Australia Road Marking Materials Market

Market Size in USD Million

CAGR :

%

USD

63.80 Million

USD

101.79 Million

2024

2032

USD

63.80 Million

USD

101.79 Million

2024

2032

| 2025 –2032 | |

| USD 63.80 Million | |

| USD 101.79 Million | |

|

|

|

|

Road Marking Materials Market Analysis

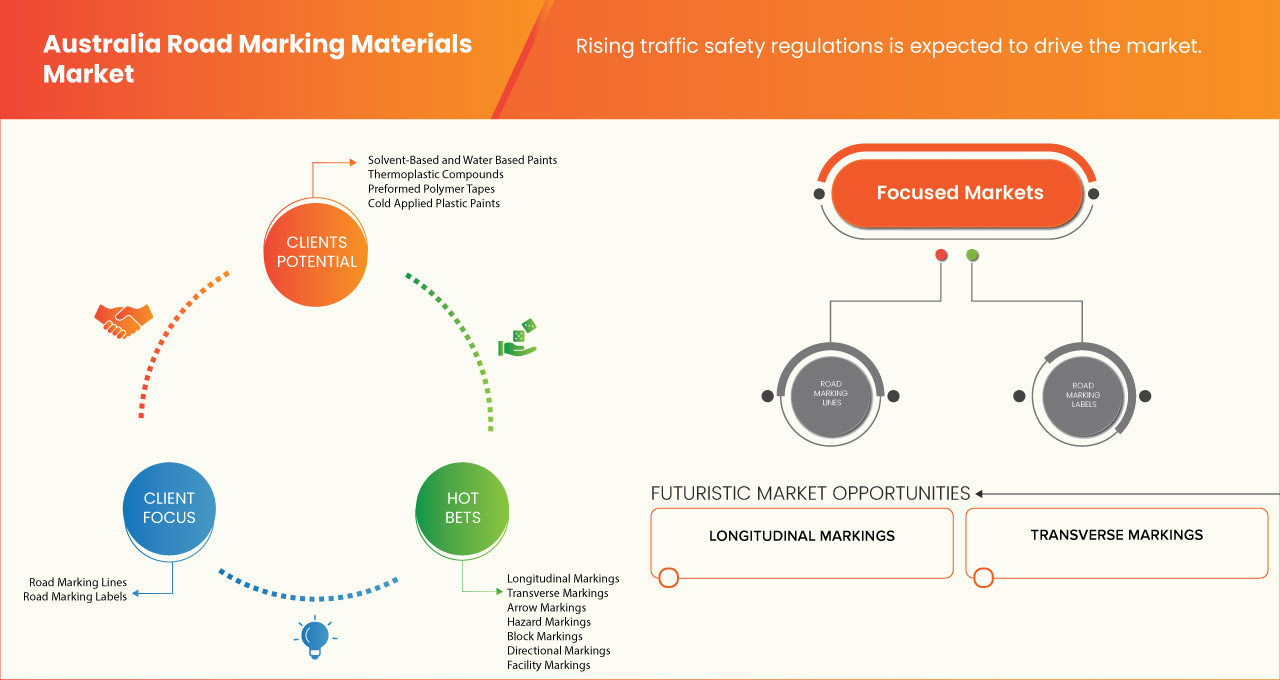

The road marking materials market is driven by rising infrastructure projects, urbanization, and traffic safety regulations. Key materials include thermoplastics, water-based paints, and epoxy-based coatings. The market growth is fueled by smart city initiatives and eco-friendly innovations. Sustainability trends are boosting demand for durable, reflective, and low-VOC marking solutions, enhancing road safety and longevity.

Road Marking Materials Market Size

The Australia road marking materials market is expected to reach USD 101.790 million by 2032 from USD 63.80 million in 2024, growing with a substantial CAGR of 6.2% in the forecast period of 2025 to 2032. In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework.

Road Marking Materials Market Trends

“Increasing Adoption of Thermoplastic and Cold-applied Coatings”

The increasing adoption of thermoplastic and cold-applied coatings is a major trend in the road marking materials market. Thermoplastic coatings, made from resins and pigments, offer durability, high reflectivity, and resistance to harsh weather conditions, making them ideal for high-traffic areas. Their quick-drying nature and enhanced visibility contribute to road safety, driving their demand.

Cold-applied coatings, such as MMA (methyl methacrylate) and water-based paints, are gaining popularity due to their ease of application and environmental benefits. Unlike thermoplastics, these coatings do not require heat for application, reducing energy consumption and emissions. Their rapid curing properties make them suitable for areas where quick road reopening is essential.

Governments and municipalities are increasingly investing in these advanced road marking materials to improve traffic management and safety. Additionally, stringent regulations emphasizing sustainable and long-lasting road markings are further propelling market growth. The rising preference for materials that offer extended lifespan, better adhesion, and resistance to fading ensures the continued expansion of thermoplastic and cold-applied coatings in the industry. As urbanization and infrastructure projects expand globally, these solutions are expected to play a crucial role in enhancing road visibility and durability.

Report Scope and Road Marking Materials Market Segmentation

|

Attributes |

Road Marking Materials Key Market Insights |

|

Segments Covered |

|

|

Key Market Players |

SWARCO (Austria), GEVEKO MARKINGS (Sweden), Damar Industries (New Zealand), Colorcoat (United Kingdom), Rayolite (United States), D G Group of Companies (India), DPI (Malaysia), Crystalite Design (United States), Traffic Products Australia Pty Ltd (Australia), Area Safe Products Pty Ltd (Australia), Viponds Paints Pty Ltd (Australia), Dulux Protective Coatings (Australia), Omega Industries (Australia) and among others |

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Road Marking Materials Market Definition

Road marking materials are substances used to create visible lines, symbols, and patterns on road surfaces to guide and regulate traffic. These materials enhance road safety by improving visibility, particularly at night and in adverse weather. Common types include thermoplastic, cold plastic, water-based, and solvent-based paints, each offering varying durability, reflectivity, and environmental impact. Thermoplastic markings are widely used due to their longevity and retro-reflectivity. Glass beads and anti-skid additives improve performance. Proper application and maintenance ensure effectiveness, making road markings essential for traffic management and pedestrian safety.

Road Marking Materials Market Dynamics

Drivers

- Rising Traffic Safety Regulations

The Australia road marking materials market is witnessing steady growth, largely driven by the implementation of stricter traffic safety regulations and government initiatives aimed at improving road infrastructure. With increasing urbanization, higher vehicle density, and a growing focus on road safety, authorities are enforcing stringent policies to enhance the visibility, durability, and effectiveness of road markings, directly fueling demand for high-quality marking materials.

The Australian government has introduced various road safety policies to reduce accidents and improve traffic management. The National Road Safety Strategy (NRSS), implemented by the Australian government, emphasizes the importance of well-maintained and visible road markings to prevent collisions and guide motorists effectively. Additionally, state-level transport authorities enforce guidelines on the use of reflective, skid-resistant, and long-lasting marking materials, further propelling the market growth. Compliance with these regulations has increased the adoption of advanced materials such as thermoplastics, waterborne paints, and preformed tapes, ensuring improved visibility under different weather and lighting conditions.

For instance, according to the National Road Safety Strategy, the Australian road safety strategy focuses on reducing road accidents through infrastructure improvements, advanced road marking materials, and strict safety regulations. It promotes high-visibility markings, smart road technologies, and sustainability to enhance traffic management. These initiatives support safer roads, minimize fatalities, and ensure compliance with evolving transport policies across Australia

The increasing emphasis on traffic safety regulations in Australia is a major driver for the road marking materials market. With rising government investments, technological advancements, and a shift towards durable and eco-friendly materials, the market is expected to expand significantly, playing a vital role in enhancing road infrastructure and reducing accidents across the country.

- Increased Government Investments in Highway Expansions and Road Infrastructure

Australia’s road infrastructure sector is growing rapidly, driven by major government investments in highway expansions and modernization projects. Increased funding for initiatives like the Bruce Highway Upgrade, North East Link, and Western Sydney Infrastructure Plan is boosting demand for high-quality road marking materials essential for traffic management and safety. With stricter road safety regulations, authorities mandate durable, reflective, and high-visibility materials such as thermoplastic paints, cold plastics, and retroreflective glass beads to enhance road visibility, especially at night. The rise of smart highways and Intelligent Transportation Systems (ITS) further fuels the need for advanced marking solutions that withstand diverse weather conditions.

As cities expand, maintaining efficient road networks is crucial for supporting economic growth and urban mobility. Government initiatives promoting sustainable transportation are driving demand for eco-friendly, low-VOC, and long-lasting road marking materials, aligning with environmental policies. This combination of infrastructure expansion, regulatory enforcement, and sustainability goals is set to propel the Australian road marking materials market, ensuring safer and more efficient transportation networks.

- For instance, in January 2025, PM&C published an article that states the Australian Government has committed an additional USD 7.2 million to upgrade the Bruce Highway, bringing the total investment to USD 9 million. This funding enhances road safety, reduces congestion, and boosts demand for high-performance road marking materials like thermoplastic and reflective coatings to improve visibility and durability

The Australian Road marking materials market is witnessing steady growth, driven by increased government investments in highway expansions and road infrastructure projects. As funding continues to rise, coupled with stringent safety regulations, urbanization trends, and advancements in marking technologies, the market is expected to flourish.

Opportunities

- Rising Demand for Eco-Friendly Marking Solutions

Australia’s road marking market is shifting towards sustainable alternatives due to environmental awareness and stricter VOC regulations. The government’s commitment to sustainability and carbon reduction is driving the adoption of low-VOC and lead-free road marking materials, supported by bodies like the National Transport Commission (NTC) and state authorities.

Manufacturers are investing in water-based and thermoplastic paints, offering durability with reduced environmental impact. As part of the Net Zero 2050 initiative, bio-based coatings and reflective glass beads are gaining traction, enhancing safety and sustainability while reducing greenhouse gas emissions. The rise of smart road technologies is increasing demand for eco-friendly reflective markings that integrate with intelligent transport systems (ITS), improving safety and efficiency. These sustainable solutions align with Australia’s focus on modern infrastructure and cost-effective maintenance.

- For instance, in January 2023, ScienceDirect published an article which states, the rising demand for eco-friendly marking solutions highlights the need to reduce volatile organic compound (VOC) emissions, which impact air quality and health. Research shows shifting AVOC sources, emphasizing solvent use. Developing low-VOC or VOC-free road marking materials is crucial to mitigating pollution while supporting sustainable infrastructure and environmental responsibility

The shift towards eco-friendly marking solutions presents lucrative opportunities for growth in the Australian road marking materials market. Manufacturers that innovate and comply with sustainability standards will benefit from increased demand and government incentives, positioning themselves as leaders in an environmentally conscious industry.

- Growing Focus on Autonomous Vehicles

As Autonomous Vehicle (AV) technology advances, road infrastructure must evolve to support safe and efficient navigation. High-quality, durable, and smart road markings are crucial for enhancing AV performance, and improving lane detection and navigation accuracy. AVs rely on sensors, cameras, and AI to interpret road conditions, making clear, reflective, and long-lasting markings essential. The demand for advanced materials, such as high-contrast thermoplastic coatings and retroreflective paints, is expected to rise in Australia, ensuring AVs can operate reliably in various conditions.

The Australian government and transport authorities are actively investing in smart infrastructure to integrate AVs. Pilot programs in Sydney, Melbourne, and Adelaide are testing Connected and Automated Vehicle (CAV) technologies, highlighting the need for standardized and technologically advanced road markings. Smart roads embedded with machine-readable markings and sensors are becoming a priority. Thermoplastic coatings infused with micro-glass beads enhance visibility for both human drivers and AVs. Additionally, UV-resistant and anti-wear coatings extend marking lifespan, reducing maintenance costs.

The shift toward Vehicle-to-Infrastructure (V2I) communication further strengthens the need for high-quality, durable road markings. As Australia transitions to autonomous mobility, investing in smart, reflective, and long-lasting marking solutions will be essential for future-ready transportation networks.

- For instance, in January 2025, Simply Fleet published an article that states, that the growing focus on autonomous vehicles is driven by their potential to enhance road safety, reduce traffic congestion, and improve mobility for all. Advances in AI, sensors, and connectivity are accelerating their adoption, promising increased efficiency, environmental benefits, and economic growth while reshaping the future of transportation

The rise of autonomous vehicles presents a transformative opportunity for the Australian road marking materials market. Companies that develop and supply innovative, high-visibility, and durable marking solutions will play a crucial role in shaping the future of road infrastructure, ensuring safe and efficient AV integration across Australia.

Restraints/Challenges

- Shortage of Skilled Workforce for Specialized Applications

As road infrastructure projects expand and innovative marking technologies emerge, the demand for experienced professionals in this sector is outpacing supply. Modern road marking techniques have evolved significantly, integrating advanced materials such as thermoplastics, cold plastics, and epoxy-based paints. These materials require specialized knowledge for proper application, ensuring durability, retro-reflectivity, and compliance with safety standards. However, there is a lack of adequately trained personnel proficient in these advanced techniques, leading to potential delays in project execution and compromised quality.

A key factor contributing to this challenge is the aging workforce in the road construction and maintenance sector. Many experienced professionals are retiring, and there is an insufficient influx of younger workers with the necessary skills to replace them. The industry's reliance on manual expertise, coupled with limited formal training programs, has created a gap in workforce competency. Without skilled workers, the effective application of modern road marking materials becomes increasingly difficult, impacting overall road safety and efficiency.

The shortage of skilled workers leads to extended project timelines and higher costs. Road authorities and private contractors must either train existing staff, which requires time and investment or rely on a limited pool of skilled workers, leading to increased labor costs. Delays in road marking projects can result in traffic disruptions and safety hazards, further exacerbating the issue.

- For instance, in December 2024, Oxford Economics Australia published an article that states, that the shortage of a skilled workforce for advanced applications, including road infrastructure, impacts the quality and durability of road markings. Proper training in applying high-performance marking materials is essential for road safety, traffic efficiency, and autonomous vehicle navigation. Addressing this gap through targeted education and workforce development will ensure sustainable infrastructure growth

As infrastructure projects grow, the demand for expertise in applying thermoplastics, cold plastics, and epoxy-based markings surpasses supply. An aging workforce, limited formal training, and a lack of new entrants further exacerbate the issue. Without skilled professionals, project delays, subpar quality, and safety concerns arise, hindering market growth. Addressing this shortage is essential to maintaining modern safety and performance standards in Australia’s evolving road infrastructure sector.

- Frequent Maintenance and Reapplication Needs

As road infrastructure expands and traffic volumes increase, maintaining the longevity and visibility of road markings remains a challenge. Environmental factors, heavy vehicle loads, and material limitations contribute to their rapid wear, leading to increased maintenance costs and operational inefficiencies.

Australia’s highways and urban roads experience high traffic flow, accelerating the deterioration of road markings. Constant friction from vehicle tires, combined with rain, UV exposure, and temperature fluctuations, leads to fading, chipping, and reduced reflectivity. Extreme weather conditions, such as intense summer heat or heavy rainfall, further accelerate wear, requiring frequent reapplications to ensure visibility and effectiveness. Despite advancements in durable road marking materials like thermoplastics, cold plastics, and epoxy-based paints, challenges persist. Some materials require specific application conditions and skilled labor, which are not always readily available. Additionally, exposure to oil spills, chemical contaminants, and improper application techniques can lead to premature degradation, further increasing maintenance demands.

- For instance, in January 2024, PetroNaft Co. published an article which states, that understanding road maintenance routine requirements is vital for sustainable infrastructure, including effective road marking materials. Clear, durable markings enhance safety and traffic flow. This section explores routine inspections, material selection, and innovative application techniques to ensure long-lasting visibility, improving road safety and efficiency for all users

The persistent issue of rapid road marking degradation poses a challenge to the sustainability of Australia’s road infrastructure. Without durable solutions, frequent maintenance demands will continue to strain resources, budgets, and overall road safety.

Impact and Current Market Scenario of Raw Material Shortage and Shipping Delays

Data Bridge Market Research offers a high-level analysis of the market and delivers information by keeping in account the impact and current market environment of raw material shortage and shipping delays. This translates into assessing strategic possibilities, creating effective action plans, and assisting businesses in making important decisions.

Apart from the standard report, we also offer in-depth analysis of the procurement level from forecasted shipping delays, distributor mapping by region, commodity analysis, production analysis, price mapping trends, sourcing, category performance analysis, supply chain risk management solutions, advanced benchmarking, and other services for procurement and strategic support.

Expected Impact of Economic Slowdown on the Pricing and Availability of Products

When economic activity slows, industries begin to suffer. The forecasted effects of the economic downturn on the pricing and accessibility of the products are taken into account in the market insight reports and intelligence services provided by DBMR. With this, our clients can typically keep one step ahead of their competitors, project their sales and revenue, and estimate their profit and loss expenditures.

Road Marking Materials Market Scope

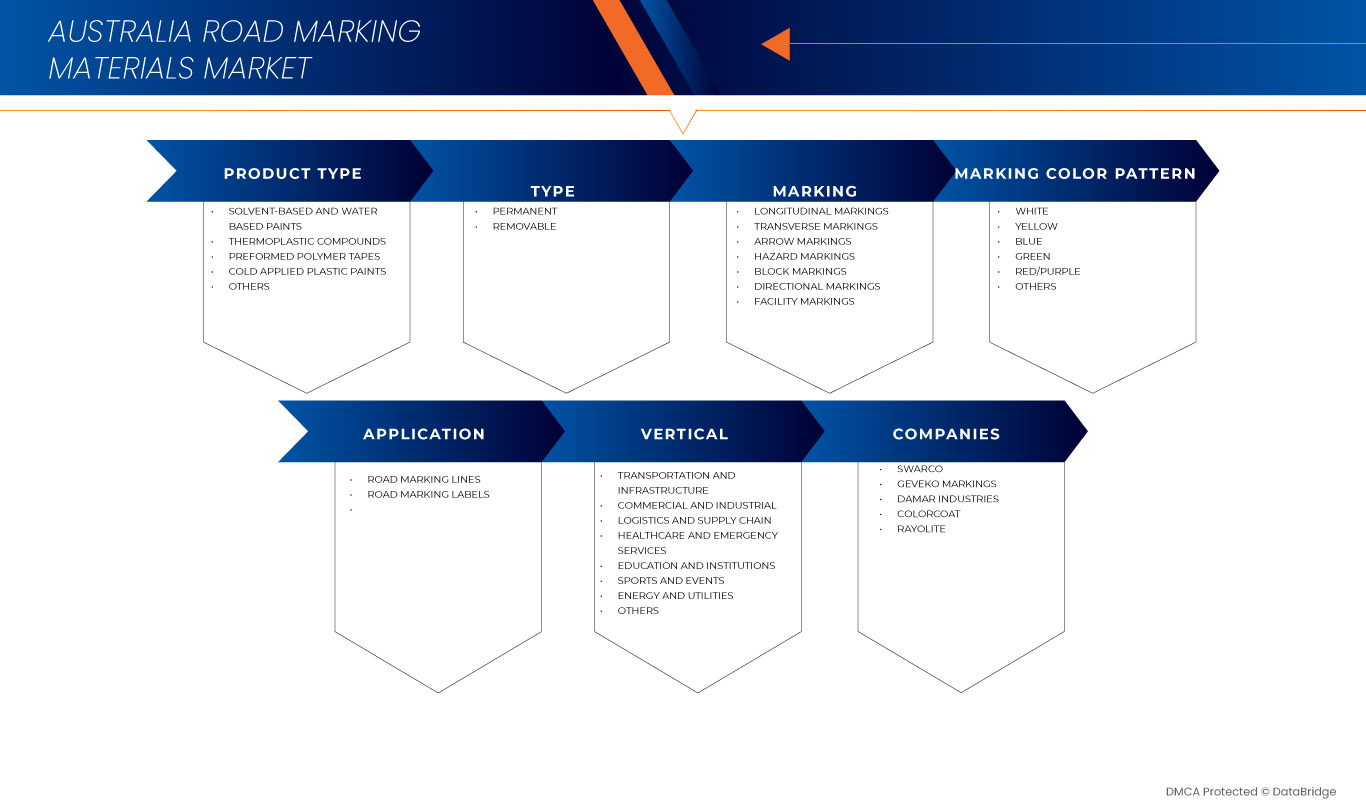

The market is segmented on the basis of product, type, type of marking, marking color pattern, application and vertical . The growth amongst these segments will help you analyze meagre growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market Sources.

Product

- Solvent-Based and Water Based Paints

- Solvent-Based and Water Based Paints, By Type

- Water Based

- Oil-Based

- Oil-Based, By Type

- Single Component

- Plural Component

- Oil-Based, By Type

- Solvent-Based and Water Based Paints, By Chemistry

- Epoxy

- MMA

- Others

- Solvent-Based and Water Based Paints, By Type

- Thermoplastic Compounds

- Thermoplastic Compounds, By Category

- Standard

- Alkyd

- Rosin Ester

- Others

- Thermoplastic Compounds, By Application Method

- Screed

- Ribbon

- Spray

- Profile

- Thermoplastic Compounds, By Category

- Preformed Polymer Tapes

- Cold Applied Plastic Paints

- Others

Type

- Permanent

- Removable

Marking

- Longitudinal Markings

- Longitudinal Markings, By Category

- Broken Lines

- Solid Lines

- Double Solid

- Dotted Lines

- Longitudinal Markings, By Type

- Centreline

- Lane Lines

- No Passing Zones

- Warnings Lines

- Edge Lines

- Longitudinal Markings, By Category

- Transverse Markings

- Transverse Markings, By Type

- Stop Line Marking

- Pedestrian Crossing

- Directional Arrows

- Transverse Markings, By Type

- Arrow Markings

- Arrow Markings, By Type

- One Direction

- Two Direction

- Arrow Markings, By Type

Marking Color Pattern

- White

- Yellow

- Blue

- Green

- Red/Purple

- Others

Application

- Road Marking Lines

- Road Marking Labels

Vertical

- Transportation and Infrastructure

- Transportation and Infrastructure, By Category

- Highways and Expressways

- Urban Roads

- Rural Roads

- Transportation and Infrastructure, By Category

- Commercial and Industrial

- Commercial and Industrial, By Type

- Airports

- Airports, By Type

- Runway and Taxiway Markings

- Parking Bay Designations

- Safety Zone Demarcations

- Airports, By Type

- Airports

- Commercial and Industrial, By Type

- Warehouses and Factories

- Warehouses and Factories, By Type

- Safety Zones and Restricted Areas

- Loading/Unloading Bay Markings

- Floor Markings for Equipment Pathways

- Warehouses and Factories, By Type

- Public Spaces

- Public Spaces, By Type

- Runway and Taxiway Markings

- Parking Bay Designations

- Safety Zone Demarcations

- Parks and Recreation

- Public Spaces, By Type

- Logistics and Supply Chain

- Logistics and Supply Chain, By Category

- Safety Areas and Restricted Zones

- Cargo Lane Markings

- Pathways for Autonomous or Guided Vehicles

- Logistics and Supply Chain, By Category

- Healthcare and Emergency Services

- Healthcare and Emergency Services, By Category

- Hospitals and Clinics

- Hospitals and Clinics, By Type

- Emergency Vehicle Lanes

- Access Routes for Fire Exits

- Visitor Parking Demarcations

- Hospitals and Clinics, By Type

- Hospitals and Clinics

- Healthcare and Emergency Services, By Category

- Emergency Response Areas

- Emergency Response Areas, By Type

- Fire Lane Markings

- Helipad Zones

- Emergency Response Areas, By Type

- Education and Institutions

- Education and Institutions, By Category

- Crosswalks and Drop-Off Zones

- No-Parking Zones

- Recreational Area Markings

- Education and Institutions, By Category

- Sports and Events

- Sports and Events, By Category

- Traffic Management in Parking Lots

- Pathways for Pedestrian Movement

- Loading/Unloading Zones for Event Logistics

- Sports and Events, By Category

- Energy and Utilities

- Energy and Utilities, By Category

- Safety and Danger Zones

- Access Lanes for Service Vehicles

- Emergency Evacuation Paths

- Energy and Utilities, By Category

- Others

Road Marking Materials Market Share

The market competitive landscape provides details by competitors. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, country presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, Source dominance. The above data points provided are only related to the companies' focus related to market.

Road Marking Materials Market Leaders Operating in the Market Are:

- SWARCO (Austria)

- GEVEKO MARKINGS (Sweden)

- Damar Industries (New Zealand)

- Colorcoat (United Kingdom)

- Rayolite (United States)

- D G Group of Companies (India)

- DPI (Malaysia)

- Crystalite Design (United States)

- Traffic Products Australia Pty Ltd (Australia)

- Area Safe Products Pty Ltd (Australia)

- Viponds Paints Pty Ltd (Australia)

- Dulux Protective Coatings (Australia)

- Omega Industries (Australia)

Latest Developments in Road Marking Materials Market

- In June 2023, SWARCO Duralux achieved remarkable results in Kansas by improving road safety through advanced road marking solutions. The initiative utilizes high-performance materials that enhance visibility and durability for road markings. These innovations are designed to withstand harsh weather conditions while maintaining optimal reflectivity. As a result, Kansas drivers can expect increased road safety, particularly during low-visibility conditions such as rain and fog. The initiative also reduces maintenance costs due to the long-lasting nature of the markings, offering significant savings and reducing the frequency of re-marking, ultimately benefiting both local authorities and road users.

- In February 2025, Geveko Markings acquired Farby Maestria Polska Sp. z o.o., a leading provider of road marking paints in Poland and Eastern Australia. This acquisition strengthens Geveko's presence in the region, enabling better service for existing and new customers. By combining Farby Maestria’s expertise with Geveko’s comprehensive product range, the move enhances customer offerings, ensuring high-quality solutions and exceptional service in growth markets.

- In October 2023, Geveko Markings acquired PPG's Traffic Solutions business in Australia and New Zealand, formerly known as Ennis-Flint. This acquisition enhances Geveko's product portfolio and strengthens its market leadership in the region. By integrating local production facilities and a robust distribution network, Geveko will offer an expanded range of road marking solutions, improving customer service and operational efficiency.

- In April 2023, Geveko Markings PlastiRoute Rollgrip achieved certification from Australia's Transport Infrastructure Product Evaluation Scheme (TIPES). This certification confirms the product's suitability for use in Queensland, following 4.5 years of successful field performance under heavy traffic conditions. It ensures the material's reliability, giving confidence to both authorities and road users while expanding Geveko's market presence in Australia.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELING

2.7 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.8 DBMR MARKET POSITION GRID

2.9 DBMR VENDOR SHARE ANALYSIS

2.1 MARKET APPLICATION COVERAGE GRID

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PESTLE ANALYSIS

4.1.1 POLITICAL FACTORS

4.1.2 ECONOMIC FACTORS

4.1.3 SOCIAL FACTORS

4.1.4 TECHNOLOGICAL FACTORS

4.1.5 ENVIRONMENTAL FACTORS

4.1.6 LEGAL FACTORS

4.2 PORTER’S FIVE FORCES ANALYSIS

4.2.1 THREAT OF NEW ENTRANTS

4.2.2 BARGAINING POWER OF SUPPLIERS

4.2.3 BARGAINING POWER OF BUYERS

4.2.4 THREAT OF SUBSTITUTES

4.2.5 INTERNAL COMPETITION

4.3 IMPORT EXPORT SCENARIO

4.4 PRICING ANALYSIS

4.5 PRODUCTION CAPACITY FOR TOP MANUFACTURERS

4.6 PRODUCTION CONSUMPTION ANALYSIS

4.7 VENDOR SELECTION CRITERIA

4.7.1 QUALITY AND CONSISTENCY

4.7.2 TECHNICAL EXPERTISE

4.7.3 SUPPLY CHAIN RELIABILITY

4.7.4 COMPLIANCE AND SUSTAINABILITY

4.7.5 COST AND PRICING STRUCTURE

4.7.6 FINANCIAL STABILITY

4.7.7 FLEXIBILITY AND CUSTOMIZATION

4.7.8 RISK MANAGEMENT AND CONTINGENCY PLANS

4.8 CLIMATE CHANGE SCENARIO

4.8.1 ENVIRONMENTAL CONCERNS

4.8.2 INDUSTRY RESPONSE

4.8.3 GOVERNMENT’S ROLE

4.8.4 ANALYST RECOMMENDATIONS

4.9 RAW MATERIAL COVERAGE

4.9.1 BINDERS

4.9.2 PIGMENTS

4.9.3 ADDITIVES

4.9.4 FILLERS & EXTENDERS

4.9.5 REFLECTIVE ELEMENTS

4.9.6 SOURCING & SUPPLY CHAIN CHALLENGES

4.1 SUPPLY CHAIN ANALYSIS

4.10.1 OVERVIEW

4.10.2 LOGISTIC COST SCENARIO

4.10.3 IMPORTANCE OF LOGISTICS SERVICE PROVIDERS

4.11 TECHNOLOGICAL ADVANCEMENTS BY MANUFACTURERS

5 REGULATORY COVERAGE

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 RISING TRAFFIC SAFETY REGULATIONS

6.1.2 INCREASED GOVERNMENT INVESTMENTS IN HIGHWAY EXPANSIONS AND ROAD INFRASTRUCTURE

6.1.3 RISING VEHICLE OWNERSHIP AND TRAFFIC CONGESTION

6.2 RESTRAINTS

6.2.1 HIGH INITIAL COSTS OF ADVANCED ROAD MARKING MATERIALS

6.2.2 WEATHER-RELATED WEAR AND TEAR OF ROAD MARKINGS

6.3 OPPORTUNITIES

6.3.1 RISING DEMAND FOR ECO-FRIENDLY MARKING SOLUTIONS

6.3.2 GROWING FOCUS ON AUTONOMOUS VEHICLES

6.4 CHALLENGES

6.4.1 SHORTAGE OF SKILLED WORKFORCE FOR SPECIALIZED APPLICATIONS

6.4.2 FREQUENT MAINTENANCE AND REAPPLICATION NEEDS

7 AUSTRALIA ROAD MARKING MATERIALS MARKET, BY PRODUCT TYPE

7.1 OVERVIEW

7.2 SOLVENT-BASED AND WATER BASED PAINTS

7.3 THERMOPLASTIC COMPOUNDS

7.4 PREFORMED POLYMER TAPES

7.5 COLD APPLIED PLASTIC PAINTS

7.6 OTHERS

8 AUSTRALIA ROAD MARKING MATERIALS MARKET, BY TYPE

8.1 OVERVIEW

8.2 PERMANENT

8.3 REMOVABLE

9 AUSTRALIA ROAD MARKING MATERIALS MARKET, BY MARKING

9.1 OVERVIEW

9.2 LONGITUDINAL MARKINGS

9.3 TRANSVERSE MARKINGS

9.4 ARROW MARKINGS

9.5 HAZARD MARKINGS

9.6 BLOCK MARKINGS

9.7 DIRECTIONAL MARKINGS

9.8 FACILITY MARKINGS

10 AUSTRALIA ROAD MARKING MATERIALS MARKET, BY MARKING COLOR PATTERN

10.1 OVERVIEW

10.2 WHITE

10.3 YELLOW

10.4 BLUE

10.5 GREEN

10.6 RED/PURPLE

10.7 OTHERS

11 AUSTRALIA ROAD MARKING MATERIALS MARKET, BY APPLICATION

11.1 OVERVIEW

11.2 ROAD MARKING LINES

11.3 ROAD MARKING LABELS

12 AUSTRALIA ROAD MARKING MATERIALS MARKET, BY VERTICAL

12.1 OVERVIEW

12.2 TRANSPORTATION AND INFRASTRUCTURE

12.3 COMMERCIAL AND INDUSTRIAL

12.4 LOGISTICS AND SUPPLY CHAIN

12.5 HEALTHCARE AND EMERGENCY SERVICES

12.6 EDUCATION AND INSTITUTIONS

12.7 SPORTS AND EVENTS

12.8 ENERGY AND UTILITIES

12.9 OTHERS

13 AUSTRALIA ROAD MARKING MATERIALS MARKET: COMPANY LANDSCAPE

13.1 COMPANY SHARE ANALYSIS: AUSTRALIA

14 SWOT ANALYSIS

15 COMPANY PROFILES

15.1 SWARCO

15.1.1 COMPANY SNAPSHOT

15.1.2 PRODUCT PORTFOLIO

15.1.3 RECENT DEVELOPMENT/NEWS

15.2 GEVEKO MARKINGS

15.2.1 COMPANY SNAPSHOT

15.2.2 PRODUCT PORTFOLIO

15.2.3 RECENT DEVELOPMENT/NEWS

15.3 DAMARINDUSTRIES

15.3.1 COMPANY SNAPSHOT

15.3.2 PRODUCT PORTFOLIO

15.3.3 RECENT DEVELOPMENT/NEWS

15.4 COLORCOAT

15.4.1 COMPANY SNAPSHOT

15.4.2 PRODUCT PORTFOLIO

15.4.3 RECENT DEVELOPMENT/NEWS

15.5 RAYOLITE

15.5.1 COMPANY SNAPSHOT

15.5.2 PRODUCT PORTFOLIO

15.5.3 RECENT DEVELOPMENT/NEWS

15.6 AREA SAFE PRODUCTS PTY LTD.

15.6.1 COMPANY SNAPSHOT

15.6.2 PRODUCT PORTFOLIO

15.6.3 RECENT DEVELOPMENT/NEWS

15.7 CRYSTALITE DESIGN

15.7.1 COMPANY SNAPSHOT

15.7.2 PRODUCT PORTFOLIO

15.7.3 RECENT DEVELOPMENT/NEWS

15.8 D G GROUP OF COMPANIES

15.8.1 COMPANY SNAPSHOT

15.8.2 PRODUCT PORTFOLIO

15.8.3 RECENT DEVELOPMENT/NEWS

15.9 DPI

15.9.1 COMPANY SNAPSHOT

15.9.2 PRODUCT PORTFOLIO

15.9.3 RECENT DEVELOPMENT/NEWS

15.1 DULUX PROTECTIVE COATINGS

15.10.1 COMPANY SNAPSHOT

15.10.2 PRODUCT PORTFOLIO

15.10.3 RECENT DEVELOPMENT/NEWS

15.11 OMEGA INDUSTRIES

15.11.1 COMPANY SNAPSHOT

15.11.2 PRODUCT PORTFOLIO

15.11.3 RECENT DEVELOPMENT/NEWS

15.12 TRAFFIC PRODUCTS AUSTRALIA PTY LTD

15.12.1 COMPANY SNAPSHOT

15.12.2 PRODUCT PORTFOLIO

15.12.3 RECENT DEVELOPMENT/NEWS

15.13 VIPONDS PAINTS PTY LTD.

15.13.1 COMPANY SNAPSHOT

15.13.2 PRODUCT PORTFOLIO

15.13.3 RECENT DEVELOPMENT/NEWS

16 QUESTIONNAIRE

17 RELATED REPORTS

List of Table

TABLE 1 PRODUCTION CAPACITY FOR TOP MANUFACTURERS

TABLE 2 REGULATORY COVERAGE

TABLE 3 AUSTRALIA ROAD MARKING MATERIALS MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 4 AUSTRALIA ROAD MARKING MATERIALS MARKET, BY PRODUCT TYPE, 2018-2032 (TONS)

TABLE 5 AUSTRALIA SOLVENT-BASED AND WATER BASED PAINTS IN ROAD MARKING MATERIALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 6 AUSTRALIA OIL-BASED IN ROAD MARKING MATERIALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 7 AUSTRALIA SOLVENT-BASED AND WATER BASED PAINTS IN ROAD MARKING MATERIALS MARKET, BY CHEMISTRY, 2018-2032 (USD THOUSAND)

TABLE 8 AUSTRALIA THERMOPLASTIC COMPOUNDS IN ROAD MARKING MATERIALS MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 9 AUSTRALIA THERMOPLASTIC COMPOUNDS IN ROAD MARKING MATERIALS MARKET, BY APPLICATION METHOD, 2018-2032 (USD THOUSAND)

TABLE 10 AUSTRALIA ROAD MARKING MATERIALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 11 AUSTRALIA ROAD MARKING MATERIALS MARKET, BY MARKING, 2018-2032 (USD THOUSAND)

TABLE 12 AUSTRALIA LONGITUDINAL MARKINGS IN ROAD MARKING MATERIALS MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 13 AUSTRALIA LONGITUDINAL MARKINGS IN ROAD MARKING MATERIALS MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 14 AUSTRALIA TRANSVERSE MARKINGS IN ROAD MARKING MATERIALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 15 AUSTRALIA ARROW MARKINGS IN ROAD MARKING MATERIALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 16 AUSTRALIA ROAD MARKING MATERIALS MARKET, BY MARKING COLOR PATTERN, 2018-2032 (USD THOUSAND)

TABLE 17 AUSTRALIA ROAD MARKING MATERIALS MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 18 AUSTRALIA ROAD MARKING MATERIALS MARKET, BY VERTICAL, 2018-2032 (USD THOUSAND)

TABLE 19 AUSTRALIA TRANSPORTATION AND INFRASTRUCTURE IN ROAD MARKING MATERIALS MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 20 AUSTRALIA COMMERCIAL AND INDUSTRIAL IN ROAD MARKING MATERIALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 21 AUSTRALIA AIRPORTS IN ROAD MARKING MATERIALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 22 AUSTRALIA WAREHOUSES AND FACTORIES IN ROAD MARKING MATERIALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 23 AUSTRALIA PUBLIC SPACES IN ROAD MARKING MATERIALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 24 AUSTRALIA LOGISTICS AND SUPPLY CHAIN IN ROAD MARKING MATERIALS MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 25 AUSTRALIA HEALTHCARE AND EMERGENCY SERVICES IN ROAD MARKING MATERIALS MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 26 AUSTRALIA HOSPITALS AND CLINICS IN ROAD MARKING MATERIALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 27 AUSTRALIA EMERGENCY RESPONSE AREAS IN ROAD MARKING MATERIALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 28 AUSTRALIA EDUCATION AND INSTITUTIONS IN ROAD MARKING MATERIALS MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 29 AUSTRALIA SPORTS AND EVENTS IN ROAD MARKING MATERIALS MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 30 AUSTRALIA ENERGY AND UTILITIES IN ROAD MARKING MATERIALS MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

List of Figure

FIGURE 1 AUSTRALIA ROAD MARKING MATERIALS MARKET

FIGURE 2 AUSTRALIA ROAD MARKING MATERIALS MARKET: DATA TRIANGULATION

FIGURE 3 AUSTRALIA ROAD MARKING MATERIALS MARKET: DROC ANALYSIS

FIGURE 4 AUSTRALIA ROAD MARKING MATERIALS MARKET: COUNTRYWISE ANALYSIS

FIGURE 5 AUSTRALIA ROAD MARKING MATERIALS MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 AUSTRALIA ROAD MARKING MATERIALS MARKET: MULTIVARIATE MODELLING

FIGURE 7 AUSTRALIA ROAD MARKING MATERIALS MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 8 AUSTRALIA ROAD MARKING MATERIALS MARKET: DBMR MARKET POSITION GRID

FIGURE 9 AUSTRALIA ROAD MARKING MATERIALS MARKET: VENDOR SHARE ANALYSIS

FIGURE 10 APPLICATION COVERAGE GRID: AUSTRALIA ROAD MARKING MATERIALS MARKET

FIGURE 11 AUSTRALIA ROAD MARKING MATERIALS MARKET: SEGMENTATION

FIGURE 12 EXECUTIVE SUMMARY

FIGURE 13 FIVE SEGMENTS COMPRISE THE AUSTRALIA ROAD MARKING MATERIALS MARKET, BY PRODUCT TYPE (2024)

FIGURE 14 STRATEGIC DECISIONS

FIGURE 15 INCREASED GOVERNMENT INVESTMENTS IN HIGHWAY EXPANSIONS AND ROAD INFRASTRUCTURE IS EXPECTED TO DRIVE THE AUSTRALIA ROAD MARKING MATERIALS MARKET IN THE FORECAST PERIOD (2025-2032)

FIGURE 16 THE SOLVENT-BASED AND WATER BASED PAINTS SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE AUSTRALIA ROAD MARKING MATERIALS MARKET IN 2025 AND 2032

FIGURE 17 PORTER’S FIVE FORCES ANALYSIS

FIGURE 18 IMPORT EXPORT SCENARIO (USD THOUSAND)

FIGURE 19 AUSTRALIA ROAD MARKING MATERIALS MARKET, 2024-2032, AVERAGE SELLING PRICE (USD/KG)

FIGURE 20 PRODUCTION CONSUMPTION ANALYSIS

FIGURE 21 VENDOR SELECTION CRITERIA

FIGURE 22 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES FOR AUSTRALIA ROAD MARKING MATERIALS MARKET

FIGURE 23 AUSTRALIA ROAD MARKING MATERIALS MARKET: BY PRODUCT TYPE, 2024

FIGURE 24 AUSTRALIA ROAD MARKING MATERIALS MARKET: BY TYPE, 2024

FIGURE 25 AUSTRALIA ROAD MARKING MATERIALS MARKET, BY MARKING, 2024

FIGURE 26 AUSTRALIA ROAD MARKING MATERIALS MARKET: BY MARKING COLOR PATTERN, 2024

FIGURE 27 AUSTRALIA ROAD MARKING MATERIALS MARKET, BY APPLICATION, 2024

FIGURE 28 AUSTRALIA ROAD MARKING MATERIALS MARKET: BY VERTICAL, 2024

FIGURE 29 AUSTRALIA ROAD MARKING MATERIALS MARKET: COMPANY SHARE 2024 (%)

Australia Road Marking Materials Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Australia Road Marking Materials Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Australia Road Marking Materials Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.