Asia Pacific Self Injections Market

Market Size in USD Billion

CAGR :

%

USD

9.45 Billion

USD

21.94 Billion

2024

2032

USD

9.45 Billion

USD

21.94 Billion

2024

2032

| 2025 –2032 | |

| USD 9.45 Billion | |

| USD 21.94 Billion | |

|

|

|

|

Self-Injections Market Size

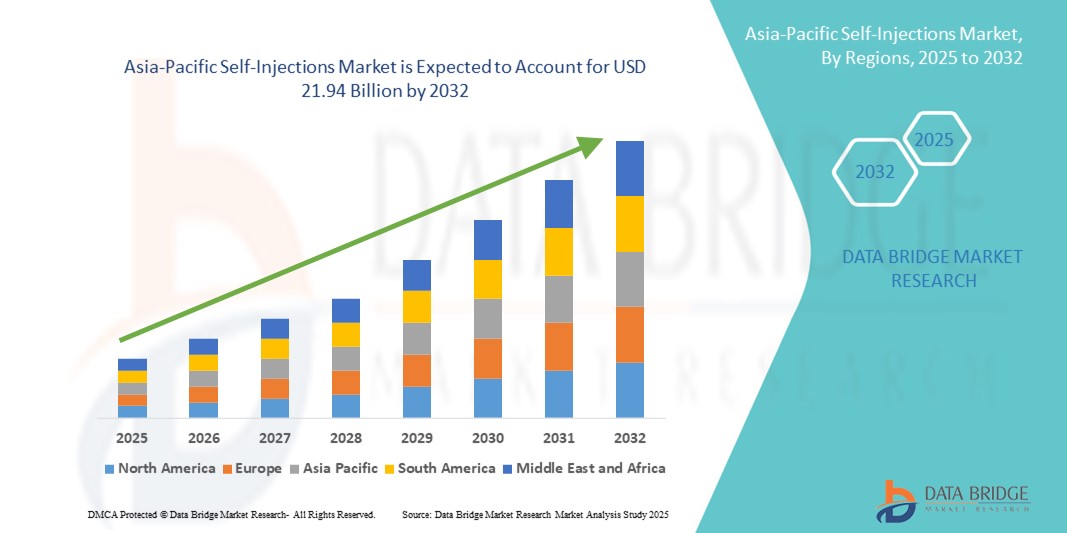

- The Asia-Pacific self-injections market size was valued at USD 9.45 billion in 2024 and is expected to reach USD 21.94 billion by 2032, at a CAGR of 11.10% during the forecast period

- The market growth is largely fueled by the increasing prevalence of chronic diseases such as diabetes, rheumatoid arthritis, and multiple sclerosis, which require long-term therapeutic regimens and have led to growing adoption of convenient drug delivery methods such as self-injection systems. Technological advancements in drug delivery devices—such as auto-injectors and wearable injectors—are also contributing significantly to the rise of digital and connected healthcare environments across both home and clinical settings

- Furthermore, rising patient preference for self-administered therapies, coupled with healthcare providers’ emphasis on reducing hospital visits and improving medication adherence, is establishing self-injection systems as the preferred mode of drug delivery. These converging factors are accelerating the uptake of self-injection solutions, thereby significantly boosting the industry's growth across various therapeutic areas including oncology, hormonal disorders, and rare diseases

Self-Injections Market Analysis

- Self-injection devices, which allow patients to administer medication independently at home or in outpatient settings, are becoming essential components of modern healthcare systems due to their enhanced convenience, reduced need for clinic visits, and improved medication adherence

- The escalating demand for self-injections is primarily fueled by the increasing prevalence of chronic diseases such as diabetes, rheumatoid arthritis, and multiple sclerosis, growing patient preference for at-home care, and technological advancements in drug delivery systems

- China dominated the Asia-Pacific self-injections market, fueled by growing use of biologics, supportive healthcare reforms, and increasing domestic production of auto-injectors and prefilled syringes

- India is expected to witness the highest growth rate in the Asia-Pacific self-injections market, driven by a high chronic disease load, greater acceptance of self-care, and increased accessibility to biologics and biosimilars

- The subcutaneous segment dominated the self-injections market with a market share of 61.3% in 2024, due to its widespread usage in chronic disease management and better patient compliance

Report Scope and Self-Injections Market Segmentation

|

Attributes |

Self-Injections Market Insights |

|

Segments Covered |

|

|

Countries Covered |

Asia-Pacific

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Self-Injections Market Trends

“Rising Demand for Intelligent and User-Centric Solutions”

- A significant and accelerating trend in the Asia-Pacific self-injections market is the growing emphasis on intelligent and user-friendly solutions that enhance patient autonomy and medication adherence

- For instance, self-injection devices integrated with digital monitoring features and reminder systems are enabling real-time tracking of drug administration, helping patients and caregivers manage chronic conditions more effectively

- Pharmaceutical companies and medtech firms are incorporating smart technologies into auto-injectors and pen devices—such as sensors that detect injection completion or send refill alerts—to ensure better compliance and treatment outcomes

- The adoption of connected health platforms enables seamless synchronization between injection devices and mobile health apps, allowing patients to monitor injection history, receive dosage alerts, and communicate with healthcare providers from the comfort of home

- These developments align with the broader trend of personalized medicine and digital therapeutics, where treatment delivery is tailored to individual health profiles, supported by real-time data

- The demand for such advanced self-injection solutions is growing rapidly in Asia-Pacific, driven by increasing chronic disease prevalence, rising health literacy, and greater investment in remote patient monitoring and at-home care solutions

Self-Injections Market Dynamics

Driver

“Growing Need Due to Rising Chronic Disease Burden and Home-Based Care Adoption”

- The increasing prevalence of chronic conditions such as diabetes, multiple sclerosis, and rheumatoid arthritis, coupled with the accelerating adoption of home-based care solutions, is a significant driver for the heightened demand for self-injection devices

- For instance, in April 2024, Heron Therapeutics announced advancements in sustained-release drug delivery platforms aimed at enhancing post-surgical pain management via self-administered injections—an innovation expected to contribute significantly to the growth of the self-injections market during the forecast period

- As patients become more engaged in managing their own healthcare, self-injection devices offer advanced features such as pre-filled syringes, auto-injectors, and smart injectors with dose tracking and feedback alerts, providing a compelling alternative to hospital-based drug administration

- Furthermore, the growing popularity of telemedicine and the desire for remote, personalized treatment options are making self-injection systems an integral component of patient-centric care, offering convenience, adherence support, and reduced need for clinic visits

- The ease of use, improved patient autonomy, and the ability to administer biologics and specialty drugs at home are key factors propelling the adoption of self-injection systems across both developed and emerging markets. The trend towards digital health and the increasing availability of user-friendly self-injection options further contribute to market growth

Restraint/Challenge

“Concerns Regarding Safety, Training, and High Product Costs”

- Concerns surrounding the safe and accurate use of self-injection devices pose a significant challenge to broader market adoption. Users may lack confidence in their ability to properly administer medications without clinical supervision, particularly among elderly or visually impaired populations

- For instance, market reports have shown that training and education gaps remain a key concern, especially in low-resource settings, hindering effective self-injection practices and adherence

- Addressing these concerns through better instructional design, patient education programs, and intuitive device interfaces is crucial for building user confidence. Companies such as Amgen and Teva emphasize patient support tools and video guides in their device ecosystems to improve self-injection success rates

- In addition, the relatively high cost of biologics and associated self-injection systems—especially for therapies involving auto-injectors or wearable injectors—can be a barrier to access in price-sensitive markets

- While some cost reductions have been achieved through biosimilars and improved manufacturing efficiencies, the overall price point still limits widespread adoption, particularly for uninsured or underinsured populations

- Overcoming these challenges through improved product design, affordability, expanded reimbursement coverage, and targeted patient training will be vital for sustained growth of the self-injections market

Self-Injections Market Scope

The market is segmented on the basis of product type, dosage form, route of administration, application, age group, gender, and distribution channel.

- By Product Type

On the basis of product type, the Asia-Pacific self-injections market is segmented into self-injection devices and self-injection formulations. The self-injection devices segment held the largest market revenue share of 54.8% in 2024, driven by increasing patient preference for home-based treatments and technological advancements in autoinjectors and pen injectors.

The self-injection formulations segment is anticipated to witness the fastest growth rate of 22.3% CAGR from 2025 to 2032, owing to rising demand for ready-to-use biologics and specialty drug formulations for chronic diseases such as diabetes, rheumatoid arthritis, and multiple sclerosis.

- By Dosage Form

On the basis of dosage form, the Asia-Pacific self-injections market is segmented into single dose and multi-dose. The single dose segment dominated the market with a revenue share of 59.6% in 2024, due to its convenience, reduced contamination risk, and ease of use.

The multi-dose segment is projected to register a strong CAGR of 21.1% during the forecast period, supported by increasing adoption in clinical and emergency settings.

- By Route of Administration

On the basis of route of administration, the Asia-Pacific self-injections market is segmented into subcutaneous, intramuscular, and others. The subcutaneous segment accounted for the largest share of 61.3% in 2024, due to its widespread usage in chronic disease management and better patient compliance.

The intramuscular segment is projected to grow at a CAGR of 20.5% from 2025 to 2032, particularly in the context of vaccines and hormone therapies that require deep tissue delivery.

- By Application

On the basis of application, the Asia-Pacific self-injections market is segmented into autoimmune diseases, pain management, emergency drugs, oncology, hormonal disorders, and others. The autoimmune diseases segment held the highest revenue share of 38.5% in 2024, driven by rising cases of conditions such as rheumatoid arthritis, psoriasis, and inflammatory bowel disease.

The oncology segment is expected to show the fastest CAGR of 23.4% from 2025 to 2032, due to increasing availability of injectable cancer drugs and supportive therapy administered at home.

- By Age Group

On the basis of age group, the Asia-Pacific self-injections market is segmented into adult, geriatric, and pediatric. The adult segment dominated the market with 52.7% share in 2024, reflecting the higher prevalence of chronic diseases and lifestyle-related disorders in this group.

The geriatric segment is anticipated to experience a CAGR of 20.9% from 2025 to 2032, due to increased adoption of self-administered therapies for conditions such as osteoporosis and diabetes.

- By Gender

On the basis of gender, the Asia-Pacific self-injections market is segmented into male and female. The female segment held a slightly higher market share of 50.8% in 2024, due to higher rates of autoimmune disorders and hormonal treatments that necessitate regular injections.

The male segment is growing at a CAGR of 19.6% from 2025 to 2032, supported by rising demand in areas such as testosterone therapy and chronic pain management.

- By Distribution Channel

On the basis of distribution channel, the Asia-Pacific self-injections market is segmented into direct tender, hospital pharmacy, online pharmacy, and others. The hospital pharmacy segment captured the largest market share of 46.9% in 2024, attributed to the institutional buying of injectable medications and devices.

Meanwhile, the online pharmacy segment is projected to grow at the fastest CAGR of 24.2% from 2025 to 2032, owing to increasing digitalization, patient convenience, and widespread acceptance of e-pharmacy platforms in countries such as India, China, and Japan.

Self-Injections Market Regional Analysis

- Asia-Pacific accounted for a significant share of the global self-injections market in 2024 and is projected to grow at the fastest CAGR of 24% during 2025–2032, driven by rising healthcare expenditure, expanding patient population with chronic diseases, and increasing preference for self-care therapies. The region’s rapid digitalization, government-led awareness initiatives, and cost-effective device availability are further fueling adoption of self-injection systems across urban and rural healthcare landscapes

- Countries such as China, Japan, and India are leading innovation and manufacturing capacity, while smaller nations in Southeast Asia are witnessing rising acceptance of injectable therapies due to better accessibility, affordability, and integration of online pharmacy and teleconsultation services

- Market growth is supported by public health campaigns promoting independence in disease management, improved regulatory frameworks, and a rising number of patients with diabetes, cancer, and autoimmune diseases requiring regular parenteral treatments

China Self-Injections Market Insight

The China self-injections market held the largest revenue share of 39.7% within the Asia-Pacific market in 2024, propelled by growing use of biologics, supportive healthcare reforms, and increasing domestic production of auto-injectors and prefilled syringes. Expanding health insurance coverage, chronic disease burden, and government initiatives such as "Healthy China 2030" are contributing to the market surge. The presence of local biotech innovators offering cost-effective, user-friendly injection devices is also strengthening market penetration in both Tier 1 and Tier 2 cities.

Japan Self-Injections Market Insight

The Japan self-injections market is expanding steadily due to its aging population (nearly 30% over age 65), widespread tech literacy, and demand for discreet and minimally invasive drug delivery solutions. Patient preference for compact, easy-to-use injection devices, especially for conditions such as diabetes, cancer, and rheumatoid arthritis, is driving innovation. Pharmaceutical companies are introducing compliance-enabled devices integrated with smartphone applications for adherence monitoring and refill reminders.

India Self-Injections Market Insight

The India self-injections market is among the fastest-growing countries in the Asia-Pacific self-injections market, driven by a high chronic disease load, greater acceptance of self-care, and increased accessibility to biologics and biosimilars. Government healthcare programs, rising private insurance penetration, and the emergence of health-tech startups are enabling broader distribution of auto-injectors and prefilled syringes. The country's growing middle-class population and rural healthcare expansion are unlocking new growth opportunities.

South Korea Self-Injections Market Insight

The South Korea self-injections market benefits from a robust pharma and medical device ecosystem, widespread health awareness, and government support for digital health and remote treatment modalities. Patients increasingly rely on smart injectable solutions for chronic conditions such as multiple sclerosis and hormone therapy. The adoption of app-connected devices and partnerships between pharmaceutical and tech companies are accelerating innovation in the market.

Singapore Self-Injections Market Insight

Singapore self-injections market is witnessing strong growth in self-injection adoption due to high digital healthcare integration, patient-centric health policies, and excellent infrastructure. The government’s Smart Nation initiative and support for aging-in-place strategies have encouraged the uptake of home-use injectors among elderly and chronic disease patients. Demand for advanced self-injection solutions, including wearable injectors, is also rising in clinical research and high-end hospital settings.

Self-Injections Market Share

The Asia-Pacific self-injections industry is primarily led by well-established companies, including:

- Bayer AG (Germany)

- UCB Pharma (Belgium)

- Ipsen Biopharmaceuticals, Inc. (France)

- Teva Pharmaceuticals Industries Ltd (Israel)

- Recipharm AB (Sweden)

- SCHOTT Pharma (Germany)

- Lilly (U.S.)

- AstraZeneca (U.K.)

- Takeda Pharmaceuticals Company Limited (Japan)

- Novartis AG (Switzerland)

- Pfizer Inc. (U.S.)

- Sanofi (France)

- AbbVie (U.S.)

- Biogen (U.S.)

- YPSOMED (Switzerland)

- Bausch Health Companies Inc. (Canada)

- Merck & Co. (U.S.)

- Amgen Inc. (U.S.

- Johnson & Johnson Services, Inc. (U.S.)

- PharmaJet (U.S.)

- Societe Industrielle de Sonceboz SA (Switzerland)

- Terumo Corporation (Japan)

- Haselmeier (Germany)

- Midas Pharma GmbH (Germany)

- BD (U.S.)

- Phillips-Medisize (U.S.)

- West Pharmaceutical Services (U.S.)

- Gerresheimer AG (Germany)

- Oval Medical Technologies Ltd. (SMC Limited) (U.K.)

- SHL Medical AG (Switzerland)

- Novo Nordisk A/S (Denmark)

- AptarGroup, Inc. (U.S.)

- Boehringer Ingelheim International GmbH (Germany)

- F. Hoffmann-La Roche Ltd (Switzerland)

- GSK plc (U.K.)

Latest Developments in Asia-Pacific Self-Injections Market

- In September 2024, Evotec shares jumped 6% after announcing a technology development partnership with Novo Nordisk centered on cell therapy. The collaboration involves funding for development activities in Germany and Italy, along with upfront payments, potential milestone achievements, and royalty incentives. Dr. Cord Dohrmann, Evotec's Chief Scientific Officer, expressed optimism about creating innovative stem cell-based therapies through this partnership

- In September 2024, Tremfya (guselkumab) was FDA-approved for adults with moderately to severely active ulcerative colitis, in addition to its approvals for plaque psoriasis and psoriatic arthritis. It is the first dual-acting interleukin-23 inhibitor for this condition, showing significant remission rates in the QUASAR study. Administered as a 200 mg intravenous induction dose, it follows with subcutaneous maintenance doses of 100 mg every 8 weeks or 200 mg every 4 weeks. This approval highlights Johnson & Johnson's commitment to advancing treatments for inflammatory bowel disease

- In July 2024, Biogen has acquired Human Immunology Biosciences (HI-Bio), enhancing its immunology pipeline with felzartamab, a promising therapeutic candidate. The acquisition will advance felzartamab into Phase 3 trials for various indications. Positive interim results have been reported in Phase 2 studies for IgA nephropathy and antibody-mediated rejection

- In July 2024, Biogen has acquired Human Immunology Biosciences (HI-Bio), enhancing its immunology pipeline with felzartamab, a promising therapeutic candidate. The acquisition will advance felzartamab into Phase 3 trials for various indications. Positive interim results have been reported in Phase 2 studies for IgA nephropathy and antibody-mediated rejection

- In July 2024, AstraZeneca had successfully acquired Amolyt Pharma for up to USD 1.05 billion, enhancing its Alexion Rare Disease pipeline. This includes the Phase III peptide eneboparatide for hypoparathyroidism, expanding AstraZeneca's focus on rare endocrine diseases and calcium regulation treatments

- In June 2024, Aptar Digital Health partnered with SHL Medical to enhance connected device technologies by integrating its SaMD platform. This collaboration aimed to improve the patient experience during self-administration of injectable therapies, supporting better adherence and disease management for patients

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.