Asia Pacific Water Purifier Market

Market Size in USD Billion

CAGR :

%

USD

3.40 Billion

USD

6.58 Billion

2025

2033

USD

3.40 Billion

USD

6.58 Billion

2025

2033

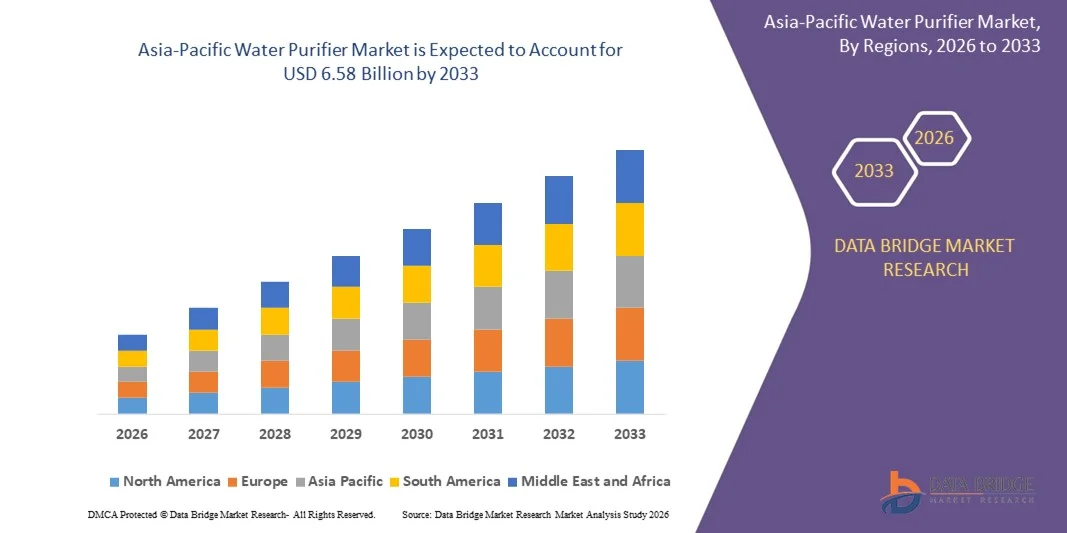

| 2026 –2033 | |

| USD 3.40 Billion | |

| USD 6.58 Billion | |

|

|

|

|

Asia-Pacific Water Purifier Market Size

- The Asia-Pacific water purifier market size was valued at USD 3.40 billion in 2025 and is expected to reach USD 6.58 billion by 2033, at a CAGR of 8.60% during the forecast period

- The market growth is largely fuelled by rising concerns over water contamination and increasing incidence of waterborne diseases

- In addition, growing urbanisation and improving household awareness regarding safe drinking water are supporting market expansion

Asia-Pacific Water Purifier Market Analysis

- The market is witnessing steady innovation, with manufacturers focusing on multi-stage purification, smart monitoring features, and energy-efficient systems

- Consumer preference is gradually shifting towards technologically advanced and low-maintenance purifiers, driven by rising disposable incomes and lifestyle improvements

- China dominated the water purifier market in 2025, supported by persistent concerns over industrial pollution and urban water contamination. High population density and growing awareness of water-related health risks have driven widespread adoption of household water purification systems

- Japan is expected to witness the highest compound annual growth rate (CAGR) in the Asia-Pacific water purifier market due to increasing consumer focus on hygiene and water quality, rising demand for compact and technologically advanced purification systems, and growing preference for premium home appliances.

- The RO purifier segment held the largest market revenue share in 2025, driven by its high efficiency in removing dissolved solids, heavy metals, and chemical contaminants commonly found in water sources. RO systems are widely adopted across households due to growing health awareness and the preference for advanced multi-stage purification solutions

Report Scope and Asia-Pacific Water Purifier Market Segmentation

|

Attributes |

Asia-Pacific Water Purifier Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

Asia-Pacific

|

|

Key Market Players |

• Haier Group Corporation (China) |

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Asia-Pacific Water Purifier Market Trends

Rise of Advanced and Smart Water Purification Solutions

- The growing shift toward advanced and smart water purification systems is transforming the water purifier market by enabling efficient removal of contaminants and real-time monitoring of water quality. Technologies such as RO, UV, and multi-stage filtration allow users to ensure safe drinking water at the point of consumption. This results in improved health outcomes, reduced exposure to waterborne diseases, and stronger consumer trust in purification solutions

- The rising demand for effective purification solutions in areas facing poor or inconsistent water quality is accelerating the adoption of high-performance water purifiers. These systems are particularly effective in eliminating bacteria, viruses, dissolved solids, and chemical pollutants. The trend is further supported by increasing health awareness, preventive lifestyle choices, and growing reliance on purified water for daily consumption

- The improving affordability and user-friendly design of modern water purifiers are making them attractive for routine household use. Features such as compact designs, easy installation, and filter replacement alerts enable regular usage without significant technical or cost barriers. This convenience supports long-term adoption and encourages replacement of traditional water treatment methods

- For instance, in recent years, household adoption of multi-stage purification systems has increased after users reported noticeable improvements in taste and clarity of drinking water. Consumers also observed reduced instances of water-related health issues, reinforcing confidence in advanced purification technologies. This has contributed to repeat purchases and positive word-of-mouth adoption

- While advanced water purification technologies are enhancing water safety and consumer confidence, their long-term impact depends on continuous innovation, cost optimization, and consumer education. Manufacturers must focus on efficient product design, improved filtration efficiency, and value-based offerings. These efforts are essential to fully capitalize on growing demand and sustain market momentum

Asia-Pacific Water Purifier Market Dynamics

Driver

Rising Health Awareness and Growing Concerns Over Water Contamination

- Increasing awareness of health risks associated with contaminated drinking water is driving consumers to invest in water purification solutions as a preventive measure. Contaminants such as bacteria, heavy metals, and chemical residues have heightened concerns over water safety. This has strengthened demand for reliable purification systems across households

- Consumers are becoming more aware of the long-term health and financial risks linked to untreated water, including medical expenses and reduced quality of life. This awareness has led to higher adoption of household water purifiers. The shift is supported by growing emphasis on wellness, hygiene, and safe consumption practices

- In addition, supportive initiatives promoting access to clean drinking water and improvements in water quality standards are encouraging the use of purification systems. Awareness campaigns and product availability through multiple sales channels are improving consumer reach. These factors collectively contribute to steady market growth

- For instance, increased consumer focus on preventive healthcare has contributed to a steady rise in first-time water purifier installations. Households are increasingly prioritizing safe daily water intake as part of broader health management practices. This trend is supporting consistent demand for purification solutions

- While awareness and supportive measures are driving adoption, sustained growth depends on ensuring product affordability and improving after-sales support. Integrating purification systems into routine household practices is also essential. Continued education on water quality risks will further strengthen long-term adoption

Restraint/Challenge

High Initial Cost and Ongoing Maintenance Requirements

- The relatively high upfront cost of advanced water purifiers, particularly those using RO and multi-stage technologies, limits adoption among price-sensitive consumers. These systems often require additional components and installation expenses. As a result, affordability remains a key concern for widespread market penetration

- Ongoing maintenance requirements, including periodic filter replacements and servicing, add to the total cost of ownership. For many households, these recurring expenses create hesitation toward long-term use. This is especially true in areas where perceived water quality risks are moderate

- Market penetration is also challenged by limited consumer understanding of maintenance needs. Improper upkeep can lead to reduced system efficiency or discontinued usage over time. Inadequate after-sales support further impacts customer satisfaction and long-term retention

- For instance, users of advanced purification systems have reported reduced performance when filters are not replaced on schedule. Cost concerns and lack of awareness are common reasons for delayed maintenance. This negatively affects system efficiency and user experience

- While purification technologies continue to advance, addressing cost and maintenance challenges remains critical. Market players must focus on durable filters, cost-effective servicing models, and consumer education. These strategies are essential to overcome adoption barriers and support sustained market expansion

Asia-Pacific Water Purifier Market Scope

The market is segmented on the basis of technology, accessories, portability, end-user, and distribution channel

- By Technology

On the basis of technology, the Asia-Pacific water purifier market is segmented into Gravity Purifier, UV Purifier, RO Purifier, Sediment Filter, Water Softener, and Others. The RO purifier segment held the largest market revenue share in 2025, driven by its high efficiency in removing dissolved solids, heavy metals, and chemical contaminants commonly found in water sources. RO systems are widely adopted across households due to growing health awareness and the preference for advanced multi-stage purification solutions.

The UV purifier segment is expected to witness the fastest growth rate from 2026 to 2033, supported by its effectiveness in eliminating bacteria and viruses without altering water taste or mineral content. UV purifiers are increasingly preferred as complementary systems alongside RO units, especially in areas with biologically contaminated water

- By Accessories

Based on accessories, the Asia-Pacific water purifier market is segmented into Pitcher Filter, Under Sink Filter, Shower Filter, Faucet Mount, Water Dispenser, Replacement Filters, Counter Top, Whole House, and Others. The under sink filter segment accounted for the largest revenue share in 2025, attributed to its high filtration capacity, space-saving design, and ability to support multi-stage purification systems. These systems are widely used in residential settings seeking long-term and discreet water treatment solutions.

The replacement filters segment is expected to witness the fastest growth rate from 2026 to 2033, driven by the recurring need for filter replacement and rising installed base of water purifiers. Increasing consumer awareness regarding timely maintenance is further supporting demand

- By Portability

On the basis of portability, the market is segmented into Portable Water Purifiers and Non-Portable Water Purifiers. The non-portable water purifiers segment dominated the market in 2025, driven by widespread installation of fixed purification systems in residential and commercial spaces. These systems offer higher purification capacity and are suited for continuous household water consumption.

The portable water purifiers segment is expected to witness the fastest growth rate from 2026 to 2033, supported by increasing outdoor activities, travel usage, and demand for emergency water purification solutions

- By End-User

Based on end-user, the Asia-Pacific water purifier market is segmented into Commercial, Residential, and Industrial. The residential segment held the largest market share in 2025, driven by rising health awareness, concerns over tap water quality, and increasing adoption of household purification systems. Growing focus on preventive healthcare continues to support residential demand.

The commercial segment is expected to witness the fastest growth rate from 2026 to 2033, supported by increasing installation of water purification systems across offices, hospitality establishments, and healthcare facilities to ensure safe drinking water

- By Distribution Channel

On the basis of distribution channel, the market is segmented into Retail Stores, Direct Sales, and Online. The retail stores segment accounted for the largest revenue share in 2025, driven by strong consumer preference for in-store product evaluation, brand comparison, and after-sales support. Physical retail presence continues to play a key role in purchase decisions.

The online segment is expected to witness the fastest growth rate from 2026 to 2033, supported by expanding e-commerce platforms, competitive pricing, and the convenience of home delivery and installation services

Asia-Pacific Water Purifier Market Regional Analysis

- China dominated the water purifier market in 2025, supported by persistent concerns over industrial pollution and urban water contamination. High population density and growing awareness of water-related health risks have driven widespread adoption of household water purification systems

- The strong presence of domestic manufacturers, rapid technological advancements, and increasing government focus on improving water quality standards continue to reinforce China’s leading position in the global water purifier market

Japan Water Purifier Market Insight

The Japan water purifier market is expected to witness the fastest growth rate from 2026 to 2033, driven by strong consumer focus on hygiene, water purity, and product quality. Increasing adoption of compact and technologically advanced purification systems aligns with urban living and limited space requirements. The rising demand for high-efficiency filtration solutions, combined with growing preference for premium and innovative home appliances, is significantly contributing to the rapid expansion of the water purifier market in Japan.

Asia-Pacific Water Purifier Market Share

The Asia-Pacific water purifier industry is primarily led by well-established companies, including:

• Haier Group Corporation (China)

• Midea Group Co., Ltd. (China)

• Xiaomi Corporation (China)

• Panasonic Corporation (Japan)

• Sharp Corporation (Japan)

• LG Electronics Inc. (South Korea)

• Coway Co., Ltd. (South Korea)

• Samsung Electronics Co., Ltd. (South Korea)

• Toshiba Corporation (Japan)

• Hitachi, Ltd. (Japan)

• Kent RO Systems Ltd. (India)

• Eureka Forbes Ltd. (India)

• Livpure Private Limited (India)

• AO Smith India Water Products Pvt. Ltd. (India)

• Pureit (India)

Latest Developments in Asia-Pacific Water Purifier Market

- In March 2023, Eureka Forbes launched next-generation RO+UV purifiers in India. The purifiers featured IoT-enabled monitoring to enhance user experience and convenience. This development aimed to strengthen Eureka Forbes’ presence in urban households. It also promoted the adoption of smart water purification systems across the market

- In May 2023, Kent RO Systems expanded its manufacturing facilities in Southeast Asia. The expansion improved accessibility to emerging markets such as Vietnam and Thailand. It enabled faster distribution and increased availability of water purifiers. The move supported market growth and penetration in the region

- In July 2023, Panasonic collaborated with Vietnam's Ministry of Health to integrate smart purifiers into public water systems. This initiative enhanced access to clean drinking water in rural areas. It also supported public health improvement and increased brand visibility. The development positioned Panasonic as a key player in government-supported water purification projects

- In September 2023, Eureka Forbes partnered with rural development programs to supply compact purifiers to underserved regions. This initiative addressed affordability concerns and expanded market reach. It facilitated access to safe drinking water for low-income households. The move strengthened Eureka Forbes’ social impact and market presence

- In November 2023, Kent introduced eco-friendly purifiers with 25% reduced energy consumption. The development aligned with sustainability goals and appealed to environmentally conscious consumers. It also enhanced operational efficiency and promoted energy savings. This initiative reinforced Kent’s competitive position in the water purifier market

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.