Asia Pacific Protein Purification Isolation Market

Market Size in USD Billion

CAGR :

%

USD

2.24 Billion

USD

6.87 Billion

2024

2032

USD

2.24 Billion

USD

6.87 Billion

2024

2032

| 2025 –2032 | |

| USD 2.24 Billion | |

| USD 6.87 Billion | |

|

|

|

|

Protein Purification and Isolation Market Size

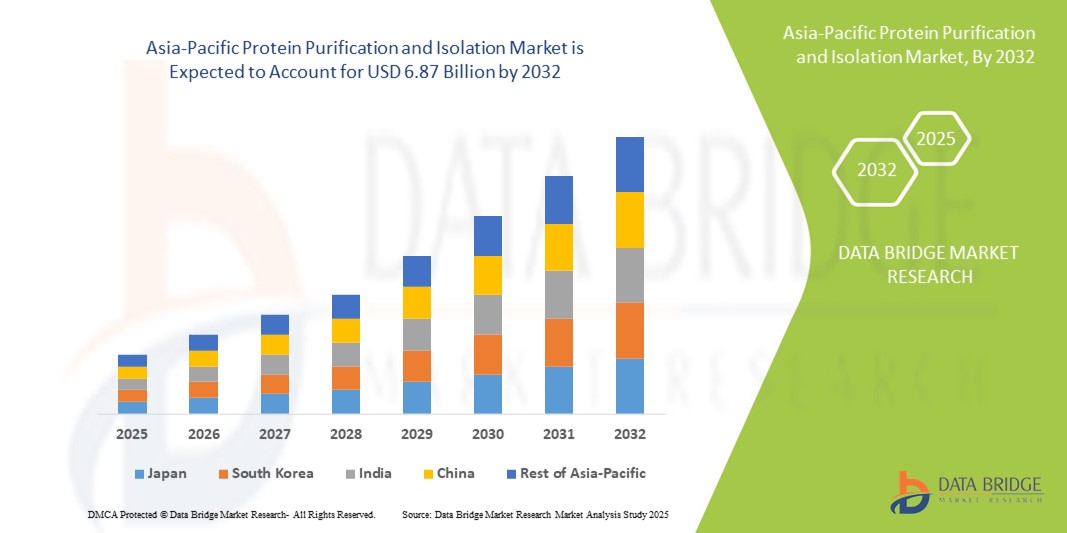

- The Asia-Pacific protein purification and isolation market size was valued at USD 2.24 billion in 2024 and is expected to reach USD 6.87 billion by 2032, at a CAGR of 15.00% during the forecast period

- The market growth is largely fueled by the increasing demand for biopharmaceuticals, personalized medicine, and advanced research in genomics and proteomics, which is driving the adoption of protein purification and isolation technologies across academic, clinical, and industrial applications

- Furthermore, rising consumer and industry demand for high-quality, purified proteins to support drug discovery, vaccine development, and diagnostic assays is establishing protein purification and isolation solutions as essential tools in modern life sciences. These converging factors are accelerating the uptake of protein purification and isolation solutions, thereby significantly boosting the industry's growth

Protein Purification and Isolation Market Analysis

- Protein purification and isolation techniques, which enable the separation and extraction of target proteins from complex biological mixtures, are increasingly vital in biotechnology, pharmaceutical research, and diagnostics due to their critical role in drug discovery, personalized medicine, and advanced therapeutic development

- The escalating demand for protein purification and isolation is primarily fueled by the rising prevalence of chronic diseases, growth in proteomics and genomics research, and the increasing adoption of advanced biopharmaceuticals requiring high-purity proteins

- China dominated the protein purification and isolation market in Asia-Pacific with the largest revenue share of 37.8% in 2024, driven by significant investments in life sciences research, rapid expansion of biopharmaceutical manufacturing, and strong government support for R&D infrastructure. The presence of leading domestic biotech firms and collaborations with global pharmaceutical companies further strengthen China’s leadership position

- India is expected to be the fastest-growing country in the protein purification and isolation market, registering a CAGR of 12.6% from 2025 to 2032, supported by the expansion of pharmaceutical manufacturing, increasing government funding in biotechnology, rising healthcare demand, and the presence of cost-effective CROs (Contract Research Organizations) and CDMOs (Contract Development and Manufacturing Organizations)

- The instruments segment dominated the protein purification and isolation market with a market revenue share of 41.5% in 2024, driven by the adoption of automated purification systems and high-throughput platforms in pharmaceutical and biotech industries

Report Scope and Protein Purification and Isolation Market Segmentation

|

Attributes |

Protein Purification and Isolation Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

Asia-Pacific

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Protein Purification and Isolation Market Trends

Growing Need for Advanced and Efficient Protein Purification Solutions

- A significant and accelerating trend in the Asia-Pacific protein purification and isolation market is the increasing adoption of advanced purification technologies, including chromatography systems, membrane filtration, and magnetic separation techniques. These technologies are enhancing efficiency, reproducibility, and yield in protein isolation processes across research and biopharmaceutical applications

- For instance, biopharmaceutical companies and research institutions are increasingly implementing high-throughput chromatography platforms to enable faster and more accurate purification of monoclonal antibodies and recombinant proteins, which is critical for drug development pipelines

- The growing focus on biologics, personalized medicine, and protein-based therapeutics is driving demand for high-purity protein isolation solutions. Companies are also investing in automated and scalable purification platforms that reduce manual intervention, minimize errors, and improve overall operational efficiency

- Furthermore, integration of novel purification methods such as affinity-based separations and single-use technologies is enabling more flexible workflows, reducing cross-contamination risks, and lowering production costs in both small-scale research and commercial production

- The trend towards more streamlined, scalable, and high-yield protein purification systems is reshaping expectations for laboratory and manufacturing efficiency. Companies such as GE Healthcare, Merck KGaA, and Sartorius are continuously enhancing their purification solutions with better throughput, reduced processing time, and compatibility with complex protein mixtures

- The demand for efficient, reliable, and cost-effective protein purification and isolation systems is growing rapidly across both research laboratories and biopharmaceutical manufacturing sectors, driven by increased R&D activities and the expansion of biologics production in the Asia-Pacific region

Protein Purification and Isolation Market Dynamics

Driver

Growing Need Due to Rising Biopharmaceutical and Research Activities

- The increasing demand for high-purity proteins in biopharmaceutical production, clinical research, and academic studies is a significant driver for the growth of the Protein Purification and Isolation market

- For instance, in April 2024, Thermo Fisher Scientific announced the launch of an advanced chromatography system designed to streamline protein purification workflows and enhance throughput in biopharma labs. Such innovations by key companies are expected to drive the Protein Purification and Isolation industry growth in the forecast period

- As research organizations and pharmaceutical companies expand their R&D activities, there is a growing need for precise, scalable, and reproducible protein purification methods, ensuring high-quality outputs for therapeutic and diagnostic applications

- Moreover, the rising adoption of automated and high-throughput purification technologies is reducing manual errors, accelerating workflow efficiency, and improving overall laboratory productivity

- The versatility of protein purification systems for applications such as monoclonal antibody production, vaccine development, and biomarker discovery further strengthens market adoption

- Increasing government initiatives and funding in life sciences research are encouraging laboratories to invest in state-of-the-art instruments and consumables for protein isolation, further propelling market growth

Restraint/Challenge

High Costs and Technical Complexity of Advanced Protein Purification Systems

- Advanced protein purification platforms, such as automated chromatography or high-end electrophoresis instruments, often involve significant upfront costs, limiting accessibility for small-scale laboratories or research institutions

- Premium systems from companies such as GE Healthcare, Agilent Technologies, or Bio-Rad can cost several tens of thousands of dollars, creating budget constraints, especially in developing markets

- Some purification workflows require specialized training and skilled personnel to operate complex instruments, which can slow adoption in smaller or less-experienced labs

- In addition operational costs, including consumable replacement, regular maintenance, and software updates, add to the overall expenditure, further restricting widespread adoption

- Overcoming these challenges requires manufacturers to develop cost-effective and user-friendly solutions, making high-quality protein purification accessible to a broader market

- Providing training programs, technical support, and modular systems can help laboratories handle complex processes more efficiently, promoting faster adoption

- Simplified, scalable purification systems tailored for research and industrial needs are likely to accelerate market growth across Asia-Pacific and other regions

- Companies offering integrated purification solutions, combining consumables, instruments, and software support, are expected to gain a competitive edge in the market

Protein Purification and Isolation Market Scope

The market is segmented on the basis of technology, product type, application, and end user.

- By Technology

On the basis of technology, the Asia-Pacific protein purification and isolation market is segmented into precipitation, centrifugation, preparative chromatography techniques, electrophoresis, Western blotting, dialysis and diafiltration, and centrifugation. The preparative chromatography techniques segment dominated the largest market revenue share of 38.6% in 2024, driven by its ability to deliver high-purity proteins efficiently and reproducibly. This technology is extensively used in both research and industrial applications, particularly in the production of protein therapeutics and biologics. Preparative chromatography supports scalability and consistency, which are critical for regulatory compliance in pharmaceutical manufacturing. Its versatility across various types of biomolecules makes it a preferred method for labs and biotech companies. In addition, the technology enables minimal protein degradation, which is vital for sensitive therapeutic proteins. The widespread adoption of automated chromatography systems further strengthens its market dominance. Research institutes also prefer this method due to its reliability in producing consistent results.

The centrifugation segment is expected to witness the fastest CAGR of 14.2% from 2025 to 2032, owing to its simplicity, cost-effectiveness, and adaptability. Centrifugation allows rapid separation of proteins, cellular components, and biomolecules without requiring complex instrumentation. It is widely used in academic labs and emerging biotech startups for preliminary purification and sample preparation. The method is particularly effective for high-throughput workflows and small to medium-scale protein isolation. With increasing protein research activities in Asia-Pacific, demand for efficient centrifugation systems is rising. Technological advancements in rotor designs and automation options are further enhancing performance and throughput. Furthermore, centrifugation complements other purification techniques, making it integral to multi-step workflows. Its ease of operation and low maintenance costs make it attractive for budget-conscious labs.

- By Product Type

On the basis of product type, the Asia-Pacific protein purification and isolation market is segmented into instruments and consumables. The instruments segment accounted for the largest market revenue share of 41.5% in 2024, driven by the adoption of automated purification systems and high-throughput platforms in pharmaceutical and biotech industries. Instruments provide precision, reproducibility, and efficiency, which are critical for regulatory-compliant protein production. They are essential for large-scale production of biologics and therapeutic proteins. Research labs also rely on advanced instruments for consistent sample processing. Continuous innovations in system design, automation, and integration with digital tools are driving adoption. Instruments reduce human error, improve workflow efficiency, and enable scalability. The growing focus on R&D in Asia-Pacific is encouraging labs to invest in state-of-the-art purification instruments. In addition, collaborations between instrument manufacturers and biotech companies are expanding access to cutting-edge technologies.

The consumables segment is expected to register the fastest CAGR of 12.8% from 2025 to 2032, fueled by recurring demand for chromatography columns, filters, membranes, and buffers. Consumables are critical for the day-to-day operation of protein purification workflows. Their use spans academic research, CROs, and industrial applications. Rising protein research activities in China, India, and Japan are increasing demand for high-quality consumables. Consumables allow precise experimental control and support reproducibility in experiments. They are essential in preparative chromatography, centrifugation, and electrophoresis processes. The availability of cost-effective consumables is driving adoption in emerging laboratories. Manufacturers are also introducing specialized consumables tailored for specific protein types. Their recurring nature ensures a stable market growth trajectory.

- By Application

On the basis of application, the Asia-Pacific protein purification and isolation market is segmented into drug screening, target identification, biomarker discovery, protein-protein interaction studies, protein therapeutics, and disease diagnosis and monitoring. The protein therapeutics segment dominated the market with a revenue share of 35.9% in 2024, driven by the growing biologics pipeline, development of monoclonal antibodies, and demand for therapeutic proteins. This segment is critical in treating chronic and rare diseases. Pharmaceutical companies invest heavily in protein purification to ensure high-quality therapeutics. The segment’s growth is supported by regulatory requirements demanding consistency and purity. The rising prevalence of protein-based drugs is encouraging large-scale adoption of purification technologies. Academic research is also contributing by exploring new therapeutic protein candidates. Advancements in purification technologies further enhance yield and efficiency, consolidating this segment’s dominance.

The drug screening segment is expected to witness the fastest CAGR of 13.7% from 2025 to 2032, driven by expansion of pharmaceutical R&D and high-throughput screening initiatives. Drug screening relies on precise and efficient protein purification to identify potential therapeutic targets. The need for faster, cost-effective drug discovery processes is fueling adoption. Asia-Pacific countries such as China and India are investing heavily in pharma research infrastructure. Integration of automated platforms and consumables accelerates screening workflows. Rising biotech startups are increasingly performing in-house drug screening activities. The growth of personalized medicine is further driving the demand for efficient protein isolation. High-throughput drug screening combined with optimized purification methods ensures reproducible results and accelerates time-to-market.

- By End User

On the basis of end user, the Asia-Pacific protein purification and isolation market is segmented into biotech and pharma industries, contract research organizations (CROs), academic research institutes, and hospital and diagnostic centers. The biotech and pharma industries segment held the largest market revenue share of 42.1% in 2024, due to substantial investments in biologics, protein therapeutics, and personalized medicine. These industries require high-throughput purification systems for consistent protein production. They prioritize advanced instruments for regulatory compliance and scalable manufacturing. Collaborations with instrument and consumable manufacturers strengthen their R&D capabilities. Continuous demand for novel protein therapeutics drives the segment’s dominance. The growth of pharmaceutical manufacturing facilities in China and Japan contributes significantly. Biotech companies leverage cutting-edge purification technologies for competitive advantage.

The academic research institutes segment is expected to register the fastest CAGR of 12.5% from 2025 to 2032, fueled by increasing protein-focused research, government funding, and the establishment of new life sciences laboratories in Asia-Pacific countries. Academic institutions are expanding protein purification programs for fundamental and translational research. The growth of university-industry collaborations enhances research capabilities. Funding for advanced lab equipment and consumables supports adoption. Rising interest in protein-protein interaction studies and biomarker discovery drives demand. Academic institutes also act as early adopters of new technologies, influencing broader market trends. Expansion of specialized research centers in China, India, and Japan further accelerates growth.

Protein Purification and Isolation Market Regional Analysis

- The Asia-Pacific protein purification and isolation market is poised to grow at a robust CAGR during the forecast period from 2025 to 2032. The growth is primarily driven by increasing investments in life sciences research, expansion of biopharmaceutical manufacturing, and rising demand for high-quality proteins in research, diagnostics, and therapeutics across the region

- Technological advancements in purification instruments and consumables, combined with rising disposable incomes and urbanization in key countries such as China, Japan, and India, are further fueling adoption

- In addition, supportive government initiatives promoting biotechnology infrastructure, smart laboratory systems, and research collaborations are strengthening the market landscape in Asia-Pacific. The availability of cost-effective protein purification solutions is enabling wider adoption across both academic and industrial laboratories

Japan Protein Purification and Isolation Market Insight

The Japan protein purification and isolation market is gaining momentum due to the country’s advanced biotechnology sector, emphasis on high-quality research, and a strong focus on innovation. Japanese research institutions and pharmaceutical companies increasingly demand reliable protein purification and isolation systems for drug screening, biomarker discovery, and therapeutic protein development. The integration of automated and high-throughput purification technologies enhances workflow efficiency and reduces manual errors, which is particularly valued in Japan’s highly regulated biopharmaceutical environment. Rising government support for R&D and collaborations with global pharmaceutical firms are boosting market growth. Furthermore, Japan’s aging population is increasing the demand for innovative therapeutics and protein-based diagnostics, thereby supporting sustained growth across clinical and industrial applications.

China Protein Purification and Isolation Market Insight

The China protein purification and isolation market dominated the Protein Purification and Isolation market in Asia-Pacific with the largest revenue share of 37.8% in 2024. This leadership is attributed to significant investments in life sciences research, rapid expansion of biopharmaceutical manufacturing, and strong government support for biotechnology infrastructure and R&D initiatives. The presence of leading domestic biotech firms, combined with strategic collaborations with global pharmaceutical companies, further strengthens China’s market position. The country’s expanding middle class, technological adoption, and development of cost-effective purification systems are encouraging adoption across research institutions, contract research organizations (CROs), and pharmaceutical manufacturers. The growing focus on high-quality protein therapeutics, biomarker discovery, and precision medicine also drives market demand.

India Protein Purification and Isolation Market Insight

The India protein purification and isolation market is expected to be the fastest-growing country in the Asia-Pacific Protein Purification and Isolation market, registering a CAGR of 12.6% from 2025 to 2032. Growth is supported by the expansion of pharmaceutical and biopharmaceutical manufacturing, rising healthcare demand, and increasing government funding in biotechnology research. The presence of cost-effective CROs and CDMOs provides affordable protein purification and isolation solutions, making India an attractive hub for both domestic and international pharmaceutical companies. Rising investments in automation, laboratory infrastructure, and high-throughput protein purification technologies are further accelerating market adoption. India’s growing focus on protein-based therapeutics, diagnostics, and academic research positions it as a high-potential market within the Asia-Pacific region.

Protein Purification and Isolation Market Share

The Protein Purification and Isolation industry is primarily led by well-established companies, including:

- General Electric Company (U.S.)

- Thermo Fisher Scientific Inc. (U.S.)

- QIAGEN (Germany)

- Bio-Rad Laboratories, Inc. (U.S.)

- Agilent Technologies, Inc. (U.S.)

- Promega Corporation (U.S.)

- Purolite (U.K.)

- BioVision, Inc. (U.S.)

- Abcam plc (U.K.)

- Danaher Corporation (U.S.)

- PerkinElmer (U.S.)

- Takara Bio Inc. (Japan)

- Lonza (Switzerland)

- Repligen Corporation (U.S.)

- Waters Corporation (U.S.)

Latest Developments in Asia-Pacific Protein Purification and Isolation Market

- In April 2023, Abcam, a global leader in antibody production, entered into a collaboration with Lunaphore Technologies, a company specializing in tissue analysis solutions. This partnership aimed to validate primary antibodies for Lunaphore's COMET platform, which is designed for multiplexed tissue analysis. By integrating Abcam's high-quality antibodies with Lunaphore's innovative technology, the collaboration sought to improve the accuracy and efficiency of protein studies, thereby advancing protein purification and isolation processes in research and drug development

- In October 2024, Merck KGaA, Darmstadt, Germany, a leading science and technology company, launched a new line of protein purification reagents. These reagents were developed to improve the efficiency and reproducibility of protein isolation processes, catering to the needs of researchers in the fields of proteomics and drug discovery. The launch underscored Merck KGaA's commitment to advancing scientific research by providing high-quality solutions for protein purification

- In July 2025, Thermo Fisher Scientific, a leading provider of laboratory equipment and reagents, announced the expansion of its protein purification portfolio. The company introduced new chromatography systems and consumables designed to enhance the efficiency and scalability of protein purification processes. These innovations aimed to support the growing demand for biopharmaceuticals and personalized medicine by providing researchers with advanced tools for protein isolation and analysis

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.