Australia Urology Surgery Market

Market Size in USD Million

CAGR :

%

USD

160.55 Million

USD

277.90 Million

2024

2032

USD

160.55 Million

USD

277.90 Million

2024

2032

| 2025 –2032 | |

| USD 160.55 Million | |

| USD 277.90 Million | |

|

|

|

Urology Surgery Market Analysis

The urology surgical market has undergone significant evolution over the past few decades, driven by advancements in technology, improved surgical techniques, and a growing global aging population. Historically, urology surgeries, such as those for kidney stones, prostate issues, and bladder conditions, were primarily invasive procedures with long recovery times. However, the introduction of minimally invasive techniques, such as laparoscopic surgery and robotic-assisted surgery, has transformed the landscape. These innovations have allowed for more precise operations, reduced hospital stays, faster recovery times, and fewer complications, making surgeries more appealing to both patients and healthcare providers. Furthermore, the integration of technologies such as 3D imaging, AI-based diagnostic tools, and enhanced robotic systems has further refined surgical planning and execution.

As the incidence of urological conditions, such as benign prostatic hyperplasia, bladder cancer, and kidney stones, increases due to demographic changes, particularly in aging populations, the demand for advanced surgical treatments continues to grow. Moreover, the shift towards outpatient procedures, as well as an increasing focus on personalized and value-based care, is driving the development of more cost-effective and efficient surgical solutions. The market is also witnessing a surge in the adoption of telemedicine and remote monitoring tools, which complement surgical treatments by enabling continuous care and follow-up. As these trends continue to shape the future of the urology surgical market, ongoing research into novel technologies and treatment protocols will likely expand the scope of surgical options, improve patient outcomes, and increase accessibility to cutting-edge care globally.

Urology Surgery Market Size

Australia urology surgery market size was valued at USD 160.55 million in 2024 and is projected to reach USD 277.90 million by 2032, with a CAGR of 7.1% during the forecast period of 2025 to 2032. In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework.

Urology Surgery Market Trends

“Rise of Robotic-Assisted and Minimally Invasive Surgeries”

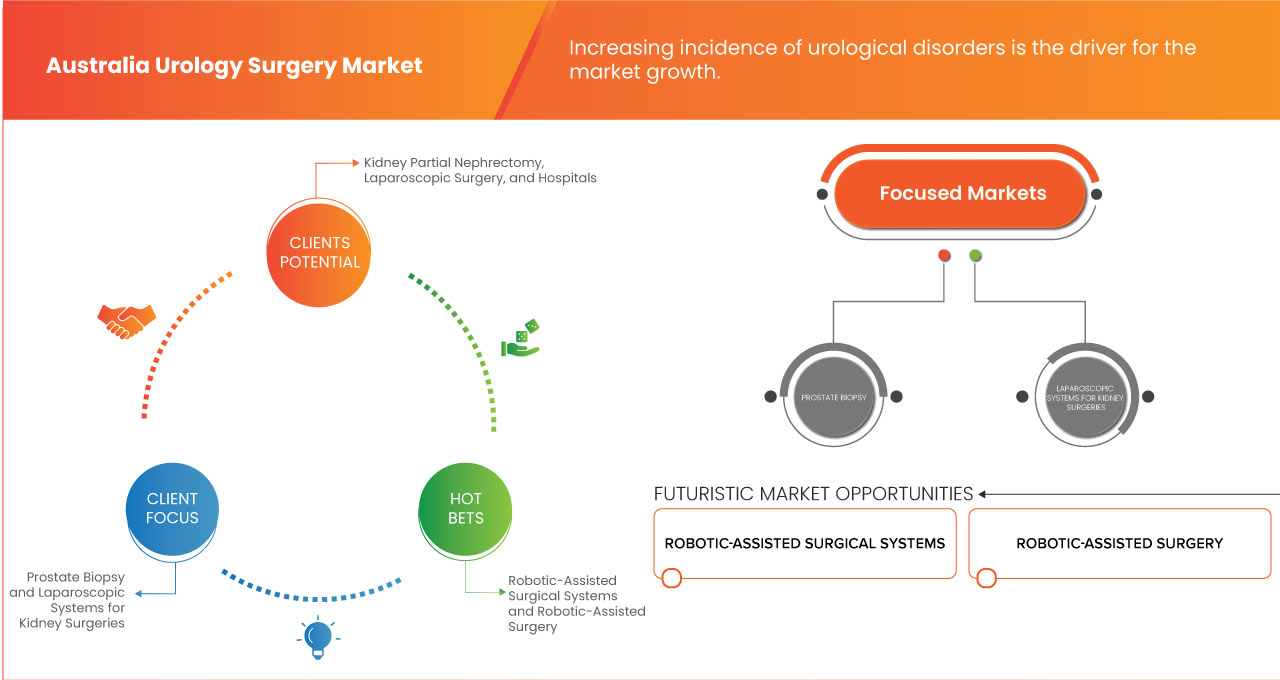

The Australia urology surgery market is expanding, fueled by technological advancements, a growing aging population, and rising health awareness. Innovations in minimally invasive procedures and robotic surgery is a key trend for enhancing precision, reducing recovery times, and improving patient outcomes. The aging population's increased prevalence of urological conditions such as prostate cancer, kidney stones, and bladder disorders is further driving demand for these services. In addition, the growing focus on early diagnosis and preventive care is encouraging more people to seek treatment. The private healthcare sector is also experiencing growth, providing greater access to advanced urological procedures.

Report Scope and Urology Surgery Market Segmentation

|

Attributes |

Urology Surgery key Market Insights |

|

Segments Covered |

|

|

Key Market Players |

Boston Scientific Corporation (U.S.), Siemens Healthineers AG (Germany), Cook (U.S.), Olympus Corporation (Japan), Stryker (U.S.), Medtronic (Ireland), GE HealthCare (U.S.), Johnson & Johnson Services, Inc. (U.S.), and Intuitive Surgical Operations, Inc. (U.S.) among others |

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Urology Surgery Market Definition

Australia urology surgery market involves medical procedures and treatments related to the diagnosis, prevention, and treatment of diseases affecting the male and female urinary systems, as well as male reproductive organs. Urology surgeries include those for conditions such as kidney stones, bladder cancer, prostate issues, urinary tract infections, and erectile dysfunction. The market encompasses the use of advanced technologies, surgical instruments, minimally invasive techniques, and robotic surgery in treating these conditions. Key technologies employed in urology surgery include laser treatments, endoscopy, robotic systems, and advanced imaging techniques.

Urology Surgery Market Dynamics

Drivers

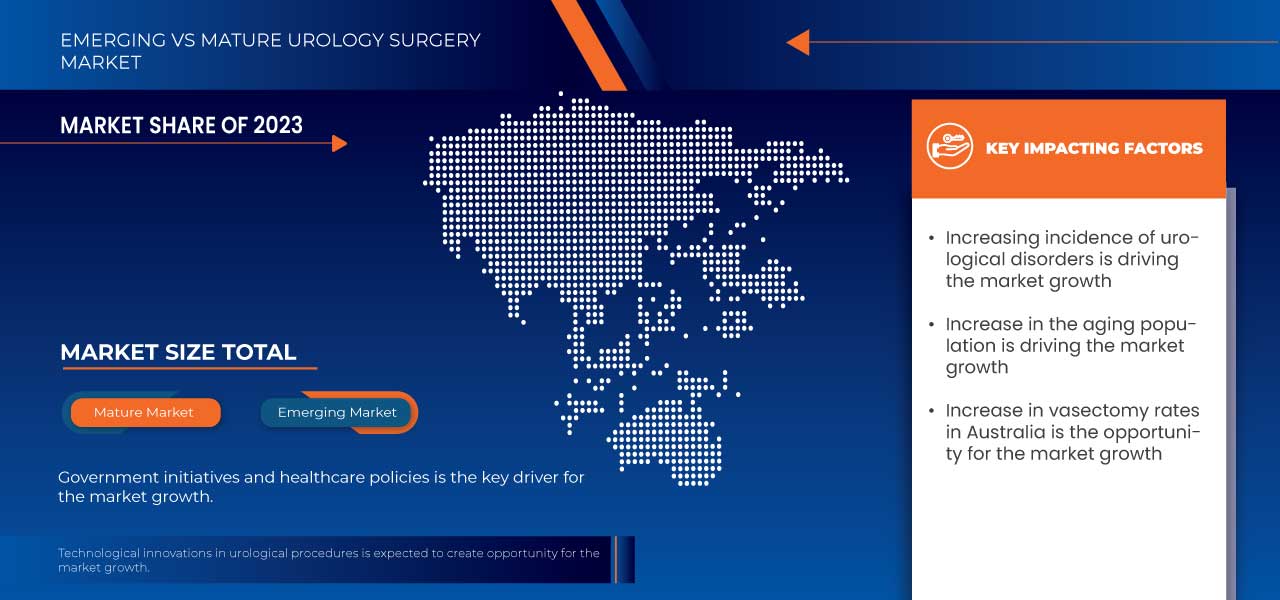

- Increasing Incidence of Urological Disorders

The increasing incidence of urological disorders in Australia serves as a significant driver for the urology surgery market due to the growing number of patients requiring surgical interventions. Conditions such as prostate cancer, bladder cancer, kidney stones, urinary incontinence, and Benign Prostatic Hyperplasia (BPH) have seen rising prevalence rates, particularly among the aging population. As these disorders become more common, patients are often left with limited options for management, making surgical procedures a critical component of their treatment plans. This trend stimulates demand for surgeries and necessitates the development of specialized surgical facilities and training for healthcare professionals, further expanding the market.

For instance,

In January 2024, according to an article published in the Cancer Australia, prostate cancer was the most commonly diagnosed cancer in Australia. Moreover, according to the same source, in 2022, it is estimated that a male has a 1 in 6 (or 17%) risk of being diagnosed with prostate cancer by the age of 85.

Moreover, the higher incidence of urological disorders emphasizes the importance of early diagnosis and intervention, which often leads to more effective and less invasive surgical options. As public and clinical awareness of urological health increases, more patients are likely to seek proactive care and timely treatment, contributing to the growth of the surgery market. With the ongoing advancements in surgical techniques and technologies, healthcare providers are better equipped to address these disorders comprehensively. Consequently, the escalating rates of urological conditions become a focal point for driving innovations in treatment options, enhancing patient outcomes, and increasing the overall demand within the urology surgery market in Australia.

- Increase in the Aging Population

The increasing aging population in Australia acts as a significant driver for the urology surgery market, as older individuals are more susceptible to various urological disorders. Conditions such as Benign Prostatic Hyperplasia (BPH), prostate cancer, urinary incontinence, and kidney stones are more prevalent among the elderly. As the proportion of older adults in the population rises, the demand for urological surgeries escalates correspondingly. This demographic trend leads to a greater number of patients requiring surgical interventions and stresses the healthcare system to provide adequate resources, facilities, and specialized care tailored to the unique needs of older patients.

For instance,

In October 2023, according to an article published in the University of Sydney, Australia is stated to grow older, faster. Moreover, it is estimated that, by 2026, more than 22 percent of Australians will be aged over 65, which is up from 16 percent in 2020.

Furthermore, an aging population often leads to an increased focus on preventive care and early diagnosis, as well as a growing acceptance of surgical options to improve quality of life. Older adults typically seek effective treatments for urological issues that significantly impact their daily activities and overall well-being. As healthcare providers become more aware of the specific needs of this demographic, there is a concerted effort to implement innovative surgical techniques and therapies designed to address urological conditions more effectively. As a result, the aging population drives the demand for urological surgeries and encourages advancements in medical technology and treatment approaches within the urology surgery market in Australia.

Opportunities

- Technological Innovations in Urological Procedures

Technological innovations, particularly in robotic surgery and minimally invasive procedures, have significantly transformed the landscape of the Australia urology surgery market. The integration of advanced technologies such as robotic-assisted surgery has led to more precise, efficient, and less invasive procedures, drastically improving patient outcomes. These innovations allow urologists to perform complex surgeries with greater accuracy, minimizing the risk of complications and reducing the need for large incisions. Minimally invasive techniques, including laparoscopic and endoscopic procedures, have enhanced the overall surgical experience by significantly lowering recovery times, reducing pain, and improving post-operative care. As a result, patients experience shorter hospital stays and faster return to daily activities, contributing to higher patient satisfaction. The growing adoption of these technologies is transforming traditional urological surgeries into more efficient and less disruptive options, making them more appealing to a wider patient base. This shift in treatment options presents a substantial opportunity for growth in the Australia urology surgery market, as the demand for advanced, patient-friendly surgical alternatives continues to rise.

For instance,

In January 2024, according to the article published by HOMI ZARGAR, robotic urological surgery offers precision through robotic arms with high-definition cameras, enabling smaller incisions, reduced blood loss, and quicker recovery. This technology provides enhanced dexterity, better visualization, and access to challenging areas, leading to less pain and faster healing. As a result, patients often discharge earlier. These advancements create a significant opportunity, driving growth in the Australia urology surgery market.

Technological advancements, especially in robotic surgery and minimally invasive techniques, have revolutionized the Australia urology surgery market. Robotic-assisted surgeries offer greater precision, enabling surgeons to perform complex procedures with minimal invasiveness. These innovations reduce recovery times, decrease complications, and shorten hospital stays. Minimally invasive methods, such as laparoscopic and endoscopic surgeries, enhance patient comfort and speed up the healing process. With these improvements, patients experience quicker recoveries and better outcomes. As these technologies become more widely adopted, they open up significant opportunities for growth in the urology surgery market, driven by the increasing demand for more efficient and less disruptive procedures.

- Increase in Vasectomy Rates in Australia

Increased vasectomy rates present a strong opportunity for the Australia urology surgery market. As more men opt for vasectomies as a permanent contraceptive solution, there is a consistent demand for this procedure. Vasectomy surgeries are typically quick, minimally invasive, and have low complication rates, making them a popular choice for men seeking family planning options. In addition, the growing awareness and acceptance of vasectomy as a safe, reliable form of contraception further boosts its adoption. This trend creates a steady patient base for urologists and contributes to an ongoing need for surgical services, post-operative care, and counseling. The rise in vasectomy procedures also opens up avenues for market growth in related areas, such as vasectomy reversals and follow-up treatments. As a result, the increasing demand for vasectomies drives expansion in the urology surgery sector, presenting a significant opportunity for the Australia urology surgery market.

For instance,

In December 2020, according to the article published by ABC News, Australia has the second-highest rate of vasectomies globally, with one in four men over 40 opting for the procedure. This widespread adoption highlights a strong demand for vasectomy services and related treatments. As more men seek permanent contraception, the increased vasectomy rates create significant growth opportunities for the Australia urology surgery market, driving demand for surgical and post-operative care.

The rise in vasectomy rates offers a valuable opportunity for the Australia urology surgery market. As more men choose vasectomy as a permanent contraception option, the demand for this procedure continues to grow. This trend also boosts the need for post-operative care and follow-up treatments. In addition, the growing acceptance of vasectomies supports market expansion in related services such as vasectomy reversals, driving overall growth in the urology surgery sector.

Restraints/Challenges

- Shortage of Specialized Professionals

The shortage of specialized professionals in the field of urology significantly hampers the growth of the urology surgery market in Australia by creating bottlenecks in patient access to care. With an increasing prevalence of urological conditions, such as prostate cancer and urinary tract disorders, the demand for urological consultations and surgical interventions has surged. However, the limited number of trained urologists exacerbates the situation, leading to extended wait times for patients seeking treatment. These delays can result in disease progression and complicated conditions, ultimately affecting patient outcomes and satisfaction. As patients wait longer for surgical procedures, many may opt for alternative treatments or forego necessary surgeries altogether, thereby further diminishing market demand.

For instance,

In August 2023, according to an article published in The Medical Journal of Australia, the shortage of doctors in remote, rural and regional Australian communities is a longstanding health policy challenge. It is the main reason about why almost 3000 overseas‐trained doctors enter the labor force annually — a similar number to the domestic graduate output of Australian medical schools.

In addition, the shortage of specialized healthcare professionals’ strains existing resources and increases the workload for urologists, often resulting in burnout and job dissatisfaction. This scenario creates a challenging environment where urologists may become overburdened, which can diminish the quality of care provided. The complexity of urological surgeries requires not only skilled surgeons but also a robust support team, including nurses and technical staff who are trained in urological procedures. When the workforce is inadequate, the overall efficiency and effectiveness of surgical services decline, posing significant limits on the market's ability to respond to patient needs. Consequently, this shortage will likely continue to act as a major restraint, hindering the urology surgery market's potential to evolve and expand in Australia.

- Complexity of the Surgical Procedures

The complexity of urological surgical procedures poses a significant restraint on the Australia urology surgery market, as these intricate interventions require highly specialized skills and extensive training. Many urological surgeries, such as robotic-assisted prostatectomy or reconstructive surgeries, demand not only precision but also advanced knowledge of the urinary and reproductive systems. The need for high levels of expertise can limit the number of qualified professionals able to perform these procedures, thereby constraining the overall capacity of the market to meet growing patient demands. Moreover, the higher risks associated with complex surgeries can lead to increased caution among healthcare providers, which may result in a reluctance to perform these operations, further exacerbating patient wait times and access to care.

In addition, the intricacy of these procedures often necessitates sophisticated surgical equipment and advanced facility capabilities, which can be a substantial financial burden for healthcare providers. Smaller clinics or hospitals may struggle to invest in the latest technologies needed for such surgeries, leading to disparities in access to care across different regions. This financial challenge can create a bottleneck, where only a limited number of facilities can offer complex urological surgical services. As a result, patients in less equipped areas may need to travel long distances to receive appropriate care, which adds logistical challenges and may discourage them from pursuing essential treatments. Thus, the complexity of urological procedures acts as a considerable restraint on market growth, limiting both the supply of qualified professionals and the accessibility of advanced surgical care for patients across Australia.

This market report provides details of new recent developments, trade regulations, import-export analysis, production analysis, value chain optimization, market share, impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, strategic market growth analysis, market size, category market growths, application niches and dominance, product approvals, product launches, geographic expansions, technological innovations in the market. To gain more info on the market contact Data Bridge Market Research for an Analyst Brief, our team will help you take an informed market decision to achieve market growth.

Urology Surgery Market Scope

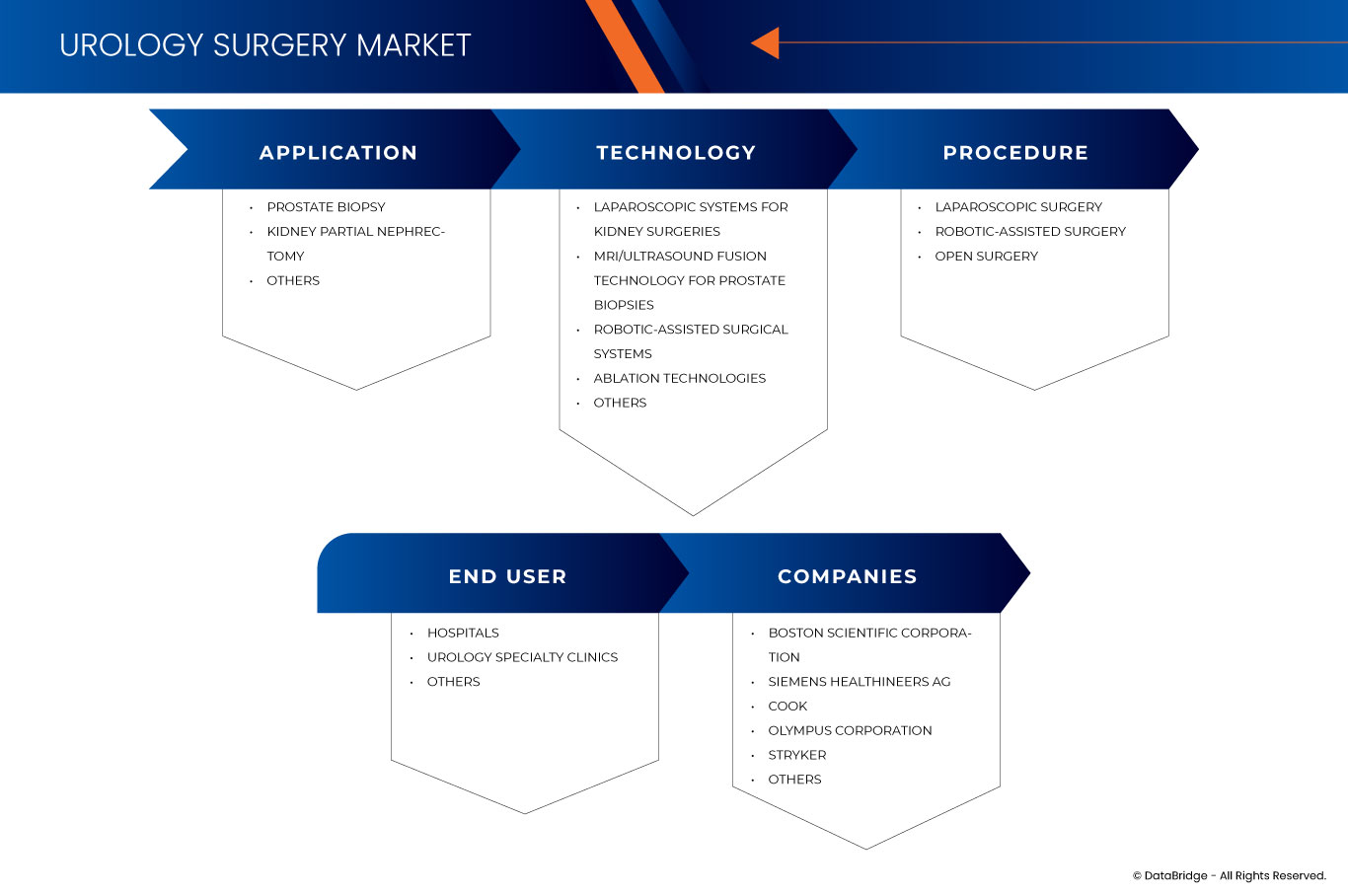

The market is segmented on the basis of application, technology, procedure, and end user. The growth amongst these segments will help you analyze meagre growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Application

- Prostate Biopsy

- Kidney Partial Nephrectomy

- Early-Stage Renal Cell Carcinoma

- Benign Kidney Tumors

- Others

Technology

- Laparoscopic Systems for Kidney Surgeries

- MRI/Ultrasound Fusion Technology for Prostate Biopsies

- Robotic-Assisted Surgical Systems

- Ablation Technologies

- Others

Procedure

- Laparoscopic Surgery

- Robotic-Assisted Surgery

- Open Surgery

End User

- Hospitals

- Urology Specialty Clinics

- Others

Urology Surgery Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

Urology Surgery Market Leaders Operating in the Market Are:

- Boston Scientific Corporation (U.S.)

- Siemens Healthineers AG (Germany)

- Cook (U.S.)

- Olympus Corporation (Japan)

- Stryker (U.S.)

- Medtronic (Ireland)

- GE HealthCare (U.S.)

- Johnson & Johnson Services, Inc. (U.S.)

- Intuitive Surgical Operations, Inc. (U.S.)

Latest Developments in Urology Surgery Market

- In November 2024, Boston Scientific Corporation announced the completion of its acquisition of Axonics, Inc., a leader in devices for urinary and bowel dysfunction. This acquisition expands Boston Scientific’s Urology portfolio, enhancing its offerings in sacral neuromodulation and tailored treatments for incontinence

- In November 2024, Johnson & Johnson MedTech, announced that the U.S. Food & Drug Administration (FDA) has approved the VARIPULSE Platform for treating drug-resistant paroxysmal Atrial Fibrillation (AFib). This approval positions the company to expand its portfolio of innovative solutions, enhancing its market leadership and offering new therapeutic options to patients with challenging AFib cases

- In October 2024, Boston Scientific Corporation announced FDA approval for the FARAWAVE NAV Ablation Catheter, designed for treating paroxysmal atrial fibrillation (AF), and FDA 510(k) clearance for FARAVIEW Software. These technologies integrate with the FARAPULSE PFA System and OPAL HDx Mapping System, enabling efficient cardiac mapping and therapy with a single catheter

- In May 2024, Biosense Webster, Inc., announced the launch of CARTO 3 System Version 8, the newest iteration of its advanced three-dimensional (3D) heart mapping system used in cardiac ablation procedures. This launch strengthens the company’s position as a pioneer in cardiac technology, offering enhanced capabilities that improve procedural precision and patient outcomes, further solidifying its leadership in the cardiovascular space

- In March 2024, Biosense Webster, Inc., announced the submission of the VARIPULSE Platform for Premarket Approval (PMA) to the U.S. Food & Drug Administration (FDA). This submission marks a significant step in advancing the platform’s approval, which will enable the company to expand its product offerings and strengthen its market presence in the growing atrial fibrillation treatment market

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELING

2.7 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.8 DBMR MARKET POSITION GRID

2.9 MARKET END USER COVERAGE GRID

2.1 DBMR VENDOR SHARE ANALYSIS

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PESTAL ANALYSIS

4.2 PORTERS FIVE FORCES ANALYSIS

4.3 HEALTHCARE EXPENDITURE WITH A FOCUS ON UROLOGY SURGERY

4.3.1 CYSTOSCOPY (SMALL BLADDER TUMOUR RESECTION)

4.3.2 TOTAL PROSTATECTOMY

4.3.3 TRANSRECTAL PROSTATE BIOPSY

4.3.4 PARTIAL NEPHRECTOMY

4.3.5 VISUAL LASER ABLATION (REMOVAL OF TISSUE FOR ENLARGED PROSTATE)

4.4 UROLOGY SURGERY PROCEDURE VOLUME TRENDS:

5 EPIDEMIOLOGY

6 AUSTRALIA UROLOGY SURGERY MARKET: REGULATIONS

6.1 REGULATORY AUTHORITIES IN THE AUSTRALIA-

7 MARKET OVERVIEW

7.1 DRIVERS

7.1.1 INCREASING INCIDENCE OF UROLOGICAL DISORDERS

7.1.2 INCREASE IN THE AGING POPULATION

7.1.3 GOVERNMENT INITIATIVES AND HEALTHCARE POLICIES

7.2 RESTRAINTS

7.2.1 SHORTAGE OF SPECIALIZED PROFESSIONALS

7.2.2 COMPLEXITY OF THE SURGICAL PROCEDURES

7.3 OPPORTUNITIES

7.3.1 TECHNOLOGICAL INNOVATIONS IN UROLOGICAL PROCEDURES

7.3.2 INCREASE IN VASECTOMY RATES IN AUSTRALIA

7.3.3 EXPANDING UROLOGY AWARENESS CAMPAIGNS

7.4 CHALLENGES

7.4.1 LACK OF SKILLED PROFESSIONALS

7.4.2 POST-SURGICAL COMPLICATIONS

8 AUSTRALIA UROLOGY SURGERY MARKET, BY APPLICATION

8.1 OVERVIEW

8.2 PROSTATE BIOPSY

8.3 KIDNEY PARTIAL NEPHRECTOMY

8.3.1 EARLY-STAGE RENAL CELL CARCINOMA

8.3.2 BENIGN KIDNEY TUMORS

8.4 OTHERS

9 AUSTRALIA UROLOGY SURGERY MARKET, BY TECHNOLOGY

9.1 OVERVIEW

9.2 LAPAROSCOPIC SYSTEMS FOR KIDNEY SURGERIES

9.3 MRI/ULTRASOUND FUSION TECHNOLOGY FOR PROSTATE BIOPSIES

9.4 ROBOTIC-ASSISTED SURGICAL SYSTEMS

9.5 ABLATION TECHNOLOGIES

9.6 OTHERS

10 AUSTRALIA UROLOGY SURGERY MARKET, BY PROCEDURE

10.1 OVERVIEW

10.2 LAPAROSCOPIC SURGERY

10.3 ROBOTIC-ASSISTED SURGERY

10.4 OPEN SURGERY

11 AUSTRALIA UROLOGY SURGERY MARKET, BY END USER

11.1 OVERVIEW

11.2 HOSPITALS

11.3 UROLOGY SPECIALTY CLINICS

11.4 OTHERS

12 AUSTRALIA UROLOGY SURGERY MARKET: COMPANY LANDSCAPE

12.1 COMPANY SHARE ANALYSIS: AUSTRALIA

13 SWOT ANALYSIS

14 COMPANY PROFILES

14.1 BOSTON SCIENTIFIC CORPORATION

14.1.1 COMPANY SNAPSHOT

14.1.2 REVENUE ANALYSIS

14.1.3 PRODUCT PORTFOLIO

14.1.4 RECENT DEVELOPMENT

14.2 SIEMENS HEALTHINEERS AG

14.2.1 COMPANY SNAPSHOT

14.2.2 REVENUE ANALYSIS

14.2.3 PRODUCT PORTFOLIO

14.2.4 RECENT DEVELOPMENT

14.3 COOK

14.3.1 COMPANY SNAPSHOT

14.3.2 PRODUCT PORTFOLIO

14.3.3 RECENT DEVELOPMENT

14.4 OLYMPUS CORPORATION

14.4.1 COMPANY SNAPSHOT

14.4.2 REVENUE ANALYSIS

14.4.3 PRODUCT PORTFOLIO

14.4.4 RECENT DEVELOPMENT

14.5 STRYKER

14.5.1 COMPANY SNAPSHOT

14.5.2 REVENUE ANALYSIS

14.5.3 PRODUCT PORTFOLIO

14.5.4 RECENT DEVELOPMENT

14.6 GE HEALTHCARE

14.6.1 COMPANY SNAPSHOT

14.6.2 REVENUE ANALYSIS

14.6.3 PRODUCT PORTFOLIO

14.6.4 RECENT DEVELOPMENT

14.7 INTUITIVE SURGICAL OPERATIONS, INC.

14.7.1 COMPANY SNAPSHOT

14.7.2 REVENUE ANALYSIS

14.7.3 PRODUCT PORTFOLIO

14.7.4 RECENT DEVELOPMENT

14.8 JOHNSON & JOHNSON SERVICES, INC

14.8.1 COMPANY SNAPSHOT

14.8.2 REVENUE ANALYSIS

14.8.3 PRODUCT PORTFOLIO

14.8.4 RECENT DEVELOPMENTS

14.9 MEDTRONIC

14.9.1 COMPANY SNAPSHOT

14.9.2 REVENUE ANALYSIS

14.9.3 PRODUCT PORTFOLIO

14.9.4 RECENT DEVELOPMENT

15 QUESTIONNAIRE

16 RELATED REPORTS

List of Table

TABLE 1 FEES AND COSTS BY STATE AND TERRITORY:

TABLE 2 AUSTRALIA UROLOGY SURGERY MARKET: BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 3 AUSTRALIA KIDNEY PARTIAL NEPHRECTOMY IN UROLOGY SURGERY MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 4 AUSTRALIA UROLOGY SURGERY MARKET, BY TECHNOLOGY, 2018-2032 (USD MILLION)

TABLE 5 AUSTRALIA UROLOGY SURGERY MARKET, BY PROCEDURE, 2018-2032 (USD MILLION)

TABLE 6 AUSTRALIA UROLOGY SURGERY MARKET, BY END USER, 2018-2032 (USD MILLION)

List of Figure

FIGURE 1 AUSTRALIA UROLOGY SURGERY MARKET

FIGURE 2 AUSTRALIA UROLOGY SURGERY MARKET: DATA TRIANGULATION

FIGURE 3 AUSTRALIA UROLOGY SURGERY MARKET: DROC ANALYSIS

FIGURE 4 AUSTRALIA UROLOGY SURGERY MARKET: COUNTRY-WISE ANALYSIS

FIGURE 5 AUSTRALIA UROLOGY SURGERY MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 AUSTRALIA UROLOGY SURGERY MARKET: MULTIVARIATE MODELLING

FIGURE 7 AUSTRALIA UROLOGY SURGERY MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 8 AUSTRALIA UROLOGY SURGERY MARKET: DBMR MARKET POSITION GRID

FIGURE 9 AUSTRALIA UROLOGY SURGERY MARKET: MARKET END USER COVERAGE GRID

FIGURE 10 AUSTRALIA UROLOGY SURGERY MARKET: VENDOR SHARE ANALYSIS

FIGURE 11 AUSTRALIA UROLOGY SURGERY MARKET: SEGMENTATION

FIGURE 12 THREE SEGMENTS COMPRISE THE AUSTRALIA UROLOGY SURGERY MARKET, BY APPLICATION

FIGURE 13 INCREASING INCIDENCE OF UROLOGICAL DISORDERS IS EXPECTED TO DRIVE THE AUSTRALIA UROLOGY SURGERY MARKET IN THE FORECAST PERIOD

FIGURE 14 THE PROSTATE BIOPSY SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE AUSTRALIA UROLOGY SURGERY MARKET IN 2025 AND 2032

FIGURE 15 DROC ANALYSIS

FIGURE 16 AUSTRALIA UROLOGY SURGERY MARKET: BY APPLICATION, 2024

FIGURE 17 AUSTRALIA UROLOGY SURGERY MARKET: BY APPLICATION, 2025-2032 (USD MILLION)

FIGURE 18 AUSTRALIA UROLOGY SURGERY MARKET: BY APPLICATION, CAGR (2025-2032)

FIGURE 19 AUSTRALIA UROLOGY SURGERY MARKET: BY APPLICATION, LIFELINE CURVE

FIGURE 20 AUSTRALIA UROLOGY SURGERY MARKET: BY TECHNOLOGY, 2024

FIGURE 21 AUSTRALIA UROLOGY SURGERY MARKET: BY TECHNOLOGY, 2025-2032 (USD MILLION)

FIGURE 22 AUSTRALIA UROLOGY SURGERY MARKET: BY TECHNOLOGY, CAGR (2025-2032)

FIGURE 23 AUSTRALIA UROLOGY SURGERY MARKET: BY TECHNOLOGY, LIFELINE CURVE

FIGURE 24 AUSTRALIA UROLOGY SURGERY MARKET: BY PROCEDURE,2024

FIGURE 25 AUSTRALIA UROLOGY SURGERY MARKET: BY PROCEDURE, 2025-2032 (USD MILLION)

FIGURE 26 AUSTRALIA UROLOGY SURGERY MARKET: BY PROCEDURE, CAGR (2025-2032)

FIGURE 27 AUSTRALIA UROLOGY SURGERY MARKET: BY PROCEDURE, LIFELINE CURVE

FIGURE 28 AUSTRALIA UROLOGY SURGERY MARKET: BY END USER,2024

FIGURE 29 AUSTRALIA UROLOGY SURGERY MARKET: BY END USER, 2025-2032 (USD MILLION)

FIGURE 30 AUSTRALIA UROLOGY SURGERY MARKET: BY END USER, CAGR (2025-2032)

FIGURE 31 AUSTRALIA UROLOGY SURGERY MARKET: BY END USER, LIFELINE CURVE

FIGURE 32 AUSTRALIA UROLOGY SURGERY MARKET: COMPANY SHARE 2024 (%)

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.