Asia Pacific Womens Health Diagnostics Market

Market Size in USD Billion

CAGR :

%

USD

4.79 Billion

USD

9.48 Billion

2025

2033

USD

4.79 Billion

USD

9.48 Billion

2025

2033

| 2026 –2033 | |

| USD 4.79 Billion | |

| USD 9.48 Billion | |

|

|

|

|

Asia-Pacific Women’s Health Diagnostics Market Size

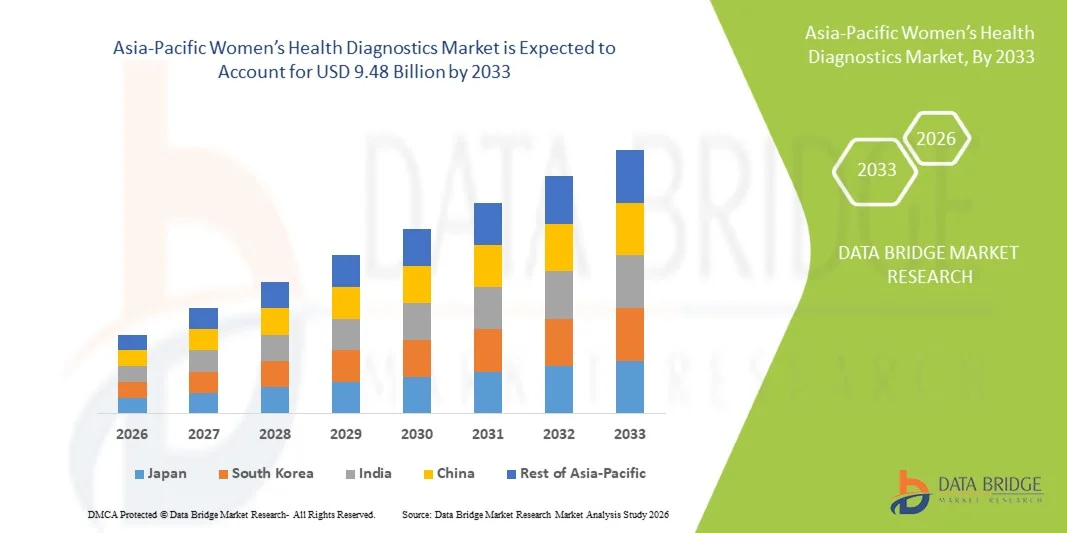

- The Asia-Pacific women’s health diagnostics market size was valued at USD 4.79 billion in 2025 and is expected to reach USD 9.48 billion by 2033, at a CAGR of 8.9% during the forecast period

- The market growth is largely fueled by the increasing prevalence of women-specific health conditions, rising awareness about early disease detection, and the expanding adoption of advanced diagnostic technologies such as molecular testing and point-of-care solutions across the region

- Furthermore, growing government initiatives, favorable reimbursement policies, and rising demand for personalized and preventive healthcare solutions are positioning women’s health diagnostics as a critical component of modern healthcare infrastructure. These converging factors are accelerating the adoption of women-focused diagnostic solutions, thereby significantly boosting the industry’s growth

Asia-Pacific Women’s Health Diagnostics Market Analysis

- Women’s health diagnostics, encompassing tests for conditions such as breast cancer, cervical cancer, reproductive health, and prenatal disorders, are increasingly vital components of modern healthcare systems in both clinical and home-based settings due to their role in early detection, personalized care, and improved patient outcomes

- The escalating demand for women’s health diagnostics is primarily fueled by growing awareness of women-specific health conditions, rising preventive healthcare initiatives, and increasing adoption of advanced diagnostic technologies such as AI-assisted imaging, molecular testing, and point-of-care solutions

- China dominated the Asia-Pacific women’s health diagnostics market with the largest revenue share of 37.9% in 2025, characterized by high population density, rising healthcare expenditure, and a strong presence of hospitals and diagnostic centers, with substantial growth in breast and cervical cancer screening programs driven by innovations from both established diagnostic companies and emerging healthcare tech startups focusing on AI, telemedicine, and portable testing solutions

- India is expected to be the fastest growing country in the women’s health diagnostics market during the forecast period due to increasing urbanization, rising disposable incomes, expanding healthcare infrastructure, and growing adoption of preventive screening programs across metropolitan and semi-urban areas

- Breast cancer testing segment dominated the Asia-Pacific women’s health diagnostics market with a market share of 40.2% in 2025, driven by high disease prevalence, established screening programs, and the adoption of advanced imaging and molecular testing technologies for early detection and continuous monitoring

Report Scope and Asia-Pacific Women’s Health Diagnostics Market Segmentation

|

Attributes |

Asia-Pacific Women’s Health Diagnostics Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

Asia-Pacific

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework |

Asia-Pacific Women’s Health Diagnostics Market Trends

“Enhanced Accuracy Through AI and Digital Health Integration”

- A significant and accelerating trend in the Asia-Pacific women’s health diagnostics market is the integration of artificial intelligence (AI) and digital health platforms, which is significantly enhancing the accuracy, speed, and personalization of diagnostic testing and reporting

- For instance, AI-powered mammography and cervical cancer screening platforms can detect early-stage abnormalities with higher precision, while connected apps provide patients and healthcare providers with seamless access to diagnostic results and personalized recommendations

- AI integration in diagnostics enables predictive risk assessments, pattern recognition in imaging, and intelligent alerts for abnormal results. For instance, some AI-enabled pap smear analysis tools highlight high-risk areas and notify clinicians for further review, improving early intervention outcomes

- The seamless integration of women’s health diagnostics with digital health platforms facilitates centralized patient management, allowing tracking of multiple diagnostic parameters such as hormonal levels, fertility markers, and imaging results through a single interface

- This trend towards more intelligent, data-driven, and connected diagnostic systems is fundamentally reshaping patient and provider expectations for women’s healthcare. Consequently, companies such as Roche Diagnostics are developing AI-enabled solutions with automated image analysis and digital reporting to enhance early detection and personalized care

- The demand for diagnostics that offer AI and digital integration is growing rapidly across both clinical and home-based settings, as patients and healthcare providers increasingly prioritize convenience, actionable insights, and precision care

Asia-Pacific Women’s Health Diagnostics Market Dynamics

Driver

“Rising Need Due to Growing Awareness and Preventive Healthcare Focus”

- The increasing prevalence of women-specific health conditions, coupled with growing awareness of preventive healthcare, is a significant driver for the heightened demand for women’s health diagnostics in Asia-Pacific

- For instance, in March 2025, Siemens Healthineers launched AI-powered breast and cervical cancer screening solutions in India to enhance early detection and reduce mortality rates

- As patients and healthcare providers become more aware of conditions such as breast cancer, cervical cancer, and reproductive disorders, diagnostic solutions enabling early intervention and improved outcomes are increasingly sought after

- Furthermore, expanding healthcare infrastructure, government-led screening programs, and rising adoption of point-of-care testing are making women’s health diagnostics more accessible across urban and semi-urban regions

- The convenience of integrated diagnostics, rapid test results, and personalized insights are key factors propelling adoption, alongside increasing investments from both private and public healthcare sectors in women-focused diagnostic programs

- Rising health insurance coverage and reimbursement policies for women-specific diagnostic tests are encouraging more patients to undergo regular screenings and advanced testing procedures

- Growing collaborations between hospitals, clinics, and diagnostic companies are facilitating wider deployment of advanced diagnostics and promoting early disease detection programs across the region

- Increasing digital literacy and telehealth adoption are supporting higher utilization of connected diagnostic solutions and mobile health apps for women’s healthcare management

Restraint/Challenge

“High Cost and Regulatory Compliance Hurdle”

- The high costs of advanced diagnostic equipment and tests, along with complex regulatory approval requirements, pose a significant challenge to broader adoption of women’s health diagnostics in Asia-Pacific

- For instance, the high price of AI-enabled imaging systems for breast and cervical cancer screening limits accessibility in developing countries and smaller healthcare facilities

- Regulatory compliance, including approval from local health authorities and adherence to international diagnostic standards, can delay product launches and increase operational costs for companies

- While some low-cost and portable testing solutions are emerging, premium diagnostics with AI, molecular testing, and digital platform integration remain relatively expensive, limiting adoption among price-sensitive populations

- Overcoming these challenges through government subsidies, reimbursement programs, and development of cost-effective solutions will be vital for sustained market growth and wider accessibility of women’s health diagnostics

- Limited awareness in rural areas and cultural barriers around women’s health can restrict adoption of diagnostic tests, particularly for reproductive and gynecological conditions. Data privacy and cybersecurity concerns related to connected diagnostics and digital health platforms pose additional challenges, requiring robust security measures to build patient trust

- Infrastructure gaps and shortage of trained healthcare professionals in remote areas can further hinder effective implementation and utilization of advanced women’s health diagnostics across the Asia-Pacific region

Asia-Pacific Women’s Health Diagnostics Market Scope

The market is segmented on the basis of application and end user.

- By Application

On the basis of application, the Asia-Pacific women’s health diagnostics market is segmented into osteoporosis testing, OVC testing, cervical cancer testing, breast cancer testing, pregnancy and fertility testing, prenatal genetic screening and carrier testing, infectious disease testing, STD testing, and ultrasound tests. The breast cancer testing segment dominated the market with the largest market revenue share of 40.2% in 2025, driven by high disease prevalence among women in the region. Hospitals and diagnostic centers prioritize breast cancer testing due to its role in early detection, which significantly reduces mortality rates. Advanced imaging technologies such as 3D mammography, MRI, and AI-assisted screening have increased diagnostic accuracy and patient adoption. Public awareness campaigns and government screening programs further support widespread testing. Additionally, private-public partnerships and mobile screening units have enhanced accessibility across urban and semi-urban areas. Rising healthcare expenditure and growing patient awareness of preventive health measures further reinforce the dominance of this segment.

The cervical cancer testing segment is anticipated to witness the fastest growth rate of 24% from 2026 to 2033, fueled by rising awareness of HPV infections and preventive screening programs. HPV DNA testing, liquid-based cytology, and AI-enabled imaging are becoming preferred methods due to early detection capabilities. Expansion of point-of-care testing and telemedicine integration supports rapid adoption, particularly in semi-urban and rural regions. Government vaccination and screening initiatives further accelerate growth. Favorable reimbursement policies are enabling broader access among middle-income populations. The adoption of portable and AI-assisted diagnostic tools also supports faster market penetration.

- By End User

On the basis of end user, the Asia-Pacific women’s health diagnostics market is segmented into hospitals, diagnostic and imaging centers, clinics, and home care settings. The hospitals segment dominated the market with the largest revenue share of 47% in 2025, owing to high patient footfall and the availability of advanced diagnostic technologies. Hospitals provide comprehensive services including mammography, molecular testing, and imaging, making them preferred centers for complex diagnostics. Government-led screening programs are frequently conducted through hospital networks, increasing utilization. Hospitals also serve as referral centers for smaller clinics and diagnostic centers, further strengthening their dominance. Skilled healthcare professionals capable of interpreting complex diagnostic results add to their preference. Continuous investment in hospital infrastructure and equipment ensures capacity expansion and supports adoption of advanced women’s health diagnostics.

The diagnostic and imaging centers segment is expected to witness the fastest growth rate of 23% from 2026 to 2033, driven by demand for outpatient diagnostics and rapid testing. These centers offer convenience and specialized services, including AI-assisted imaging, molecular diagnostics, and point-of-care testing. Expansion of standalone diagnostic facilities and collaborations with telehealth platforms improve accessibility in urban and semi-urban areas. Cost-effectiveness and shorter turnaround times attract patients seeking preventive and early-stage diagnostics. Awareness campaigns and corporate health initiatives further boost adoption. Continuous technological upgrades and introduction of portable diagnostic solutions contribute to rapid growth of this segment.

Asia-Pacific Women’s Health Diagnostics Market Regional Analysis

- China dominated the Asia-Pacific women’s health diagnostics market with the largest revenue share of 37.9% in 2025, characterized by high population density, rising healthcare expenditure, and a strong presence of hospitals and diagnostic centers, with substantial growth in breast and cervical cancer screening programs driven by innovations from both established diagnostic companies and emerging healthcare tech startups focusing on AI, telemedicine, and portable testing solutions

- Patients and healthcare providers in the country highly value the accuracy, early detection capabilities, and comprehensive reporting offered by women’s health diagnostics, particularly for breast cancer, cervical cancer, and reproductive health assessments

- This widespread adoption is further supported by expanding healthcare infrastructure, government-led screening programs, high population density, and increasing investments in both public and private healthcare sectors, establishing advanced diagnostics as a preferred solution for improving women’s health outcomes across hospitals, diagnostic centers, and clinics

The China Women’s Health Diagnostics Market Insight

The China women’s health diagnostics market captured the largest revenue share of 37.9% in 2025, fueled by the rising prevalence of women-specific health conditions and the growing emphasis on preventive healthcare. Patients are increasingly prioritizing early detection of breast cancer, cervical cancer, and reproductive health disorders through advanced diagnostic technologies such as AI-assisted imaging, molecular testing, and point-of-care solutions. Government-led screening programs and expanding healthcare infrastructure further accelerate adoption across hospitals and diagnostic centers. Moreover, China’s rapidly growing middle class and increasing digital health literacy are significantly contributing to the market’s expansion.

Japan Women’s Health Diagnostics Market Insight

The Japan women’s health diagnostics market is gaining momentum due to the country’s high-tech healthcare culture, aging population, and demand for personalized and convenient diagnostic solutions. The Japanese market places a strong emphasis on early detection and continuous monitoring, driving the adoption of AI-assisted imaging, non-invasive prenatal testing, and connected diagnostic devices. Integration of diagnostics with telehealth platforms and hospital management systems is further fueling growth. Additionally, increasing awareness campaigns and routine screening programs support higher utilization in both clinical and home-based settings.

India Women’s Health Diagnostics Market Insight

The India women’s health diagnostics market accounted for a leading revenue share in Asia-Pacific in 2025, attributed to the country’s expanding population, rising healthcare awareness, and increasing accessibility to advanced diagnostic technologies. India is experiencing strong demand for breast and cervical cancer screening, prenatal genetic testing, and reproductive health diagnostics across hospitals, clinics, and diagnostic centers. Government initiatives promoting preventive health, rising urbanization, and the expansion of private healthcare infrastructure are key factors propelling the market. Affordable diagnostic solutions and the growth of telemedicine services further support widespread adoption in urban and semi-urban regions.

Australia Women’s Health Diagnostics Market Insight

The Australia women’s health diagnostics market is expanding steadily due to advanced healthcare infrastructure, widespread awareness of women-specific health conditions, and strong adoption of preventive screening programs. Hospitals and diagnostic centers prioritize breast cancer, cervical cancer, and reproductive health testing due to early detection benefits. Integration of AI-assisted diagnostics and telemedicine platforms is enhancing patient care and reporting efficiency. Additionally, government support for preventive healthcare and reimbursement schemes for diagnostic tests are fostering consistent growth. The country’s high standard of healthcare services and technological readiness further strengthen market adoption.

Asia-Pacific Women’s Health Diagnostics Market Share

The Asia-Pacific Women’s Health Diagnostics industry is primarily led by well-established companies, including:

- Hologic, Inc. (U.S.)

- F. Hoffmann-La Roche Ltd (Switzerland)

- Siemens Healthineers AG (Germany)

- Abbott (U.S.)

- BD (U.S.)

- Quest Diagnostics Incorporated (U.S.)

- GE HealthCare (U.S.)

- Koninklijke Philips N.V. (Netherlands)

- Thermo Fisher Scientific Inc. (U.S.)

- Bio Rad Laboratories, Inc. (U.S.)

- PerkinElmer (U.S.)

- FUJIFILM Holdings Corporation (Japan)

- QIAGEN (Netherlands)

- Danaher (U.S.)

- CANON MEDICAL SYSTEMS CORPORATION (Japan)

- Sysmex Corporation (Japan)

- Myriad Genetics, Inc. (U.S.)

- Carestream Health Inc. (U.S.)

- DiaSorin S.p.A. (Italy)

- IDEXX Laboratories, Inc. (U.S.)

What are the Recent Developments in Asia-Pacific Women’s Health Diagnostics Market?

- In June 2025, International Agency for Research on Cancer (IARC) launched the “CanScreen5 Training of Trainers programme” for cancer screening in the Asia‑Pacific region marking a coordinated push to standardize and improve cancer screening quality (breast & cervical) across 16 APAC countries

- In April 2025, the World Health Organization (WHO), along with partners, launched the Regional Roadmap for Elimination of Mother-to-Child Transmission of HIV, Syphilis and Hepatitis B for the Asia‑Pacific region a development that underscores increased attention to infectious disease testing (including maternal screening), prenatal diagnostics, and women’s health screening infrastructure

- In May 2024, Becton, Dickinson and Company (BD) partnered with Healthians a leading diagnostics service provider in India to roll out at‑home self‑collection HPV test kits for cervical cancer screening, enabling women to collect samples privately at home

- In June 2023, a multi‑stakeholder group founded the Asia-Pacific Women's Cancer Coalition to coordinate regional efforts against breast and cervical cancer, aiming to accelerate early detection, screening uptake, and equitable access through advocacy, partnerships and adoption of innovative diagnostics

- In May 2023, the Union for International Cancer Control (UICC) convened its Regional Dialogue for Asia‑Pacific on women’s cancers in Manila, bringing together stakeholders from 22 countries to discuss integrated strategies for cancer detection, financing, screening access, and treatment strengthening regional collaboration on women’s diagnostics

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.