems can flag unusual findings and notify lab personnel in real time

- The seamless integration of parasitology identification systems with laboratory information management platforms facilitates centralized tracking and analysis of infection data. Through a single interface, labs can manage multiple tests, monitor trends, and generate reports efficiently

- This trend towards more intelligent, automated, and interconnected diagnostic systems is fundamentally reshaping expectations for laboratory efficiency and accuracy. Consequently, companies such as DiaSys and Sysmex are developing AI-enabled diagnostic solutions with features such as automated parasite recognition and workflow optimization

- The demand for parasitology identification solutions that offer AI-assisted automation and real-time reporting is growing rapidly across hospitals and diagnostic centers, as healthcare providers increasingly prioritize accuracy, speed, and workflow efficiency

Asia-Pacific Parasitology Identification Market Dynamics

Driver

“ising Prevalence of Parasitic Infections and Increasing Diagnostic Awareness”

- The increasing prevalence of parasitic infections, coupled with growing awareness among healthcare providers and patients about the importance of accurate diagnostics, is a significant driver for market growth

- For instance, in 2024, diagnostic centers in India and China expanded parasitology testing services to meet rising clinical demand, emphasizing early detection and management of parasitic diseases

- Advanced diagnostic solutions such as fecal identification, morphological identification, and immunological techniques provide reliable and rapid results, encouraging wider adoption in hospitals and laboratories

- Furthermore, government initiatives and public health programs targeting parasitic disease control are increasing investments in diagnostic infrastructure across Asia‑Pacific

- The growing need for precise, high-throughput, and cost-effective testing capabilities, combined with rising funding for parasitic disease surveillance, is propelling market expansion

- Rising adoption of rapid diagnostic tests (RDTs) in point-of-care settings is further driving demand for faster and decentralized parasitology diagnostics

- Increasing collaborations between private diagnostic companies and public health organizations are expanding access to advanced parasitology testing across remote and underserved regions

Restraint/Challenge

“Shortage of Skilled Workforce and High Equipment Costs”

- The limited availability of trained laboratory personnel capable of accurately performing parasitology identification procedures poses a significant challenge to market growth

- For instance, smaller diagnostic centers in rural Asia‑Pacific often struggle to hire and retain skilled technicians for advanced parasitology testing

- High costs associated with purchasing and maintaining automated and AI-assisted diagnostic equipment can hinder adoption, particularly for budget-constrained facilities

- While consumables and basic testing equipment are affordable, sophisticated platforms such as molecular or immunological systems require substantial capital investment

- Overcoming these challenges through workforce training, government support, and development of cost-effective diagnostic solutions will be vital for sustained market growth

- Limited awareness among smaller clinics about advanced diagnostic methods can delay adoption of automated and AI-assisted parasitology tools

- Inconsistent regulatory standards across countries in Asia‑Pacific may create hurdles for the approval and deployment of novel diagnostic equipment

Asia-Pacific Parasitology Identification Market Scope

The market is segmented on the basis of product, methods, pathogen type, sample, stool concentration & sample preparation, and end user.

- By Product

On the basis of products, the market is segmented into devices, consumables & accessories. The Consumables & Accessories segment dominated the market with the largest revenue share of 41.2% in 2025. This is driven by the high recurring demand for reagents, test kits, slides, stains, and sample containers required for routine parasitology testing in hospitals and diagnostic centers. Consumables are essential for both traditional and automated diagnostic methods, ensuring consistent testing quality and accuracy. Their recurring usage provides a stable revenue stream for suppliers, making this segment critical to market stability. In addition, consumables are widely used in research labs and government disease surveillance programs, further cementing their dominance. High adoption in emerging economies such as China and India also contributes to the segment’s significant market share.

The Devices segment is expected to witness the fastest CAGR of 15.4% from 2026 to 2033, fueled by the rising adoption of automated diagnostic equipment and AI-assisted microscopy systems. Devices such as automated fecal analyzers, microscopes, and molecular testing platforms improve testing speed and accuracy. Increasing investments in advanced laboratory infrastructure and government health initiatives are driving hospitals and diagnostic centers to adopt state-of-the-art devices. The trend toward workflow automation and high-throughput testing is also boosting demand for new devices in both clinical and research settings.

- By Methods

On the basis of methods, the market is segmented into fecal identification, morphological identification, molecular techniques, Maldi-TOF MS, immunological techniques, rapid diagnostic tests (RDTs), others. The Fecal Identification segment dominated the market with a 39.5% share in 2025 due to its widespread use for routine parasitic testing. It is cost-effective, reliable, and applicable in both clinical and research settings. Fecal identification is highly suitable for large-scale screening of protozoan and helminth infections. Laboratories in hospitals and diagnostic centers prefer fecal testing due to ease of sample collection, minimal equipment requirements, and proven diagnostic reliability. In addition, training and workflow processes are well-established, further supporting its dominance. High adoption in countries such as China and India for public health and disease surveillance programs strengthens the segment’s market share.

The Molecular Techniques segment is expected to witness the fastest growth rate of 17.2% from 2026 to 2033. The growth is fueled by its high sensitivity and specificity, enabling detection of low parasite loads and mixed infections. Molecular diagnostics, including PCR-based methods, are increasingly adopted for rapid, accurate, and high-throughput testing. Government initiatives for parasitic disease monitoring, along with rising investments in research and advanced laboratories, are supporting growth. Molecular techniques also reduce manual error and integrate easily with automated systems, making them attractive for modern diagnostic workflows.

- By Pathogen Type

On the basis of pathogen type, the market is segmented into protozoan, helminths, ectoparasites. The Helminths segment dominated the market with a 42.1% share in 2025, owing to the high prevalence of helminthic infections across Asia‑Pacific, particularly in rural and semi-urban areas. Routine fecal testing, school health programs, and community screening initiatives largely focus on detecting helminths. Hospitals and diagnostic centers prioritize helminth identification due to the significant health burden and treatment requirements associated with infections. Public health initiatives and mass drug administration programs further support this segment. The affordability and established protocols for helminth detection contribute to its dominance.

The Protozoan segment is expected to witness the fastest CAGR of 16.5% from 2026 to 2033, driven by increasing detection of malaria, amoebiasis, and giardiasis cases. Molecular techniques, immunological assays, and RDTs are widely applied to protozoan infections, supporting rapid diagnostics. Rising government surveillance programs and healthcare awareness campaigns are encouraging early diagnosis and treatment. Advanced testing technologies allow protozoan detection even at low parasite loads, driving demand for modern diagnostic methods.

- By Sample

On the basis of sample type, the market is segmented into feces, blood, urine, serum & plasma, others. The Feces segment dominated the market with a 40.3% share in 2025, primarily because fecal samples are the primary medium for detecting intestinal parasites. They are easy to collect, cost-effective, and suitable for high-volume testing in hospitals and diagnostic labs. Stool-based testing is widely used for routine screenings, school health programs, and community surveillance. Established protocols and low equipment dependency further strengthen this segment. Public health authorities rely heavily on fecal diagnostics to track parasitic disease prevalence.

The Blood segment is expected to witness the fastest growth rate of 15.8% from 2026 to 2033, driven by the rising prevalence of blood-borne protozoan infections such as malaria and trypanosomiasis. Advanced molecular diagnostics and immunological tests are increasingly used to detect blood parasites with high sensitivity. Growing awareness and government funding for infectious disease monitoring further accelerate adoption. Hospitals and specialized diagnostic centers are increasingly preferring blood-based testing for rapid and accurate diagnostics.

- By Stool Concentration and Sample Preparation

On the basis of stool processing, the market is segmented into concentration technique, unconcentration technique. The Concentration Technique segment dominated the market with a 37.6% share in 2025, as it enhances parasite detection sensitivity by concentrating ova, cysts, or larvae in stool samples. It is widely used in diagnostic labs for routine helminth and protozoan detection. The method improves accuracy for low-parasite-load samples, which is critical for both clinical and surveillance testing. High adoption in hospitals, public health programs, and school screenings strengthens its market dominance. Laboratories also prefer this method due to standardized protocols and reproducible results.

The Unconcentration Technique segment is expected to witness the fastest CAGR of 14.9% from 2026 to 2033, fueled by the adoption of rapid and simplified sample preparation methods. Unconcentration techniques are gaining traction in small diagnostic centers and point-of-care settings due to reduced processing time and lower equipment requirements. Growing use in field studies and outbreak investigations supports segment growth. In addition, integration with automated and AI-assisted systems enhances workflow efficiency and accuracy, supporting the segment’s rapid growth in the region.

- By End User

On the basis of end user, the market is segmented into diagnostic centers, hospitals, clinics, others. The Hospitals segment dominated the market with a 38.7% share in 2025, driven by the presence of advanced laboratory infrastructure, high patient footfall, and adoption of multiple parasitology testing methods. Hospitals often conduct routine parasitic screenings for inpatients and outpatients, and public health collaborations further enhance testing volume. Integration with hospital information systems and laboratory automation increases workflow efficiency, supporting dominance. Government funding and public-private partnerships in major hospitals in China and India also contribute to market leadership.

The Diagnostic Centers segment is expected to witness the fastest CAGR of 16.2% from 2026 to 2033, owing to rising outsourcing of parasitology testing, growing number of standalone labs, and demand for rapid, reliable diagnostics. Diagnostic centers are increasingly adopting automated and AI-assisted tools for high-throughput testing. Expansion in urban and semi-urban regions, along with awareness campaigns, fuels demand. The segment benefits from flexible testing options and cost-effective services, attracting a growing patient base.

Asia-Pacific Parasitology Identification Market Regional Analysis

- China dominated the Asia‑Pacific parasitology identification market with the largest revenue share of 36.8% in 2025, characterized by well-established healthcare infrastructure, high government healthcare spending, and the presence of leading diagnostic companies, with hospitals and research centers experiencing substantial adoption of advanced parasitology testing solutions

- Healthcare providers in the region highly value the accuracy, efficiency, and reliability offered by modern parasitology identification solutions, including fecal identification, morphological, and molecular diagnostic techniques

- This widespread adoption is further supported by increasing public health initiatives, growing awareness of parasitic diseases, and the expansion of hospitals and diagnostic centers, establishing parasitology identification as a critical component of disease management and research in both clinical and community settings

The China Parasitology Identification Market Insight

The China parasitology identification market captured the largest revenue share of 36.8% in 2025, fueled by well-established healthcare infrastructure and high government healthcare spending. Hospitals and diagnostic centers are rapidly adopting advanced diagnostic techniques such as fecal identification, molecular methods, and automated systems. The growing focus on public health programs and parasitic disease surveillance is driving demand. Furthermore, increasing awareness among healthcare providers and patients about early detection and management of parasitic infections supports market expansion. China’s investment in laboratory automation and AI-assisted diagnostics is also enhancing efficiency and accuracy, boosting adoption in both clinical and research settings.

India Parasitology Identification Market Insight

The India parasitology identification market accounted for the largest market revenue share in Asia‑Pacific after China in 2025, attributed to rapid urbanization, expanding healthcare infrastructure, and high rates of adoption of modern diagnostic technologies. The prevalence of parasitic infections and government initiatives for disease control are driving demand for accurate and rapid diagnostics. Growing investments in hospitals and diagnostic centers, along with rising awareness among healthcare providers and patients, support the adoption of both conventional and automated diagnostic methods. In addition, the increasing number of standalone diagnostic laboratories and rising focus on research and academic institutions contribute to market growth. Affordable testing solutions and emerging domestic manufacturers further bolster the market in India.

Japan Parasitology Identification Market Insight

The Japan parasitology identification market is growing steadily due to high healthcare standards, advanced diagnostic infrastructure, and technological adoption. Hospitals and research centers in Japan emphasize accurate and efficient parasitology testing for clinical and epidemiological purposes. The integration of automated and AI-assisted diagnostic systems with laboratory workflows is supporting higher throughput and accuracy. Japan’s aging population and rising focus on preventive healthcare are increasing the demand for rapid and reliable diagnostics. Government-supported public health programs targeting parasitic diseases further promote adoption. In addition, collaboration between private diagnostic companies and research institutions is accelerating the availability of advanced testing solutions.

Australia Parasitology Identification Market Insight

The Australia parasitology identification market is witnessing steady growth due to well-established healthcare systems, high standards of laboratory diagnostics, and a focus on infectious disease monitoring. Hospitals, diagnostic centers, and research institutions prioritize accurate and rapid testing using both traditional and advanced methods. The adoption of molecular techniques, immunological assays, and automated identification systems is increasing to improve efficiency and reliability. Public health initiatives targeting parasitic infections among indigenous and rural populations are driving demand. Furthermore, rising government funding for laboratory infrastructure and research programs enhances market expansion. Australia’s focus on innovation and integration of digital tools in diagnostics supports sustained growth.

Asia-Pacific Parasitology Identification Market Share

The Asia-Pacific Parasitology Identification industry is primarily led by well-established companies, including:

- Abbott (U.S.)

- BIOMÉRIEUX (France)

- Thermo Fisher Scientific Inc. (U.S.)

- Siemens Healthineers AG (Germany)

- Bio‑Rad Laboratories, Inc. (U.S.)

- QIAGEN (Netherlands)

- Danaher (U.S.)

- BD (U.S.)

- Meridian Bioscience, Inc. (U.S.)

- Hologic, Inc. (U.S.)

- PerkinElmer (U.S.)

- Agilent Technologies, Inc. (U.S.)

- Sysmex Corporation (Japan)

- Bruker Corporation (U.S.)

- Luminex Corporation (U.S.)

- Trinity Biotech plc (Ireland)

- Cepheid (U.S.)

- R‑Biopharm AG (Germany)

- Creative Diagnostics (U.S.)

- Randox Laboratories Ltd. (U.K.)

What are the Recent Developments in Asia-Pacific Parasitology Identification Market?

- In October 2025, ARUP published in the Journal of Clinical Microbiology validation data showing its deep‑learning convolutional neural network (CNN) for parasite detection achieved 98.6% agreement with manual microscopy, while identifying 169 additional organisms that human microscopists had missed including rare parasites

- In April 2025, BRIN (National Research and Innovation Agency, Indonesia) announced development of an AI‑based system to detect malaria parasites using blood‑smear microphotographs and morpho‑geometric feature extraction to automatically recognize different malaria parasite species, aiming to support malaria surveillance and diagnosis across Indonesia

- In March 2025, ARUP Laboratories announced that it had expanded its AI‑augmented screening tool for human gastrointestinal parasites to now include wet‑mount slides, making it “the first and only laboratory” to apply AI screening across the entire ova & parasite testing process. This expansion reportedly increases sensitivity and diagnostic yield, reduces human error and lab‑staff workload, and speeds up turnaround time potentially shifting labs worldwide toward more automated parasitology workflows

- In April 2024, a study published in PLOS Neglected Tropical Diseases demonstrated that a deep‑learning system (DLS) applied to digitized stool‑slide images from a resource-limited setting outperformed conventional microscopy detecting many soil‑transmitted helminth (STH) infections that were missed manually, particularly light-intensity infections

- In January 2024, researchers published results for a fully automatic digital feces‑analyzer Orienter FA280 which combines AI‑based image analysis and automated sample handling. The system’s performance in parasite detection and ova identification from stool samples was evaluated showing good agreement with the traditional formalin-ethyl acetate concentration technique (FECT), illustrating growing adoption of automated stool diagnostics that reduce manual workload.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.