Benelux Africa And Saudi Arabia Nuclear Infrastructure Market

Market Size in USD Billion

CAGR :

%

USD

3.23 Billion

USD

3.93 Billion

2024

2032

USD

3.23 Billion

USD

3.93 Billion

2024

2032

| 2025 –2032 | |

| USD 3.23 Billion | |

| USD 3.93 Billion | |

|

|

|

|

Nuclear Infrastructure Market Size

- The Benelux, Africa, and Saudi Arabia nuclear infrastructure market was valued at USD 3.23 billion and is expected to reach USD 3.93 billion by 2032

- During the forecast period of 2025 to 2032 the market is likely to grow at a CAGR of 2.6%, primarily driven by the electricity demand boosts nuclear infrastructure

- This growth is driven by factors such as the energy demand, environmental sustainability, energy security, government policies, and aging nuclear facilities.

Nuclear Infrastructure Market Analysis

- The nuclear infrastructure market encompasses the facilities, technologies, services, and regulatory frameworks essential for nuclear power generation, including reactor construction, fuel supply chains, waste management, grid integration, and decommissioning

- It involves key stakeholders such as governments, nuclear operators, engineering firms, and equipment manufacturers. Market dynamics are driven by energy policies, technological advancements, supply chain reliability, and regulatory compliance, all of which impact the efficiency and sustainability of nuclear power projects

- Africa, where nuclear energy is still in the early stages, lacks well-established waste management systems, making infrastructure development critical for handling future radioactive materials safely. Africa is rapidly advancing its nuclear infrastructure, with countries such as South Africa, Egypt, Ghana, Kenya, and Nigeria leading nuclear deployment initiatives to address rising electricity demand

- For Instance, in March 2025 data shared by the Nuclear Business Platform revealed that Africa is set to add up to 15,000 MW of nuclear capacity by 2035, with an estimated USD 105 billion market potential. This expansion is driven by growing electricity demand, pushing nations such as Nigeria, Egypt, Ghana, and Kenya to invest in large-scale nuclear projects and Small Modular Reactors (SMRs)

- Africa is exploring nuclear energy to address its growing power needs and industrial expansion, ensuring a stable and long-term electricity supply. Meanwhile, Saudi Arabia is integrating nuclear energy into its Vision 2030 strategy, aligning it with AI-driven power demands and green energy goals

Report Scope and Nuclear Infrastructure Market Segmentation

|

Attributes |

Nuclear Infrastructure Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

Benelux

Africa Saudi Arabia |

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Nuclear Infrastructure Market Trends

“Improving Energy Security”

- One prominent trend in Benelux, Africa, And Saudi Arabia nuclear infrastructure market is the improvement of energy security

- The International Energy Agency (IEA) reports that nuclear power generation in Europe is expected to grow significantly, with several new reactors being activated and existing ones being upgraded for efficiency

- For instance, improving energy security in 2025, nuclear power is poised to hit a new milestone, playing a crucial role in improving energy security as global electricity demand continues to rise. However, challenges such as high costs, project delays, and financing issues must be overcome to fully unlock its potential. This shift highlights the need for efficient planning and investment to ensure nuclear power can meet the growing energy needs while remaining economically viable

- This shift emphasizes the importance of strategic planning and investment to ensure that nuclear power can effectively address increasing energy demands while staying financially sustainable

Nuclear Infrastructure Market Dynamics

Driver

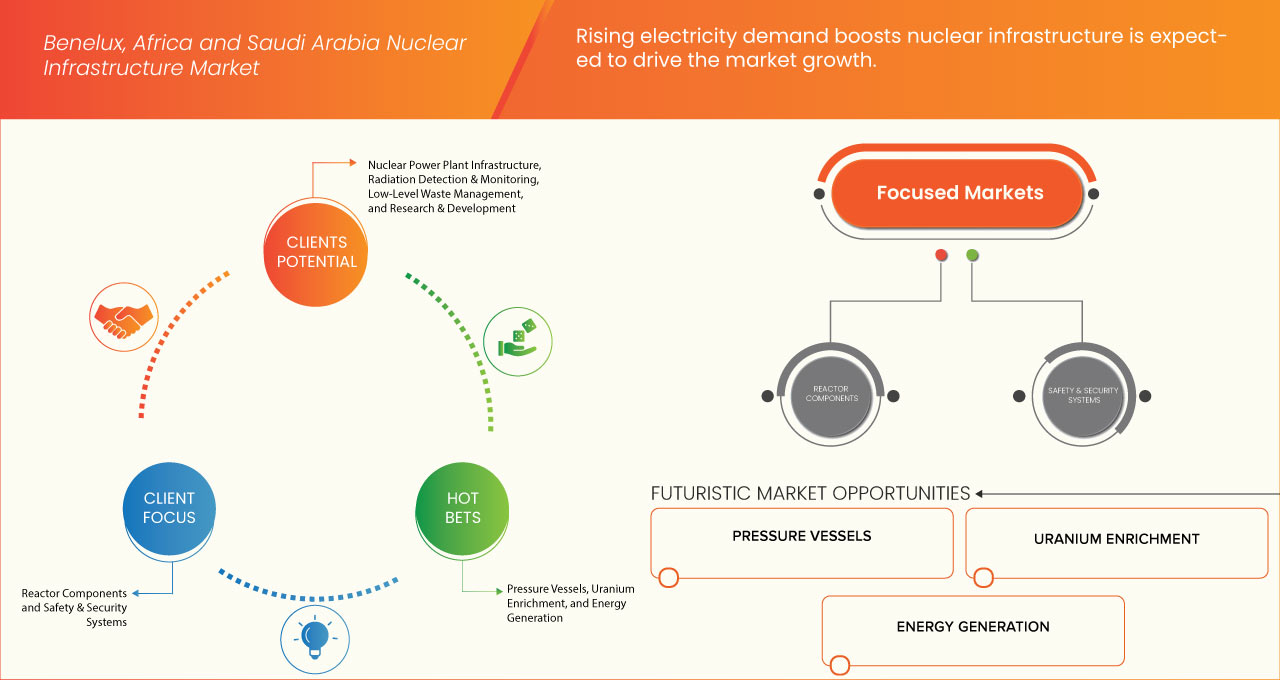

“Rising Electricity Demand Boosts Nuclear Infrastructure”

- Rising electricity demand is driving the expansion of nuclear infrastructure as utilities invest in new power plants and reactor life extensions

- Advanced reactor technologies are being developed to enhance energy security and grid stability. This growth increases the need for nuclear fuel, reactor components, and supporting systems

- The market is evolving with innovations in modular reactors and fuel recycling. Enhanced safety measures and efficiency improvements are key focus areas. Supply chain investments are rising to meet growing infrastructure needs. Decarbonization goals further accelerate nuclear infrastructure development

For instance,

- In March 2024, as per White & Case LLP. South Africa is advancing plans to expand its nuclear energy capacity, targeting 2,500 MW of new generation by 2032/33. The country’s draft Integrated Resource Plan 2023 outlines multiple scenarios, including a potential 14,500 MW nuclear build program by 2050. With electricity demand growing and the push for net-zero emissions intensifying, nuclear infrastructure development is gaining momentum

- In September 2023, according to an article published by the World Nuclear Association, Saudi Arabia reaffirmed its commitment to developing nuclear energy as part of its Saudi Vision 2030 roadmap. The country plans to construct its first nuclear power plant and has established the Nuclear Energy Holding Company to oversee development. Initially, Saudi Arabia aims to build two 1.4 GWe reactors, with a long-term goal of reaching 17 GWe of nuclear capacity by 2040. To strengthen its nuclear framework, the Kingdom has decided to rescind the Small Quantities Protocol and fully implement IAEA Comprehensive Safeguards

- The rising electricity demand across Benelux, Africa, and Saudi Arabia is accelerating the expansion of nuclear infrastructure as a reliable and sustainable energy solution

Opportunity

“Small Modular Reactors (SMRs) Enhance Energy Scalability and Grid Stability”

- The deployment of Small Modular Reactors (SMRs) is gaining momentum in Belgium, Netherlands, Luxembourg, Africa, and Saudi Arabia offering scalable and stable energy solutions

- In Benelux, SMRs are being explored to support decarbonization and energy security, with Belgium reconsidering nuclear after reactor shutdowns, the Netherlands planning nuclear expansion, and Luxembourg evaluating cross-border cooperation

- In Africa, nations such as South Africa, Ghana, Egypt, and Nigeria see SMRs as a cost-effective solution for grid stability and industrial growth

- In addition, in Africa and Saudi Arabia, SMRs are emerging as a strategic solution to meet growing energy demands and support industrialization. Countries such as South Africa, Egypt, Ghana, and Nigeria view SMRs as a means to enhance grid reliability and power remote areas with minimal infrastructure

For instance,

- In December 2023, Nuclear Business Platform highlighted that Small Modular Reactors (SMRs) are gaining traction in Africa due to their scalability, lower costs, and suitability for small grids. SMRs offer flexibility for remote deployment and address challenges such as high capital costs and local expertise shortages. Early engagement between SMR vendors and African governments is mutually beneficial, providing market entry for vendors and local expertise development for African nations. With over 70 SMR designs available (IAEA), careful selection and proactive collaboration are crucial for accelerating nuclear adoption in Africa

- In December 2024, Tractebel announced a partnership with Finnish technology firm Steady Energy to provide engineering services for the LDR-50 Small Modular Reactor (SMR), designed for clean heating. Steady Energy has secured agreements for 15 reactors in Finland and plans to expand into Sweden and the Baltics. Construction of the first plant could begin by 2029, with district heating operations expected in the early 2030s, marking a significant step in advancing nuclear-powered heating solutions

- Small Modular Reactors (SMRs) are poised to play a transformative role in the nuclear infrastructure of the market by offering scalable, cost-effective, and reliable energy solutions

Restraint/Challenge

“Lengthy Approval Timelines Delay Nuclear Plant Construction Projects”

- In Benelux, stringent regulatory frameworks and multi-layered approval processes require extensive safety assessments, environmental impact studies, and public consultations before construction begins

- These prolonged timelines hinder the expansion of nuclear capacity, impacting energy security and climate goals

- In Africa, despite growing interest in nuclear energy to meet rising electricity demand, bureaucratic hurdles, lack of regulatory harmonization, and the need for international approvals slow down project execution

For instance,

- In August 2024, according to the news published by NucNet, South Africa’s plan to procure 2,500 MW of new nuclear power faces a delay of up to six months due to legal challenges and the need for more public consultation. Energy Minister Kgosientsho Ramokgopa announced the postponement, citing insufficient public participation. A government gazette document enabling procurement has been withdrawn, and officials will revise a report addressing regulatory conditions

- In February 2025, according to the article published by the World Nuclear Association, the Netherlands is facing delays in its nuclear expansion plans, making it unlikely to have a new reactor operational by 2035. Minister Sophie Hermans stated that site selection is a key issue, with Borssele initially favored alongside Tweede Maasvlakte and Terneuzen, while Eemshaven was excluded due to local opposition

- Addressing approval timeline challenges is essential for the timely expansion of nuclear infrastructure in Benelux, Africa, and Saudi Arabia. By reducing bureaucratic delays while upholding strict safety and environmental standards, these regions can attract investment, improve energy security, and achieve long-term sustainability goals.

Nuclear Infrastructure Market Scope

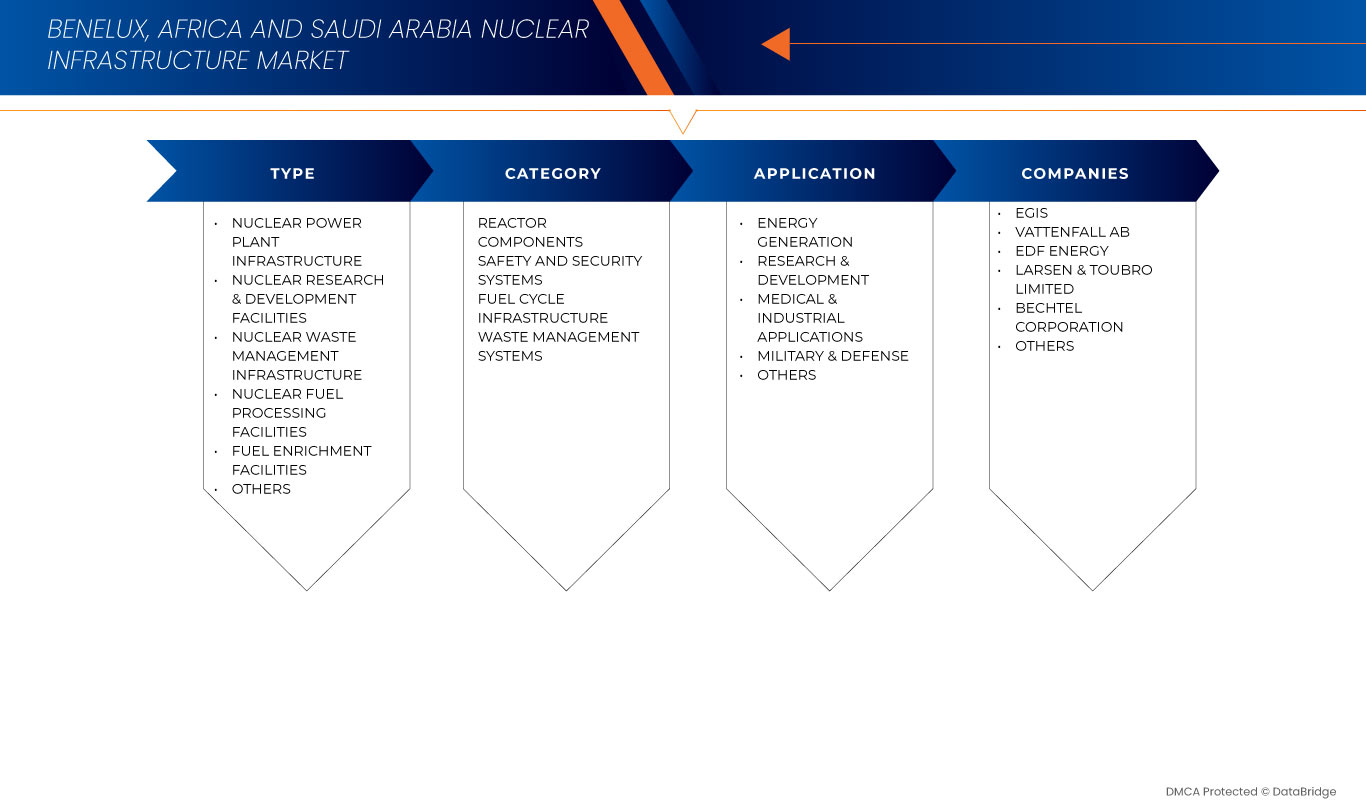

The market is segmented on the basis type, category, and application.

|

Segmentation |

Sub-Segmentation |

|

By Type |

|

|

By Category |

|

|

By Application |

|

Nuclear Infrastructure Market Regional Analysis

“Benelux is the Dominant country in the nuclear infrastructure market”

- Benelux dominates the nuclear infrastructure market, driven by strong government support for nuclear energy, with a focus on upgrading existing plants and expanding nuclear capabilities to meet energy demands while reducing carbon emissions

- Benelux is investing in next-generation nuclear technologies and exploring nuclear options to diversify their energy sources

- In Benelux, nuclear power remains a cornerstone of energy security, with Belgium already generating a significant share of its electricity from nuclear sources

Nuclear Infrastructure Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- Egis (France)

- Vattenfall AB (Sweden)

- EDF Energy (U.K.)

- LARSEN & TOURBO LIMITED (India)

- Bechtel Corporation (U.S.)

- Westinghouse Electric Company LLC. (U.S.)

- Tata Consulting Engineers Limited (India)

- Tractebel (Belgium)

- Assystem (France)

- Eskom Holdings SOC Ltd (South Africa)

Latest Developments in Nuclear Infrastructure Market

- In November 2024, Egis is contributing to the world’s largest fusion project, which aims to demonstrate nuclear fusion as a large-scale, carbon-free energy source. They are involved in the design, consultancy, and project management of ITER's nuclear facilities, supporting the development of the Tokamak and other critical infrastructure for this ambitious project

- In June 2024, Vattenfall AB plans to development of new nuclear power at the Ringholes site in Sweden, aiming to enhance Sweden's energy security and reduce carbon emissions. The initiative includes a focus on modernizing the existing infrastructure and potentially introducing new nuclear technology. This development is closely tied to nuclear

- In March 2025, EDF Energy launched the cheapest fixed tariff among major suppliers ahead of the energy price cap increase to USD 1,923 on April 1. The Simply Fixed Jun26v5 tariff offered a 16-month fixed rate at USD 1,742, saving customers up to USD 207 compared to the new cap. No smart meter was required, and there were no exit fees for direct sign-ups. EDF also introduced a tracker tariff staying USD 50 below the cap and a USD 64 referral bonus for customers. This move helped customers save on rising energy costs while ensuring price stability

- In October 2024, Larsen & Toubro Limited and Clean Core Thorium Energy (CCTE) have entered into a strategic partnership to advance clean energy solutions globally. The collaboration focuses on the development and deployment of CCTE’s patented ANEEL fuel, made from thorium and enriched uranium. This fuel is designed for use in various nuclear reactors, aiming to enhance energy security, improve safety, and significantly reduce waste and costs

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELING

2.7 TYPE TIMELINE CURVE

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 DBMR VENDOR SHARE ANALYSIS

2.11 MARKET APPLICATION COVERAGE GRID

2.12 SECONDARY SOURCES

2.13 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PORTER’S FIVE FORCES

4.2 REGULATION COVERAGE

4.3 PESTEL ANALYSIS

4.4 TECHNOLOGICAL ADVANCEMENT IN NUCLEAR INFRASTRUCTURE

4.5 SUPPLY CHAIN ANALYSIS

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 RISING ELECTRICITY DEMAND BOOSTS NUCLEAR INFRASTRUCTURE

5.1.2 GOVERNMENT SUBSIDIES AND POLICIES ENCOURAGE NUCLEAR ENERGY DEVELOPMENT

5.1.3 GEOPOLITICAL TENSIONS BOOST ENERGY SECURITY THROUGH NUCLEAR POWER

5.1.4 DECARBONIZATION POLICIES DRIVE NUCLEAR ENERGY ADOPTION FOR CLEAN POWER

5.2 RESTRAINTS

5.2.1 LIMITED AVAILABILITY OF URANIUM AFFECTS FUEL SUPPLY STABILITY

5.2.2 NUCLEAR PROJECTS DEMAND HIGH UPFRONT CAPITAL INVESTMENTS

5.3 OPPORTUNITIES

5.3.1 SMALL MODULAR REACTORS (SMRS) ENHANCE ENERGY SCALABILITY AND GRID STABILITY

5.3.2 LOCAL URANIUM EXPLORATION BOOSTS FUEL SELF-SUFFICIENCY AND EXPORTS

5.3.3 EXPANSION OF NUCLEAR POWER TO ENHANCE ENERGY SECURITY AND SUSTAINABILITY

5.4 CHALLENGES

5.4.1 LENGTHY APPROVAL TIMELINES DELAY NUCLEAR PLANT CONSTRUCTION PROJECTS

5.4.2 WASTE MANAGEMENT SOLUTIONS REQUIRE INFRASTRUCTURE AND LONG-TERM PLANNING

6 BENELUX, AFRICA, AND SAUDI ARABIA NUCLEAR INFRASTRUCTURE MARKET, BY TYPE

6.1 OVERVIEW

6.2 NUCLEAR POWER PLANT INFRASTRUCTURE

6.3 NUCLEAR RESEARCH & DEVELOPMENT FACILITIES

6.4 NUCLEAR WASTE MANAGEMENT INFRASTRUCTURE

6.5 NUCLEAR FUEL PROCESSING FACILITIES

6.6 FUEL ENRICHMENT FACILITIES

6.7 OTHERS

7 BENELUX, AFRICA, AND SAUDI ARABIA NUCLEAR INFRASTRUCTURE MARKET, BY CATEGORY

7.1 OVERVIEW

7.2 REACTOR COMPONENTS

7.2.1 PRESSURE VESSELS

7.2.2 STEAM GENERATORS

7.2.3 REACTOR COOLANT PUMPS

7.2.4 CONTROLLER RODS

7.2.5 OTHERS

7.3 SAFETY & SECURITY SYSTEMS

7.3.1 RADIATION DETECTION & MONITORING

7.3.2 CONTAINMENT STRUCTURES

7.3.3 EMERGENCY COOLING SYSTEMS

7.3.4 OTHERS

7.4 FUEL CYCLE INFRASTRUCTURE

7.4.1 URANIUM ENRICHMENT

7.4.2 FUEL FABRICATION

7.4.3 SPENT FUEL STORAGE

7.5 WASTE MANAGEMENT SYSTEMS

7.5.1 LOW-LEVEL WASTE MANAGEMENT

7.5.2 HIGH-LEVEL WASTE REPOSITORIES

8 BENELUX, AFRICA, AND SAUDI ARABIA NUCLEAR INFRASTRUCTURE MARKET, BY APPLICATION

8.1 OVERVIEW

8.2 ENERGY GENERATION

8.3 RESEARCH & DEVELOPMENT

8.4 MEDICAL & INDUSTRIAL APPLICATIONS

8.5 MILITARY & DEFENSE

8.6 OTHERS

9 BENELUX, AFRICA, AND SAUDI ARABIA NUCLEAR INFRASTRUCTURE MARKET, BY COUNTRY

9.1 BENELUX

9.1.1 BELGIUM

9.1.2 NETHERLANDS

9.1.3 LUXEMBOURG

9.2 AFRICA

9.3 SAUDI ARABIA

10 BENELUX, AFRICA, AND SAUDI ARABIA NUCLEAR INFRASTRUCTURE MARKET, COMPANY LANDSCAPE

10.1 COMPANY SHARE ANALYSIS: BENELUX

10.2 COMPANY SHARE ANALYSIS: AFRICA

10.3 COMPANY SHARE ANALYSIS: SAUDI ARABIA

11 SWOT ANALYSIS

12 COMPANY PROFILES

12.1 EGIS

12.1.1 COMPANY SNAPSHOT

12.1.2 PRODUCT PORTFOLIO

12.1.3 RECENT DEVELOPMENT

12.2 VATTENFALL AB

12.2.1 COMPANY SNAPSHOTS

12.2.2 REVENUE ANALYSIS

12.2.3 SERVICE PORTFOLIO

12.2.4 RECENT DEVELOPMENTS

12.3 EDF ENERGY

12.3.1 COMPANY SNAPSHOT

12.3.2 REVENUE ANALYSIS

12.3.3 PRODUCT PORTFOLIO

12.3.4 RECENT DEVELOPMENTS

12.4 LARSEN & TOUBRO LIMITED

12.4.1 COMPANY SNAPSHOT

12.4.2 REVENUE ANALYSIS

12.4.3 PRODUCT PORTFOLIO

12.4.4 RECENT DEVELOPMENTS/NEWS

12.5 BECHTEL CORPORATION

12.5.1 COMPANY SNAPSHOT

12.5.2 SERVICE PORTFOLIO

12.5.3 RECENT DEVELOPMENTS/NEWS

12.6 ASSYSTEM

12.6.1 COMPANY SNAPSHOT

12.6.2 REVENUE ANALYSIS

12.6.3 PRODUCT PORTFOLIO

12.6.4 RECENT DEVELOPMENTS/NEWS

12.7 ESKOM HOLDINGS SOC LTD

12.7.1 COMPANY SNAPSHOT

12.7.2 PRODUCT PORTFOLIO

12.7.3 RECENT DEVELOPMENTS

12.8 TATA CONSULTING ENGINEERS LIMITED

12.8.1 COMPANY SNAPSHOT

12.8.2 PRODUCT PORTFOLIO

12.8.3 RECENT DEVELOPMENTS

12.9 TRACTEBEL

12.9.1 COMPANY SNAPSHOT

12.9.2 SERVICE PORTFOLIO

12.9.3 RECENT DEVELOPMENTS

12.1 WESTINGHOUSE ELECTRIC COMPANY LLC.

12.10.1 COMPANY SNAPSHOT

12.10.2 PRODUCT PORTFOLIO

12.10.3 RECENT DEVELOPMENTS/NEWS

13 QUESTIONNAIRE

14 RELATED REPORTS

List of Table

TABLE 1 REGULATION COVERAGE FOR THE NUCLEAR INFRASTRUCTURE MARKET

TABLE 2 NUCLEAR REACTORS EXPORTS

TABLE 3 NUCLEAR REACTORS IMPORTS

TABLE 4 CONSTRUCTION AND INSTALLATION WORKS

TABLE 5 EQUIPMENT AND OTHER COSTS

TABLE 6 BENELUX, AFRICA, AND SAUDI ARABIA NUCLEAR INFRASTRUCTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 7 BENELUX, AFRICA, AND SAUDI ARABIA NUCLEAR INFRASTRUCTURE MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 8 BENELUX, AFRICA, AND SAUDI ARABIA REACTOR COMPONENTS IN NUCLEAR INFRASTRUCTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 9 BENELUX, AFRICA, AND SAUDI ARABIA SAFETY & SECURITY SYSTEMS IN NUCLEAR INFRASTRUCTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 10 BENELUX, AFRICA, AND SAUDI ARABIA FUEL CYCLE INFRASTRUCTURE IN NUCLEAR INFRASTRUCTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 11 BENELUX, AFRICA, AND SAUDI ARABIA WASTE MANAGEMENT SYSTEMS IN NUCLEAR INFRASTRUCTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 12 BENELUX, AFRICA, AND SAUDI ARABIA NUCLEAR INFRASTRUCTURE MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 13 BENELUX, AFRICA, AND SAUDI ARABIA NUCLEAR INFRASTRUCTURE MARKET, BY COUNTRY, 2018-2032 (USD THOUSAND)

TABLE 14 BENELUX NUCLEAR INFRASTRUCTURE MARKET, BY COUNTRY, 2018-2032 (USD THOUSAND)

TABLE 15 BENELUX NUCLEAR INFRASTRUCTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 16 BENELUX NUCLEAR INFRASTRUCTURE MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 17 BENELUX REACTOR COMPONENTS IN NUCLEAR INFRASTRUCTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 18 BENELUX SAFETY & SECURITY SYSTEMS IN NUCLEAR INFRASTRUCTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 19 BENELUX FUEL CYCLE INFRASTRUCTURE IN NUCLEAR INFRASTRUCTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 20 BENELUX WASTE MANAGEMENT SYSTEMS IN NUCLEAR INFRASTRUCTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 21 BENELUX NUCLEAR INFRASTRUCTURE MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 22 BELGIUM NUCLEAR INFRASTRUCTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 23 BELGIUM NUCLEAR INFRASTRUCTURE MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 24 BELGIUM REACTOR COMPONENTS IN NUCLEAR INFRASTRUCTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 25 BELGIUM SAFETY & SECURITY SYSTEMS IN NUCLEAR INFRASTRUCTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 26 BELGIUM FUEL CYCLE INFRASTRUCTURE IN NUCLEAR INFRASTRUCTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 27 BELGIUM WASTE MANAGEMENT SYSTEMS IN NUCLEAR INFRASTRUCTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 28 BELGIUM NUCLEAR INFRASTRUCTURE MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 29 NETHERLANDS NUCLEAR INFRASTRUCTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 30 NETHERLANDS NUCLEAR INFRASTRUCTURE MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 31 NETHERLANDS REACTOR COMPONENTS IN NUCLEAR INFRASTRUCTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 32 NETHERLANDS SAFETY & SECURITY SYSTEMS IN NUCLEAR INFRASTRUCTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 33 NETHERLANDS FUEL CYCLE INFRASTRUCTURE IN NUCLEAR INFRASTRUCTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 34 NETHERLANDS WASTE MANAGEMENT SYSTEMS IN NUCLEAR INFRASTRUCTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 35 NETHERLANDS NUCLEAR INFRASTRUCTURE MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 36 LUXEMBOURG NUCLEAR INFRASTRUCTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 37 LUXEMBOURG NUCLEAR INFRASTRUCTURE MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 38 LUXEMBOURG REACTOR COMPONENTS IN NUCLEAR INFRASTRUCTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 39 LUXEMBOURG SAFETY & SECURITY SYSTEMS IN NUCLEAR INFRASTRUCTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 40 LUXEMBOURG FUEL CYCLE INFRASTRUCTURE IN NUCLEAR INFRASTRUCTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 41 LUXEMBOURG WASTE MANAGEMENT SYSTEMS IN NUCLEAR INFRASTRUCTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 42 LUXEMBOURG NUCLEAR INFRASTRUCTURE MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 43 AFRICA NUCLEAR INFRASTRUCTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 44 AFRICA NUCLEAR INFRASTRUCTURE MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 45 AFRICA REACTOR COMPONENTS IN NUCLEAR INFRASTRUCTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 46 AFRICA SAFETY & SECURITY SYSTEMS IN NUCLEAR INFRASTRUCTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 47 AFRICA FUEL CYCLE INFRASTRUCTURE IN NUCLEAR INFRASTRUCTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 48 AFRICA WASTE MANAGEMENT SYSTEMS IN NUCLEAR INFRASTRUCTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 49 AFRICA NUCLEAR INFRASTRUCTURE MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 50 SAUDI ARABIA NUCLEAR INFRASTRUCTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 51 SAUDI ARABIA NUCLEAR INFRASTRUCTURE MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 52 SAUDI ARABIA REACTOR COMPONENTS IN NUCLEAR INFRASTRUCTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 53 SAUDI ARABIA SAFETY & SECURITY SYSTEMS IN NUCLEAR INFRASTRUCTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 54 SAUDI ARABIA FUEL CYCLE INFRASTRUCTURE IN NUCLEAR INFRASTRUCTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 55 SAUDI ARABIA WASTE MANAGEMENT SYSTEMS IN NUCLEAR INFRASTRUCTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 56 SAUDI ARABIA NUCLEAR INFRASTRUCTURE MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

List of Figure

FIGURE 1 BENELUX, AFRICA, AND SAUDI ARABIA NUCLEAR INFRASTRUCTURE MARKET

FIGURE 2 BENELUX, AFRICA, AND SAUDI ARABIA NUCLEAR INFRASTRUCTURE MARKET: DATA TRIANGULATION

FIGURE 3 BENELUX, AFRICA, AND SAUDI ARABIA NUCLEAR INFRASTRUCTURE MARKET: DROC ANALYSIS

FIGURE 4 BENELUX, AFRICA, AND SAUDI ARABIA NUCLEAR INFRASTRUCTURE MARKET: COUNTRY-WISE MARKET ANALYSIS

FIGURE 5 BENELUX, AFRICA, AND SAUDI ARABIA NUCLEAR INFRASTRUCTURE MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 BENELUX, AFRICA, AND SAUDI ARABIA NUCLEAR INFRASTRUCTURE MARKET: MULTIVARIATE MODELLING

FIGURE 7 BENELUX, AFRICA, AND SAUDI ARABIA NUCLEAR INFRASTRUCTURE MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 8 BENELUX, AFRICA, AND SAUDI ARABIA NUCLEAR INFRASTRUCTURE MARKET: DBMR MARKET POSITION GRID

FIGURE 9 BENELUX, AFRICA, AND SAUDI ARABIA NUCLEAR INFRASTRUCTURE MARKET: VENDOR SHARE ANALYSIS

FIGURE 10 BENELUX, AFRICA, AND SAUDI ARABIA NUCLEAR INFRASTRUCTURE MARKET: APPLICATION COVERAGE GRID

FIGURE 11 BENELUX, AFRICA, AND SAUDI ARABIA NUCLEAR INFRASTRUCTURE MARKET: SEGMENTATION

FIGURE 12 SIX SEGMENTS COMPRISE THE BENELUX, AFRICA, AND SAUDI ARABIA NUCLEAR INFRASTRUCTURE MARKET, BY TYPE (2024)

FIGURE 13 BENELUX, AFRICA, AND SAUDI ARABIA NUCLEAR INFRASTRUCTURE MARKET

FIGURE 14 STRATEGIC DECISIONS

FIGURE 15 RISING ELECTRICITY DEMAND BOOSTS NUCLEAR INFRASTRUCTURE IS EXPECTED TO DRIVE THE BENELUX, AFRICA, AND SAUDI ARABIA NUCLEAR INFRASTRUCTURE MARKET IN THE FORECAST PERIOD

FIGURE 16 THE NUCLEAR POWER PLANT INFRASTRUCTURE SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE BENELUX, AFRICA, AND SAUDI ARABIA NUCLEAR INFRASTRUCTURE MARKET IN 2025 AND 2032

FIGURE 17 DROC ANALYSIS

FIGURE 18 ELECTRICITY GENERATION SOURCES, BELGIUM, 2023

FIGURE 19 TIMELINE OF DEPLOYMENT OF SMR DESIGNS TO 2030

FIGURE 20 URANIUM PRODUCTION

FIGURE 21 BENELUX, AFRICA, AND SAUDI ARABIA NUCLEAR INFRASTRUCTURE MARKET: BY TYPE (2024)

FIGURE 22 BENELUX, AFRICA, AND SAUDI ARABIA NUCLEAR INFRASTRUCTURE MARKET: BY CATEGORY (2024)

FIGURE 23 BENELUX, AFRICA, AND SAUDI ARABIA NUCLEAR INFRASTRUCTURE MARKET: BY APPLICATION (2024)

FIGURE 24 BENELUX NUCLEAR INFRASTRUCTURE MARKET: COMPANY SHARE 2024 (%)

FIGURE 25 AFRICA NUCLEAR INFRASTRUCTURE MARKET: COMPANY SHARE 2024 (%)

FIGURE 26 SAUDI ARABIA NUCLEAR INFRASTRUCTURE MARKET: COMPANY SHARE 2024 (%)

Benelux Africa And Saudi Arabia Nuclear Infrastructure Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Benelux Africa And Saudi Arabia Nuclear Infrastructure Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Benelux Africa And Saudi Arabia Nuclear Infrastructure Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.