Emea Solid Oral Nutraceutical Excipient Market

Market Size in USD Million

CAGR :

%

USD

287.04 Million

USD

478.63 Million

2024

2032

USD

287.04 Million

USD

478.63 Million

2024

2032

| 2025 –2032 | |

| USD 287.04 Million | |

| USD 478.63 Million | |

|

|

|

|

EMEA Solid Oral Nutraceutical Excipient Market Size

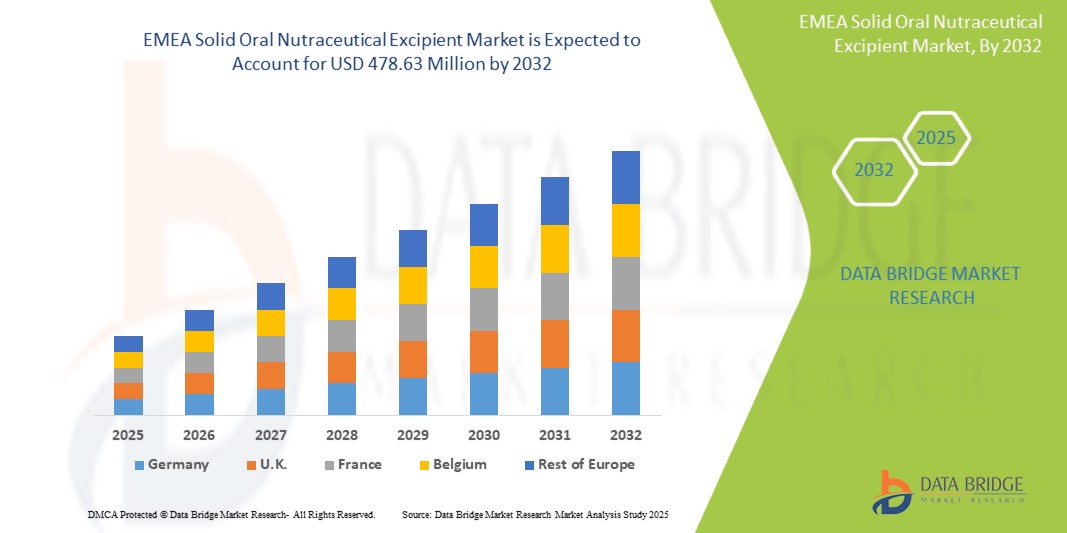

- The EMEA solid oral nutraceutical excipient market size was valued at USD 287.04 million in 2024 and is expected to reach USD 478.63 million by 2032, at a CAGR of 6.60% during the forecast period

- The market growth is largely driven by increasing health consciousness among consumers, growing demand for dietary supplements, and a surge in chronic lifestyle-related diseases, which is encouraging the formulation of high-quality solid oral nutraceuticals across Europe, the Middle East, and Africa

- Moreover, advancements in excipient functionality, including improved bioavailability and taste-masking, are pushing manufacturers to innovate formulations. These trends are strengthening the role of excipients as critical components in nutraceutical delivery, thereby propelling market expansion in the EMEA region

EMEA Solid Oral Nutraceutical Excipient Market Analysis

- Solid oral nutraceutical excipients, which support the formulation, stability, and effectiveness of dietary supplements, are becoming increasingly important for tablets, capsules, and powders across preventive and therapeutic nutrition in the EMEA region

- The rising demand is largely driven by growing consumer interest in health and wellness, an aging population, and increasing use of supplements for immune support, digestive health, and chronic condition management

- Europe dominated the EMEA solid oral nutraceutical excipient market with the largest revenue share of 63.2% in 2024, supported by advanced manufacturing capabilities, stringent quality regulations, and high consumer awareness in countries like Germany, France, and the U.K.

- The Middle East and Africa are projected to be the fastest growing region in the EMEA solid oral nutraceutical excipient market during the forecast period due to increasing healthcare investments, growing middle-class populations, and heightened interest in nutritional products

- Binder segment dominated the solid oral nutraceutical excipient market with a market share of 39.1% in 2024, owing to its critical role in maintaining tablet cohesion, stability, and uniformity in solid dosage forms

Report Scope and EMEA Solid Oral Nutraceutical Excipient Market Segmentation

|

Attributes |

EMEA Solid Oral Nutraceutical Excipient Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

Europe

Middle East and Africa

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

EMEA Solid Oral Nutraceutical Excipient Market Trends

“Rising Demand for Clean Label and Plant-Based Excipients”

- A significant and accelerating trend in the EMEA solid oral nutraceutical excipient market is the growing preference for clean label and plant-based excipients, driven by heightened consumer awareness regarding ingredient transparency, sustainability, and ethical sourcing. This shift is reshaping product development across both mature and emerging markets in the region

- For instance, leading manufacturers like Roquette Frères and DFE Pharma are expanding their offerings to include natural and botanical binders, fillers, and disintegrants that meet vegan, allergen-free, and non-GMO standards. These clean label excipients support nutraceutical brands in making desirable product claims that align with consumer health values

- The clean label movement is especially strong in Europe, where regulatory frameworks such as EFSA guidelines and increasing demand for minimally processed ingredients are driving reformulation efforts. In parallel, plant-based trends are gaining ground in the Middle East and Africa, aligning with lifestyle changes and rising interest in natural wellness solutions

- These excipients not only satisfy growing consumer expectations but also contribute to enhanced marketability of finished products by enabling claims such as “no artificial additives” and “naturally derived.” As a result, manufacturers are prioritizing clean excipient sourcing to differentiate their products and expand market reach

- This trend toward natural, transparent, and sustainable excipient solutions is creating new innovation pathways and competitive advantages for companies operating in the EMEA nutraceutical space

EMEA Solid Oral Nutraceutical Excipient Market Dynamics

Driver

“Rising Nutraceutical Consumption Fueled by Preventive Health and Aging Population”

- The increasing focus on preventive health and wellness, combined with a growing aging population across Europe and parts of the Middle East, is driving robust demand for nutraceuticals, which in turn is propelling the need for effective solid oral excipients

- For instance, European countries such as Germany, France, and Italy have witnessed high demand for dietary supplements targeting immune support, cognitive health, and joint care, particularly among older adults and health-conscious consumers. This has significantly boosted the formulation of tablets and capsules using specialized excipients

- In the Middle East and Africa, growing disposable incomes, shifting health preferences, and increasing access to health products are contributing to a steady rise in nutraceutical consumption. This regional expansion is pushing manufacturers to adopt excipients that enhance product performance, bioavailability, and shelf life

- The functional advantages offered by excipients including improved tablet integrity, disintegration time, and protection of active ingredients are essential to maintaining the quality and effectiveness of supplements, making them indispensable in the growing EMEA nutraceutical sector

Restraint/Challenge

“Regulatory Complexity and Limited Awareness in Emerging Markets”

- Regulatory fragmentation across the EMEA region presents a significant challenge to the solid oral nutraceutical excipient market, with variations in excipient approval, labeling, and usage requirements delaying product launches and increasing compliance burdens for manufacturers

- For instance, while Europe operates under strict EFSA regulations ensuring safety and efficacy, many Middle Eastern and African countries lack standardized excipient guidelines, creating barriers to streamlined market access and limiting cross-border consistency in product formulation

- Additionally, limited awareness of advanced excipient functionalities among smaller nutraceutical companies and formulators in developing markets leads to underutilization of innovative excipients and reliance on basic ingredients, often compromising product quality and performance

- Addressing these challenges requires greater harmonization of regulatory standards, investment in technical training, and broader educational initiatives to highlight the critical role of excipients. Supporting formulators with accessible regulatory pathways and scientific guidance will be essential for unlocking market potential across diverse EMEA regions.

EMEA Solid Oral Nutraceutical Excipient Market Scope

The market is segmented on the basis of functionality, formulation, end product, excipient source, and distribution channel.

- By Functionality

On the basis of functionality, the EMEA solid oral nutraceutical excipient market is segmented into binders, fillers & diluents, suspension & viscosity agents, coatings, disintegrants, and others. The binders segment dominated the market with the largest market revenue share of 39.1% in 2024, driven by their essential role in providing mechanical strength and cohesion to tablets and capsules. Binders help maintain product integrity, facilitate compression, and improve the stability of solid dosage forms. Their demand is further enhanced by innovations in natural and multifunctional binding agents that support clean label claims.

The coatings segment is expected to witness the fastest CAGR from 2025 to 2032, driven by increasing demand for taste-masking, moisture protection, and controlled-release functionalities. The adoption of film and functional coatings is particularly high in advanced European manufacturing facilities to improve consumer acceptability and product shelf life.

- By Formulation

On the basis of formulation, the EMEA solid oral nutraceutical excipient market is segmented into tablets, capsules, gummies, and others. The tablets segment held the largest revenue share in 2024, owing to the widespread preference for cost-effective, easy-to-administer, and stable dosage forms across all consumer demographics. Tablets also allow for high-volume production and enhanced control over dosage accuracy, making them the most commonly manufactured solid oral nutraceutical format.

The gummies segment is projected to witness the fastest growth rate from 2025 to 2032, attributed to increasing consumer preference for chewable and palatable supplement forms, particularly among children and older adults. The trend toward enjoyable, flavorful delivery formats is boosting the adoption of excipients that support gummy consistency, texture, and shelf stability.

- By End Product

On the basis of end product, the EMEA solid oral nutraceutical excipient market is segmented into probiotics, prebiotics, protein and amino acid supplements, vitamin supplements, mineral supplements, omega-3 supplements, and other supplements. The vitamin supplements segment led the market in 2024, owing to their widespread use in preventive health and wellness regimens, especially in the European market. The rising demand for immune health and energy-supporting vitamins like C, D, and B-complex has driven the need for compatible excipients to enhance stability and bioavailability.

The probiotic supplements segment is expected to witness the fastest CAGR during the forecast period, as awareness of gut health increases across the EMEA region. Formulating probiotics in solid oral formats presents unique challenges that require excipients with moisture resistance and viability-protection capabilities, thus pushing innovation in this area.

- By Excipient Source

On the basis of excipient source, the EMEA solid oral nutraceutical excipient market is segmented into synthetic and natural. The synthetic segment held the largest market share in 2024 due to its consistent performance, scalability, and cost-effectiveness. These excipients are widely used across established pharmaceutical-grade nutraceutical manufacturers, especially for formulations requiring high stability and precision.

The natural segment is anticipated to register the fastest growth from 2025 to 2032, propelled by the clean-label movement and increasing demand for plant-based, non-GMO, and allergen-free ingredients. Consumer preferences are shifting toward more sustainable and traceable sources, making natural excipients a key area of innovation and investment.

- By Distribution Channel

On the basis of distribution channel, the EMEA solid oral nutraceutical excipient market is segmented into direct tender, retail sales, and others. The direct tender segment held the largest revenue share in 2024, particularly in Europe, where nutraceutical manufacturers often establish long-term procurement contracts with excipient suppliers to ensure consistent quality and regulatory compliance. This model is prevalent among large-scale supplement producers and pharmaceutical companies.

The retail sales segment is projected to grow at the fastest CAGR during the forecast period, driven by the rise in online nutraceutical brands and smaller manufacturers sourcing excipients through distributors and e-commerce platforms. As formulation activities expand among startups and private label companies, retail and B2B distribution is expected to gain prominence.

EMEA Solid Oral Nutraceutical Excipient Market Regional Analysis

- Europe dominated the EMEA solid oral nutraceutical excipient market with the largest revenue share of 63.2% in 2024, supported by advanced manufacturing capabilities, stringent quality regulations, and high consumer awareness in countries like Germany, France, and the U.K.

- Consumers in this region prioritize high-quality, scientifically backed nutraceuticals supported by clean-label ingredients and natural excipient formulations that align with growing health and sustainability trends

- This widespread adoption is further supported by robust healthcare infrastructure, increasing awareness around preventive health, and active R&D investments by key manufacturers, positioning Europe as a leader in both innovation and consumption of solid oral nutraceutical excipients

The U.K. Solid Oral Nutraceutical Excipient Market Insight

The U.K. solid oral nutraceutical excipient market is anticipated to grow at a noteworthy CAGR during the forecast period, fueled by rising health consciousness, increased demand for dietary supplements, and preference for natural, high-quality formulations. Consumers in the U.K. are actively seeking supplements supporting immunity, mental wellness, and healthy aging, driving demand for advanced excipients that improve dosage form integrity and effectiveness. The U.K.’s proactive approach to nutraceutical regulations and its expanding private-label supplement segment further contribute to the market’s positive outlook.

Germany Solid Oral Nutraceutical Excipient Market Insight

The Germany solid oral nutraceutical excipient market is projected to expand at a considerable CAGR, supported by the country’s leadership in pharmaceutical manufacturing, high per capita supplement consumption, and innovation in clean-label excipient solutions. German consumers favor science-backed nutraceuticals with proven efficacy, creating strong demand for functional excipients that ensure stability, rapid disintegration, and enhanced bioavailability. Additionally, collaborations between ingredient manufacturers and supplement brands are advancing excipient technologies tailored for specific health applications such as bone health, digestion, and cardiovascular wellness.

Middle East Solid Oral Nutraceutical Excipient Market Insight

The Middle East solid oral nutraceutical excipient market is poised to grow steadily throughout the forecast period, fueled by increasing health awareness, expanding urban populations, and a rising shift toward preventive care. Countries such as Saudi Arabia and the UAE are witnessing growing demand for dietary supplements addressing immunity, energy, and digestive health. Local and regional manufacturers are investing in quality excipient sourcing to meet consumer preferences for safe, effective, and easy-to-consume supplement formats. This trend is further supported by government initiatives promoting health and wellness across the region.

Saudi Arabia Solid Oral Nutraceutical Excipient Market Insight

The Saudi Arabia solid oral nutraceutical excipient market is expected to grow at a strong CAGR, supported by the country’s Vision 2030 health initiatives, growing urban middle class, and increased awareness of lifestyle-related health conditions. The population's rising interest in preventative health and wellness is encouraging demand for nutraceuticals in tablet and capsule forms, creating a parallel demand for reliable, high-quality excipients. Investment in local production facilities and government support for nutritional innovation are expected to further boost market development.

Africa Solid Oral Nutraceutical Excipient Market Insight

The Africa solid oral nutraceutical excipient market is gradually gaining momentum, driven by improving healthcare infrastructure, increasing focus on nutrition, and the growing availability of dietary supplements across the continent. Rising demand for fortified products in regions like Southern and Western Africa is creating opportunities for excipient manufacturers to offer affordable and stable solutions that meet the needs of both mass and niche markets.

South Africa Solid Oral Nutraceutical Excipient Market Insight

The South Africa solid oral nutraceutical excipient market is anticipated to grow at a promising CAGR, supported by rising consumer health awareness, growing supplement consumption, and increasing preference for locally produced nutraceuticals. The market benefits from expanding urbanization, greater access to retail health products, and interest in supplements targeting immunity, energy, and chronic disease prevention. South Africa's established pharmaceutical and nutraceutical industries also contribute to demand for advanced excipients with superior performance and regulatory compliance.

EMEA Solid Oral Nutraceutical Excipient Market Share

The EMEA solid oral nutraceutical excipient industry is primarily led by well-established companies, including:

- BASF SE (Germany)

- DFE Pharma GmbH & Co. KG (Germany)

- Roquette Frères (France)

- IMCD Group (Netherlands)

- Meggle GmbH & Co. KG (Germany)

- Croda International Plc (U.K.)

- Kerry Group plc (Ireland)

- JRS Pharma LP (Germany)

- Colorcon Inc. (U.S.)

- Ashland Global Holdings Inc. (U.S.)

- Evonik Industries AG (Germany)

- Ingredion Incorporated (U.S.)

- Finar Limited (India)

- Miteni S.p.A. (Italy)

- Sensient Technologies Corporation (U.S.)

- Merck KGaA (Germany)

- Lactose India Limited (India)

- Biogrund GmbH (Germany)

- Seppic S.A. (France)

- Freund-Vector Corporation (U.S.)

What are the Recent Developments in EMEA Solid Oral Nutraceutical Excipient Market?

- In March 2024, Roquette Frères (France) announced the expansion of its nutraceutical excipient production facility in Lestrem, France, aimed at enhancing capacity for plant-based excipients used in solid oral dosage forms. This move reflects the company’s strategic focus on meeting the rising demand for natural, functional excipients in Europe and the broader EMEA market, aligning with consumer trends favoring clean-label and vegan supplements

- In February 2024, IMCD Group (Netherlands) launched a specialized excipient formulation support service targeting small and mid-sized nutraceutical manufacturers in the EMEA region. The initiative aims to accelerate time-to-market for tablets and capsules by providing expertise in co-processing, flowability improvement, and compression optimization, thereby addressing formulation challenges and boosting excipient efficiency

- In January 2024, DFE Pharma GmbH & Co. KG (Germany) introduced a new line of direct compressible lactose grades tailored for dietary supplement tablets in EMEA. Designed for high-speed tableting and enhanced stability in moisture-sensitive formulations, this innovation supports increasing regional demand for efficient, high-performance excipients in nutraceutical manufacturing

- In December 2023, Meggle GmbH & Co. KG (Germany) entered a strategic distribution partnership with a major nutraceutical ingredient supplier in the Middle East to expand the reach of its solid oral excipients across Saudi Arabia and the UAE. This expansion marks a focused effort to serve the growing supplement market in the Gulf region, particularly for immune-boosting and energy-enhancing tablets

- In November 2023, BASF SE (Germany) launched a pilot project in South Africa focused on developing locally adapted excipient solutions for nutritional supplements. This initiative, involving collaboration with local nutraceutical companies and universities, aims to address regional needs for affordable and stable tablet and capsule formulations suited to local climate and healthcare challenges

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.