Global Water Softeners Market

Market Size in USD Billion

CAGR :

%

USD

3.35 Billion

USD

5.57 Billion

2024

2032

USD

3.35 Billion

USD

5.57 Billion

2024

2032

| 2025 –2032 | |

| USD 3.35 Billion | |

| USD 5.57 Billion | |

|

|

|

|

Water Softeners Market Size

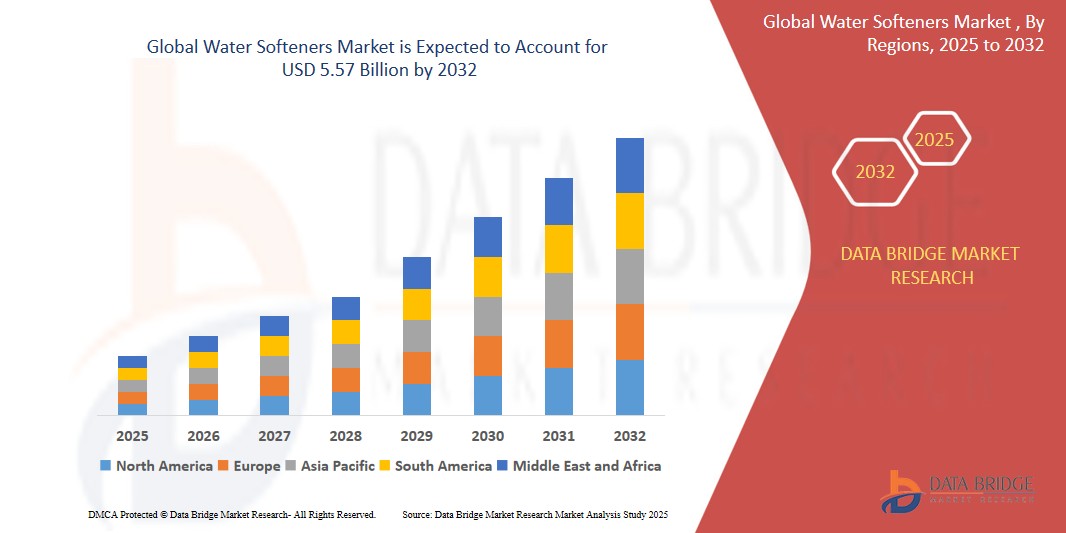

- The global water softeners market size was valued at USD 3.35 billion in 2024 and is expected to reach USD 5.57 billion by 2032, growing at a CAGR of 6.6% during the forecast period.

- This growth is primarily driven by rising water hardness levels globally, increased consumer awareness about health and plumbing damage, and the adoption of water softeners in residential and industrial setups.

Water Softeners Market Analysis

- Water softeners are treatment devices designed to remove hardness-causing minerals such as calcium and magnesium from water, helping to prevent scale build-up in plumbing, appliances, and industrial equipment.

- The market is witnessing consistent growth due to rising urbanization, infrastructure development, and concerns over hard water effects on appliances and human health—especially in regions with high water hardness levels.

- North America is projected to dominate the global water softeners market with a share of 38.10%, driven by increased residential adoption, aging water infrastructure, and high levels of water hardness across several U.S. states.

- Asia-Pacific is expected to be the fastest-growing region in the water softeners market, driven by rapid urban development, increased awareness about water quality, and growth in the industrial and residential construction sectors.

- The salt-based water softeners segment is expected to hold the largest market share of 68.24%, owing to its proven effectiveness in removing hardness minerals and widespread adoption in both residential and industrial applications.

Report Scope and Water Softeners Market Segmentation

|

Attributes |

Water Softeners Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework.

|

Water Softeners Market Trends

“Rising Adoption of Smart and Salt-Free Water Softeners”

- A key trend in the global water softeners market is the rising adoption of smart and salt-free water softeners, driven by increasing demand for low-maintenance, eco-friendly, and efficient water treatment solutions.

- Consumers are increasingly turning toward salt-free alternatives due to concerns about sodium discharge, water wastage, and environmental sustainability—especially in regions with brine discharge restrictions.

- Smart water softeners equipped with IoT capabilities, remote monitoring, and real-time water usage tracking are gaining popularity among tech-savvy consumers and commercial end-users seeking operational efficiency and water conservation.

For instance, Culligan International and EcoWater Systems have launched digitally connected softeners with Wi-Fi and app-based monitoring features to enhance customer experience and maintenance efficiency.

- As end-users become more conscious of environmental impact, maintenance convenience, and water conservation, the shift toward non-electric, salt-free, and smart water softeners is expected to redefine product development and accelerate market expansion.

Water Softeners Market Dynamics

Driver

“Growing Awareness of Hard Water Effects on Health and Infrastructure”

- One of the primary drivers of the water softeners market is the growing awareness of the negative impacts of hard water on both human health and plumbing infrastructure.

- Hard water, which contains high concentrations of calcium and magnesium, leads to scale buildup in pipes and appliances, reducing efficiency and lifespan while increasing maintenance costs.

- In residential settings, hard water causes skin irritation, hair damage, and reduced soap efficiency, leading consumers to seek effective treatment systems.

- In industrial and commercial sectors, water hardness affects boiler efficiency, cooling systems, and manufacturing processes, making water softeners critical for operational reliability.

For instance, residential installations in hard water regions of the U.S.—like Arizona and Texas—have seen a notable increase, with local utility partnerships promoting softeners as a long-term infrastructure protection solution.

- As more regions recognize the economic and health benefits of softening hard water, adoption is expected to rise significantly across both developed and developing markets.

Restraint/Challenge

“High Initial Cost and Maintenance Requirements”

- Despite the benefits, the high initial investment and ongoing maintenance costs of water softeners pose a restraint to market growth, especially in cost-sensitive markets.

- Traditional salt-based water softeners require regular salt replenishment and periodic servicing, which increases operational costs and deters price-conscious consumers.

- In addition, installation costs, plumbing adjustments, and water usage for regeneration further elevate the total cost of ownership.

For instance, small households and low-income regions may delay adoption or opt for cheaper filtration alternatives due to concerns over installation complexity and recurring expenses.

- This cost challenge is particularly pressing in Asia-Pacific and Latin America, where economic constraints and lower awareness can limit penetration despite rising demand.

- Addressing this restraint requires affordable pricing strategies, low-maintenance models, and government incentives, especially in regions with high water hardness but limited purchasing power.

Water Softeners Market Scope

The market is segmented on the basis of type, and application.

- By Type

On the basis of type, the Water Softeners Market is segmented into Salt-Based Water Softeners and Salt-Free Water Softeners. The Salt-Based Water Softeners segment dominates the market, accounting for the largest revenue share of 58.7% in 2025, owing to their high efficiency in reducing water hardness through ion exchange, making them a preferred choice for regions with extremely hard water. These systems are extensively used in residential and commercial sectors due to their proven effectiveness in preventing scale buildup in appliances and plumbing.

However, the Salt-Free Water Softeners segment is projected to witness the highest CAGR of 8.63% during the forecast period of 2025–2032. This growth is driven by increasing consumer preference for eco-friendly, low-maintenance, and sodium-free solutions, especially in areas with regulatory restrictions on brine discharge. Rising awareness of environmental impact and operational cost savings further contributes to the growth of salt-free systems.

- By Process

Based on the process, the Water Softeners Market is categorized into Ion Exchange, Distillation, and Reverse Osmosis. The Ion Exchange segment held the largest share of 64.1% in 2025, attributed to its wide adoption across both residential and industrial applications. The method’s reliability, high efficiency in calcium and magnesium removal, and cost-effectiveness make it the dominant process technology in the market.

Meanwhile, the Reverse Osmosis (RO) segment is expected to record the fastest CAGR of 7.94% during 2025–2032, fueled by growing demand for multifunctional water treatment systems that provide not only softening but also contaminant and impurity removal. The increasing penetration of RO systems in both residential and commercial sectors, combined with technological advancements in energy efficiency and compact system design, are key growth factors.

By Application

On the basis of application, the market is segmented into Residential, Commercial, and Industrial. The Residential segment accounted for the largest market share of 47.6% in 2025, driven by rising consumer awareness about the health and appliance-related impacts of hard water. Increasing urbanization, improved living standards, and expanding housing developments in emerging economies further support segment dominance.

However, the Industrial segment is projected to grow at the highest CAGR of 7.38% over the forecast period, due to the rising need for scale-free, efficient water in sectors such as food processing, manufacturing, energy, and pharmaceuticals. Industrial facilities require consistent water quality to maintain equipment efficiency, reduce operational costs, and comply with stringent water usage standards, all of which contribute to the growing demand for industrial-grade water softening solutions.

Global Water Softeners Market Regional Analysis

North America Water Softeners Market Insight

North America holds a prominent share in the global water softeners market, backed by high awareness of hard water issues and widespread use across residential, commercial, and industrial sectors. Regulatory measures for water quality and a well-established plumbing infrastructure further boost the demand for softening systems across the region.

Technological advancements and increased emphasis on energy-efficient appliances have driven the adoption of both salt-based and salt-free systems in households and commercial establishments.

- U.S. Water Softeners Market Insight

The U.S. represents the largest market in North America in 2025, owing to increasing concerns about scaling, energy inefficiency, and appliance longevity caused by hard water. Residential users dominate the market, with growing penetration of water softening systems in new housing projects and retrofits. Additionally, commercial facilities such as hotels, hospitals, and restaurants are investing in water softeners to improve operational efficiency and service quality.

- Canada Water Softeners Market Insight

Canada’s water softeners market is projected to grow steadily over the forecast period, driven by rising demand for clean water solutions in urban households and small-scale industries. The presence of hard water in several provinces and increasing awareness of water-related appliance damage are encouraging adoption. Government rebates for water-efficient technologies and a growing emphasis on sustainable water usage practices further support market expansion.

Europe Water Softeners Market Insight

The European water softeners market is expected to grow at a healthy CAGR through 2032, supported by stringent water quality regulations, growing consumer awareness, and sustainability initiatives. The residential sector remains a key contributor, while commercial and industrial applications are gaining traction, particularly in Western Europe.

Increasing focus on energy efficiency, health concerns regarding limescale, and the environmental impact of hard water on heating systems are driving widespread use of water softening solutions.

- Germany Water Softeners Market Insight

Germany leads the European market due to high demand in both residential and industrial segments. The country’s advanced infrastructure and strict regulations around water efficiency and system maintenance fuel adoption. Water softeners are increasingly integrated into HVAC systems and water heating applications, reducing scaling and improving longevity and energy savings.

- United Kingdom Water Softeners Market Insight

The U.K. water softeners market is witnessing robust growth, particularly in southern and eastern regions where water hardness levels are among the highest in Europe. The growing preference for sustainable home improvement solutions, coupled with high costs of appliance repair due to scale damage, is accelerating adoption. The commercial sector, especially hospitality, is also investing in water softeners to enhance service quality and reduce maintenance costs.

Asia-Pacific Water Softeners Market Insight

Asia-Pacific is projected to be the fastest-growing region in the global water softeners market, with a CAGR exceeding 9.5% during the forecast period. Rapid urbanization, increasing industrialization, and growing awareness of water treatment benefits are key drivers across emerging economies. Expanding middle-class populations and rising construction of residential complexes further contribute to market growth, particularly in developing countries.

- China Water Softeners Market Insight

China dominates the Asia-Pacific region in terms of market share, supported by significant growth in residential and industrial water treatment needs. Water hardness in several provinces and increased investment in infrastructure development have spurred demand for water softeners. In addition, consumer awareness about the negative impact of hard water on health and appliances is rising, driving penetration of home water treatment solutions.

- India Water Softeners Market Insight

India’s water softeners market is growing at a rapid pace, driven by increasing urban population, rising disposable income, and awareness of hard water issues, especially in Tier-1 and Tier-2 cities. Residential adoption is gaining momentum, while commercial demand is rising from healthcare, hospitality, and food service sectors. Furthermore, government initiatives promoting clean water access and smart city developments are expected to accelerate the adoption of water softening technologies.

Water Softeners Market Share

The Water Softeners industry is primarily led by well-established companies, including:

- Grünbeck Wasseraufbereitung GmbH (Germany)

- BWT Wassertechnik GmbH (Germany)

- Harvey Water Softeners Ltd (UK)

- Kinetico UK Ltd (UK)

- Canature Environmental Products Co., Ltd. (China)

- Qinyuan Group Co., Ltd. (China)

- Ion Exchange (India) Ltd (India)

- Kent RO Systems Ltd (India)

- Coway Co., Ltd (South Korea)

- Woongjin Coway (South Korea)

- Culligan International Company (U.S.)

- Kinetico Incorporated (U.S.)

- Water-Right Inc. (U.S.)

- EcoWater Systems LLC (U.S.)

- A.O. Smith Corporation (U.S.)

- Pentair plc (Ireland)

- Whirlpool Corporation (U.S.)

- Hellenbrand Inc. (U.S.)

- 3M Company (U.S.)

Latest Developments in Global Water Softeners Market

- In February 2025, Culligan International launched its next-generation HE Connect Series, a smart residential water softener line integrated with IoT-enabled features. The new system allows real-time monitoring of water usage, salt levels, and service alerts via mobile app. This innovation is aimed at strengthening Culligan’s market position by offering convenience, efficiency, and predictive maintenance for modern households increasingly adopting smart home technologies.

- In August 2024, Pentair Plc announced the acquisition of a regional water treatment solutions provider in Southeast Asia to expand its footprint in high-growth emerging markets. The strategic move enables Pentair to access a wider customer base in the residential and light commercial segments while offering localized water softening solutions tailored to varying degrees of water hardness across the region.

- In May 2024, A.O. Smith Corporation introduced a new range of compact, eco-friendly water softeners under the ProLine XE series, featuring high-efficiency regeneration cycles and reduced salt and water consumption. This launch is aligned with rising demand for sustainable water treatment appliances in urban housing and helps A.O. Smith solidify its presence in North America and key international markets focused on green technology adoption.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.