Asia Pacific Wound Care Biologics Market

Market Size in USD Million

CAGR :

%

USD

435.50 Million

USD

994.26 Million

2024

2032

USD

435.50 Million

USD

994.26 Million

2024

2032

| 2025 –2032 | |

| USD 435.50 Million | |

| USD 994.26 Million | |

|

|

|

|

Asia-Pacific Wound Care Biologics Market Size

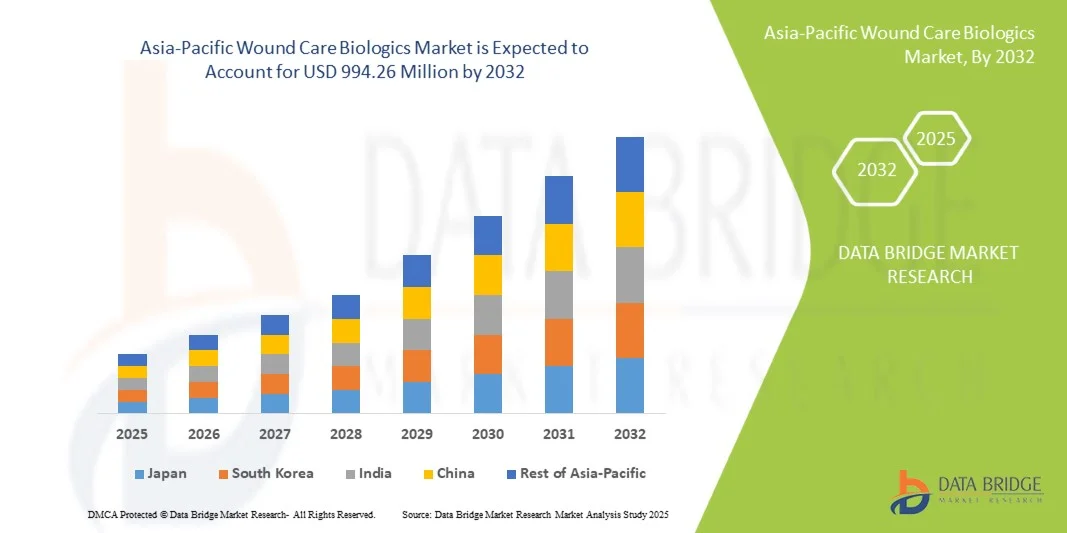

- The Asia-Pacific wound care biologics market size was valued at USD 435.50 million in 2024 and is expected to reach USD 994.26 million by 2032, at a CAGR of 10.87% during the forecast period

- The market growth is largely fueled by increasing prevalence of chronic wounds, rising geriatric population, and growing adoption of advanced biologic therapies and regenerative medicine in wound management across hospitals and specialized care centers

- Furthermore, supportive government initiatives, rising healthcare expenditure, and increasing awareness about novel wound care solutions are driving the adoption of biologics in the region, thereby significantly boosting the market’s growth

Asia-Pacific Wound Care Biologics Market Analysis

- Wound care biologics, including growth factors, skin substitutes, and platelet-rich plasma therapies, are increasingly vital components of advanced wound management in both hospital and home care settings due to their ability to accelerate healing, reduce infection risks, and improve patient outcomes

- The escalating demand for wound care biologics is primarily fueled by the rising prevalence of chronic wounds, diabetic foot ulcers, and pressure ulcers, along with increasing awareness among healthcare providers and patients about the benefits of regenerative therapies

- Japan dominated the Asia-Pacific wound care biologics market with the largest revenue share of 36.3% in 2024, characterized by advanced healthcare infrastructure, high adoption of innovative therapies, and strong presence of leading industry players, with substantial growth in biologic-based wound treatments driven by clinical research and hospital adoption

- China is expected to be the fastest growing country in the Asia-Pacific wound care biologics market during the forecast period due to increasing incidence of chronic wounds, rising geriatric population, and growing healthcare expenditure

- Skin substitutes segment dominated the Asia-Pacific wound care biologics market with a market share of 41.5% in 2024, driven by their effectiveness in treating complex wounds, ease of application, and increasing acceptance in both hospital and outpatient care settings

Report Scope and Asia-Pacific Wound Care Biologics Market Segmentation

|

Attributes |

Asia-Pacific Wound Care Biologics Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

Asia-Pacific

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Asia-Pacific Wound Care Biologics Market Trends

“Advancements in Regenerative Therapies and Biologics Integration”

- A significant and accelerating trend in the Asia-Pacific wound care biologics market is the increasing integration of advanced regenerative therapies, such as growth factors, skin substitutes, and platelet-rich plasma, into standard wound management practices, enhancing healing outcomes and reducing recovery times

- For instance, ReCell® Spray-On Skin and Apligraf® are being increasingly adopted in hospitals and specialized wound care centers across Japan and Australia, offering clinicians effective biologic treatment options for chronic and complex wounds

- Biologics integration enables personalized wound care solutions, where treatment can be tailored based on wound type, patient health status, and healing response. For instance, growth factor therapies in some Stratagraft® applications have shown accelerated tissue regeneration and reduced infection rates

- The seamless integration of biologics with conventional wound care products, such as hydrocolloids and foam dressings, allows healthcare providers to optimize healing while minimizing patient discomfort and treatment duration

- This trend towards more advanced, effective, and patient-centric wound care therapies is fundamentally reshaping treatment protocols. Consequently, companies such as 3M and Smith & Nephew are developing biologics with enhanced regenerative properties and ease of application in outpatient and home care settings

- The demand for biologics offering improved healing, reduced scarring, and integration with standard care is growing rapidly across hospitals and clinics, as healthcare providers increasingly prioritize efficacy and patient outcomes

Asia-Pacific Wound Care Biologics Market Dynamics

Driver

“Rising Chronic Wound Prevalence and Aging Population”

- The increasing prevalence of chronic wounds, diabetic foot ulcers, and pressure ulcers, coupled with the rising geriatric population across Asia-Pacific, is a significant driver for the heightened demand for advanced wound care biologics

- For instance, in March 2024, Smith & Nephew expanded its cellular and tissue-based product line in China, looking to address the growing burden of diabetic wounds in the region. Such initiatives by key companies are expected to drive market growth during the forecast period

- As healthcare systems in countries such as Japan, China, and India increasingly adopt biologics to improve treatment outcomes, wound care therapies offer benefits such as faster healing, lower infection risks, and reduced hospitalization duration, providing a compelling upgrade over traditional dressings

- Furthermore, government initiatives and reimbursement policies supporting regenerative therapies are encouraging hospitals and clinics to incorporate biologics into standard care protocols, promoting widespread adoption

- The combination of rising patient awareness, clinician acceptance, and availability of user-friendly biologic solutions is key to propelling adoption across hospitals, outpatient centers, and home care settings in the Asia-Pacific region

Restraint/Challenge

“High Cost and Regulatory Compliance Hurdles”

- Concerns regarding the high cost of biologics, coupled with complex regulatory approval processes across Asia-Pacific countries, pose a significant challenge to broader market penetration. Biologics often require rigorous clinical trials and compliance with local health authorities, which can delay commercialization

- For instance, delayed approvals of cellular and tissue-based products in India and Southeast Asia have limited their immediate availability to patients and healthcare providers

- Addressing these challenges through streamlined regulatory pathways, cost-effective production methods, and clinician education is crucial for building market confidence. Companies such as Organogenesis and Acelity emphasize compliance with regional health authorities while demonstrating clinical efficacy to reassure stakeholders

- In addition, price sensitivity among healthcare providers and patients in emerging Asia-Pacific markets can limit adoption of premium biologic therapies, even as awareness of their benefits grows. While generic or simplified biologic solutions are becoming available, advanced regenerative products still carry a premium

- Overcoming these challenges through government support, reimbursement schemes, and more affordable biologic options will be vital for sustained growth in the Asia-Pacific wound care biologics market

Asia-Pacific Wound Care Biologics Market Scope

The market is segmented on the basis of product type, wound type, and end user.

- By Product Type

On the basis of product type, the market is segmented into synthetic skin grafts, growth factors, allografts, and xenografts. The synthetic skin grafts segment dominated the market with the largest revenue share of 41.5% in 2024, driven by their proven efficacy in treating chronic wounds, burns, and surgical wounds. Synthetic grafts are widely used due to their availability, consistent quality, and reduced risk of disease transmission compared to biological grafts. Hospitals and specialized wound care centers prefer synthetic grafts for standardized wound coverage and faster integration with host tissue. The segment’s dominance is also fueled by increasing research and development initiatives aimed at enhancing graft durability and functionality. In addition, the ability of synthetic grafts to be combined with other biologics or dressings for optimized wound healing contributes to their widespread adoption. Overall, synthetic skin grafts provide reliable, scalable, and cost-effective solutions for advanced wound management, cementing their leading market position.

The growth factors segment is anticipated to witness the fastest CAGR from 2025 to 2032, driven by rising adoption in chronic ulcer management and post-surgical wound care. Growth factor therapies stimulate cell proliferation, angiogenesis, and tissue regeneration, making them ideal for complex or non-healing wounds. Their personalized application allows clinicians to tailor treatments based on wound type and patient-specific healing responses. Increasing awareness among healthcare providers and patients about regenerative medicine benefits is further boosting demand. Furthermore, supportive reimbursement policies and clinical evidence of accelerated healing times are driving rapid adoption in hospitals and outpatient clinics. Innovations in delivery mechanisms, such as hydrogels or scaffolds, also enhance the efficacy and convenience of growth factor treatments.

- By Wound Type

On the basis of wound type, the market is segmented into ulcers, surgical and traumatic wounds, and burns. The ulcers segment dominated the market with the largest revenue share in 2024, largely due to the rising prevalence of diabetic foot ulcers, pressure ulcers, and venous leg ulcers across Asia-Pacific, Europe, and North America. Chronic ulcers require specialized wound care biologics to promote healing and prevent infection, which drives hospitals and wound clinics to adopt advanced biologic solutions. Long-term management of ulcers with biologics helps reduce hospital stays and improves patient quality of life, contributing to segment growth. In addition, government initiatives supporting chronic wound care and reimbursement schemes for advanced therapies are further encouraging biologic adoption. The increasing incidence of comorbidities such as diabetes and vascular disorders in aging populations is also a key factor sustaining demand. Overall, ulcers remain the primary target for customized biologic wound care solutions due to high patient volume and clinical complexity.

The surgical and traumatic wounds segment is expected to witness the fastest growth during 2025–2032, fueled by rising elective surgeries, trauma cases, and post-operative wound care needs. Customized biologics accelerate tissue regeneration and reduce scarring, making them essential in post-surgical and trauma recovery. Hospitals and ambulatory surgical centers are increasingly integrating biologics into their standard wound care protocols for improved outcomes. Increasing awareness among surgeons and wound care specialists about faster healing and lower complication rates drives adoption. Innovations in biologics tailored for surgical wounds, such as bioengineered scaffolds combined with growth factors, further support market expansion.

- By End User

On the basis of end user, the market is segmented into hospitals, ambulatory surgical centers, burn centers, and wound clinics. The hospitals segment dominated the market with the largest revenue share in 2024, driven by the high volume of chronic wound, burn, and post-surgical cases treated in inpatient settings. Hospitals benefit from access to specialized wound care teams and advanced biologic products, ensuring optimal healing outcomes. The dominance is further supported by well-established procurement systems, higher budgets for advanced therapies, and growing focus on reducing patient readmissions. In addition, hospitals often act as key centers for clinical trials and adoption of innovative biologics, reinforcing their leading position. Integration of biologics into hospital protocols ensures standardized treatment approaches and improved patient satisfaction, contributing to sustained growth.

The wound clinics segment is expected to witness the fastest CAGR from 2025 to 2032, driven by the increasing prevalence of chronic wounds and rising outpatient care adoption. Wound clinics provide specialized, personalized care and leverage biologics for targeted healing strategies. Convenience, faster treatment cycles, and reduced hospitalization make clinics attractive for patients with recurring ulcers or post-operative wounds. Growing partnerships between biologics manufacturers and wound care centers further fuel adoption. Clinics are also increasingly equipped with advanced application technologies, enabling efficient delivery of synthetic grafts, growth factors, and allografts. Rising awareness among patients about faster recovery and reduced complications further supports the rapid growth of wound clinic end users.

Asia-Pacific Wound Care Biologics Market Regional Analysis

- Japan dominated the Asia-Pacific wound care biologics market with the largest revenue share of 36.3% in 2024, characterized by advanced healthcare infrastructure, high adoption of innovative therapies, and strong presence of leading industry players, with substantial growth in biologic-based wound treatments driven by clinical research and hospital adoption

- Healthcare providers in the region highly value the effectiveness, reliability, and integration of wound care biologics with existing treatment protocols for chronic wounds, burns, and surgical wounds

- This widespread adoption is further supported by increasing healthcare expenditure, a growing geriatric population, and rising prevalence of diabetes and other chronic conditions, establishing biologics as a preferred solution for hospitals, burn centers, and specialized wound clinics

The Japan Wound Care Biologics Market Insight

The Japan wound care biologics market is gaining momentum due to the country’s advanced healthcare infrastructure, aging population, and high adoption of innovative regenerative therapies. The Japanese market places significant emphasis on quality and efficacy, with hospitals and specialized clinics increasingly using biologics for chronic wounds, burns, and surgical wounds. Integration of biologics with conventional wound care protocols and hospital digital health systems is fueling growth. Moreover, the high prevalence of diabetes and pressure ulcers in elderly patients is such asly to further drive demand for advanced wound healing solutions in both hospital and outpatient settings.

China Wound Care Biologics Market Insight

The China wound care biologics market accounted for a substantial revenue share in Asia-Pacific in 2024, attributed to the country’s large patient population, increasing incidence of chronic wounds, and growing healthcare infrastructure. Hospitals and wound care centers are increasingly adopting biologics to improve patient outcomes and reduce healing time. Government support for healthcare modernization, coupled with rising awareness about advanced wound care solutions among clinicians and patients, is boosting adoption. In addition, domestic manufacturers and international collaborations are enhancing the availability and affordability of biologics across urban and semi-urban regions.

India Wound Care Biologics Market Insight

The India wound care biologics market is expanding rapidly due to rising healthcare awareness, growing geriatric population, and increasing incidence of diabetes-related wounds and ulcers. Advanced biologic therapies are being increasingly adopted in hospitals, outpatient clinics, and specialized wound care centers. The push towards improving healthcare infrastructure and availability of cost-effective biologics is facilitating broader patient access. Moreover, the presence of both domestic and international manufacturers offering innovative wound healing solutions is accelerating market growth in residential, clinical, and hospital settings.

South Korea Wound Care Biologics Market Insight

The South Korea wound care biologics market is witnessing significant growth due to the country’s advanced healthcare system, high patient awareness, and increasing adoption of regenerative therapies for chronic wounds and burns. Hospitals and specialized wound care centers are increasingly integrating biologics into treatment protocols to improve healing outcomes and reduce hospitalization time. Rising prevalence of diabetes and an aging population are key factors driving demand for effective wound care solutions. Government support through healthcare reimbursement policies and initiatives promoting advanced medical technologies is further encouraging adoption. In addition, collaborations between domestic manufacturers and global biologics companies are expanding access to innovative products across clinical and outpatient settings.

Asia-Pacific Wound Care Biologics Market Share

The Asia-Pacific Wound Care Biologics industry is primarily led by well-established companies, including:

- Smith+Nephew (U.K.)

- 3M (U.S.)

- Integra LifeSciences Corporation (U.S.)

- Convatec Inc. (U.K.)

- Mölnlycke AB (Sweden)

- Cardinal Health (U.S.)

- Medline Industries, Inc. (U.S.)

- Johnson & Johnson Services Inc. (U.S.)

- B. Braun SE (Germany)

- Coloplast (Denmark)

- URGO MEDICAL (France)

- Maxigen Biotech Inc. (Taiwan)

- AMS BioteQ (Taiwan)

- Oneness Biotech Co., Ltd. (Taiwan)

- Dyamed Biotech Sdn Bhd. (Singapore)

- Sonoma Pharmaceuticals, Inc. (Malaysia)

- Lingel Pro (China)

- BIONOVA (India)

- Medtronic (Ireland)

What are the Recent Developments in Asia-Pacific Wound Care Biologics Market?

- In October 2025, MiMedx announced the launch of EPIXPRESS®, a tissue allograft composed of dehydrated human amnion/chorion membrane (DHACM). EPIXPRESS® is designed to provide a protective barrier that supports the healing cascade and protects the wound bed to aid in the development of granulation tissue in acute and chronic closures

- In September 2025, Smith & Nephew introduced the CENTRIO PRP System, a novel solution designed to manage chronic exuding wounds, including diabetic foot ulcers and venous leg ulcers. This system utilizes platelet-rich plasma (PRP) technology to enhance wound healing processes. The launch underscores the company's commitment to advancing wound care treatments in the Asia-Pacific region

- In October 2024, Royal Biologics launched two innovative wound care products: the Peak Powder Collagen Matrix and ElectroFiber 3D. These products are designed to enhance wound healing by providing advanced collagen-based and bioengineered solutions, respectively

- In June 2023, Bionova launched a bioactive wound dressing designed to promote faster healing of chronic wounds. The dressing incorporates natural bioactive compounds, aiming to reduce inflammation and accelerate tissue regeneration, thereby addressing the increasing prevalence of chronic wounds in the Asia-Pacific region

- In June 2023, NovaBone received 510(k) clearance from the U.S. Food and Drug Administration for its Wound Matrix, a fully resorbable, sterile, single-use device intended for the management of partial and full-thickness wounds. This clearance supports the company's expansion into the advanced wound care market

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.