Brazil Ophthalmology Products Market

Market Size in USD Billion

CAGR :

%

USD

1.69 Billion

USD

2.61 Billion

2024

2032

USD

1.69 Billion

USD

2.61 Billion

2024

2032

| 2025 –2032 | |

| USD 1.69 Billion | |

| USD 2.61 Billion | |

|

|

|

|

Brazil Ophthalmology Products Market Analysis

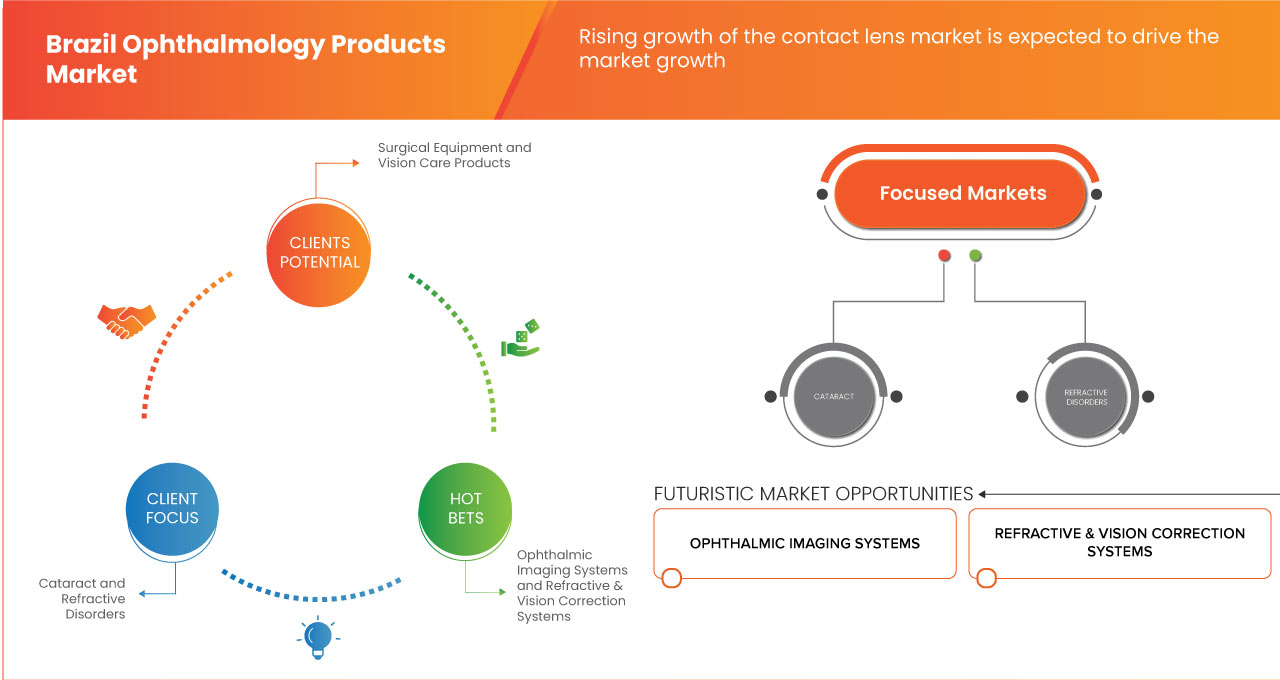

The country witnesses an increasing prevalence of refractive errors such as myopia, especially in younger populations due to the rise in digital screen usage, the demand for contact lenses as a preferred vision correction solution is growing. Younger generations, in particular, are increasingly opting for contact lenses over traditional glasses, driven by the convenience, comfort, and aesthetic appeal they offer. Additionally, advancements in contact lens technology, such as the development of daily disposable lenses, multifocal lenses for presbyopia, and extended wear lenses, have further spurred market growth by providing tailored solutions to diverse customer needs. The expansion of e-commerce platforms has also made contact lenses more accessible, especially in urban areas, while premium brands like Johnson & Johnson, Alcon, and Bausch + Lomb are intensifying their presence in the market.

Brazil Ophthalmology Products Market Size

Data Bridge Market Research analyzes that the Brazil ophthalmology products market is expected to reach USD 2.61 billion by 2032 from USD 1.69 billion in 2024, growing at a CAGR of 5.7% in the forecast period of 2025 to 2032.

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework.

Brazil Ophthalmology Products Market Trends

“Increasing Adoption of Advanced Surgical Technologies ”

One notable trend in Brazil's ophthalmology products market is the increasing adoption of advanced surgical technologies, particularly in cataract and refractive surgeries. As the aging population grows and the prevalence of eye conditions such as cataracts and myopia rises, there is a heightened demand for innovative surgical procedures, including the use of femtosecond lasers and premium intraocular lenses. This trend is further fueled by rising awareness of eye health and improvements in healthcare infrastructure, which facilitate access to modern ophthalmic treatments. Consequently, eye care professionals are increasingly integrating these advanced tools and techniques into their practices, enhancing patient outcomes and driving market growth.

Report Scope and Brazil Ophthalmology Products Market Segmentation

|

Attributes |

Brazil Ophthalmology Products Market Insights |

|

Segments Covered |

|

|

Key Market Players |

Heidelberg Engineering GmbH (Germany), PHELCOM (U.S.), OCULUS (Germany), Kowa Company, Ltd. (Dubai), Volk Optical (U.S.), Medmont (Australia), Optolentes (Brazil), ALCON (Switzerland), Johnson & Johnson Services, Inc. (U.S.), Essilor Luxottica (France), STAAR SURGICAL (California), ZIEMER OPHTHALMIC SYSTEMS AG (Switzerland), haag-streit (Switzerland) and among others |

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Brazil Ophthalmology Products Market Definition

The ophthalmology products market in Brazil includes medical devices, diagnostics, and treatments for conditions like cataracts, glaucoma, macular degeneration, and refractive errors. Driven by an aging population, increasing healthcare awareness, and technological advancements, the market sees rising demand for products like surgical tools, contact lenses, and advanced therapies. However, it faces challenges such as stringent regulatory requirements, lengthy approval processes, and high costs for market entry. Additionally, the reimbursement process within Brazil's public healthcare system, particularly through the Unified Health System (SUS), can limit access to innovative ophthalmic products, slowing adoption and market growth despite the demand.

Brazil Ophthalmology Products Market Dynamics

Drivers

- Rising Growth of the Contact Lens Market

The country witnesses an increasing prevalence of refractive errors such as myopia, especially in younger populations due to the rise in digital screen usage, the demand for contact lenses as a preferred vision correction solution is growing. Younger generations, in particular, are increasingly opting for contact lenses over traditional glasses, driven by the convenience, comfort, and aesthetic appeal they offer. Additionally, advancements in contact lens technology, such as the development of daily disposable lenses, multifocal lenses for presbyopia, toric lenses for astigmatism, and extended wear lenses, have further spurred market growth by providing tailored solutions to diverse customer needs. The expansion of e-commerce platforms has also made contact lenses more accessible, especially in urban areas, while premium brands like Johnson & Johnson, Alcon, and Bausch + Lomb are intensifying their presence in the market. Furthermore, the Brazilian market is seeing growing interest in cosmetic contact lenses, including colored lenses, as the younger population embraces these products for both aesthetic and functional purposes. The rise of disposable contact lenses and subscription-based models for easy delivery is making it more convenient for consumers to incorporate contact lenses into their daily routines, while private healthcare insurance is expanding access to optical care. However, challenges remain, including the continued dominance of glasses, the need for consumer education on proper lens care, and logistical issues that could impact product availability in more remote areas. Despite these challenges, the Brazilian contact lens market is poised for robust growth, with the middle-class expansion and increased awareness of eye health driving the adoption of contact lenses across different segments of the population.

For instance,

- In June 2021, according to an news published by Johnson&Johnson, Johnson & Johnson’s latest eye innovations in IOL (intraocular lens) and contact lens technologies focus on advanced solutions for vision correction, including improved multifocal lenses and extended wear options. These innovations drive demand for high-quality ophthalmic products, supporting the Brazil ophthalmology products market by offering advanced, accessible, and convenient solutions for diverse consumer needs

- In July 2024, according to the news published by Optometric Care Associates, the growth of the contact lens market in Brazil is driven by increasing demand for vision correction, cosmetic appeal, and convenience. With advancements in disposable lenses, multifocal options, and smart lenses, it fuels the Brazil ophthalmology products market by expanding access to innovative, user-friendly, and personalized eye care solutions

- In November 2022, according to an article published in ResearchGate, the paper on the Sustainability Paradigm in the Cosmetics Industry highlights the growing shift toward eco-friendly practices and Circular Economy. While focused on cosmetics, its principles drive consumer demand for sustainable products, influencing broader healthcare markets like ophthalmology, encouraging sustainable contact lens solutions and environmentally-conscious innovations in Brazil’s ophthalmic sector

The Brazilian contact lens market is experiencing significant growth driven by both consumer demand and technological advancements. With an increasing number of individuals in Brazil turning to contact lenses as an alternative to traditional eyeglasses, the market shows strong potential, especially as companies continue to innovate in terms of product offerings and distribution channels. While challenges remain, such as the education gap around proper lens usage and competition from eyeglasses, the market outlook for contact lenses remains positive, with opportunities arising from the sustainability trend, smart contact lens innovations, and the rise of e-commerce. The overall shift toward more convenient, cost-effective, and aesthetically appealing vision correction options suggests a continued upward trajectory for the industry in Brazil in the coming years.

- Rising Incidence of Refractive Errors in Younger Populations

The demand for contact lenses and eyeglasses. With increasing screen time, including the widespread use of smartphones, computers, and tablets, the younger Brazilian population is experiencing a surge in myopia (nearsightedness), which is one of the leading causes of refractive errors. According to studies, digital eye strain and lack of outdoor activities have contributed to the growing prevalence of myopia in children and adolescents, pushing the demand for corrective vision solutions. This trend is further amplified by the rapid urbanization of Brazil, where digital device usage is higher among urban youth compared to rural areas. As more children and teenagers are diagnosed with myopia, there is an increasing need for early intervention and preventive measures, such as contact lenses specifically designed for myopic control and orthokeratology lenses. Additionally, the adoption of preventive and corrective strategies by eye care professionals in Brazil is gaining momentum, which is encouraging greater acceptance of modern vision correction products like contact lenses. The shift toward non-glass solutions is also driven by aesthetic preferences, as contact lenses are seen as more convenient, comfortable, and appealing to younger consumers who prefer the freedom from glasses in their daily lives and activities. The growing awareness of eye health and the availability of advanced lenses are supporting this shift, making it a key growth driver in the Brazilian ophthalmology market.

For instance,

- In December 2022, according to an article published by National Library of Medicine, the article highlights the rising incidence of refractive errors, particularly myopia, in younger populations, driven by increased screen time and limited outdoor activities. This trend is spurring demand for vision correction products, including contact lenses and eyeglasses, acting as a key driver for the Brazil ophthalmology products market by expanding the market for youth-focused corrective solutions

- In October 2022, according to an article published in ResearchGate, the study on the prevalence of refractive errors among children under five in Nepal underscores the rising incidence of early-onset refractive issues. This trend is driving demand for early vision correction solutions, such as contact lenses and pediatric eyewear, acting as a key driver for the Brazil Ophthalmology Products Market, particularly in youth-centric products

- In October 2024, according to an article published in National Library of Medicine, the study on refractive errors and ocular alignment in school-aged children from low-income areas of São Paulo, Brazil, highlights a significant prevalence of myopia (7.70%) and hyperopia (3.24%) among children. The findings underscore the increasing need for vision correction products such as contact lenses and eyeglasses in Brazil, acting as a key driver for the Brazil Ophthalmology Products Market, especially among youth and low-income populations. Increased awareness and demand for early diagnosis and refractive error correction further stimulate market growth in pediatric ophthalmic solutions

The rising incidence of refractive errors in younger populations is not only altering the landscape of vision correction in Brazil but is also fueling demand for innovative ophthalmology products like contact lenses. With myopia rates continuing to rise, especially among children and teenagers, the Brazilian ophthalmology market will likely see increased investments in advanced contact lenses, myopia management solutions, and eye care technologies. This trend underscores the growing need for early intervention and effective solutions, creating a substantial growth opportunity for companies involved in contact lens manufacturing and other ophthalmology-related products in Brazil.

- Focus on Pediatric Ophthalmology

Studies show that a significant portion of school-aged children in Brazil, especially in low-income areas, suffer from uncorrected myopia, hyperopia, and other visual disorders that, if left untreated, can lead to lifelong vision problems. As early detection and intervention become central to reducing childhood vision impairment, the demand for pediatric ophthalmic products, including eyeglasses, contact lenses, and diagnostic equipment, is on the rise. The Brazilian government’s initiatives, such as the "Ver na Escola" project, have further highlighted the need for affordable, accessible vision care for children, particularly those in underserved areas. Furthermore, with the increasing use of digital screens among children, the rate of digital eye strain and myopia is growing, making early vision correction and eye health awareness critical for the future of Brazil’s pediatric population. The market for pediatric eyewear and corrective lenses is expected to expand as ophthalmic technology improves, offering more comfortable, effective, and customizable solutions for children. These innovations are expected to fuel market growth, providing tailored solutions that address the unique needs of young patients, including pediatric contact lenses for myopia management and orthokeratology lenses.

For instance,

- In February 2025, according to an article published in ResearchGate, the focus on pediatric ophthalmology is increasing globally, with significant research and advancements in early detection, myopia management, and vision correction for children. In Brazil, this trend drives demand for pediatric eyeglasses, contact lenses, and diagnostic equipment, positioning pediatric ophthalmic products as a key growth driver in the Brazilian ophthalmology market

- In May 2024, according to an article published in National Library of Medicine, the study on pediatric ophthalmopathy highlights growing research trends in myopia, retinopathy of prematurity, and glaucoma in children. With increased focus on early diagnosis and eye care technologies, this trend drives demand for pediatric ophthalmic products like myopia control lenses, contributing to the growth of the Brazil ophthalmology products market

- In September 2024, according to the news published in American Academy of Opthalmology, the Preview 2024 Pediatric Ophthalmology Subspecialty Day will feature discussions on crucial pediatric eye health issues like strabismus, amblyopia, and myopia management. Sessions on new technologies, DEI in healthcare, and pediatric surgery practices, such as topical anesthesia in strabismus surgery, will drive clinical advancements and innovation in pediatric ophthalmology, influencing practices in Brazil’s growing ophthalmology products market

- In May 2024, according to news published in University Hospitals, the article "Visionary Innovations: Advancing Pediatric Eye Care with Technology & Education" from University Hospitals explores how innovations in pediatric eye care, such as advanced diagnostic tools and digital health education, are transforming treatment outcomes. These technological advancements are likely to drive the demand for ophthalmology products in Brazil, especially in the pediatric segment, further expanding the country's market

- In December 2024, according to the article published in MDPI, discusses the advancements in pediatric ophthalmology, including new treatments, diagnostic tools, and surgical techniques. These innovations contribute to the growing demand for ophthalmology products in Brazil, particularly in the pediatric sector, driving market growth by improving early detection and treatment options

Opportunities

- Rise in the Aging Population

The older individuals are more susceptible to various eye disorders and diseases. Conditions such as cataracts, age-related macular degeneration (AMD), diabetic retinopathy, and glaucoma are prevalent among the elderly, creating a substantial demand for ophthalmic care and treatments. As a result, healthcare systems and ophthalmic providers are poised to expand their services, enhance diagnostic and therapeutic options, and cater to the unique needs of this demographic. This growing patient base necessitates an array of solutions, from surgical interventions and advanced drug therapies to vision correction products, ensuring a steady and increasing demand for ophthalmic procedures and products.

For instance,

- In March 2023, according to an article published in the NCBI, Cataract is a leading cause of visual impairment in old age. Lens opacification is notoriously associated with several geriatric conditions, including frailty, fall risk, depression and cognitive impairment. Moreover, according to the same source, in 2020, the leading worldwide causes of blindness in patients aged 50 years and older were cataract, followed by glaucoma, under-corrected refractive error, age-related macular degeneration, and diabetic retinopathy

- In 2024, according to an article published in the sciencedirect, the increase in the aging population creates opportunities to address near vision loss, refraction disorders, and cataracts through advanced diagnostic tools and treatments. This trend generates demand for innovations in assistive technologies and public health initiatives, ultimately driving growth in the healthcare sector and improving care for age-related vision conditions

- In July 2022, according to an article published in the sciencedirect, the aging population has seen a rise in dry eye disease (DED), with a prevalence of 9.2% in those aged 60 or older. The odds ratio for aging compared to younger age is 1.313, reflecting a decline in ocular surface integrity, tear film stability, and increased inflammation in the eye

- In July 2022, according to an article published in the research gate, the aging population is contributing to a significant rise in visual impairment, with 1.09 billion people over 35 affected by presbyopia. As life expectancy increases, acquired blindness, particularly from presbyopia, is expected to grow, becoming the second most common cause of blindness globally, as reported by the WHO

Moreover, addressing the eye health needs of the aging population can stimulate further investments in research and development within the ophthalmology sector. Pharmaceutical companies and medical device manufacturers are focus on creating innovative solutions tailored specifically for age-related conditions, potentially leading to breakthroughs in treatment protocols and patient care. The integration of new technologies, such as tele ophthalmology and advanced imaging techniques, facilitate better management of eye health in older adults, making it easier to monitor and treat conditions remotely. Overall, the aging population amplifies the need for existing ophthalmic services and presents a fertile ground for innovation and growth within the Brazil ophthalmology products market.

- Rise in Online Retail and E-Health Platforms

With the increasing adoption of e-commerce, patients can conveniently purchase items such as prescription glasses, contact lenses, and over-the-counter eye care products from the comfort of their homes. This trend is especially appealing to younger, tech-savvy consumers and those in remote areas with limited access to traditional optical stores. The ability to compare prices, read reviews, and access a wider range of products online enhances customer satisfaction and encourages usage, thereby driving growth in the ophthalmic product segment.

For instance,

- In September 2020, according to an article published in the NCBI, the rise in online retail and e-health platforms is fueled by 5G's ability to support increasing bandwidth demands and deliver ultra-high-definition multimedia streaming. This enables enhanced user experiences, such as high-quality video consultations and real-time remote examinations, improving physician-patient relationships and expanding healthcare access, particularly in underserved areas

- In January 2022, according to an article published in the NCBI, the rise in e-health platforms has greatly impacted ophthalmology, especially for remote diagnoses like papilledema through asynchronous imaging. Video consultations surged during the COVID-19 pandemic, enabling ophthalmologists to remotely assess conditions, triage urgent cases, and improve accessibility to specialized care, especially in underserved or remote areas

- In May 2021, according to an article published in the science direct, the rise in e-health platforms, including telemedicine, enables remote patient evaluations, improving healthcare distribution. It addresses healthcare shortages in distant areas, reduces travel-related carbon footprints, and connects patients with rare diseases to specialized care, overcoming transport challenges and enhancing overall access to medical services

- In February 2021, according to an article published in the science direct, the rise in e-health platforms is driven by digital transformation (DT), which enhances healthcare delivery through technologies that improve operational efficiency, patient-centered approaches, and workforce practices. DT in healthcare creates new business opportunities, supports value creation, and addresses challenges like an aging society, benefiting multiple stakeholders across the ecosystem

In addition to retail opportunities, e-health platforms facilitate telehealth services that allow patients to consult with eye care professionals remotely. Virtual consultations for routine eye examinations, follow-ups, and triaging for more serious conditions can significantly improve access to care, particularly for older adults or individuals with mobility challenges. These platforms enhance patient engagement and adherence to eye health recommendations and allow ophthalmologists to reach a broader patient base without the constraints of geographic boundaries. Furthermore, the integration of digital health tools, such as mobile apps for monitoring eye health or managing chronic conditions, can create a seamless patient experience and foster proactive eye care, further propelling growth in the ophthalmology market.

- Enhanced Patient Education

Enhanced patient education represents a significant opportunity for the Brazil ophthalmology products market by empowering individuals to take charge of their eye health. With the proliferation of online resources and e-health platforms, patients have unprecedented access to information regarding various eye conditions, preventive measures, and treatment options. This increased awareness can lead to greater patient engagement, prompting individuals to seek regular eye examinations, early diagnosis, and timely interventions. As patients become more informed about risks associated with eye diseases—such as glaucoma, diabetic retinopathy, and age-related macular degeneration—they are more likely to take proactive steps to maintain their ocular health, ultimately driving demand for ophthalmic services and products.

For instance,

- In July 2024, according to an article published in the science direct, the rise in e-health platforms, especially through generative AI like LLMs, enhances patient education by providing accurate, real-time information. In ophthalmology, LLMs assist in answering patient queries about symptoms and diseases such as cataracts and glaucoma, and streamline medical documentation, improving communication and understanding between patients and healthcare providers

- In February 2023, according to an article published in the NCBI, the rise in e-health platforms can enhance patient education by increasing public awareness of common eye diseases and their risk factors. Education on conditions like glaucoma, cataracts, and age-related macular degeneration can promote early detection, encourage regular eye care, and empower individuals to manage modifiable lifestyle risk factors

- In February 2023, according to an article published in the researchgate, the study highlights the importance of enhanced patient education by showing varying levels of awareness of common eye diseases. While most respondents were aware of cataracts and glaucoma, awareness of conditions like AMD and diabetic retinopathy was lower. Education on eye diseases and their risk factors can improve knowledge and early detection

Moreover, enhanced patient education fosters better communication between healthcare providers and patients. As patients become more knowledgeable, they can ask informed questions and participate in shared decision-making regarding their treatment plans. This leads to a collaborative healthcare environment, where ophthalmologists can tailor their approaches to meet individual patient needs. By leveraging digital platforms, healthcare professionals can disseminate valuable educational content, including videos, webinars, and interactive tools, which can improve understanding of complex conditions and treatment regimens. This enhances patient satisfaction and builds trust in healthcare providers, resulting in higher patient retention rates and referrals. Overall, the focus on patient education aligns with the growing emphasis on preventive healthcare, positioning the Brazil ophthalmology products market for sustained growth and improved clinical outcomes.

Brazil Ophthalmology Products Market Scope

Brazil ophthalmology products market is segmented into five notable segments based on product type, application, technology, end user, and distribution channel. The growth amongst these segments will help you analyze meagre growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

By Product Type

- Surgical Equipment

- Cataract Surgery Devices

- Phacoemulsification Systems

- Ophthalmic Viscoelastic Devices (OVDs)

- Femtosecond Lasers for Cataract Surgery

- Refractive Surgery Devices

- Excimer Lasers

- Femtosecond Lasers

- Microkeratomes

- Vitrectomy & Retinal Surgery Devices

- Vitrectomy Machines

- Retinal Lasers

- Endoilluminators/Vitreous Cutters

- Glaucoma Surgery Devices

- Minimally Invasive Glaucoma Surgery (MIGS) Devices

- Laser Trabeculoplasty Systems

- Glaucoma Drainage Devices

- Opthalmic Microscope

- Cataract Surgery Devices

- Vision Care Products

-

- Spectacles & Contact Lenses

- Prescription Glasses

- Blue Light Blocking Glasses

- Contact Lenses

- Soft Contact Lenses

- Hybrid Contact Lenses

- Rigid Gas Permeable Lenses

- Scleral Lenses

- Cosmetic & Prosthetic Contact Lenses

- Opthalmic Solutions & Eye Drops

- Artificial Tears

- Anti-Allergic Drops

- Anti-Glaucoma Drops

- Antibiotic Eye Drops

- Intraocular Lenses (IOLs)

- Monofocal IOLS

- Toric IOLS

- Multifocal IOLS

- Accommodative IOLS

-

- Diagnostic & Monitoring Equipment

- Ophthalmic Imaging Systems

- Optical Coherence Tomography (OCT)

- By Type

- Spectral-Domain OCT

- Swept-Source OCT

- OCT-Angiography

- Time-Domain OCT

- By Portability

- Stationary

- Portable

- By Type

- Fundus Cameras

- By Type

- Digital Fundus Cameras

- Widefield Fundus Cameras

- Specialized Fundus Cameras

- By Technology

- Color Fundus Photography

- Fluorescein Angiography (FA) Fundus Cameras

- Infrared Fundus Photography

- Auto-Fluorescence Fundus Cameras

- Indocyanine Green Angiography (Icg) Fundus Cameras

- By Type

- Slit Lamp Biomicroscopes

- By Type

- LED Slit Lamps

- Halogen Slit Lamps

- By Modality

- Tabletop Slit Lamps

- Portable Slit Lamps

- By Type

- Corneal Topography Systems

- Fluorescein Angiography Systems

- Retinal Imaging Devices

- Optical Coherence Tomography (OCT)

- Refractive & Vision Correction Systems

- Autorefractors & Keratometers

- Phoropters

- Wavefront Aberrometers

- Tonometers

- Applanation Tonometers (Goldmann Tonometer)

- Non-Contact Tonometers (Nct)

- Rebound Tonometers

- Indentation Tonometers

- Perimeters (Visual Field Analyzers)

- By Type

- Static Perimeters

- Kinetic Perimeters

- By Technology

- Humphrey Visual Field Analyzer

- Conventional Perimetry

- Frequency Doubling Technology (Fdt) Perimetry

- Goldmann Perimeter

- By Mode

- Automated Visual Field Analyzers

- Manual Visual Field Analyzers

- By Type

- Ophthalmic Ultrasound Imaging Systems

- B-Scan Ultrasound

- A-Scan Ultrasound

- UBM (Ultrasound Biomicroscopy)

- Microperimetry Devices

- Others

- Ophthalmic Imaging Systems

By Application

- Cataract

- Refractive Disorders

- Glaucoma

- Diabetic Retinopathy

- Age-Related Macular Degeneration

- Dry Eye Disease

- Inflammatory Diseases

- Ocular Trauma

- Others

By Technology

- Laser-Based Ophthalmic Equipment

- Excimer Lasers

- Femtosecond Lasers

- Argon Lasers

- Yag Lasers

- 3D & Digital Imaging Ophthalmic Systems

- AI-Integrated Ophthalmic Diagnostic Equipment

- Automated OCT Analysis

- AI-Based Retinal Screening

- Wearable Ophthalmic Devices

- Others

By End User

- Ophthalmic Clinics & Specialty Eye Care Centers

- Hospitals

- Optical Retail Stores

- Ambulatory Surgery Centers (Ascs)

- Academic & Research Institutes

By Distribution Channel

- Hospital & Clinic-Based Procurement

- Retail Stores & Optical Chains

- Direct Sales

- Online Platforms

Brazil Ophthalmology Products Market Regional Analysis

The market is analyzed and market size insights and trends are provided five notable segments based on product type, application, technology, end user, and distribution channel as referenced above.

The country section of the report also provides individual market impacting factors and changes in regulation in the market domestically that impacts the current and future trends of the market. Data points like down-stream and upstream value chain analysis, technical trends and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of local brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

Brazil Ophthalmology Products Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, local presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

Brazil Ophthalmology Products Market Leader Operating in the Market Are:

- Alcon Inc. (USA)

- EssilorLuxottica (France)

- Bausch + Lomb (USA)

- Johnson & Johnson (USA)

- Topcon Corporation (Japan)

- Heidelberg Engineering GmbH (Germany)

- PHELCOM (Bulgaria)

- OCULUS (Germany)

- Kowa Company, Ltd. (Japan)

- Volk Optical (USA)

- Medmont (Australia)

- Optolentes (Peru)

- Cooper Companies (USA)

- STAAR Surgical (USA)

Latest Developments Brazil Ophthalmology Products Market

- In March 2023, Ottobock acquired Brillinger, a leading medical supply chain in Baden-Württemberg, expanding its care network in southern Germany. The takeover enhanced Ottobock’s growth strategy, allowing for improved patient care and rehabilitation services across multiple locations in the region

- In July 2024, Ottobock acquired Sahva A/S, a top orthopedic technology provider in Denmark, to boost its presence in the Scandinavian market. In 2024, Ottobock achieved a 7% revenue growth and a 17% increase in earnings, driving sustainable and profitable expansion

- In May 2024, Ottobock launched the Evanto Prosthetic Foot, a groundbreaking mechanical foot offering improved mobility. Designed for activity levels 2 to 4, it combines stability, flexibility, and energy return, enhancing comfort and adaptability across different terrains, while supporting users’ increased mobility and quality of life

- In August 2023, AlterG acquired by ReWalk Robotics, aiming to expand commercial scale and accelerate its path to profitability. The acquisition strengthens ReWalk's position in the rehabilitation technology market, enhancing its ability to deliver innovative solutions and drive future growth

- In December 2024, Cyberdyne Inc. received conformity certification under the EU Medical Device Regulation for its small model of the HAL for Medical Use Lower Limb Type. Prior to this certification, only patients over 150 cm in height were eligible for Cybernics Treatment. With the new certification, EU patients ranging from approximately 100 cm to 150 cm can now undergo Cybernics Treatment

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF THE BRAZIL OPHTHALMOLOGY PRODUCTS MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 BRAZIL OPHTHALMOLOGY PRODUCTS MARKET: GEOGRAPHICAL SCOPE

2.3 BRAZIL OPHTHALMOLOGY PRODUCTS MARKET: YEARS CONSIDERED FOR THE STUDY

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 BRAZIL OPHTHALMOLOGY PRODUCTS MARKET: MULTIVARIATE MODELLING

2.7 DBMR MARKET POSITION GRID

2.8 VENDOR SHARE ANALYSIS

2.9 SECONDARY SOURCES

2.1 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PESTAL ANALYSIS

4.2 PORTERS FIVE FORCES ANALYSIS

4.3 HEALTHCARE ECONOMY

4.4 MICRO AND MACRO ECONOMIC FACTORS

4.5 INNOVATION TRACKER AND STRATEGIC ANALYSIS

4.5.1 INNOVATION TRACKER

4.5.2 STRATEGIC ANALYSIS

4.6 VALUE CHAIN ANALYSIS

4.6.1 RAW MATERIAL SOURCING & PROCUREMENT

4.6.2 PRODUCT DESIGN & R&D

4.6.3 MANUFACTURING & ASSEMBLY

4.6.4 DISTRIBUTION & LOGISTICS

4.6.5 MARKETING & SALES

4.6.6 END USERS (HOSPITALS, CLINICS, OPTICAL STORES, PATIENTS)

5 BRAZIL OPHTHALMOLOGY PRODUCTS MARKET

5.1 DRIVERS

5.1.1 RISING GROWTH OF THE CONTACT LENS MARKET

5.1.2 RISING INCIDENCE OF REFRACTIVE ERRORS IN YOUNGER POPULATIONS

5.1.3 FOCUS ON PEDIATRIC OPHTHALMOLOGY

5.2 RESTRAINTS

5.2.1 LIMITED AWARENESS IN RURAL AREAS

5.2.2 REGULATORY BARRIERS IMPEDING GROWTH AND INNOVATION IN BRAZIL'S OPHTHALMOLOGY SECTOR

5.3 OPPORTUNITIES

5.3.1 RISE IN THE AGING POPULATION

5.3.2 RISE IN ONLINE RETAIL AND E-HEALTH PLATFORMS

5.3.3 ENHANCED PATIENT EDUCATION

5.4 CHALLENGES

5.4.1 RISING COSTS OF OPHTHALMIC TREATMENTS

5.4.2 SHORTAGE OF EYE CARE PROFESSIONALS

6 BRAZIL OPHTHALMOLOGY PRODUCTS MARKET, BY PRODUCT TYPE

6.1 OVERVIEW

6.2 SURGICAL EQUIPMENT

6.2.1 CATARACT SURGERY DEVICES

6.2.1.1 PHACOEMULSIFICATION SYSTEMS

6.2.1.2 OPHTHALMIC VISCOELASTIC DEVICES (OVDS)

6.2.1.3 FEMTOSECOND LASERS FOR CATARACT SURGERY

6.2.2 REFRACTIVE SURGERY DEVICES

6.2.2.1 EXCIMER LASERS

6.2.2.2 FEMTOSECOND LASERS

6.2.2.3 MICROKERATOMES

6.2.3 VITRECTOMY & RETINAL SURGERY DEVICES

6.2.3.1 VITRECTOMY MACHINES

6.2.3.2 RETINAL LASERS

6.2.3.3 ENDOILLUMINATORS/VITREOUS CUTTERS

6.2.4 GLAUCOMA SURGERY DEVICES

6.2.4.1 MINIMALLY INVASIVE GLAUCOMA SURGERY (MIGS) DEVICES

6.2.4.2 LASER TRABECULOPLASTY SYSTEMS

6.2.4.3 GLAUCOMA DRAINAGE DEVICES

6.2.5 OPHTHALMIC MICROSCOPE

6.3 VISION CARE PRODUCTS

6.3.1 SPECTACLES & CONTACT LENSES

6.3.1.1 PRESCRIPTION GLASSES

6.3.1.2 BLUE LIGHT BLOCKING GLASSES

6.3.1.3 CONTACT LENSES

6.3.1.4 SOFT CONTACT LENSES

6.3.1.5 HYBRID CONTACT LENSES

6.3.1.6 RIGID GAS PERMEABLE LENSES

6.3.1.7 SCLERAL LENSES

6.3.1.8 COSMETIC & PROSTHETIC CONTACT LENSES

6.3.2 OPTHALMIC SOLUTIONS & EYE DROPS

6.3.2.1 ARTIFICIAL TEARS

6.3.2.2 ANTI-ALLERGIC DROPS

6.3.2.3 ANTI-GLAUCOMA DROPS

6.3.2.4 ANTIBIOTIC EYE DROPS

6.3.3 INTRAOCULAR LENSES (IOLS)

6.3.3.1 MONOFOCAL IOLS

6.3.3.2 TORIC IOLS

6.3.3.3 MULTIFOCAL IOLS

6.3.3.4 ACCOMMODATIVE IOLS

6.4 DIAGNOSTIC & MONITORING EQUIPMENT

6.4.1 OPHTHALMIC IMAGING SYSTEMS

6.4.1.1 OPTICAL COHERENCE TOMOGRAPHY (OCT)

6.4.1.1.1 BY TYPE

6.4.1.1.1.1 SPECTRAL-DOMAIN OCT

6.4.1.1.1.2 SWEPT-SOURCE OCT

6.4.1.1.1.3 OCT-ANGIOGRAPHY

6.4.1.1.1.4 TIME-DOMAIN OCT

6.4.1.1.2 BY PROBABILITY

6.4.1.1.2.1 STATIONARY

6.4.1.1.2.2 PORTABLE

6.4.1.2 FUNDUS CAMERAS

6.4.1.2.1 BY TYPE

6.4.1.2.1.1 DIGITAL FUNDUS CAMERAS

6.4.1.2.1.2 WIDEFIELD FUNDUS CAMERAS

6.4.1.2.1.3 SPECIALIZED FUNDUS CAMERAS

6.4.1.2.2 BY TECHNOLOGY

6.4.1.2.2.1 COLOR FUNDUS PHOTOGRAPHY

6.4.1.2.2.2 FLUORESCEIN ANGIOGRAPHY (FA) FUNDUS CAMERAS

6.4.1.2.2.3 INFRARED FUNDUS PHOTOGRAPHY

6.4.1.2.2.4 AUTO-FLUORESCENCE FUNDUS CAMERAS

6.4.1.2.2.5 INDOCYANINE GREEN ANGIOGRAPHY (ICG) FUNDUS CAMERAS

6.4.1.3 SLIT LAMP BIOMICROSCOPES

6.4.1.3.1 BY TYPE

6.4.1.3.1.1 LED SLIT LAMPS

6.4.1.3.1.2 HALOGEN SLIT LAMPS

6.4.1.3.2 BY MODALITY

6.4.1.3.2.1 TABLETOP SLIT LAMPS

6.4.1.3.2.2 PORTABLE SLIT LAMPS

6.4.1.4 CORNEAL TOPOGRAPHY SYSTEMS

6.4.1.5 FLUORESCEIN ANGIOGRAPHY SYSTEMS

6.4.1.6 RETINAL IMAGING DEVICES

6.4.2 REFR.ACTIVE & VISION CORRECTION SYSTEMS

6.4.2.1 AUTOREFRACTORS & KERATOMETERS

6.4.2.2 PHOROPTERS

6.4.2.3 WAVEFRONT ABERROMETERS

6.4.3 TONOMETERS

6.4.3.1 APPLANATION TONOMETERS (GOLDMANN TONOMETER)

6.4.3.2 NON-CONTACT TONOMETERS (NCT)

6.4.3.3 REBOUND TONOMETERS

6.4.3.4 INDENTATION TONOMETERS

6.4.4 PERIMETERS (VISUAL FIELD ANALYZERS)

6.4.4.1 BY TYPE

6.4.4.1.1 STATIC PERIMETERS

6.4.4.1.2 KINETIC PERIMETERS

6.4.4.2 BY TECHNOLOGY

6.4.4.2.1 HUMPHREY VISUAL FIELD ANALYZER

6.4.4.2.2 CONVENTIONAL PERIMETRY

6.4.4.2.3 FREQUENCY DOUBLING TECHNOLOGY (FDT) PERIMETRY

6.4.4.2.4 GOLDMANN PERIMETER

6.4.4.3 BY MODE

6.4.4.3.1 AUTOMATED VISUAL FIELD ANALYZERS

6.4.4.3.2 MANUAL VISUAL FIELD ANALYZERS

6.4.5 OPHTHALMIC ULTRASOUND IMAGING SYSTEMS

6.4.5.1 B-SCAN ULTRASOUND

6.4.5.2 A-SCAN ULTRASOUND

6.4.5.3 UBM (ULTRASOUND BIOMICROSCOPY)

6.4.6 MICROPERIMETRY DEVICES

6.5 OTHERS

7 BRAZIL OPHTHALMOLOGY PRODUCTS MARKET, BY TECHNOLOGY

7.1 OVERVIEW

7.2 LASER-BASED OPHTHALMIC EQUIPMENT

7.2.1 LASER-BASED OPHTHALMIC EQUIPMENT

7.2.1.1 EXCIMER LASERS

7.2.1.2 FEMTOSECOND LASERS

7.2.1.3 ARGON LASERS

7.2.1.4 YAG LASERS

7.3 3D & DIGITAL IMAGING OPHTHALMIC SYSTEMS

7.4 AI-INTEGRATED OPHTHALMIC DIAGNOSTIC EQUIPMENT

7.4.1 AI-INTEGRATED OPHTHALMIC DIAGNOSTIC EQUIPMENT

7.4.1.1 AUTOMATED OCT ANALYSIS

7.4.1.2 AI-BASED RETINAL SCREENING

7.5 WEARABLE OPHTHALMIC DEVICES

7.6 OTHERS

8 BRAZIL OPHTHALMOLOGY PRODUCTS MARKET, BY APPLICATION

8.1 OVERVIṀEW

8.2 CATARACT

8.3 REFRACTIVE DISORDERS

8.4 GLAUCOMA

8.5 DIABETIC RETINOPATHY

8.6 AGE-RELATED MACULAR DEGENERATION

8.7 DRY EYE DISEASE

8.8 INFLAMMATORY DISEASES

8.9 OCULAR TRAUMA

8.1 OTHERS

9 BRAZIL OPHTHALMOLOGY PRODUCTS MARKET, BY END USER

9.1 OVERVIEW

9.2 OPHTHALMIC CLINICS & SPECIALTY EYE CARE CENTERS

9.3 HOSPITALS

9.4 OPTICAL RETAIL STORES

9.5 AMBULATORY SURGERY CENTERS (ASCS)

9.6 ACADEMIC & RESEARCH INSTITUTES

10 BRAZIL OPHTHALMOLOGY PRODUCTS MARKET, BY DISTRIBUTION CHANNEL

10.1 OVERVIEW

10.1.1 HOSPITAL & CLINIC-BASED PROCUREMENT

10.1.2 RETAIL STORES & OPTICAL CHAINS

10.1.3 DIRECT SALES

10.1.4 ONLINE PLATFORMS

11 BRAZIL OPHTHALMOLOGY PRODUCTS MARKET: COMPANY LANDSCAPE

11.1 COMPANY SHARE ANALYSIS: BRAZIL

12 SWOT ANALYSIS

13 COMPANY PROFILES

13.1 ESSILOR LUXOTTICA

13.1.1 COMPANY SNAPSHOT

13.1.2 REVENUE ANALYSIS

13.1.3 PRODUCT PORTFOLIO

13.1.4 RECENT DEVELOPMENT

13.2 ALCON

13.2.1 COMPANY SNAPSHOT

13.2.2 REVENUE ANALYSIS

13.2.3 PRODUCT PORTFOLIO

13.2.4 RECENT DEVELOPMENT

13.3 JOHNSON & JOHNSON SERVICES, INC.

13.3.1 COMPANY SNAPSHOT

13.3.2 REVENUE ANALYSIS

13.3.3 PRODUCT PORTFOLIO

13.3.4 RECENT DEVELOPMENT

13.4 BAUSCH + LOMB

13.4.1 COMPANY SNAPSHOT

13.4.2 REVENUE ANALYSIS

13.4.3 PRODUCT PORTFOLIO

13.4.4 RECENT NEWS

13.5 TOPCON CORPORATION

13.5.1 COMPANY SNAPSHOT

13.5.2 REVENUE ANALYSIS

13.5.3 PRODUCT PORTFOLIO

13.5.4 RECENT DEVELOPMENT

13.6 CARL ZEISS MEDITEC AG

13.6.1 COMPANY SNAPSHOT

13.6.2 REVENUE ANALYSIS

13.6.3 PRODUCT PORTFOLIO

13.6.4 RECENT DEVELOPMENT

13.7 COOPER COMPANIES

13.7.1 COMPANY SNAPSHOT

13.7.2 REVENUE ANALYSIS

13.7.3 PRODUCT PORTFOLIO

13.7.4 RECENT DEVELOPMENT

13.8 EYECARE SPECIALISTS

13.8.1 COMPANY SNAPSHOT

13.8.2 PRODUCT PORTFOLIO

13.8.3 RECENT DEVELOPMENT

13.9 GLAUKOS CORPORATION

13.9.1 COMPANY SNAPSHOT

13.9.2 REVENUE ANALYSIS

13.9.3 PRODUCT PORTFOLIO

13.9.4 RECENT DEVELOPMENT

13.1 HAAG-STREIT

13.10.1 COMPANY SNAPSHOT

13.10.2 PRODUCT PORTFOLIO

13.10.3 RECENT DEVELOPMENT

13.11 HEIDELBERG ENGINEERING GMBH

13.11.1 COMPANY. SNAPSHOT

13.11.2 4 PRODUCT PORTFOLIO

13.11.3 RECENT DEVELOPMENT

13.12 HOYA CORPORATION

13.12.1 COMPANY SNAPSHOT

13.12.2 REVENUE ANALYSIS

13.12.3 PRODUCT PORTFOLIO

13.12.4 RECENT DEVELOPMENT

13.13 INTALIGHT

13.13.1 COMPANY SNAPSHOT

13.13.2 PRODUCT PORTFOLIO

13.13.3 RECENT DEVELOPMENT

13.14 IRIDEX CORPORATION

13.14.1 COMPANY SNAPSHOT

13.14.2 REVENUE ANALYSIS

13.14.3 PRODUCT PORTFOLIO

13.14.4 RECENT DEVELOPMENT

13.15 KOWA COMPANY, LTD.

13.15.1 COMPANY SNAPSHOT

13.15.2 PRODUCT PORTFOLIO

13.15.3 RECENT DEVELOPMENT

13.16 MARCO

13.16.1 COMPANY SNAPSHOT

13.16.2 PRODUCT PORTFOLIO

13.16.3 RECENT DEVELOPMENT

13.17 MEDMONT

13.17.1 COMPANY SNAPSHOT

13.17.2 PRODUCT PORTFOLIO

13.17.3 RECENT DEVELOPMENT

13.18 NIDEK CO.

13.18.1 COMPANY SNAPSHOT

13.18.2 PRODUCT PORTFOLIO

13.18.3 RECENT DEVELOPMENT

13.19 NOVA EYE, INC.

13.19.1 COMPANY SNAPSHOT

13.19.2 REVENUE ANALYSIS

13.19.3 PRODUCT PORTFOLIO

13.19.4 RECENT DEVELOPMENT

13.2 OCULUS

13.20.1 COMPANY SNAPSHOT

13.20.2 PRODUCT PORTFOLIO

13.20.3 RECENT DEVELOPMENT

13.21 OPTOLENTES

13.21.1 COMPANY SNAPSHOT

13.21.2 PRODUCT PORTFOLIO

13.21.3 RECENT DEVELOPMENT

13.22 PHELCOM

13.22.1 COMPANY SNAPSHOT

13.22.2 PRODUCT PORTFOLIO

13.22.3 RECENT DEVELOPMENT

13.23 REICHERT, INC.

13.23.1 COMPANY SNAPSHOT

13.23.2 PRODUCT PORTFOLIO

13.23.3 RECENT DEVELOPMENT

13.24 STAAR SURGICAL

13.24.1 COMPANY SNAPSHOT

13.24.2 REVENUE ANALYSIS

13.24.3 PRODUCT PORTFOLIO

13.24.4 RECENT NEWS

13.25 TOMEY CORPORATION

13.25.1 COMPANY SNAPSHOT

13.25.2 PRODUCT PORTFOLIO

13.25.3 RECENT DEVELOPMENT

13.26 VISIONIX

13.26.1 COMPANY SNAPSHOT

13.26.2 PRODUCT PORTFOLIO

13.26.3 RECENT DEVELOPMENT

13.27 VOLK OPTICAL

13.27.1 COMPANY SNAPSHOT

13.27.2 SERVICE PORTFOLIO

13.27.3 RECENT DEVELOPMENT

13.28 ZIEMER OPHTHALMIC SYSTEMS AG

13.28.1 COMPANY SNAPSHOT

13.28.2 PRODUCT PORTFOLIO

13.28.3 RECENT DEVELOPMENT

14 QUESTIONNAIRE

15 RELATED REPORTS

List of Table

TABLE 1 BRAZIL OPHTHALMOLOGY PRODUCTS MARKET, BY PRODUCT TYPE, 2018-2032 (USD MILLION)

TABLE 2 BRAZIL SURGICAL EQUIPMENT IN OPHTHALMOLOGY PRODUCTS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 3 BRAZIL CATARACT SURGERY DEVICES IN OPHTHALMOLOGY PRODUCTS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 4 BRAZIL REFRACTIVE SURGERY DEVICES IN OPHTHALMOLOGY PRODUCTS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 5 BRAZIL VITRECTOMY & RETINAL SURGERY DEVICES IN OPHTHALMOLOGY PRODUCTS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 6 BRAZIL GLAUCOMA SURGERY DEVICES IN OPHTHALMOLOGY PRODUCTS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 7 BRAZIL VISION CARE PRODUCTS IN OPHTHALMOLOGY PRODUCTS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 8 BRAZIL SPECTACLES & CONTACT LENSES IN OPHTHALMOLOGY PRODUCTS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 9 BRAZIL CONTACT LENSES IN OPHTHALMOLOGY PRODUCTS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 10 BRAZIL OPTHALMIC SOLUTIONS & EYE DROPS IN OPHTHALMOLOGY PRODUCTS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 11 BRAZIL INTRAOCULAR LENSES (IOLS) IN OPHTHALMOLOGY PRODUCTS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 12 BRAZIL DIAGNOSTIC & MONITORING EQUIPMENT IN OPHTHALMOLOGY PRODUCTS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 13 BRAZIL DIAGNOSTIC & MONITORING EQUIPMENT IN OPHTHALMOLOGY PRODUCTS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 14 BRAZIL OPTICAL COHERENCE TOMOGRAPHY (OCT) IN OPHTHALMOLOGY PRODUCTS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 15 BRAZIL OPTICAL COHERENCE TOMOGRAPHY (OCT) IN OPHTHALMOLOGY PRODUCTS MARKET, BY PORTABILITY, 2018-2032 (USD MILLION)

TABLE 16 BRAZIL FUNDUS CAMERA IN OPHTHALMOLOGY PRODUCTS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 17 BRAZIL FUNDUS CAMERA IN OPHTHALMOLOGY PRODUCTS MARKET, BY TECHNOLOGY, 2018-2032 (USD MILLION)

TABLE 18 BRAZIL SLIT LAMP BIOMICROSCOPES IN OPHTHALMOLOGY PRODUCTS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 19 BRAZIL SLIT LAMP BIOMICROSCOPES IN OPHTHALMOLOGY PRODUCTS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 20 BRAZIL REFRACTIVE & VISION CORRECTION SYSTEMS IN OPHTHALMOLOGY PRODUCTS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 21 BRAZIL TONOMETERS IN OPHTHALMOLOGY PRODUCTS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 22 BRAZIL PERIMETERS (VISUAL FIELD ANALYZERS) IN OPHTHALMOLOGY PRODUCTS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 23 BRAZIL PERIMETERS (VISUAL FIELD ANALYZERS) IN OPHTHALMOLOGY PRODUCTS MARKET, BY TECHNOLOGY, 2018-2032 (USD MILLION)

TABLE 24 BRAZIL PERIMETERS (VISUAL FIELD ANALYZERS) IN OPHTHALMOLOGY PRODUCTS MARKET, BY MODE, 2018-2032 (USD MILLION)

TABLE 25 BRAZIL OPHTHALMIC ULTRASOUND IMAGING SYSTEMS IN OPHTHALMOLOGY PRODUCTS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 26 BRAZIL OPHTHALMOLOGY PRODUCTS MARKET, BY TECHNOLOGY, 2018-2032 (USD MILLION)

TABLE 27 BRAZIL LASER-BASED OPHTHALMIC EQUIPMENT IN OPHTHALMOLOGY PRODUCTS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 28 BRAZIL AI-INTEGRATED OPHTHALMIC DIAGNOSTIC EQUIPMENT IN OPHTHALMOLOGY PRODUCTS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 29 BRAZIL OPHTHALMOLOGY PRODUCTS MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 30 BRAZIL OPHTHALMOLOGY PRODUCTS MARKET, BY END USER, 2018-2032 (USD MILLION)

TABLE 31 BRAZIL OPHTHALMOLOGY PRODUCTS MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD MILLION)

List of Figure

FIGURE 1 BRAZIL OPHTHALMOLOGY PRODUCTS MARKET: SEGMENTATION

FIGURE 2 BRAZIL OPHTHALMOLOGY PRODUCTS MARKET: DATA TRIANGULATION

FIGURE 3 BRAZIL OPHTHALMOLOGY PRODUCTS MARKET: DROC ANALYSIS

FIGURE 4 BRAZIL OPHTHALMOLOGY PRODUCTS MARKET: COUNTR-YWISE MARKET ANALYSIS

FIGURE 5 BRAZIL OPHTHALMOLOGY PRODUCTS MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 BRAZIL OPHTHALMOLOGY PRODUCTS MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 BRAZIL OPHTHALMOLOGY PRODUCTS MARKET: DBMR MARKET POSITION GRID

FIGURE 8 BRAZIL OPHTHALMOLOGY PRODUCTS MARKET: VENDOR SHARE ANALYSIS

FIGURE 9 BRAZIL OPHTHALMOLOGY PRODUCTS MARKET: SEGMENTATION

FIGURE 10 RISING GROWTH OF THE CONTACT LENS MARKET IS DRIVING THE GROWTH OF THE BRAZIL OPHTHALMOLOGY PRODUCTS MARKET FROM 2025 TO 2032

FIGURE 11 THE SURGICAL EQUIPMENT SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE BRAZIL OPHTHALMOLOGY PRODUCTS MARKET IN 2025 AND 2032

FIGURE 12 BRAZIL OPHTHALMOLOGY PRODUCTS MARKET EXECUTIVE SUMMARY

FIGURE 13 STRATEGIC DECISIONS

FIGURE 14 THREE SEGMENTS COMPRISE THE BRAZIL OPHTHALMOLOGY PRODUCTS MARKET, BY PRODUCT TYPE (2024)

FIGURE 15 DRIVERS AND RESTRAINTS OF THE BRAZIL OPHTHALMOLOGY PRODUCTS MARKET

FIGURE 16 BRAZIL OPHTHALMOLOGY PRODUCTS MARKET: BY PRODUCT TYPE, 2024

FIGURE 17 BRAZIL OPHTHALMOLOGY PRODUCTS MARKET: BY PRODUCT TYPE, 2025 TO 2032 (USD MILLION)

FIGURE 18 BRAZIL OPHTHALMOLOGY PRODUCTS MARKET: BY PRODUCT TYPE, CAGR (2025- 2032)

FIGURE 19 BRAZIL OPHTHALMOLOGY PRODUCTS MARKET: BY PRODUCT TYPE, LIFELINE CURVE

FIGURE 20 BRAZIL OPHTHALMOLOGY PRODUCTS MARKET: BY TECHNOLOGY, 2024

FIGURE 21 BRAZIL OPHTHALMOLOGY PRODUCTS MARKET: BY TECHNOLOGY, 2025 TO 2032 (USD MILLION)

FIGURE 22 BRAZIL OPHTHALMOLOGY PRODUCTS MARKET: BY TECHNOLOGY, CAGR (2025-2032)

FIGURE 23 BRAZIL OPHTHALMOLOGY PRODUCTS MARKET: BY TECHNOLOGY, LIFELINE CURVE

FIGURE 24 BRAZIL OPHTHALMOLOGY PRODUCTS MARKET: BY APPLICATION, 2024

FIGURE 25 BRAZIL OPHTHALMOLOGY PRODUCTS MARKET: BY APPLICATION, 2025 TO 2032 (USD MILLION)

FIGURE 26 BRAZIL OPHTHALMOLOGY PRODUCTS MARKET: BY APPLICATION, CAGR (2025-2032)

FIGURE 27 BRAZIL OPHTHALMOLOGY PRODUCTS MARKET: BY APPLICATION, LIFELINE CURVE

FIGURE 28 BRAZIL OPHTHALMOLOGY PRODUCTS MARKET: BY END USER, 2024

FIGURE 29 BRAZIL OPHTHALMOLOGY PRODUCTS MARKET: BY END USER, 2025 TO 2032 (USD MILLION)

FIGURE 30 BRAZIL OPHTHALMOLOGY PRODUCTS MARKET: BY END USER, CAGR (2025-2032)

FIGURE 31 BRAZIL OPHTHALMOLOGY PRODUCTS MARKET: BY END USER, LIFELINE CURVE

FIGURE 32 BRAZIL OPHTHALMOLOGY PRODUCTS MARKET: BY DISTRIBUTION CHANNEL, 2024

FIGURE 33 BRAZIL OPHTHALMOLOGY PRODUCTS MARKET: BY DISTRIBUTION CHANNEL, 2025 TO 2032 (USD MILLION)

FIGURE 34 BRAZIL OPHTHALMOLOGY PRODUCTS MARKET: BY DISTRIBUTION CHANNEL, CAGR (2025- 2032)

FIGURE 35 BRAZIL OPHTHALMOLOGY PRODUCTS MARKET: BY DISTRIBUTION CHANNEL, LIFELINE CURVE

FIGURE 36 BRAZIL OPHTHALMOLOGY PRODUCTS MARKET: COMPANY SHARE 2024 (%)

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.