Asia Pacific Transfection Market

Market Size in USD Billion

CAGR :

%

USD

1.18 Billion

USD

2.62 Billion

2025

2033

USD

1.18 Billion

USD

2.62 Billion

2025

2033

| 2026 –2033 | |

| USD 1.18 Billion | |

| USD 2.62 Billion | |

|

|

|

|

Asia-Pacific Transfection Market Size

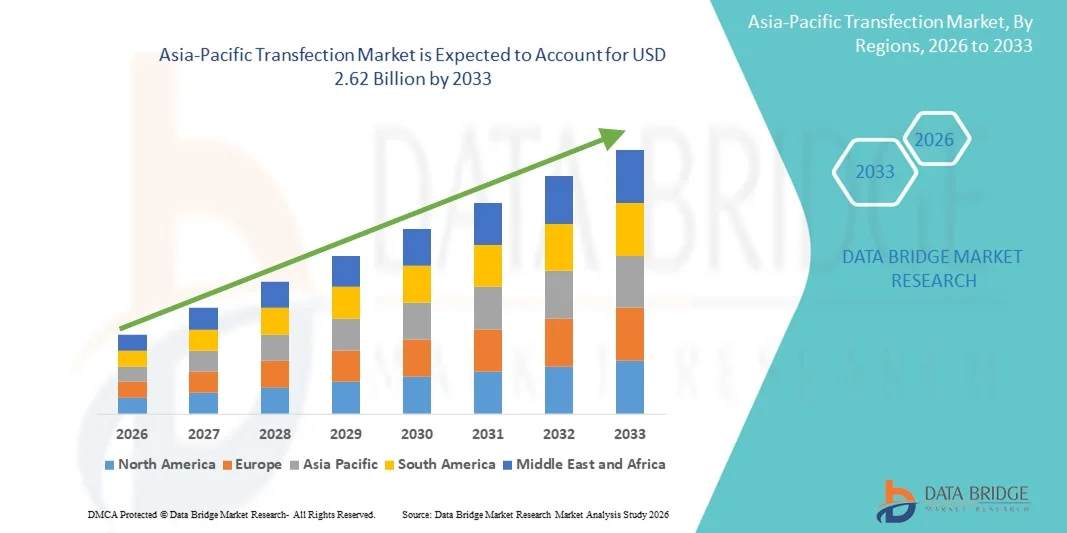

- The Asia-Pacific transfection market size was valued at USD 1.18 billion in 2025 and is expected to reach USD 2.62 billion by 2033, at a CAGR of 10.49% during the forecast period

- The market growth is largely fueled by increasing demand for efficient gene delivery solutions, rapid advancements in molecular biology and cell‑based research, and rising investments in biotechnology infrastructure across key APAC countries such as China, India, Japan, and South Korea, driving adoption of transfection technologies in drug discovery, genomics, and therapeutic research

- Furthermore, expanding biopharmaceutical R&D activities, growing clinical trial initiatives, and heightened focus on precision medicine and cell/gene therapies are significantly boosting the uptake of transfection reagents and equipment. These converging factors are accelerating the use of transfection technologies across academic, pharmaceutical, and biotech sectors, thereby substantially enhancing the industry’s growth outlook

Asia-Pacific Transfection Market Analysis

- Transfection technologies, enabling the delivery of nucleic acids and proteins into cells, are increasingly vital tools in molecular biology, drug discovery, and cell/gene therapy applications in both academic and commercial research settings due to their efficiency, versatility, and compatibility with advanced research platforms

- The escalating demand for transfection solutions is primarily fueled by rapid advancements in biotechnology, increasing R&D investments, growing clinical trial activities, and rising adoption of CRISPR and non-viral/viral transfection methods, enabling efficient gene editing, molecular research, and therapeutic development

- China dominated the Asia-Pacific transfection market with the largest revenue share of 41% in 2025, characterized by substantial government support for biotech research, a high concentration of biopharmaceutical companies, and increasing adoption of reagents, kits, and instruments, with mammalian cells and molecules such as plasmid DNA, siRNA, and RNP complexes being widely used

- India is expected to be the fastest-growing country in the Asia-Pacific transfection market during the forecast period due to expanding biotechnology infrastructure, growing biotech startups, and increasing investments in precision medicine and CRISPR-based transfection methods

- Transient transfection segment dominated the Asia-Pacific transfection market with a market share of 58.5% in 2025, driven by its versatility, high efficiency, and widespread use in research, preclinical, and early-stage clinical applications

Report Scope and Asia-Pacific Transfection Market Segmentation

|

Attributes |

Asia-Pacific Transfection Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

Asia-Pacific

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework |

Asia-Pacific Transfection Market Trends

Advancements in CRISPR and Non-Viral Transfection Methods

- A significant and accelerating trend in the Asia‑Pacific transfection market is the growing adoption of CRISPR-based transfection technologies alongside non-viral transfection methods, enabling precise gene editing and safer delivery of genetic material into cells

- For instance, researchers in China and India are increasingly using lipid-based and electroporation methods for CRISPR transfection in mammalian cells, improving transfection efficiency while reducing cytotoxicity

- CRISPR integration in transfection workflows enables applications such as targeted gene knockouts, gene insertions, and functional genomic studies. Non-viral transfection methods are widely used in early-stage research and preclinical studies, providing scalable and cost-effective solutions for academic and industrial labs

- The seamless integration of transfection techniques with advanced laboratory automation and analytical platforms facilitates centralized workflows for drug discovery, molecular biology, and bioproduction processes. Researchers can now combine transfection with high-throughput screening and live-cell imaging for optimized experimental outcomes

- This trend towards more precise, efficient, and integrated transfection methods is fundamentally reshaping user expectations for research capabilities. Consequently, companies such as Lonza and Thermo Fisher are developing advanced transfection kits and instruments that support CRISPR and non-viral approaches with higher reproducibility and throughput

- Emergence of hybrid transfection platforms combining viral and non-viral methods is gaining traction, offering improved transfection efficiency while minimizing cellular toxicity. These hybrid solutions are particularly popular in gene therapy research where high precision and cell viability are critical

- The demand for transfection solutions that offer high efficiency, low cytotoxicity, and compatibility with automated lab systems is growing rapidly across both academic and industrial sectors, as researchers prioritize speed, accuracy, and scalability in experimental workflows

Asia-Pacific Transfection Market Dynamics

Driver

Rising Biotech R&D Activities and Precision Medicine Adoption

- The increasing prevalence of biotechnology research, drug discovery initiatives, and gene therapy projects is a significant driver for the heightened demand for transfection technologies in the Asia-Pacific region

- For instance, in 2025, several Indian and Chinese biotech startups expanded their research programs in CRISPR and RNAi-based therapeutics, investing in high-throughput transfection platforms for mammalian cell studies

- As researchers focus on novel therapeutics and personalized medicine, transfection techniques provide reliable delivery of plasmid DNA, siRNA, and RNP complexes, offering essential support for in vitro and in vivo applications

- Furthermore, the growing collaboration between academic institutions, biopharmaceutical companies, and contract research organizations (CROs) is accelerating the adoption of advanced transfection reagents, kits, and instruments across the region

- The efficiency, reproducibility, and scalability of modern transfection technologies are key factors propelling their adoption in both research and preclinical stages, enabling high-throughput experiments, drug screening, and bioproduction

- Government support and funding initiatives in countries such as China, Japan, and India for biotech R&D and gene therapy programs are providing additional impetus for market growth, making transfection technologies more accessible to researchers

- Increasing adoption in biopharmaceutical manufacturing for protein production and gene therapy vectors is driving demand for robust transfection solutions capable of handling large-scale and high-yield applications

Restraint/Challenge

Cytotoxicity Concerns and Regulatory Hurdles

- Concerns surrounding the cytotoxic effects of certain transfection reagents, especially in sensitive cell types, pose a significant challenge to broader adoption. High reagent concentrations or viral methods may negatively impact cell viability, affecting experimental outcomes

- For instance, some studies have reported reduced viability in primary mammalian cells following electroporation or lipid-based transfection, leading researchers to seek optimized protocols or alternative delivery methods

- Addressing these cytotoxicity concerns through improved reagent formulations, optimized protocols, and safer non-viral alternatives is crucial for building user confidence. Companies such as Polyplus-transfection and Thermo Fisher emphasize biocompatible reagents and validated kits to reduce cellular stress

- In addition, navigating regulatory compliance for gene-editing experiments, viral vector use, and therapeutic applications can be complex, particularly across multiple Asia-Pacific countries with varying standards

- Overcoming these challenges through rigorous product validation, training for lab personnel, and alignment with regional regulations will be vital for sustained market growth

- High cost of advanced transfection reagents and instruments remains a restraint, particularly for smaller academic labs or emerging biotech companies, limiting broader adoption despite technological benefits

- Need for skilled workforce and technical expertise to operate complex transfection platforms and optimize protocols is another challenge, requiring training and experience for effective implementation

Asia-Pacific Transfection Market Scope

The market is segmented on the basis of type, methods, CRISPR transfection methods, products, organism, types of molecule, application, stage, end user, and distribution channel.

- By Type

On the basis of type, the Asia-Pacific transfection market is segmented into transient transfection and stable transfection. The transient transfection segment dominated the market with the largest revenue share of 58.5% in 2025, driven by its flexibility and rapid expression of target genes in research and preclinical studies. Transient transfection allows researchers to quickly assess protein function and gene expression without permanent modification of the host genome, which is ideal for high-throughput screening and experimental validation. Academic and pharmaceutical laboratories prefer transient transfection for its cost-effectiveness and compatibility with multiple cell types. Its widespread adoption is supported by increasing demand in genomics, RNAi research, and protein expression studies. Standardized reagent kits and instruments further enhance reproducibility and efficiency. The segment also benefits from growing R&D initiatives and the rise of automated lab workflows in the region.

The stable transfection segment is expected to witness the fastest growth rate at a projected CAGR of 20% during 2026–2033, fueled by the need for long-term gene expression in industrial, therapeutic, and commercial applications. Stable transfection ensures reproducible cell lines for protein production, gene therapy research, and large-scale bioproduction. Increasing adoption in biopharmaceutical manufacturing and preclinical studies supports growth. Stable transfection is critical in applications requiring consistent gene expression over multiple cell generations. The segment is further strengthened by demand for advanced cell line development services from CROs and CMOs. Rising government funding and biotech initiatives in Asia-Pacific countries also accelerate growth.

- By Methods

On the basis of methods, the market is segmented into non-viral methods and viral methods. The non-viral methods segment dominated with 62% share in 2025 due to its safety, low cytotoxicity, and applicability across a wide range of cell types. Non-viral methods such as lipid-based transfection, electroporation, and polymer-mediated delivery are widely used in academic research, preclinical studies, and CRISPR-based experiments. Their ease of handling and lower regulatory burden maker them highly favorable for early-stage research. Non-viral methods are also preferred in high-throughput drug screening and protein expression applications. The segment benefits from innovations in transfection kits and automated platforms that improve reproducibility. Strong adoption in mammalian cells further strengthens this segment’s dominance. Continuous improvements in reagent formulations and delivery protocols support consistent experimental outcomes.

The viral methods segment is expected to witness the fastest growth during the forecast period, driven by increasing gene therapy research, in vivo applications, and precision medicine initiatives. Viral vectors, including lentivirus and adenovirus, provide stable gene integration and high transfection efficiency, making them essential for therapeutic development. The segment growth is further fueled by rising demand for viral vector production and clinical trial activity in Asia-Pacific. Viral methods are preferred for stable and long-term gene expression in preclinical and clinical applications. Increasing investment in viral vector manufacturing facilities also contributes to rapid growth.

- By CRISPR Transfection Methods

On the basis of CRISPR transfection methods, the market is segmented into non-viral methods and viral methods. The non-viral CRISPR transfection segment dominated in 2025 due to lower cytotoxicity, ease of use, and compatibility with mammalian cells. Techniques such as electroporation of RNP complexes or lipid-mediated delivery enable rapid, transient gene editing and are widely used in functional genomics and drug discovery studies. Non-viral CRISPR transfection is ideal for high-throughput screening, allowing multiple experiments to be conducted quickly. Its safety profile and reduced regulatory requirements contribute to strong adoption in academic and industrial research. The segment also benefits from the availability of standardized kits and automated delivery platforms.

The viral CRISPR transfection segment is expected to grow the fastest during the forecast period, supported by clinical and therapeutic applications requiring stable, long-term gene modification. Viral CRISPR vectors enable durable gene expression, critical in gene therapy, regenerative medicine, and disease modeling studies. Rising investments in clinical trials and precision therapeutics further accelerate segment growth. The segment also benefits from increasing availability of viral vector production services in the region.

- By Products

On the basis of products, the market is segmented into reagents & kits, instruments, and software. The reagents & kits segment dominated with 65% share in 2025, owing to their essential role in performing transfection experiments efficiently. Kits provide standardized reagents and protocols that ensure reproducibility, making them highly preferred by research labs and biopharma companies. They support multiple transfection methods, including transient, stable, viral, and non-viral approaches. Continuous innovation, such as CRISPR-ready reagents and high-throughput formats, further boosts demand. The segment also benefits from increasing academic and industrial R&D initiatives in Asia-Pacific. Growing adoption in mammalian cell research and protein expression studies reinforces dominance.

The instruments segment is expected to witness the fastest growth during the forecast period, driven by rising adoption of automated transfection platforms, electroporators, and high-throughput systems. Instruments improve reproducibility, scalability, and efficiency, particularly in biopharmaceutical manufacturing and preclinical studies. Growth is fueled by increasing focus on large-scale protein production, gene therapy vector synthesis, and integrated laboratory automation solutions. Increasing automation in research laboratories is also supporting rapid expansion of this segment.

- By Organism

On the basis of organism, the market is segmented into mammalian cells, plants, fungi, virus, and bacteria. The mammalian cells segment dominated in 2025 with 65% share due to their extensive use in therapeutic research, drug discovery, and protein production. Mammalian cells provide biologically relevant models that mimic human physiology, enabling accurate functional studies. Their compatibility with multiple transfection methods and CRISPR applications further enhances adoption. Academic and commercial laboratories favor mammalian cells for high-throughput screening and gene-editing research. The segment is supported by increasing R&D investments and the growing adoption of cell-based assays.

The bacteria segment is expected to witness the fastest growth during the forecast period, driven by rising microbial gene-editing research and synthetic biology applications. Bacteria are widely used for recombinant protein production, enzyme synthesis, and metabolic engineering due to their rapid growth and scalability. Increasing demand for cost-effective and high-yield industrial bioproduction supports segment expansion. Academic and commercial research labs are adopting bacterial systems for functional genomics and gene-editing studies. The segment benefits from advancements in non-viral transfection methods optimized for prokaryotic cells. Rising investment in industrial biotechnology and microbial engineering in Asia-Pacific further accelerates growth.

- By Types of Molecule

On the basis of molecule type, the market is segmented into plasmid DNA, siRNA, proteins, DNA oligonucleotides, RNP complexes, and others. The plasmid DNA segment dominated in 2025 with 40% share due to its versatility, ease of use, and widespread application in gene expression studies, reporter assays, and protein production. Plasmids are compatible with multiple transfection methods, including transient and stable approaches, and are widely adopted in research, preclinical, and therapeutic applications. Their compatibility with both viral and non-viral delivery methods enhances usability across labs. Academic institutions and biopharmaceutical companies heavily rely on plasmid DNA for high-throughput functional studies. Continuous innovation in plasmid design and delivery reagents further strengthens this segment.

The RNP complexes segment is expected to witness the fastest growth during the forecast period, driven by increasing adoption of CRISPR-based gene-editing applications. RNP complexes offer high-efficiency transient gene editing with minimal off-target effects, making them suitable for both research and clinical studies. Their fast action and reduced cytotoxicity make them ideal for sensitive mammalian cells. Rising investments in precision therapeutics and gene editing research are supporting rapid growth. The segment benefits from availability of standardized RNP delivery kits and automated transfection instruments.

- By Application

On the basis of application, the market is segmented into in vitro, in vivo, bioproduction, and others. The in vitro application segment dominated in 2025 with 55% share, due to its extensive use in drug screening, functional genomics, and academic research. In vitro transfection allows controlled experimentation, supporting reproducibility and rapid validation of gene function. It is particularly relevant for high-throughput studies, protein expression analysis, and early-stage drug discovery. Academic and industrial labs prefer in vitro applications for flexibility, cost-effectiveness, and speed of experimentation. The segment also benefits from integration with high-content screening and analytical platforms. Continuous demand for R&D in molecular biology further strengthens its dominance.

The bioproduction segment is expected to witness the fastest growth during the forecast period, fueled by rising demand for large-scale production of proteins, viral vectors, and biologics. Industrial adoption of transfection techniques for commercial-scale bioproduction is increasing, especially in biopharmaceutical manufacturing. Bioproduction applications require reproducibility, high yield, and scalability, driving demand for optimized reagents and automated platforms. The segment is supported by growing clinical and therapeutic applications in Asia-Pacific. Increasing collaboration between biopharma and CMOs further accelerates growth.

- By Stage

On the basis of stage, the market is segmented into research, preclinical, clinical phases, and commercial. The research stage segment dominated in 2025 with 50% share, supported by high volumes of academic and pharmaceutical R&D activities. Research labs rely on transfection for functional studies, protein expression, gene-editing experiments, and early-stage drug discovery. Availability of standardized kits, reagents, and instruments enhances reproducibility and reliability. The segment benefits from high adoption in universities, biotech startups, and government-funded research programs. Continuous innovation in CRISPR, non-viral, and viral transfection platforms further reinforces dominance.

The clinical phases segment is expected to witness the fastest growth during the forecast period, driven by increasing adoption of transfection for gene therapy, RNAi therapeutics, and CRISPR-based interventions. Rising clinical trial activity and regulatory approvals for gene-modifying therapies accelerate demand. This segment also benefits from improved safety profiles and high-efficiency delivery systems. Growing investments in translational medicine and precision therapeutics contribute to segment growth. Automated and scalable transfection platforms support expansion in clinical research.

- By End User

On the basis of end user, the market is segmented into biopharma, CROs, CMOs/CDMOs, academia, hospitals, clinical labs, and others. The biopharma segment dominated in 2025 with 45% share due to extensive R&D and large-scale bioproduction activities requiring transfection solutions. Biopharma companies leverage advanced reagents, instruments, and CRISPR methods for therapeutic development. High investments in precision medicine, gene therapy, and biologics pipelines support strong demand. The segment benefits from increasing adoption of automated and high-throughput transfection platforms. Biopharma companies’ focus on efficiency, reproducibility, and scalability further strengthens this segment.

The CROs segment is expected to witness the fastest growth during the forecast period, driven by outsourcing of research, gene-editing, protein production, and high-throughput screening activities. CROs provide scalability, expertise, and faster timelines for biotech and pharmaceutical companies. They enable smaller firms to access advanced transfection capabilities without investing heavily in infrastructure. Rising clinical trial outsourcing in Asia-Pacific supports segment growth. CROs are increasingly integrating automated transfection and analytical platforms to support client projects.

- By Distribution Channel

On the basis of distribution channel, the market is segmented into direct tender, retail sales, and others. The direct tender segment dominated in 2025 due to large-scale procurement by biopharma companies, academic institutions, and government research laboratories. Bulk orders and long-term contracts ensure a consistent supply of reagents, kits, and instruments. Direct tender procurement supports scalability, cost-effectiveness, and timely delivery of transfection products. High-volume usage in large labs and R&D facilities reinforces dominance. This channel is also preferred for integration of automated platforms in industrial and clinical research.

The retail sales segment is expected to witness the fastest growth during the forecast period, driven by increasing demand from smaller academic labs, startups, and individual researchers purchasing transfection reagents, kits, and instruments online or through distributors. Convenience, accessibility, and e-commerce adoption contribute to rapid growth. Retail channels enable researchers to access advanced products without committing to large-scale procurement. Increasing awareness of standardized kits and user-friendly instruments supports segment expansion.

Asia-Pacific Transfection Market Regional Analysis

- China dominated the Asia-Pacific transfection market with the largest revenue share of 41% in 2025, characterized by substantial government support for biotech research, a high concentration of biopharmaceutical companies, and increasing adoption of reagents, kits, and instruments, with mammalian cells and molecules such as plasmid DNA, siRNA, and RNP complexes being widely used

- Researchers and biopharma companies in China are increasingly investing in CRISPR, RNAi, and large-scale protein production studies, fueling demand for advanced transfection reagents, kits, and instruments

- The country’s growth is supported by substantial government funding initiatives, favorable regulatory frameworks, and increasing collaboration between academic institutions, CROs, and CMOs/CDMOs. High adoption of automated and high-throughput transfection platforms in research laboratories and biopharmaceutical manufacturing further accelerates market expansion.

The China Transfection Market Insight

The China transfection market captured the largest revenue share in 2025 within Asia-Pacific, driven by strong biotechnology research infrastructure, rapid growth in pharmaceutical R&D, and widespread adoption of gene-editing and protein expression technologies. Research institutions and biopharma companies are increasingly investing in CRISPR, RNAi, and large-scale protein production studies, fueling demand for advanced transfection reagents, kits, and instruments. The country’s growth is supported by substantial government funding initiatives, favorable regulatory frameworks, and increasing collaboration between academia and industry. High adoption of automated and high-throughput transfection platforms further accelerates market expansion. Cost-effective transfection solutions and a strong focus on therapeutic protein development contribute to China’s leading position. Overall, China’s expanding biotechnology ecosystem and increasing R&D investments make it the dominant driver of the Asia-Pacific transfection market.

Japan Transfection Market Insight

The Japan transfection market is witnessing significant growth due to the country’s advanced biotech research environment, emphasis on precision medicine, and rising adoption of CRISPR and RNAi technologies. Japanese research labs prioritize high-quality, reproducible transfection methods for both academic and industrial applications. The integration of automated platforms and high-throughput systems in laboratories is further accelerating adoption. Japan’s focus on innovative therapeutic development, biopharmaceutical production, and regulatory support for advanced research enhances market expansion. Demand for transient and stable transfection methods across mammalian cell studies contributes to steady growth. Overall, Japan’s emphasis on technological sophistication and innovation is supporting the increasing adoption of transfection solutions.

India Transfection Market Insight

The India transfection market accounted for the largest growth rate in Asia-Pacific in 2025, fueled by a rapidly expanding biotech research sector, increasing pharmaceutical R&D, and growing adoption of gene-editing technologies. India’s rising number of academic institutions, CROs, and biotech startups is driving demand for transfection reagents, kits, and instruments. Government initiatives promoting biotechnology, digitalization of research labs, and smart lab infrastructure further support market growth. Cost-effective transfection solutions and increasing manufacturing capabilities for reagents and kits make advanced technologies more accessible. India’s focus on protein expression, RNAi studies, and CRISPR research is accelerating adoption. Overall, the country is emerging as one of the fastest-growing transfection markets in Asia-Pacific.

South Korea Transfection Market Insight

The South Korea transfection market is expanding steadily due to the country’s strong emphasis on biopharmaceutical research, regenerative medicine, and gene-editing technologies. High adoption of automated transfection platforms in research institutions and pharmaceutical companies is driving demand. The government’s support for biotech R&D and collaboration between academia and industry accelerates market growth. South Korea is witnessing increasing applications of transfection in protein production, CRISPR gene editing, and in vitro studies. Advanced instruments, kits, and reagents are being widely adopted for both research and industrial purposes. Overall, South Korea’s technology-driven research ecosystem supports consistent growth in the transfection market.

Asia-Pacific Transfection Market Share

The Asia-Pacific Transfection industry is primarily led by well-established companies, including:

- Thermo Fisher Scientific Inc. (U.S.)

- Promega Corporation (U.S.)

- QIAGEN (Netherlands)

- Bio Rad Laboratories, Inc. (U.S.)

- Lonza (Switzerland)

- MaxCyte, Inc. (U.S.)

- Takara Bio Inc. (Japan)

- SBS Genetech Co., Ltd. (China)

- FUJIFILM Irvine Scientific, Inc. (U.S.)

- Cytiva (U.S.)

- Geno Technology, Inc. (U.S.)

- R&D Systems, Inc. (U.S.)

- Applied Biological Materials Inc. (Canada)

- Beckman Coulter, Inc. (U.S.)

- Agilent Technologies, Inc. (U.S.)

- Altogen Biosystems (U.S.)

- SignaGen Laboratories (U.S.)

- Sinobiological (China)

- Beyotime Institute of Biotechnology (China)

- Hanbio Biotechnology Co., Ltd. (China)

What are the Recent Developments in Asia-Pacific Transfection Market?

- In April 2025, scientists published a new study demonstrating viral delivery of an RNA‑guided genome editor for transgene‑free germline editing in plants, showing advanced viral vector systems can be used to deliver genome editing tools without traditional transfection constructs. While focused on plant biology, this research showcases evolving vector delivery technologies that inform transfection and viral delivery systems across biological systems and hints at broader methodological innovation

- In December 2024, Atlantis Bioscience announced a strategic partnership with PackGene to expand distribution of high‑quality AAV (Adeno‑Associated Virus) vector services across Asia and Southeast Asia, enabling researchers easier access to vector platforms used in gene therapy and related transfection studies. This collaboration supports gene delivery and cellular research workflows throughout the region by providing ready‑to‑use vector services that advance drug development and vaccine research

- In March 2024, Takara Bio launched its new PrimeCap™ T7 RNA Polymerase (low dsRNA), a high‑performance mutant T7 RNA polymerase optimized for mRNA therapeutic research and development. This product supports mRNA work and transfection workflows across the APAC research community, strengthening reagent portfolios and aiding labs engaged in advanced transfection and transcript synthesis studies. The launch reflects growing demand for precise mRNA tools in gene editing, vaccine development, and cellular research in Asia‑Pacific

- In April 2022, WuXi Advanced Therapies and A*STAR announced a partnership to bring proprietary TESSA™ technology — a transfection‑free, scalable AAV manufacturing process to the Asia‑Pacific region. This collaboration aims to foster scientific innovation in cell and gene therapy production and establish training programs for next‑generation scientists. The TESSA™ platform improves virus yields, significantly impacting capabilities in gene therapy manufacture and delivery workflows that intersect with transfection‑related technologies

- In March 2022, WuXi Advanced Therapies announced the launch of the TESSA™ technology to improve scalable manufacture of AAV vectors, representing a notable innovation in high‑yield viral vector production that supports gene delivery and therapeutic development efforts used in transfection workflows across the region. This technology reduces manufacturing complexity and accelerates gene therapy production pipelines

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.