Emea Denim Jeans Market

Market Size in USD Billion

CAGR :

%

USD

26.28 Billion

USD

41.21 Billion

2024

2032

USD

26.28 Billion

USD

41.21 Billion

2024

2032

| 2025 –2032 | |

| USD 26.28 Billion | |

| USD 41.21 Billion | |

|

|

|

|

Denim Jeans Market Size

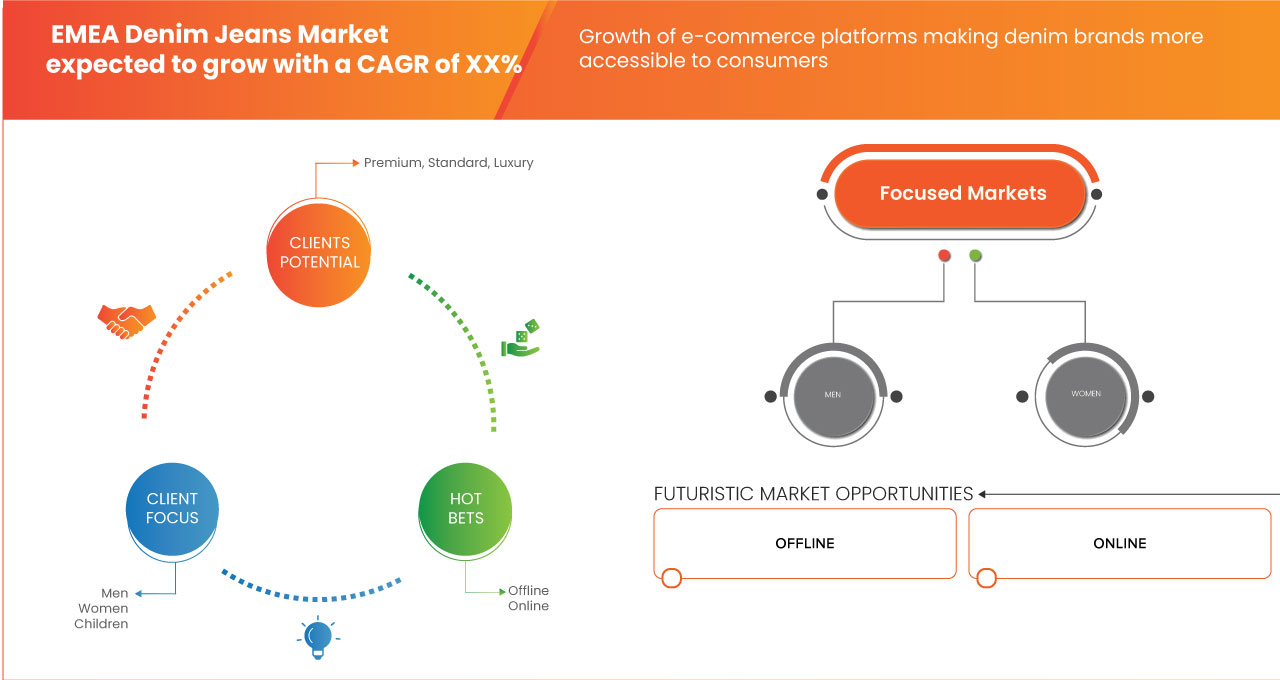

- The EMEA denim jeans market was valued at USD 26.28 billion in 2024 and is expected to reach USD 41.21 billion by 2032

- During the forecast period of 2025 to 2032 the market is likely to grow at a CAGR of 5.90%, primarily driven by the growth of e-commerce platforms making denim brands more accessible to consumers

Denim Jeans Market Analysis

- Growing urbanization and rising disposable incomes are expected to drive the growth of the denim jeans market. As more consumers seek casual and fashionable apparel, denim jeans continue to be a preferred choice across various demographics

- The expanding retail sector and booming e-commerce industry serve as major strengths for the market. The increasing number of fashion outlets, specialty stores, and department stores has made denim more accessible to a broader consumer base

- In addition, easy access to raw materials supports manufacturing efficiency, while constant product innovations and enhancements in denim quality continue to fuel market growth and attract consumer interest

- For instance, C&A introduced innovative recycled denim flooring in its Vienna and Madrid stores as part of a sustainable retail design initiative. The flooring was made from denim off-cuts sourced from C&A’s FIT factory in Germany and developed in collaboration with Swiss company LICO. Each square meter used around one kilogram of recycled denim, paired with other eco-friendly materials

- This project helped reduce textile waste, promoted responsible sourcing, and enhanced the store experience

- Through this initiative, C&A strengthened its sustainability efforts and brand image while engaging customers in its environmental mission

Report Scope and Denim Jeans Market Segmentation

|

Attributes |

Denim Jeans Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

Europe

Middle East & Africa

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Denim Jeans Market Trends

“Rising Demand For Sustainable And Eco-Friendly Denim Products Due To Environmental Concerns Across The Europe”

- Consumers, particularly millennials and Gen Z, are seeking stylish, versatile clothing that aligns with fashion trends

- Social media, influencers, and e-commerce platforms play a pivotal role in shaping these preferences, as they provide exposure to the latest styles and enable easy access to trendy product

- Consumers across EMEA are increasingly prioritizing sustainability in their fashion choices. Environmental awareness, particularly among younger demographics, is driving demand for denim made with organic materials, reduced water U.S.ge, and low-impact dyes

- For Instance, In March 2024, as per Textile Industries Media Group, LLC, Jeanologia, a leading eco-efficient textile technology company based in Spain, celebrated its ongoing commitment to sustainability on World Water Day. The company has pioneered technologies that drastically reduce water consumption, CO2 emissions, and harmful chemical U.S.ge in textile production. Jeanologia’s innovations, like its H2 ZERO effluent recycling system and Air Fiber Washer, are helping the denim industry adopt more sustainable and eco-friendly practices

- As a result, many brands are integrating sustainable practices into their production processes, enhancing brand appeal and aligning with global sustainability goals

- This trend is also encouraged by EU regulations pushing for circular fashion, as well as consumer preference for transparency in sourcing and ethical labor practices. Manufacturers that align their offerings with these values stand to gain long-term loyalty and differentiation in a crowded market

Denim Jeans Market Dynamics

Driver

“Growth Of E-Commerce Platforms Making Denim Brands More Accessible To Consumers”

- The expansion of online shopping channels has significantly broadened the reach of denim brands. Consumers now enjoy access to a wider variety of products from both global and local players

- Features such as virtual try-ons, detailed product visualization, and mobile-friendly platforms have enhanced the overall shopping experience. E-commerce also allows brands to reach underpenetrated regions across EMEA with lower distribution costs

- In addition, the rise of digital marketing, social commerce, and influencer partnerships boosts brand visibility and customer engagement. These tools provide new opportunities for customer acquisition and brand building in both urban and rural markets

For instance,

- In December 2022, in a recent publication, Membership Services Ltd. Emphasize Nudie Jeans partnered with Centra to launch a Ship-from-Store eCommerce model to boost sustainability. The system allowed customers to receive orders from nearby stores, reducing shipping distances and emissions. This approach supported local retailers, avoided unnecessary warehouse shipments, and improved delivery speed. By integrating physical and digital retail, Nudie strengthened its eco-friendly strategy. The model helped eCommerce grow sustainably in Europe, supporting wider access to denim jeans and enhancing market growth

- In March 2022, Findings from Mahadeva Esys Private Limited, indicate that Turkey expanded its role as a major fabric exporter, supported by strong manufacturing infrastructure and an FTA with the EU. Colombia remained a key importer of Turkish fabrics during this period. Large Turkish units supplied global brands, ensuring steady export volumes. This strong export capability helped meet rising fabric demands in MEA countries as well, supporting denim jeans production by ensuring material availability and fostering market growth

- The growing adoption of digital retail strategies has significantly expanded consumer access to denim across the EMEA region

- With enhanced shopping features and localized fulfillment models like Nudie Jeans’ Ship-from-Store, brands have improved efficiency and sustainability in their operations.

Opportunity

“Growing Trend For Premium, Customized Denim Jeans Catering To Specific Customer Preferences”

- In urban fashion hubs like Paris, Milan, and Dubai, demand is rising for exclusive denim that reflects individual style. Gen Z and millennials are especially drawn to unique fits, washes, and tailored designs

- Consumers are moving beyond standard options, seeking personalization through bespoke finishes, embroidery, distressing, and name stitching. Both digital platforms and in-store services are enabling this shift

- This trend toward premiumization helps brands tap into higher-margin segments. It also strengthens customer loyalty by offering more personalized and engaging shopping experiences

For instance,

- In June 2023, Data shared by Nielsen Consumer LLC reveals that Shein led the ultra-fast fashion market with rapid product launches and low prices, releasing over 315,000 new items in 2022, far surpassing Zara and H&M. While Shein gained market share in Spain and the U.K., Zara shifted upmarket and H&M focused on sustainability. This ultra-fast fashion trend reshaped consumer expectations, especially among Gen Z. For the EMEA denim jeans market

- The growing demand for personalized and premium denim offerings in urban fashion hubs like Paris, Milan, and Dubai presents a significant opportunity for the EMEA denim jeans market

- With consumers increasingly seeking bespoke styles, finishes, and customization options, brands can capitalize on this trend by offering tailored denim collections that reflect individual tastes

Restraint/Challenge

“Adapting Quickly To Rapidly Changing Fashion Trends In A Highly Competitive Market”

- The fashion landscape in the EMEA region is highly fragmented, with major differences in style preferences, seasonality, and consumer spending across countries

- Fast fashion giants and influencer-led microbrands are speeding up trend cycles, pushing denim brands to launch new collections more frequently

- Smaller producers in Eastern Europe and North Africa often can’t keep up due to slower production and limited R&D. This can result in outdated stock and lost relevance in fast-moving markets like the U.K., Germany, and the U.A.E.

For instance,

- In September 2024, as per HEURITECH, fast fashion continued to dominate the market with brands releasing new collections every week, driven by AI and social media trends. These rapid cycles allowed companies to meet real-time consumer demand, but raised concerns over sustainability. Fast fashion brands are increasingly adopting eco-friendly practices, though critics argue these efforts are often superficial

- The rapidly changing fashion trends in the EMEA region create significant challenges for denim brands, especially smaller manufacturers who struggle to keep pace with fast fashion cycles.

- The constant pressure to release new collections and stay relevant amidst influencer-driven trends can lead to outdated inventory and loss of market share

Denim Jeans Market Scope

The market is segmented on the basis fabric, product, demography, price range, form factor, material, and distribution channel.

|

Segmentation |

Sub-Segmentation |

|

By Fabric |

|

|

By Product |

|

|

By Demography |

|

|

By Price Range |

|

|

By Form Factor |

|

|

By Material

|

|

|

By Distribution Channel |

|

Denim Jeans Market Regional Analysis

“Germany is the Dominant Country in the Denim Jeans Market”

- Germany is expected to dominate the market due to well-established fashion industry with major global retailers and brands, such as Zalando and Hugo Boss, playing key roles in promoting denim

- The country also has a highly fashion-conscious consumer base that values both style and quality, driving consistent demand for jeans across age groups and genders

- Many German brands emphasize ethical sourcing, organic cotton, and sustainable production practices, making the country a hub for responsible denim fashion and attracting environmentally conscious shoppers

“Germany is Projected to Register the Highest Growth Rate”

- Germany is expected to be the fastest growing country in the market due to advanced retail infrastructure and strong e-commerce capabilities support denim market dominance

- Efficient distribution networks, widespread brick-and-mortar stores, and leading online platforms ensure denim products are accessible, well-marketed, and rapidly delivered—boosting both local and international sales

Denim Jeans Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- Inditex S.A. (Spain)

- Ralph Lauren Corporation (U.S.)

- UNIQLO Co. (U.S.)

- C&A (Belgium)

- MARKS AND SPENCER GROUP PLC (U.K.)

- H&M Group (Sweden)

- Primark Limited (U.K.)

- Next Retail Ltd. (U.K.)

- Levi Strauss & Co. (U.S.)

- The Gap, Inc. (U.S.)

- PVH Corp. (U.S.)

- U.S. Polo Assn. (U.S.)

- Tommy Hilfiger Licensing B.V. (Netherlands)

- Mavi Jeans Inc. (Turkey)

- Kontoor Brands, Inc. (U.S.)

- Pepe Jeans (Spain)

- Carhartt, Inc. (U.S.)

- VF CORPORATION (U.S.)

- Jil Sander (part of the OTB group) (Italy)

- EVERLANE (U.S.)

- FRAME (U.S.)

- ELV Denim (U.K.)

- Blackhorse Lane Ateliers (U.K.)

- DAWSON DENIM (MFG) LTD. (U.K.)

- Hiut Denim Co. (U.K.)

- MUD Jeans (Netherlands)

- Mott & Bow (U.S.)

- Hebtroco (U.K.)

- EDWIN Europe GmbH (U.K.)

- Marques'Almeida (U.K.)

- Pajotten (U.K.)

Latest Developments in EMEA Denim Jeans Market

- In April 2024, H&M Group announced the relaunch of Cheap Monday, set for the end of summer 2024. Originally launched in 2004, the brand returned with a bold focus on individuality and youth culture, spotlighting distressed denim and the comeback of skinny jeans. The new line included expressive, affordable styles available at weekday.com and select retailers. The revival helped H&M Group tap into the Gen Z market and expand its portfolio with a rebellious, fashion-forward denim brand that promotes self-expression

- In January 2022 , UNIQLO CO., LTD. launched its Denim 2.0 initiative to reduce the environmental impact of denim production. The company introduced BlueCycle jeans, which used 99% less water than traditional finishing methods. This innovation was developed at UNIQLO’s Jeans Innovation Centre in Los Angeles. The initiative reimagined classic jeans using sustainable methods. It helped the company lower its environmental footprint while maintaining product quality

- In September 2024, C&A introduced innovative recycled denim flooring in its Vienna and Madrid stores as part of a sustainable retail design initiative. The flooring was made from denim off-cuts sourced from C&A’s FIT factory in Germany and developed in collaboration with Swiss company LICO. Each square meter used around one kilogram of recycled denim, paired with other eco-friendly materials. This project helped reduce textile waste, promoted responsible sourcing, and enhanced the store experience. Through this initiative, C&A strengthened its sustainability efforts and brand image while engaging customers in its environmental mission

- In April 2023, Blackhorse Lane Ateliers officially launched the U.K.’s first sustainable Denim Wash Lab in partnership with the University of the Arts London. The project began in 2020 but was delayed due to the pandemic. The lab was created to fill the gap in denim washing and finishing expertise within the U.K. It became a resource for students, start-ups, and brands to explore eco-friendly denim techniques. This initiative supported knowledge-sharing and reduced environmental impact in denim production

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF EMEA DENIM JEANS MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 DBMR MARKET POSITION GRID

2.7 DBMR MARKET POSITION GRID

2.8 VENDOR SHARE ANALYSIS

2.9 MULTIVARIATE MODELING

2.1 FABRIC TIMELINE CURVE

2.11 FABRIC TIMELINE CURVE

2.12 SECONDARY SOURCES

2.13 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 RAW MATERIAL COVERAGE

4.2 PORTERS FIVE FORCES

4.3 VENDOR SELECTION CRITERIA

4.4 PESTLE ANALYSIS

4.5 REGULATION COVERAGE

4.6 SUPPLY CHAIN ANALYSIS

4.6.1 LOGISTICS COST SCENARIO

4.6.2 IMPORTANCE OF LOGISTICS SERVICE PROVIDERS

4.7 CLIMATE CHANGE SCENARIO

4.7.1 ENVIRONMENTAL CONCERNS

4.7.2 INDUSTRY RESPONSE

4.7.3 GOVERNMENT’S ROLE

4.7.4 ANALYST RECOMMENDATIONS

4.8 TARIFF & ITS IMPACT

4.8.1 OVERVIEW OF TARIFFS AND TRADE REGULATIONS:

4.8.2 IMPACT ON PRICE OF DENIM JEANS

4.8.3 SUPPLY CHAIN DISRUPTIONS

4.8.4 GEOPOLITICAL TENSIONS AND ECONOMIC DIPLOMACY

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 RISING DEMAND FOR SUSTAINABLE AND ECO-FRIENDLY DENIM PRODUCTS DUE TO ENVIRONMENTAL CONCERNS ACROSS THE EUROPE

5.1.2 GROWTH OF E-COMMERCE PLATFORMS MAKING DENIM BRANDS MORE ACCESSIBLE TO CONSUMERS

5.1.3 EXPANDING MIDDLE-CLASS POPULATION WITH INCREASING DISPOSABLE INCOME FOR FASHION PURCHASES

5.1.4 PARTNERSHIPS WITH CELEBRITIES AND INFLUENCERS ARE ENHANCING BRAND VISIBILITY AND APPEAL

5.2 RESTRAINTS

5.2.1 RAW MATERIAL COSTS LEAD TO PRICING INSTABILITY FOR DENIM PRODUCTS

5.2.2 INTENSE COMPETITION FROM INTERNATIONAL BRANDS AND LOW-COST IMPORTS IMPACTING MARKET SHARE

5.3 OPPORTUNITIES:

5.3.1 GROWING TREND FOR PREMIUM, CUSTOMIZED DENIM JEANS CATERING TO SPECIFIC CUSTOMER PREFERENCES

5.3.2 IMPLEMENTATION OF AUTOMATION AND ROBOTICS IN DENIM MANUFACTURING FOR INCREASED EFFICIENCY AND ACCURACY

5.3.3 INTEGRATION OF AI AND MACHINE LEARNING FOR TREND FORECASTING AND PERSONALIZED DENIM DESIGNS

5.4 CHALLENGES

5.4.1 ADAPTING QUICKLY TO RAPIDLY CHANGING FASHION TRENDS IN A HIGHLY COMPETITIVE MARKET

5.4.2 OVERCOMING CONSUMER PRICE SENSITIVITY WHILE MAINTAINING BRAND VALUE

6 EMEA DENIM JEANS MARKET, BY FABRIC

6.1 OVERVIEW

6.2 100% COTTON DENIM

6.3 RAW/DRY

6.4 CRUSHED

6.5 WASHED DENIM/ACID WASH DENIM

6.6 COLORED

6.7 SELVEDGE

6.8 ECRU

6.9 BUBBLE GUM

6.1 RAMIE COTTON DENIM

6.11 VINTAGE

6.12 FOX FIBER-BASED

6.13 REVERSE

6.14 RING SPUN DENIM/DUAL RING SPUN DENIM

6.15 OTHERS

7 EMEA DENIM JEANS MARKET, BY PRODUCT

7.1 OVERVIEW

7.2 GOOD STRAIGHT

7.3 SKINNY

7.4 RELAXED

7.5 BOYFRIEND

7.6 BOOTCUT

7.7 WIDE-LEG

7.8 CROPPED WIDE-LEG

7.9 HIGH-RISE

7.1 DISTRESSED

7.11 FLARED

7.12 JEGGINGS

7.13 LOW-RISE

7.14 CIGARETTE

7.15 BLACK

7.16 BLEACHED

7.17 WHITE

7.18 PLEATED

7.19 OTHERS

8 EMEA DENIM JEANS MARKET, BY DEMOGRAPHY

8.1 OVERVIEW

8.2 MEN

8.2.1 MEN, BY FABRIC

8.2.1.1 100% COTTON DENIM

8.2.1.2 RAW/DRY

8.2.1.3 WASHED DENIM/ACID WASH DENIM

8.2.1.4 COLORED

8.2.1.5 CRUSHED

8.2.1.6 SELVEDGE

8.2.1.7 ECRU

8.2.1.8 BUBBLE GUM

8.2.1.9 RAMIE COTTON DENIM

8.2.1.10 VINTAGE

8.2.1.11 FOX FIBER -BASED

8.2.1.12 REVERSE

8.2.1.13 RING SPUN DENIM/DUAL RING SPUN DENIM

8.2.1.14 OTHERS

8.3 WOMEN

8.3.1 WOMEN, BY FABRIC

8.3.1.1 100% COTTON DENIM

8.3.1.2 RAW/DRY

8.3.1.3 WASHED DENIM/ACID WASH DENIM

8.3.1.4 COLORED

8.3.1.5 SELVEDGE

8.3.1.6 CRUSHED

8.3.1.7 ECRU

8.3.1.8 BUBBLE GUM

8.3.1.9 RAMIE COTTON DENIM

8.3.1.10 VINTAGE

8.3.1.11 FOX FIBER -BASED

8.3.1.12 REVERSE

8.3.1.13 RING SPUN DENIM/DUAL RING SPUN DENIM

8.3.1.14 OTHERS

8.4 CHILDREN

8.4.1 CHILDREN, BY FABRIC

8.4.1.1 100% COTTON DENIM

8.4.1.2 RAW/DRY

8.4.1.3 CRUSHED

8.4.1.4 WASHED DENIM/ACID WASH DENIM

8.4.1.5 COLORED

8.4.1.6 SELVEDGE

8.4.1.7 ECRU

8.4.1.8 BUBBLE GUM

8.4.1.9 RAMIE COTTON DENIM

8.4.1.10 VINTAGE

8.4.1.11 FOX FIBER -BASED

8.4.1.12 REVERSE

8.4.1.13 RING SPUN DENIM/DUAL RING SPUN DENIM

8.4.1.14 OTHERS

9 EMEA DENIM JEANS MARKET, BY PRICE RANGE

9.1 OVERVIEW

9.2 PREMIUM

9.3 STANDARD

9.4 LUXURY

10 EMEA DENIM JEANS MARKET, BY DISTRIBUTION CHANNEL

10.1 OVERVIEW

10.2 OFFLINE

10.2.1 OFFLINE, BY TYPE

10.2.1.1 BRAND STORES

10.2.1.2 SUPERMARKETS & HYPERMARKETS

10.2.1.3 GARMENTS SHOPS

10.2.1.4 OTHERS

10.3 ONLINE

10.3.1 ONLINE, BY TYPE

10.3.1.1 E-COMMERCE WEBSITE

10.3.1.2 COMPANY-OWNED WEBSITE

11 EMEA DENIM JEANS MARKET, BY REGION

11.1 EUROPE

11.1.1 GERMANY

11.1.2 SPAIN

11.1.3 NETHERLANDS

11.1.4 FRANCE

11.1.5 ITALY

11.1.6 TURKEY

11.1.7 U.K.

11.1.8 BELGIUM

11.1.9 RUSSIA

11.1.10 SWITZERLAND

11.1.11 REST OF EUROPE

11.2 MIDDLE EAST & AFRICA

11.2.1 SOUTH AFRICA

11.2.2 U.A.E.

11.2.3 SAUDI ARABIA

11.2.4 KUWAIT

11.2.5 OMAN

11.2.6 REST OF MIDDLE EAST & AFRICA

12 EMEA DENIM JEANS MARKET

12.1 COMPANY SHARE ANALYSIS: EUROPE

12.2 COMPANY SHARE ANALYSIS: MIDDLE EAST & AFRICA

13 SWOT ANALYSIS

14 COMPANY PROFILES

14.1 ZARA FRANCE, S.A.R.L.

14.1.1 COMPANY SNAPSHOT

14.1.2 PRODUCT PORTFOLIO

14.1.3 RECENT DEVELOPMENT

14.2 H&M GROUP

14.2.1 COMPANY SNAPSHOT

14.2.2 REVENUE ANALYSIS

14.2.3 BRAND PORTFOLIO

14.2.4 RECENT DEVELOPMENT

14.3 RALPH LAUREN MEDIA LLC

14.3.1 COMPANY SNAPSHOT

14.3.2 REVENUE ANALYSIS

14.3.3 PRODUCT PORTFOLIO

14.3.4 RECENT DEVELOPMENTS/NEWS

14.4 UNIQLO CO., LTD(A SUBSIDIARY OF FAST RETAILING CO., LTD)

14.4.1 COMPANY SNAPSHOT

14.4.2 PRODUCT PORTFOLIO

14.4.3 RECENT DEVELOPMENTS/NEWS

14.5 C&A MODE GMBH & CO. KG

14.5.1 COMPANY SNAPSHOT

14.5.2 PRODUCT PORTFOLIO

14.5.3 RECENT DEVELOPMENT

14.6 BLACKHORSE LANE ATELIERS

14.6.1 COMPANY SNAPSHOT

14.6.2 PRODUCT PORTFOLIO

14.6.3 RECENT DEVELOPMENTS/NEWS

14.7 CARHARTT, INC.

14.7.1 COMPANY SNAPSHOT

14.7.2 PRODUCT PORTFOLIO

14.7.3 RECENT DEVELOPMENTS/NEWS

14.8 CALVIN KLEIN INC. (A SUBSIDIARY OF PVH CORP.)

14.8.1 COMPANY SNAPSHOT

14.8.2 PRODUCT PORTFOLIO

14.8.3 RECENT DEVELOPMENT/NEWS

14.9 DAWSON DENIM (MFG) LTD

14.9.1 COMPANY SNAPSHOT

14.9.2 PRODUCT PORTFOLIO

14.9.3 RECENT DEVELOPMENTS/NEWS

14.1 EDWIN EUROPE GMBH

14.10.1 COMPANY SNAPSHOT

14.10.2 PRODUCT PORTFOLIO

14.10.3 RECENT DEVELOPMENT

14.11 ELV DENIM

14.11.1 COMPANY SNAPSHOT

14.11.2 PRODUCT PORTFOLIO

14.11.3 RECENT DEVELOPMENT

14.12 EVERLANE

14.12.1 COMPANY SNAPSHOT

14.12.2 PRODUCT PORTFOLIO

14.12.3 RECENT DEVELOPMENTS/NEWS

14.13 FRAME

14.13.1 COMPANY SNAPSHOT

14.13.2 PRODUCT PORTFOLIO

14.13.3 RECENT DEVELOPMENTS/NEWS

14.14 GAP INC.

14.14.1 COMPANY SNAPSHOT

14.14.2 REVENUE ANALYSIS

14.14.3 BRAND PORTFOLIO

14.14.4 RECENT DEVELOPMENT

14.15 HEBTROCO

14.15.1 COMPANY SNAPSHOT

14.15.2 PRODUCT PORTFOLIO

14.15.3 RECENT DEVELOPMENTS/NEWS

14.16 HIUT DENIM CO.

14.16.1 COMPANY SNAPSHOT

14.16.2 PRODUCT PORTFOLIO

14.16.3 RECENT DEVELOPMENTS/NEWS

14.17 JIL SANDER IS PART OF THE OTB GROUP

14.17.1 COMPANY SNAPSHOT

14.17.2 PRODUCT PORTFOLIO

14.17.3 RECENT DEVELOPMENTS/NEWS

14.18 KONTOOR BRANDS, INC.

14.18.1 COMPANY SNAPSHOT

14.18.2 REVENUE ANALYSIS

14.18.3 PRODUCT PORTFOLIO

14.18.4 RECENT DEVELOPMENT

14.19 LEVI STRAUSS & CO.

14.19.1 COMPANY SNAPSHOT

14.19.2 REVENUE ANALYSIS

14.19.3 BRAND PORTFOLIO

14.19.4 RECENT DEVELOPMENT

14.2 MARKS AND SPENCER PLC

14.20.1 COMPANY SNAPSHOT

14.20.2 REVENUE ANALYSIS

14.20.3 PRODUCT PORTFOLIO

14.20.4 RECENT DEVELOPMENT

14.21 MARQUES ' ALMEIDA

14.21.1 COMPANY SNAPSHOT

14.21.2 PRODUCT PORTFOLIO

14.21.3 RECENT DEVELOPMENTS/NEWS

14.22 MAVI JEANS INC.

14.22.1 COMPANY SNAPSHOT

14.22.2 REVENUE ANALYSIS

14.22.3 PRODUCT PORTFOLIO

14.22.4 RECENT DEVELOPMENTS/NEWS

14.23 MOTT & BOW

14.23.1 COMPANY SNAPSHOT

14.23.2 PRODUCT PORTFOLIO

14.23.3 RECENT DEVELOPMENTS/NEWS

14.24 MUD JEANS.

14.24.1 COMPANY SNAPSHOT

14.24.2 PRODUCT PORTFOLIO

14.24.3 RECENT DEVELOPMENTS/NEWS

14.25 NEXT PLC

14.25.1 COMPANY SNAPSHOT

14.25.2 REVENUE ANALYSIS

14.25.3 PRODUCT PORTFOLIO

14.25.4 RECENT DEVELOPMENT

14.26 PAJOTTEN.

14.26.1 COMPANY SNAPSHOT

14.26.2 PRODUCT PORTFOLIO

14.26.3 RECENT DEVELOPMENTS/NEWS

14.27 PEPE JEANS

14.27.1 COMPANY SNAPSHOT

14.27.2 PRODUCT PORTFOLIO

14.27.3 RECENT DEVELOPMENTS/NEWS

14.28 PRIMARK LIMITED

14.28.1 COMPANY SNAPSHOT

14.28.2 PRODUCT PORTFOLIO

14.28.3 RECENT DEVELOPMENT

14.29 TOMMY HILFIGER LICENSING B.V. (A PART OF PVH CORP)

14.29.1 COMPANY SNAPSHOT

14.29.2 PRODUCT PORTFOLIO

14.29.3 RECENT DEVELOPMENTS/NEWS

14.3 USPA

14.30.1 COMPANY SNAPSHOT

14.30.2 PRODUCT PORTFOLIO

14.30.3 RECENT DEVELOPMENTS/NEWS

14.31 VF CORPORATION

14.31.1 COMPANY SNAPSHOT

14.31.2 REVENUE ANALYSIS

14.31.3 BRAND PORTFOLIO

14.31.4 RECENT DEVELOPMENT

15 QUESTIONNAIRE

16 RELATED REPORTS

List of Table

TABLE 1 SUSTAINABILITY AND CERTIFICATION STANDARDS IN THE TEXTILE AND APPAREL INDUSTRY IN EUROPE AND MEA

TABLE 2 EUROPE DENIM JEANS MARKET, BY FABRIC, 2018-2032 (USD MILLION)

TABLE 3 MIDDLE EAST & AFRICA DENIM JEANS MARKET, BY FABRIC, 2018-2032 (USD MILLION)

TABLE 4 EUROPE DENIM JEANS MARKET, BY FABRIC, 2018-2032 (USD MILLION UNITS)

TABLE 5 MIDDLE EAST & AFRICA DENIM JEANS MARKET, BY FABRIC, 2018-2032 (USD MILLION UNITS)

TABLE 6 EUROPE DENIM JEANS MARKET, BY PRODUCT, 2018-2032 (USD MILLION)

TABLE 7 MIDDLE EAST & AFRICA DENIM JEANS MARKET, BY PRODUCT, 2018-2032 (USD MILLION)

TABLE 8 EUROPE DENIM JEANS MARKET, BY DEMOGRAPHY, 2018-2032 (USD MILLION)

TABLE 9 MIDDLE EAST & AFRICA DENIM JEANS MARKET, BY DEMOGRAPHY, 2018-2032 (USD MILLION)

TABLE 10 EUROPE MEN IN DENIM JEANS MARKET, BY FABRIC, 2018-2032 (USD MILLION)

TABLE 11 MIDDLE EAST & AFRICA MEN IN DENIM JEANS MARKET, BY FABRIC, 2018-2032 (USD MILLION)

TABLE 12 EUROPE WOMEN IN DENIM JEANS MARKET, BY FABRIC, 2018-2032 (USD MILLION)

TABLE 13 MIDDLE EAST & AFRICA WOMEN IN DENIM JEANS MARKET, BY FABRIC, 2018-2032 (USD MILLION)

TABLE 14 EUROPE CHILDREN IN DENIM JEANS MARKET, BY FABRIC, 2018-2032 (USD MILLION)

TABLE 15 MIDDLE EAST & AFRICA CHILDREN IN DENIM JEANS MARKET, BY FABRIC, 2018-2032 (USD MILLION)

TABLE 16 EUROPE DENIM JEANS MARKET, BY PRICE RANGE, 2018-2032 (USD MILLION)

TABLE 17 MIDDLE EAST & AFRICA DENIM JEANS MARKET, BY PRICE RANGE, 2018-2032 (USD MILLION)

TABLE 18 EUROPE DENIM JEANS MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD MILLION)

TABLE 19 MIDDLE EAST & AFRICA DENIM JEANS MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD MILLION)

TABLE 20 EUROPE OFFLINE IN DENIM JEANS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 21 MIDDLE EAST & AFRICA OFFLINE IN DENIM JEANS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 22 EUROPE ONLINE IN DENIM JEANS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 23 MIDDLE EAST & AFRICA ONLINE IN DENIM JEANS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 24 EUROPE DENIM JEANS MARKET, BY COUNTRY, 2018-2032 (USD MILLION)

TABLE 25 GERMANY DENIM JEANS MARKET, BY FABRIC, 2018-2032 (USD MILLION)

TABLE 26 GERMANY DENIM JEANS MARKET, BY FABRIC, 2018-2032 ( MILLION UNITS)

TABLE 27 GERMANY DENIM JEANS MARKET, BY PRODUCT, 2018-2032 (USD MILLION)

TABLE 28 GERMANY DENIM JEANS MARKET, BY DEMOGRAPHY, 2018-2032 (USD MILLION)

TABLE 29 GERMANY MEN IN DENIM JEANS MARKET, BY FABRIC, 2018-2032 (USD MILLION)

TABLE 30 GERMANY WOMEN IN DENIM JEANS MARKET, BY FABRIC, 2018-2032 (USD MILLION)

TABLE 31 GERMANY CHILDREN IN DENIM JEANS MARKET, BY FABRIC, 2018-2032 (USD MILLION)

TABLE 32 GERMANY DENIM JEANS MARKET, BY PRICE RANGE, 2018-2032 (USD MILLION)

TABLE 33 GERMANY DENIM JEANS MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD MILLION)

TABLE 34 GERMANY OFFLINE IN DENIM JEANS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 35 GERMANY ONLINE IN DENIM JEANS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 36 SPAIN DENIM JEANS MARKET, BY FABRIC, 2018-2032 (USD MILLION)

TABLE 37 SPAIN DENIM JEANS MARKET, BY FABRIC, 2018-2032 ( MILLION UNITS)

TABLE 38 SPAIN DENIM JEANS MARKET, BY PRODUCT, 2018-2032 (USD MILLION)

TABLE 39 SPAIN DENIM JEANS MARKET, BY DEMOGRAPHY, 2018-2032 (USD MILLION)

TABLE 40 SPAIN MEN IN DENIM JEANS MARKET, BY FABRIC, 2018-2032 (USD MILLION)

TABLE 41 SPAIN WOMEN IN DENIM JEANS MARKET, BY FABRIC, 2018-2032 (USD MILLION)

TABLE 42 SPAIN CHILDREN IN DENIM JEANS MARKET, BY FABRIC, 2018-2032 (USD MILLION)

TABLE 43 SPAIN DENIM JEANS MARKET, BY PRICE RANGE, 2018-2032 (USD MILLION)

TABLE 44 SPAIN DENIM JEANS MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD MILLION)

TABLE 45 SPAIN OFFLINE IN DENIM JEANS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 46 SPAIN ONLINE IN DENIM JEANS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 47 NETHERLANDS DENIM JEANS MARKET, BY FABRIC, 2018-2032 (USD MILLION)

TABLE 48 NETHERLANDS DENIM JEANS MARKET, BY FABRIC, 2018-2032 ( MILLION UNITS)

TABLE 49 NETHERLANDS DENIM JEANS MARKET, BY PRODUCT, 2018-2032 (USD MILLION)

TABLE 50 NETHERLANDS DENIM JEANS MARKET, BY DEMOGRAPHY, 2018-2032 (USD MILLION)

TABLE 51 NETHERLANDS MEN IN DENIM JEANS MARKET, BY FABRIC, 2018-2032 (USD MILLION)

TABLE 52 NETHERLANDS WOMEN IN DENIM JEANS MARKET, BY FABRIC, 2018-2032 (USD MILLION)

TABLE 53 NETHERLANDS CHILDREN IN DENIM JEANS MARKET, BY FABRIC, 2018-2032 (USD MILLION)

TABLE 54 NETHERLANDS DENIM JEANS MARKET, BY PRICE RANGE, 2018-2032 (USD MILLION)

TABLE 55 NETHERLANDS DENIM JEANS MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD MILLION)

TABLE 56 NETHERLANDS OFFLINE IN DENIM JEANS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 57 NETHERLANDS ONLINE IN DENIM JEANS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 58 FRANCE DENIM JEANS MARKET, BY FABRIC, 2018-2032 (USD MILLION)

TABLE 59 FRANCE DENIM JEANS MARKET, BY FABRIC, 2018-2032 ( MILLION UNITS)

TABLE 60 FRANCE DENIM JEANS MARKET, BY PRODUCT, 2018-2032 (USD MILLION)

TABLE 61 FRANCE DENIM JEANS MARKET, BY DEMOGRAPHY, 2018-2032 (USD MILLION)

TABLE 62 FRANCE MEN IN DENIM JEANS MARKET, BY FABRIC, 2018-2032 (USD MILLION)

TABLE 63 FRANCE WOMEN IN DENIM JEANS MARKET, BY FABRIC, 2018-2032 (USD MILLION)

TABLE 64 FRANCE CHILDREN IN DENIM JEANS MARKET, BY FABRIC, 2018-2032 (USD MILLION)

TABLE 65 FRANCE DENIM JEANS MARKET, BY PRICE RANGE, 2018-2032 (USD MILLION)

TABLE 66 FRANCE DENIM JEANS MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD MILLION)

TABLE 67 FRANCE OFFLINE IN DENIM JEANS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 68 FRANCE ONLINE IN DENIM JEANS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 69 ITALY DENIM JEANS MARKET, BY FABRIC, 2018-2032 (USD MILLION)

TABLE 70 ITALY DENIM JEANS MARKET, BY FABRIC, 2018-2032 ( MILLION UNITS)

TABLE 71 ITALY DENIM JEANS MARKET, BY PRODUCT, 2018-2032 (USD MILLION)

TABLE 72 ITALY DENIM JEANS MARKET, BY DEMOGRAPHY, 2018-2032 (USD MILLION)

TABLE 73 ITALY MEN IN DENIM JEANS MARKET, BY FABRIC, 2018-2032 (USD MILLION)

TABLE 74 ITALY WOMEN IN DENIM JEANS MARKET, BY FABRIC, 2018-2032 (USD MILLION)

TABLE 75 ITALY CHILDREN IN DENIM JEANS MARKET, BY FABRIC, 2018-2032 (USD MILLION)

TABLE 76 ITALY DENIM JEANS MARKET, BY PRICE RANGE, 2018-2032 (USD MILLION)

TABLE 77 ITALY DENIM JEANS MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD MILLION)

TABLE 78 ITALY OFFLINE IN DENIM JEANS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 79 ITALY ONLINE IN DENIM JEANS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 80 TURKEY DENIM JEANS MARKET, BY FABRIC, 2018-2032 (USD MILLION)

TABLE 81 TURKEY DENIM JEANS MARKET, BY FABRIC, 2018-2032 ( MILLION UNITS)

TABLE 82 TURKEY DENIM JEANS MARKET, BY PRODUCT, 2018-2032 (USD MILLION)

TABLE 83 TURKEY DENIM JEANS MARKET, BY DEMOGRAPHY, 2018-2032 (USD MILLION)

TABLE 84 TURKEY MEN IN DENIM JEANS MARKET, BY FABRIC, 2018-2032 (USD MILLION)

TABLE 85 TURKEY WOMEN IN DENIM JEANS MARKET, BY FABRIC, 2018-2032 (USD MILLION)

TABLE 86 TURKEY CHILDREN IN DENIM JEANS MARKET, BY FABRIC, 2018-2032 (USD MILLION)

TABLE 87 TURKEY DENIM JEANS MARKET, BY PRICE RANGE, 2018-2032 (USD MILLION)

TABLE 88 TURKEY DENIM JEANS MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD MILLION)

TABLE 89 TURKEY OFFLINE IN DENIM JEANS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 90 TURKEY ONLINE IN DENIM JEANS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 91 U.K. DENIM JEANS MARKET, BY FABRIC, 2018-2032 (USD MILLION)

TABLE 92 U.K. DENIM JEANS MARKET, BY FABRIC, 2018-2032 ( MILLION UNITS)

TABLE 93 U.K. DENIM JEANS MARKET, BY PRODUCT, 2018-2032 (USD MILLION)

TABLE 94 U.K. DENIM JEANS MARKET, BY DEMOGRAPHY, 2018-2032 (USD MILLION)

TABLE 95 U.K. MEN IN DENIM JEANS MARKET, BY FABRIC, 2018-2032 (USD MILLION)

TABLE 96 U.K. WOMEN IN DENIM JEANS MARKET, BY FABRIC, 2018-2032 (USD MILLION)

TABLE 97 U.K. CHILDREN IN DENIM JEANS MARKET, BY FABRIC, 2018-2032 (USD MILLION)

TABLE 98 U.K. DENIM JEANS MARKET, BY PRICE RANGE, 2018-2032 (USD MILLION)

TABLE 99 U.K. DENIM JEANS MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD MILLION)

TABLE 100 U.K. OFFLINE IN DENIM JEANS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 101 U.K. ONLINE IN DENIM JEANS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 102 BELGIUM DENIM JEANS MARKET, BY FABRIC, 2018-2032 (USD MILLION)

TABLE 103 BELGIUM DENIM JEANS MARKET, BY FABRIC, 2018-2032 ( MILLION UNITS)

TABLE 104 BELGIUM DENIM JEANS MARKET, BY PRODUCT, 2018-2032 (USD MILLION)

TABLE 105 BELGIUM DENIM JEANS MARKET, BY DEMOGRAPHY, 2018-2032 (USD MILLION)

TABLE 106 BELGIUM MEN IN DENIM JEANS MARKET, BY FABRIC, 2018-2032 (USD MILLION)

TABLE 107 BELGIUM WOMEN IN DENIM JEANS MARKET, BY FABRIC, 2018-2032 (USD MILLION)

TABLE 108 BELGIUM CHILDREN IN DENIM JEANS MARKET, BY FABRIC, 2018-2032 (USD MILLION)

TABLE 109 BELGIUM DENIM JEANS MARKET, BY PRICE RANGE, 2018-2032 (USD MILLION)

TABLE 110 BELGIUM DENIM JEANS MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD MILLION)

TABLE 111 BELGIUM OFFLINE IN DENIM JEANS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 112 BELGIUM ONLINE IN DENIM JEANS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 113 RUSSIA DENIM JEANS MARKET, BY FABRIC, 2018-2032 (USD MILLION)

TABLE 114 RUSSIA DENIM JEANS MARKET, BY FABRIC, 2018-2032 ( MILLION UNITS)

TABLE 115 RUSSIA DENIM JEANS MARKET, BY PRODUCT, 2018-2032 (USD MILLION)

TABLE 116 RUSSIA DENIM JEANS MARKET, BY DEMOGRAPHY, 2018-2032 (USD MILLION)

TABLE 117 RUSSIA MEN IN DENIM JEANS MARKET, BY FABRIC, 2018-2032 (USD MILLION)

TABLE 118 RUSSIA WOMEN IN DENIM JEANS MARKET, BY FABRIC, 2018-2032 (USD MILLION)

TABLE 119 RUSSIA CHILDREN IN DENIM JEANS MARKET, BY FABRIC, 2018-2032 (USD MILLION)

TABLE 120 RUSSIA DENIM JEANS MARKET, BY PRICE RANGE, 2018-2032 (USD MILLION)

TABLE 121 RUSSIA DENIM JEANS MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD MILLION)

TABLE 122 RUSSIA OFFLINE IN DENIM JEANS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 123 RUSSIA ONLINE IN DENIM JEANS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 124 SWITZERLAND DENIM JEANS MARKET, BY FABRIC, 2018-2032 (USD MILLION)

TABLE 125 SWITZERLAND DENIM JEANS MARKET, BY FABRIC, 2018-2032 ( MILLION UNITS)

TABLE 126 SWITZERLAND DENIM JEANS MARKET, BY PRODUCT, 2018-2032 (USD MILLION)

TABLE 127 SWITZERLAND DENIM JEANS MARKET, BY DEMOGRAPHY, 2018-2032 (USD MILLION)

TABLE 128 SWITZERLAND MEN IN DENIM JEANS MARKET, BY FABRIC, 2018-2032 (USD MILLION)

TABLE 129 SWITZERLAND WOMEN IN DENIM JEANS MARKET, BY FABRIC, 2018-2032 (USD MILLION)

TABLE 130 SWITZERLAND CHILDREN IN DENIM JEANS MARKET, BY FABRIC, 2018-2032 (USD MILLION)

TABLE 131 SWITZERLAND DENIM JEANS MARKET, BY PRICE RANGE, 2018-2032 (USD MILLION)

TABLE 132 SWITZERLAND DENIM JEANS MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD MILLION)

TABLE 133 SWITZERLAND OFFLINE IN DENIM JEANS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 134 SWITZERLAND ONLINE IN DENIM JEANS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 135 REST OF EUROPE DENIM JEANS MARKET, BY FABRIC, 2018-2032 (USD MILLION)

TABLE 136 REST OF EUROPE DENIM JEANS MARKET, BY FABRIC, 2018-2032 ( MILLION UNITS)

TABLE 137 MIDDLE EAST & AFRICA DENIM JEANS MARKET, BY COUNTRY, 2018-2032 (USD MILLION)

TABLE 138 SOUTH AFRICA DENIM JEANS MARKET, BY FABRIC, 2018-2032 (USD MILLION)

TABLE 139 SOUTH AFRICA DENIM JEANS MARKET, BY FABRIC, 2018-2032 (USD MILLION UNITS)

TABLE 140 SOUTH AFRICA DENIM JEANS MARKET, BY PRODUCT, 2018-2032 (USD MILLION)

TABLE 141 SOUTH AFRICA DENIM JEANS MARKET, BY DEMOGRAPHY, 2018-2032 (USD MILLION)

TABLE 142 SOUTH AFRICA MEN IN DENIM JEANS MARKET, BY FABRIC, 2018-2032 (USD MILLION)

TABLE 143 SOUTH AFRICA WOMEN IN DENIM JEANS MARKET, BY FABRIC, 2018-2032 (USD MILLION)

TABLE 144 SOUTH AFRICA CHILDREN IN DENIM JEANS MARKET, BY FABRIC, 2018-2032 (USD MILLION)

TABLE 145 SOUTH AFRICA DENIM JEANS MARKET, BY PRICE RANGE, 2018-2032 (USD MILLION)

TABLE 146 SOUTH AFRICA DENIM JEANS MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD MILLION)

TABLE 147 SOUTH AFRICA OFFLINE IN DENIM JEANS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 148 SOUTH AFRICA ONLINE IN DENIM JEANS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 149 U.A.E. DENIM JEANS MARKET, BY FABRIC, 2018-2032 (USD MILLION)

TABLE 150 U.A.E. DENIM JEANS MARKET, BY FABRIC, 2018-2032 (USD MILLION UNITS)

TABLE 151 U.A.E. DENIM JEANS MARKET, BY PRODUCT, 2018-2032 (USD MILLION)

TABLE 152 U.A.E. DENIM JEANS MARKET, BY DEMOGRAPHY, 2018-2032 (USD MILLION)

TABLE 153 U.A.E. MEN IN DENIM JEANS MARKET, BY FABRIC, 2018-2032 (USD MILLION)

TABLE 154 U.A.E. WOMEN IN DENIM JEANS MARKET, BY FABRIC, 2018-2032 (USD MILLION)

TABLE 155 U.A.E. CHILDREN IN DENIM JEANS MARKET, BY FABRIC, 2018-2032 (USD MILLION)

TABLE 156 U.A.E. DENIM JEANS MARKET, BY PRICE RANGE, 2018-2032 (USD MILLION)

TABLE 157 U.A.E. DENIM JEANS MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD MILLION)

TABLE 158 U.A.E. OFFLINE IN DENIM JEANS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 159 U.A.E. ONLINE IN DENIM JEANS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 160 SAUDI ARABIA DENIM JEANS MARKET, BY FABRIC, 2018-2032 (USD MILLION)

TABLE 161 SAUDI ARABIA DENIM JEANS MARKET, BY FABRIC, 2018-2032 (USD MILLION UNITS)

TABLE 162 SAUDI ARABIA DENIM JEANS MARKET, BY PRODUCT, 2018-2032 (USD MILLION)

TABLE 163 SAUDI ARABIA DENIM JEANS MARKET, BY DEMOGRAPHY, 2018-2032 (USD MILLION)

TABLE 164 SAUDI ARABIA MEN IN DENIM JEANS MARKET, BY FABRIC, 2018-2032 (USD MILLION)

TABLE 165 SAUDI ARABIA WOMEN IN DENIM JEANS MARKET, BY FABRIC, 2018-2032 (USD MILLION)

TABLE 166 SAUDI ARABIA CHILDREN IN DENIM JEANS MARKET, BY FABRIC, 2018-2032 (USD MILLION)

TABLE 167 SAUDI ARABIA DENIM JEANS MARKET, BY PRICE RANGE, 2018-2032 (USD MILLION)

TABLE 168 SAUDI ARABIA DENIM JEANS MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD MILLION)

TABLE 169 SAUDI ARABIA OFFLINE IN DENIM JEANS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 170 SAUDI ARABIA ONLINE IN DENIM JEANS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 171 KUWAIT DENIM JEANS MARKET, BY FABRIC, 2018-2032 (USD MILLION)

TABLE 172 KUWAIT DENIM JEANS MARKET, BY FABRIC, 2018-2032 (USD MILLION UNITS)

TABLE 173 KUWAIT DENIM JEANS MARKET, BY PRODUCT, 2018-2032 (USD MILLION)

TABLE 174 KUWAIT DENIM JEANS MARKET, BY DEMOGRAPHY, 2018-2032 (USD MILLION)

TABLE 175 KUWAIT MEN IN DENIM JEANS MARKET, BY FABRIC, 2018-2032 (USD MILLION)

TABLE 176 KUWAIT WOMEN IN DENIM JEANS MARKET, BY FABRIC, 2018-2032 (USD MILLION)

TABLE 177 KUWAIT CHILDREN IN DENIM JEANS MARKET, BY FABRIC, 2018-2032 (USD MILLION)

TABLE 178 KUWAIT DENIM JEANS MARKET, BY PRICE RANGE, 2018-2032 (USD MILLION)

TABLE 179 KUWAIT DENIM JEANS MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD MILLION)

TABLE 180 KUWAIT OFFLINE IN DENIM JEANS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 181 KUWAIT ONLINE IN DENIM JEANS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 182 OMAN DENIM JEANS MARKET, BY FABRIC, 2018-2032 (USD MILLION)

TABLE 183 OMAN DENIM JEANS MARKET, BY FABRIC, 2018-2032 (USD MILLION UNITS)

TABLE 184 OMAN DENIM JEANS MARKET, BY PRODUCT, 2018-2032 (USD MILLION)

TABLE 185 OMAN DENIM JEANS MARKET, BY DEMOGRAPHY, 2018-2032 (USD MILLION)

TABLE 186 OMAN MEN IN DENIM JEANS MARKET, BY FABRIC, 2018-2032 (USD MILLION)

TABLE 187 OMAN WOMEN IN DENIM JEANS MARKET, BY FABRIC, 2018-2032 (USD MILLION)

TABLE 188 OMAN CHILDREN IN DENIM JEANS MARKET, BY FABRIC, 2018-2032 (USD MILLION)

TABLE 189 OMAN DENIM JEANS MARKET, BY PRICE RANGE, 2018-2032 (USD MILLION)

TABLE 190 OMAN DENIM JEANS MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD MILLION)

TABLE 191 OMAN OFFLINE IN DENIM JEANS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 192 OMAN ONLINE IN DENIM JEANS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 193 REST OF MIDDLE EAST & AFRICA DENIM JEANS MARKET, BY FABRIC, 2018-2032 (USD MILLION)

TABLE 194 REST OF MIDDLE EAST & AFRICA DENIM JEANS MARKET, BY FABRIC, 2018-2032 (USD MILLION UNITS)

List of Figure

FIGURE 1 EMEA DENIM JEANS MARKET: SEGMENTATION

FIGURE 2 EMEA DENIM JEANS MARKET: DATA TRIANGULATION

FIGURE 3 EMEA DENIM JEANS MARKET: DROC ANALYSIS

FIGURE 4 EUROPE DENIM JEANS MARKET: MARKET ANALYSIS

FIGURE 5 MIDDLE EAST & AFRICA DENIM JEANS MARKET: MARKET ANALYSIS

FIGURE 6 EMEA DENIM JEANS MARKET: MARKET ANALYSIS

FIGURE 7 EMEA DENIM JEANS MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 8 EUROPE DENIM JEANS MARKET: DBMR MARKET POSITION GRID

FIGURE 9 MIDDLE EAST & AFRICA DENIM JEANS MARKET: DBMR MARKET POSITION GRID

FIGURE 10 EMEA DENIM JEANS MARKET: VENDOR SHARE ANALYSIS

FIGURE 11 EMEA DENIM JEANS MARKET: MULTIVARIATE MODELING

FIGURE 12 EUROPE DENIM JEANS MARKET: FABRIC TIMELINE CURVE

FIGURE 13 MIDDLE EAST & AFRICA DENIM JEANS MARKET: FABRIC TIMELINE CURVE

FIGURE 14 EMEA DENIM JEANS MARKET: SEGMENTATION

FIGURE 15 FOURTEEN SEGMENTS COMPRISE THE EUROPE DENIM JEANS MARKET, BY FABRIC (2024)

FIGURE 16 FOURTEEN SEGMENTS COMPRISE THE MIDDLE EAST & AFRICA DENIM JEANS MARKET, BY FABRIC (2024)

FIGURE 17 EUROPE DENIM JEANS MARKET: EXECUTIVE SUMMARY

FIGURE 18 MIDDLE EAST & AFRICA DENIM JEANS MARKET: EXECUTIVE SUMMARY

FIGURE 19 STRATEGIC DECISIONS

FIGURE 20 RISING DEMAND FOR SUSTAINABLE AND ECO-FRIENDLY DENIM PRODUCTS DUE TO ENVIRONMENTAL CONCERNS IS EXPECTED TO DRIVE THE EUROPE DENIM JEANS MARKET DURING THE FORECAST PERIOD OF 2025 TO 2032

FIGURE 21 RISING DEMAND FOR SUSTAINABLE AND ECO-FRIENDLY DENIM PRODUCTS DUE TO ENVIRONMENTAL CONCERNS IS EXPECTED TO DRIVE THE MIDDLE EAST & ARICA DENIM JEANS MARKET DURING THE FORECAST PERIOD OF 2025 TO 2032

FIGURE 22 FABRIC SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE EUROPE DENIM JEANS MARKET IN 2025 & 2032

FIGURE 23 FABRIC SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE MIDDLE EAST & AFRICA DENIM JEANS MARKET IN 2025 & 2032

FIGURE 24 SUPPLY CHAIN ANALYSIS FOR THE EMEA DENIM JEANS MARKET

FIGURE 25 DRIVERS, RESTRAINTS, OPPORTUNITY & CHALLENGES

FIGURE 26 EUROPEAN UNION DENIM IMPORT

FIGURE 27 SUB-SAHARAN AFRICA’S TOTAL TRADE: APPAREL AND HOME TEXTILES

FIGURE 28 AVERAGE TEXTILE CONSUME OF EU CITIZEN

FIGURE 29 APPAREL RETAIL SALE IN UAE

FIGURE 30 TEXTILE FIBRE PRICES (CTS/KG)

FIGURE 31 SHARE OF ULTRA-FAST FASHION BRANDS IN THE FASHION CATEGORY

FIGURE 32 EUROPE DENIM JEANS MARKET, BY FABRIC, 2024

FIGURE 33 MIDDLE EAST & AFRICA DENIM JEANS MARKET, BY FABRIC, 2024

FIGURE 34 EUROPE DENIM JEANS MARKET, BY PRODUCT, 2024

FIGURE 35 MIDDLE EAST & AFRICA DENIM JEANS MARKET, BY PRODUCT, 2024

FIGURE 36 EUROPE DENIM JEANS MARKET, BY DEMOGRAPHY, 2024

FIGURE 37 MIDDLE EAST & AFRICA DENIM JEANS MARKET, BY DEMOGRAPHY, 2024

FIGURE 38 EUROPE DENIM JEANS MARKET, BY PRICE RANGE, 2024

FIGURE 39 MIDDLE EAST AND AFRICA DENIM JEANS MARKET, BY PRICE RANGE, 2024

FIGURE 40 EUROPE DENIM JEANS MARKET, BY DISTRIBUTION CHANNEL, 2024

FIGURE 41 MIDDLE EAST & AFRICA DENIM JEANS MARKET, BY DISTRIBUTION CHANNEL, 2024

FIGURE 42 EUROPE OVERVIEW

FIGURE 43 MIDDLE EAST & AFRICA OVERVIEW

FIGURE 44 EUROPE DENIM JEANS MARKET: COMPANY SHARE 2024 (%)

FIGURE 45 MIDDLE EAST & AFRICA DENIM JEANS MARKET: COMPANY SHARE 2024 (%)

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.