Benelux Earthworks And Excavation Equipment Market

Market Size in USD Billion

CAGR :

%

USD

4.24 Billion

USD

6.07 Billion

2024

2032

USD

4.24 Billion

USD

6.07 Billion

2024

2032

| 2025 –2032 | |

| USD 4.24 Billion | |

| USD 6.07 Billion | |

|

|

|

|

Earthworks & Excavation Equipment Market Size

- The Benelux earthworks & excavation equipment market was valued at USD 4.24 billion in 2024 and is expected to reach USD 6.07 billion by 2032

- During the forecast period of 2025 to 2032 the market is likely to grow at a CAGR of 4.7%, primarily driven by the construction equipment in underground integrity.

- This growth is driven by factors such as increasing infrastructure development, urbanization, and advancements in excavation technology

Earthworks & Excavation Equipment Market Analysis

- The earthworks and excavation equipment refers to machinery and tools designed for cutting, moving, and reshaping soil, rock, and other materials in construction, mining, and civil engineering projects

- The demand for these earthworks is significantly driven by the Its continuous growth outpaces infrastructure projects, mining and quarrying, and others as construction activities require a diverse range of earthmoving equipment for various applications

- As governments and private sectors focus on sustainable construction and modernization, the market is expected to grow, enhancing efficiency, safety, and environmental compliance while supporting the region’s evolving infrastructure landscape

- The Netherlands country stands out as one of the dominant country for earthworks and excavation equipment, driven by its vast land development needs and resource-driven economic growth

- For instance, Benelux was poised for significant growth, with major projects driving expansion across Belgium, the Netherlands, and Luxembourg. The report highlighted five key developments, including De Zalmhaven Tower, Heysel Plateau Regeneration, Terneuzen Lock Construction, Zeewolde Data Center, and Binnenhof Renovation. These projects emphasized sustainable construction, infrastructure modernization, and digital innovation, reinforcing the region’s commitment to economic growth and technological advancement in the construction sector

- Earthworks and excavation equipment rank as the second-most crucial piece of equipment in construction, following excavator systems, and play a pivotal role in preferable over electric-powered and hybrid-powered equipment

Report Scope and Earthworks & Excavation Equipment Market Segmentation

|

Attributes |

Earthworks & Excavation Equipment Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Earthworks & Excavation Equipment Market Trends

“Advancements in Electric and Autonomous Construction Equipment”

- One prominent trend in the Benelux earthworks & excavation equipment market is the advancements in electric and autonomous construction equipment

- These focus on sustainability and stringent emissions regulations is driving the adoption of electric and autonomous construction equipment

- For instance, according to the blog published by Baum Publications Ltd., the rapid electrification of construction equipment is transforming the industry, with battery-powered machines now being introduced across earthmoving, lifting, and roadbuilding applications. These electric solutions deliver zero emissions, lower noise levels, reduced operating and maintenance costs, and immediate torque performance, making them especially attractive for urban and environmentally sensitive projects. As more manufacturers roll out commercial models—from compact excavators to electric backhoe loaders and tandem rollers—the technology is set to redefine operational efficiency in construction

- The transition towards electric and autonomous construction equipment in the Benelux earthworks & excavation Equipment market is accelerating due to stringent environmental regulations and the need for enhanced efficiency

- As infrastructure projects expand, the demand for sustainable and automated solutions continues to rise, offering manufacturers and suppliers significant growth opportunities. Embracing these advancements will not only improve productivity and reduce operational costs but also align with the region’s sustainability goals, shaping the future of construction in Benelux

Earthworks & Excavation Equipment Market Dynamics

Driver

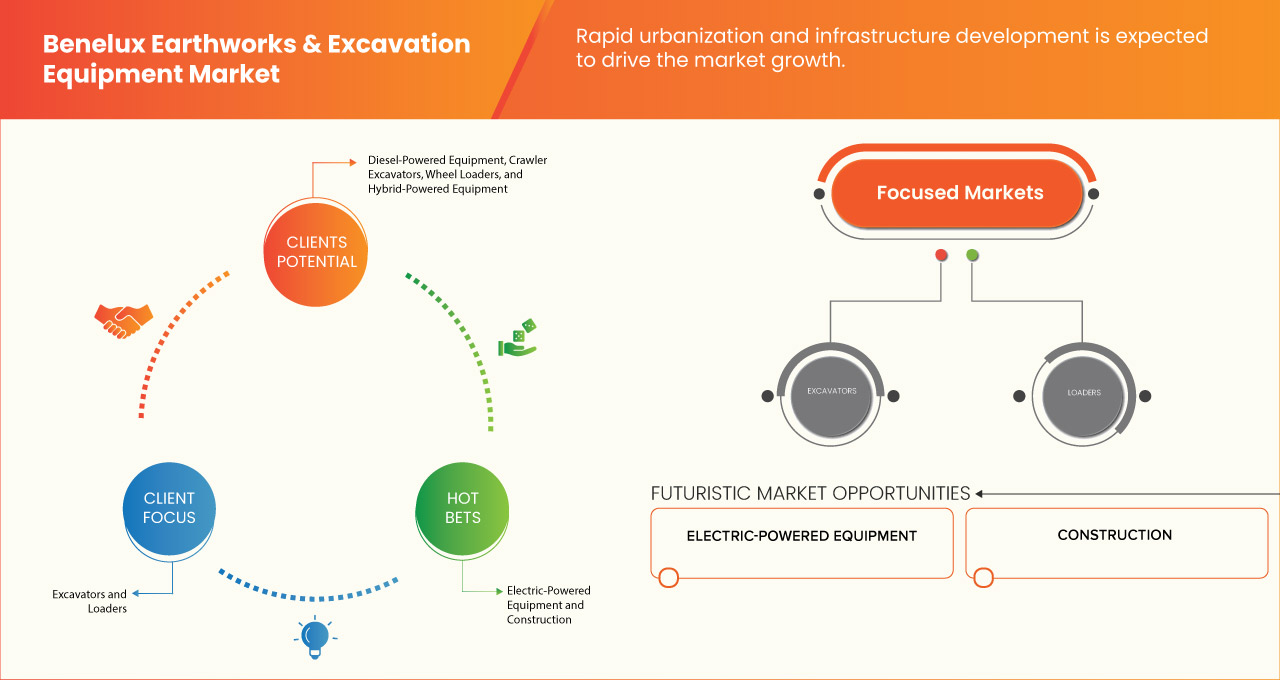

“Rapid Urbanization and Infrastructure Development”

- The Benelux region is experiencing rising demand for earthworks and excavation equipment, driven by rapid urbanization and large-scale infrastructure projects

- Urban renewal initiatives, alongside a strong emphasis on sustainable construction, are key factors accelerating equipment adoption. Governments and private sector players are investing in smart cities, modern transportation networks, and resource-efficient building practices, further fueling market expansion

- In addition, the shift toward eco-friendly construction techniques and stringent environmental regulations is pushing the adoption of advanced excavation machinery to enhance efficiency and sustainability in the region’s infrastructure development

- Rapid urbanization and infrastructure expansion in the Benelux region are driving the demand for earthworks and excavation equipment

- Sustainable urban renewal and construction initiatives are key factors boosting the adoption of advanced machinery. In addition, increasing investments in smart cities, modern transportation networks, and resource-efficient building projects are further accelerating market growth.

For instance,

- According to an article published by the FIEC (European Construction Industry Federation), the number of building permits in residential construction in Belgium has shown fluctuations in recent years, with a peak of 57,720 permits in 2021, followed by a decline to an estimated 47,980 in 2023 and a forecasted 47,150 in 2024. While this indicates a shift in residential construction activity, the continued demand for housing particularly in collective dwellings remains a key driver for the Earthworks & Excavation Equipment Market. Infrastructure modernization and urban development projects will sustain the need for excavation machinery, supporting efficiency in site preparation, foundation work, and large-scale residential projects across Belgium

- In December 2023, North Rhine-Westphalia’s first electric 35-ton excavator was deployed at the Hutchinson site in Aachen-Rothe Erde. Led by ecoPARKS GmbH, Landmarken, and Stadtmarken, the project is transforming the former industrial site into a mixed-use urban quarter. Aligning with rapid urbanization across Benelux and neighboring regions it integrates sustainable construction, recycling 98% of materials and using electric machinery to cut emissions. Spanning 30,000 square meters, the development blends residential, commercial, and production spaces, setting a benchmark for eco-friendly urban infrastructure

- Sustainable urban renewal and construction initiatives are key factors boosting the adoption of advanced machinery. In addition, increasing investments in smart cities, modern transportation networks, and resource-efficient building projects are further accelerating market growth

Opportunity

“Integration of AI and Machine Learning in Machinery”

- These advanced technologies enhance operational efficiency, precision, and safety by enabling predictive maintenance, real-time data analysis, and autonomous machine control

- AI-driven automation reduces downtime, optimizes fuel consumption, and minimizes human error, leading to cost savings and improved productivity

- As the demand for smart construction and mining solutions grows, companies that invest in AI-powered machinery will gain a competitive edge, accelerating project timelines and meeting the evolving needs of the industry

For instance,

- In October 2024, John Deere introduced SmartDetect, an AI-powered object detection system, into select utility and production-class wheel loaders to enhance operator visibility and job site safety. Utilizing stereo cameras and machine learning, SmartDetect provides 3D perception, detects bystanders and obstacles, and delivers real-time alerts through a secondary display. Future enhancements include an Assist feature for automatic stopping and SmartDetect Digital for push notifications, near-miss reports, and heat maps. This integration of AI and machine learning into construction machinery presents significant opportunities for Benelux, earthworks and excavation market

- In October 2023, according to the blog published by Pace Publishing Limited in Equipment Journal, AI-powered video telematics is transforming construction safety by providing real-time visibility, reducing blind spots, and enhancing risk detection through deep learning technology. AI-driven cameras and cloud-based platforms like VisionTrack’s NARA improve safety by differentiating between people and objects, minimizing false alarms, and enabling instant incident reporting. Adopting AI-driven telematics can enhance safety, optimize operations, and ensure compliance with evolving regulations, giving construction firms a competitive edge

- The adoption of AI and machine learning in construction equipment is driving significant improvements in efficiency, safety, and automation. These technologies enhance precision, reduce manual intervention, and optimize decision-making, leading to smarter and more productive worksites

Restraint/Challenge

“High Cost of Advanced Machinery With Automation Features”

- The high cost of advanced earthworks and excavation equipment with automation features affects market adoption. The substantial upfront investment makes these machines less accessible to small and mid-sized contractors

- In addition, ongoing maintenance expenses and the need for operator training increase the financial burden. This cost factor limits adoption, particularly in price-sensitive markets, where businesses may opt for traditional equipment over automated solutions

- The significant investment required for acquiring technologically advanced equipment poses a barrier to widespread adoption

For instance,

- In September 2023, according to an article published by ING Bank N.V., Europe's construction sector is facing a slowdown as new building demand plummet. High interest rates and escalating building costs have significantly reduced the appetite for new projects. Although ongoing construction activities and a strong focus on sustainability have maintained current volumes, experts anticipate a sharp decline beginning in 2024. This forecast highlights the challenges ahead for the European construction market, as cost pressures and tighter financing conditions reshape the industry's growth prospects

- The financial burden of purchasing, maintaining, and upgrading these machines limits accessibility, slowing down the pace of automation in certain industries. Without cost-effective solutions or supportive financing options, the growth of automated machinery in earthworks and excavation may face delays, impacting overall market expansion

Earthworks & Excavation Equipment Market Scope

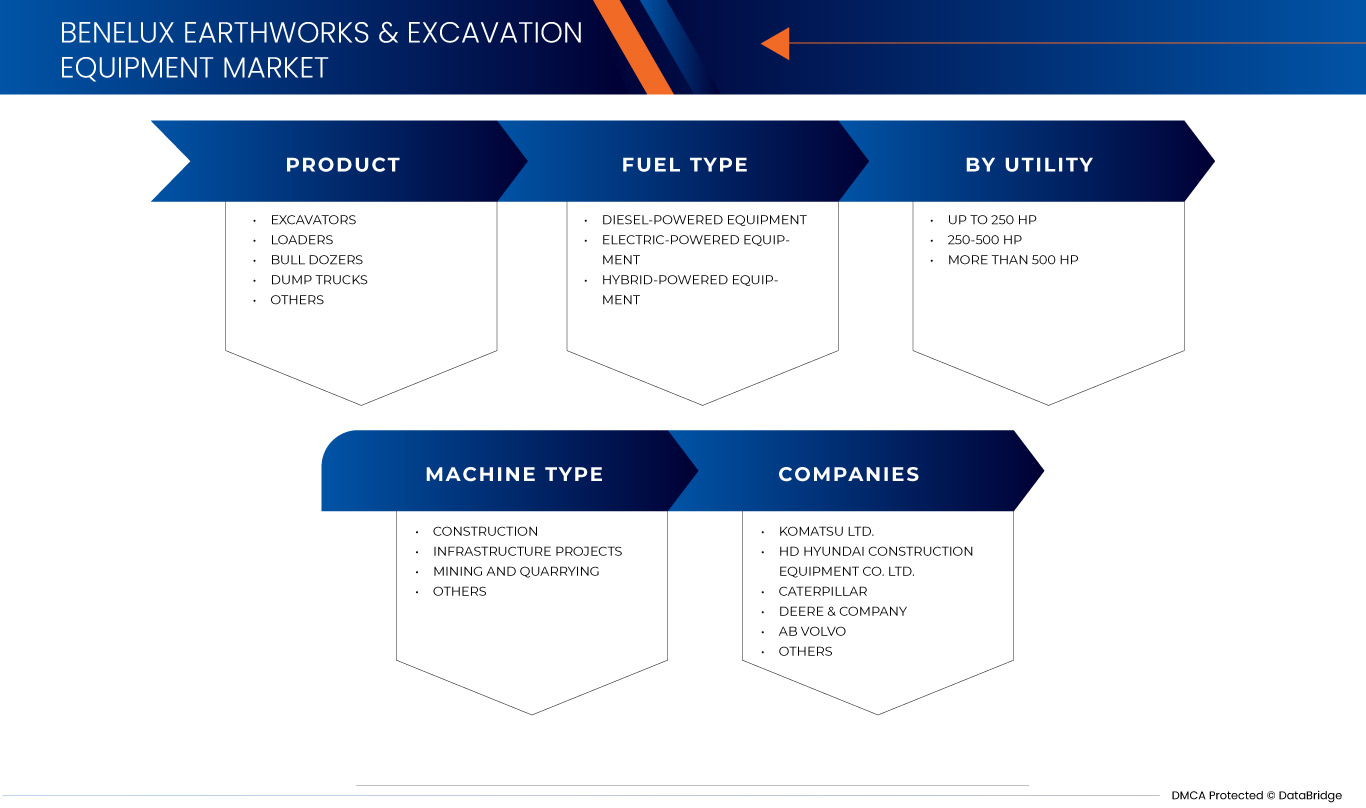

The Benelux earthworks & excavation equipment market is segmented into four notable segments based on products, fuel type, engine type, and application.

|

Segmentation |

Sub-Segmentation |

|

By Products |

|

|

By Fuel Type |

|

|

By Engine Type |

|

|

By Application |

|

Earthworks & Excavation Equipment Market Country Analysis

“Netherlands is the Dominant and the Highest Growth Rate Country in the Earthworks & Excavation Equipment Market”

- Netherlands dominates the earthworks & excavation equipment market, driven by large-scale infrastructure projects, rapid urbanization, and increasing investments in mining and construction. The region's demand for earthmoving equipment surpasses Benelux due to its vast land development needs and resource-driven economic growth

- The Netherlands holds a significant share due to increased demand for high integrated construction, rapid urbanization, and increasing investments, and continuous advancements in earthworks

- The region's demand for earthmoving equipment surpasses Benelux due to its vast land development needs and resource-driven economic growth

- In addition, The increasing number of construction projects across the Benelux region is significantly driving demand for earthwork and excavation services, fueling industry growth

Earthworks & Excavation Equipment Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- Komatsu Ltd. (Japan)

- HD Hyundai Construction Equipment Co.,Ltd. (South Korea)

- Caterpillar (U.S.)

- Deere & Company (U.S.)

- AB Volvo (Sweden)

- JC Bamford Excavators Ltd. (U.K.)

- Doosan Bobcat (U.S.)

- CNH Industrial N.V. (U.K.)

- LIEBHERR (Switzerland)

- Kobelco Construction Machinery Co., Ltd. (Japan)

- Hitachi Construction Machinery (Japan)

- Sumitomo Heavy Industries Ltd. (Japan)

- Terex Corporation (U.S.)

- XCMG Group (China)

- Manitou BF (France)

Latest Developments in Earthworks & Excavation Equipment Market

- In July 2024, Komatsu Ltd. completed its acquisition of GHH Group GmbH, a German manufacturer of underground mining equipment. The company expanded its underground portfolio and accelerated new product development by integrating GHH's factories and rebuild facilities. Komatsu strengthened its production and service capabilities, reaching key markets in Europe, South Africa, India, and Chile. The combined team improved customer access to a wider range of products and continued GHH’s trusted service support. This acquisition added significant value to customer operations and broadened Komatsu’s market reach

- In June 2024, Doosan Bobcat announced its decision to acquire Mottrol, a South Korea-based hydraulic component manufacturer, for 246 billion KRW. The acquisition, involving the purchase of 100% of Mottrol’s shares, aimed to enhance Doosan Bobcat’s hydraulic technology capabilities and expand its global competitiveness in the construction equipment market. The acquisition significantly strengthened its industry leadership position

- In September 2024, Hitachi Construction Machinery Co., Ltd. introduced the EH4000AC-5, a next-generation rigid dump truck with a nominal payload of 242 tons and a gross machine operating weight of 427 tons. This full-model upgrade from the EH4000AC-3 incorporates advanced metal fabrication technologies from hydraulic excavator manufacturing, enhancing durability and achieving the industry's highest payload capacity in its class. Following field tests at mining sites, the company plans to begin sales in 2025. The EH4000AC-5 will make its first public appearance at MINExpo, the world’s largest mining trade show, held from September 24 to 26 in Las Vegas

- In October 2021, Kobelco Construction Machinery Co., Ltd. commemorated the production of its 300,000th hydraulic excavator at the Itsukaichi Factory in Hiroshima, Japan. A ceremony was held to mark this significant milestone, highlighting Kobelco’s commitment to innovation, excellence, and industry leadership in construction machinery

- In February 2025, Liebherr launched two world premières at Bauma 2025. The company introduced the new Generation 6 Telescopic Handler, which increased load capacity by up to nine percent and featured a redesigned cabin for enhanced comfort. They also presented the T 48-8s model, marking their entry into the 8-Metre Class. The machines offered improved safety, advanced assistance systems, and a proven hydrostatic drive for precise control. This launch expanded Liebherr’s product range and strengthened its competitive edge in material handling and industrial applications

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELING

2.7 PRODUCTS TIMELINE CURVE

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 DBMR VENDOR SHARE ANALYSIS

2.11 MARKET APPLICATION COVERAGE GRID

2.12 SECONDARY SOURCES

2.13 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PORTERS 5 FORCES

4.2 SUPPLY CHAIN ANALYSIS OF THE BENELUX EARTHWORKS & EXCAVATION EQUIPMENT MARKET

4.3 REGULATORY STANDARDS

4.4 TECHNOLOGICAL TRENDS IN BENELUX EARTHWORKS & EXCAVATION EQUIPMENT MARKET

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 RAPID URBANIZATION AND INFRASTRUCTURE DEVELOPMENT

5.1.2 GROWING CONSTRUCTION PROJECTS CONTINUES TO ACCELERATE MARKET DEMAND AND INDUSTRY GROWTH

5.1.3 INCREASING INVESTMENTS IN TRANSPORTATION AND SMART CITIES

5.1.4 RISING DEMAND FOR SMART AND AUTOMATED MACHINERY

5.2 RESTRAINTS

5.2.1 HIGH COST OF ADVANCED MACHINERY WITH AUTOMATION FEATURES

5.2.2 LIMITED INFRASTRUCTURE DEVELOPMENT IN UNDERDEVELOPED REGIONS

5.3 OPPORTUNITIES

5.3.1 ADVANCEMENTS IN ELECTRIC AND AUTONOMOUS CONSTRUCTION EQUIPMENT

5.3.2 INTEGRATION OF AI AND MACHINE LEARNING IN MACHINERY

5.3.3 DEMAND FOR MULTI-FUNCTIONAL AND COMPACT EQUIPMENT

5.4 CHALLENGES

5.4.1 DELAYS IN GOVERNMENT PROJECT APPROVALS AND FUNDING

5.4.2 STRICT REGULATORY COMPLIANCE AND SAFETY STANDARDS

6 BENELUX EARTHWORKS & EXCAVATION EQUIPMENT MARKET, BY PRODUCTS

6.1 OVERVIEW

6.2 EXCAVATORS

6.2.1 CRAWLER EXCAVATORS

6.2.2 MINI EXCAVATORS

6.2.3 WHEELED EXCAVATORS

6.2.4 LONG REACH EXCAVATORS

6.2.5 DRAGLINE EXCAVATORS

6.2.6 SKID STEER EXCAVATORS

6.2.7 SUCTION EXCAVATORS

6.3 LOADERS

6.3.1 WHEEL LOADERS

6.3.2 BACKHOE LOADERS

6.3.3 SKID STEER LOADERS

6.4 BULL DOZERS

6.5 DUMP TRUCKS

6.6 OTHERS

7 BENELUX EARTHWORKS & EXCAVATION EQUIPMENT MARKET, BY FUEL TYPE

7.1 OVERVIEW

7.2 DIESEL-POWERED EQUIPMENT

7.3 ELECTRIC-POWERED EQUIPMENT

7.4 HYBRID-POWERED EQUIPMENT

8 BENELUX EARTHWORKS & EXCAVATION EQUIPMENT MARKET, BY ENGINE TYPE

8.1 OVERVIEW

8.2 UP TO 250 HP

8.3 250-500 HP

8.4 MORE THAN 500 HP

9 BENELUX EARTHWORKS & EXCAVATION EQUIPMENT MARKET, BY APPLICATION

9.1 OVERVIEW

9.2 CONSTRUCTION

9.2.1 COMMERCIAL

9.2.2 RESIDENTIAL

9.3 INFRASTRUCTURE PROJECTS

9.4 MINING AND QUARRYING

9.5 OTHERS

10 BENELUX, EARTHWORKS & EXCAVATION EQUIPMENT MARKET, BY COUNTRY

10.1 BENELUX

10.1.1 NETHERLANDS

10.1.2 BELGIUM

10.1.3 LUXEMBOURG

11 BENELUX EARTHWORKS & EXCAVATION EQUIPMENT MARKET, COMPANY LANDSCAPE

11.1 COMPANY SHARE ANALYSIS: BENELUX

12 SWOT ANALYSIS

13 COMPANY PROFILE

13.1 KOMATSU LTD.

13.1.1 COMPANY SNAPSHOT

13.1.2 REVENUE ANALYSIS

13.1.3 BUSINESS PORTFOLIO

13.1.4 RECENT DEVELOPMENTS

13.2 HD HYUNDAI CONSTRUCTION EQUIPMENT CO.,LTD.

13.2.1 COMPA.NY SNAPSHOT

13.2.2 REVENUE ANALYSIS

13.2.3 PRODUCT PORTFOLIO

13.2.4 RECENT DEVELOPMENTS/NEWS

13.3 CATERPILLAR

13.3.1 COMPANY SNAPSHOT

13.3.2 REVENUE ANALYSIS

13.3.3 BRAND PORTFOLIO

13.3.4 RECENT DEVELOPMENTS

13.4 DEERE & COMPANY

13.4.1 COMPANY SNAPSHOT

13.4.2 REVENUE ANALYSIS

13.4.3 PRODUCT PORTFOLIO

13.4.4 RECENT DEVELOPMENTS

13.5 AB VOLVO

13.5.1 COMPANY SNAPSHOT

13.5.2 REVENUE ANALYSIS

13.5.3 PRODUCT PORTFOLIO

13.5.4 RECENT DEVELOPMENTS

13.6 CNH INDUSTRIAL N.V.

13.6.1 COMPANY SNAPSHOT

13.6.2 REVENUE ANALYSIS

13.6.3 PRODUCT PORTFOLIO

13.6.4 RECENT DEVELOPMENTS/NEWS

13.7 DOOSAN BOBCAT

13.7.1 COMPANY SNAPSHOT

13.7.2 REVENUE ANALYSIS

13.7.3 PRODUCT PORTFOLIO

13.7.4 RECENT DEVELOPMENTS

13.8 HITACHI CONSTRUCTION MACHINERY CO., LTD.

13.8.1 COMPANY SNAPSHOT

13.8.2 REVENUE ANALYSIS

13.8.3 PRODUCT PORTFOLIO

13.8.4 RECENT DEVELOPMENTS

13.9 J C BAMFORD EXCAVATORS LTD.

13.9.1 COMPANY SNAPSHOT

13.9.2 PRODUCT PORTFOLIO

13.9.3 RECENT DEVELOPMENTS

13.1 KOBELCO CONSTRUCTION MACHINERY CO., LTD.

13.10.1 COMPANY SNAPSHOT

13.10.2 PRODUCT PORTFOLIO

13.10.3 RECENT DEVELOPMENTS/NEWS

13.11 LIEBHERR

13.11.1 COMPANY SNAPSHOT

13.11.2 REVENUE ANALYSIS

13.11.3 PRODUCT PORTFOLIO

13.11.4 RECENT DEVELOPMENTS

13.12 MANITOU BF

13.12.1 COMPANY SNAPSHOT

13.12.2 REVENUE ANALYSIS

13.12.3 BRAND PORTFOLIO

13.12.4 RECENT DEVELOPMENTS

13.13 SUMITOMO HEAVY INDUSTRIES, LTD.

13.13.1 COMPANY SNAPSHOT

13.13.2 REVENUE ANALYSIS

13.13.3 PRODUCT PORTFOLIO

13.13.4 RECENT DEVELOPMENTS

13.14 TEREX CORPORATION

13.14.1 COMPANY SNAPSHOT

13.14.2 REVENUE ANALYSIS

13.14.3 PRODUCT PORTFOLIO

13.14.4 RECENT DEVELOPMENTS

13.15 XCMG GROUP

13.15.1 COMPANY SNAPSHOT

13.15.2 REVENUE ANALYSIS

13.15.3 PRODUCT PORTFOLIO

13.15.4 RECENT DEVELOPMENT

14 QUESTIONNAIRE

15 RELATED REPORTS

List of Table

TABLE 1 REGULATORY STANDARDS RELATED TO BENELUX EARTHWORKS & EXCAVATION EQUIPMENT MARKET

TABLE 2 REGULATORY COMPLIANCE & SAFETY STANDARDS

TABLE 3 BENELUX EARTHWORKS & EXCAVATION EQUIPMENT MARKET, BY PRODUCTS, 2018-2032 (USD THOUSAND)

TABLE 4 BENELUX EXCAVATORS IN EARTHWORKS & EXCAVATION EQUIPMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 5 BENELUX LOADERS IN EARTHWORKS & EXCAVATION EQUIPMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 6 BENELUX EARTHWORKS & EXCAVATION EQUIPMENT MARKET, BY FUEL TYPE, 2018-2032 (USD THOUSAND)

TABLE 7 BENELUX EARTHWORKS & EXCAVATION EQUIPMENT MARKET, BY ENGINE TYPE, 2018-2032 (USD THOUSAND)

TABLE 8 BENELUX EARTHWORKS & EXCAVATION EQUIPMENT MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 9 BENELUX CONSTRUCTION IN EARTHWORKS & EXCAVATION EQUIPMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 10 BENELUX EARTHWORKS & EXCAVATION EQUIPMENT MARKET, BY COUNTRY, 2018-2032 (USD THOUSAND)

TABLE 11 NETHERLANDS EARTHWORKS & EXCAVATION EQUIPMENT MARKET, BY PRODUCTS, 2018-2032 (USD THOUSAND)

TABLE 12 NETHERLANDS EXCAVATORS IN EARTHWORKS & EXCAVATION EQUIPMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 13 NETHERLANDS LOADERS IN EARTHWORKS & EXCAVATION EQUIPMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 14 NETHERLANDS EARTHWORKS & EXCAVATION EQUIPMENT MARKET, BY FUEL TYPE, 2018-2032 (USD THOUSAND)

TABLE 15 NETHERLANDS EARTHWORKS & EXCAVATION EQUIPMENT MARKET, BY ENGINE TYPE, 2018-2032 (USD THOUSAND)

TABLE 16 NETHERLANDS EARTHWORKS & EXCAVATION EQUIPMENT MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 17 NETHERLANDS CONSTRUCTION IN EARTHWORKS & EXCAVATION EQUIPMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 18 BELGIUM EARTHWORKS & EXCAVATION EQUIPMENT MARKET, BY PRODUCTS, 2018-2032 (USD THOUSAND)

TABLE 19 BELGIUM EXCAVATORS IN EARTHWORKS & EXCAVATION EQUIPMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 20 BELGIUM LOADERS IN EARTHWORKS & EXCAVATION EQUIPMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 21 BELGIUM EARTHWORKS & EXCAVATION EQUIPMENT MARKET, BY FUEL TYPE, 2018-2032 (USD THOUSAND)

TABLE 22 BELGIUM EARTHWORKS & EXCAVATION EQUIPMENT MARKET, BY ENGINE TYPE, 2018-2032 (USD THOUSAND)

TABLE 23 BELGIUM EARTHWORKS & EXCAVATION EQUIPMENT MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 24 BELGIUM CONSTRUCTION IN EARTHWORKS & EXCAVATION EQUIPMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 25 LUXEMBOURG EARTHWORKS & EXCAVATION EQUIPMENT MARKET, BY PRODUCTS, 2018-2032 (USD THOUSAND)

TABLE 26 LUXEMBOURG EXCAVATORS IN EARTHWORKS & EXCAVATION EQUIPMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 27 LUXEMBOURG LOADERS IN EARTHWORKS & EXCAVATION EQUIPMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 28 LUXEMBOURG EARTHWORKS & EXCAVATION EQUIPMENT MARKET, BY FUEL TYPE, 2018-2032 (USD THOUSAND)

TABLE 29 LUXEMBOURG EARTHWORKS & EXCAVATION EQUIPMENT MARKET, BY ENGINE TYPE, 2018-2032 (USD THOUSAND)

TABLE 30 LUXEMBOURG EARTHWORKS & EXCAVATION EQUIPMENT MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 31 LUXEMBOURG CONSTRUCTION IN EARTHWORKS & EXCAVATION EQUIPMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

List of Figure

FIGURE 1 BENELUX EARTHWORKS & EXCAVATION EQUIPMENT MARKET

FIGURE 2 BENELUX EARTHWORKS & EXCAVATION EQUIPMENT MARKET: DATA TRIANGULATION.

FIGURE 3 BENELUX EARTHWORKS & EXCAVATION EQUIPMENT MARKET: DROC ANALYSIS

FIGURE 4 BENELUX EARTHWORKS & EXCAVATION EQUIPMENT MARKET: COUNTRY-WISE MARKET ANALYSIS

FIGURE 5 BENELUX EARTHWORKS & EXCAVATION EQUIPMENT MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 BENELUX EARTHWORKS & EXCAVATION EQUIPMENT MARKET: MULTIVARIATE MODELLING

FIGURE 7 BENELUX EARTHWORKS & EXCAVATION EQUIPMENT MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 8 BENELUX EARTHWORKS & EXCAVATION EQUIPMENT MARKET: DBMR MARKET POSITION GRID

FIGURE 9 BENELUX EARTHWORKS & EXCAVATION EQUIPMENT MARKET: VENDOR SHARE ANALYSIS

FIGURE 10 BENELUX EARTHWORKS & EXCAVATION EQUIPMENT MARKET: APPLICATION COVERAGE GRID

FIGURE 11 BENELUX EARTHWORKS & EXCAVATION EQUIPMENT MARKET: SEGMENTATION

FIGURE 12 FIVE SEGMENTS COMPRISE THE BENELUX EARTHWORKS & EXCAVATION EQUIPMENT MARKET, BY PRODUCTS (2024)

FIGURE 13 BENELUX EARTHWORKS & EXCAVATION EQUIPMENT MARKET: EXECUTIVE SUMMARY.

FIGURE 14 STRATEGIC DECISIONS

FIGURE 15 RAPID URBANIZATION AND INFRASTRUCTURE DEVELOPMENT IS EXPECTED TO DRIVE THE BENELUX EARTHWORKS & EXCAVATION EQUIPMENT MARKET IN THE FORECAST PERIOD

FIGURE 16 THE EXCAVATORS SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE BENELUX EARTHWORKS & EXCAVATION EQUIPMENT MARKET IN 2025 AND 2032

FIGURE 17 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES IN BENELUX EARTHWORKS & EXCAVATION EQUIPMENT MARKET

FIGURE 18 NUMBER OF BUILDING PERMITS IN RESIDENTIAL CONSTRUCTION (BELGIUM)

FIGURE 19 KEY BENELUX CONSTRUCTION PROJECTS (2022)

FIGURE 20 BENELUX EARTHWORKS & EXCAVATION EQUIPMENT MARKET: BY PRODUCTS, 2024

FIGURE 21 BENELUX EARTHWORKS & EXCAVATION EQUIPMENT MARKET: BY FUEL TYPE, 2024

FIGURE 22 BENELUX EARTHWORKS & EXCAVATION EQUIPMENT MARKET: BY ENGINE TYPE, 2024

FIGURE 23 BENELUX EARTHWORKS & EXCAVATION EQUIPMENT MARKET: BY APPLICATION, 2024

FIGURE 24 BENELUX EARTHWORKS & EXCAVATION EQUIPMENT MARKET: COMPANY SHARE 2024 (%)

Benelux Earthworks And Excavation Equipment Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Benelux Earthworks And Excavation Equipment Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Benelux Earthworks And Excavation Equipment Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.